How this failed investor stumbled on a

stock “ranking” system that banked him $5,000,000 in seven years…

I asked him to recreate that same system for conservative, dividend stocks.

He did. He’s only letting my readers use it.

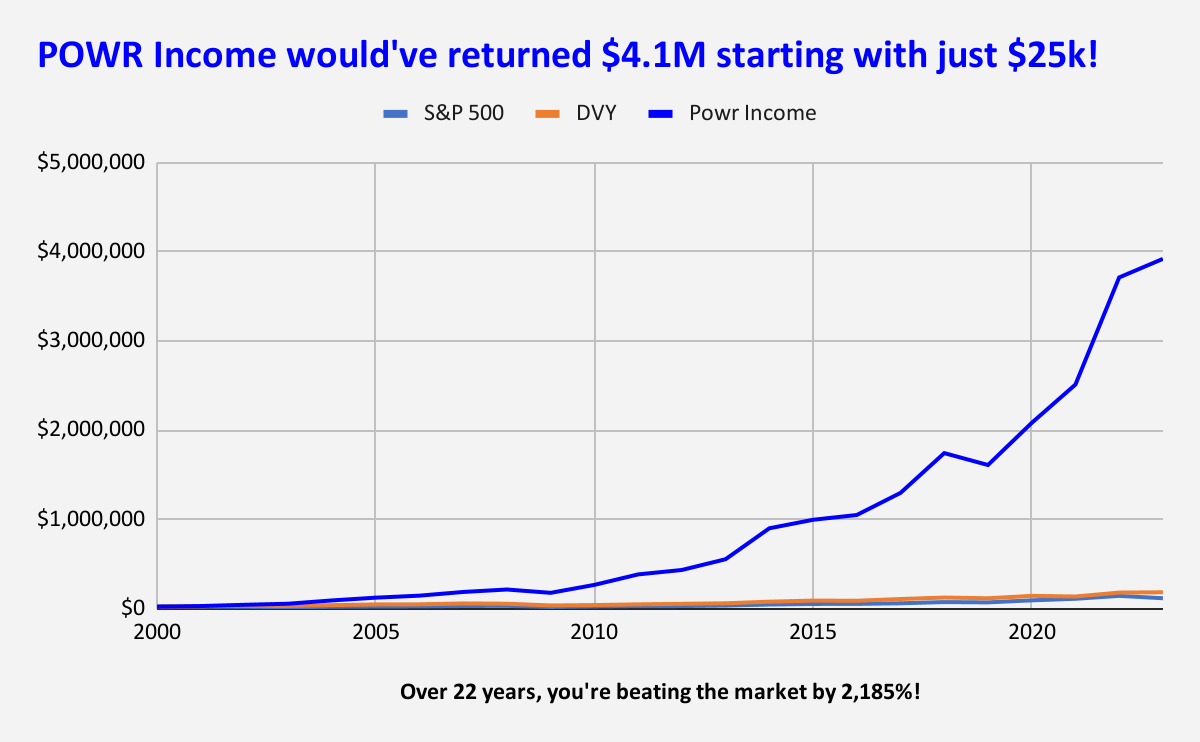

This has changed everything I thought about dividend investing as you could’ve turned $25k into $4.1M over the last two decades buying these 4%+ yielding dividend stocks

Hi, this is Tim Plaehn,

You might know me as the “Dividend Hunter” because for decades I’ve believed investing for dividends is the #1 way to generate income especially in retirement.

You might know me as the “Dividend Hunter” because for decades I’ve believed investing for dividends is the #1 way to generate income especially in retirement.

And I still believe that to my soul.

However, I recently met an incredible investor, Patrick, through my colleague, Steve, here at Investors Alley.

You might not believe this old soul is saying this…

But

Patrick might’ve changed everything about how I viewed dividend stocks.

In fact, Patrick’s rags-to-riches story has flipped my investing thesis on its head…

And, honestly, it made me rethink a few tenets of my approach to the stock market.

His story is so good, I wanted to share it with you…

Patrick was once a broke investor watching his portfolio slowly get carved up from trying to trade and time the market…

All things I tell you to stay the heck away from.

Patrick didn’t give up.

In a few short years…

This investor — with almost no investing experience — had made $5 million dollars in profits.

There’s no beginner’s luck here.

No buying Tesla for $10 or anything like that.

Instead, he used a system he stumbled on… a “ranking software” that he wielded to such perfection, the software creators hired him on the spot after hearing his story.

I, of course, was skeptical. I don’t like learning new tricks. I like my dividends.

When Steve intro’d Patrick, I challenged him directly.

I selfishly asked Patrick to replicate the approach he used… but do it for dividend stocks.

Patrick traded more small-to-mid cap names and I didn’t want any part of that.

I challenged Pat and he came through. He built a strategy for me and you over 12 months and hundreds of trial-and-error calculations.

It’s a brand-new, proprietary, 100% computed system called, “POWR INCOME.”

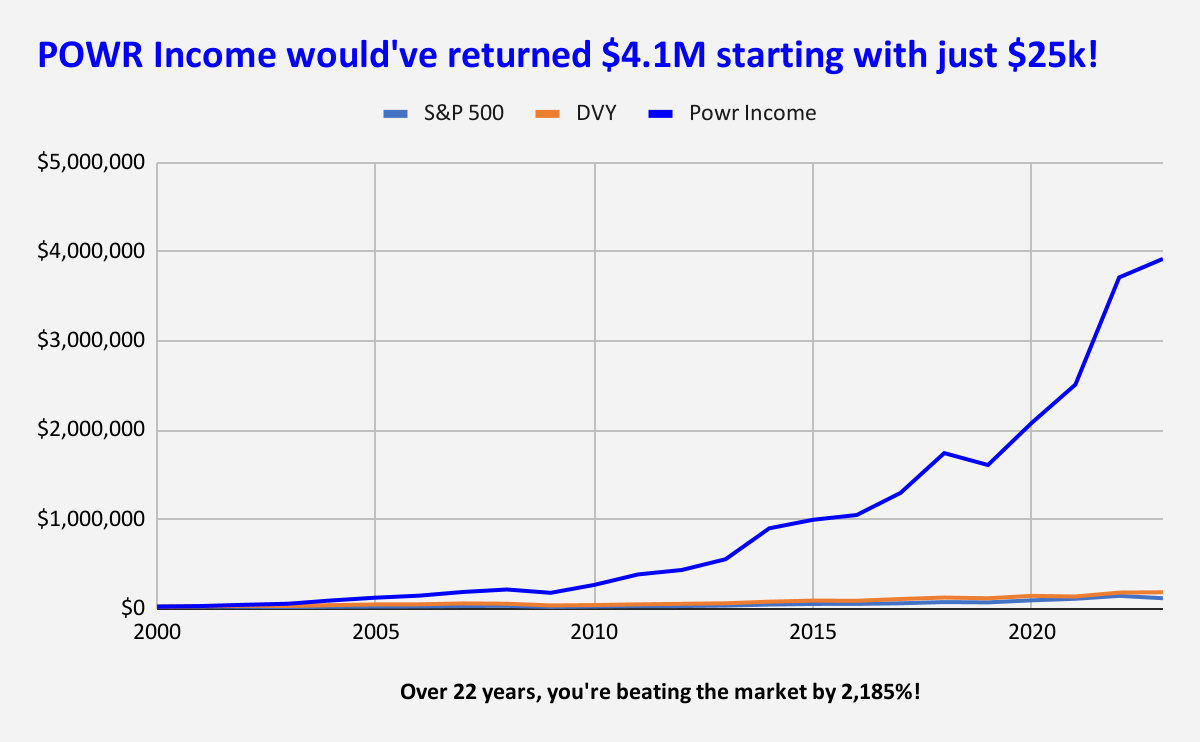

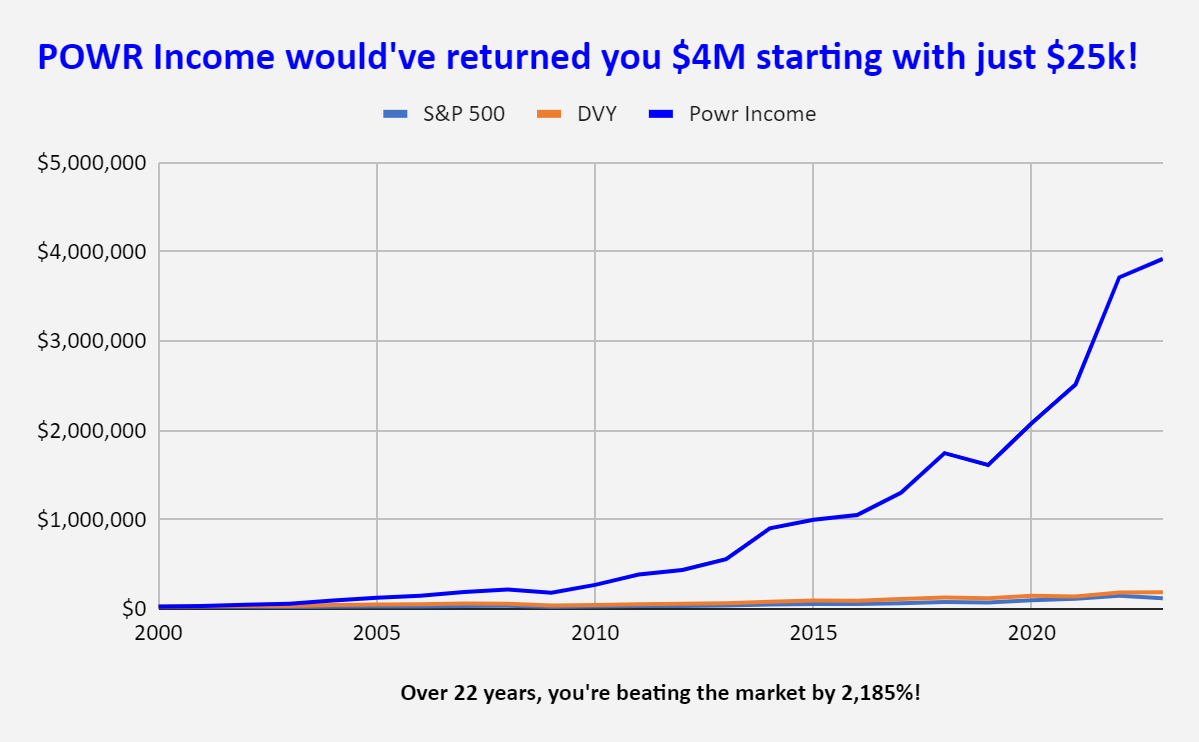

Patrick rigorously backtested the POWR Income system… and he found that hypothetically, if you had followed it for the past 22 years…

You could’ve turned a small stake of $25k into an eye-opening $4.1 million dollars.

See for yourself:

These millions in returns easily outstrips the S&P 500 and the DVY Dividend Select ETF by light years.

You would’ve beaten the market by 2,185%!

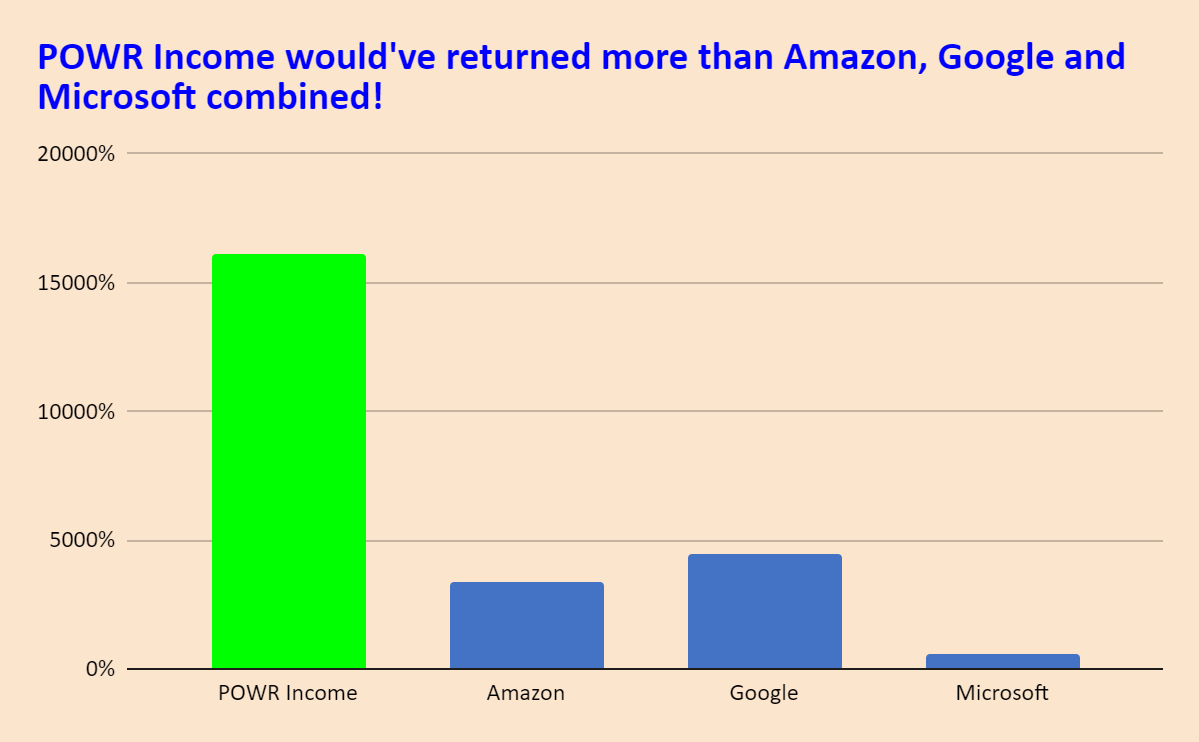

Those gains top Google (from its IPO), Microsoft and Amazon’s returns in the same timeframe… combined!

Who knew dividend stocks could potentially outperform the very best stocks in the world

No one else on Wall Street, in America, or the world has access to this black box of an income system as it was specifically designed for you, my income readers.

Honestly, I’m not sure how it’s even built.

Patrick built it for me… but he’s not allowed to share how the system is built…

However, to protect you and me…

He’s also not allowed to use the POWR Income system anywhere else except here.

This income system takes conservative dividend stocks, ranks them according to 118 factors, and calculates the absolute best buys right now.

Today, I’ll show the top 5 being ranked right now… today.

They’re flashing green!

For how long… there’s no telling. This POWR system updates daily.

- All of these stocks pay a dividend.

- There’s no trading involved…

- No options, or risky bets.

- All NYSE and NASDAQ stocks you can buy from your brokerage, IRA, or 401k at little to no fee.

- All conservative dividend plays but lesser known dividend stocks.

Much like my high-yield and dividend growth plays I’m always going on about.

You’d be buying stocks like:

- Karo — a software company paying a 14% dividend

- The Buckle — an apparel company selling jeans and shoes at a 4% dividend

- OneOK — one of my favorite midstream stocks paying 6% (I have this stock in my services)

- CompX — a security company making stuff like P.O. Box locks yielding 4%

- BBVA — a Spanish international bank throwing off 8%

And dozens and hundreds more over the last decades…

Before I share this POWR Income system and how you can buy the first 5 stocks…

You need to first hear Patrick’s story.

Maybe you’ve made some of the same mistakes as he did. That’s okay. No one teaches us about the markets in school or at work.

Patrick (it’s not his real name. He wishes to remain anonymous) started investing in stocks and ETFs in 2014.

By 2019 he’d be a millionaire.

How?

Again — there was no luck here. He didn’t catch a ride on Nvidia.

No lottery option bet. And GameStop mania wasn’t

for another 7 years…

for another 7 years…

He dove into the market like everyone else does…

You deposit money into Fidelity and start fiddling.

There was one problem…

Patrick knew nothing about investing.

Stocks? No idea what made a good stock or bad.

Patrick was a writer in Bolivia! Words, not numbers.

No financial background, no “in” on Wall Street slipping him stock tips.

In Bolivia, the CDs in 2014 there were paying pennies as they did here in the US.

He was starting from scratch.

So Patrick asked around and his sister knew a little about investments and she recommended buying ETFs.

Makes sense. Low fees. Lots of diversity.

“Ok, sounds good,” Patrick said.

Fidelity deposit ready to deploy.

He even subscribed to one of the most popular financial publishers around (I won’t name names today)…

Off he went.

As you can imagine for a rookie…

Quickly, Patrick hit a wall.

Wait — what ETFs do I buy?

It’s the age-old question we all have when we get into investing our money. “Where do I put my dang money?”

Being smarter than the average investor, Patrick looked for a system that would pick what ETFs to buy, at what level, etc.

From there, he struck gold, made millions and the rest is history!

Just kiddin’, folks.

Of course, that didn’t happen. I jumped ahead a bit.

Patrick’s sister had recommended simple ETFs like the SPY & QQQ, the normal ones. But, Patrick felt he could do better…

(He wanted to show up sis).

By the middle of 2014, Patrick was swing trading a variety of ETFs… and, as you might guess, started losing money.

He saw stocks had bigger moves daily than ETFs, so took a stab at trading stocks…

“I’ll make my money back fast.”

Famous last words for most new traders.

Fast forwarding…

Two years into investing and trading all his money, he had lost 25% of his net worth.

What stung more is if he had listened to his sister and just bought the SPY or the QQQs, he would be in the green 12% rather than 25% in the red.

He’d never live it down if he told her…

When you’re down 25%, to get back to even, you’d need a 33% gain, which is difficult when ETFs only go up 6-10% per year.

You can imagine the frustration and a bit of panic.

At one point, he had even taken a HELOC out on his house to invest in the markets. This was not good.

The mistakes he made investing,

he’s very upfront about.

Maybe you can relate to them, I know I can:

Here’s what he said:

- You buy and sell based on technical analysis: Many claim you can just look at a chart and know where it’s going. C’mon, folks.

- You change your investing strategy every month: A new guru shows up in your email promising you this ‘new trading strategy’ will double your money by Friday. It’s the worst committed sin in this publishing industry I’m in.

- You buy a stock based on where it’s come from: Just because an investment is up 100% the last 12 months doesn’t mean it’s going up another 100%. 2021 saw stocks go straight up, 2022, straight down.

- You use a stock screener with a couple of screening values: All stock screener data isn’t accurate. And simply screening for dividend stocks that “pay over 8% yields” isn’t a great strategy. As I’ve told you with high yield dividends, there’s a lot of junk companies out there. That’s why you subscribe to me, to dig through the junk.

- You buy as a stock goes up, but when it drops, you panic sell: This is how most investors lose money. You say, “I would never do this,” yet we all do it.

- You bought “the dip” in a stock simply because it went down: I love value buying, I talk about it all the time in The Dividend Hunter. However, if a stock goes down 10%, there’s a reason. Knowing “why” is key before buying.

Patrick stood at an impasse.

Give up, or try a different approach.

Like I said, he subscribed to different newsletters, day traded, swing traded, options, all of it.

Results – down 25% while the market was double-digit green.

He decided to start from scratch.

While doing research late into the night, he realized he needed a way to back-test his strategies before using them.

Back-test simply means you put in certain ‘rules’ that you follow and a computer calculates how well those ‘rules’ would’ve worked in the past.

Every strategy he had been using, he ran through back-testing and all of them were failures.

And these were strategies you’ll see in your inbox daily.

All his strategies were simple, common stuff you’d read anywhere.

Think like you’re getting stock tips off CNBC.

All, over the long-term… would lose money.

WHY?

You can’t beat Wall Street trying to use common knowledge.

The Street is too smart.

Yet, millions make this mistake daily.

Especially if you’re trading.

Wall Street is the house that always wins.

You coming in trying to beat ‘em is like bringing a paper sword to a gunfight.

Or, as in the Air Force, like racing a commercial Boeing American Airlines uses against a F-22 Raptor… it’s not going to work.

And if the Boeing happens to win, it’s rare. Call it luck.

No.

If you’re going to beat the market handily again and again, you’d need to do something more complex.

Something Wall Street can’t untangle.

Patrick realized there are 1000’s of factors that go into determining the value of a stock and whether it’s worth a buy.

Examples of factors are regular ones you’ve heard of:

- Price-to-earnings (P/E)

- EPS

- Return-on-Assets

- Return-on-Equity

- Dividend yield

- Relative volume

- Market cap

But there’s also other, more differentiated factors:

- CEO track record

- Insider buying & selling

- Relative strength

- Bullish or bearish institution sentiment

There are literally thousands of factors or ‘angles’ to view a stock.

And Patrick wasn’t trying to hit homeruns here…

He simply wanted to find a trading strategy he could use again and again that beat the market by a wide margin.

Yes, beat the market better than even hedge funds.

Hedge funds have capital constraints, investors to please, and frankly, too much money to be able to invest anywhere they want.

Patrick was a free bird. He could invest anywhere at anytime.

(You have this advantage too).

If he could just figure out a combination of factors put together, backtest it thoroughly through bull and bear markets…

There’s potential to make money.

Not get mega-rich or some pie-in-the-sky dream…

But at least get his account back the 25% it lost and make more.

Here’s where it gets interesting…

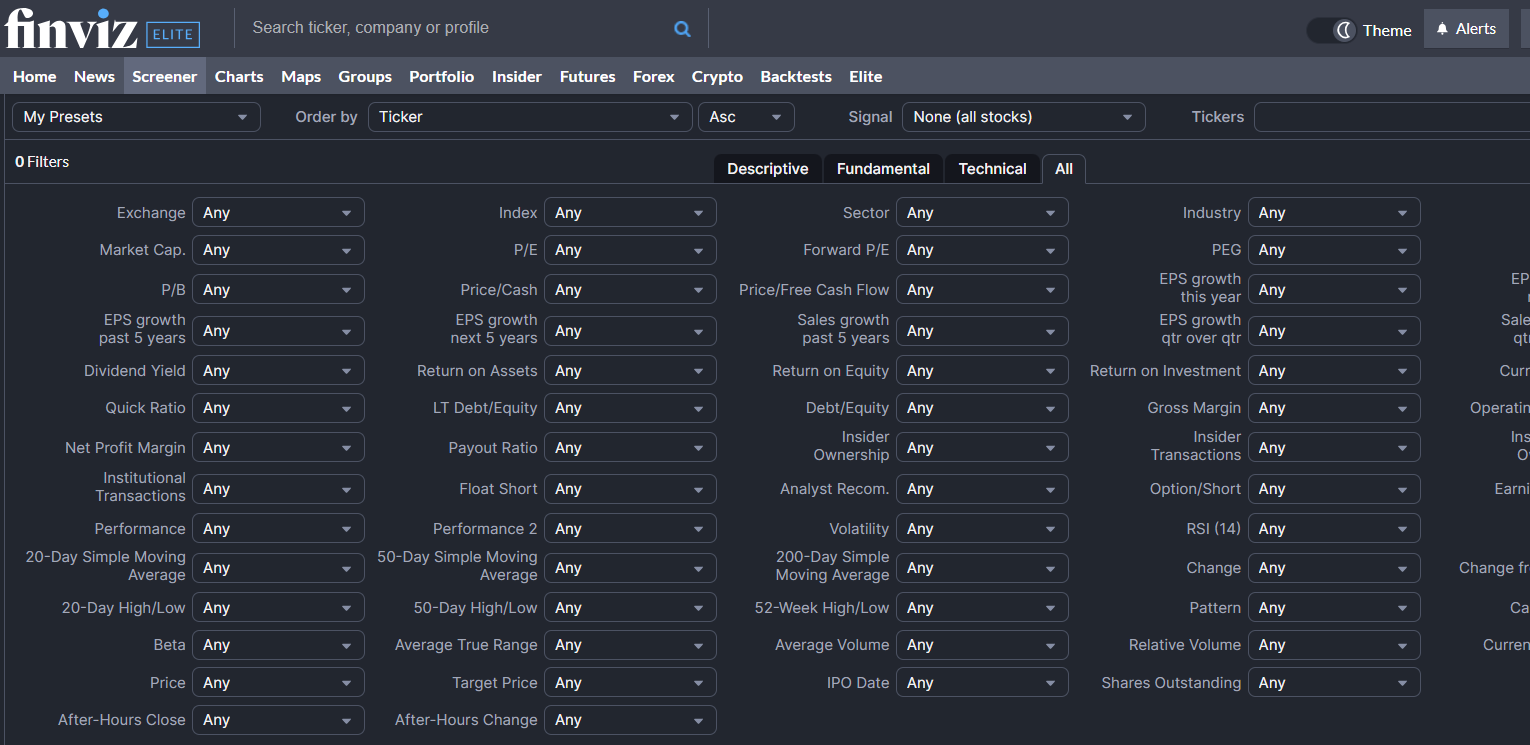

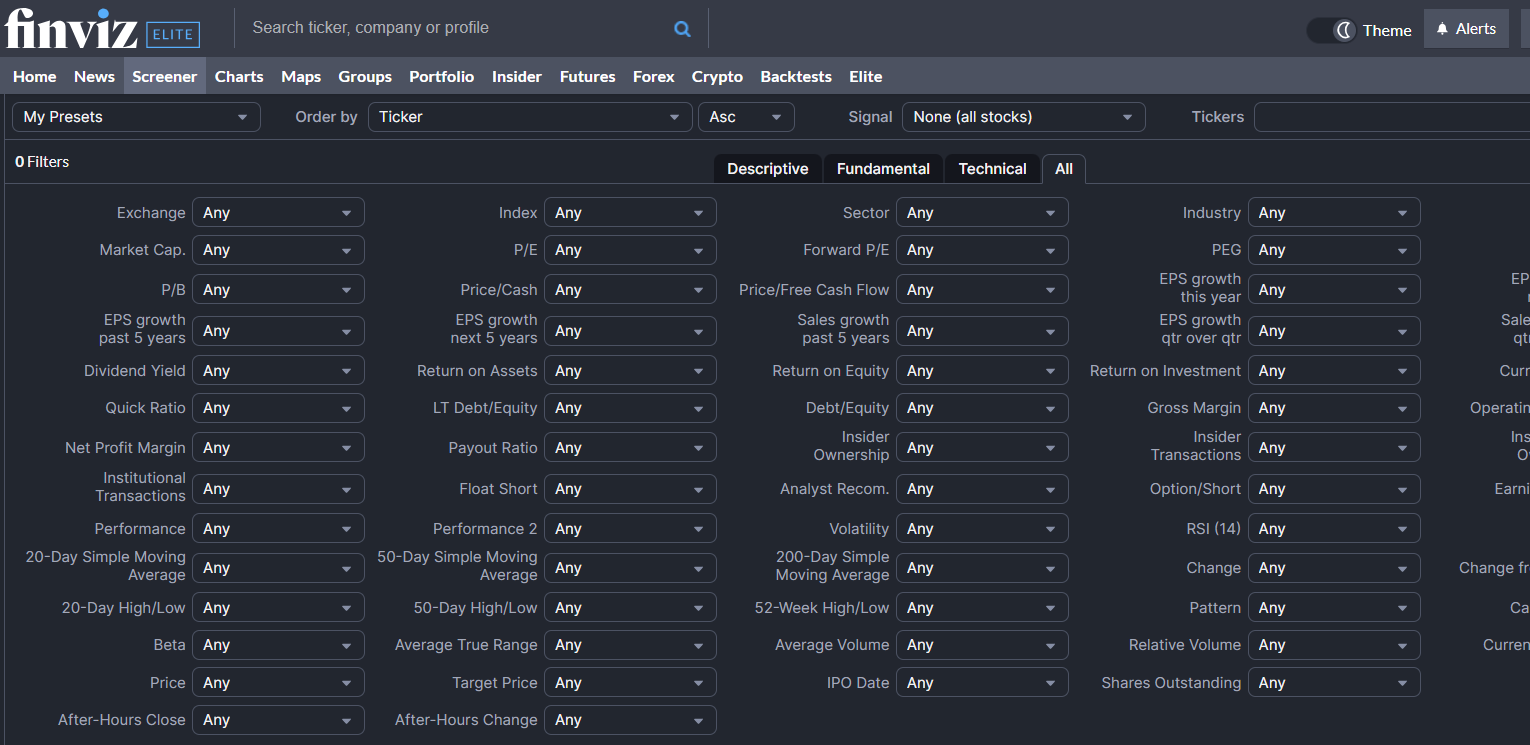

If you go to a stock screener… you’re met with a wall of options.

Take a look here from Finviz.

On their popular screener, there’s about 67 ‘screens’ you can run to filter down the list of stocks you want.

Sure, you could tick through boxes:

- “I only want stocks that pay dividends over 5%”

- “Stocks should be under $10B of market cap”

- “Company should be profitable”

That’s only 3 factors to start…

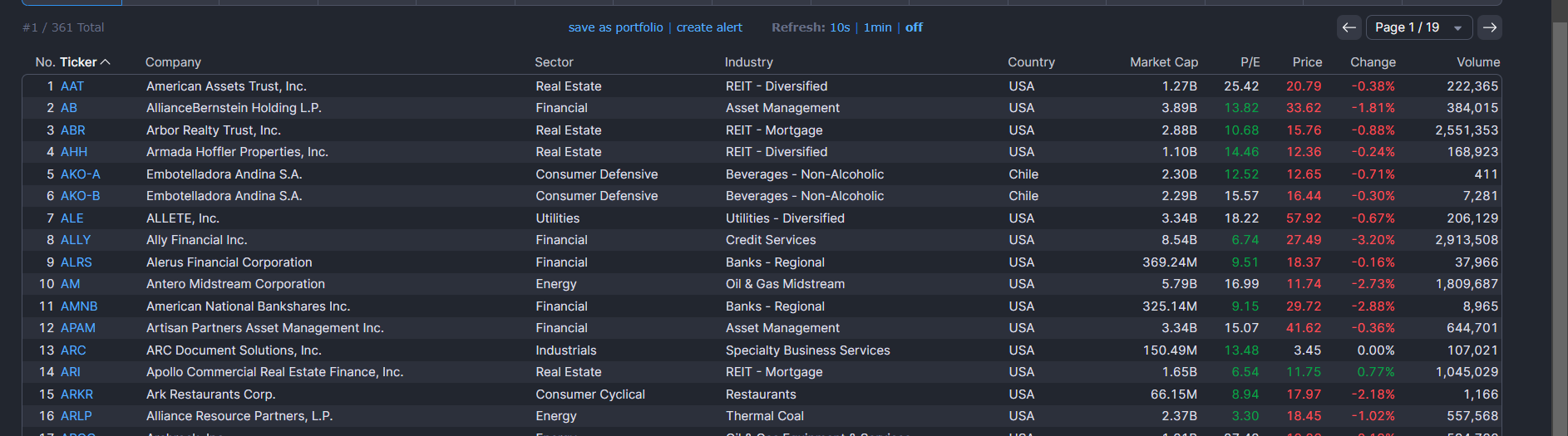

But after putting in just those 3 factors, you have 361 stocks to choose from.

And they’re in alphabetical order here. You can order by market cap, volume, you name it.

Patrick discovered just because you screen for stocks, there’s no guarantee you’ll find the diamond in the rough out of those 100’s of stocks.

Not only that…

You don’t even know if buying stocks with 5%+ dividends, under $10B market cap, and profitable is a GOOD long-term strategy.

Maybe it’s good for 12 months… maybe only 3 months.

You’d need to screen through stocks daily to figure out if you are invested in the very best stocks.

Even then, say you put in more factors and whittle the list down to 100…

Are you going to run that screener and keep up with 100 stocks regularly?

What if a stock stops paying a dividend, are you going to be able to figure that out and remove the dividend slasher from your investments in time?

This is hours and hours of DAILY research required to keep up with all this.

You’d have to become a stock analyst to monitor these plays. Those guys get paid $150k/yr because it’s an endless job.

Patrick was hit with that realization right away.

Until…

He discovered a new software…

The software “Ranked” stocks you’re screening by thousands of factors that you handpick.

From there, you can backtest as many as you can to find a winning strategy.

In this case, the “ranking” software would bubble the very best of the screened stocks to the top.

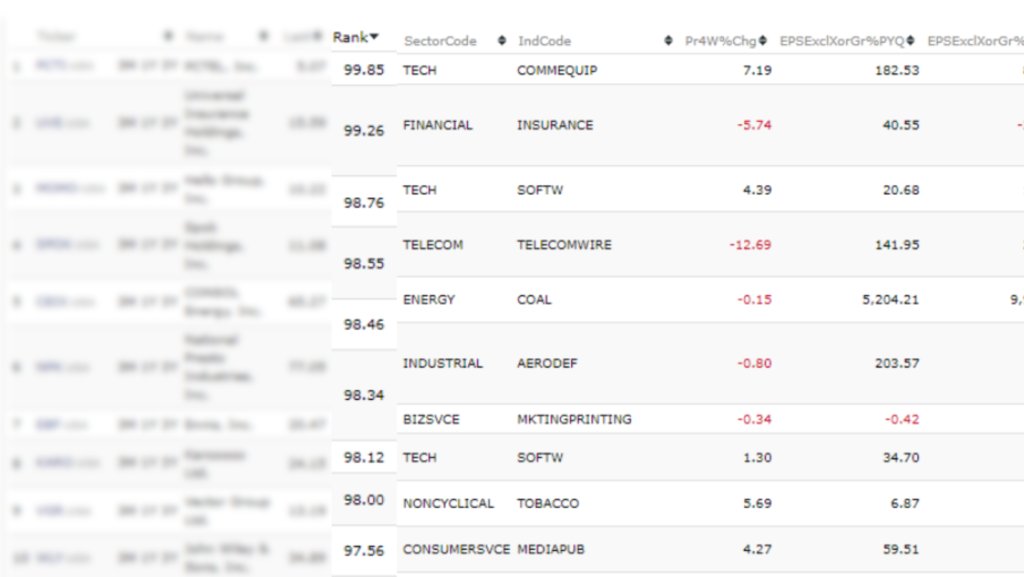

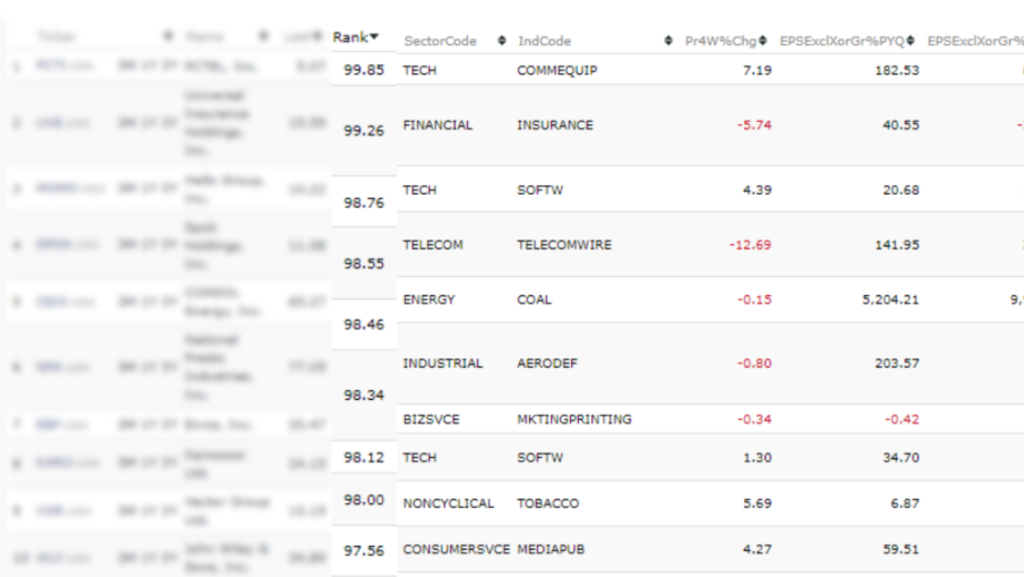

For example, these are the current rankings as of this writing for my POWR Income strategy I’ll show you…

These will change daily, but you’ll see the “RANK” for the top stock is 99.85%!

These will change daily, but you’ll see the “RANK” for the top stock is 99.85%!

That’s as near perfect a buy as you get. Meaning, that #1 dividend stock is ranked near the top in every single one of the 118 factors.

Screaming buy!

The best stocks are on top.

Plus, this special ‘ranking’ software… a software that costs $30k+ per year… would always have you in the very best of the screened stocks at all times.

Sound unbelievable?

Remember, Patrick was down 25% at the time of this discovery.

Then, in October 2015 (right before the double-digit drop in the markets that happened early 2016), he starts using this new ‘ranking’ software.

Suddenly, it all clicked…

In 2016, Patrick made 45% on his money (making back his 25% loss and then some).

The S&P only gained 9.5%.

In 2017, he made 58%.

In 2018, 14% (market was red that year)

In 2019, 16%.

2020 — a whopping 105% return!

By the end of 2020, Patrick had made $1.78M in profits.

It didn’t stop there…

The company who made the $30k/yr ranking software saw what Patrick was doing and hired him to work on the software to make it better.

Patrick made it a whole lot better.

Since then, Patrick’s banked a total of $5M in profits using his strategy.

Now, his strategy was swing trading small caps. I don’t like swing trading, so it wasn’t for me.

Still, my colleague, Steve, told me about Patrick’s success and I had a challenge.

Could Patrick build an investing strategy just as successful as his for my audience around conservative dividend stocks?

Steve said Patrick could.

Being an income & dividend guy, I was curious if there was a way to help me find a winning dividend strategy that could complement The Dividend Hunter and Monthly Dividend Multiplier.

Steve and Patrick challenged my thinking…

They said:

“Tim, what you do with generating dividend income is great.

But what if we built a strategy that flipped everything on its head. Meaning, pursue the exact opposite goal you use in your services.”

I didn’t understand.

What they meant was —

Rather than investing for dividend income

with capital gains as a ‘bonus’…

What if you invest in dividend stocks for capital gains and the dividends are the ‘bonus’.

The problem was I didn’t like trading.

I’m a long-term investor.

I don’t want to be tied to my computer 24/7 getting in and out of positions.

Trying to ‘scalp’ 1% on a move in a stock is not my idea of fun. I’d rather you keep your 1% and I’ll go do a mountain camping trip with my dog.

I was pretty strict with Steve and Patrick, especially about this.

They assured me they’d build a system where I would NOT be trading stocks. Meaning, I wouldn’t be buying one day and selling it the next.

I’m too old for that junk.

It was going to be an impossible task for Patrick to build a system I’d be satisfied with. That was my thought at least.

Call me stubborn. Call it ‘you can’t teach an old dog new tricks.’

Even worse…

As Patrick packed up, I snuck in one request…

“I like high dividends. I don’t want any 1% dividend yields like Apple.

If you can’t get me into at least a 4% dividend stock, I don’t want any part of this.”

I probably am a bit harsh about this point.

Maybe I just wanted to feel in control. Maybe I didn’t want to feel like a fraud if I showed you a strategy that didn’t pay much in dividends.

After all, I love dividends and I believe in them.

Most of my net worth and retirement is invested in dividends.

30,000+ readers buy my newsletters to get my dividend stock picks, recommendations, and advice about the market.

No way am I throwing 20 years of work away to buy low-paying dividends to try and make a buck.

After all:

I’ve made a career in just one field —> INCOME

And made some of the biggest calls of my 20+ year career recently

I was in the Air Force. I was Captain Tim Plaehn.

After that, I was a Certified Financial Planner doing what I can to help others retire well.

However, I was handcuffed on what I could say and what I could recommend.

That’s when I teamed up with Investors Alley.

My publisher, Investors Alley, was founded in 1998, before many mainstream publications including the Motley Fool and MarketWatch.

But rather than focus on the next ‘big thing’ in tech or cryptocurrency or the ‘news of the day’…

We focus on one single area.

An area that makes us far less money than other big-name publications… but it’s the most important.

We’ve become the leading resource for how to generate retirement income for the average American.

We send out over 5 million emails every month.

100,000s+ retirees just like you have read my retirement income ideas and many have followed along to set themselves up to retire for good.

99% when they first join me are skeptical because I do not recommend washed-out, ragged advice you see everywhere.

They say, “Tim, my financial advisor doesn’t understand why you recommend this.”

When income assets crashed in March 2020, I quickly triggered a recommendation into a private, little known income class… and one reader said it nearly saved his retirement.

Meanwhile, I’ve been recommending energy assets for the past 5 years.

Long before we hit historic oil prices.

Everyone scoffed in 2018.

Until a new skeptical reader said he had a chance at 150% gains on a little-known midstream company you’ve never heard of, Antero Midstream.

Recommended oil at bottom of Covid crash… up 150% in a year!

Talking heads always only recommend ‘what’s hot.’

I ignore that gruff.

I didn’t stop there.

When oil was trading for negative $30,

I was still recommending to buy.

I called it a trade that would ‘set you up for life.’

I saved panic selling during the Covid crash

I recommended that little-known oil stock I love, OKE.

Someone who bought OKE starting with $25k would’ve 4X’d their account in 3 years.

Great dividend stocks can move both

your income and your portfolio

OKE is also at multi-year highs.

All the gurus recommend the riskiest tech stocks… until stocks like Peloton and Zoom collapsed 80% in 6 months.

Instead, in September 2020… months after the “Covid stock bump”, I wrote about potential 100% gains in two stocks… Ralph Lauren and Tanger Outlet.

Boring to most.

“Retail is dead… people will only buy online!” everyone claimed.

Turns out that was a bigger lie than ‘inflation is transitory.’

Ralph Lauren ended up close to 100% gains… hit 88% in 7 months at its peak with a 3% dividend kicker.

Big call I made to STAY in retail stocks despite Covid

But Tanger did even better…

I knew retail would stay hot… and it had one of its hottest years

264% gains in 8 months… and a 5% dividend income stream to boot!

My call was at the very bottom.

Both have stayed in the green while the overpriced tech names are still floundering and the stock market’s down double digits.

In fact, 86% of my main recommendations beat the market in a crashing 2022 market.

So I’ve generated huge capital gains for subscribers like you…

But it was never the goal.

I’ve always said “you can rely on the right dividend stocks, but you can’t rely on capital gains”

One thing I know when studying my favorite companies like MAIN or OKE is I can forecast whether a dividend is safe, growing, or bound to be cut.

That’s a safety net for me.

When I had friends & family selling off assets in 2009 to pay their bills… there was no certainty there.

That was panic.

I vowed to never put myself in that position again.

I always want my assets producing income so I never panic sell.

Because I had been there myself too.

I moved to Uruguay a few decades ago to build a little business and retire. However, I didn’t have the cashflow to sustain it.

Going broke overseas taught me the value of

building assets quickly to generate cash

It wasn’t until I met the wealthy retirees there… guys paying for Uruguayan beach houses in cash… they told me, “Tim, cash is king.”

And that mantra has stuck with me forever.

I believe it and follow it perfectly.

Still, when Steve and Patrick approached me about their system, I was reluctant.

“I’m a dividend guy.”

Here’s what they told me that changed my entire thinking:

The more capital you generate…

The more dividends you can collect.

“You’re doing a disservice to your dividend subscribers if you don’t give them a chance to grow their capital.”

My stomach turned in knots hearing this…

I admit I’ve received emails from readers who have said, “Tim, I need to generate more income for retirement, but I can’t put $300k into a stock to get more dividends. I don’t have that much.”

I can’t give personalized advice… so there’s not much I can do.

The feeling of not being able to help my subscribers feels awful.

What if you get upset? What if you lose precious time to generate retirement income?

I pour my heart and soul into my dividend products, The Dividend Hunter and Monthly Dividend Multiplier.

Up to now:

The Dividend Hunter helps you pay your bills with high-yield dividend stocks

Monthly Dividend Multiplier gives you big raises in your income as we invest in stocks raising their dividends quickly

These aren’t ‘get rich’ strategies, and I never promise they are.

They do require some capital, but I always say you can start with $25,000 minimum. That’ll be enough to collect a few thousand dollars per year.

However…

I get it.

We’re in a time of high inflation. It’s sticky.

Grocery bills are elevated and likely will stay that way.

Filling up my Tacoma is getting more expensive and I love truckin’.

Every place you go wants you to tip them more, what’s up with that?

You need a way to stay ahead of inflation.

The best way to do that is to grow your portfolio faster.

But without taking any huge risks and not from trading options or momentum plays.

That’s where I’m comfortable investing.

So I gave Patrick that challenge to build me a ‘ranking’ strategy that would hand you the best capital gain stocks, that pay 4%+ in dividends, and aren’t too volatile.

It took Patrick nearly 12 months…

Still, he built one and it’s incredible when you see the results.

Here are the stats from building POWR Income:

You could’ve turned $25k into $4.1M over the last 22 years with gains as high as 408% and 359%

Your average return each year would’ve been 24.3%!

Look how this strategy backtests against the S&P 500 and the DVY Dividend ETF.

The strategy just got better over time. Of course, nothing is guaranteed for future results… still…

And look how it’s breaking away near the end.

The strategy has gotten more efficient especially in this current market.

Mind you — this is through the tech bubble, 2008, the bull market, the Covid crash and recovery, as well as the bear market of 2022.

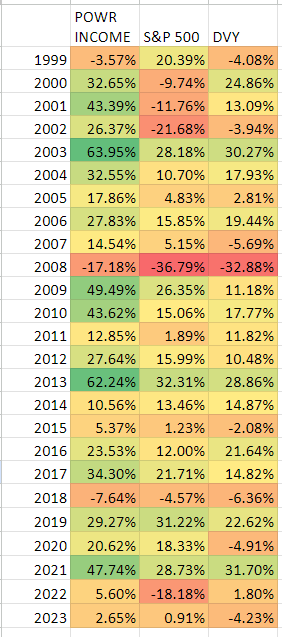

Here’s the full, year-by-year backtested stats to back this up:

Here’s the full, year-by-year backtested stats to back this up:

*THIS ANNUAL CHART UPDATED IN MARCH 2023*

Every year except 3 were winners… some BIG winning years easily doubling the market.

Of course, this is hypothetical. Patrick only just created this ranking system, so no one was actually able to place all those trades and get these results.

And as always, past performance is no guarantee of future results.

But you can see the power of this system.

Look at some of the major winning years…

2003 — 64% (at bottom of market)

2009 — 49% (at bottom of market)

2021 — 48% (at bottom of market at the time)

Even winning in 2022.

So if you feel we’re near a bottom in stocks, there’s a massive opportunity waiting.

Yet, even in up years like 2019, you could’ve banked nearly 30%.

This strategy works in any market clearly.

Here’s just a small sample of the big winners you could have landed:

- 408.10%

- 359.70%

- 338.10%

- 311.10%

- 303.20%

- 295.10%

- 288.70%

- 271.00%

- 261.00%

- 259.10%

- 255.00%

- 254.70%

- 232.00%

- 226.30%

- 226.30%

- 222.00%

- 215.40%

- 205.10%

- 199.60%

- 183.40%

Some of these wins were over a couple years… others you would’ve pocketed in less than a year.

The average hold over 22 years for a stock is about 128 days. That’s less than 6 months.

So, again, there’s no trading here.

The win rate is around 68%.

You would’ve been invested in great companies like:

- Triton International (TRTN): a booming rental company that’s up 169% over the past 5 years paying a 4% dividend

- Ternium (TX): A strong steel company out of Luxembourg paying a nice 11% dividend

- Even IBM (IBM): The technological juggernaut that surprisingly pays a 5% dividend at this time

These are ones of hundreds you would’ve invested in at the best and worst times in the market.

After the tech bubble crash:

You would’ve been buying near the bottom:

- 94% win in 84 days on SPMYY in 2003

- 136% win in 308 days on YPF in 2003

- 122% win in 336 days on HERB in 2002

- 157% win in 336 days on ANFI in 2002

- 199% win in 224 days on SID in 2003

And those are just a few examples. Many double-digit winners in there as well.

And those are just a few examples. Many double-digit winners in there as well.

Winners after Covid:

Again, buying near the bottom at many instances:

- 58% win in 28 days on LYTS

- 46% win in 28 days on UMC

- 40% win in 28 days on EVC

- 45% win in 56 days on VALE

- 64% win in 29 days on BBAR

There’s a dozen more examples…

There’s a dozen more examples…

Winners during high inflation and 2022 bear market:

This strategy beat the market and was green while the market went red.

- 64% win in 85 days on TKC

- 53% win in 28 days on APTS

- 32% win in 84 days on VIV

- 32% win in 56 days on NVEC

- 98% win in 168 days on GRIN

These are just a handful of thousands of past potential investing opportunities at a 68% backtested win rate.

These are just a handful of thousands of past potential investing opportunities at a 68% backtested win rate.

While also returning an average of 24.3% per year.

All using Patrick’s “ranking” software approach called POWR Income.

This is why “Ranking” works inside the POWR Income dividend strategy.

Patrick realized this and immediately hit a 45% profit the first year he used it. That’s over triple the returns of a normal index fund.

Compound that over time… you’re making 7-figures vs. 6-figures.

And all you do is follow the “Ranking.”

The idea is back to the “screening stocks” idea.

Here’s why “Ranking” Stocks is the secret sauce that makes this dividend strategy work

When you screen for a stock, essentially, the more criteria you put in, the less and less stocks will fit into said criteria.

If that’s the case, how is it possible to find winning stocks if you can’t look at a company from every possible angle.

Even worse…

Some criteria are more important than others.

For example — I like companies with manageable debt. That’s much more important to me than if a stock is above the 50-day moving average. Doesn’t mean both aren’t important… but just one is more important than another.

Much like when you bake a cake…

You don’t put 1 cup of milk, 1 cup of sugar, 1 cup of baking powder, 1 cup of flour… you’d end up with a blown up, milky mess.

No, of course not.

When you bake a cake, you don’t put “1 cup of every ingredient”. Some ingredients are more important than others. Shouldn’t how you view stocks be the same?

You put in different ingredients with different weights to them.

Some ‘factors’ are more important than others.

Yes — this makes looking for stocks more complex, but that’s the point!

You can’t beat Wall Street using simple screens like “screen for stocks above 50-day moving average and profit.”

Algorithms will sniff that ‘edge’ out quickly and squeeze your positions.

Markets are hyper-efficient.

You can’t beat it using simple, same-old approaches.

Think of the market as a computer that keeps getting smarter.

The more complex your strategy is compiled, the less chance there is for Wall Street to uncover the ‘secret.’

They’d rather focus their effort on the easy money… suckers trying to ‘game’ the system.

Instead, you’re building an impenetrable wall over your portfolio that the market can’t mess with and rig against you.

You worked too hard for your money to be hoodwinked by some computers.

You need a complex strategy that’s the black box you can never destroy… and Wall Street can never penetrate.

That’s why Patrick’s “Ranking” POWR Income strategy uses 118 weighted factors to rank its stocks.

Not 5 or 10…

118 out of thousands of different factors.

Putting that into a calculator… it means there are practically INFINITE possibilities for the ‘ranking software’ to put together.

Exponent of 2000 ^118 = Infinity

No one is cracking this.

Yet, in 12 months, Patrick has compiled a strategy (after hundreds of tests) to build you a massive portfolio from conservative, smaller dividend plays.

It’s so secret, Patrick won’t even share all the factors with me.

Only he knows and it’s saved on his computer so the formula is never messed with.

However, Patrick did share a few of the 118 factors he built POWR Income with:

- Size of the company

- Growth… don’t want to invest in companies that just have high growth… moderate growth is easier

- Value of company

- Technical factors — we want to buy when on sale or if there’s a good chance the stock will keep rising

- Sentiment factors — are analysts bullish or bearish

- Insider buying — are insiders buying or mass selling?

- Stability — how stable are the financials?

These are just 7 of the 118.

With practically infinite combinations, it’ll take Wall Street likely a few centuries to wring the efficiency out of this complex model.

Here’s a quick peek at what I’ll be looking at for the first 5 stocks you’ll buy using POWR Income:

On the far left is the company recommended ranked from #1.

On the far left is the company recommended ranked from #1.

The Ranking number “99” means that stock is as close to a perfect buy in this environment. (it’s out of 100).

You’ll also notice the various industries you’re diversified in. Tech, industrial, coal, software, media.

There’s opportunity everywhere at the moment.

One the far right is the first of dozens of factors these stocks are ranked on… and it’s complicated.

But, let me be clear…

The complexity of the model doesn’t mean it’s difficult for you to follow.

All you need to do is buy when POWR Income says buy…

And sell when POWR Income says sell.

I’ll send the alerts right to your inbox.

You’ll see how to get the alerts and the first 5 stocks to buy in a minute.

What you’re seeing here is a system that is complex, black box ,and steady for you to compound your profits over time.

Again, there’s no ‘get rich quick’ here. I showed you all the past back-tested returns. Some years have been slow, others life-changing.

There’s no telling what’s coming, but I expect a little of both.

There’s over $30k+ of software going into POWR Income…

Plus, a trading expert who’s made millions pushing the buttons.

A key reason you want to use this system now is it’ll take your emotions out of the market. It’s easy to get sucked into the daily chatter of stocks. Sure, it’s fun to listen to.

But, you don’t want to make decisions based on emotions.

The POWR Income system is 100% ranked based on 118 objective, weighted factors.

The first 5 POWR Income stocks are

already ready for you

We’ll average about 128 days of holding per stock. Some stocks, according to the prior data, we may hold for over 3 years.

Each of these stocks pays a minimum of 4% yields on your money…

Meaning, as we wait to collect capital gains, we’ll be collecting some cash as we go.

You can find these first 5 stocks in my new bonus report, POWR Dividend Plays for Triple Digit Gains.

This report will likely be updated monthly so you can go back to it regularly for a refresh on what stocks you should be in .

You can buy them right from your IRA, 401k, or brokerage.

None will have K-1s attached…

Simply buy and hold. No selling covered calls on them or swing trading.

Buy, hold, collect dividends, then sell for a capital gain.

You can then take those capital gains and go back to The Dividend Hunter to collect 10-12% yields from our dividend plays there.

Rinse and Repeat.

And I’ll keep you updated on what stocks to buy in my brand-new service, POWR Income.

POWR Income is the first (and last) service I’ll offer on generating big gains from conservative dividend stocks.

Our entire process will center around our ‘ranking’ software.

The goal = build you a bigger portfolio so you can invest in high-yield stocks to collect more dividends for life

POWR Income isn’t a passive product for me.

POWR Income isn’t a passive product for me.

However, we’ll be relying on the ‘ranking’ software Patrick built to push for market-beating returns.

There’s no emotional buying or selling…

Everything runs on this system to keep you and me in check no matter what the market does.

What’s my job then?

To keep you on top of what stocks to buy and which to sell.

I’ll also be making decisions on certain stocks that are on the ‘line’ about being in and out if I feel there’s a strong fundamental case for us to hold the stock.

Or, if a stock temporarily drops due to certain macro news…

I will keep you in the stock to make sure we’re not shaken out by ‘fake news’ out there.

Again…

Consider POWR Income a compliment to Dividend Hunter and Monthly Dividend Multiplier.

Meaning — take the capital gain profits you make (and we hold for an average of 128 days)… and roll into the other two services to accelerate your dividends.

They all should work together.

Remember, here’s just a few of the winners the ‘ranking software’ behind POWR Income has produced in backtesting:

- 408.10%

- 359.70%

- 338.10%

- 311.10%

- 303.20%

- 295.10%

- 288.70%

- 271.00%

You have $15-20k…

You could’ve generated up to $81,600 in profits. That doesn’t even include the 4%+ yields you’d collect in the interim!

You take that $81,600 and put into The Dividend Hunter to collect 10-12% yields…

You just added almost $10k in extra income per year to your account.

All by starting with POWR Income.

I collect, on average, 70 checks every single quarter. That’s about 280 dividend checks per year.

I could start collecting even more as I bank triple-digit profits from POWR Income opportunities.

You could accelerate your dividend income starting today without working.

Every single day (on average) there is money pouring into my account.

And I’m not worth millions, mind you.

You don’t need millions to enjoy a high income from dividends.. You simply need to know the right dividend stocks to buy.

Because all dividend stocks aren’t equal.

There’s over 4,174 dividend stocks trading on just the US exchanges right now.

But it’s impossible to invest in thousands of stocks.

I’ve figured, if you focus most of your attention on dividend stocks… you can get paid a check every single day for life.

You can start with buying one share of each and grow from there.

In fact, to collect one per day, in January 2022 (for example), you only needed around $605 to collect one dividend (on average) per day.

So, if you have at least $605, you can start collecting a check.

Obviously, as you add more money to your portfolio, that account balance grows, and you collect more dividends.

One subscriber, R.C., saw her portfolio jump 71% in under 2 years investing in the dividend stocks I recommend.

But, more importantly, she’s collecting huge dividends.

One day… $165.07

Another day… $175.07.

A third day…. $155.06.

She’s doing this again and again.

She claims: “I’ve never trusted someone in finance more than Tim. Now, I buy his recommendations right away…“

“Put your money into these, they don’t fluctuate a ton and your dividends are growing. Your effective yield will be much higher.” – R.C., subscriber

The big key — she felt she could do it all on her own.

“We hired 5 different money managers. We received mediocre results and high fees. I realized I needed to manage my own money, but didn’t have time.”

Now, 5 years later, she’s still collecting checks.

Another reader, Don, was diagnosed with multiple sclerosis and forced to live off disability at 61.

His disability was set to run out by 67… but, fortunately, he found my dividend strategies and he’s now “more confident than ever” he’ll be able to retire comfortably. “I won’t have to worry anymore”, he claims.

“More confident than ever” he can retire comfortably. – Don, subscriber (compensated for testimonial sharing his story)

Another reader, Charles, is planning on retiring in a few years… but still paying for his son’s college.

He found me while looking for a way to generate income after his job was over. He found me while Googling online.

Charles and his wife plan to retire to Europe… and now he can:

“Tim’s dividend stocks provide enough income to give us

flexibility on when we can retire.”

Charles, subscriber (compensated for sharing his story)

Charles is reinvesting…

Another reader, Ray, uses his dividends to cover everyday expenses: “We had our furnace break recently… cost $12,000 to repair. Having regular dividend income helped take a load off our shoulders. Thank you Tim!”

I love stories like that.

Dividends making ends meet.

These are just a couple of dozens and dozens of readers who are collecting dividends almost daily.

And the more capital you can gather… the more dividends you can collect.

It’s obvious math.

Up to now, I’ve only been able to help you live off the portfolio you’ve built while you worked.

Today, that changes.

With POWR Income, you’ll now be able to rapidly grow your portfolio balance with dividend stocks at the same.

This will (likely) be my only product I’ll ever release focusing on capital gains first and dividends second.

In these rougher economic times, I want you to not be worried you’re going to run out of money even if you’re collecting dividends.

There’s no reason you can’t both be shooting for higher gains…

While then also collecting and living off your dividends at the same time.

They should work together for you 24/7.

POWR Income is going to be a simple product.

I’m not going to bombard you with tons of information. Most of the product will be focused on our buy & sell recommendations.

Meaning, I’m not clogging up your inbox with ‘extra’ content. Only the picks you really want.

| Here’s everything you get with a 1-year POWR Income subscription:

TODAY ONLY: $300 IN SAVINGS IN ADDITION TO…

|

The ‘ranking’ software behind POWR Income would cost $30k/year to access…

Plus, another $150k/yr for an analyst.

POWR Income and your first 5 stocks to buy costs less than 1% of this to access

Patrick’s salary is not cheap…

A Wall Street analyst would go (on the low end) for $150k/year.

Plus, the ‘ranking software’ powering POWR Income would set you back over $30k/year… not to mention the work to build your own investing strategy.

(It took Patrick 12+ months to build POWR Income’s machine).

I’ve negotiated to get POWR Income to be pennies on the dollar for you to access…

I’m talking it’ll cost less than 1% of these costs.

Instead, my publisher and firm bears the weight of the cost for you.

I expect, in the future, to be able to retail POWR Income for $2,997/year.

Especially if you’re getting a shot at turning $25k into $4.1M.

You can get everything this system produces for virtually pennies compared to the backtested gains it produced

However, on this page only, I’ll cut that price down even further for you… because you’re one of my subscribers already.

Before I share the price…

Let me also introduce you to my co-editor.

Get two editors for the price of one!

Jay Soloff, our expert short-term investor, will be on hand

Jay’s been a fixture at Investors Alley for half a decade.

Jay’s been a fixture at Investors Alley for half a decade.

Jay’s traded options for over 21 years.

Because we’re doing shorter-term investing (averaging 128 days), it makes sense to bring in an expert of shorter trading.

Jay has a product where he’s in and out of income trades in 48 hours!

Jay’s also an expert on faster income gains from covered calls, spreads, and more.

Jay’s also an expert on faster income gains from covered calls, spreads, and more.

That’s why I’ve invited our in-house short-term income pro, Jay Soloff, to join me as a partner for POWR Income.

Jay traded on the floor of the largest Option Exchange in the world — the CBOE.

There’s something unique about Jay.

Not only was he a trader on the floor…he was a Market Maker.

The Market Maker is the ‘invisible hand’ in the market. They provide liquidity to keep traders buying and selling.

This is important because the Market Makers see the ebb and flow of the market. Jay’s experience behind the scenes has provided him with insight into the options market other folks simply don’t have.

Take a look at some of his trades the past few years:

- VXZ = 367% gain.

- XLY = 170% in just a few days.

- WMT = a 178% score.

- DISH = 109% without breaking a sweat.

- FAST = 233% as the market fell.

- GLD = 156% in the bag.

- XLB = a 222% profit.

- ARNC = a fast 70%.

And… a 1,421% home run on ETFC.

These were just recommendations and there’s no performance guarantee here.

But, Jay’s performance has been stellar.

Jay will be releasing his research in our monthly issues.

But that’s not all.

Jay will lead the brigade for potential double-digit winners that may close in under 3 months

This is Jay’s sweet spot…

But there will be many opportunities inside POWR Income where we may not be in a dividend stock for 3 years… or even 3 months.

Our average hold is 128 days…

However — sometimes we need to make a faster move than that.

Like this play on BBAR…

You would’ve been in and out in 29 days for a 64% gain.

Or, this play in 2022… You’d bag a 64% win holding the stock for just 85 days.

Some may even go for triple-digit gains!

Like this quick move in SSNT in 84 days for a 116% winner!

You could’ve doubled your money in under 3 months. And you would’ve gotten out of SSNT right before they cut their dividend to zero.

This is why you need to be nimble inside POWR Income … and Jay’s going to help us with that.

Here’s 80% off POWR Income right now

The first stock you buy could pay off your subscription this year.

You won’t pay over $200k for the data, software and analyst to run POWR Income…

You won’t even pay $2,997, which is what I’ll likely charge in the future…

For just one payment of $797, you can immediately get your hands on the first 5 stocks of POWR Income.

If you can land a 116% winner in 3 months like I just showed you…

Just $1,000 into that stock would pay out $1,160 in profits… which is double what you would pay right now.

And your $797 is locked in every year no matter when I raise the price in the future.

So this is the absolute best opportunity to give POWR Income a try and a shot at finally growing your capital gains as fast as your dividends are in my other products.

Try out POWR Income for 60 days risk-free…

If after that, you don’t feel it makes sense for you, get a 100% refund to your account

This is a dynamic product to add to your portfolio, but it’s not going to be for everyone.

POWR Income can quickly grow your capital gains without taking huge risks or trading. The goal to grow your account to invest in more high-paying dividend stocks.

If you’re already happy with your portfolio balance… then you likely should pass on POWR Income.

If you’re not willing to let go of a stock in under 12 months… then this is NOT for you at the moment.

Don’t join with the plan to refund.

Join with the positive outlook that you can invest in both dividends and for capital gains at the same time.

You’ll want different stocks for each…

But POWR Income is a perfect compliment to your investing strategy if you’re already enjoying my other services.

Patrick went from losing a quarter of his account to making millions in a few short years…

And it all happened extremely quickly after he started investing by ‘ranking’ and not by screening

Try it out for yourself with POWR Income

I’m not promising you’ll make $5M in seven years like Patrick. He used a shorter term strategy…

But if you can handily beat the market day in and day out, you’re far ahead of almost everyone you know.

The reason ‘ranking’ works is because you’re looking at a stock from multiple angles without bias. Instead, all 118 factors are weighted so you’re looking at the very best potential plays for you to buy every single day.

POWR Income updates daily.

I’ll be updating our positions every 1-2 weeks. Some weeks, we may change many of our stocks… sometimes none.

This is an active service while also being above the ‘trading noise’ nonsense.

You can put yourself on the path to potentially triple-digit gains from conservative stocks… including ones I love like OKE… right now.

The price is as low as it gets.

And this is a strategy that has been thoroughly tested through 3 recessions and a raging bull market.

The ‘ranking’ approach is also so complex, the Wall Street “algorithms” will never be able to untangle it.

You’ll not feel like the stock market is against you anymore.

Combine POWR Income with my other services and you’ll have a complete approach to making money with dividend stocks.

Click the button below and on the next page you can join and get the first 5 stocks.

The next page is secure and you’re in the hands of a 25-year old financial publisher (that’s older than the Motley Fool).

I’ll see you inside,

Tim Plaehn & Jay Soloff

Editors of POWR Income