– Tim Plaehn, Editor, The Dividend Hunter

![]()

Once when asked about the right time to sell stocks renowned investor Warren Buffett said, “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for 10 years.” By that of course he means he’s not looking for gains today, tomorrow, next month, next year or even next decade.

There are certain stocks that once you put them in your portfolio you’ll never want to sell them. In Buffett’s case the most famous example of this is The Coca-Cola Company.

Buffett began buying Coca-Cola stock in 1988 and by 1995 he had about 100,000 shares. Today he has over 400 million shares.

Along the way he’s collected over 110 dividend payments from Coca-Cola. No one will ever say that Coca-Cola is a high-yield stock but combining the company’s consistency in paying dividends and Buffett’s foresight to hold the stock for nearly 30 years now has enriched him almost beyond imagination.

The next dividend payment from Coca-Cola will be for 41 cents. Multiply that times 400 million and then four times a year and then multiple years and you start to see the power of holding a stock forever.

Forever Stock #1:

12 Dividends

a Year and a 10% yield.

Yielding 10%, and having a twelve-year track record of superior dividend growth, this may just be the best income stock that exists.

Yielding 10%, and having a twelve-year track record of superior dividend growth, this may just be the best income stock that exists.

I regularly review a large number of high yield stocks. I try to dig out the details that separate a high-quality company from one that has the potential to truly whack investor wealth. I often talk about how tremendous value can be found in the dark corners of the stock market, where the investing public doesn’t understand how these undiscovered nuggets of dividend paying companies operate. But sometimes I realize I need to go back and discuss a stock that should be a core holding for almost every stock market investor.

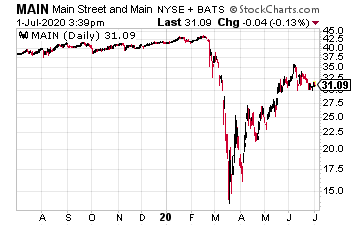

We can all learn some lessons from an overview of how Main Street Capital Corporation (MAIN) operates and pays investors. MAIN is a business development company (BDC) a class of stocks that operate under special laws and tax rules that require them to provide financing to small and mid-size corporations.

There are about 40 publicly traded BDCs, ranging from market caps measured in tens of millions up to Ares Capital Corporation (ARCC) with almost $5 billion of market value.

Overall, I think the BDC space carries a lot of risk, primarily driven by the restrictions the government rules put on the business type, and only about one-tenth of the stocks in the group offer acceptable investment risk. Out of this small subset, Main Street Capital stands well above the rest as a company that has developed a very strong business model inside of the BDC rules.

A BDC can make either debt (loans) or equity (buying shares) investments in its client companies. Most BDCs focus on the debt side, make high-interest rate business loans with cash for BDC dividends coming from the interest rate spread a BDC earns. Main Street Capital makes plenty of loans, but it also puts a significant amount of capital into equity investments. These investments allow MAIN to participate directly in the growth of its client companies. The two-tier model has worked very well for Main Street Capital, with the strongest evidence coming from MAIN’s dividend payment record.

- MAIN has paid uninterrupted monthly dividends since switching from quarterly to monthly in September 2008.

- Starting in 2011, MAIN has been able to increase the monthly dividend every year.

- Since 2012, the company has twice a year paid bonus dividends out of the profits earned from the equity investments. Those special dividends added meaningful value, adding 25% of extra cash income each year on top of the monthly dividends.

- The special dividend was suspended during the COVID-19 crisis. The monthly dividends were not reduced.

(Note: My 36 Month Accelerated Income Plan can show you how to earn over $4,000 a month in extra income even if you have $0 invested today.)

These facts add up to a very high-quality income investment with a 10% yield on the monthly dividends alone. The bonus dividends are just that, an added bonus on top of a great yield. The regular dividend increases will result in a low-teens yield on cost in just a few years. I know of no other stock that can be counted on to pay you 12-plus dividends per year and provide a growing cash income stream. If you do not own any MAIN shares, go buy some.

Main Street Capital teaches us another lesson about income stock investing. You can see I have laid out the case that MAIN is one of the most consistent dividend paying and dividend growing stocks you can buy. Yet over the last year alone there is a 41% difference between the 52-week low and the 52-week high share prices. Stability of business operations and dividend payments does not lead to stability in share prices.

As income-focused investors, we need to always be aware that those big share price swings that occur regularly in the market do not indicate the quality of the income stream we want to earn from an income-focused portfolio. We buy for the income, and share price swings are only viewed as buying opportunities when share prices experience a decline.

Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

Related: This #1 Stock Pays Your Bills FOR LIFE

Forever Stock #2:

The Benchmark Stock

Paying You Every Month

In the entire stock universe, there is a small sub-sector that has been consistently handing out double digit returns to investors regardless of market conditions.

I want to spend some time here discussing a different way to analyze stock investments and an investment strategy that does not involve trying to find stocks that will go up more in value than the market averages.

While I find it very difficult to find stocks that will consistently generate above average capital gains, I find it an easier task to build a portfolio of stocks that will provide me with a cash flow pay raise every quarter.

The strategy I use is to focus my search on finding higher yield stocks with histories and future potential for regular and growing dividend payments. Most stock market analysts, advisors, and investors themselves focus on new products, revenues, earnings per share, and share prices and what effects the latest economic news will have on the individual company metrics. The result is a blizzard of information that is often contradictory and share prices that end up moving up and down together, no matter how good the prospects of an individual company might be.

Recently the “experts” were proven right when the bear market they had been predicting since 2013 finally happened. They were wrong about the cause, since the COVID-19 outbreak was an unforeseen event. Yet most investors had been buying shares on the ride up from the last correction in 2011 and many, many sold out when prices of a large number of stocks dropped in the February to March bear market of 2020. These investors let their worries about share prices push them to sell low, after buying high.

A dividend-focused approach to stock market investing takes out the part where investors have to try to figure out whether share prices are going to go up or down, and which stocks will do better or be able to buck the trend if the market is falling in general. With a dividend-centric investing strategy, you work to find stocks with attractive yields and growing dividends. These stocks will produce a growing cash flow stream and also, in the longer term, generate high share prices. Let’s look at a couple of examples:

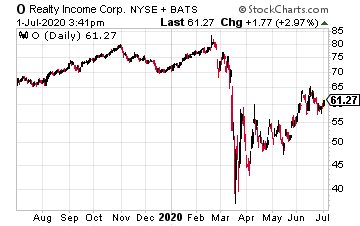

Realty Income Corp (O) is the poster child stock for this cash flow focused investing strategy.

This conservatively managed REIT has increased its dividend rate almost 100 times in the last 25 years, with zero dividend reductions. There have been 90 consecutive quarterly increases or six straight years of quarter over quarter dividend growth. During the last decade, the yield on O has ranged from about 4.5% to around 7.5%. The dividend growth rate has averaged 4.5% per year. The regular dividend payments with steady growth in those dividends have produced an average total return of over 14% per year from Realty Income.

And as a bonus, the company pays monthly dividends.

While Realty Income is an awfully good investment choice, I like to use O as my benchmark and look to find income stocks that can produce a better return than the stock’s current 5% yield combined with 5% annual dividend growth. Using this approach, you can find those stocks where the market has severely mispriced companies that focus on making high and steady cash payouts to investors.

To employ the dividend-focused investment strategy, you need to dig out those companies and stocks with above average yields and histories of steady dividend increases. Study the business operations of each company to understand how the cash flow is earned to pay those growing dividends and make your own evaluation whether the business will continue to support a growing dividend stream. This is a crucial step because many high yield companies do not provide the visibility for future cash flows that will let you sleep at night.

Then, build a diversified portfolio of dividend paying stocks. You will want to own companies from different sectors including finance and equity REITs like O above and business development companies (BDCs) like MAIN. These are the sectors that allow a company to generate steady and growing cash flows to support the dividend stream you want to earn.

The goal is to buy these stocks for the long term, and you will own many of them for years collecting dividends along the way, just as Buffett has done with Coca-Cola.

However, you must be ready to drop those companies that fail to live up to your cash flow forecasts and add new candidates that offer better combinations of yield and dividend growth potential. If you are investing for the growth of an investment account, use the dividend earnings to buy new holdings or to pick up more shares of companies that have fallen out of favor with the market.

With this type of stock market portfolio, you should see your dividend earnings grow every single quarter no matter the market conditions. That’s a great feeling and one that can help you sleep at night.

The #1 Stock to Retire on (Over $1 million in income up for grabs)

Retiring well doesn’t have to be complicated. Forget “buy and hold” investments… forget options… forget Bitcoin…

One stock is all you need. And it’s not a blue chip stock like Wal-Mart. Over your entire retirement, you should see over $1 million hit your bank account thanks to this stock.

If you’re serious about a retirement with less financial worries, this #1 stock is your secret weapon. The first payout of the $1 million is days away.

Click here before you miss the window.

Positions: Long MAIN