1 Stock = 4 ways to generate

income this month!

Simply use the Never-Ending

Income “Wheel”

Unlike dividend stocks or covered calls…

With the “Wheel”, you could collect a consistent $1,000/month

no matter if stocks are going up, down or sideways.

*on a $20,000 portfolio

“If you already own stocks…

you may be able to collect even more income than covered calls”

– Jay

Check out this one strategy allowing you to collect income 4 different ways this month.

I’m talking you collect income before you own the stock…

Then, even more after you own the stock…

Plus, dividends and capital gains on top.

Yes… that’s 4 different ways to generate income from one single stock.

I’ve never shared this before, so listen closely.

Because by the end of this page, you could generate a consistent $1,000/month no matter what stocks are doing.

Whether the market is volatile and bearish… you collect income.

Market is bullish… you collect.

Market sluggish? Still you collect your income.

It’s unlike any other strategy you’ll see out there…

… and it’s only getting traction right now… this year.

TastyTrade told its 250k subscribers, this strategy is very “popular” but “conservative”.

Markus Heitkotter told his 85k subscribers, he believes the “Wheel” has the power to “generate 30%/year rather safely” in income.

I’m not promising that…

But if you can at least capture $1,000 per moth starting with $20,000… you can snowball that into bigger and bigger cash returns.

I’ll show you the math in a bit.

$1,000 is more dividend shares to purchase…

It’s groceries for the week…

It’s money to go out for a nice steak dinner.

And you aren’t taking a ton of risk.

I’d argue it’s even more conservative than investing in straight dividends or trading covered calls.

See, if you invest in a stock, when market’s drop, you lose money until it pops back to your buy-in price.

You buy a dividend stock… and like in 2020, you could see your dividend yield go from 5% → 0% virtually overnight.

You trade a covered call… and your shares could drop with you sitting on losing positions until your stock bounces back.

I’m not saying you should stop investing in dividends and covered calls, of course.

Just diversify.

As there’s a way to continually collect income again and again.

Today, I’m going to introduce you to the never-ending income “Wheel.”

It’s called the “Wheel” because you’re able to generate income all the time, every week. Again and again.

Think of it like a set of rugged off wheel tires on a nice, red pickup truck.

Those tires join the other cars on the smooth highways… through the back roads to get home.

But when snow hits… or mud clogging up the dirt roads…

While other cars have to park and wait…

Your off roaders keep going. Around and around no matter the weather or climate.

The “Wheel” is your off road tires.

It keeps moving… keeps collecting you income no matter the market, politician, or Federal Reserve land mines that get thrown.

No other strategy I’ve found can say that. Not buy and hold. Not covered calls.

That’s what you’ll see today.

What if starting with a mere $20,000… you could collect up to $1,000/month.

Sure, that doesn’t sound like a ton.

$1,000/month = $12,000/year…

Or a 60% return on your capital!

Does 60% get your attention?

I’m showing you a never-ending income wheel that’s low-risk, conservative… a perfect addition to your arsenal if you love consistent income.

Sounds exciting.

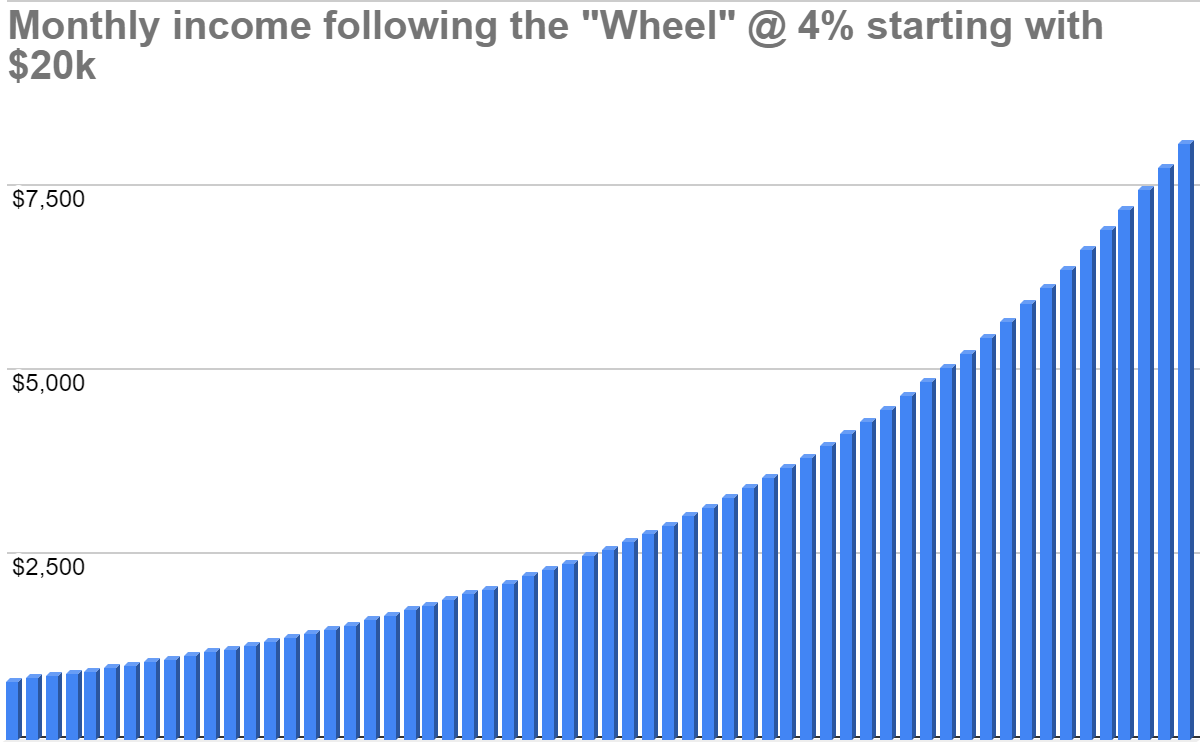

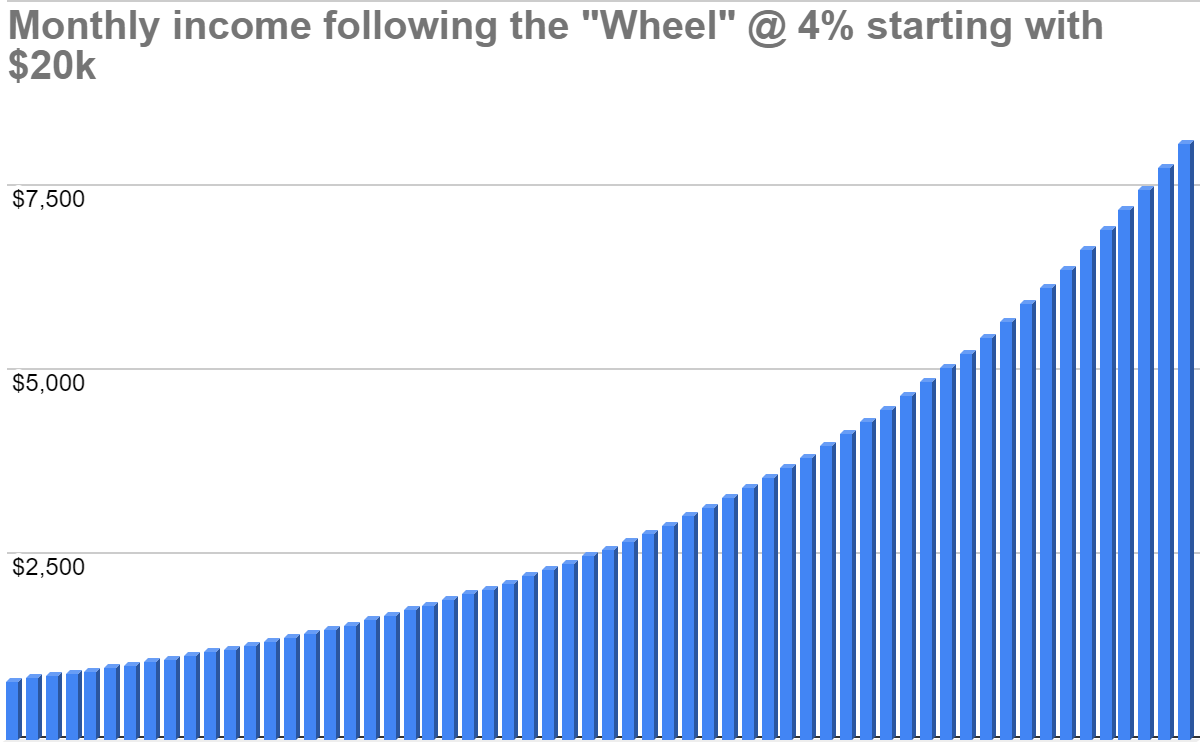

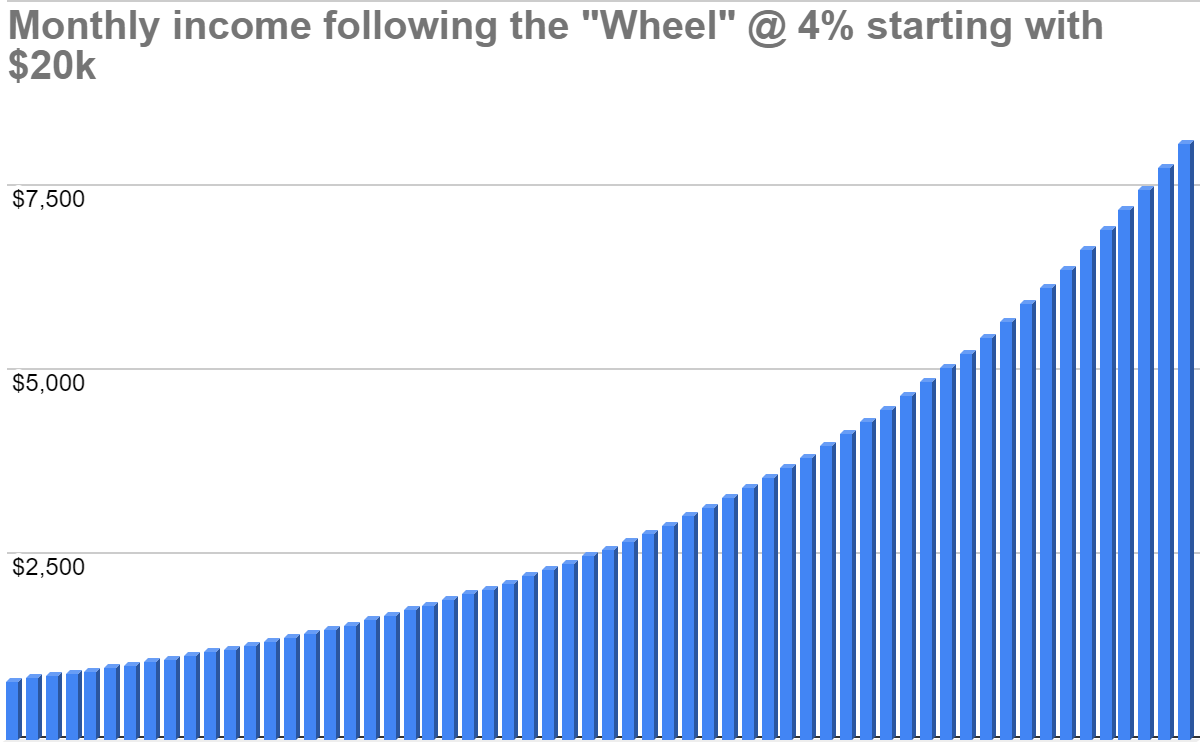

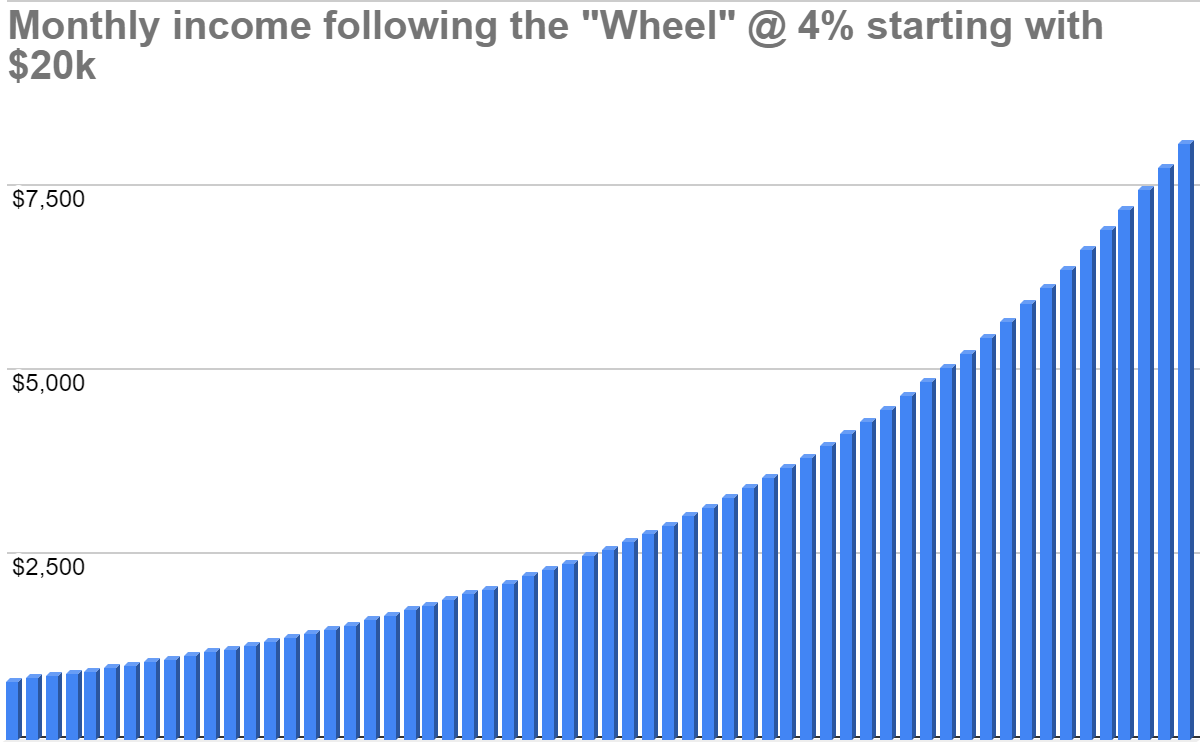

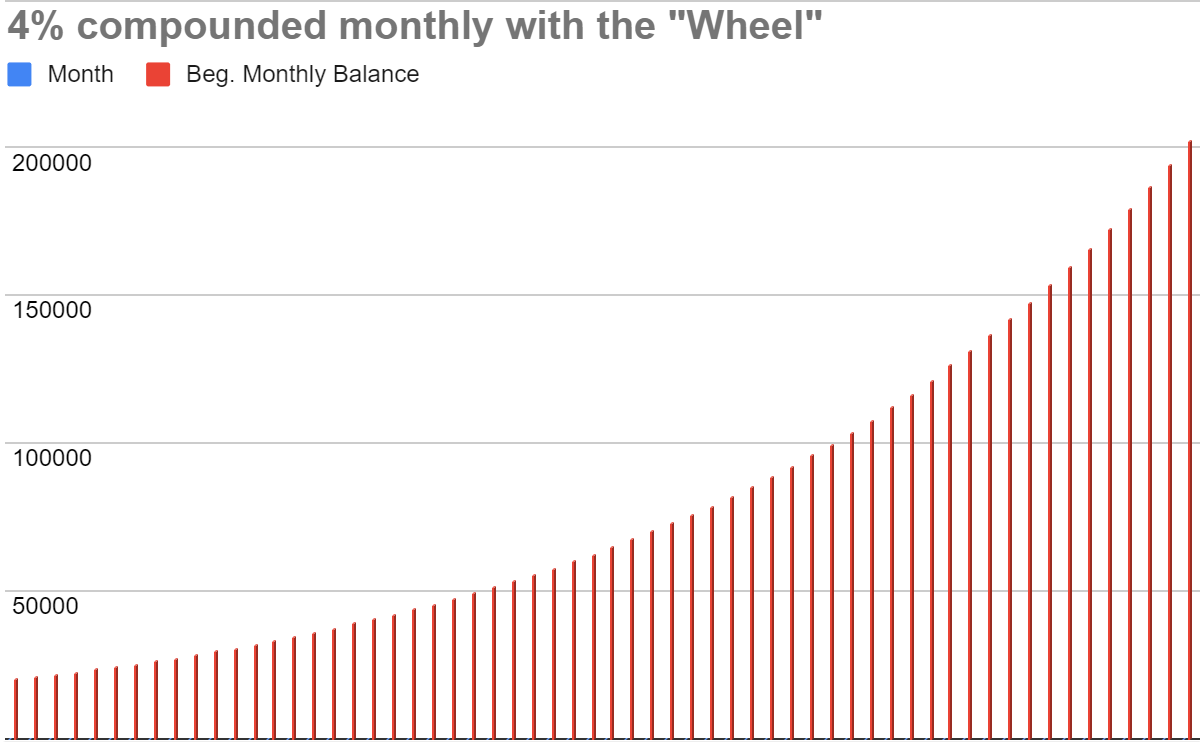

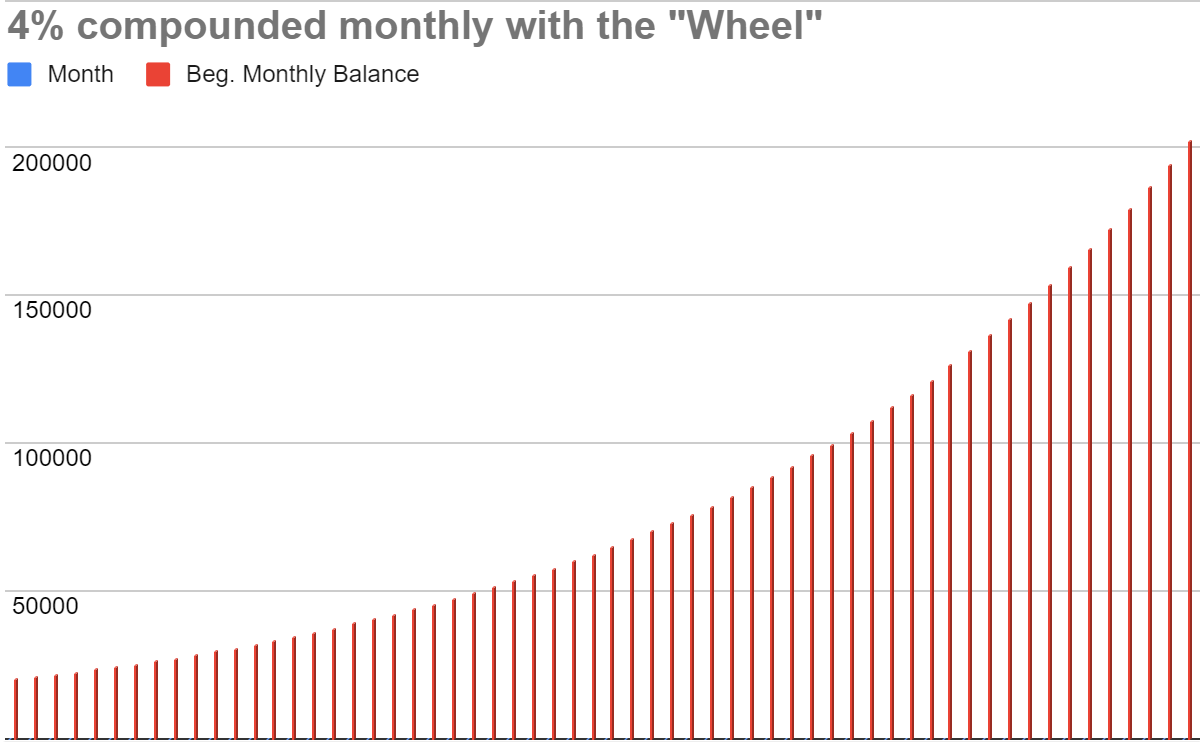

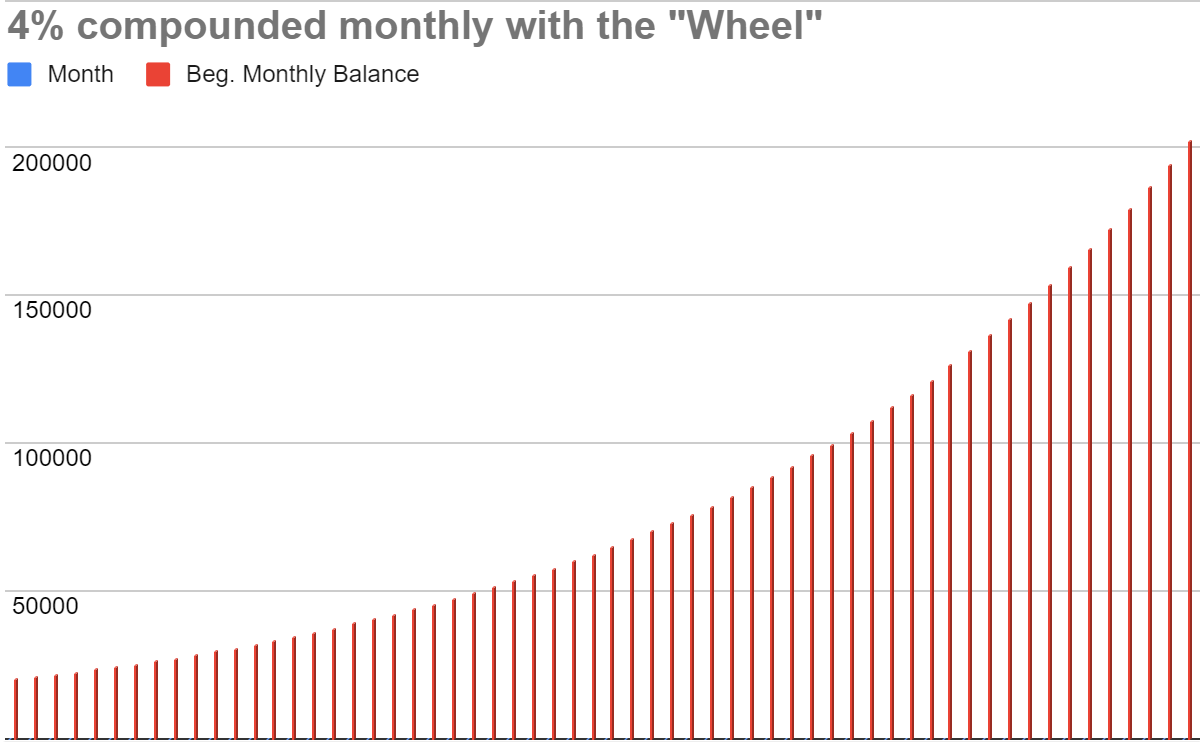

Watch how fast it can stack up:

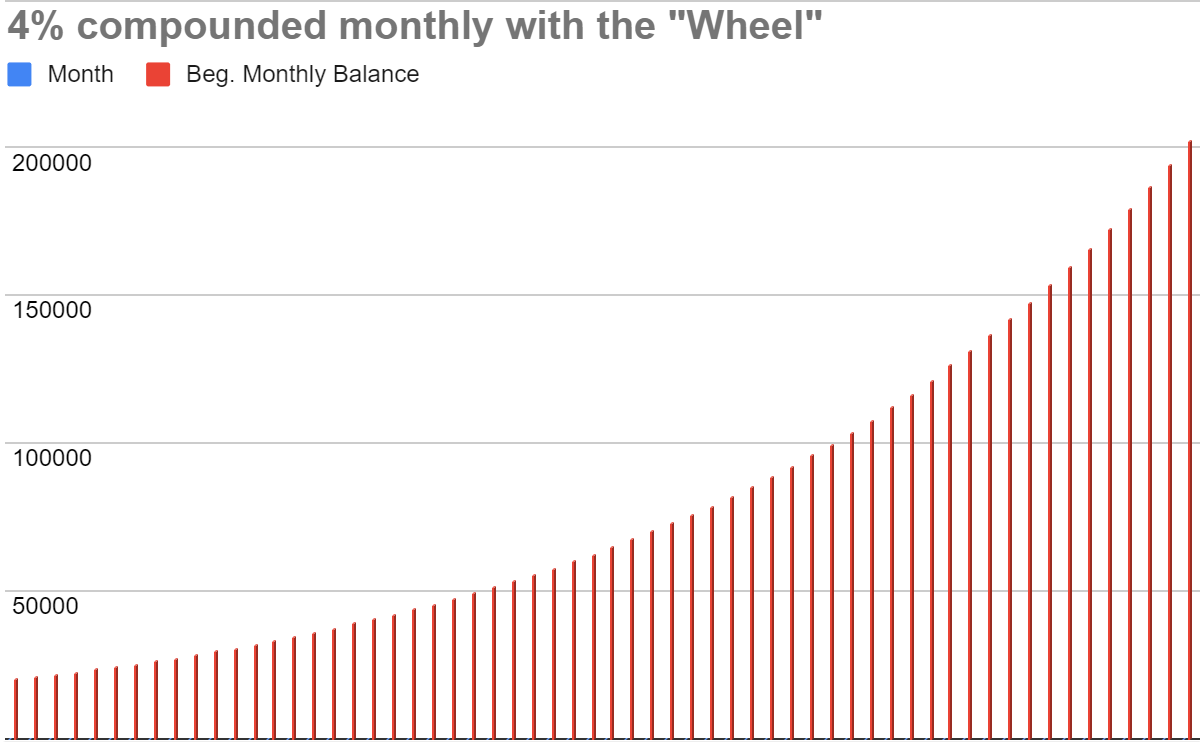

Over 60 months, compounding 4% per month… your monthly income could go from $1,000 every month to $8,092.

Or… $97,104/year.

That’s a near 400% return on your initial $20k investment.

To get to that $97k/year…

Your portfolio balance, after compounding, would explode to over $202,301 in 60 months.

Now, of course, this is pure speculation and 4% on the nose isn’t going to happen every month.

Some months may be 5%… others 3%. Still more higher or lower.

The point is I’m showing you the potential of starting to use the never-ending “Wheel” strategy right now.

Even if the first check is $250/week…

There’s more to come.

Because, remember… the “Wheel” is always moving… there’s always income to be made every single week.

The secret is tapping into a “loophole” in the markets only a seasoned options expert is able to spot.

Don’t let that intimidate you… I’ve been trading for over 20 years… but I can show you exactly what I’m seeing.

The loophole is quick to spot…

It deals with the volatility of the stock…

And with it… identifies brief moments in the market where you can collect quick income with a high probability of success.

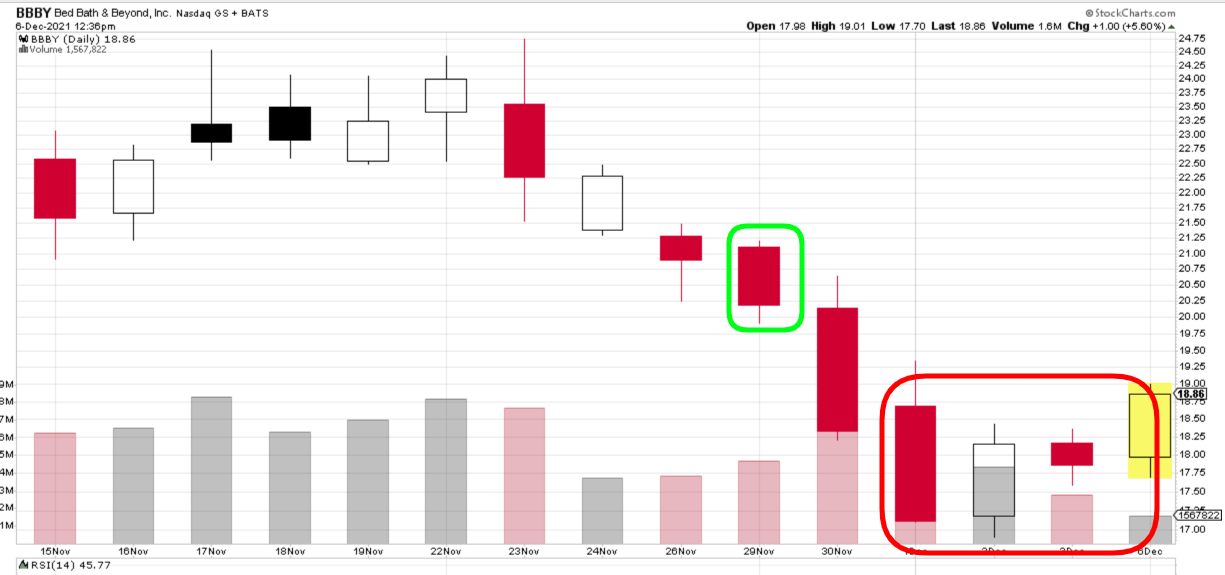

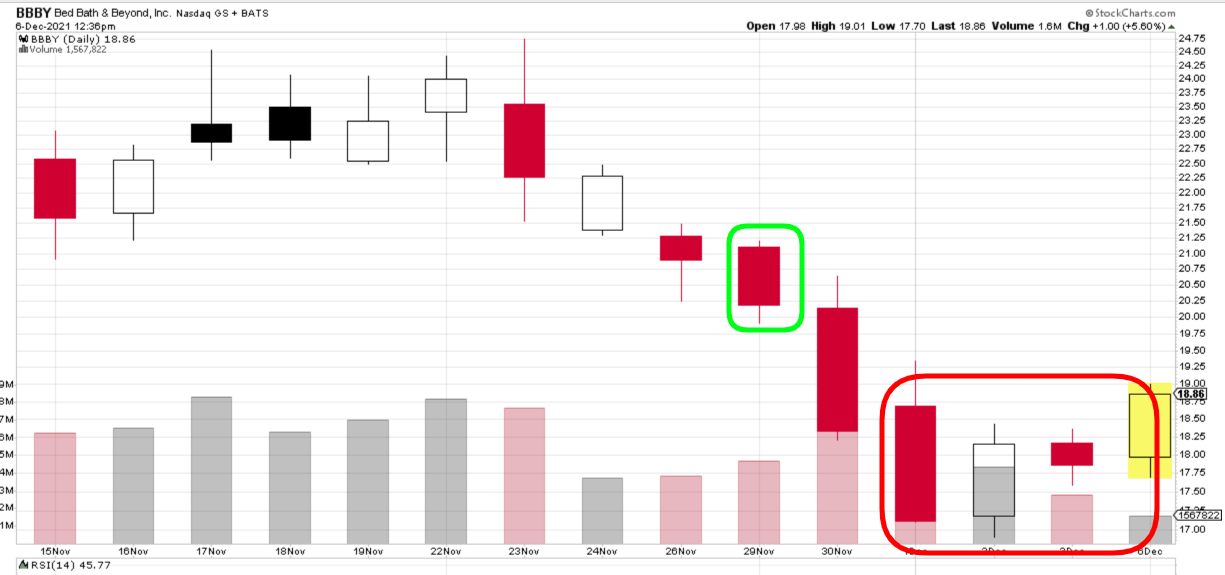

Take this opportunity I found in Bed, Bath & Beyond (BBBY).

Now, for many, owning this stock has been a heartbreaker.

If you’re a buy and hold investor, you’ve experienced 75% drawdowns from the mid 2010s.

However, while buy and hold-ers have struggled, there’s still income to be made with the “Wheel.”.

See… by spotting volatility in the stock, I’m able to capture a 4.9% return in 17 days.

I’ll break down this entire opportunity later…

But what I did was take advantage of the volatility in the stock to collect quick income…

And AS LONG as the volatility stays high, I can continue to collect income again and again, every week… until it no longer makes sense to do so.

That’s the never-ending “Wheel.”

You keep collecting, until it doesn’t make sense anymore, and you go find ANOTHER opportunity to “wheel.”

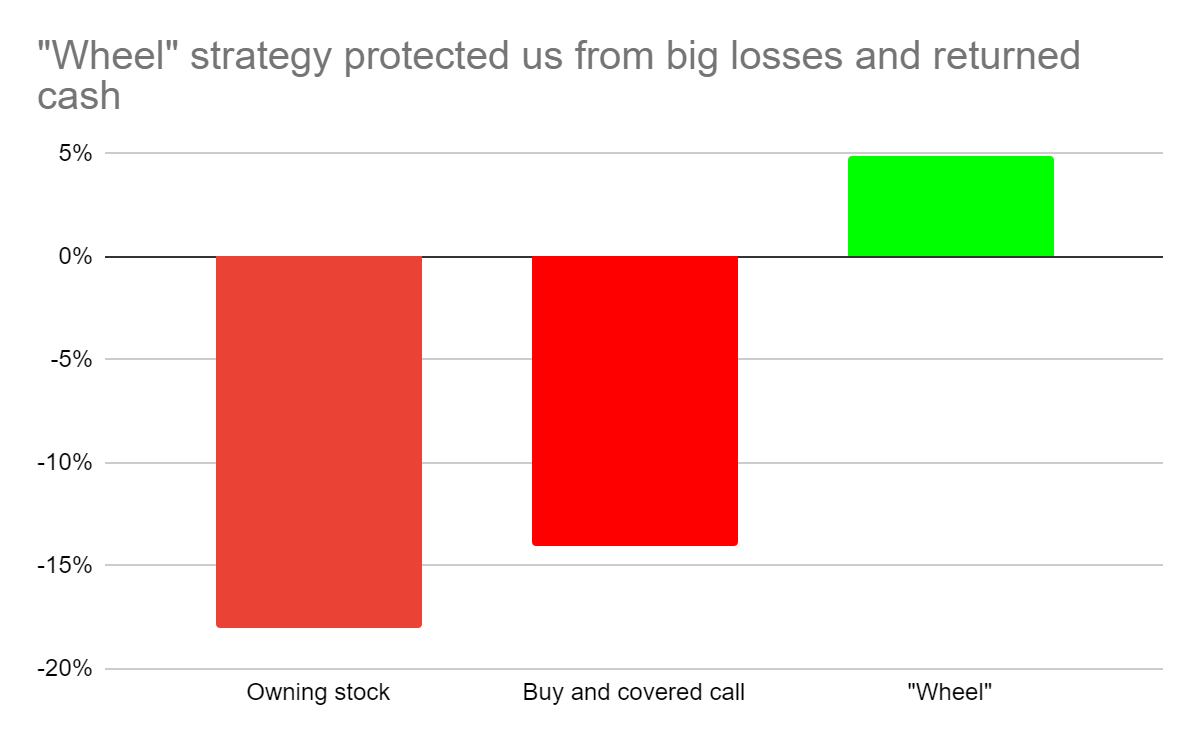

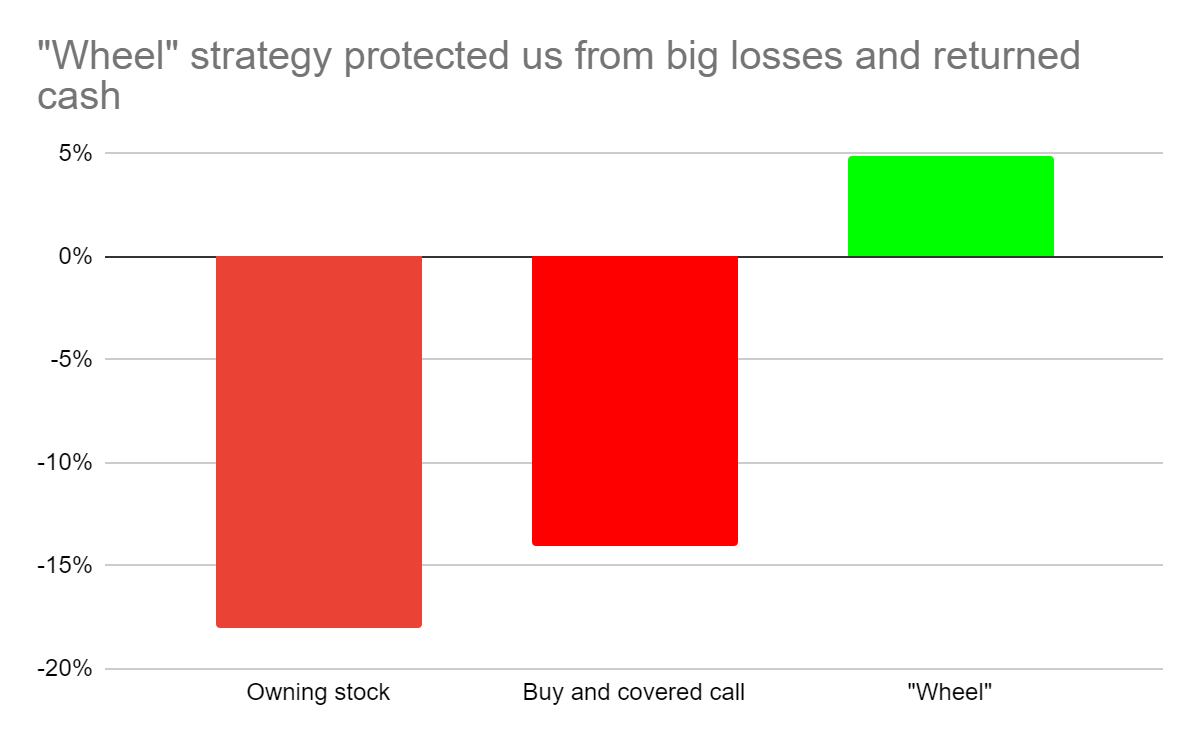

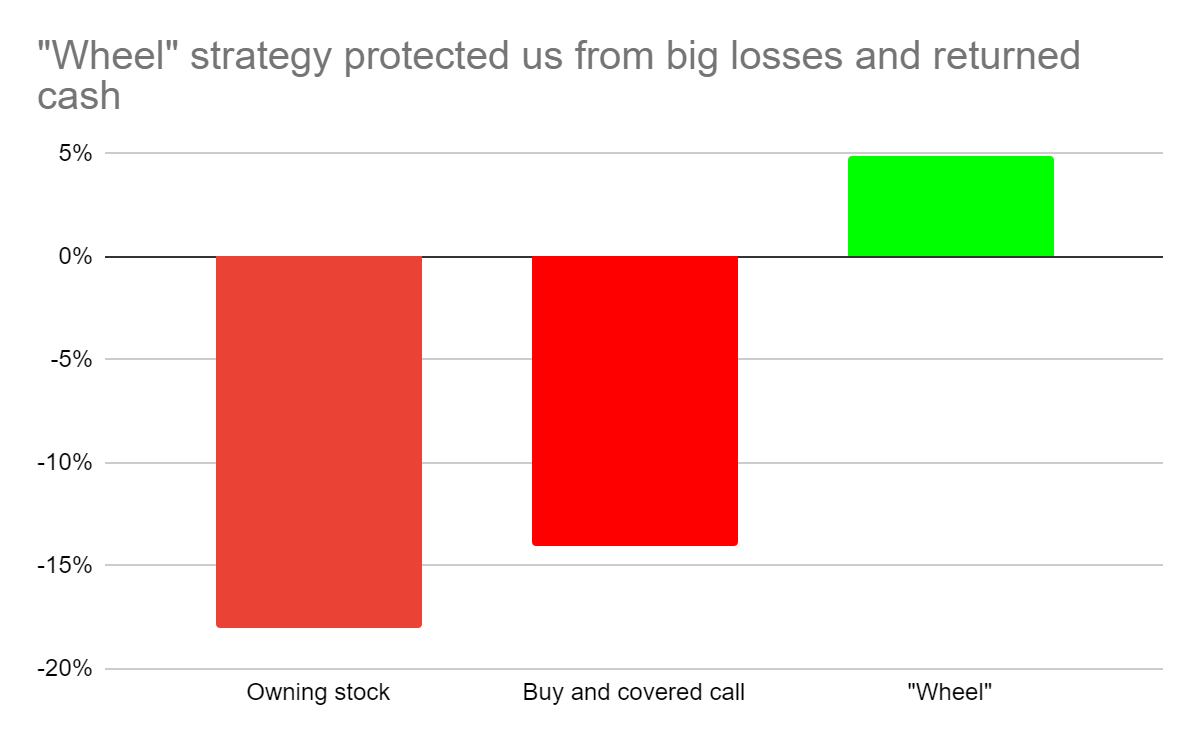

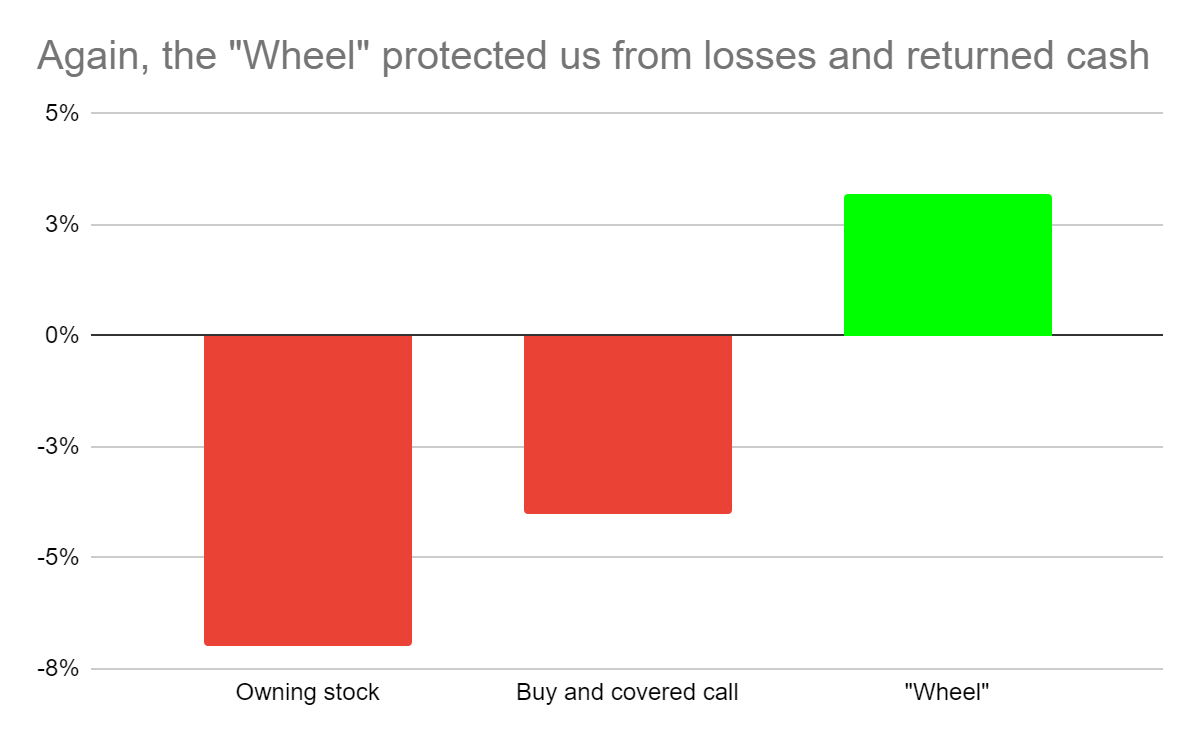

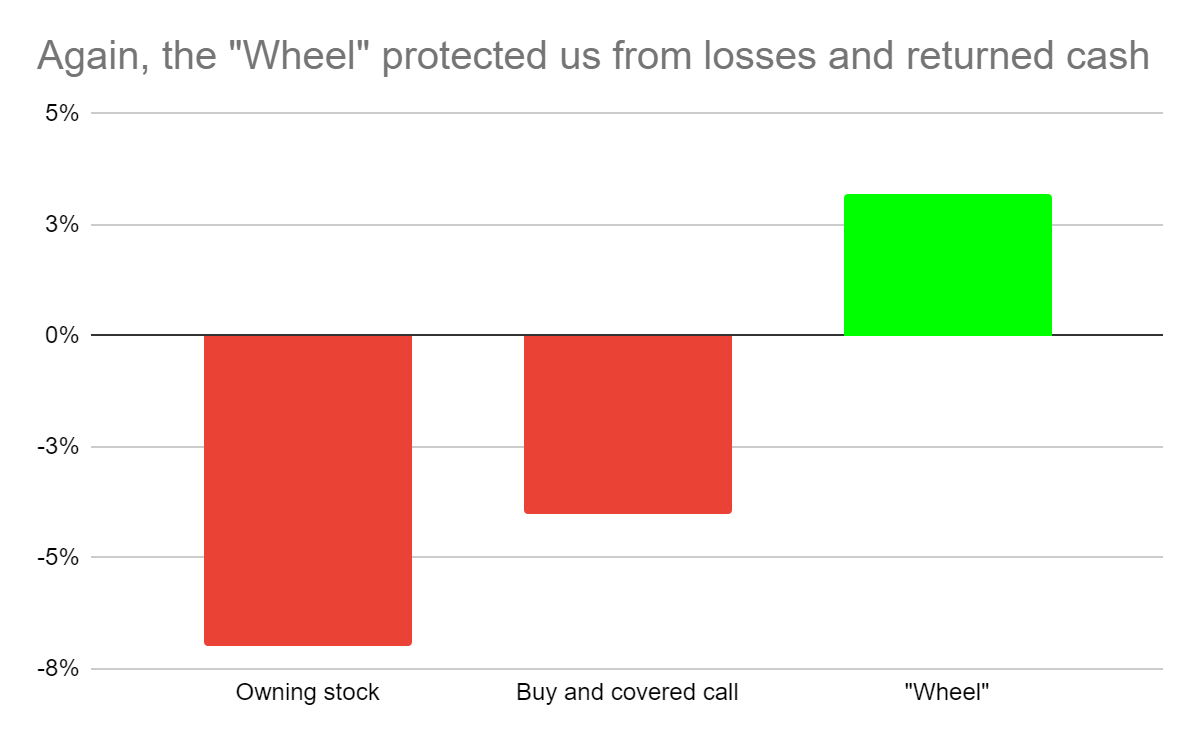

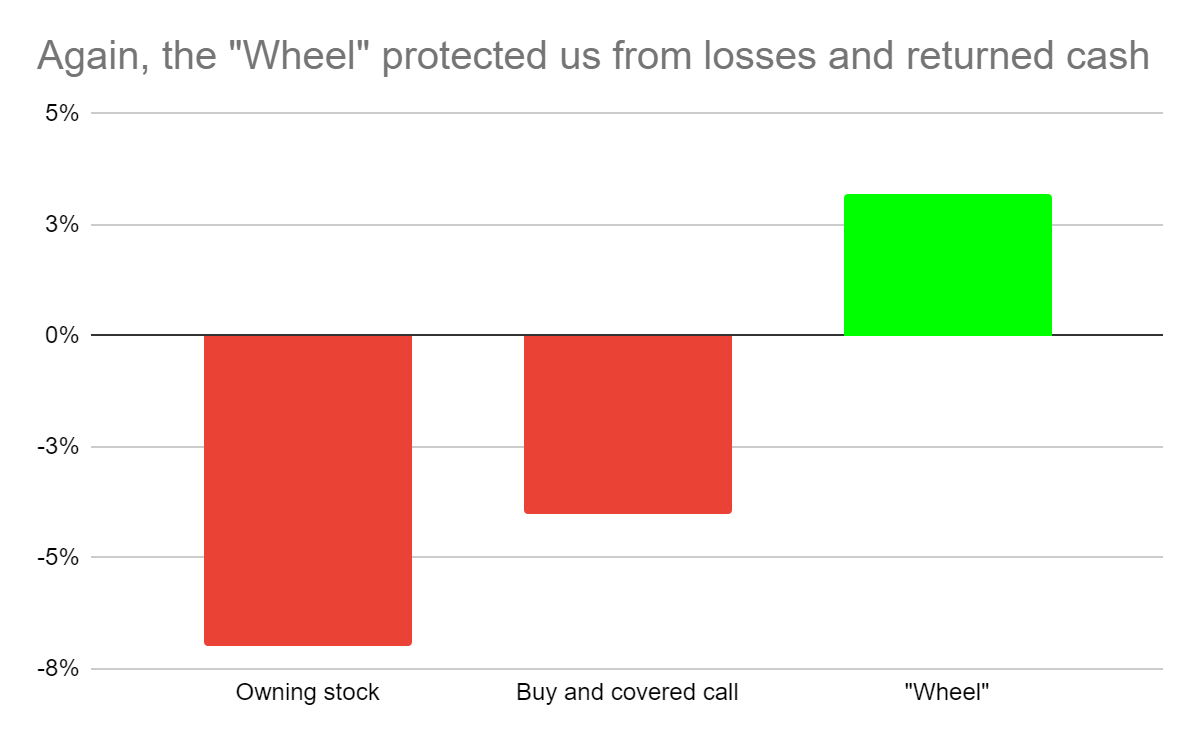

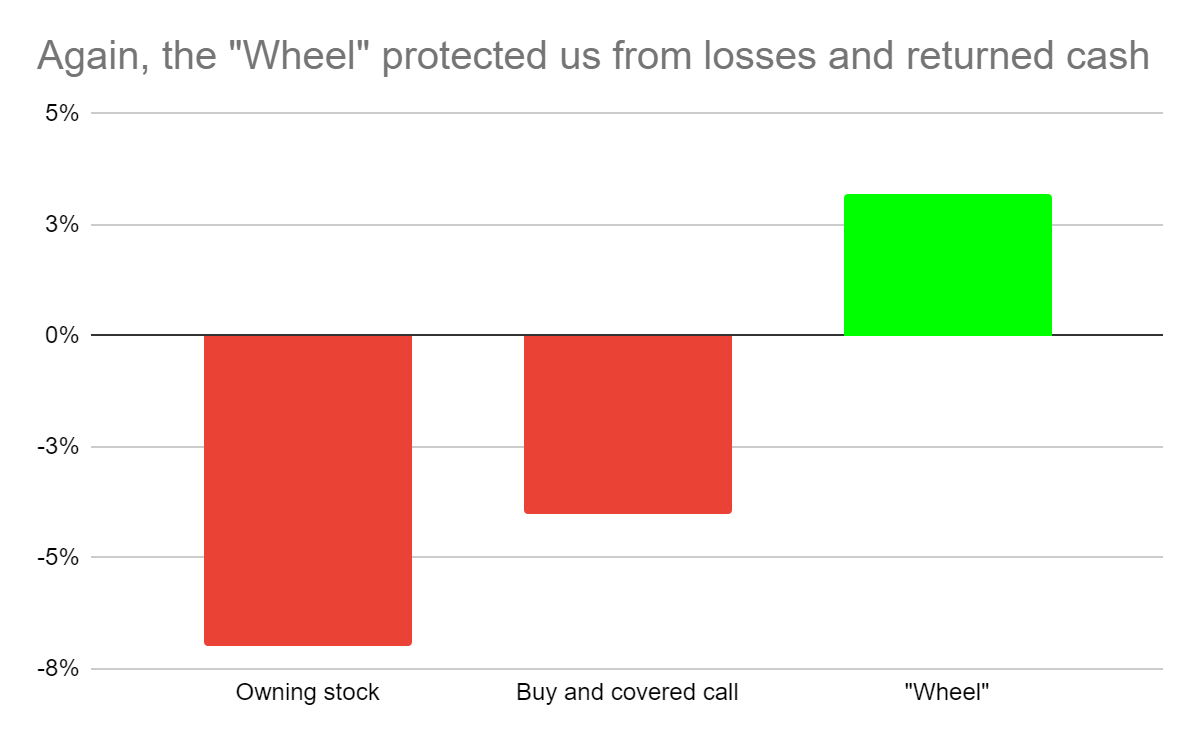

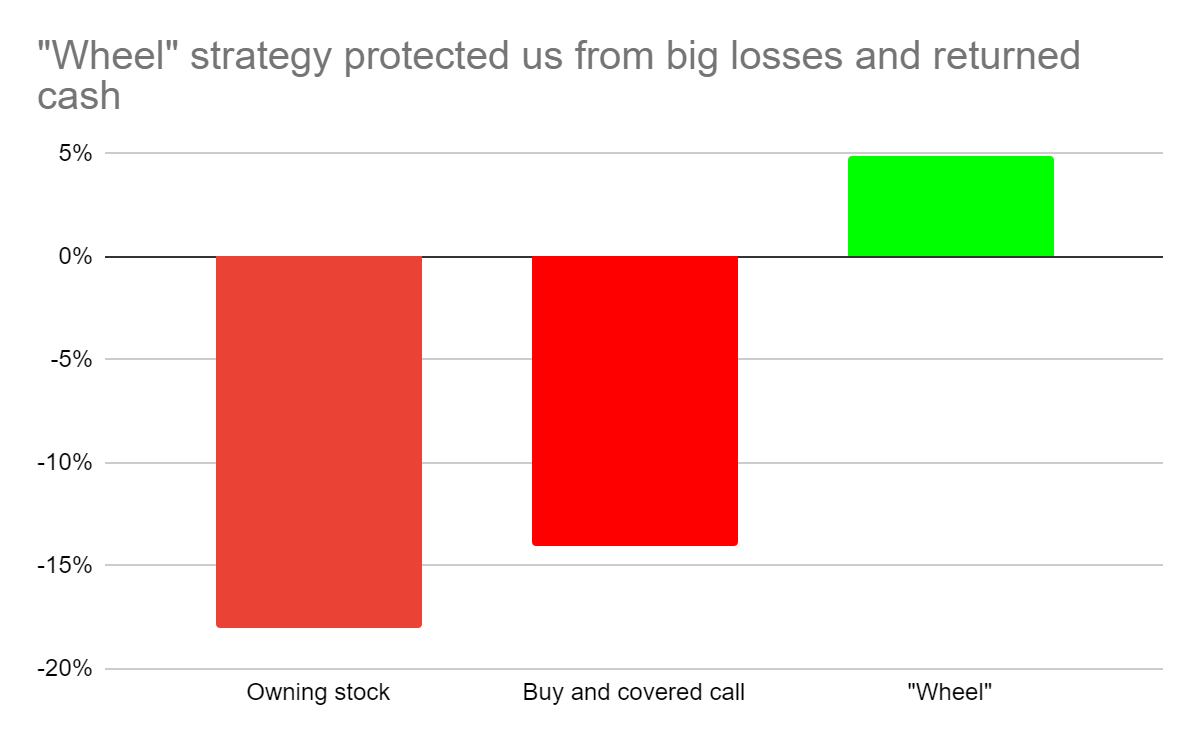

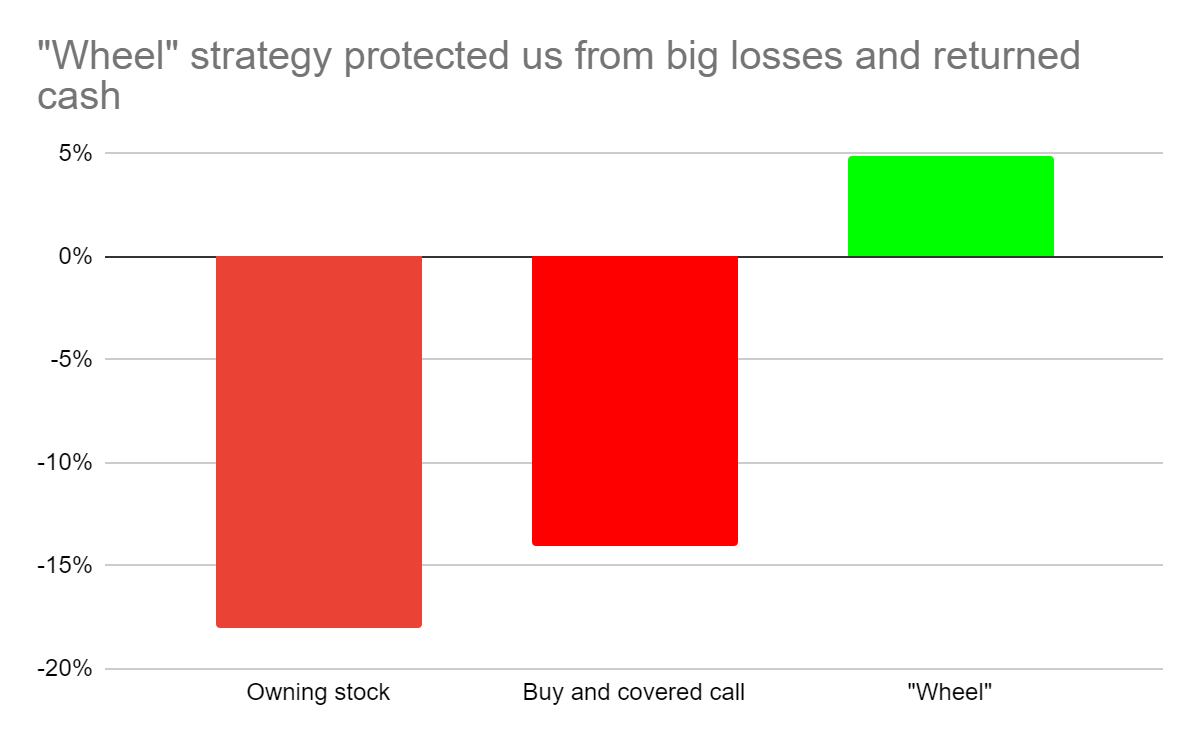

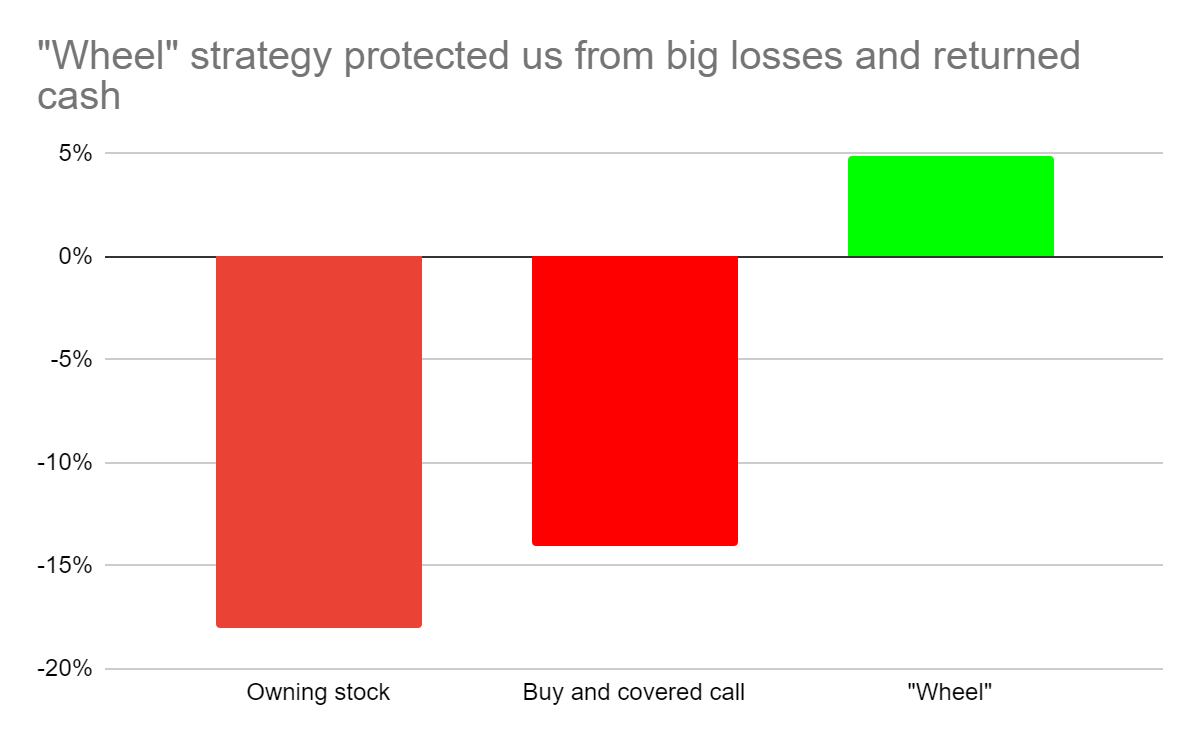

Here’s how the “Wheel” differs from owning the stock or a covered call…

I made this trade WITHOUT owning the stock.

Owning the stock would’ve been too risky here.

I took the “lower risk” approach.

Because with the “Wheel”, I only acquire shares at lower prices than its current price. (you’ll see how)..

And I’m glad I didn’t own the stock as it dropped 18% after I completed the trade.

Meaning, if you were bullish on the stock, you would buy shares and be down 18%.

If you traded covered calls, you’d capture (I’d estimate) 4% in covered call income… but lose 18% in your shares.

With the “Wheel”… in my sample trade, I’m owning 0 shares, nailed down a 4.9% win and no shares in my arsenal.

With $5,000… that’s nearly $250 in income within 17 days.

You do this 4x per month… and you’re on pace to continually collect $250 per week… or $1,000 over a month (on average).

Of course, nothing is guaranteed… and all opportunities don’t generate exactly the income we want…

But you can see the potential here.

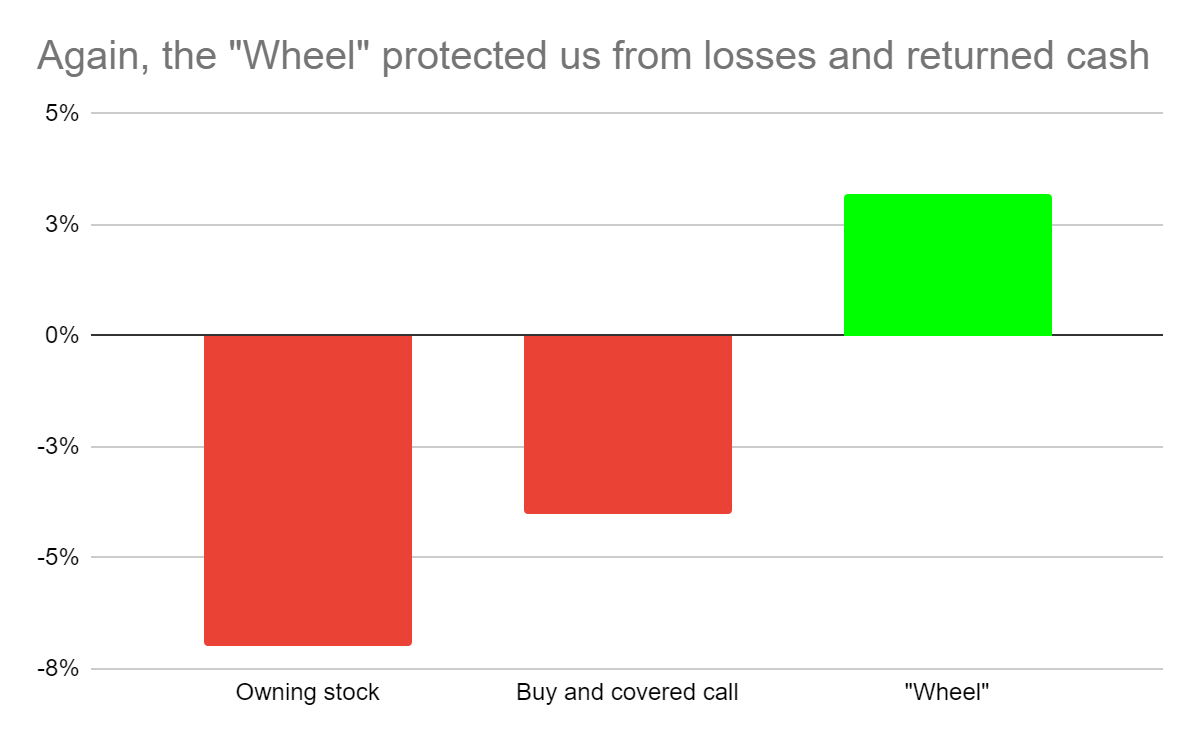

I used the “Wheel” strategy again with Peloton (PTON).

In November 2021, I opened a paper trade because I was bullish on the stock. It had just cratered nearly 50% after earnings.

I felt a bottom was in.

But rather than dive in and gobble up shares…

I took to the “Wheel”.

Remember — the high volatility meant I could now collect income again and again until volatility died down.

It’s all about collecting quick cash.

The “Wheel” provides these income opportunities at a click of the button. Rather than risking $5,000+ to buy 100 shares…

I instead did the opposite.

I collected money!

On Day 1 too.

Now, this was a paper trade to show you the power of the “Wheel”, but the point is… thanks to my volatility loophole in the market… (a loophole I can spot after 20+ years trading)…

I was able to nail down a 3.2% profit.

…but that wasn’t all.

Sometimes (not always), as part of the “Wheel” strategy, we’ll acquire shares and then collect income while owning the shares.

We do that until we sell the shares… and then collect more income from NOT owning the shares once again.

In this Peloton trade… 17 days later, I would’ve purchased the shares…

And this is where the “Wheel” gets interesting…

But not for $5,000.

Instead, for $4,700.

A full 6% discount on the original price when we collected our first income.

Plus, I still enjoy the 3.2% profit on my money.

…saved money on the shares…

…while also collecting income.

You can’t do that with dividend stocks… or covered calls.

Don’t worry if you don’t have a clear picture yet… I’m going to break it down for you step by step in 2 minutes.

This is just a broad overview now, but you can see the potential.

That’s why I’m shedding light on this “Wheel” strategy with you.

You can be bullish on stocks, collect income, and still not have to risk your hard-earned money into a stock that may make a sudden move.

I’m going to show you all that with the “Wheel” strategy today.

Bonus hint — after I would’ve bought the Peloton shares, Day 1 of owning, I could’ve collected more income on my shares. Perhaps another 3.2% in the following couple weeks.

It’s the magic of the never-ending “Wheel.”

Income is available at your fingertips.

Let me show you what I mean.

Take a look at this randomized chart of a sample stock.

Think of any stock chart, and MOST look like this. Well, we’ll say the average chart looks something like this.

Facebook (or “Meta”) is a great example:

Stocks go up, stocks go down.

If you bought shares early 2019… by December 2021, you’d have a nice 91% win here.

Here’s where the “Wheel” comes into play.

Rather than simply holding shares through these ups and downs…

You can lower your risk putting the “Wheel” in motion, collecting income when the stock goes up, down or sideways.

When there’s big drops, you’re acquiring shares at a discounted price, then selling them later for a profit.

Here’s what I mean:

Every “X” is profit…

Every “0” is where you acquire shares. Those shares would then be sold later for a higher price every single time.

Meaning, while Facebook goes up 91%…

You could potentially see higher profits when the stock goes sideways or down… and only see slightly lower profits on big run ups in the stock.

It’s hard to calculate back-tested math…

But I estimate you would beat the 91% returns ‘buy and hold’ investors made following the “Wheel”.

Yes, it takes more effort than blindly holding shares…

However, you collect income as the stock goes up, buy shares at a discount, and then collect more income as you own the shares… before selling them for (likely) a profit.

Although, there’s no guarantee you’ll make money.

If a stock wildly drops, it’s harder to make money with “Wheel.”

In this instance with Facebook… I believe you’d see over 100%+ returns.

Others have run similar tests with their own “Wheel” trades…

Take a look:

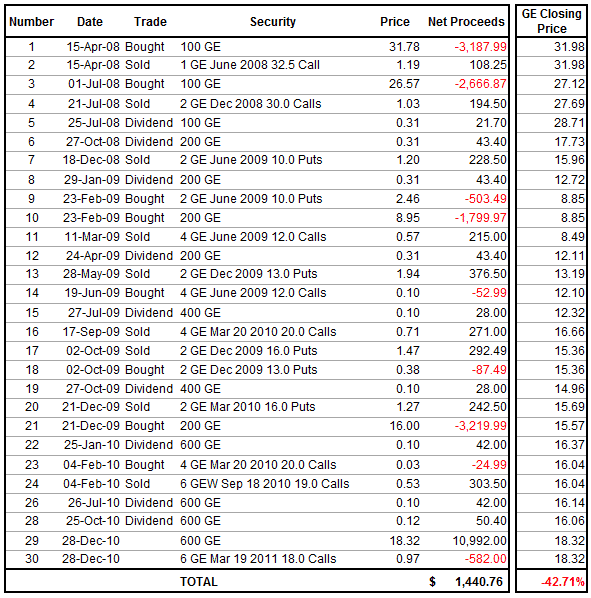

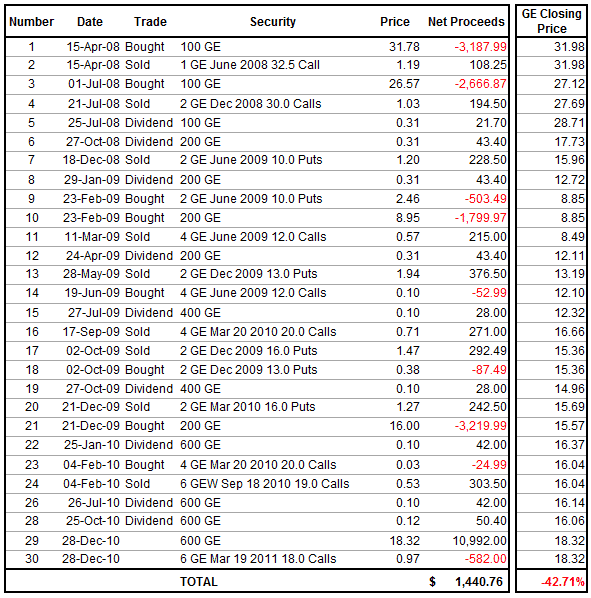

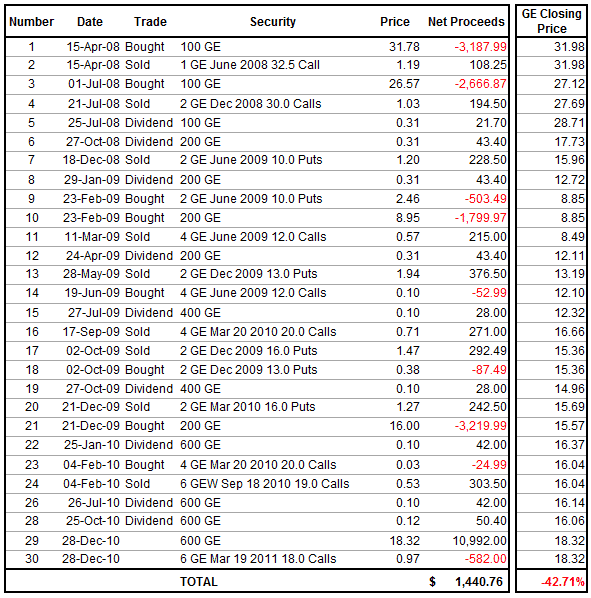

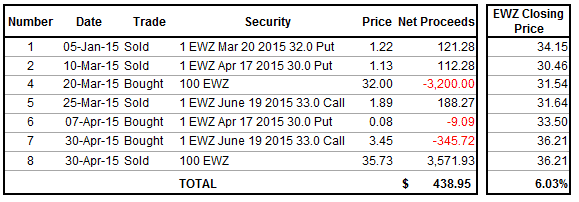

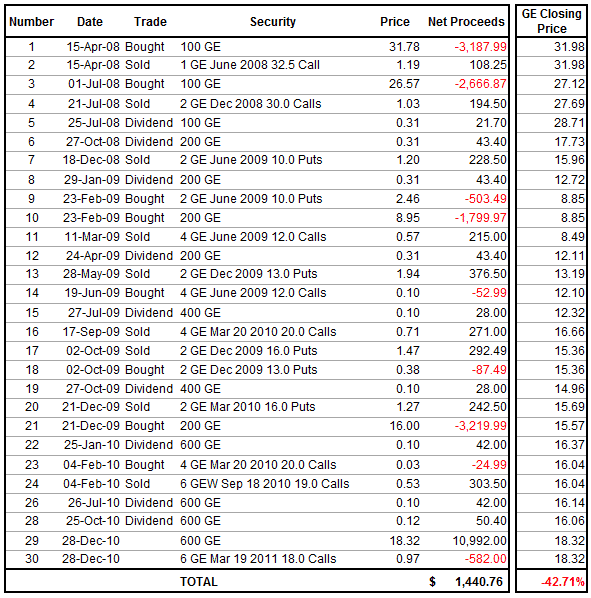

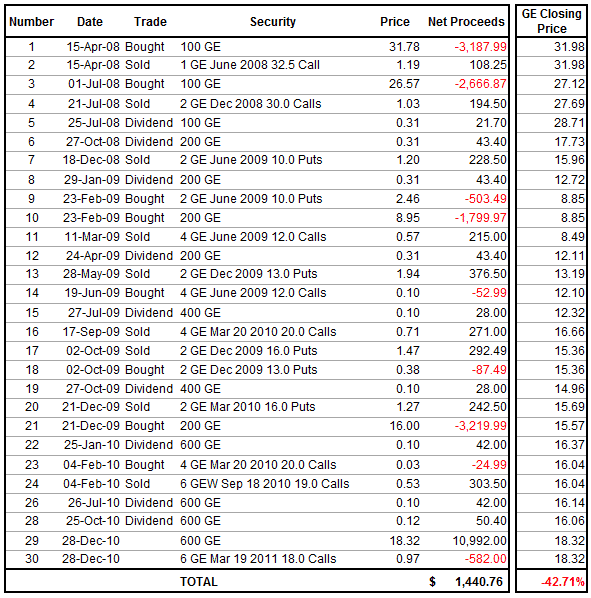

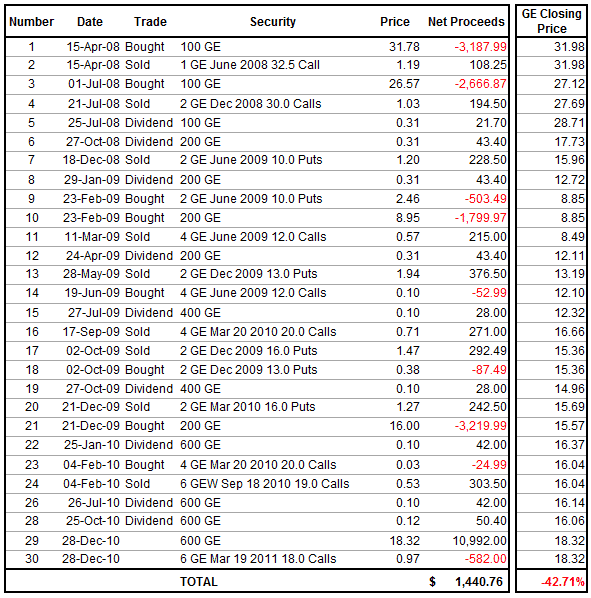

OptionsTrading HQ shared his trading log… including a timeframe during the 2008 crisis.

He ran a 2 year “Wheel” strategy on GE with larger timeframe intervals.

Check out the results… as it’s very interesting:

For over 2.5 years, he traded GE stock using the “Wheel” strategy.

Over the course of that timeframe, General Electric cratered 42.7%.

That’s losing almost half of your investment.

If you invested just for the dividend… or even to sell covered calls… you’d be in a pretty deep hole.

However, using the “Wheel” strategy, he banked a 45% return on his mere $3,187 initial stake.

Meaning, rather than lose over one thousand dollars buying and holding…

Trading the “Wheel” generated a profit.

That doesn’t mean it only works when stocks go down.

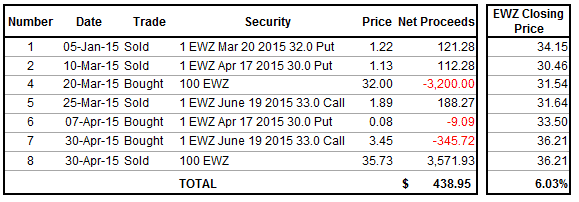

He shared another trade log over a 4 month span.

Again… buying and holding was outperformed.

In this case, buying and holding resulted in a 6% profit in 4 months. Not bad… that’s a 24% annualized gain.

Meanwhile, using the “Wheel” strategy, he actually had a shot at 10% returns.

Not a huge difference until you add up.

Over a year, that’s a 40% annualized return vs. 24%. You’d be doubling your money in less than two years vs. three buying and holding.

Of course, I haven’t verified his portfolio, nor audited his statements.

I can only share what he decided to post in public. Above is simply showing you the power of the “Wheel” strategy.

The secret behind this strategy — the “loophole” — isn’t something easily identified on a chart or in some SEC report.

The loophole requires a bit of a technician who understands volatility.

I’ve studied and traded volatility for 20 years…

And I’ll open my secrets to you today.

I’ll show you how the “Wheel” works… why it works…

Plus, 2 opportunities open right now that could hand you $1,000/month starting now.

Again, this strategy is conservative and as low risk as it comes.

I recommend starting with $5,000 per opportunity I share. Meaning, 2 trades today should have $10,000 available to trade. 4 trades in a month = $20,000.

Before I show you the “Wheel” strategy and the loophole behind it, let me quickly re-introduce myself.

Hey — I’m Jay Soloff.

You may know me from Options Floor Trader PRO where we look to turn a few hundred bucks into thousands with our winners up to 1,421% gains.

Or, more likely, from following me inside Weekly Income Accelerator, where we’re generating income from stocks in our portfolio using covered calls.

If you’ve traded alongside me for at least 2021… you know my income-generating trades with covered calls have been explosive.

Take a look:

Only 2 losing trades over nearly 12 months.

| Jay, just wanted to thank you… Learned so much from your trades, the perfect explanations, and examples. I have executed some of your trades and also developed the tools and skills to make my own… Your educational system for learning about options is excellent. – Rick |

Here, you had opportunities to generate income of:

- 5.19% in 23 days…

- 8.41% in 30 days…

- 4.02% in 30 days…

Plus more. You see the winners and losers there.

If you had $5,000 in just these three opportunities (meaning, you owned the stock and sold call options against them)…

You would’ve generated $881 in income over 30 days for each.

Not bad.

We’re not shooting for home runs here.

You simply want to own shares in good stocks and collect some cash while you wait for it to grow in value.

Some of the opportunities closed out in 30 days… others lasted up to 50 days until the trade finished.

Holding stocks you like and collecting income while you wait for them to grow is an amazing strategy.

I tell you you’re leaving money on the table if you’re not selling covered calls regularly on your stocks.

So what makes “The Wheel” different?

“The Wheel” is more opportunistic.

We’re looking for more unusual plays in the market vs. taking a stock we like and generating income on it.

While “covered calls” focus on your stock, holding stocks that are good and waiting for opportunities to sell option calls on them…

“The Wheel” is focusing on the options themselves.

We’re looking for options that are paying fat premiums… and trading those. We do it again and again until the premiums don’t make sense anymore.

Think of it like this:

Covered calls is like a surfer.

The “Wheel” is an extreme surfer.

The average surfer sticks to the same beach… and waits patiently for a nice wave. When it comes, he’s ready.

The rest of the time, he’s sitting there waiting.

The “Wheel” strategy is almost the opposite.

The surfer looks for which beach has the best waves that day and goes to the beach. He isn’t married to his favorite beach.

He’s married to the waves.

That’s the difference between covered calls (inside Weekly Income Accelerator) and The “Wheel” strategy.

When you own stock, you’re dedicated to “your” beach (i.e. your stock). Picking the right moment to sell covered calls.

Because sometimes the premium you collect doesn’t make sense for the potential rise in stock price.

If you own Ford’s stock (F)… and the stock looks ready to move… selling a $0.50 covered call make not make sense, as the stock could move $2. (You’re then sitting on a $1.50 loss).

i.e. patient surfer. Waiting for the right time.

“The Wheel” trader is finding the edge and exploiting whenever possible.

Every week, it’s NOT simply holding our favorite stocks and collecting income when they pay dividends or when it makes sense with a covered call…

It’s actively FINDING the stocks that will generate us the best income this week.

Like a shark on the hunt 24/7.

The opportunity means faster and larger income.

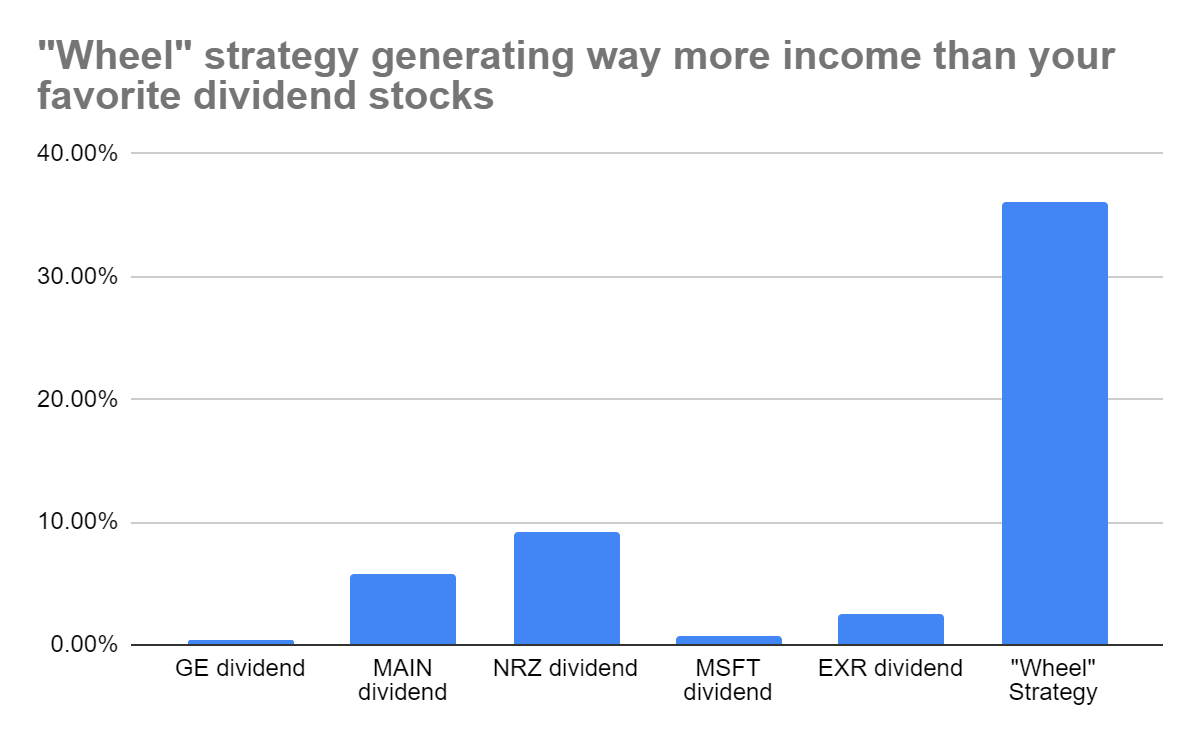

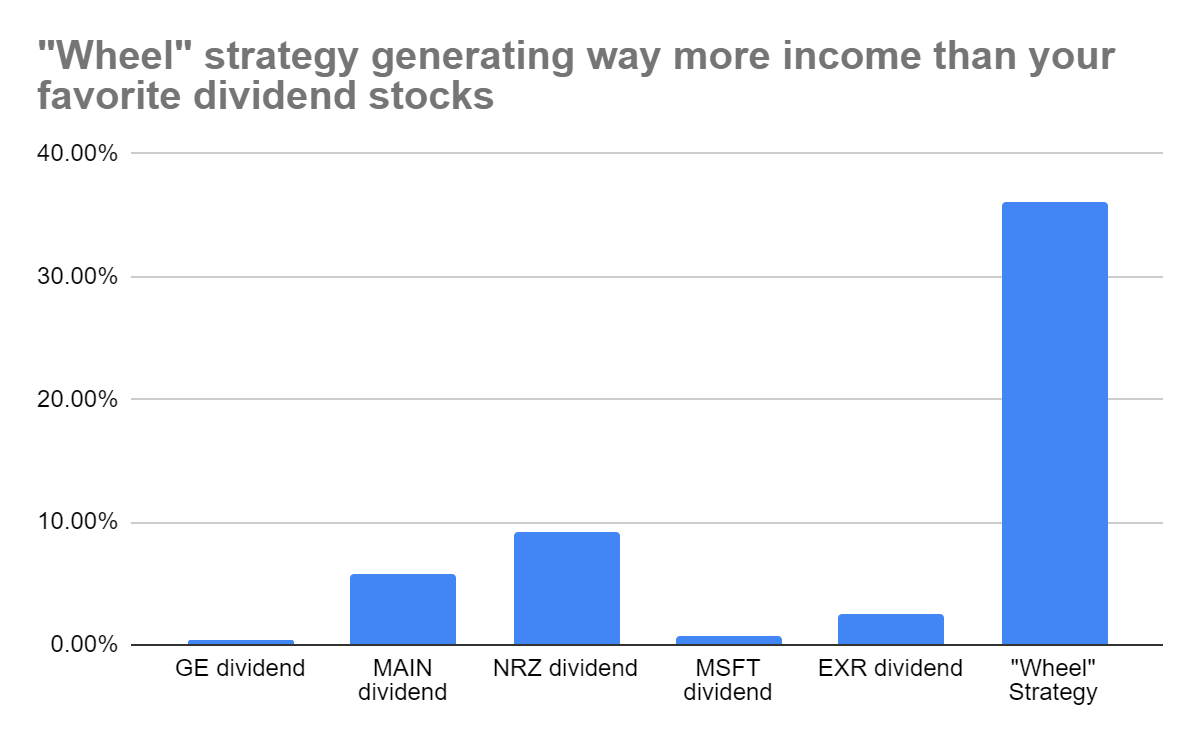

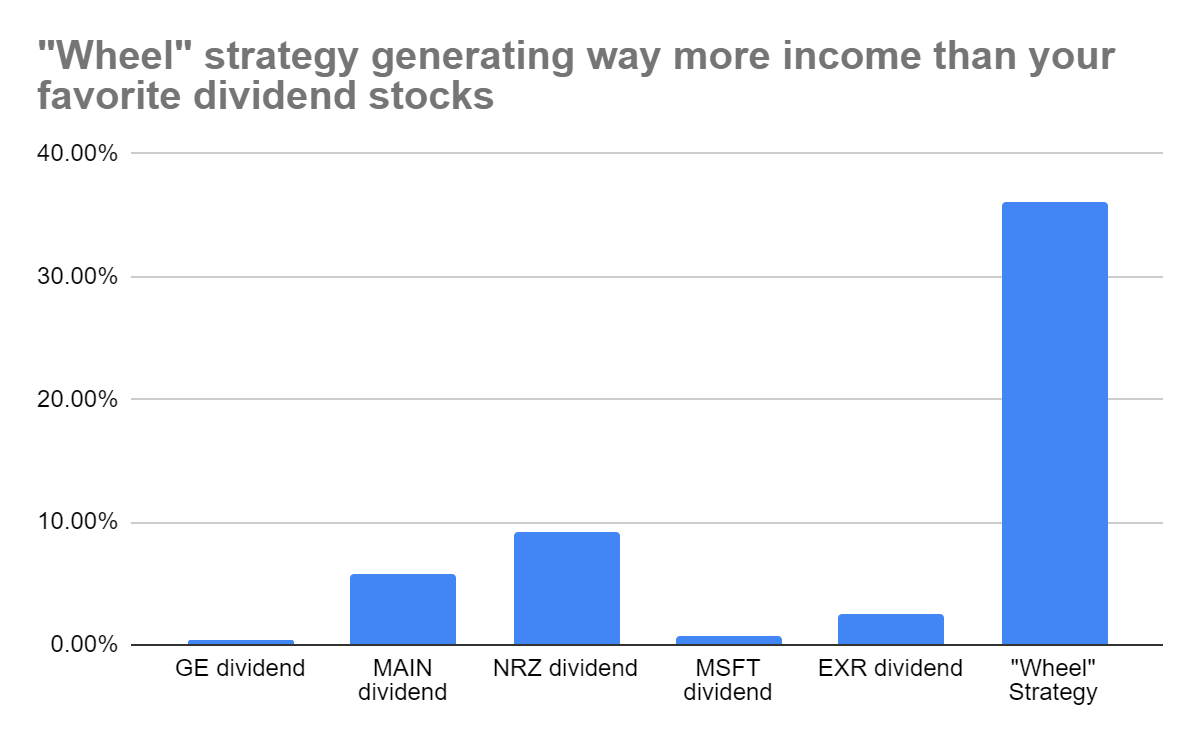

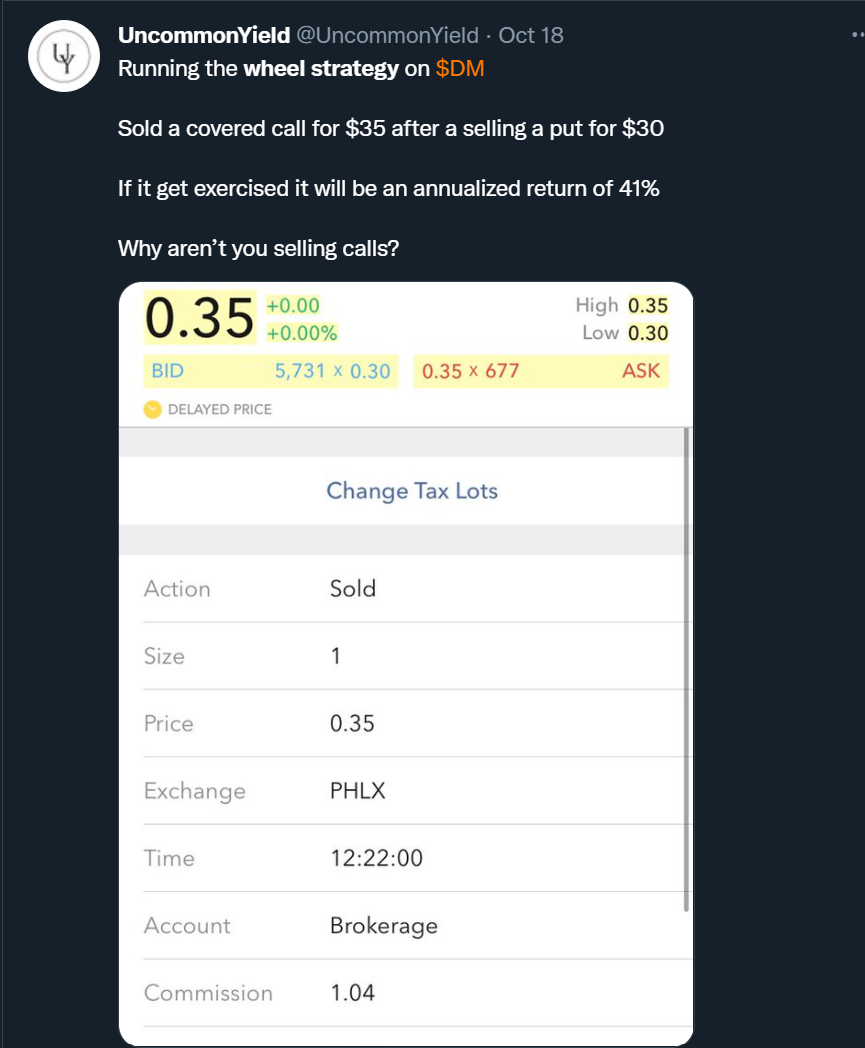

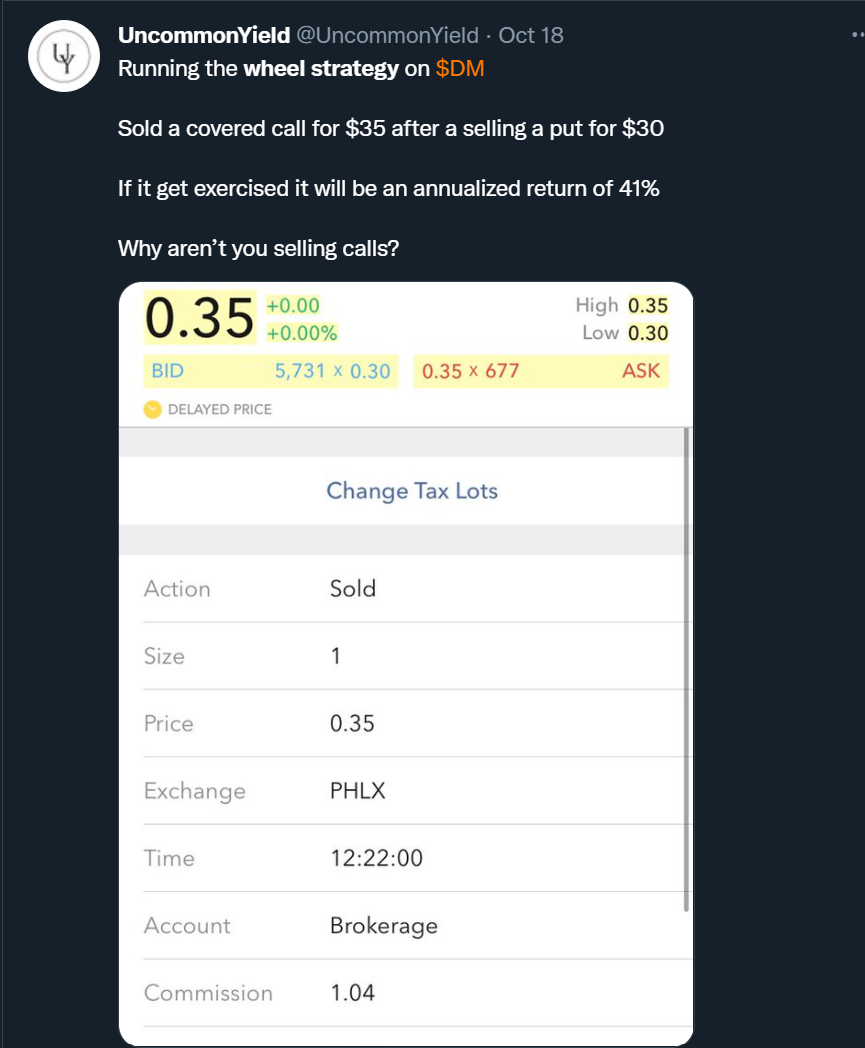

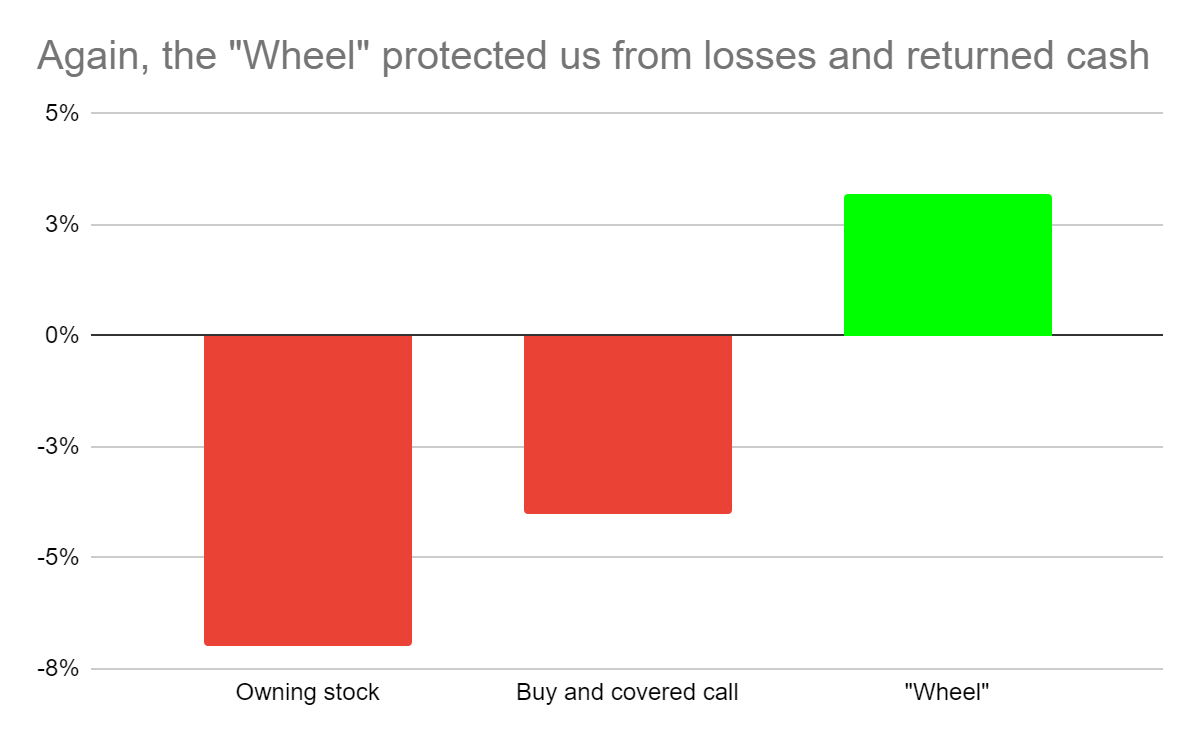

Take a look comparing returns from the Wheel Strategy vs. the others on an annualized basis.

That doesn’t mean you should abandon your stock portfolio…

It also doesn’t mean to sell off your dividend stocks.

All have a place for generating income.

I’m simply showing a conservative, low-risk way to add a few more hundred bucks to your wallet.

Covered calls are awesome.

The “Wheel” strategy is just “Covered calls on Steroids”

If you’ve traded covered calls, you know how easy it is.

Now, imagine seeing even large returns from stocks you may not even OWN yet.

It’s true.

With “The Wheel” strategy, you start collecting income BEFORE you own the stock… then, WHILE you own the shares, followed by earning more income once they’re gone too.

With “The Wheel” you could make income 4 different times from one stock.

4 times, that’s right.

Owning dividend shares = 2 ways to profit (yield and capital gains)

Covered calls = 3 ways to profit (yield, capital gains AND covered call income)

“The Wheel” = 4 ways to generate income (pre-owning shares, yield on ownership, capital gains AND covered call income)

4 opportunities to make money this month.

| [Jay] gives you simple, easy, no-brainer trades and I recommend anyone to follow him. I invest in dividend stocks for retirement, but Jay adds a little fun into the mix with his option trades. Thanks, Jay!.- Paul |

There is no other strategy on the market I can identify that hands you 4 different ways to profit from ONE stock in ONE month.

You’re getting it today.

Another huge benefit is with all 4 of these opportunities, you have more income flowing into your account to LOWER YOUR COST BASIS on any shares you acquire.

With “The Wheel”, you may own shares for a short time or longer. I’ll share the precise details in a moment.

However, I know Tim Plaehn is more the dividend expert… but I know when you collect your dividends, you’re lowering your cost basis in your original shares. Meaning, the income ‘discounts’ what you originally bought the shares for.

Well, collecting dividends is one form of lowering cost basis.

My “Wheel Strategy” provides up to 4 ways to lower the cost basis… and it can happen every month if the timing is right.

The more you run this strategy, the lower your cost basis… the higher returns once you sell shares at a higher price point.

This will all make sense when I share this loophole in the market… and how you can exploit it for up to $250 per week in income. The more you make, the more you can invest and bump up that income.

Here we go – Here’s the massive loophole in the market.

This is a trade secret among option pros.

This is why the “Wheel” strategy works

You’re about to sneak a peek behind the curtain to see how the sausage is made.

Enter if you dare.

I told you this loophole requires a bit of a technician’s touch.

That doesn’t mean you can’t do it yourself… it just means you have to know what you’re looking for.

Okay…

I’m an options trader. That’s my bread and butter as I shared.

So I want to look for my edge in the options field.

I’m not a purist chartist who bases all my investment decisions on ‘where the stock’s resistance is’ etc.

I’m also not a fundamental trader who’s reading SEC reports all day.

Instead, I want to understand WHY an option is priced as it is.

An option is priced based on:

Intrinsic value + Time value

Intrinsic value simply means the difference between the actual price of the STOCK and the OPTION strike price value.

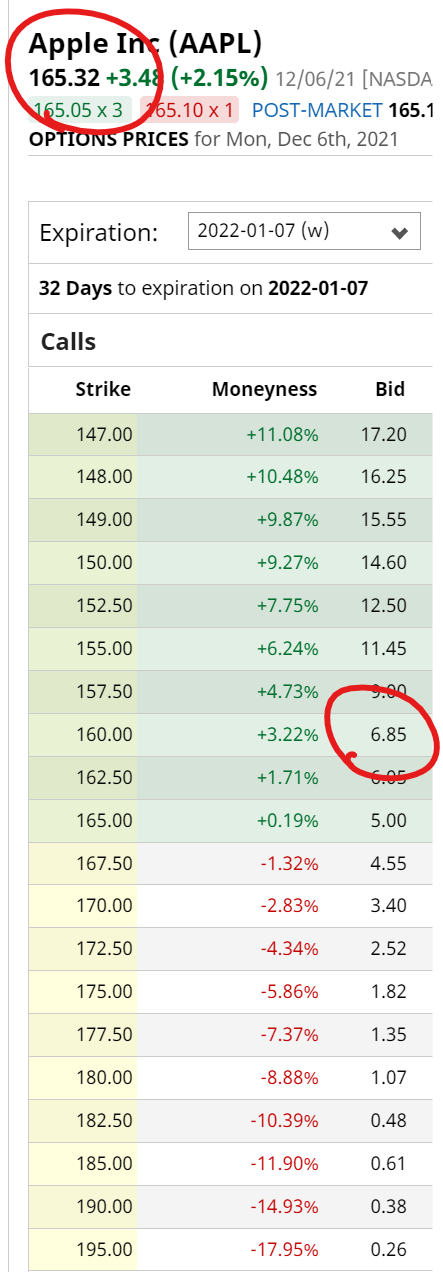

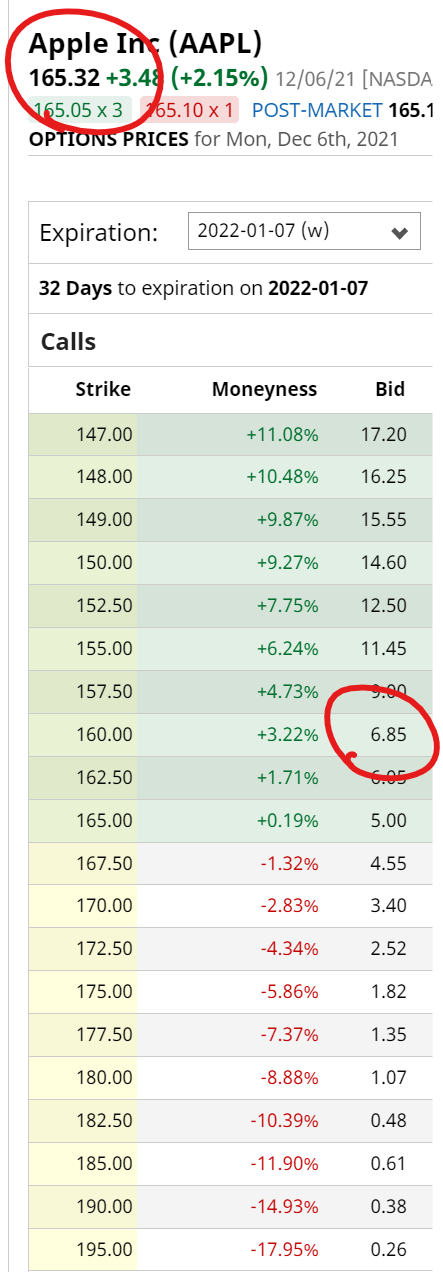

For example, a stock like Apple (AAPL).

Let me show you what the options chain looks like.

If I buy the $160 option that expires in 4 weeks… meaning, I expect the price to be AT (or above) this specific strike price in 4 weeks… check out the price of the option.

It’s $6.85 ($685).

Since the stock price is $165.32, as of this screenshot, $5.32 is the intrinsic value… and the remaining $1.53 is time value.

If we bought the $170 option at $3.40 — baked into that option price is all time value because the strike price is higher than the current stock price.

That time value is never constant.

Two things are happening with that time value every single trading day:

1. As the option gets closer to expiration, that time value starts going down

Here’s an example:

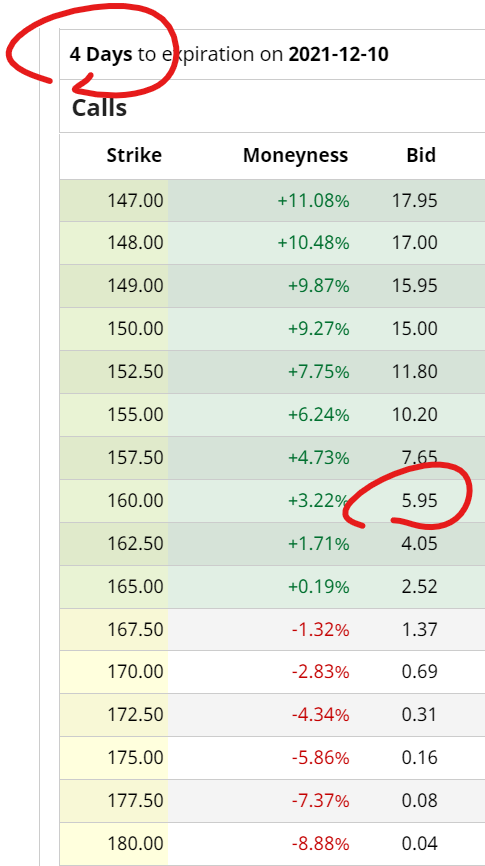

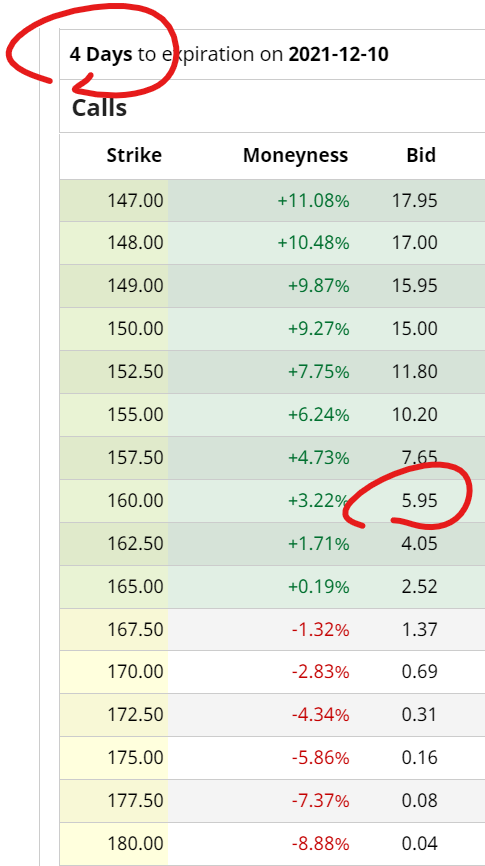

This option expiring 8 weeks out… is more expensive than the option expiring 4 weeks out. And the option expiring 1 week out is less expensive than both.

| 8 weeks: | 4 weeks: | 1 week: |

|

|

|

That’s because as an option moves to expiration, it becomes less valuable as there’s now less time for the stock to move.

Second.

2. As market volatility goes up and down… the option will inflate or deflate

When stocks crash 20% in a week… “implied volatility” in the markets pick up like we saw in November 2021 as Black Friday signals a downturn.

“Implied volatility” is what it sounds like.

There’s an “implication” more volatility will occur.

Volatile markets = less predictable markets

Less predictable markets = less chance of knowing where a stock might move

Think about it.

If you see two bears.

One is sleeping.

The other is awake and very hungry…

You can draw two conclusions… as long as Bear #1 stays asleep, he is more predictable and less likely to attack or really do anything.

Bear #2… Mr. Hungry Bear… there’s no telling what he might do. He could be starving and want to eat you.

Or, it could do nothing. Or maybe it does little damage and munches on some bugs.

There’s no knowing.

That’s a strange analogy, but that’s how options are priced.

More volatility = unpredictable

Unpredictable = higher options prices (thanks to implied volatility)

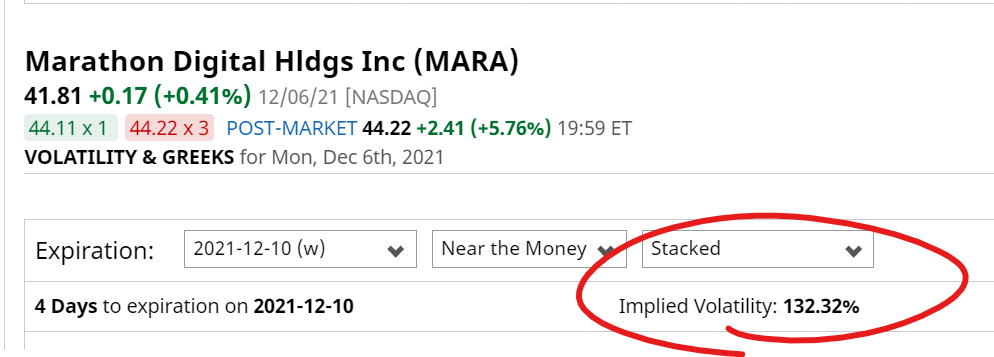

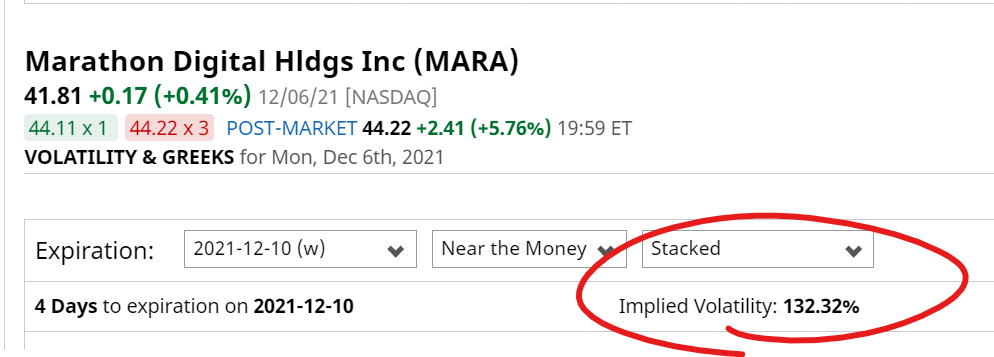

Here’s an implied volatility example from a “Wheel” trade one of my colleagues opened recently:

132% implied volatility is very high.

I look for stocks that are ranked high in implied volatility.

What does any of this have to do with the “Wheel” strategy?

Well,

The “Wheel” strategy works because we’re taking advantage of these temporary inflated options prices to collect income.

And that’s the key word…

Temporary.

The “Wheel” strategy is one you can use over and over.

Our best use is during heightened times of volatility because we can sell options to those who are overpaying.

Let’s look at two examples I shared from “Wheel” trades I paper traded so to demonstrate the strategy to you.

Bed, Bath & Beyond (BBBY).

Got into this trade after a big spike in the stock on some news.

Big spikes = chaos in implied volatility.

Chaos = higher options prices.

Here’s where “Wheel” comes into play.

The “Wheel” strategy is a bullish trade.

We are bullish on Bed, Bath & Beyond (at least in the short term).

Many large volume spikes with lower volume days to follow are bullish for a stock.

So, since volatility inflated options prices, I DID NOT want to buy options to take a bullish position.

(that would be overpaying… like buying a stock at the top).

Instead, I wanted to “Wheel” into it.

What does that mean…okay…

To “Wheel”, we want to collect income without owning the stock.

HOWEVER – if the time comes you do have to own the stock, we’ll pick up shares at a cheaper price than what it’s trading at right now.

So, what here’s what I did:

- On November 9th, I sold the $20 November 26th put for $1.05 while stock was at $21.59.

By “selling” the put, I’m taking a bullish position. As those who buy puts are bearish, I’m selling puts to these bearish traders.

Right away, I collect $105 on $2,159 of risk (100 shares of BBBY).

That’s a 4.9% immediate return.

As you can see in the chart above, 2 weeks later, the option expired worthless as price closed above $20.

With the “Wheel”, if volatility is still peaked, we can sell another put right away and collect more income.

You can do this again and again never-ending.

A $5,000 trade here would’ve resulted in over $210 in income.

Pretty simple once you do it and collect the cash.

I recommend rolling that cash into the next opportunity…

Or, feel free to take that money out and use as you wish. It’s up to you once the trade closes.

Great, right?

“Okay, Jay. Is that it for the “Wheel”, you sell a put?”

Not at all.

Remember this chart I showed you

All the “X”s = income.

All the “0s” = acquiring shares.

Let’s fast forward a week for BBBY after our expired winner.

Watch how the stock drops over 10% in a week.

Now, if I had just “bought” 100 shares on November 9th because I was bullish instead of selling the put, I’d be DOWN as much as 19% on my shares.

If I had bought shares and sold covered calls… my call options would expire worthless (great), but my shares would still be deep red.

With the “Wheel”, I’m collecting income… but also lowering my risk of buying shares too high.

Now, if I had opened another “Wheel” trade after my 1st trade expired and sold another put again to collect more income…

If this downtrend trend continued…

I may have to acquire the shares later.

But then I’d be getting them at a 10%+ discount. Who doesn’t want that?

However, it doesn’t stop there.

If I do take over the shares… I still want to collect income.

And if you’ve traded covered calls before, you’ll know exactly what to do.

STEP #2:

- If we DO NOT acquire the shares, we sell more puts for income.

- If we DO acquire the shares, we sell covered calls to collect income

Again, we’ve bought shares at a huge discount.

Now, we collect 3-5% in income waiting for our stock to bounce back.

Back to the Facebook chart…

When we acquire the shares at “0”, we’re then selling covered calls to collect income… until they bounce back.

At that point:

STEP #3: We allow our shares to be called away + (you guessed it) we sell more puts again

3 steps to the “Wheel” right there.

#1. Sell puts (a bullish position) to collect 3-5% income

#2. Upon expiration, sell more puts OR allow shares to ‘be put’ to you (aka you acquire shares)

#3. Sell covered calls on those shares until they’re called away

Repeat.

OR — find another high Implied Volatility stock to run the “Wheel” strategy on.

As you can see…

There are multiple ways to make money here.

In just one month, you could collect income 4 different ways:

#1. You collect income when selling the put

#2. Collect income when you sell covered calls

#3. Collect income when your shares are called away (thus, you made capital gains)

#4. If a dividend stock, collect the dividends if you own the shares

You’re always making money.

Of course, if a stock just keeps going down, you would lose money from the stock losses as shares wouldn’t get called away.

However, as I showed you, you can still come out way ahead as shown in this trading sample:

As GE crashed 42%… this trader says he was up 45% trading the “Wheel” strategy.

I’ll take that.

But I take it a step further to make sure we’re collecting as much as income as possible with less risk if a stock drops.

How do we help alleviate those losses?

That’s the second piece after looking at “Implied Volatility”.

We also want to look at the chart for where a stock could go.

There’s no definite answer where a stock will go… but we can make high probability assumptions.

With Bed, Bath & Beyond, here’s what I saw looking at the weekly chart.

See that blue line?

That’s a line around the $18/share mark.

It’s a heavy point of resistance on the stock.

You can see 4 prior points the price touches it.

…1x in 2018

…2x in 2019

…1x in 2021

The prior time it broke through the blue line in 2020… it then pulled back to the break out point in 2021 before going up again.

When I entered the trade November 2021, the stock broke through that blue line… pulled back to blue line again… and I can then make a high probability assumption the stock will bounce and go higher.

Meaning, if we have to acquire shares under the “Wheel” strategy, we’ll have our shares called away eventually for a profit, plus enjoy the income we received selling our calls and puts.

These are the key pieces I look for before opening a “Wheel” trade.

To succeed in trading the “Wheel” and have a chance at collecting income 4x in one month.

#1. I’m studying the Implied Volatility to identify a stock and then once that’s satisfied,

#2. Checking the stock chart to see where I can lower the risk on the trade.

If both of these pieces aren’t meant… I’m NOT trading the “Wheel” strategy on them.

| Jay is excellent. You can listen to him all day and his knowledge is second to none. He’s surgical when it comes to breaking down an options trade and finding the next opportunity.– Samuel B. |

Like I mentioned before…

This is an advanced strategy only a professional technician could spot.

Now, I’ve shown you how to spot it for yourself.

Of course, this takes practice. I have 20 years of experience spotting these trends.

Plus, it takes time.

If you want to log the hours to generate $1,000/month starting with $20,000… I’ve shown you the blueprint.

But before you do that…

I have something interesting to show you.

I have two trades open for you right now.

Their stocks have been volatile… the implied volatility is elevated.

Remember, that means these options are primed to be sold for higher than normal.

I’ve found not one, but two opportunities you can take advantage of right now.

All you’ll need to do is log in to the portal — which I’ll give you access to in a minute — set up the trade, and you’re done.

From here, I’ll guide you when we should close out the opportunity, let it expire, or exercise to acquire the shares.

There are many paths to take with the “Wheel” strategy, and it’s going to be fun.

I showed you one of my first “Wheel” trades executed in November 2021. The returns were 4.9% in just a couple weeks.

I can’t promise those kind of returns every time… but it’s possible one of these trades could produce even more profit in that fast a time frame.

I’m sharing these brand-new open trades inside a special portal locked by a password.

The only way to gain access is by joining me as a Member inside my “wheel” service, Profit Wheel 360.

Profit Wheel 360 is one of the first services on the planet to focus exclusively on trading the “Wheel Strategy.”

Our goal with the service —> To target 3-5% returns every trade again and again up to 4x per month.

So far, in 2022, 77% of our trades hit over 3%!

| All I can say: absolutely the best service – it’s really well suited for people like myself who knew a little about the stock market but without your strong guidance, I would have never dared to use options! Even an option newbie can follow: first you get an alert on your cell phone, then I can barely wait until the email arrives with your explicit easy instructions.- Karin |

I recommend starting with $20,000 total so you can execute on the 3-4 trades that will be open at the same time.

I’m about to show you 2 trades right now once you join.

Again, these trades could land 3-5% in the next month.

That’s up to $250… do that for every 3-4 trades… and you’re hitting $250/week in an endless loop. That’s an average of $1,000 per month…$13,000/year.

We’re chasing high premiums here.

Maybe we end up acquiring the shares to trade… maybe not.

Every opportunity is different.

It’s going to be fun.

You’ll enjoy seeing the profits… but also watch how interesting it is to trade this strategy.

Maybe the ‘fun’ isn’t important to you… but I know trading with a unique, fun edge makes the job more enjoyable.

Profit Wheel 360 is a service that I’ll be building more features into as it grows.

That’s why… as a new member, you’ll receive a 25% off discount you can lock in for life if you join now.

Once you exit this page, that 25% discount expires.

That’s why… it makes sense to grab a seat at the profit wheel table while you can save a few bucks.

Not to mention… the 2 opportunities I’ll share with you in a minute… they’re going to expire very soon.

These are trading plays mind you…

It’s not a ‘buy and hold forever’ service.

Profit Wheel 360 is ‘Buy and Hold 2.0’ for those looking for more income each month

Because our strategy is bullish on stocks… but instead of just blindly paying face value… we’re collecting income BEFORE we own shares… collecting more income AFTER we buy the shares… and doing it on a never-ending loop…

Well, not forever. Until it makes sense to pursue a more ‘juicy’ opportunity in the market due to high volatility.

| You are the real deal. I love you, Jay! – Jake B. |

Here’s what you can expect from Profit Wheel 360:

- 3-4 trades per month: These trades will last 20-30 days each. Meaning, you can have all 4 open at one time, maybe 3. Imagine $250 trickling in week-in and week-out. Sure, we’ll have some trades that don’t work out, but that’s okay. There’s another one coming right down the pipeline.

- Detailed write-up on HOW to make the trades: The learning curve for the “Wheel” strategy isn’t too steep. Still, I never want you to enter a trade without full confidence you put on the trade correctly. I’ll show you every step… for every trade. Each write-up will have ‘entry screenshots’ to reveal exactly how you set up the trade.

- Bi-weekly video round-up & tips: Every two weeks, I’ll drop a video with updates on our open and closed positions. I’ll share what went right and wrong. These are the learning points… maybe the most important parts of the service. See, you don’t need to keep track of our record. I’ll do that myself inside the Profit Wheel 360 portal. You’ll be able to watch these videos on-demand.

- Open mailbag (get every question of yours answered): The bi-weekly Mailbag allows you to ask any question you want. I’ll then answer your question in the bi-weekly video. No question is off limits. Don’t feel you need to have all the answers. Happy to answer the most basic of questions about this strategy (and options).

- Video vault with lessons: Maybe you need a refresher on how to place trades or “why the Wheel strategy works.” There’s a special tab in the service where I’ll house all my instructional videos. Those will never be taken down

Just the trades alone are valued at $1,997…

$250 per week = $13,000 per year.

I’m discounting myself by valuing it at $1,497…

Add in the bonuses (including bi-weekly videos) and you’re knocking on the door to $3,000 of value.

However, you won’t have to pay anything near that as a new Member to Profit Wheel 360.

Stick with me and I’ll reveal your special 25% discount for joining now.

| Jay just wanted to thank you for the great program. Learned so much from your trades, the perfect explanations, and examples. I have also developed the tools and skills to make my own [options trades].

I have been a biology teacher for the last 29 years and your educational system for learning about options is excellent. I look forward to continuing with this subscription and future option trading.- Rich |

Join Profit Wheel 360 today.

Click the button below and you’ll be taken to a secure page to finish joining as a new Member.

Of course,

You’re backed by my rock-solid 60-day money back promise

| Jay just wanted to thank you for the great program. Learned so much from your trades, the perfect explanations, and examples. I have also developed the tools and skills to make my own [options trades].

I have been a biology teacher for the last 29 years and your educational system for learning about options is excellent. I look forward to continuing with this subscription and future option trading.- Rich T. |

Because this is still a relatively new service, I’m tempted to offer no refunds.

However, I want to make this as easy as possible for you.

That’s why — purchase today. Give the service a test run for 60 days. After that, if you aren’t satisfied, send me a message and receive a full refund.

This is as easy as it comes for you.

So,

Who is Profit Wheel 360 for?

Because you already are familiar with income and likely options… I expect you’ll fit right in trading Profit Wheel 360.

Should you join:

- If you’re interested in regular income coming faster than dividends… yes.

- If you have $20,000 available to try a lucrative, but conservative income strategy… yes

- If you trade covered calls on stocks you love… but also looking for more income on stocks you don’t already own. While you wait for good covered call opportunities in your account, I’ll send over “wheel” trades to collect premium as a 2nd income stream to your covered calls.

Who Profit Wheel 360 is NOT for:

- You want to ‘get rich quick.’ The “Wheel Strategy” isn’t a fast money maker. That’s the honest truth. It’s a compounder. You compound your income over time. (Some call it ‘snowballing’ your money)

- You refuse to touch options. I believe folks do themselves a disservice not trading options as they’re worried about going broke. Options take time to learn, but can be very profitable.

- You are happy with the income you have. Look if you collect all the income you want, great. I’m not going to argue with you. If you want to stick with what you know and have, this isn’t for you. I want people excited to win and achieve higher and higher income.

Leave this page if any of the last 3 describe you. I’d rather only give seats away to those who WANT to learn more.

You also want to EARN more.

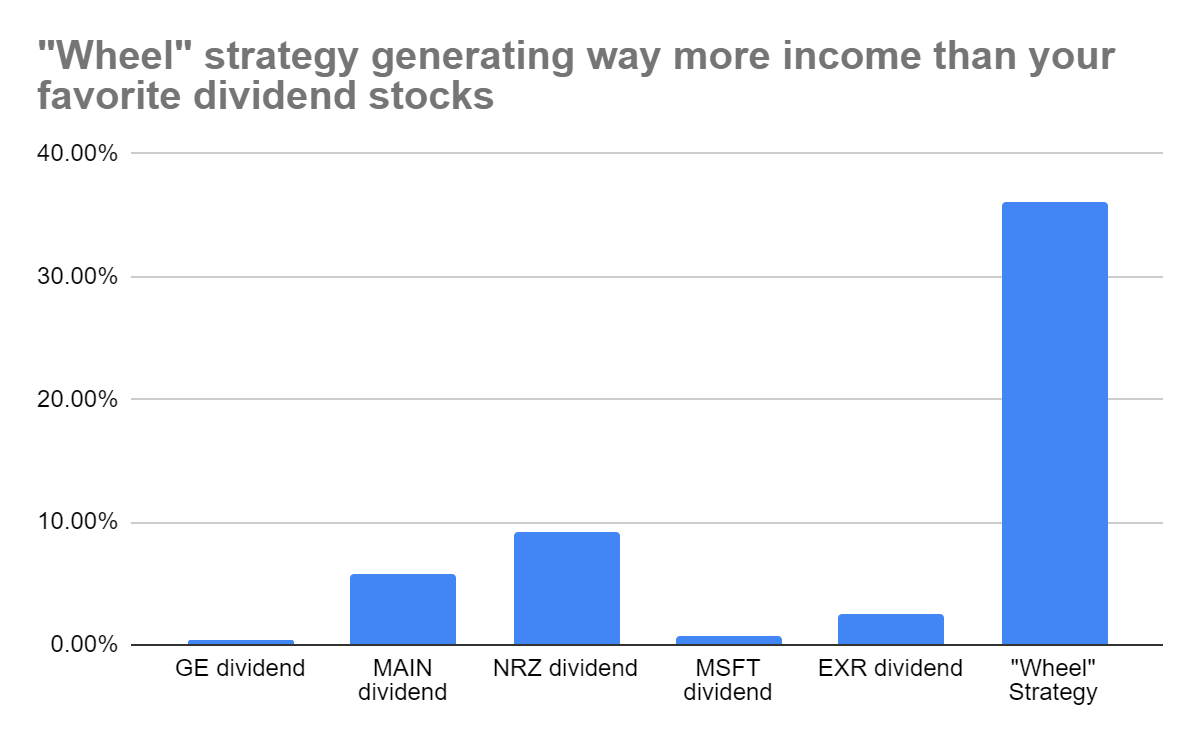

I showed you the charts of how the “Wheel Strategy” lines up with covered calls and dividend income.

This was one particular trade.

Plus, compare it here to top dividend stocks:

Get ready to use a conservative strategy to identify amazing income opportunities in the market that could return us 3-5%.

I’m hoping for more… but that’s what I conservatively estimate will be the returns.

Check out how your income could look following this strategy now.

Over 60 months, compounding 4% per month… your monthly income could go from $1,000 every month to $8,092.

Or… $97,104/year.

That’s a near 400% return on your initial $20k investment.

To get to that $97k/year…

Your portfolio balance, after compounding, would explode to over $202,301.

Now, this is just a projection estimate. These numbers aren’t likely to play out like this.

But you can see the potential ahead for you.

Because even though this is not some wild gun-slinging options service as you might see advertised out there for $5,000/yr…

We’re playing the long game and looking to compound our profits.

You won’t pay $5,000…

For just $1,497, you can realize the potential for you starting today with Profit Wheel 360.

The first step is to click the button below.

On the next page, put in your information and then you’ll have access to the first 2 opportunities that could net $250 each over the next few weeks.

You’re backed by my 60 day money back guarantee.

If you love income… you’ll love receiving income again and again from top opportunities in the market.

I’ll find the plays… you simply push a few buttons in your brokerage.

Then, go enjoy life.

Click the button below and join me inside Profit Wheel 360.

Join now,

Thanks for reading,

Jay Soloff

Founder of Profit Wheel 360