What if a comfortable retirement was as easy as buying one, two, or three stocks…

Then just sitting back and collecting the income for life?

No day trading…watching the markets…or looking for the next hot stock.

Here’s the catch, though…

Are you ready?

The stocks I’m going to show you today ARE NOT companies you’ll hear about on the news.

They aren’t trying to put people on Mars, cure cancer, or invent the next social media.

Far from it, in fact.

They’re companies in the most important areas of society…I’m talking real estate, energy, finance…

But, here’s where it gets interesting.

These companies are bringing in a ton of cash each month…and they want to pay that cash out to you for owning the stock.

One stock I recommend is throwing off over 15% in dividends each year…

Another over 12%…

Buy these stocks now and hold them forever.

But I won’t stop that.

What if you could turn buying these high yields into a cash cow for years to come…think about what’s possible.

John S. just emailed us in December, saying “[I’ve built] my income from $4,500 to $8,500/month…in two years.”

John has nearly doubled his income by following my simple buy and hold strategy.

After reading this letter today, you can change your entire retirement.

How would you like all your bills paid each month for the rest of your life…

…without anyone’s help…

…without any complicated investments…

…without any special training, and…

…without playing the Powerball…

Imagine every month having enough cash in your checking account to cover your expenses…

Your groceries, prescriptions, electric bills… anything you need.

Plus, have some leftover to treat yourself guilt-free with eating out, entertainment and travel.

You’re not rich per se, but you’re taken care of week-in and week-out.

No more avoiding the mailbox because of the “mystery” bills stacked on the ad pages.

Many might say that’s “complete and absolute freedom”…

How would you like to know your next medical bill won’t be a concern?

You’re guaranteed the best treatment without awkward check-out conversations about your past due balance.

It sounds unbelievable… but I’ll prove it to you this is possible today.

And it’s incredibly simple to do…

You only need one stock to pay your bills for life.

That’s it. No options, cryptocurrencies, day trading, futures, or penny stock plays.

One stock. It’s that simple.

Even better, you can easily set yourself up for this type of lifetime income in under 12 minutes.

Anyone who knows how to work a computer will understand.

All you need to do is keep reading along with me these next few moments.

Because if you’re looking for financial security during retirement — meaning, you’re not stressing about a stock market crash or running out of money—

Please listen up to what I’m about to say.

In this exclusive presentation, you’re about to receive a proven, mathematically-based plan to generate a passive income stream that will outlive you.

You’ll receive this plan free.

It’s a 36-month plan where you could create $4,804 in monthly income that continues to grow each year.

Over 10 years, that’s $576,480 in income.

Here, finally, is a predictable plan where you could start with as little as $25,000 in your 401(k) or IRA and still generate a comfortable living.

Warren Buffett makes $6,731 per minute using the exact same income method to pay bills at his company.

And you could be paying your bills too. I’ll even show you what investments to make.

These are investments meant to generate income. Our focus isn’t rising share prices.

In fact, I’ll prove to you that investing for capital gains might doom your retirement.

“Focus on the income,” I always say.

If you had followed my 36-month plan in the past, here’s where you could’ve been now.

[Note:] these are actual, real opportunities inside my own portfolio. No cherry-picked stocks like other financial presentations try to do.

One of my favorite plays, following the plan, could’ve generated for you an amazing $2,766 per month like clockwork. As a bonus, your portfolio would have soared 111%.

If everything stayed the same, over 10 years, you’ll generate $331,920 in income alone.

Another of my go-to plays, after following the plan, would’ve handed you an incredible $1,922 per month going forward. Plus, your portfolio would’ve seen an 88% increase.

Over 10 years, that’s $230,640 in cash to your bank account.

You’ll see it’s a perfect complement to your Social Security.

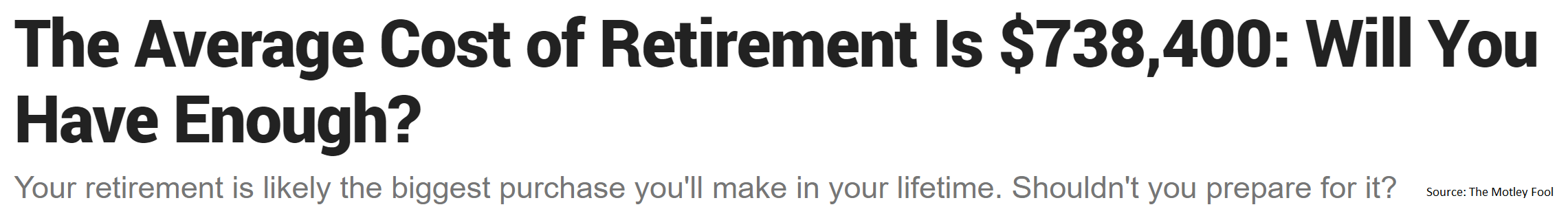

The Motley Fool predicts the average cost of retirement is $738,400.

That sounds daunting. Well, retirement will tend to go for 30 years..

Thus, if we have $230,640 every 10 years…plus, an average of $1,341 per month in Social Security, according to Investopedia…

We’d end up with income alone of $1,174,680. That is more than enough to pay for retirement. And that’s not even touching your portfolio principal. This is income alone.

This is the reliable income waiting for you today…

Predictable income without a job equals freedom for life. If only more retirees knew about what you’ll see today.

This truly is a game-changer for retirement living.

And, frankly, it can’t come at a better time…

Because I built this plan to solve the one looming issue most retirees face.

36 Months To Squelch The #1 Retirement Fear

A recent CNN poll revealed the #1 fear of retirees is running out money.

Let me repeat that: today’s retirees fear running out of money more than anything in the world, including death.

You’re forced to depend on the government or get charity from family if you don’t have any money. Maybe even rely on strangers.

Living off Social Security alone is tough, already seeing as the average monthly check is $1,341, according to Investopedia.

I’ve surveyed thousands of investors, and this same concern continues to pop up.

I have an Excel spreadsheet with over 1,000 detailed responses from retirees. I asked them directly:

“What’s your biggest fear financially?”

The #1 answer, by far, was “I am afraid I’ll run out of money and go broke.”

That’s when I decided to put together this 36-month income battle-plan.

If you’re prepared to be a disciplined and consistent investor, this plan will be your saving light.

Because in retirement, you need to be focused on income if you want your money to outlive you. Living stress-free without taking a part-time job requires regular cash flow.

I’ve calculated 36 months as the ideal runway needed to create your own, personal money tree. I’ve done the math myself for you.

At the end of 36 months, you’ll have a virtually passive income stream. You only need to check up on 1-2x per month.

Our entire goal with the 36-month plan is to lay the groundwork in our portfolio for massive income. That’s it, plain and simple.

Income pays your bills, hence our focus.

And you’ll be shocked how little the risk is to do this…

Thousands Already Make Income This Way

Many have already paid up to $100/year for the information you’ll find in the plan, but you’re getting it 100% free.

It’s a bill-paying roadmap I’ve put together — with exact calculations — which any man, woman, or teenager can follow.

And you don’t need tons of money to be successful.

Starting with as little as $25,000, you’ll be able to generate a healthy 5-6 figures of income annually if you follow what I’ll share with you.

Many of my 6,043 paid subscribers already use this income stream with excellent results.

Tom and Gayle H. praised the income they get:

“…I have had great success investing my retirement nest egg… My wife and I are living off of the [income] payments and have seen a total portfolio return of 23% over the past year.

We have been so successful that we now have some “extra” money to put to work…

So a big thank you from two very grateful subscribers.”

— Tom and Gayle H., husband and wife

Steve L. wrote me saying:

“I have been following your advice…I am seeing my [income] stream grow. I just might be able to retire before 65.”

Gary F. says:

“I have invested just under $100k, and my return percentage is higher than my financial agent can manage. Go figure.”

Jerry M. had some inspiring words:

“You have completely changed how I think about investments…”

Here’s Ross giving my program 5-stars:

“I am doing much BETTER than I ever did on my own or with ANY OTHER program!”

—Ross H.

Brad B. wrote in excited:

“Thanks for what you do, my account balance hasn’t looked this good ever, and I’ve only been on board a few months.”.

It’s helped so many people.

Freedom To Spend Your Time As You Wish

Thanks to my easy-to-follow, virtually passive method, you’ll have awesome days where income automatically shows up in your account.

You’ll feel that stress sitting in your chest disappear. You’ll start living in the present again rather than worrying about the future.

The simple, joyful things in life, like getting together for dinner with your friends won’t be a budgeting nightmare.

You’ll have enough saved to weather any unexpected medical bills or house repairs. Even being in a position to give more to your grandchildren’s fundraisers. Plus, they will be no more fears about being forced to pull out the credit card and go into debt.

It’s freedom. Freedom to spend your time as you want without any outside pressures. You won’t need to make concessions to pay that inflated gas bill in the winter months. You’ll enjoy the freedom of not relying on others.

Freedom is a beautiful thing.

The only way to get to this ‘freedom from monthly bills’ is to have an accelerated income stream in place.

That’s why…

If you hold any ounce of doubt that you won’t go broke

in the next 20, 30, 40 years,then it makes zero sense

to skip what I’m about to show you.

Because, honestly, it doesn’t take a rocket scientist to generate a solid passive income from the stock market.

Tons of crackpot financial advisors want you to think so in order to justify their outrageous $10,000 – $20,000 annual fees.

That’s typically what a crooked Wall Street firm will charge you for the type of plan I’ll show you free today. I would know as I used to be a stockbroker for eight years.

As I said, this 36-month plan is something so simple anyone new to the markets could pull off.

Not to mention, it’s quite safe to do.

This doesn’t have anything to do with risky options or high-flying bets.

We will sacrifice reckless speculation and invest instead for predictable income.

There’s enough BS out there now.

You’ve Heard Enough BS Hype Out There…

That’s why, in this letter, you won’t hear inflated promises of waking up rich tomorrow.

You’ll probably hear enough hyped “get rich schemes” from other financial publications promising you 10,000% gains in bitcoin or marijuana.

I don’t believe those types of plays are prudent for the average retirement investor.

I’m simply honest with you because I want to help.

One of my subscribers, Rob B., flattered me when he confided:

“You have a unique way of doing things I really like. It’s very much like talking to a trusted friend.”

A trusted friend tells you the truth…and here it is — I can’t make you a millionaire tomorrow. No one can.

But…

I am going to show you a bulletproof 36-month roadmap so you never worry about paying bills again. The goal isn’t to make you a millionaire, though that could happen — but, to never spend another moment worrying ‘what if’ when it comes to your finances.

It all starts with understanding how to trade a specific type of stock effectively. This stock will be at the core of our income strategy.

These kinds of stocks can payout 1,000% more income than Apple and Microsoft.

You’ll be amazed at how easy it is to understand and implement.

I Created A Lifetime Income Stream Already

Using This Strategy

Hello. My name is Tim Plaehn. I am the architect behind this accelerated income plan.

Hello. My name is Tim Plaehn. I am the architect behind this accelerated income plan.

I started my career off serving as an F-16 fighter pilot in the United States Air Force while studying mathematics.

I went on to become an instructor, a position reserved for the highest-achieving pilots.

After serving, I spent eight years as a stockbroker and licensed financial advisor.

I honestly struggled for years to make money for both myself and my clients. None of the “complicated” trading methods touted worked or made any sense. Those who taught them seemed only interested in making themselves rich, not my clients.

It wasn’t until I discovered the math behind this 36-month plan that everything clicked. Rather than searching for ‘hot stocks,’ I now invest already knowing how much income I’ll generate.

That’s the beauty of this accelerated income plan.

You’ll know exactly how much you’ll receive each month to pay your bills. Plus, you’ll have some leftover to spend guilt-free.

I’ve made showing retirement investors how to do this my mission.

I am near the retirement age of most Americans… though I have no plans to slow down anytime soon. I see what’s going on with pensions drying up and Social Security checks not keeping up with inflation.

I didn’t grow up wealthy nor did I have a massive account to start investing. I started off like most Americans…I had a small account. Sometimes, even went broke.

Yet, I’ve already created a secure income stream for myself using the exact strategies I’m showing you.

Let me repeat myself so it’s clear—

I use these strategies every day. Over time, I’ve leveraged a specific type of stock where now my income stream each month could pay some of my bills if an emergency happened.

Other investors, like you, needed to see this. That’s why I became the senior income analyst here at Investors Alley.

Today, I have over 20,000 happy premium readers.

———————–

Like James E. who wrote:

“NGL performed like a dream and even exceeded the high end of my expectations. I think this is the 3rd or 4th idea I have received from you where I quickly made more than $10,000.”

And here’s another one from Wade J….

“I am a satisfied customer of yours, having finally found an advisor who reflects my view on investing for income. I’m 66 so income is my primary goal but I want stable vehicles as well. I am using many of your recommendations and some tax-free positions to fund my retirement. Thank you!”

—————–

As the writer and editor of my own publication service, I believe my biggest duty is to help you navigate the choppy waters of any correction, crash, or bear market.

And corrections and crashes are exactly why I recommend retirees invest for income and not capital gains…

The Killer Mistake Of Living Off Capital Gains

If you’re expecting to live off capital gains, you could be headed for disaster.

Capital gains don’t pay the bills. It’s not ‘real’ money until it’s in your checking account.

But the only way to capture those gains is by doing something crippling…

You have to sell your stocks to receive the profits.

Say you invested in Google in 2010. Through 2017, you would’ve seen a nice 264% winner after 7 years.

You made a great pick. So, you cash out your triple-bagger and enjoy the spoils. However, at some point, you’ll likely need more income.

So, you look for another stock. Suddenly, you’re paralyzed because what if the next stock doesn’t deliver “Google-sized” gains?

Will your retirement survive?

Plus, can you wait another 7 years for you next windfall?

It’s impossible to know what will happen in the market.

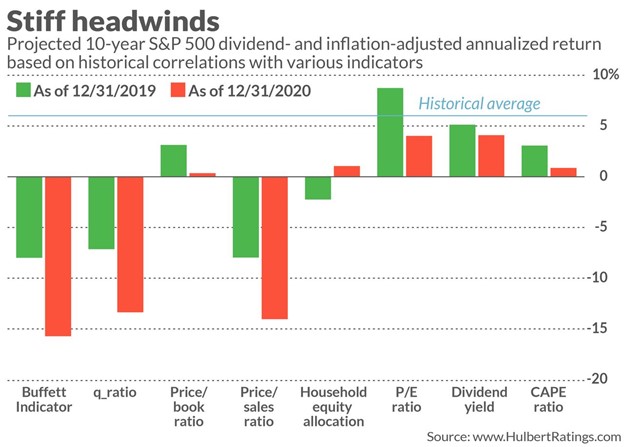

But signs suggest things are going to get ugly.

Of the 8 best indicators for long-term stock-market returns, not a single one predicts that by 2030 we’ll hit even the historical yearly average of 7%.

Three of them predict stocks will be down more than 10% a year through 2030!

But I’m no doom-and-gloomer.

So let’s go with the best-case scenario. Surely that’ll work out just fine, right?

Wrong. The best-case scenario for the next ten years is the S&P 500 growing just 4% a year.

4%…

It’ll take 25 years to double your portfolio at that pace…

With the 36-month plan, you’re earning predictable income each month no matter what the markets do.

Capital gains are not predictable and not reliable.

…thus, leaning on capital gains for retirement is a dangerous game…

I like to use a short story to illustrate this point.

Cashing out your capital gains is like chopping down the most bountiful apple tree in your orchard because you need firewood to stay warm.

Rather than letting it continue to grow and bear more apples, you’re pulling the roots out of the ground. By pulling out the roots, it will produce zero apples in the future.

You’ll enjoy the hundreds of apples it grew over the years — but at some point, those apples will be gone…

The next apple tree you plant may not grow as well as the first one or it may even die to due disease or pests…

Then, you’re in big trouble.

Then, you’re in big trouble.

Compare that to the orchard which has an assortment of fruit trees.

If one tree ever starts withering, you’d rip it out and plant a new one… all while still having other fertile trees bearing fruit.

This short parable illustrates the difference between investing in capital gains and for income.

I recommend income investing to retirees every day… and I’m so confident in it, I have my parents doing it.

My folks retired at age 62. They ran the numbers with their advisor expecting to live to age 74. Well, today, they are 86. They’re entire financial plan their advisor put together was shot to hell.

Now, they are set up with reliable income each month and living comfortably.

I told them specifically, “You mustn’t live and die based on where the stock market goes.”

The Great Myth About Stock Prices

Stock prices will swing wildly. Watching them too much could compel you to make an emotional decision.

Share prices go up and down due to an imbalance of buyers and sellers. If more buyers exist than sellers, the stock will go up due to demand.

Higher share prices bring out the greed in investors. Many will hold onto their stocks thinking it will go up forever. Those who don’t own the stock will feel they are “missing out” and potentially buy when the stock peaks.

Soon, the stock is accelerating upwards at breakneck speeds not because the underlying company is doing well…but simply by human greed.

Just look at Tesla stock. In 2013, it was trading for $36. By the end of 2020, it hit almost $695. An 827% increase.

Even though, Tesla lost money by the bundle for years.

Still, the stock has a market cap 10 time that of Ford, which actually makes money off its cars.

Even Elon Musk, Tesla’s founder and CEO, admitted the stock price “is higher than we have the right to deserve.”

It’s all greed and emotional investing — a recipe for future losses.

This exact same process happens, but in reverse, for stocks plunging. Sellers are scared of falling prices. Buyers are reluctant until the price drops so low they can’t resist.

We don’t want any part of this game if we wish to retire and never run out of money.

In your younger years, you’re investing for capital gains.

However, when you start focusing on retirement investing, it’s time to shift gears.

Capital gains are always welcome of course… but without a steady 9-5, you need a reliable way to draw income from your IRA and 401(k) without killing your fruit tree.

There’s only one predictable and safe way to do that today…

…unfortunately, most investors get it wrong…

Why The Average Investor Struggles During Retirement

Here’s what the average investor is doing.

Say you have $250,000 saved up to retire on. Your Social Security check pitches in $1,341 per month.

You believe you only need $4,000 per month to live comfortably on. You may need more or less. New Retirement reports the average income is $48,000/year for retirees.

So, after Social Security, you need only to generate $2,500 per month to live on.

Leading up to retirement, you’d invested in big-name blue chips…Microsoft,, McDonald’s, Disney.

Over 20 years, you saw these stocks skyrocket.

If you look at the last seven years since the crash in 2009, all three of these blue-chips have done remarkably well.

Starting in 2010, Microsoft stock is up around 171%…Disney’s gaining around a similar trajectory at just over 183%. McDonald’s has returned around 147%.

At these growth rates, you’d be netting around 20% per year in capital gains.

Sounds incredible, right?

Thus, in retirement, you want to be prudent and figure you might as well invest more in blue chips.

Except, we all know the market never goes up forever. At some point, it will crash. Stocks will plummet.

Look at Disney stock. In 2000, when the dotcom bubble burst, Disney shed over 66% the following 24 months. Or, in 2008, it lost 50.84% from August to April 2009.

Your portfolio got sliced in half.

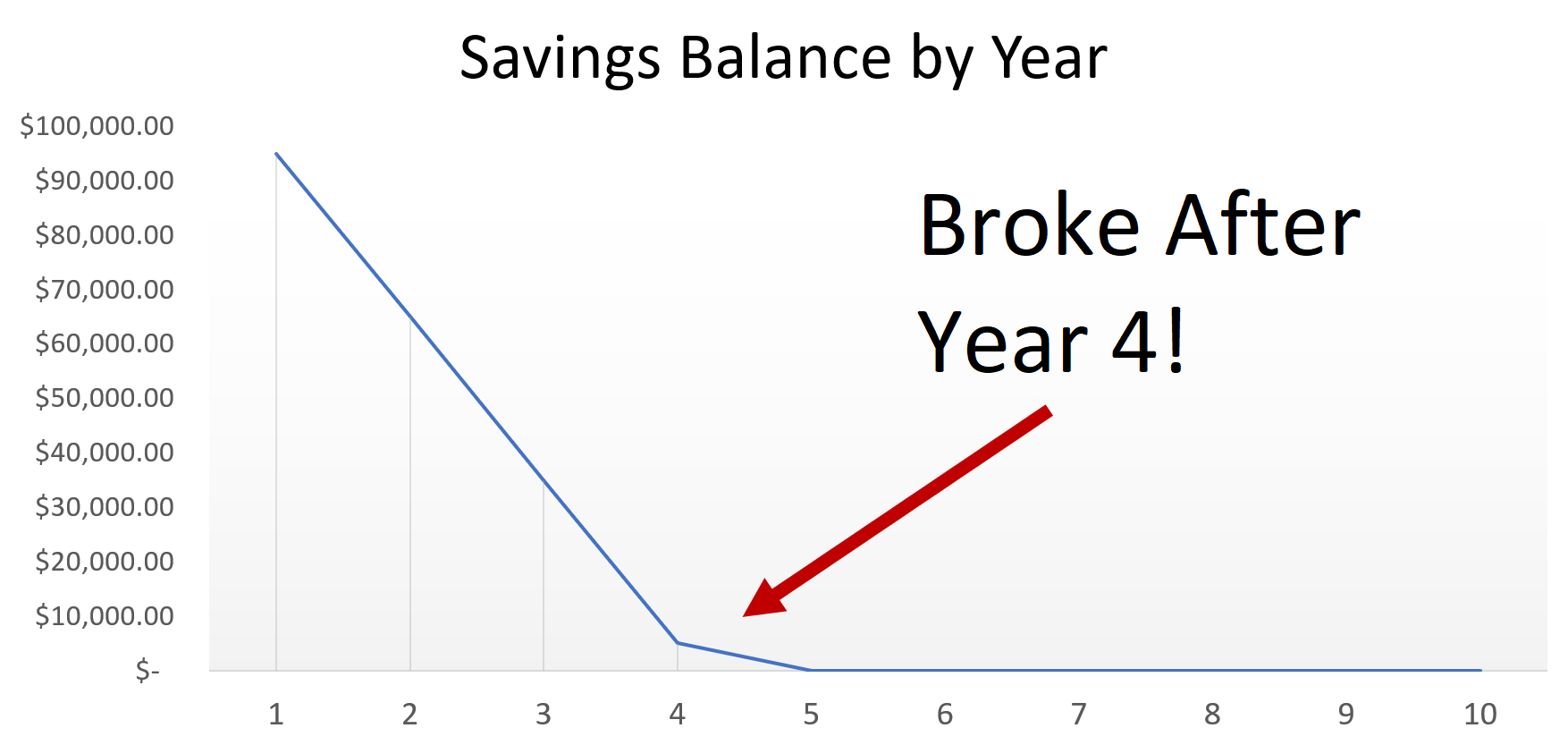

If you then tried to take out your $2,500 per month still, you’d be broke in 4 years.

Meanwhile, Vanguard predicts the stock market will return a measly 4.7% a year over the next ten years.

Meanwhile, Vanguard predicts the stock market will return a measly 4.7% a year over the next ten years.

Not very encouraging if you expect to retire on your IRA balance + capital gains.

It’s downright scary, actually.

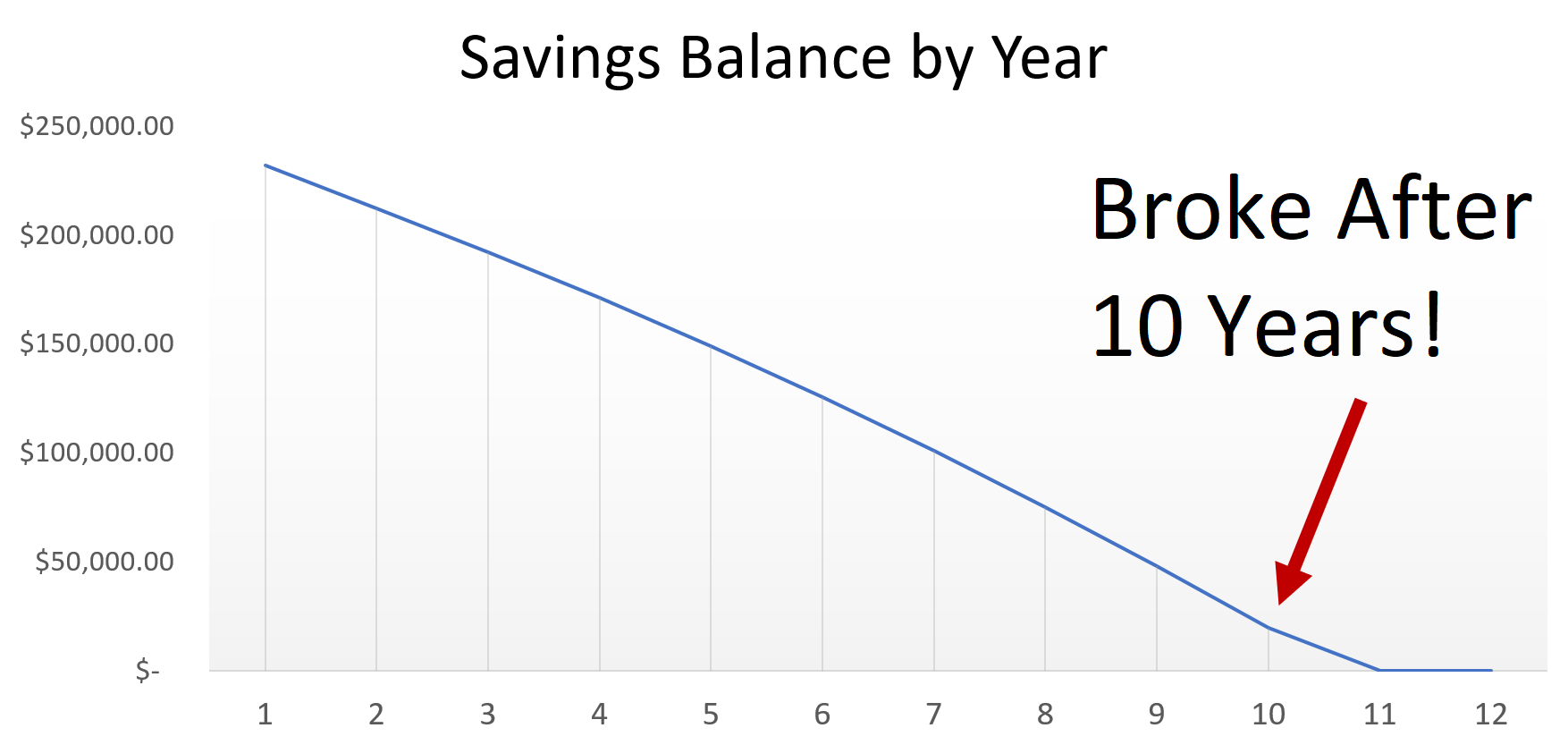

If you have $250,000 now, at 5% growth, but withdrawing your $2,500 per month to use for bills…

You’re out of money in 10 years.

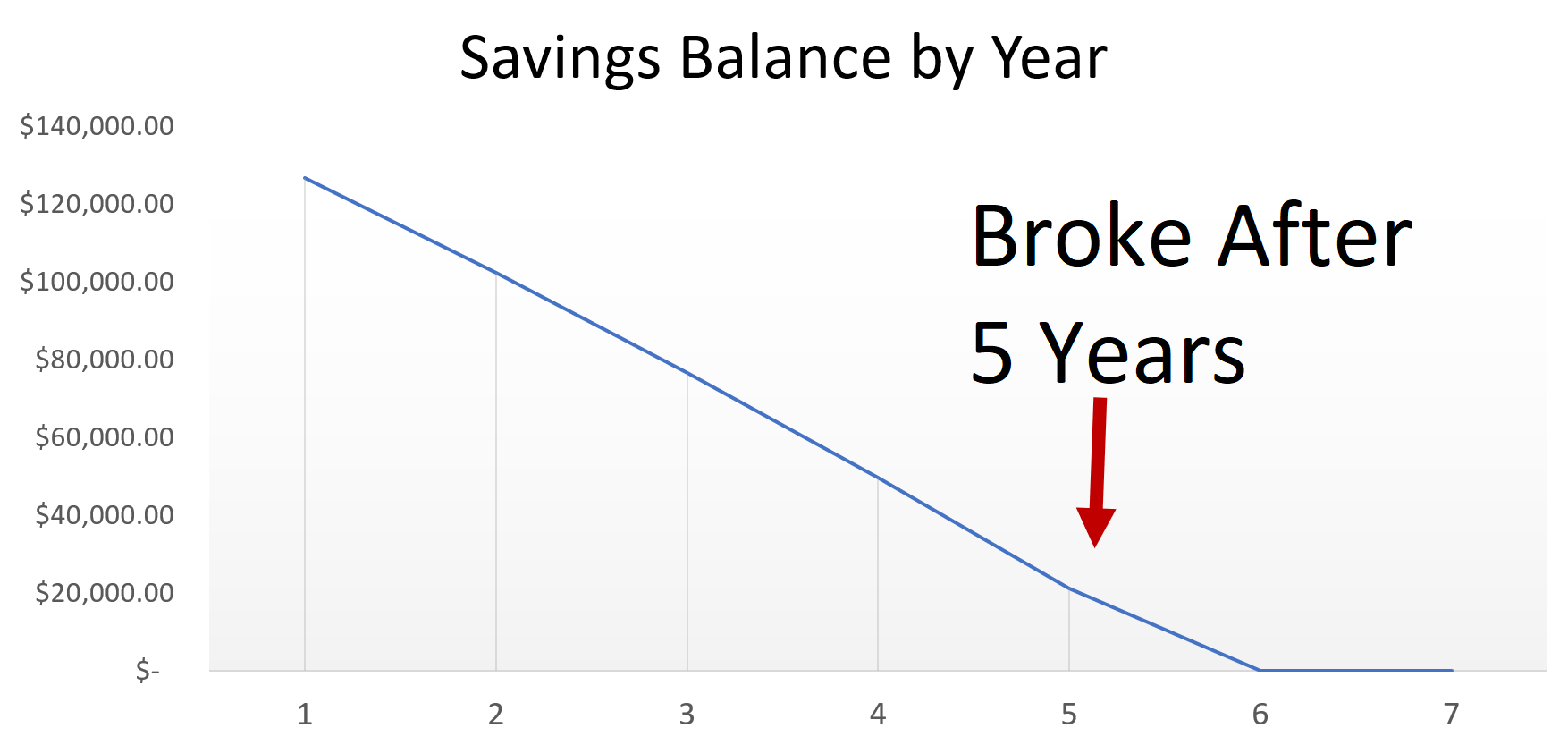

Have $150,000?

Out of money in 5 years.

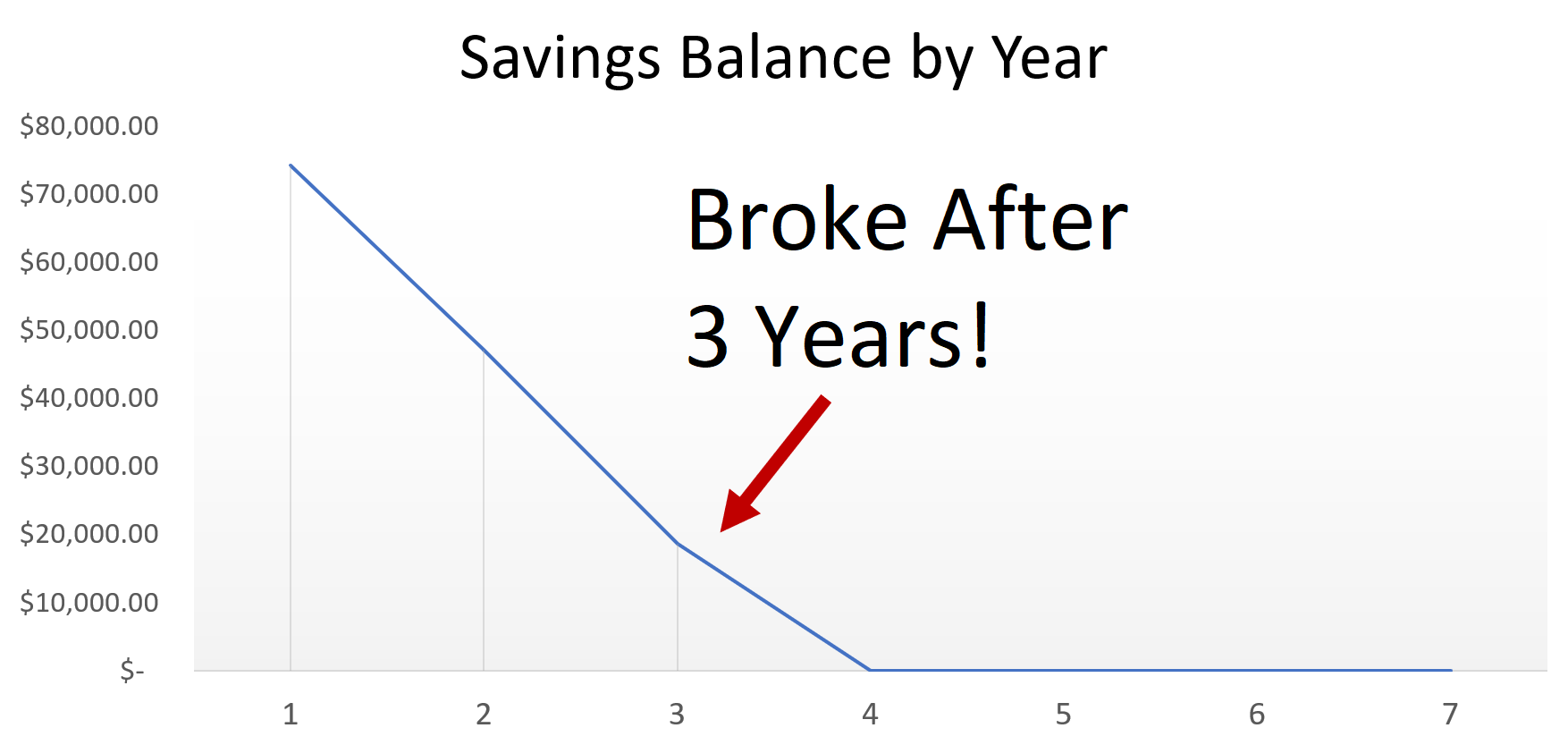

$100,000?

Broke in the middle of Year 3:

Clearly, hoping for endless bull markets won’t get you where you need to be.

At some point, leaning on capital gains is the surefire way to get blindsided.

I mentioned how I’d surveyed thousands of readers. Their #1 fear is “running out of money and going broke.”

I didn’t mention their second fear: “a stock market crash.”

I just showed you why. Because when you rely on capital gains to fund your retirement, the only way to win is if stocks keeping going up.

If stocks go down, you’re in dire straits.

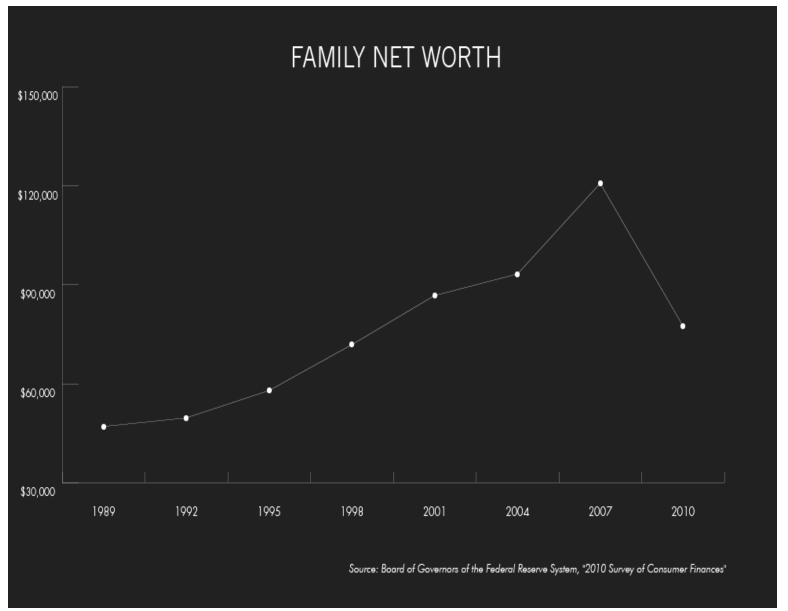

By 2010, look how fast family net worth plummeted after the Great Recession.

In 36 months, that’s close to a 50% drop.

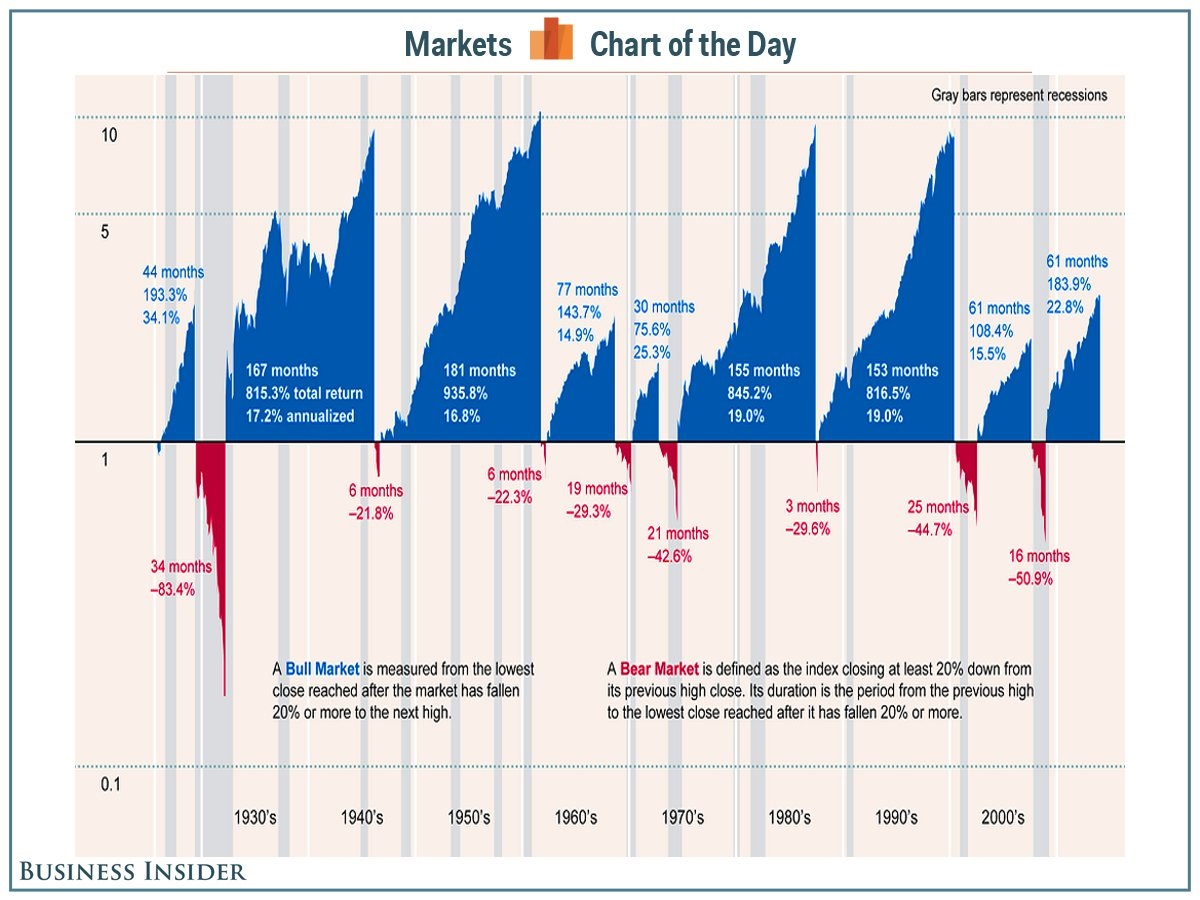

Look, you’re not alone in your fear of the stock market suffering another 2008-2009 crash.

As Business Insider shows, the markets tend to go up and down every decade. Corrections happen, on average, every 18-24 months.

If you try and time the market, you’ll eventually make a sucker’s bet and lose big. That’s why I don’t even worry about share prices.

It sounds insane, but it’s true.

With the 36-month accelerated income plan, we aren’t focused on capital gains or the market.

We only focus on one type of income-producing stocks.

You’ll continue generating income even if the market crashes tomorrow.

With the plan, you’ll see the calculations each month so you know exactly how much income you’ll generate. Then, you can scale up or down depending on your monthly bills.

Getting started only takes around 12 minutes to do, and I’ll show you step-by-step what to do.

Share Prices Are Virtually Irrelevant in Retirement

With our 36-month plan, we are not praying for massive 1,000% gains.

We want income. Period.

We will only buy companies if they are selling for cheap and have a bright financial future..

And we will only sell if we believe the stock is getting too expensive to sustain itself.

Many of my closed positions follow this exact roadmap, and it’s worked perfectly. My readers “sold” right before the stocks dropped.

Oaktree Capital Group hit one of its highest price points at $54.14 in 2015. I recommended to sell.

In the next 11 months, the stock tanked nearly 25%.

It never got back up to the $50s.

In 2019, the firm was taken off the markets after being acquired, at $49 a share.

Salient Midstream is a MLP that traded for $21 per share. Very close to its all-time highs. In March 2015, I sent an alert to “sell” as I believed the stock would crater.

Sure enough, by February 2016, the stock had lost over 72%. The stock hasn’t traded above $12 since January 2018.

Again, none of this is “guessing.” We’re not timing the market. That’s a recipe for going broke. Instead, we’re looking for valuable, cheap plays that will increase our income.

It’s all based on fundamentals included free with the 36-month plan.

Don’t worry. It’s nothing time-consuming. I’ll do most of the work for you.

Like this move.

Ventas, Inc. a real estate fund, has been a roller coaster ride. It’s gone up and down.

Well, I’ve called its top…twice…in back-to-back years.

Near its all-time high of $81.67, I told investors to sell making us a 21.65% total return. In the next 10 months, the stock lost nearly 38%.

That’s okay because when it hit all-time lows, I recommended readers to “buy” again.

Less than a year later, just a hair after Ventas reached its peak at $76.16. I felt the stock was overvalued and hit “sell.” We made out with a 35.68% total gain.

I was right on the money with the call.

I was right on the money with the call.

Less than 90 days later, the stock slumped 22%.

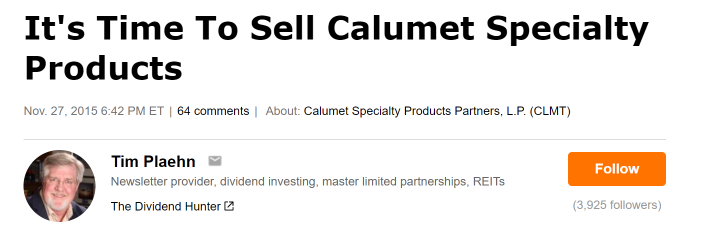

Another of my plays, Calumet Specialty Products, I recommended selling publicly on Seeking Alpha.

You can read the comments. Many ridiculed me saying, “This is the worst time to sell” or “Tim is doing his followers a disservice with this one.”

Just a few weeks later, the stock started its plunge. By mid-2016, it sunk 85%.

Many readers came back to post, “I should have listened.”

Look, I saw these dips coming because my research told me the income was about to drop.

That’s what we’re focused on. If we can nab large gains in the process, it’s a sweet bonus, of course.

Like when I recommended buying CyrusOne Inc., a data center company.

10 months after recommending to “buy,” the stock shot up 57.69% with income to boot.

Again, capital gains are nice, but we focus on income. If a company is growing and they expect to increase their income payouts, we stay with them through the dark days.

Meaning, we don’t panic if our stock goes down 10% because eventually, it will go up again.

When it goes down 10%, we buy more of the stock and pick it up at a nice discount because we’re picking up the income along the way… and that’s what this system is all about: cash income.

Another play in my private portfolio leases commercial jets. In 2009, they got hit hard like other stocks. But, if you understood the business as I do, you’d buy right through the bear market.

The stock is up over 600% since the March 2009 bottom plus another 200% in cash income.

That’s how we compound our money at a faster pace…buy good businesses when down to compound our income.

And it’s all with one type of common stock.

Retire On This One Stock

I’ve dedicated my career to one specific type of stock, which generates regular income every month.

As you might’ve guessed, I’m talking about dividend stocks — ever-dependable and predictable dividends.

But, not just any dividend stocks. I’m focused solely on high-yield dividend stocks.

These are companies that pay above-average dividends each quarter (some every month). It’s not unusual to see 7.9%…11.6%…even 21.2% yields.

All paid out regularly, like a paycheck. Meaning, you know exactly how much you’ll make every month.

We focus on high-yield dividend companies because:

- Dividends are real returns. They won’t disappear when a share price goes down.

- Where else do you get 8%…12%…20% yields?

- Dividends are more predictable than share prices.

- A higher yield makes the power of compounding exponential.

- For you and me, we have a long-term plan on generating cash forever.

These high-yields are at the heart of our 36-month plan. Because starting with as little as $25,000, you’ll have the opportunity to build up a $4,804 monthly income stream like one of my readers, Keith G.

He wrote in to tell me in June 2017:

“I am now a dividend income investor. My dividend income is well in excess of $50,000 per year. ”

$50,000 per year calculates to around $4,166 per month.

You, too, could be on a similar income path for life.

If you’re disciplined enough to stick through the plan, this is a reality for you.

The critical piece to remember right now: Cash is king during retirement.

Income = cash.

Many dividend stocks we invest in are expected to increase their pay-outs each year. This means you will see larger checks each month: no matter the economic conditions…no matter if share prices dip a bit.

Many of the plays in my dividend portfolio have been compounding income for years — overvalued stocks I sell. And stocks with a risky dividend about to be cut, too.

I can’t reveal the tickers of these companies as a gesture of respect to my private readers.

Here’s an example:

If you had followed my 36-month plan with this play, here’s where you’d be now.

You’d be making a steady $2,015 each month.

Over 10 years, that’s $241,800 in income alone.

That’s just one example.

Going into my various plays, my research told me the stocks were selling for cheap and that’s why we have capital gains.

But, again, that’s not what we’re banking on. Capital gains are excellent for when we need to unload shares and reinvest the profits for more income. But that’s all they’re for.

Our main focus is the high yield.

Dividend stocks pay you consistently whether we’re invested in a raging bull market or a bleeding bear one.

One of my insider plays reserved for subscribers kept paying their $0.52 dividend per share even when the share price cut in half.

We’ve been buying shares for even less now and earn over a 20% yield on our investment today.

How To Find The Right Companies For Your 36-Month Plan

Now, how do we find these high-yield companies?

Normally, companies paying out large sums are not “household names.” Household-name blue chips typically pay 1-3% yields. That’s not enough to retire on. We have to dig deeper to find income-producing companies.

To be successful, you only need two criteria:

1) The company is growing in the next 3-5 years. If a company isn’t growing, it’s declining.

2) The dividends have a track record of increasing or staying steady.

All of Warren Buffett’s top 5 dividend holdings have rising dividends, and we’re following his lead.

These criteria are imperative because all high yield companies aren’t strong businesses. I already showed you examples when I called the top of multiple companies.

When I first started, I looked for the highest yield companies and invested there. Over and over I found out these companies were bad news and the stock would drop as much as 95%!

Again, just searching for companies with the “highest yield” and picking a bad apple could destroy a portfolio.

That’s why I spend much of my day in the trenches — talking with executives at these companies and making decisions based off what they say.

You get a more complete company picture actually chatting with management than you will from a financial statement.

On top of that legwork, I’m attending company presentations and investor conferences looking for opportunities.

Again, these companies aren’t on the frontpage of Forbes. So, I must dig them up and sort winners from losers.

Like this one, strong REIT I found handing out 15.7% yields every single year. That’s a guaranteed 15.7% cash deposit as long as the dividend continues.

After following the 36-month accelerated income plan, you’d be collecting a $2,819.12 per month paycheck on a modest 6-figure portfolio.

Over 10 years, that’s $338,294.40 of income. Not stock gains…INCOME.

Imagine that like clockwork forever.

In fact, you’ll know down-to-the-day when your checks arrive. You do this by stagnating when you want to receive them.

I’ll show you how that works with my free Monthly Dividend Paycheck Calendar.

In the calendar you’ll get the exact dates for when you need to be an owner of the stocks in the calendar and when you should expect your paychecks. It’s pretty clear cut yet extremely powerful in helping you build wealth quickly.

Every green marker signifies when money will deposit into your checking account to pay the bills. You’ll get this calendar free when you start the plan today.

Once you’ve completed the 36-month plan, your entire financial future will be built around this calendar.

It’s pretty exciting when you see money deposited and you didn’t do a lick of work.

Retirement is supposed to be enjoyable after all. Why live in a constant state of fear the markets will collapse or not knowing how much to safely withdraw?

The 36-month plan completely cuts out the fear of the unknown out.

Because businesses are built and managed for the long-run…You and I need to invest the same way.

And we want our capital in companies that value us as shareholders and who also have a goal of producing abundant cash flows.

Their rising cash flow leads to increasing dividends for us.

That’s the key difference from what other newsletters may tell you. They’re pushing you towards companies that might pop for big gains.

In reality, it’s a friggin’ crap shoot.

Your best bet is look for companies with an ever growing pipeline of cash. Cash is king.

We focus more on cash and less time on how high the share price will go.

Ironically, we actually want to see lower stock prices. That way we can invest less capital for shares but still collect the same income.

Nothing causes more notes in my inbox than when the share price of a recommended company drops 10-20%.

Look, stock prices will change a lot — literally everyday.

It is not uncommon to see a stable, high-yield dividend-paying company move 20% or more between its high-and-low over 12 months.

I love seeing my favorite income-producing companies sink in price, because I have cash-on-hand ready to scoop up shares for a 20% discount.

In my 30 years of trading, I typically see companies with increasing dividends tend to rally from drops.

Bad companies with dividend cuts tend to crater.

When you start seeing stock market plunges with strong companies as opportunities and not dangers, you’ll be well on your way to having your bills paid for.

Let me summarize as we covered a lot in the past few minutes.

I’ve actually revealed the plan for you already, but let’s tie it all together.

Here’s how the 36-month plan works.

- Find healthy, high-yield dividend companies

- Buy when the prices are low

- Collect the dividends

- As you find more plays, add them to your portfolio and/or grow your current positions

- (If necessary) Sell when the price gets too high or yield gets too low

We’ve covered these pieces so far.

But let me share with you the true secret sauce to this plan…

And this is where you must get disciplined…

Because without this next step, your miss out on the majority of your perpetual income.

The Power Of The DRIP

Starting now, you must utilize the DRIP method.

You’ve probably heard this before. Pay attention as this next part is important.

Because if you’re able to snag a high-yield company that produces both dividends and a steady capital gain, the DRIP method could literally double your portfolio in under 36 months.

In some cases, triple it.

In some cases, triple it.

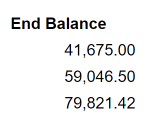

One high-yield play in our portfolio takes a $25,000 stake and turns it into $79,821.42.

Again, this requires discipline and patience. But the DRIP method really pours fuel onto your portfolio no matter how large or small.

What is the DRIP?

It’s a Dividend Reinvestment Plan. The 36-month plan cannot work if you don’t do this critical step.

While on the 36-month plan, we will be reinvesting all our dividends back into new shares.

[BONUS]:: Brokers don’t charge $5 – $10 commissions to do this. It’s free.

Remember, I didn’t pick “36 months” out of a hat. That’s the ideal timeframe to build an ever-growing money tree.

That’s why, if you have months/years before needing full-time income, or you have a large enough portfolio to take a portion of it to dedicate to this plan

You will be set up for life.

DRIP ramps up your income. You’re compounding income on top of income.

This is a secret of the wealthy.

With the right buying and selling moves, your overdue bills will literally vanish from your mailbox.

The larger your portfolio, the faster you’ll see tremendous cash dividends.

As you use DRIP, your income will continue to grow. If you’re able to reinvest when the share price is down, you’re getting more bang for your buck.

With a $150,000 portfolio using the stock above, after using the 36-month plan, you could see a $3,318.91 per month income stream for life.

Again, over 10 years, that’s a total of $398,269.20 in total income (not stock gains). Not to mention, a portfolio worth close to $300,000 which you could pass on to your children.

As you add to your positions, the income will only balloon.

Plus, your income doesn’t touch the principal. It’s all dividends. Your principal should keep compounding untouched.

At this point, you have a full-blown accelerated income machine…an escalating income with a growing account balance.

With the 36-month accelerated income plan, you’ve created an orchard of ever-producing trees to feed you and your family for life. As one goes bad, you replace it with another while the others continue producing for you.

So, the entire 36-month plan is this:

- Find healthy high-yield dividend companies

- Buy when the prices are low

- Collect the dividends & use the DRIP method

- As you find more plays, add them to your portfolio and/or grow your current positions

- Sell when the price gets too high or the yield gets too low

- Automatically pay your bills for life

The 36-Month Accelerated Income Plan PAYS YOUR BILLS FOR LIFE! (FREE)

What you’ve just read could be a major fork in the road for you. I’m guessing your goal in retirement isn’t to worry about your financial situation.

What you’ve just read could be a major fork in the road for you. I’m guessing your goal in retirement isn’t to worry about your financial situation.

You have other dreams to accomplish and places to visit.

Look, creating a lifetime of income doesn’t have to be complicated or risky. No matter what other financial advice you read today, I’m telling you it’s simple.

The hard part is staying disciplined and consistent with your strategy. Unfortunately, most retirees don’t have a strategy except hoping for a perpetual bull market. As you’ve seen, that won’t happen.

That’s why I’ve put together an entire 36-month roadmap for you — step-by-step…easy-to-follow…

Yes, you’ll get the investments to make, but also you’ll discover there’s much more to it than that.

I lay out the entire plan inside my premium report, The 36-Month Accelerated Income Plan.

It’s absolutely free.

Inside, discover:

- How to setup your 401(k), IRA, or brokerage account for the plan (takes 12 minutes) so the income continues to flow into your account

- The #1 rule that will double your money regardless of stock price

- A killer strategy to add potentially 245% portfolio increases to your account balance *takes just a few click to set up for free)

- Step-by-step directions on how to execute the 36-month accelerated plan to perfection

- When to buy & sell your stocks without losing your shirt

That’s not all…

By taking action today, I’ll give you the soap-to-nuts strategy for you to put this plan to the test right now.

By taking action today, I’ll give you the soap-to-nuts strategy for you to put this plan to the test right now.

Meaning, you’ll get my absolute best investments to inject into your personal plan and be off and running faster than you can imagine.

So, included with your FREE 36-Month Plan, I’ve included another FREE report:

“Tim Plaehn’s Top 10 Income Stocks that Pay Your Bills for LIFE!”

Inside, you’ll find:

- A little-known spin-off, leasing company shelling out unheard of 15% yields! They should see more growth as they are in the technology space.

- An incredible real estate company (one of the largest in its space) peeling off 8.8% dividends like clockwork. We’ve held this stock over 3 years because of its increasing income.

- My top performing dividend stock yielding a whopping 11.7%. We will double our money just thanks to the dividend in the next few years.

- Your ‘go-to’ 36-Month Plan stock. This is the very first one I’d recommend paying (at this writing) a 24.84% dividend! Pay your bills with this stock alone.

These are just four dependable companies churning out yields that can pay your bills for life, and I have six more to share on top of that if you receive my 36 Month Accelerated Income Plan today!

A couple I’ve had in my portfolio for 3 years and never sold the shares. I simply check-in every month and add to my position. Meanwhile, I collect their dividends and enjoy the spoils.

It feels like a regular paycheck without the work.

If you’ve read this far, I’m guessing this plan sounds interesting to you and your situation.

The 3 Dividend Stocks to “Buy and Hold Forever”

Get three tried-and-true high-yielders that are indispensable for your portfolio.

Get three tried-and-true high-yielders that are indispensable for your portfolio.

These are the ‘CORE’ holdings for the 36 Month Accelerated Income Plan.

Purchasing these three stocks today is how you start the plan…

And get on the path to a lifetime of income in retirement.

Stock #1 is a true “buy and hold forever” gem. It pays 14 dividends a year (yes that’s MORE than once a month). And has many years of dividend increases under its belt.

The second stock is as conservative as it gets but still pays out a 6% yield monthly! You can feel safe and secure owning this stock and using it for the 36 Month Plan.

Then finally we have a true high-yield juggernaut. I won’t share too many details here. That’d spoil the fun.

Get the report today and you’ll get a full write-up on each.

Plus you’ll receive my most trusted report.

The Monthly Dividend Paycheck Calendar

Hopefully, you feel I’ve been open with you here. I’m a straight-shooter. I don’t have time for investors chasing the ‘next big thing.’

Others may see investing as a sport, like hunting or fishing. Not me. I invest with the discipline to grow my income.

I wake up every morning in the Nevada hills at 5:30 am. I read the paper and study the markets.

I’m not trying to win awards, recognition, or land on the Forbes 1000 list. I invest in high-yield stocks to fund my lifestyle.

This 36-month plan isn’t some half-witted theory concocted from books.

It’s a calculated, math-driven solution to pay your bills for life.

Like I mentioned at the beginning, this won’t make you rich tomorrow.

You save for your golden years in hopes of retiring rich. After you retire, you simply need income to enjoy the rest of your days.

Dividend income, not capital gains, is how you get there.

Is it the most exciting investment strategy ever? No, of course not.

If you need to invest in a few penny stocks to get your adrenaline rush, by all means, go ahead. Just make sure you stay true to the plan I’ve laid out for you.

Once you complete the plan, you’ll then take advantage of the second free bonus I have for you: The Monthly Dividend Paycheck Calendar.

I revealed this to you before:

This calendar is your future. I expect you’ll have it up on your refrigerator.

Because I’ll map out, like a 5-star general, when each company pays its dividend. You’re then able to create a calendar for yourself that pays you on those days.

You’ll know ahead of time how much in dividend checks will hit your account.

Every month, subscribers are cashing checks:

Jonathan D., age 62 will collect $1,020 this month and every month. He’ll use that money to add to his position and collect more.

Karen T., age 54, brings home an amazing $4,423 like clockwork! She gives more of her time to charitable organizations in New York now.

Dominick B. in Houston owns just one stock and takes home an extra $850 without effort.

These are everyday Americans supplementing their Social Security with dividend income.

You can do the same.

You’ll get both of these bonuses today at no cost:

- The 36-Month Accelerated Income Plan

- The Monthly Dividend Paycheck Calendar

The Dividend Hunter

These don’t cost a penny to you. All I ask in return is you start a risk-free trial of my flagship service, The Dividend Hunter.

These don’t cost a penny to you. All I ask in return is you start a risk-free trial of my flagship service, The Dividend Hunter.

The Dividend Hunter is my private group where I reveal how to both profit from top dividend companies and see consistent “paychecks” monthly.

My ‘Monthly Dividend Paycheck Calendar’ updates each month as I find better companies to invest in. You always know which stocks are paying dividends that month.

What you get with a risk-free subscription to The Dividend Hunter:

● 12 monthly newsletter issues where I teach you how to develop a successful dividend investing strategy with my high-yield picks. These issues hold the picks that you will need for your 36-month plan.

● FREE Monthly Dividend Paycheck Calendar. You’ll get an email with step-by-step instructions on how to set up your predictable dividend income stream. An absolute must-have and it’s updated every month.

● 365-Day 100% Money Back Guarantee. You get a full 100% money back guarantee: just request a refund during the first year of your subscription and get your money back. You deserve exactly what I’m promising in this presentation.

● FREE UPGRADE #1: Weekly Buy recommendations. Every Tuesday I’ll send you an update on the current ‘best buys’ in the portfolio so you’ll know where to put any new or additional investment funds so you can reign in even more cash.

● FREE UPGRADE #2: U.S. Dividend Stock Investing for Canadian Investors. Many Canadian readers wanted in on the action such that I put together a free guide so you can invest alongside us here in the States.

● FREE UPGRADE #3: Regular training and education live sessions. This way you’ll become a better income investor that puts you in a position to make even more extra income during retirement.

● FREE UPGRADE #4: Dividend Forecaster tool. Always know exactly how much income you will receive from your investments with our Dividend Forecaster. An elite tool that comes free with your subscription.

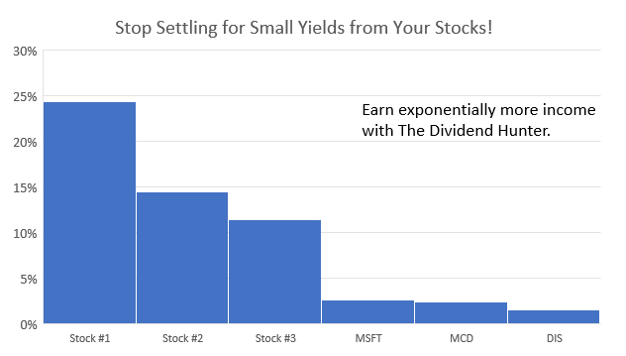

I’ll show you the top income plays to make…and they tend to beat the pants off blue chips stocks.

If we use the same blue chips as before: Microsoft, Disney, and McDonalds…

Let’s compare how much income you could potentially earn while subscribed to The Dividend Hunter.

That’s the difference from trying to do this on your own.

I get emails all the time from readers thanking me:

I just wanted to take a moment to thank you for your wonderful newsletter and dividend tips. I have subscribed to a lot of stock newsletters in the past and found them to be very hard to understand.

Your information is easy to comprehend, short and to the point.

— Jerry C., Idaho

I have tried several newsletters and yours is the only one I have stayed with.

— Vic B., Colorado

I am glad to have found The Dividend Hunter and all your weekly updates. The dividend calendar is excellent and I have been using it regularly. I eagerly await all your updates and thank you for improving my income stream with all your great ideas.

— Ronald P., a long-term subscriber

With The Dividend Hunter, we will invest in 5 distinct types of stocks to fund your 36-month plan:

- Conservative: These are the stocks that show the best combination of dividend security and share price stability. I don’t care much about short-term share price movements, but it does provide a level of comfort to you.

- Secure Dividends with Volatile Share Prices: Stocks with huge yields, but go up and down fast. We watch the share prices here to find a bargain.

- Monthly Dividend Stocks: Companies that incredibly payout cash monthly.

- Discount Plays: Stocks that investors have driven down to discount-level prices because they think the company is hurting. You and I know better and pick up shares waiting for increasing dividends and even some share price appreciation.

- Positive Surprises This Year: Sleeper stocks who could boost their dividends without notice. When the price spikes high, we are in a nice spot to dump the shares with our dividends and gains in tow.

I am not a “hot stock” picker. I don’t use some weird financial algorithm to try to find which stocks will outperform.

My goal is to help you build a portfolio of high-yielding stocks that generate a steady and growing cash flow stream.

These plays work to build your 36-month plan and beyond.

Again, the growing income stream is what will allow us to be in the stock market through both up and down periods.

You’ll get regular updates on where you should be invested. Making these trades correctly keeps you on track with the plan. For the most part though, we will kick back and enjoy our income stream.

But, it’s imperative you know when and what to buy/sell. That’s how I can help you.

And you’ll be surprised how little it will cost you.