[ExitPopup exitpopupurl=”http%3A//www.investorsalley.com/amember/signup/f9NUKdrSa” exitpopupcookiexpdays=”0″ exitpopsplash=”WAIT%21%21%21%21%5Cn%5CnI%27ve%20just%20now%20told%20you%20about%205%20gamechanging%20stocks%20that%20are%20an%5Cnintegral%20part%20of%20our%20portfolio.%5Cn%5CnAnd%20I%27ve%20warned%20you%20about%209%20big%20name%20stocks%20you%20need%20to%20avoid%20at%5Cnall%20costs.%5Cn%5CnAnd%20I%27ve%20shared%20with%20you%20just%20a%20part%20of%20my%20successful%20track%20record%20in%5Cngood%20times%20and%20bad.%5Cn%5CnAnd%20you%20know%20about%20the%20free%20bonus%2C%20reports%2C%20the%2060%20day%20full%20money%5Cnback%20guarantee%20and%20the%2060%25%20OFF%20YOUR%20FIRST%20YEAR%20rate%3A%20just%20%2479%20gets%5Cnyou%20started%20right%20away%20with%20one%20of%20the%20most%20powerful%20investment%5Cnnewsletters%20available.%5Cn%5Cn” ] [/ExitPopup]

LAST CHANCE

to Save 60%

RSVP Now to Start Your Risk-Free Trial

Fellow Investor,

The response to the special invitation I sent you has been overwhelming.

I am thrilled so many of your fellow investors took me up on this chance to try Blue Chip Gems, my new service devoted exclusively to helping you invest in the best blue chip growth stocks!

Blue chip stocks are the bedrock of my portfolio. And they should be the foundation of yours, too—especially in a market like this.

But I haven’t heard from you, so I’m writing one last time to remind you that this is your last chance to accept my invitation to try it at the guaranteed lowest rate you will ever see.

This one-time only offer to save 60% ends promptly at midnight tonight. After that, it’s gone for good.

The Perfect Investment for Today’s Market

Since the market bottom in March 2009, the S&P 500 has soared an incredible 212%.

But we’re six long years into this bull market, and as you’ve probably noticed, this market is beginning to change.

- Volatility is ramping up. We’ve had 100+ point market swings on 25 out of 46 trading days so far this year!

- Market breadth is shrinking with fewer and fewer stocks leading the market higher. The number of S&P 500 stocks hitting new 52-week highs is at a two year low even as the market trades near record levels.

- Earnings growth is slowing. While 4Q 2014 earnings were mostly in line with expectation, a slew of companies warned Wall Street to lower expectations for 2015 results. 85% of companies issued negative guidance for the 1Q 2015 earnings!

- The dollar is soaring. Its massive surge continues, with the dollar recently hitting a 12-year high against the euro. That’s bad news for commodities and multinational companies that get a significant portion of their profits overseas. And it’s starting to spook the market.

Investors are also spooked by the Federal Reserve’s looming interest rate hike, fears of another global slowdown and the never-ending Eurozone debt crisis.

Thanks to all of these factors, a “risk off” mentality is now taking hold on both Wall Street and Main Street.

The smart money is flocking to stocks that have staying power and the wherewithal to weather any storms. They want safe, stable large cap stocks that are in it for the long haul. They want companies with R&D and pipelines and deep benches that are critical drivers of growth. They want companies that have access to cash to get through tough times, invest in growth (through expansion or acquisition) and keep paying their dividends.

And blue chip stocks will be their #1 choice.

A Very Important Warning

But before we go any further, let’s be clear about one thing…

Not all blue chip stocks are created equal. Far from it.

In fact, some have been down right terrible investments.

Take Ford. Had you bought the stock on November 1, 2010 you would have paid $16.21. But almost five years later, you would actually have lost money with the stock sitting at $16.17 on March 3, 2015 despite the huge rebound in car sales.

The S&P 500 delivered a 78% return in that same period.

And it’s not the only blue chip that’s gone absolutely nowhere. Caterpillar was trading at $83.64 on November 1, 2010 and at $83 in March 2015.

Even worse, Alcoa is down a whopping 71% in this same time frame. And plenty of other well-known blue chips like Staples, Avon, JDS Uniphase, First Horizon, SuperValu, Cliffs Natural Resources, Unisys have all lost money or gone nowhere. I could go on but you get the point.

Despite their safe and solid reputation, putting your money in the wrong blue chip stock can cost you a fortune.

That’s where I come in.

Announcing My New Service: Blue Chip Gems

I’m thrilled to announce the launch of my brand new service, Blue Chip Gems.

I started Blue Chip Gems to help investors like you uncover the very best blue chip stocks for your money and avoid the dogs that are going nowhere.

I have a proven track record of identifying blue chip stocks that we can buy at a reasonable valuation that deliver long-term profits. I’m talking about winners like:

- 273% gain in Jazz Pharmaceuticals. This off-the-radar name has tripled since I recommended it in August of 2012. This stock got my attention when I saw that despite announcing rising earnings estimates and big revenue growth it was trading in bottom third of five year valuation range.

- 87% gain in Hewlett-Packard. I recommend HP in June 2012 when Wall Street hated the stock. But I saw something different… 3 positive earnings surprises in a row, $400 million in insider buying and a stock that was a huge value–selling at the very bottom of its five year valuation range. So we snapped it up at $22 and rode it to $40 for a big gain.

- 29% gain in Microsoft in just 8 months. Ditto for Microsoft. Wall Street wrote this blue chip off as dead, but with dynamic new leadership and a major business shift to embrace cloud computing, I saw the makings of a breakout. Sure enough we got on board in January 2014 and the stock jumped, handing us a handsome double-digit profit in less than a year.

- 116% gain (and counting) in Xerox. When I recommended this stock in November 2012, it was extremely beaten down—trading at the very bottom of its five year range at a dirt cheap 6x forward earnings. But I saw clear signs that the stock was ready to make a move. The company was making the shift from hardware to software—which is less cyclical and has a higher profit margin. Plus it was raising dividends and initiating a stock buyback program. Sure enough the stock surged to $13.49 from $6.23 and is still going!

I share these winners not to brag, but to show you the types of profits you can pocket when you invest in undervalued blue chips. These winners also all share some common themes that are key to how I continue to rack up market-beating profits.

So before I tell you about a few of the blue chip gems at the top of my buy list today, let me pull back the curtain and reveal a few of the criteria I use to identify my top stocks.

The Secret to Uncovering Blue Chip Gems

In order for a blue chip stock to even make my first cut it must have:

- Clear growth drivers

- A visible earnings stream

- Low currency exposure (a big risk that will hurt many multinationals as the dollar continues to soar)

- A sustainable competitive advantage

A dividend is a big plus, but not required.

But it’s my next round of analysis that is the real secret to our success. In order for a stock to be considered a Blue Chip Gems candidate, it must have two things, the first of which is a reasonable valuation.

As I said, I like to buy growth at a discount. I don’t care if a stock is projected to grow 30% a year…you still won’t find me willing to pay 50 times earnings for it. There is just too much risk in that.

And there’s absolutely no need to take that extra risk when there are great growth stocks to be had at reasonable prices. You heard me right…even in today’s pricey market, it IS still possible to find undervalued blue chip gems.

I look for blue chip growth stocks that are temporarily cheap. That could be because the company is currently misunderstood by Wall Street…or has been knocked down on a knee jerk reaction to negative news or by a temporary hiccup in business.

I’m looking for stocks with broken sentiment—NOT companies with a broken business model.

I also want to see clear changes already underway that over time will lead to value creation. This is something I’ve done over and over and over again. And it’s critically important.

Many “cheap” stocks are in the bargain bin for a good reason. And the last thing I want to do is fall into a “value trap” and buy a stock that looks cheap but is actually going nowhere. That’s exactly what happened to investors who bought stocks like Sears, Nokia and Blackberry—all once shining blue chips that were cheap because they had completely broken business models.

If you’re not careful, you can end up owning stocks like those dogs I told you about earlier—with no gains to show for years. The key is to identify those that already have a clear path to reaching their full valuation in the next 2-3 years.

My latest analysis has pinpointed 5 stocks that meet all my criteria. They are at the top of my buy list right now so let me tell you a little bit about them…

5 Blue Chip Gems to Buy Now

The first stock I want to tell you about is simply one of cheapest blue chips you can buy today for superior growth in the year ahead.

I first bought shares when it was trading at $40. It’s more than doubled since then. But you have an unbelievable opportunity to snap it up right now for just 10 times forward earnings thanks to a huge Wall Street mistake.

The company just reported blow out earnings, beating top and bottom line expectations. But the stock took a 20% haircut on overblown fears about new competition for its key drug.

This company has a pipeline bursting with innovative new drugs (including some in late stage trials). It just had biggest drug launch in history. It sports a pristine balance sheet. And enjoys rapidly increasing cash flow.

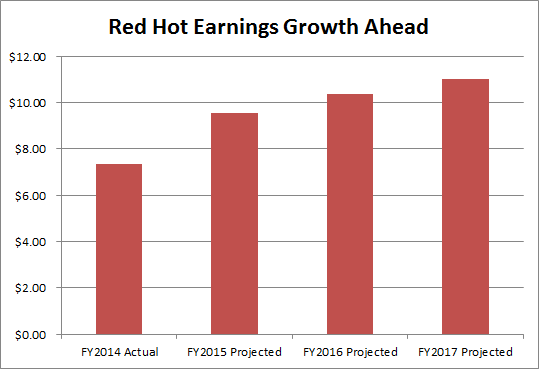

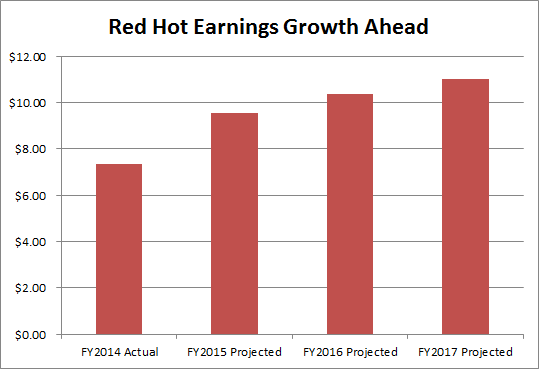

Plus it’s delivering red-hot earnings growth. It earned a little over $2 a share in FY 2013, and earned $7.35 per share in FY 2014 and projected to earn $9.53 in 2015!

The company has used takeovers to grow in the past, and with $10 billion in cash on hand, I wouldn’t be surprised to see more acquisitions in 2015.

Cheap valuation. Impressive earnings and revenue growth. A deep pipeline. This is one of my top picks for 2015 and you will kick yourself if you miss this chance to get on board.

I expect this stock to be a core holding in the Blue Chip Gems portfolio for a long time, and getting in at today’s price is an absolute gift. Don’t miss it!

You can get all the details on this stock in a special report I’ve just written, “5 Blue Chip Gems to Buy Now”. I want to give you instant access to this report absolutely free IF you respond before this invitation ends at midnight.

Click here now to get your copy before it’s too late!

Now, let’s look at the next blue chip at the top of my buy list…

Blue Chip Gem #2: Profit from Wall Street’s Mistake

The next stock on my buy list is the poster child for finding a blue chip gem that is currently undervalued and has big potential to be unlocked.

The company, has excellent long-term growth drivers, but is sorely misunderstood by Wall Street right now. This is a clear case where perception is broken, not the company’s business model.

The stock is off 26% in the last year thanks to a few factors. The company derives the majority of its revenue from its operations in China and a corruption crackdown by the Chinese government impacted one segment of the company’s clientele and took a big bite out of revenue last year. Second, the Street fears that a slowdown in China could hurt the firm’s clientele and slow growth.

But a closer look reveals that some major changes in the company’s clientele actually signals more stable growth ahead. Plus, the company will benefit from several new projects that are about to attract middle-class Chinese customers in droves.

It will also benefit since the collapse in energy prices will give its customers more money for discretionary spending.

Besides great growth potential, you’ll pocket some income along the way. The company just raised its dividend 30% and has doubled it in the last two years. It now pays a hefty 4.6% dividend.

It also doubled its share buyback program, adding another $2 billion to its plan.

But Wall Street has been slow to catch on and the stock is on sale at only 14.5 times forward earnings—well below its five-year average of 30!

Don’t miss the opportunity to snap this one up while you still can. You’ll find all the details in your free report, “5 Blue Chip Gems to Buy Now.” This report is valued at $79, but you can get it instantly and free the moment you start your risk-free trial.

Blue Chip Gem #3: The ONLY Energy Stock I’m Buying Now

This stock is the #1 way to play the US oil boom and best yet, it is insulated from plunging oil prices. In fact, this company benefits from the volatility in oil!

It is perfectly positioned to profit from the explosive growth in US oil production. It owns 70% of refinery capacity in the Gulf Coast plus plants in Louisiana, Oklahoma, Tennessee and California.

It can also process heavy crude oil from Canada and Mexico. That boosts the company’s profit margin since heavy crude is cheaper to buy than light crude. It also has ethanol plants located throughout the Midwest.

I expect the company to maintain its industry dominance since it enjoys two huge barriers to entry that keeps new competitors at bay. One, it is extremely expensive to build new refineries—about $10 billion. And two, regulatory issues and environmental restrictions keep new ones from being built. Since 1980, there have only been 7 refineries built in the U.S.

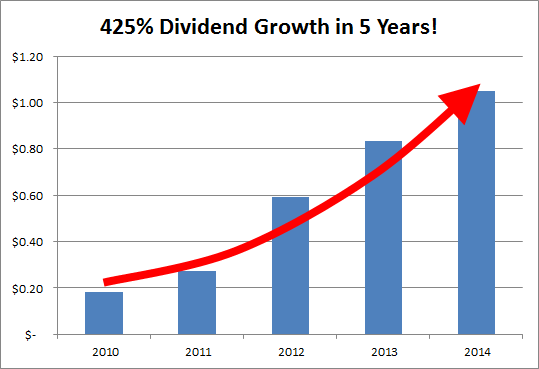

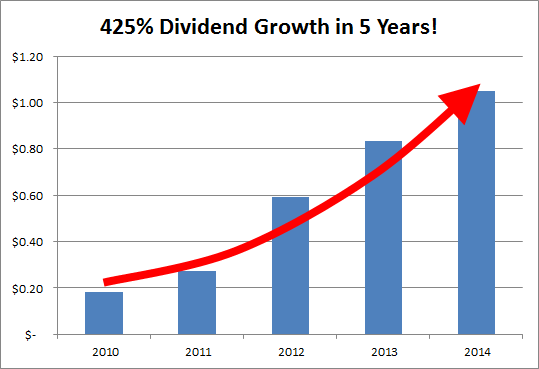

One of the things I like most about this company is its commitment to returning excess cash to shareholders. It announced a massive 45% dividend hike to start the year. With that increase, the dividend has increased an eye-popping 425% in just five years!

Margins were up $1.9 billion in 2014. And capital expenditures are slowing, resulting in more free cash flow.

And talk about dirt cheap—the stock is trading at just a 9.8 forward P/E. Full details in your “5 Blue Chip Gems to Buy Now” report.

Get your copy of this just released report today and you’ll get my full analysis on this and all the stocks I’ve told you about, plus learn about two more blue chip gems at the top of my buy list.

This special report is yours free when you accept this invitation to try my new Blue Chip Gems service. But time to act on this is dwindling quickly and if you delay, you’ll miss it. Get started here.

9 Blue Chip Stocks to Sell Now

As I’ve shown you, what you DON’T own can be as important as what you do, so I want to give you a second special report that will help make sure you own only the best of the blue chips.

In it you’ll find big-name blue chips that I recommend you sell or avoid today. (You won’t believe some of the names that made the list!)

These are stocks that are going nowhere/ready to implode/hyped to the moon/getting ready to get smacked by lower earnings/etc.

Combined with my “5 Blue Chip Gems to Buy Now” report, that’s $128 in special reports that are yours free. I’ll rush you both of these valuable reports today, right now, the moment you accept this risk-free test drive. But I must hear from you before this offer ends at midnight tonight. This exclusive offer is extended one more day for anyone who may have been traveling over this holiday weekend and unable to place an order. RSVP now.

And I have one more gift for you today…a one-time-only discount that I hope makes it easy for you to give my new service a try.

Time is Running Out!

Just a Few Hours Left to Save 60%

For the remainder of today only, you can get a full year of Blue Chip Gems for just $79 with this special invitation.

You save an incredible 60%!

That works out to just 20 cents a day for the profits and peace of mind that come with investing along side of me in Blue Chip Gems.

I guarantee this is the absolute lowest price you will EVER see for Blue Chip Gems. But I can only extend it until 11:59 p.m. tonight. After that, this huge Charter Member discount is gone for good. So don’t delay—start your no-risk trial now.

It’s easy to take it for a test drive thanks to my 100% money back guarantee.

Saying “YES” is Easy with My

100% Money Back Guarantee

It’s important to me that you to be able to try this new service with complete confidence. So it’s backed up by my 100% satisfaction guarantee.

If you should decide it’s not for you—for ANY reason—simply let me know in the first 60 days and I’ll refund every penny you paid. No hassles. No fine print. No questions asked…just a full and prompt 100% refund.

LAST CHANCE! This Extension Ends at Midnight

I also have a second guarantee for you…I guarantee that I’ll eat my own cooking so to speak. I believe so strongly in the stocks I recommend in Blue Chip Gems that I’ll be investing my own money in each and every one of them right along side of you.

That’s why no matter what the market has in store in the months ahead, I know that I’ll be sleeping well at night thanks to my portfolio of rock solid blue chip gems.

And you can too! Start today by snapping up the 5 undervalued blue chip growth stocks at the top of my buy list.

You’ll get my full analysis on each stock—including my recommended buy price—in your free copy of “5 Blue Chip Gems to Buy Now.” It’s yours free—along with “9 Blue Chips to Sell Now”–with my compliments just for giving my new Blue Chip Gems service a try.

You can put it through its paces for a full 60 days with zero risk or obligation to be sure it’s right for you.

If not, just let me know and I’ll promptly refund every penny you paid. You have my personal 100% satisfaction guarantee.

So start your free trial now and lock in a full year of service at the absolute best price you will ever see. You’ll save an incredible 60% off the regular rate.

On top of your $120 savings, you’ll also get those special reports I promised you—a $128 value–FREE. That’s $248 in free gifts and discounts!

But remember, when this offer ends at midnight it’s gone for good. So if you have any intention of giving Blue Chip Gems a try, I encourage you to start your risk-free trial now before it’s too late.

Happy Hunting,

Bret Jensen

Editor

Blue Chip Gems

P.S. Remember, this is a one-time only invitation to try my new Blue Chip Gems service risk free for the next two months, to get my two new special reports FREE AND to lock in the absolute lowest price you will ever see. This huge 60% discount ends in TODAY so I must hear from you before midnight. Once the extended deadline passes, this offer disappears for good. RSVP now before.the deadline passes and this offer disappears forever.