Announcing a new way to learn STEP-BY-STEP how to trade options for beginners now open today with limited spots available…

“Extra Cash” Options Masterclass

Go Behind the Scenes with Top Trader Jay Soloff & Learn How to Place a Winning Trade Every 24 Days…

Even On a Shoestring Budget!

Dear Reader,

If you have $100 collecting dust…

You can potentially turn that into $1,421 or more placing a simple trade every 24 days on average.

Now I know it may sound like BS…

But hang with me for just a moment because I’m showing 8,500 folks how to do this right now…

Including trades like:

- CLDR – in at $0.96, out at $3.45 over about two months

- CCJ – up 110% in 22 days

- EGO – in at $50.67, out at $199.33 in under a month

And one of our best trades came recently…

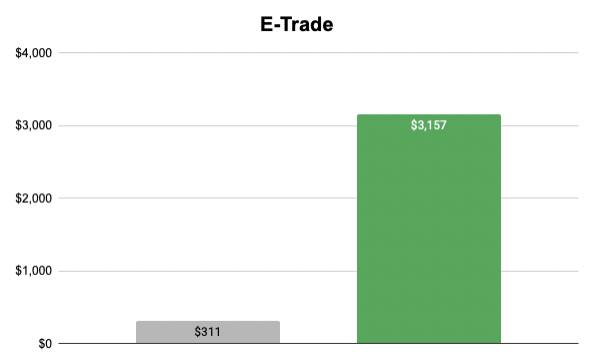

- ETFC – in for $311, out less than a week later for $3,157

Now, these results are based on when I made my buy and sell recommendations – not on the actual trading accounts of my readers, which I have no access to.

Of course, actual trading results may have been different.

But here’s the thing. Imagine if you turned $311 into $3,157 in under a week. That’s plenty to enjoy a nice vacation.

Or you could simply give your savings a boost.

But look, I’m not a fan of “get rich quick” hype.

Of course every trade won’t put three grand in your pocket on a small investment…

Options trading always carries risk.

However…

You can reduce it, and still have the chance at big winners, by only placing a certain type of trade.

If you have money from garage sales…

Bills tucked away in a sock drawer…

Or nickels and quarters overflowing in a jar…

I’ll show you how to place simple options trades for the chance at incredible paydays without betting the farm

It’s the secret to turning “spare change” into extra cash — and having fun in the process.

And it’s what 99% of options “gurus” and so-called “experts” are not teaching. That’s why I created this brand new training for you to access today.

All you need is just…

- $100 or two to learn with

- And an hour of free time per week

But, before I tell you all about it.

Let me clear the air about trading options…

Because if these trades are so much cheaper than buying & selling regular stocks… and can be more profitable… you’d be right for thinking…

Why isn’t everyone placing these trades!?

Well, here’s the deal:

After trading for 20 years I’ve discovered that most folks avoid options for the wrong reasons.

You may think trading options is too risky… complicated… or expensive.

But the truth is this:

Yes you can place risky options trades using difficult calculations and bet $1,000s each time.

Or…

You can place the type of trade I’ll show you in this “Extra Cash” Masterclass that’s simple & cheap.

In fact, Investopedia states that…

“[Options] can offer lower-cost ways to go long or short the market with limited downside risk.”

— Investopedia

Nasdaq claims you can…

“Save Money and Stress By Trading [These] Instead of Stocks”

— Nasdaq

And theBalance writes…

“You can use [these trades] to buy shares of stock without paying the market prices.”

— theBalance

Even one of Europe’s largest internationally recognized research centers concluded…

“[These trades] can be done very easily… without any additional costs needed.”

— Research Paper

And now for the first-time ever…

I’ve created an easy step-by-step Masterclass you can follow to learn how to trade the right way your north star will be: low-risk, high-reward.

The catch?

Only 100 people are allowed to join today.

I’ll explain why that’s the case in just a moment, but first you may be wondering who I am…And why I’m not like other so-called “gurus” & “experts” you’ve heard from before…

— Meet Your Instructor —

Jay Soloff Teaches

Options for Beginners

Hi I’m Jay Soloff.

In 2013 I quit my “American Dream” job trading on the largest options exchange in the world (CBOE) to start trading part-time on my own in Arizona.

Eight years later I can say it was a great decision.

Today I make more money than I ever did trading full-time in Chicago, I work on my own schedule…

And now as the Lead Options Expert here at Investor’s Alley I help over 8,500 folks trade their way to greater financial independence.

Instead of working for billion-dollar institutions…

Playing the “invisible hand” as a professional market maker in Chicago…

I now spend my time trading on my own, and helping regular folks do the same.

Hear from my readers in their own words:

“Jay, just wanted to thank you for the great program… I have been a biology teacher for the last 29 years and your educational system for learning about options is excellent.”

— Rich T.

“Jay, just wanted to thank you… Learned so much from your trades, the perfect explanations, and examples. I have executed some of your trades and also developed the tools and skills to make my own… Your educational system for learning about options is excellent.”

— Rick

“[Jay] gives you simple, easy, no-brainer trades and I recommend anyone to follow him.”

— Paul M.

“You are the real deal, Jay!”

— Jake B.

And speaking from personal experience…

Trading options gave me the freedom to escape my grueling 9-to-5

Now I spend uninterrupted, quality time with my wife and two kids at home and enjoy the outdoors:

The view from my home in Arizona.

No waiting for the 15th and 1st to roll around… or working overtime to make ends meet…

I just place these cheap & easy options trades and get on with my life.

And when you join the “Extra Cash” Masterclass, I’ll show you how to place these same trades every 24 days on average with as little as $100.

For example, look at this string of winners:

- VXX = 91% on May 2nd

- AMD = 38% on May 2nd (again)

- SLV = 198% on June 4th

- FXE = 29% on August 13th

- FEYE = 60% on September 10th

- SYNA = 127% on October 22nd

- NEM = 148% on November 5th

- VRTV = 213% on December 3rd

- DISH = 109% on January 14th

- FAST = 233% on January 28th

- AMAT = 39% on February 5th

- ETFC = 1,421% on February 11th

And as you’ll soon see, sometimes we miss out or lose when the market doesn’t go our way.

[Now “gains” and “losses” are based on when I made buy and sell recommendations – not on customers’ trading accounts which I don’t see. Actual trading results may vary.]

But here’s the thing…

In as little as a few minutes every day, and with no prior trading experience under your belt…

You’ll simply place the same types of trade over and over, and set yourself up for some nice profits.

No, the profits won’t always be “life-changing” but you could get a headstart on retirement, pay down debts, or pad your savings with each trade.

And most importantly…

You don’t have to pull from your long-term investment accounts!

- Don’t touch your 401(k)

- Leave your IRA alone

- And don’t use your retirement savings!

These trades you’ll simply use “spare change.”

Less money at play means less risk.

And that’s why I’m going to show you how you can start placing these “spare change” trades yourself.

You’ll watch, step-by-step…

How to start placing these simple & cheap options trades for fun, and enjoy nice profits too.

I’ve never given behind the scenes access quite like this before…

This training is the first of its kind, you’re going to truly see how the sausage is made.

Stick with me for just a minute and I’ll show you how to get a headstart right now.

Because in this “Extra Cash” Masterclass I’ve demystified options once and for all.

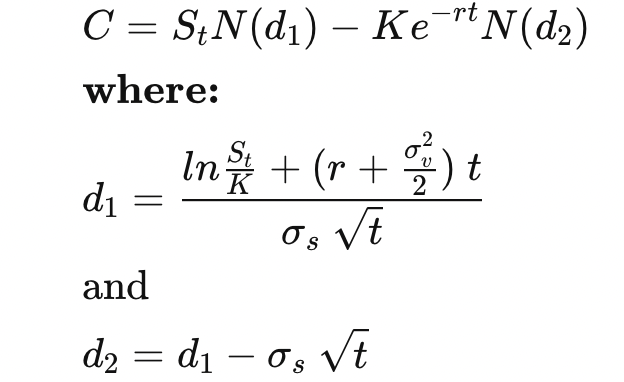

Taking concepts like Delta, Gamma, Theta, Rho…

And complicated pricing equations, like this one:

Source: Investopedia

Into a step-by-step beginner-friendly trading training I’m inviting you to enroll in today.

More on that in just a moment, I promise.

First I want to explain how it all works so that we’re on the same page:

Is it actually possible to

trade options on the cheap…

and make big profits?

Yes, but…

I want to be upfront with you: I’m not Nostradamus. No trader is right 100% of the time.

So even though you’ll see how to win more than average, and cut losses as soon as possible…

Sometimes even that isn’t enough.

Here are some examples of that in action:

- 55% loss on Virtu Financial

- 83% loss on Avaya Holdings

- 46% loss on Junior Silver Miners

- 42% loss Archer-Daniels-Midland

- 53% loss on Macy’s

But I’m sure you’ll agree, these losses are minor compared to the upside.

You’ve got to take at least some risk if you want to make outsized gains.

But with this method, you’ll only be risking “spare change”, as little as $100 in many cases.

It’s all because we follow a north star…

Trade options that are low-risk, high-reward. The only way this is possible is by learning how to trade cheap options that give you leverage.

To explain how it works, first I need to begin…

Exposing the media’s big lie about trading options

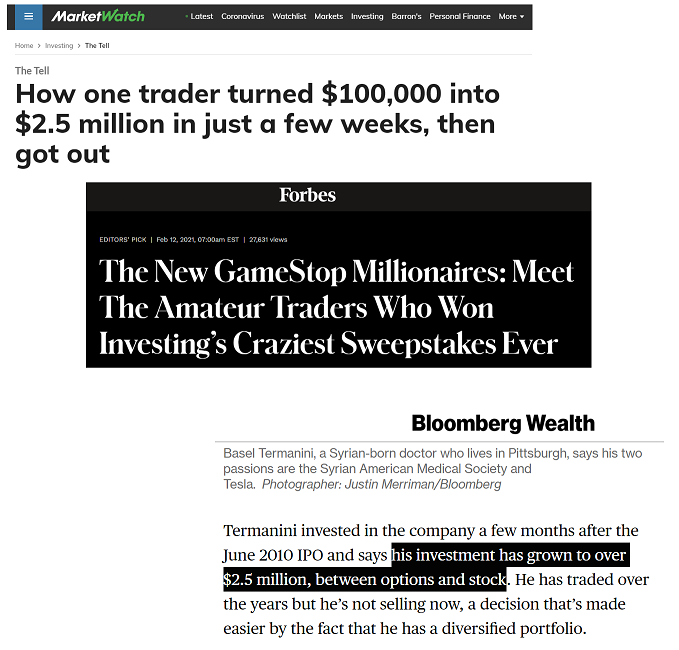

You can probably guess what it is by reading the headlines below:

You see, when the mainstream media talks about options it’s usually with only one of two angles:

Either it’s a story about someone…

- Losing $100,000s on a “Hail Mary” trade…

- Or making $100,000s on a “Hail Mary” trade.

These stories are just unrealistic.

And yet, because most folks only read the headlines…

Options are made to look like risky, one-in-a-million bets, that are no better than buying a pound of scratch-offs…

Or that you need $100,000s to start trading, and that it’s a hobby reserved for the rich.

Yet here’s the plain truth…

All options are not made equal.

Yes, you can lose big by betting your retirement on an outrageous trade.

Or, as you’re about to see proof of…

You can follow my tried-and-true approach for buying cheap options that give you high-leverage.

The difference is night and day.

Let’s look at a trade we placed last February.

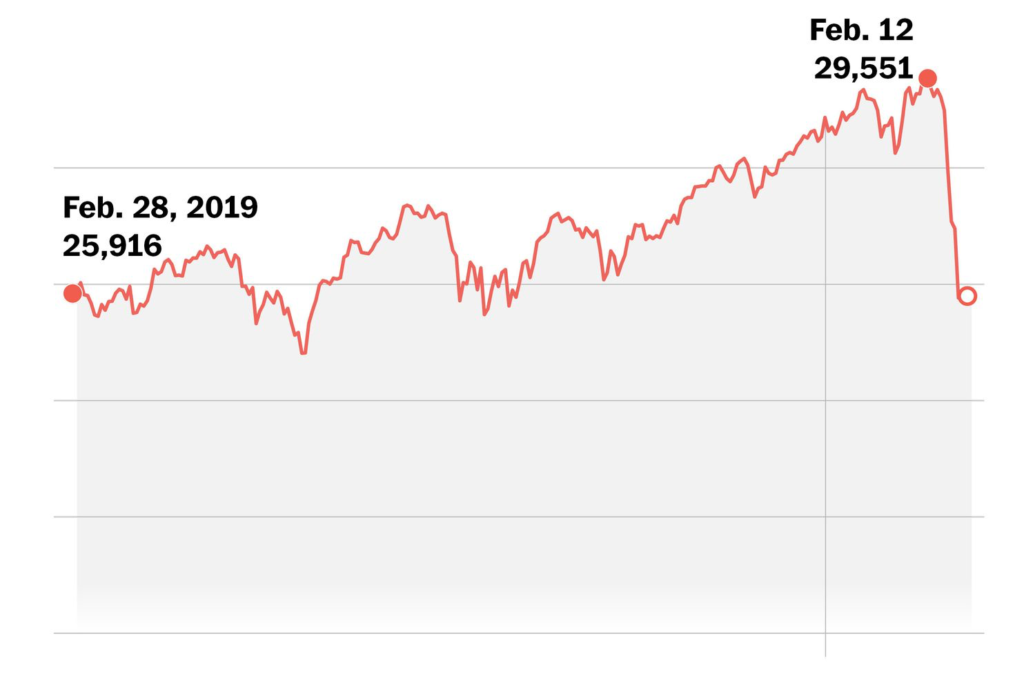

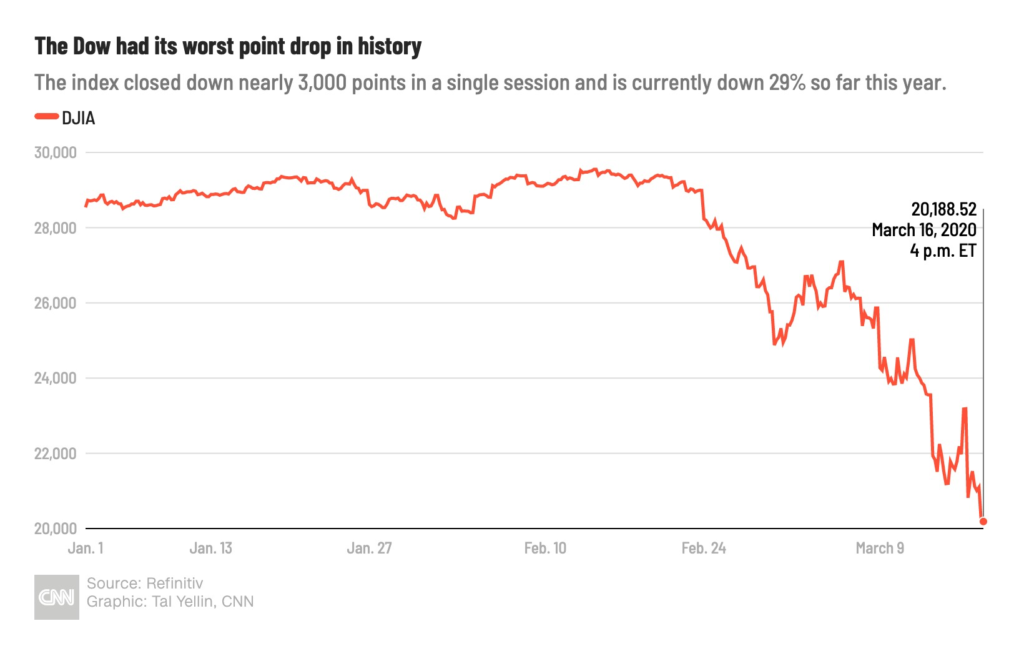

As you remember, COVID-19 was just picking up steam across America… and by February 12th, the market was in a landslide…

Source: The Washington Post

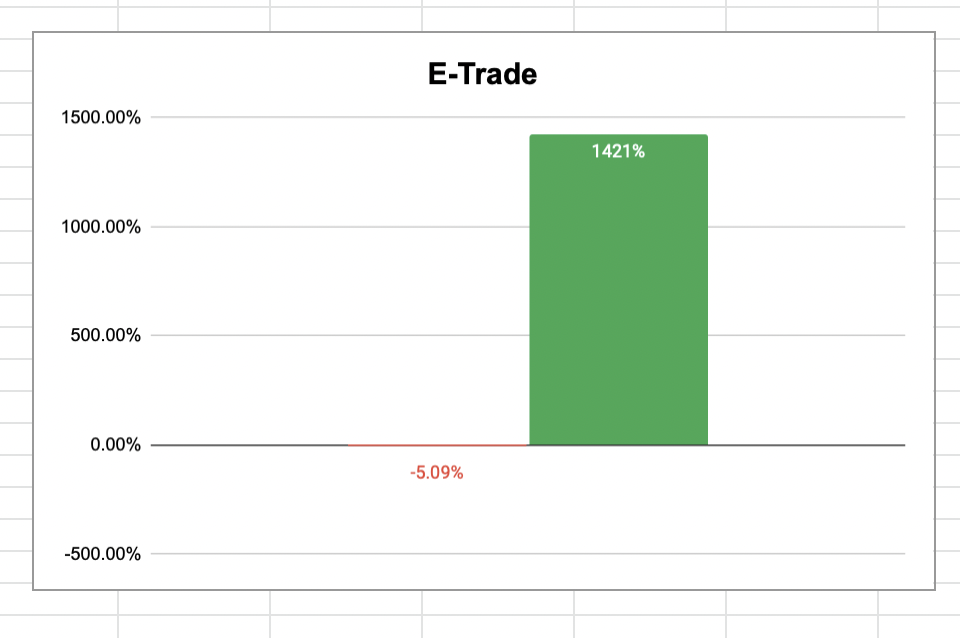

Yet that’s precisely when my readers and I bought IN and placed an options trade on E-Trade (ETFC).

Was it foolish?

Well, you be the judge:

Fast forward a month to March 2020… and the market was still devouring itself…

Source: CNN

Most investors were caught off guard and suffered major losses… maybe that included you.

And yet on March 13th…

I told my readers to close their trade on E-Trade for a whopping 1,421% gain in the midst of the panic.

But that’s not all…

Had you bought regular shares of E-Trade at the same time, instead of trading their options…

You’d be down over 5% while we made money.

With a gain that big…

You could’ve tossed in just a few hundred dollars…

Maybe $500…

Or if you had the money to spare at the time, let’s say $2,000…

And just a month later you could have cashed out with $28,420!

How’s that for a stimulus check?

Now again, I should remind you that all of our trades won’t be grand slams like this.

Not every trade works out, and certainly not to a 1,421% gain like this one did.

That’s why I say you should only use your “spare change” on this method. That way, if the trade works out, great. If not, no big deal.

This 1,421% gain in E-Trade is just an example to show you what IS possible with my method.

Because here’s the real kicker:

A regular share of E-Trade cost $43.92 a pop.

But with the unique way options work… and since we’re only interested in buying cheap options…

You could’ve bought an option that controlled 100 shares for just $71.

You couldn’t even afford 2 regular shares for that little money!

I’ll explain how this works in just a moment…

Why it’s possible to make money trading options even when stocks are going down…

And how to join the Masterclass where you’ll get my entire step-by-step trading method, including…

- How to pick “goldilocks” trades that are affordable and ready to skyrocket for incredible gains

- The #1 quickest way to reduce your risk exposure

- Secrets learned from the Chicago Board of Options Exchange (CBOE) trading floor

And you’ll be treated to…

- 4 training webinars

- Exclusive member portal access

- Guided beginner-friendly action steps

Plus much, much more!

It doesn’t matter if you’ve never opened a brokerage account in your life… or don’t have the faintest idea what you’re doing.

You’ll go from novice to trading in less than 2 weeks.

I’ll show you everything you need to know in a second.

But first, let me explain why I believe…

Why this style of trading is low-risk, high-reward

It’s simple…

By controlling 100 shares for less than the price of 2… you’re placing a high-leverage investment.

For not a lot of money… you can make a LOT back.

Because you’re only risking what you put in.

Nothing more. Nothing less.

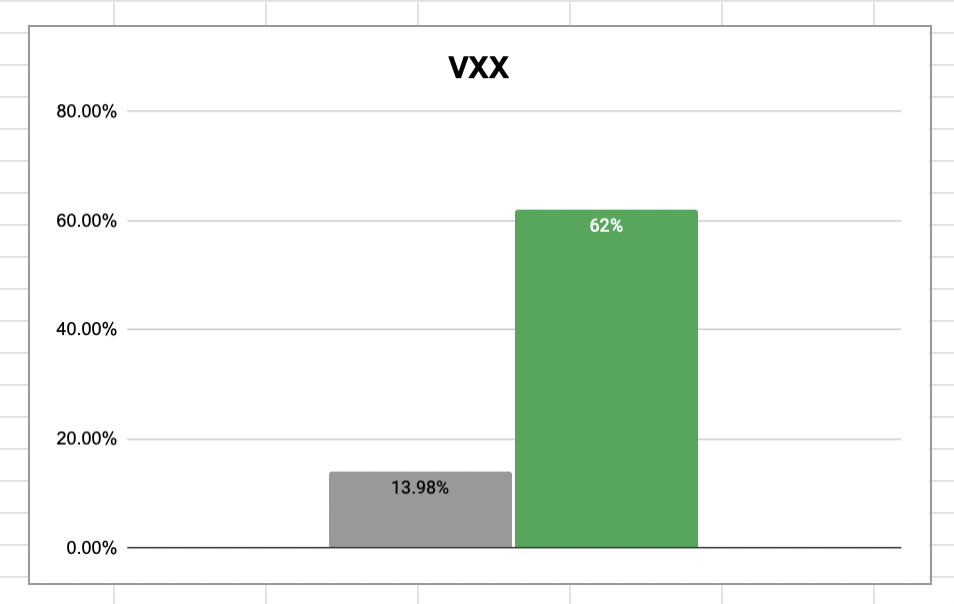

Just take another one of our best-of-the-best trades from a while back on VXX.

The cost of 1 regular share? $106.76.

The cost to control 100 shares with options? $112.

The choice was obvious.

I alerted my readers to find some extra cash to put in this trade and we waited… but not long!

Because less than 30 days later…

Barclays stock was up 13.98%.

Owning a single share would’ve put just $15 extra in your pocket. Not very impressive.

But our options trade on the other hand…

Now, it should be noted that this is based on the timing of my recommendations…

Your experience may have been different and there is no guarantee future trades will be like this.

But in the best case scenario had you invested some unused cash, let’s say $250, into this trade…

Your $250 would now be worth over $400.

Or if you had more to invest, let’s say $2,500, you would pocket an extra $1,500 in less than 30 days.

Finding the options that are cheap enough to risk only some “spare change…”

But leveraged enough to be able to turn that “spare change” into big profits.

But before we get too ahead of ourselves…

I’m sure you’d just like to know how this is even possible…

“How does buying options make this possible?” you may ask.

So allow me to answer that for you now.

Here’s how to think like a professional trader

Let’s say you’re in the market for a new family car.

After hunting for deals you finally find what you’re looking for that meets your family’s needs at a great price.

The only problem?

You have to wait 60 days until you can afford it.

But you know the car is a rare commodity that lots of folks would like to get their hands on…

So you suspect in 60 days the car will be long gone.

Enter: the options contract.

You ask the seller if you can pay him $1,000 for him to take the car listing down today…

And give you the right to buy the car from him in 60 days for his asking price of $35,000.

He agrees.

What you just did is buy an option on that car.

It’s that simple.

To demonstrate how options work, imagine these two scenarios…

Scenario #1: After 60 days, your money comes through and you’re able to buy the car after all.

You pay the $35,000 like you agreed, in addition to the $1,000 you already paid, and now you have the car you wanted.

Or…

Scenario #2: Your money doesn’t come through – or you just change your mind about wanting the car.

That means you’re only out the $1,000 you placed upfront and the dealer just lost some time.

Same with buying stock options.

You’re paying a set premium…

For the right, not the obligation, to buy or sell a stock at a predetermined price.

That’s how…

You can make $1,000s using just your “spare change”

Let’s go back to that car we just talked about.

Imagine if that car, which you have a right to buy for just $35,000…

Was suddenly worth twice that. You could buy it from the dealer for the price you agreed on…

And immediately sell for a profit!

This works in reverse too.

With put options, you can make thousands of dollars even as the markets are tanking.

Think of it as “buying insurance” on stocks you don’t even own…

And collecting the “insurance payout” when those stocks go down.

Wouldn’t you like this safety cushion now more than ever?

You saw my example earlier with E-Trade. And there’s plenty more.

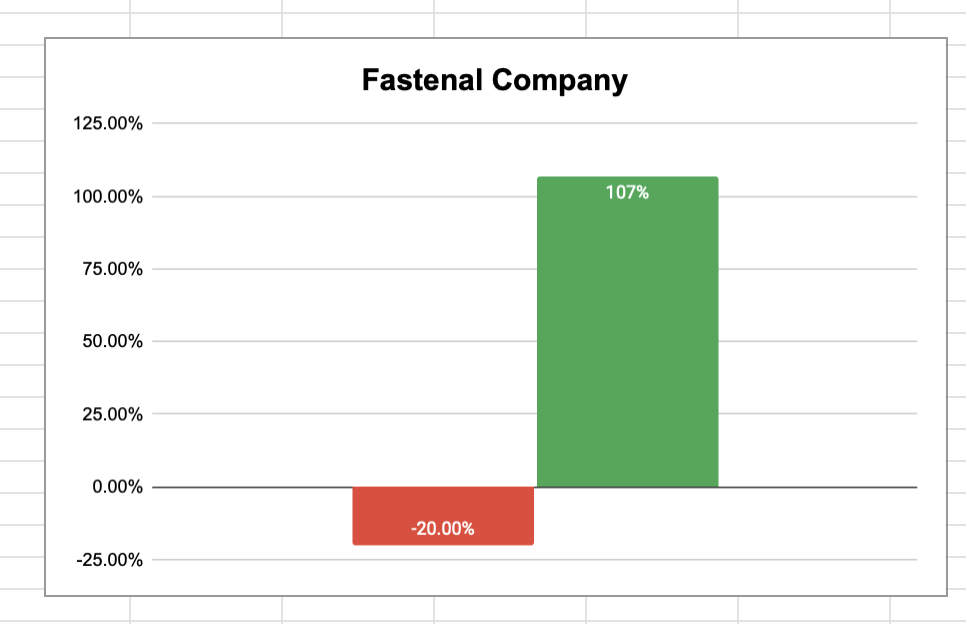

Consider a similar trade we placed on Fastenal Co. (FAST) just weeks prior to the COVID crash…

At the time, the virus was just a weird story coming out of China…

No one knew how bad it would soon get.

But spotting the volatility, I noticed an excellent opportunity — so on January 28th, I alerted my readers:

“For our trade this week, I decided to go with a stock that is vulnerable to further declines. We are going to buy a put option on Fastenal (FAST) for our portfolio.” — 01/28/2020

As you know, days later disaster struck in the market and prices began tanking, just as we predicted.

While the market fell, our trade climbed higher…

By March we locked in a solid 107% gain.

And had you bought regular shares of the company?

You’d be down nearly 20% in the same time frame:

In other words…

$500 buying options would’ve turned into $1,035.

$500 buying regular shares would’ve lost you $100.

The difference between a fun evening out for the whole family… or stress-filled days in the red.

And here’s the real kicker…

Since we’re only dealing with affordable contracts that usually control 100 shares for less than $500…

You can join in on nearly every trade I spot.

That means you’ll get trade-after-trade of practice, getting better each time, and set yourself up for profits.

You’ll have razor focus and a firm understanding of how to trade — enough to make accurate predictions on your own — so you can trade profitably in your free time!

This has been the system I’ve preached to my readers for years now, and as you’ve seen, it’s worked.

Not always. Nothing in the markets work 100% of the time.

But our win-rate is above average, and we generally cut our losers before they get too big.

That’s how we made money during the 2020 crash while others were panicking

And in the time before and since, we’ve enjoyed some amazing wins.

For example in June it was the same story.

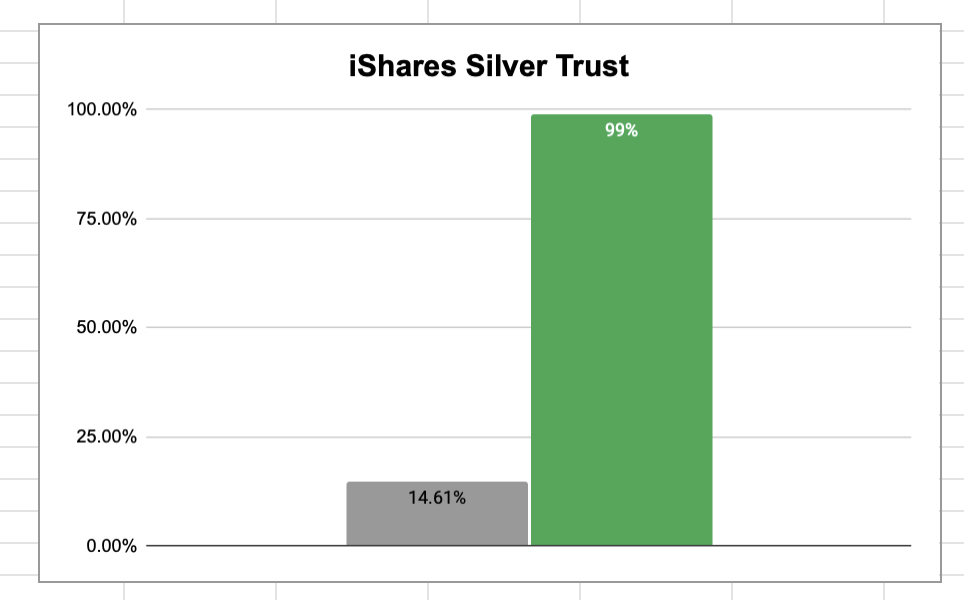

I flagged down a trade on iShares Silver Trust (SLV) for my readers.

It had all the hallmarks of a winning trade, most importantly…

- An entry price of just $52 per option controlling 100 shares

(1 regular share at the time cost $13.89)

Not to mention, plenty of volatility to help us gain some leverage.

So my readers and I got in on the play and waited.

Soon it began climbing higher… and higher…

Just a few months later I told everyone to “EXIT” and be proud of the 99% gain we had just made!

(Especially since buying regular shares would’ve resulted in only a meager 14.61% gain)!

Once again, it was the difference between a $2,000 trade turning into $3,980 with options…

Orr just $2,292 with shares…

I know which one I’d pick.

Not to mention that the S&P 500’s average yearly return is just over 5%.

Meanwhile we bagged a 99% gain in just a few short months!

It would take nearly 10 years of investing in the S&P 500 to match our quick options gain

Now you see why buying options can be so rewarding.

And there’s a step-by-step process we follow before every trade we make. We’re not trading blind just hoping things go up.

And I want you to use this process, too.

That’s why I’m so excited to invite you to enroll in my 14-Day Options Masterclass where you’ll see exactly what to do step-by-step…

Giving you an immediate advantage over other folks who try and figure it all out on their own.

You’ll see how to spot and quickly trade options that cost as little as $50 to control 100 shares…

Know when it’s the right time to “bet” that a particular trade will go up or down…

You’ll even hear me spill all the secrets I gained working on the world’s largest options exchange!

And remember…

You can place the same trade over and over again

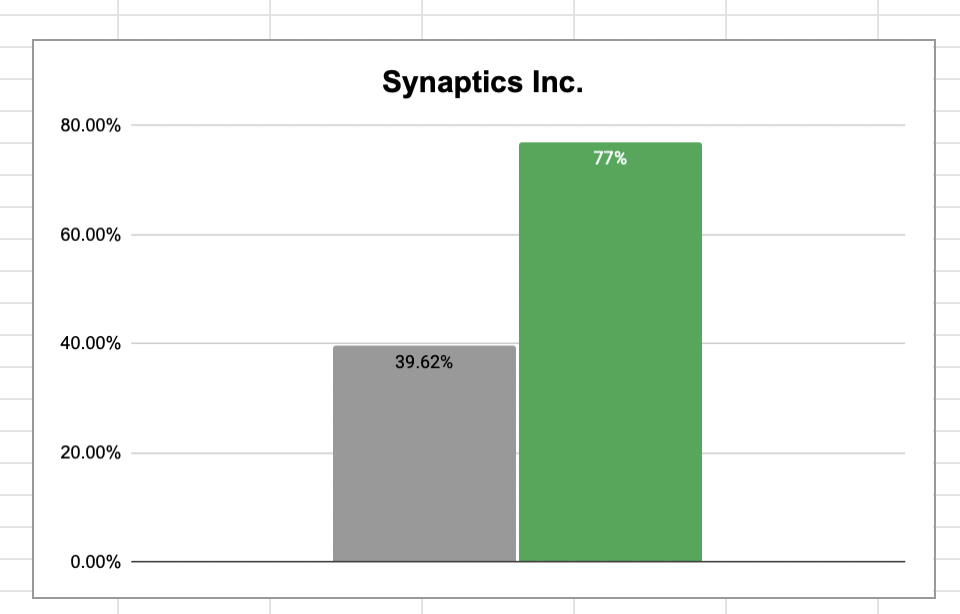

For example, later in October…

That’s when we spotted a great option to buy on Synaptics Inc. (SYNA) and bought it at just $145 to control 100 shares…

At the time, that $145 would’ve afforded you only 3 regular shares…

And like clockwork, just a few weeks later in November we sold for a phenomenal 77% gain…

That’s more than double what buyers of the regular stock enjoyed!

Unless you’re willing to wait years, weather countless bull/bear cycles…

And invest with large sums of money…

You won’t get these results unless you trade options.

But I know how difficult it can be when you’re just starting out.

On your own, it could take years of trial-and-error to figure things out — I mean, just look at what the trading dashboard looks like on Fidelity!

As a beginner, good luck.

But there’s great news:

Because enrollment for my 14-Day Options Masterclass is now open…

And you’re invited!

Together across FOUR training presentations and two weeks packed with content, you’ll get a crash course on how to trade successfully.

In the 1st training session…

- You’ll start trading right away with a step-by-step walkthrough of how to get your account approved for options.

In your 2nd training session…

- You’ll discover the secrets that make options trading more powerful than regular stocks.

- Exactly how call options and put options work

- You’ll also get a full crash course on how professional traders stay ahead of the game – by closely managing their risk the easy way.

In session #3….

- You’ll see how to find “goldilocks” options with high potential (including a quick way of doing this that 99% of traders don’t know about).

- And how to tell whether an option is just the right kind of cheap before you hit ‘buy.’

And finally, in your 4th training session you’ll get…

- A detailed explanation of how to review your trades – and find new profit opportunities

- Plus you’ll learn advanced strategies with the power to radically increase your profits (even when the market is down – or sideways!)

All in all the goal of this entire experience is to make it interactive.

You’ll get specific action steps to take between sessions to accelerate your trading and learning, And I’ll check up on you with emails.

I’ll be your “coach” every step of the way. Your success won’t be left to chance. I guarantee it.

In just a moment you’ll see how to sign up before enrollment closes… and take advantage of a special one-time bonus and guarantee.

Because by now, I hope you see the benefit of buying these cheap options…

How you can take a small amount, even as little as $100 in some cases, and watch it balloon into nice profits and extra cash…

Trying to learn how things work on your own can be a recipe for frustration or big losses.

That’s why I’m so excited to have you join my Options Masterclass and guide you step-by-step.

And this couldn’t have come at a better time!

2021 continues to be an incredible year for trading these cheap options

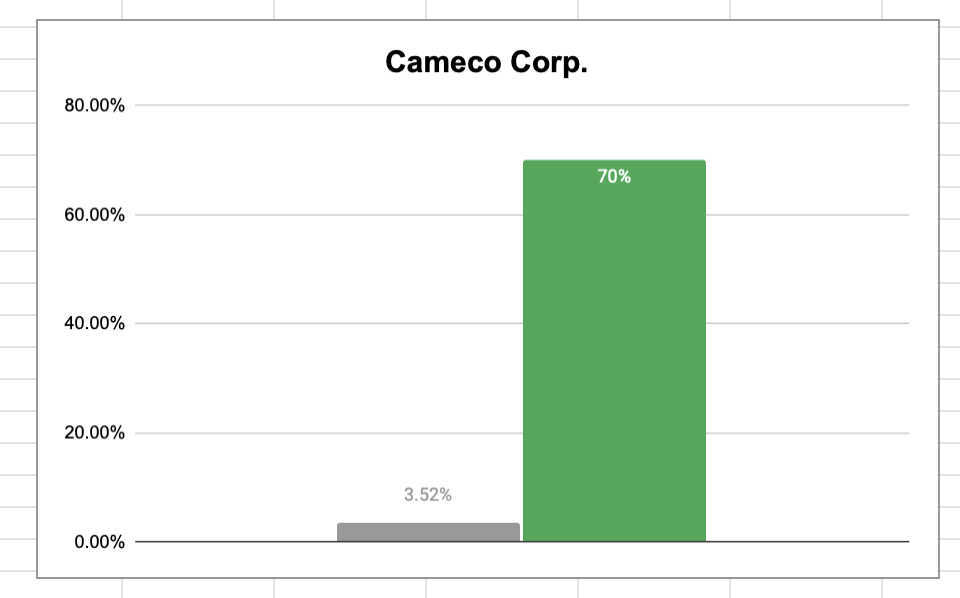

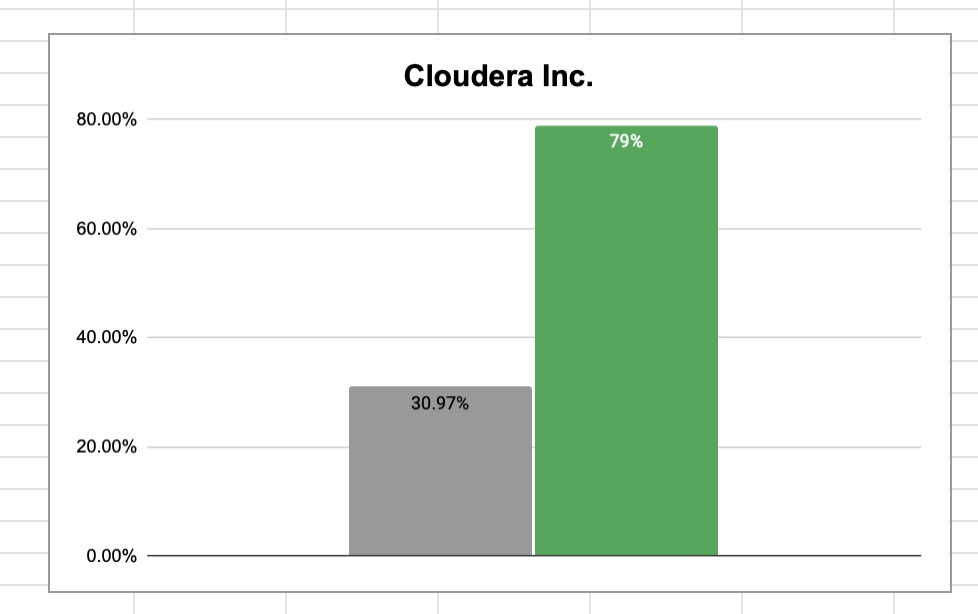

Consider this…

In May of this year we placed two simple trades.

One, on Cameco Corp. (CCJ) went on to return a nice 70% in just over a month, compared to just 3.52% with regular shares!

But here’s where it really got exciting…

Because the second trade, on Cloudera Inc. (CLDR), also returned a great 79% in the same timeframe. Over double the gain compared to regular shares!

Again, these two trades were initiated on the same day.

Same day you’re in. Same day you’re out.

If you invested $500 into one trade, you’d cash out with $850…

And if you invested another $500 in the other trade at the same time, you’d cash out with $895!

Not bad, right?

And consider that happened mere months ago and there are so many more opportunities on the horizon!

But let me be clear…

I’m not suggesting you go “all-in” on options…

Only use whatever “spare change” you have. Because not every trade will be a winner.

By all means continue investing in steady gainers like index funds over the long term for your retirement…

What I’m saying is this…

You won’t find an easier, cheaper way to turn small sums of money into big wins than by trading options… Guaranteed.

And best of all?

What you’ve seen is just scratching the surface

Every month without fail for the last few years I’ve flagged down a cheap options trade…

And as you’ve seen, considering each trade can be had for usually no more than $100, the reward potential is huge…

Since 2020 we’ve enjoyed 35 profitable trades.

That’s 35 chances to turn your extra cash into something much bigger — in just a month or two on average.

Plus with the uncertainty in the market right now…

I see plenty of more profit opportunities in the months to come.

Remember, with options you can make money whichever way the wind is blowing in the market.

That’s why if you only have, or are only willing, to part with as little as a few hundred dollars…

You could still set yourself up for big profits.

Especially now:

If 2020 was a record high for volatility…

And 2021 saw crazy stories like GameStop, AMC, and other “meme” stocks shoot sky high out of nowhere…

It looks like things won’t be calming down anytime soon.

Which is good for you and me!

Are you starting to see the possibilities?

Year-after-year we continue to pile on big wins, like…

- VXX = 91% on May 2nd

- AMD = 38% on May 2nd (again)

- SLV = 198% on June 4th

- FXE = 29% on August 13th

- FEYE = 60% on September 10th

- SYNA = 127% on October 22nd

- NEM = 148% on November 5th

- VRTV = 213% on December 3rd

- DISH = 109% on January 14th

- FAST = 233% on January 28th

- AMAT = 39% on February 5th

- ETFC = 1,421% on February 11th

- AVYA = 260% on March 10th

- UCTT = 107% on April 7th

- NRZ = 63% on May 4th

- IRM = 88% on May 4th (again)

- THC = 36% on June 16th

- NIB = 163% on July 28th

- AMKR = 94% on September 21st

- DAN = 120% on October 5th

- BDN = 125% on October 20th

- TWTR = 106% on November 3rd

- INTC = 61% on November 17th

- VIRT = 116% on December 1st

- AVT = 94% on December 15th

- BB = 115% on January 12th

- XRX = 52% on February 17th

- CCJ = 102% on February 22nd

We had plenty of losing trades along the way, too.

But these winners goes to show you what’s possible with these trades.

Because I believe that…

We’re in the middle of

“The Golden Age of Trading”

and now you can join in!

Last year 260,500 new trading accounts were opened with E-Trade in a single month.

That’s more than any full year on record.

It’s great that more folks than ever want to learn how to trade, and I’m happy you’re one of them.

You’ve just witnessed the REAL benefits to buying simple, cheap options with cash you may have around your house.

That old appliance, set of golf clubs, or tools collecting dust can all be sold — and with that cash you can start trading.

Who knows, you could have an extra $500 lying around.

If you put that $500 into a trade like FAST I showed you earlier, you would’ve doubled your money.

And that’s just scratching the surface…

Right now I have several trades on my watchlist, each with the potential to double your money or more in the weeks and months to come…

And I’ve included all the details on these picks and how to make them, all as part of the “Extra Cash” Options Masterclass.

Just like that! You’ll have recommended trades you can “copy-paste” into your options account.

Easy.

Here’s your formal invite…

Your invitation to the 14-Day “Extra Cash” Options Masterclass

An interactive experience where you see step-by-step “how the sausage is made…”

We’ll start from square 1, getting your account approved to trade options.

From there you’ll be guided through the behind-the-scenes of my own trading account.

You’ll see firsthand all the secrets I picked up on from my time on the Chicago Board of Options Exchange…

And you can apply these same secrets to your account and give yourself an immediate head start.

And that’s only the start…

This experience is unlike anything I’ve seen in my over 20 year career as a professional trader.

All in all, you’ll enjoy…

- FOUR video trainings – This is where I’ll show you some trades, guide you how to become an options trader yourself, and get you started placing your own trades. All uploaded to a private portal for you to watch.

- Frequently asked questions – You’ll get answers to my most frequently asked questions about options trading. No doubt if you’re a beginner you have these questions on your mind too, here I’ll give you ultimate clarity.

- Guided action steps – I’ll be with you every step of the way – showing how to get your account approved for options trading, trading pitfalls to avoid, what to look for when buying options, and more!

On day 1 you could join without knowing the first thing about trading options…

Yet by day 14 you’ll feel confident you could place a trade and see profits in less than a month.

Here’s what to expect:

- Session 1: We’ll get right to it by examining a handful of real option trades the way professional traders do. You’ll learn what makes these popular trades good, bad, and ugly – and how to get your account set up so you can place the profitable ones yourself.

- Session 2: You’ll discover the secret tricks to making sure your trades have the highest profit potential at the lowest risk – and how you can manage your risk the easy way.

- Session 3: This session is very exciting. Here you’ll get a complete trading walkthrough. From finding the trade inside your account to navigating the buy menu, you’ll be ready to place your first trade.

- Session 4: In the final training session we’ll recap your progress made thus far and go over what we covered. Then to close out the Masterclass, I’ll reveal several advanced strategies that can help you earn more money, faster, with even less risk.

The skills you’ll learn will go a long way…

You’ll learn secrets like…

- How to know if a stock is mispriced, and ripe for a profitable trade, in as little as 5 minutes

- If the market tanks tomorrow you can stay safe by placing this “unorthodox” options trade

- The real difference between calls and puts

- Even how to make money when you click ‘buy’ (not when you click ‘sell’)

And much, much more.

You’re getting four chances to learn directly from me in a Masterclass environment. That you can access right now and watch anytime.

That’s why only 100 people are allowed to join today. Otherwise, I just couldn’t give each person the right level of attention.

As for the price of all of this, look…

If you approached me today and asked for 1-on-1 coaching to learn how to trade options, it would cost in the ballpark of $300/hour.

And that’s why this “Extra Cash” Options Masterclass is unlike anything I’ve ever offered…

Because in total you’re getting over FOUR hours of my very best training…

And you’ll be learning the exact same things I’d teach you on a private 1-on-1 coaching call…

4 hours x $300/hour = $1,200 value.

$1,200 is what this training is worth.

But you won’t pay anywhere near that.

I’ve made the price far lower to teach as many people as I can how to start trading options.

Before I reveal how much you’re saving…

First, I have a little surprise for you.

Because your enrollment today comes with an incredible bonus at no extra charge…

A bonus that’s yours for a full year:

Free Enrollment Bonus:

1-Year Of Options Floor Trader PRO

This Masterclass will take you from A-to-Z as an options trader in just 14 days.

From never opening a trading account…

To knowing the most important terminology…

Trading secrets taken from the Chicago Board of Options Exchange…

But since my mission is to help as many people as I can learn the wonderful skill of options trading…

The last thing I want is to say goodbye to you after only 14 days.

Like learning a language…

Becoming a confident options trader requires immersion day-after-day, month-after-month, from “native speakers…”

That’s why…

I’m including a full ONE-YEAR subscription to my options trading newsletter, Options Floor Trader PRO, completely free-of-charge.

Options Floor Trader PRO is packed with…

- TWO Options Trades Per Month – you’ve seen the potential of these trades. One could 15x your money… another could 2x in a matter of days. And now you don’t have to worry about finding the right one because I’ll hand-deliver them to you twice each month. And remember… these trades can be entered for as little as $50 a pop to control 100 shares. Which means, with a little “spare change,” you can take part in nearly every recommendation. Given our win rate… and speed at cutting losses… who’s to say you won’t be up $500… $1,000… even $5,000 by New Years?

- Detailed Educational Write-Ups on Each Trade – In the Masterclass you’ll get a headstart on everything you need to know about options trading. But in these monthly newsletters, you’ll add onto your foundation with up-to-date market commentary. I’ll touch on our recent trades, what I see on the horizon, and general tips & tricks you can chew on and apply to your portfolio.

Normally a full year of access to Options Floor Trader Pro costs $199.

And today, it’s yours, included free-of-charge with the Options Masterclass!

But only if you join now.

Here’s how…

Here’s everything that’s included when you join today

- Options Masterclass Access (Value: $1,200)

Get access to 4 interactive training webinars.

Learn my highly lucrative, low risk method for trading cheap options. Everything from opening your account, to placing your first trade, to making a safe landing – recorded for you to access anytime.

Each training session is paired with guided emails and action steps. Build on the lessons learned from the previous sessions and prepare to absorb the next lessons.

When you sign up today you’ll get the opportunity to access the recordings whenever you want.

- One Full Year of Options Floor Trader PRO (Value: $199)

The premium newsletter read by over 8,500 smart traders is yours for a full year… at no extra charge!

Every month you’ll receive two cheap options trades with instructions on how to place them in your account. Scrounge up any “spare change” you have and take control of hundreds of shares for as little as $50-$100, and watch as your money could grow double or triple past a regular investment.

Paired with each new recommendation is a breakdown on the ‘whats,’ ‘whys,’ and ‘hows.’ It’s my promise to you that you will never be left in the dark or receive a trade that doesn’t meet my highest standard.

I leave no stone unturned in my research – the proof is in my write-ups you’ll find in every monthly edition.

The latest issue of Options Floor Trader PRO is emailed to you as soon as it’s available. And is yours to download or print!

Combined, the package presented here is worth more than $1,399.

And I promised you an incredible deal…

Well, here it is:

Today you pay just $79 for access to everything.

That’s over $1,200 in instant savings — a full 94% discount.

There’s just one “catch”

While I promise you this deal is yours if you act right now by clicking the big green “Join Now!” button below…

This deal is for a limited time only!

If you are unable to act right now to take advantage of this offer you risk missing out on our lowest price.

So with that out of the way…

If you’re excited about learning how to potentially turn your “spare change” into hundreds of dollars…

If you’re thrilled about your 93% discount, and would like to lock it in right now to join the Masterclass… fantastic! Since you’re seeing this page the $79 offer is still available.

But if for whatever reason you’re still on the fence…

Maybe options look a little intimidating, or maybe you’ve tried to place a trade or two in the past with no luck…

Rest assured you don’t have to worry:

100% Refund Policy

Here’s the deal: You can join now….

Go through the entire Masterclass program…

Read through every newsletter edition as it comes out… and place as many trades as you’d like…

And if for whatever reason you’re not thrilled you can request a full refund of your $79 payment.

100% Refund Policy Valid for 1 Full Year

Simply contact customer service and we’ll refund your membership fee promptly and hassle-free.

Thank you for your time and I hope you’ll lock in your limited-time price of $79.

To lock in your deal simply click the button below.

You’ll be taken to a secure order form where you can review and complete your order.

I look forward to seeing you inside.