Vol. 3 Issue 7

Analyst’s Note:

Besides the new trade this issue, we are also rolling out our CLDR calls. If you own or want to get into CLDR calls, be sure to check out the Open Position section for the trade.

Also, be sure to check out the guest column below from Euan Sinclair. Euan has written some of the most influential books on options trading across the entire industry. He brings his unique perspective on trading directly to you in his article a little further below.

As a general reminder, if you don’t hear from me on a particular trade between issues, it means that I’m still recommending a hold. Of course, that doesn’t mean you can’t take profits/cut losses with your own risk tolerance in mind.

Editor note: last week my colleague Rick Rouse finished up the beta test of his strategies. “Thank you” to everyone who participated and provided feedback. He’s taken that input and turned it into a pretty amazing options trading service that’s easy enough you can make trades form anywhere… coffee shop… the beach… even a bar. He’s even got pictures to prove it here. His objective is simple: to aim to delivery at last one 100% winner every month. Check out his write-up on how it’s done.

The Trade

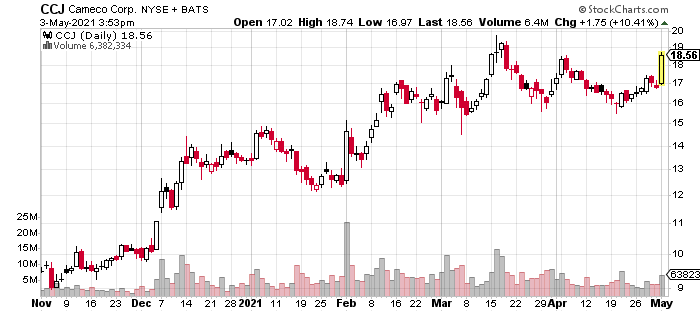

Uranium stocks are up big this week, with uranium prices having reached their highs for the year to date. Despite the spike in most uranium stocks, I believe the prices will continue to rise. In fact, I had intended to use uranium stocks before Monday’s surge, so in many ways, it reaffirms my thesis.

In a nutshell, both the U.S. and EU governments are striving towards clean energy goals. In terms of emissions, it doesn’t get much cleaner than nuclear power (which, when functioning correctly, releases only steam). Many analysts believe nuclear power will be part of the green energy future.

By far, the largest public company in the uranium space is Cameco (CCJ). We made a nice profit on CCJ earlier in the year, now we’re betting the stock will go even higher. Besides the positive overall trend in uranium prices, CCJ also just reopened one of its idle mines—a clear sign the company expects uranium prices to continue rising.

We’re going to buy June CCJ calls this time around. Earnings in CCJ come out later this week.

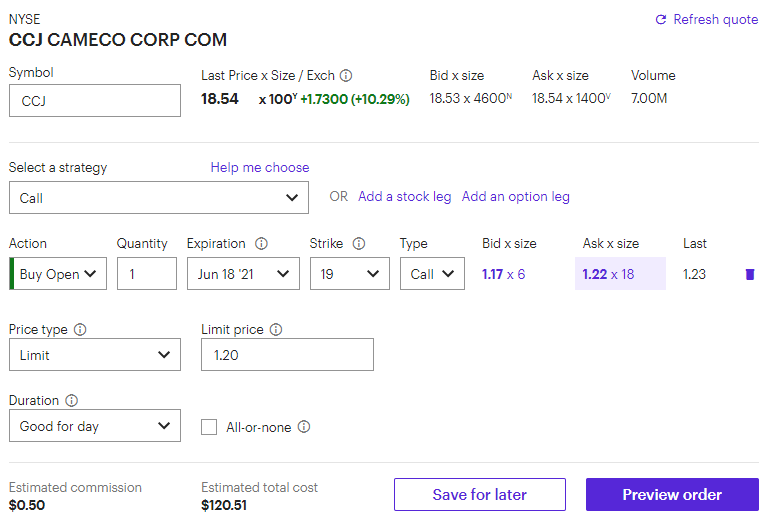

Trade Recommendation:

Buy to open Cameco (CCJ) June 18 19 calls for a price of around $1.20

CCJ is currently trading at $18.54. I’m setting the buy-up-to-price for the calls up to $2.00. However, CCJ may be down today because the stock was up so much on Monday. If that’s the case, you can either pay a lower price for the 19 strike, or shift down to the 18 strike—either choice is reasonable. Try setting your limit order as close to the midpoint of the bid/ask as possible to start with. You can always move the price until you get filled.

Remember to refer to the checklist if you are new to trading options. For example, step #7 is looking at the strike of the option. In this case, make sure you are choosing the 19 strike (call).

At expiration (in 45 days) our breakeven point is $20.20. I’m looking for a move to $21 or above in the next several weeks. The most we can lose on the trade is whatever you pay for the premium ($120 per contract at the current price). Every dollar above the breakeven point is worth $100 to us at expiration per contact owned. However, if CCJ moves higher quickly, it will change the math (in our favor).

Remember once again, try to get filled at the midpoint of the bid/ask spread and then move the price up from there. And, don’t forget to follow the steps in the checklist, and especially double-check all the trade details before you send your order in (step #10). The price may change quite a bit due to market conditions, so be sure to check the bid/ask spread before you enter your order. Keep in mind, I may send extra trade alerts that don’t coincide with the date of one of our biweekly issues.

Trade Screenshot:

Chart:

Open Trade Review:

Zynga (ZNGA) May 21 10 Call

Buy price: $1.50 (includes both roll prices from March and April)

Current price: $0.85

Days to expiration: 17

All eyes are on ZNGA earnings tomorrow. We should have a pretty good idea if we’ll make money on this trade after earnings results. Let’s see what happens.

Rocket Companies (RKT) May 28 24 Call

Buy price: $2.42 (includes two RKT trades because we extended the trade last issue)

Current price: $1.05

Days to expiration: 24

We rolled RKT out last issue (extended the trade about a month), and the stock hasn’t moved much since. That’s likely due to anticipation over earnings, which come out tomorrow. Like ZNGA, we should have a better idea about where we stand on this trade after earnings.

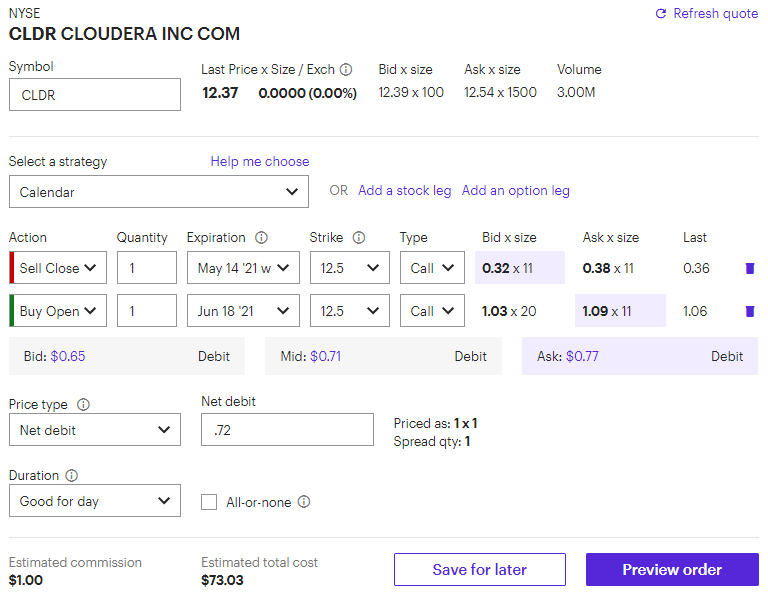

Cloudera (CLDR) May 14 12.5 calls

Buy price: $0.75

Current price: $0.35

Days to expiration: 10

CLDR was sitting around $13 for a few days last week but pulled back below $12.50 this week. But that’s okay: it makes it an easy decision to roll this trade out (extend it for another month). Why extend the trade? Earnings should be released sometime in June, and I want us to have earnings exposure, as I expect them to have a positive impact on the stock.

See order details below. If you’ve never rolled out a trade before, just make it look like the order entry form below (it’s typically called a calendar trade, a roll-out trade, or a custom trade). You can also make this trade as separate transactions. New CLDR traders only need to do the June part of the trade.

Trade Details:

Clean Energy Fuels (CLNE) May 21 13 calls

Buy price: $0.40

Current price: $0.45

Days to expiration: 17

CLNE plunged the day I recommended the trade, as analysts questioned whether the deal with Amazon (AMZN) would be worthwhile. Some of you lowered the strike for the calls purchased, and others bought the 13 calls for a much lower price than I had targeted. Either choice was reasonable. I’m using 40 cents for our 13 call entry price, although I know many of you paid less for the calls than that. Earnings in CLNE come later this week, so we may get a chance to close this trade pretty quickly if results are positive.

Discussion Topic: Getting a better fill price on your options trades

Let’s use this space to talk about an options trading quality-of-life issue. More specifically, I want to give you some advice on getting a better fill (execution) price on your options trade.

As a former market maker, I once found there was a huge advantage to being an options specialist (dealer), compared to being the market taker (the customer). Options market makers got a pretty big edge on the bid/ask spread for each contract. Typically, customers would have to sell the option on the bid and buy the option at the ask (offer)—the spread between the bid and the ask used to be quite robust.

However, competition these days has increased between exchanges and the markets have gone mainly electronic. Market makers no longer have the same edge. Bid/ask spreads have gotten significantly narrower in general. In fact, there are benefits to being a customer trading options, especially trading in smaller increments.

As customers, if we try to buy (or sell) an option in between the bid/ask spread that is shown, the market maker either has to fill (execute) the trade or change the market (what is quoted on your screen). If it’s a smaller order, the vast majority of the time, they will fill the order at a better price (higher than the bid/lower than the ask), because they don’t want to change the bid/ask quoted prices for a small order and then have someone come in at those new prices with a much bigger order. The market maker doesn’t want to honor that better price on a much larger volume trade (and thus earn less edge on the trade).

The bottom line is you always want to place a limit order in between the bid/ask spread and see what happens. If you don’t get filled on that trade, you can always alter your order afterward until it gets filled. You might as well try to a better price first as there is no downside for us, but plenty of downside to the market maker if they have to change their quotes.

Successful Trading Means Finding Edge and Properly Managing Risk

In this issue’s guest article Euan Sinclair shares the three simple but powerful components to what makes a successful trading strategy: edge, risk management, and psychology.

Learning to Trade

I’m not going to tell you that trading is easy. I’ll probably mention several times in each article that it is very hard to profit in liquid markets. But it isn’t impossible to learn how to do so. You can learn. Most successful traders learn from someone else. Practically all professionals have been taught, and almost none invent their own strategies. The big “secret” is that there is no secret. There are only so many things to base buys and sales upon.

Which brings me to my next point. It is quite possible that someone can tell you how to trade. The objection, “if it works, why would they tell anyone?” shows a fundamental misunderstanding of what works in trading. I could literally tell you 95% of what I know with no impact at all on my own profits. Sadly, the large amounts of money sloshing around the trading ecosystem attracts a lot of scam artists. But this doesn’t change my point.

Components of Success

All trading strategies need three things.

- Edge

- Risk management

- Psychology.

All three are important but having an edge is the most critical. Having edge means you can make money. Having the latter two means you can keep it. There are plenty of trading gurus who will tell you it is all about risk management or psychology. If you believe this, you won’t like me. Good risk control with no edge just means you will lose money in a consistent, controlled manner. Having good emotional control with no edge just means you won’t start screaming when you lose money.

Risk control is just a matter of process. It is easy. You don’t get paid for doing easy things.

Emotional control is something any normally functioning adult should have. Again, you don’t get paid for not acting like a toddler.

Finding Edge

Edges can generally be classified as inefficiencies or risk premia. An inefficiency is literally something that shouldn’t be there; a wrinkle that hasn’t been noticed by enough people. These are rare. When you find one, trade it as aggressively as possible because it won’t last. A good place to look for these is when products contain multiple components. For example an ETF might contain embedded options and the value of these might not be accurately reflected in the NAV (Net Asset Value). Another example, would be when a relationship with a sound economic or structural basis has been distorted by temporary trade flows and illiquidity.

A risk premium is just what it sounds like. It is a premium you are being paid to take on someone else’s unwanted risk. Because these are based on people’s natural risk aversion, they can last forever and can form the backbone of your trading strategies. Some examples are the excess return of stocks relative to bonds, the excess return or low grade bonds relative to investment grade and the implied volatility premium; the fact that options are usually overpriced. The most important thing to remember when harvesting risk-premia is that they are risky. The risk might usually be over-priced but this won’t always be the case and when things go wrong they can go wrong very quickly. It is sometimes said that selling options is like picking up pennies in front of a bulldozer. But this doesn’t disqualify the idea as a valid strategy. There are a lot of pennies to be picked up and usually bulldozers can be seen approaching.

Something that generally won’t be of much use is fundamental analysis. First, fundamental valuation is generally relevant at very long time scales. We will be focused more on trades that last days to months. Second, it is extremely unlikely that an opinion based on public information will give an edge. For an edge to exist, your opinion needs to be both correct and different. Such an edge is unlikely to come from reading the WSJ or “The Economist”.

Here is a good rule of thumb: if you can’t convince someone of your edge in a couple of sentences, you probably don’t have an edge at all.

Risk Management

I originally thought the three components of success were largely separate. I now believe that they are very much intertwined. That is, the trade sizing methodology only makes sense in the context of a particular edge. Here is a risk management example.

“Only losers add to losers”

You have probably heard something like the statement above. It is one of those things that the advisor thinks is a timeless pearl of wisdom. It isn’t. My first job was as a high-school janitor, and my boss would regularly say things like, “when you are thirsty there is nothing like a drink”. Murray would have had 100,000 twitter followers in a week.

“Losers add to losers” isn’t even trivially correct like saying that a drink helps with thirst. It is, at best, a gross simplification and, more generally, is just wrong.

The way you scale in and out of a position is dependent on why you did the trade in the first place.

Let’s say you are a trend follower and you got long in a rising market. Your prediction (And let’s be clear for a moment, despite what they say, trend followers do predict. Their prediction is “because the market is going up, it will continue to go up”. Whenever we do a trade we are implicitly predicting that the market will move in the corresponding direction. But after your trade, the market starts to drop and then drop some more. At this point it would be wrong to add to your position. This is because you are wrong. Your prediction was wrong. When you are wrong, you exit and wait for another trade. Trend followers should not add to losers.

But now imagine you are trading something that you expect to reverse its recent move. Maybe it is a spread that has deviated from its usual level and you are betting on reversion. Let’s assume it is trading $90, and you think it is worth $100 so you buy it. You think you have $10 of edge. But now the spread drops to $85. It would be a mistake to get out because now you have more edge. You have lost money but you haven’t been proven wrong (Of course if the spread keeps dropping you may have to re-evaluate your idea of fair value and hence your forecast, but that is a different story).

You shouldn’t exit a trade when you lose money. You should exit when you are wrong. Sometimes being wrong and losing money are correlated and sometimes not. If you understand your broad strategy, you will understand this distinction and know what applies in your case.

There are two lessons here:

- A scaling strategy is entirely dependent on why you are in a trade.

- Don’t look down on people just because they aren’t smart. Murray wasn’t the sharpest tool in the box, but he never claimed to be and he sure knew how to use the tools in his box. He taught me how to rivet and remove a seized nut, but I wouldn’t go to him for trading advice. I hope he is doing OK.

Next time, we will see how psychology is tied to edge and risk.

Jay here: what are your thoughts on finding edge and managing risk and how Euan approaches them? Send me an email and let me know.