ALERT: You no longer need a million dollars to retire…

Follow this strategy to generate up to tens of thousands of dollars a year for life.

Who ever heard of generating tens of thousands of dollars in income starting with just $25,000?

And that’s not income that lasts for only a few months or a few years…

I’m talking an endless stream of income that can keep going and going… it never run dry.

It lasts for life… and…

Like I said, all you need to start is $25,000…

Some would call this income impossible.

That’s why what you’ll see today is controversial…

It’s a way to generate a lifetime of income you’ll never hear shared by ‘gurus’ or financial planners (trust me I know… I used to be a Certified Financial Planner).

What you’re about to discover is the little-known, and surprisingly easy strategy I built to create far more income for your retirement with far less money than you may think possible.

Here’s what I mean:

Take $25,000 of your portfolio and put it aside.

If you have that right now, you’re set.

Because that’s all you’ll need to generate up to tens of thousands of dollars each year without doing much else at all.

Let me say it again.

After this presentation you’ll know the exact strategy and method required to carve out $25,000 from your brokerage account, 401(k) or IRA and create a lifetime of income.

It uses the single most powerful income generating strategy I’ve come across in my entire 30-year investing career.

And in only 10 minutes today, you will discover how to…

starting with just $25,000

I’m talking about an extra $10,000… $20,000 per year to use as you wish.

Take your family on vacation, maybe splurge on that expensive car you’ve had your eyes on.

All you have to do is start with $25,000 and follow the instructions in this presentation.

After you do that, you’ll have a repeatable income generating strategy you can use over and over.

This isn’t get rich quick.

Nor is it meant to be your only investing strategy.

In fact, I stress that you don’t invest all your savings in this income strategy…

In fact, stop reading unless you can dedicate at least $25,000 without breaking the bank…

Because once you master this strategy the sky’s the limit.

The more money you put in, the more income you produce.

Just follow the simple steps shared in this presentation and you can retire with far less saved than you might think possible.

Because with this strategy you don’t need millions of dollars to retire. You don’t even need hundreds of thousands to make your money last for decades.

$25,000 to start.

The rest of your portfolio beyond the $25k, let it grow as you will.

Once you put this strategy to the test, you’ll find:

- It’s the only road-map to delivering a consistent… and growing… income that lasts for the rest of your life

- You can retire with far less money than any retirement “expert” claims you need

- You will never have to sell your stocks to fund your lifestyle

- Your income will continue no matter what the economy is doing, whether the market is going up or down, or who the President is

And for a limited time, I’m sharing the full details of this $25k strategy.

There are no options…

No tech IPO or penny stock play…

It’s a plan you will never, ever hear from the mouth of Wall Street brokers because they’d go broke if everyone knew about this.

You won’t hear this plan on the news because it’s actually quite boring.

And perhaps the best news of all…

This plan does not rely on drawing down your savings.

While most retirement plans involve you selling off your assets every month to cover your expenses…

If you follow my plan, you’ll keep your net worth growing each and every year while still collecting massive checks to cover your expenses and more.

I designed this strategy for this exact reason.

You’ll receive mountains of checks without selling the shares in your 401(k) or IRA.

These $25k Opportunities Can Be Difficult to Locate

I’ve identified over 10 opportunities in the last five years that would be generating you tens of thousands of dollars in income each year.

These opportunities are all from high-income dividend stocks.

A few I invested in myself and shared with my early readers.

That doesn’t mean you’ve missed out, though.

Quite the contrary.

These income generating opportunities come like clockwork. You just need to know where to locate them.

Using the $25k plan you can sign up for today, you’ll be able to identify your first opportunity in the next 30 minutes.

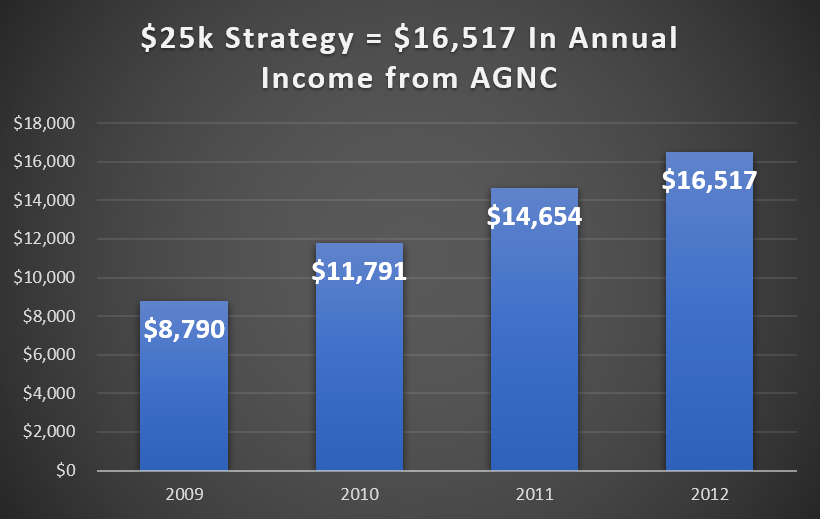

I believe starting with $25,000, it’s possible to create an extra income of up to $10,345… $15,508… or $16,517… per year in the next couple of years.

Have more than $25,000 socked away? Great, you can generate even more income.

But you need to read this presentation first to find out how to create your income stream today.

Because a strategy like this is already changing lives.

Phil J. is already following my advice, is now retired and enjoying his newfound income.

Here’s what he had to say:

“I’m 68 years old and retired. I want to say that over the years I have [followed many strategies] and yours is the only one that has made me money. I really want to thank you and I wish I had found your service years earlier.”

Jack S., one of my readers said:

“I really love your program. I am going to talk to all my friends and family – first time I have seen a program really work!”

Gary F. couldn’t believe the results he’s seeing:

“My return percentage is higher than my financial agent can manage. Go figure.”

Brad B. agreed with Gary:

“My account balance hasn’t looked this good ever, and I’ve only been on board a few months.”

Of course, your results may vary. I’m sharing these stories so you can see that the opportunities to turn $25k into a lifetime of income are real…

But only if you know where to find them.…

Because the stocks that will get you there are not Wall Street’s golden boys. They’re high-income dividend stocks you’ve likely never heard of.

While I might’ve said this is boring, I only said that because you will not be taking your $25k and investing in high-flyers like Netflix or Amazon.

Instead, you’ll be taking that $25k and creating multiple income streams that never run out…

And never require you to tap into your nest egg to fund your expenses…

Using this strategy will give you ultimate financial freedom in retirement.

Let me show you an example.

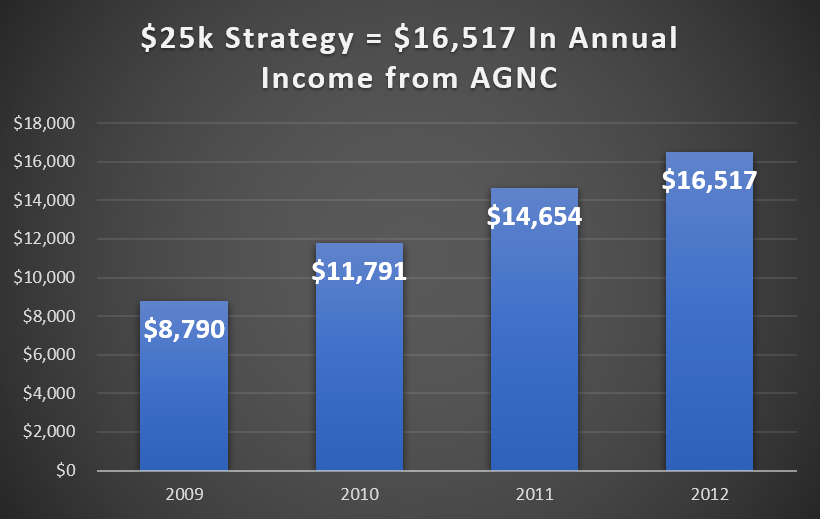

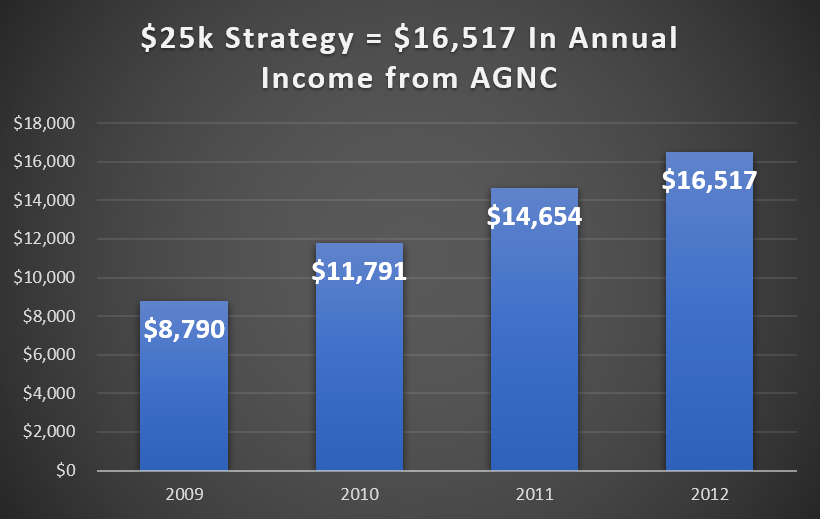

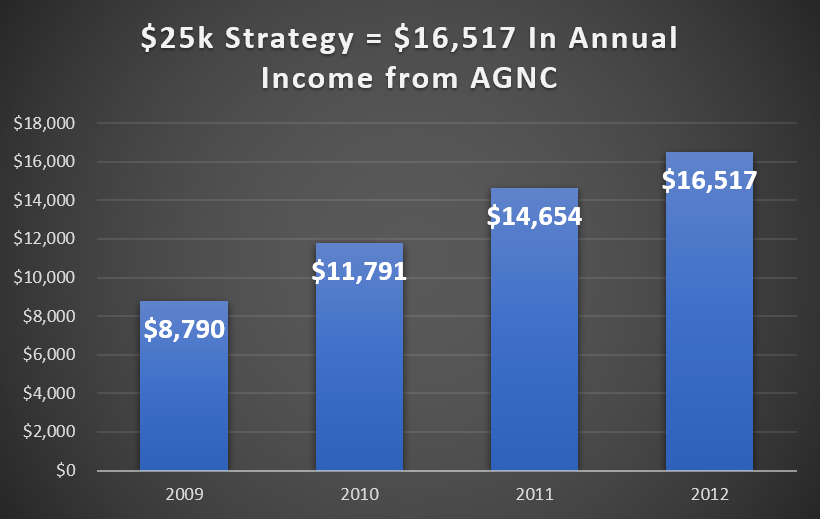

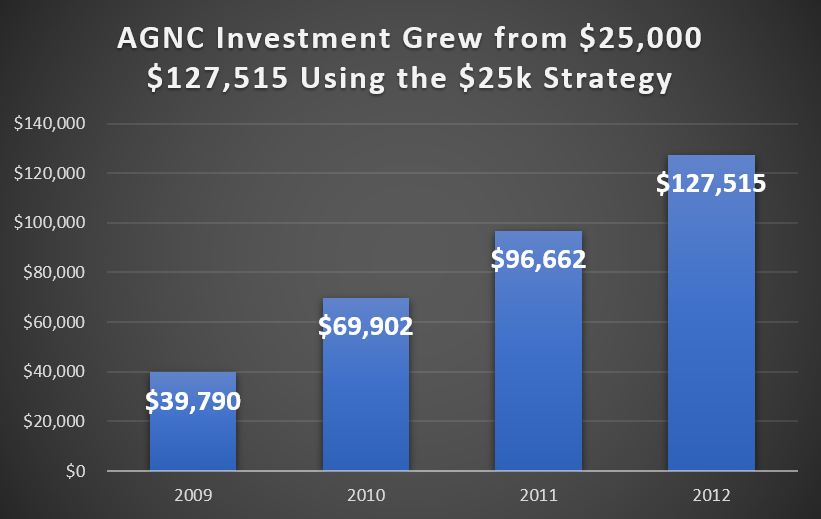

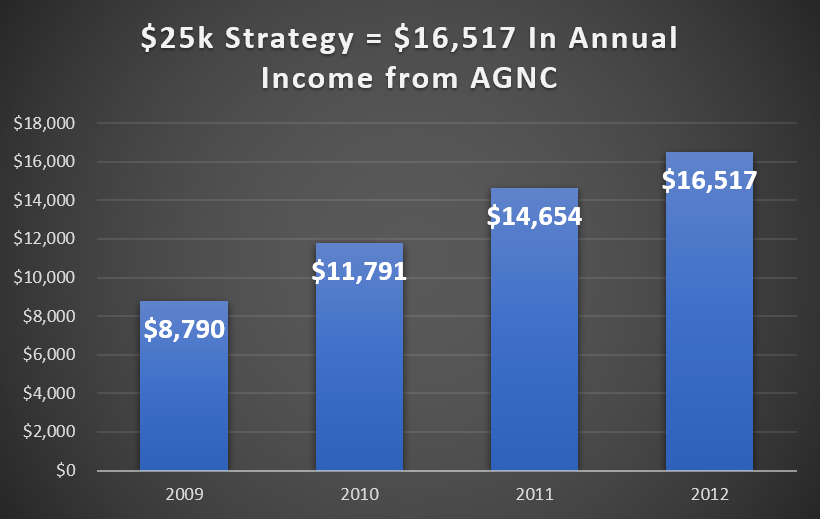

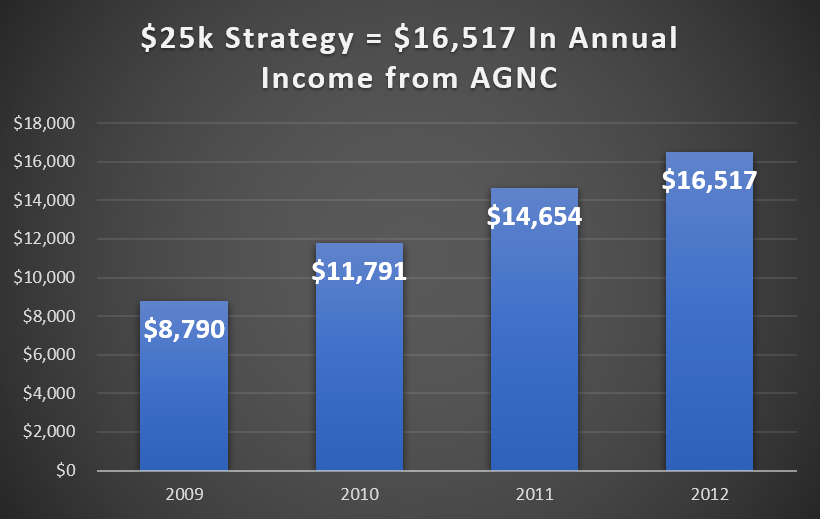

Say you started with $25,000. In just 48 months following the $25k plan, and investing in AGNC Investment Corp., you could’ve hypothetically been enjoying a $16,517 annual income today.

Once again, starting with just $25,000 you could now be collecting $16,517 in annual income!

That’s all hypothetical, based on how the stock behaved from 2009 to 2012. Actual results may have been different depending on timing and so on.

But as you can see, the potential is there.

And if you have more than $25,000 saved, you could be earning even more.

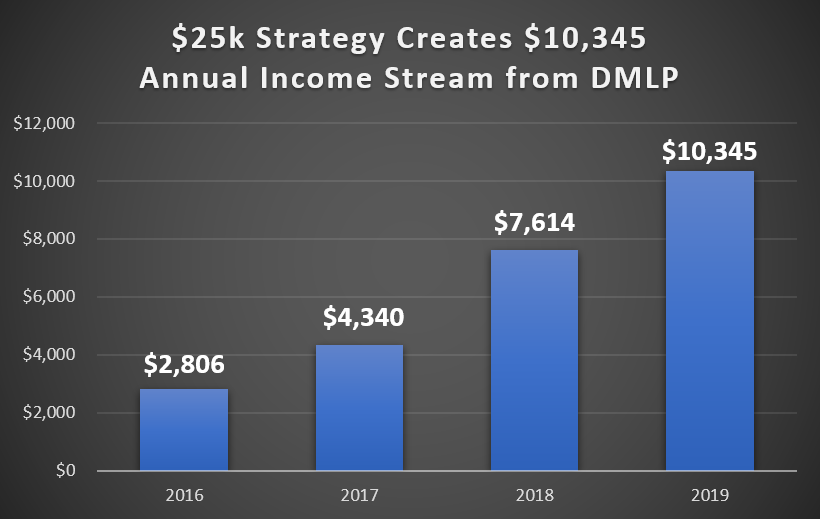

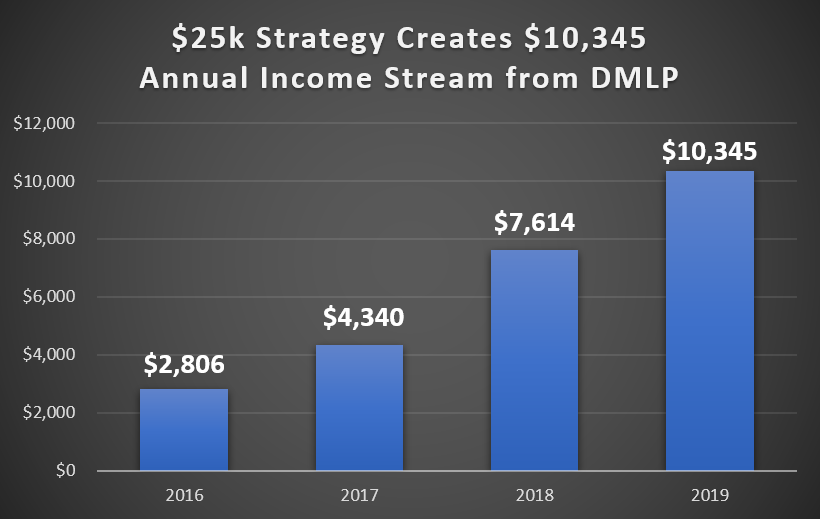

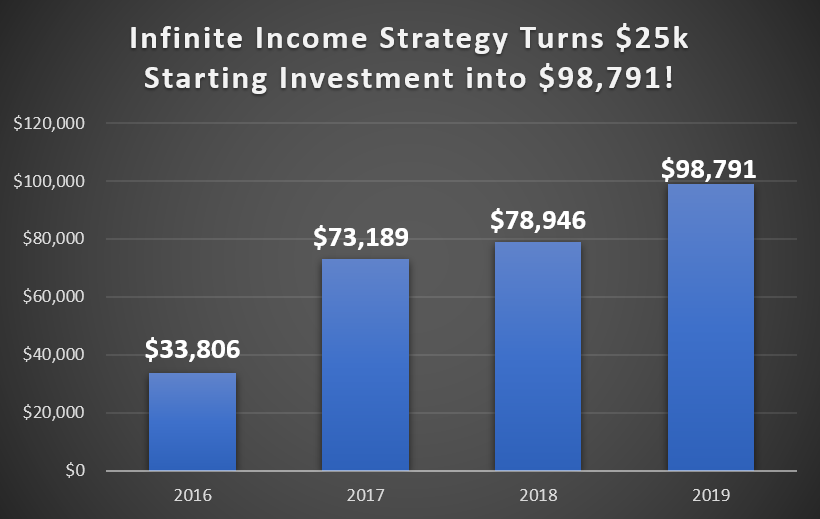

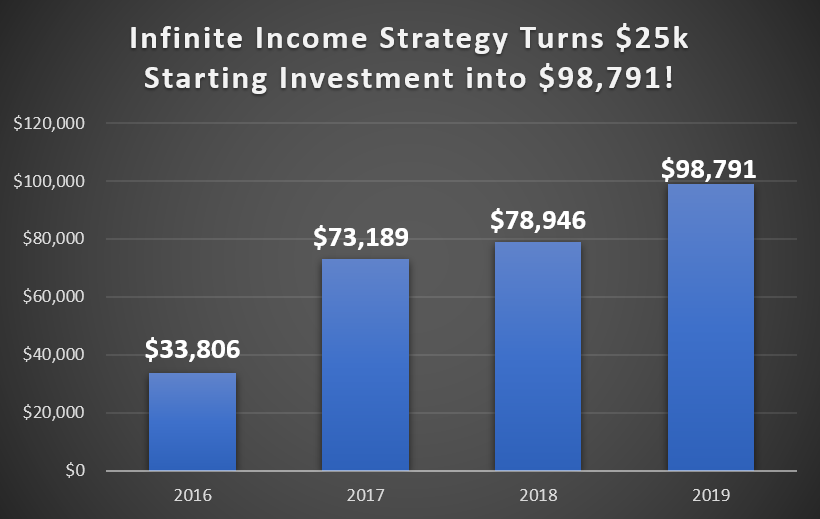

Here’s a far more recent example, Dorchester Minerals… nothing sexy here… they mine minerals.

Starting with $25k, you could’ve been generating $10,345 per year after four years.

And in 2023, after four more years of fully passive dividend growth, I think it’s safe to say your $10,345 annual income could potentially be approaching $15,000 or more.

This process is repeatable.

Once you make your first $25k investment, see how it works, and start collecting checks, you can do this over and over again…

For the rest of your life.

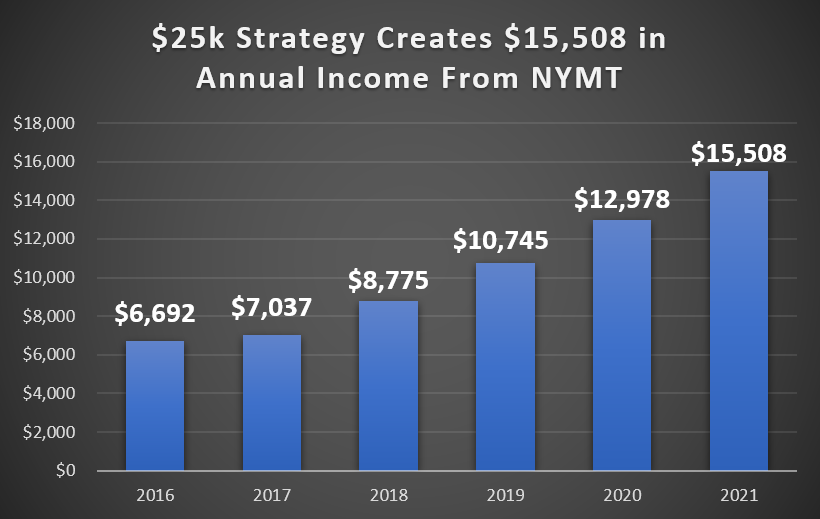

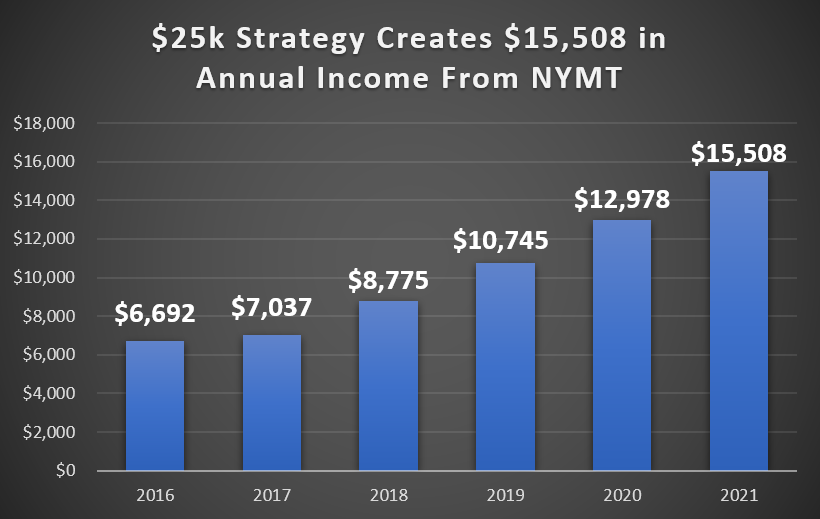

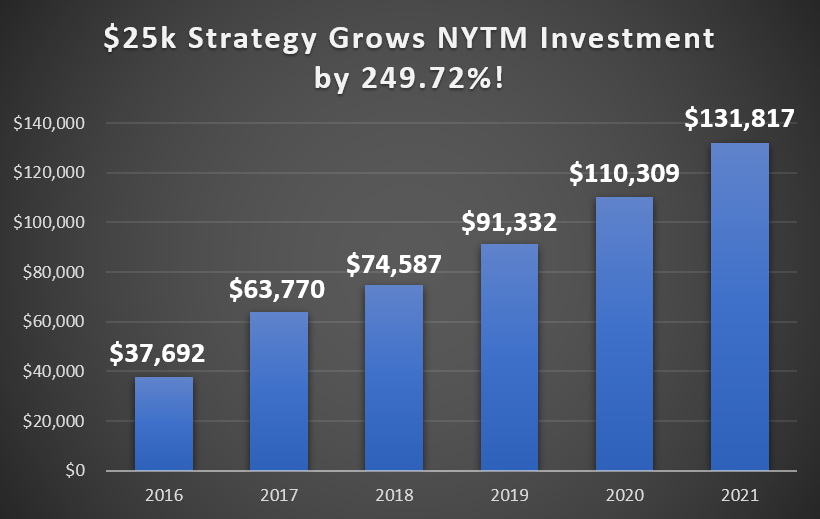

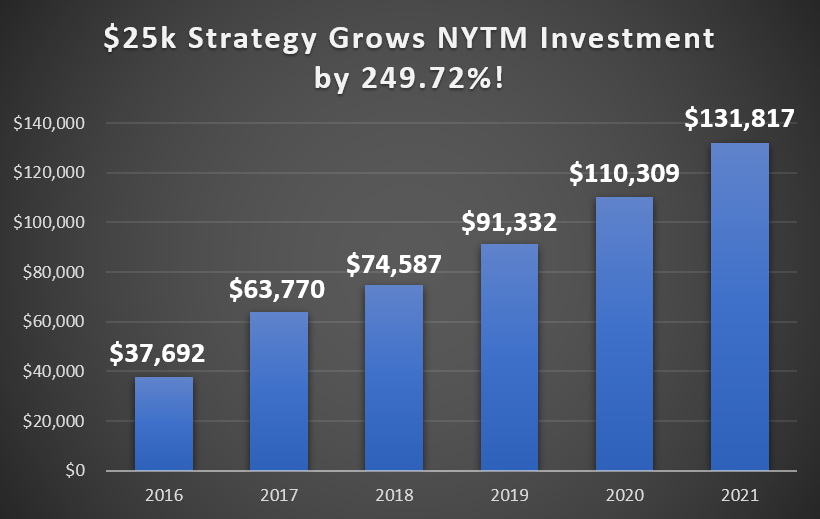

Here’s another recent example with New York Mortgage Trust. Not an exciting, high-flying stock.

Yet…

If you had started the $25k strategy in 2016, you could’ve been on the path to $15,508 in annual income.

Had you kept this process going into 2023, you’d now likely be approaching $20k/year.

And that’s starting with a $25,000 initial investment.

These aren’t outliers either.

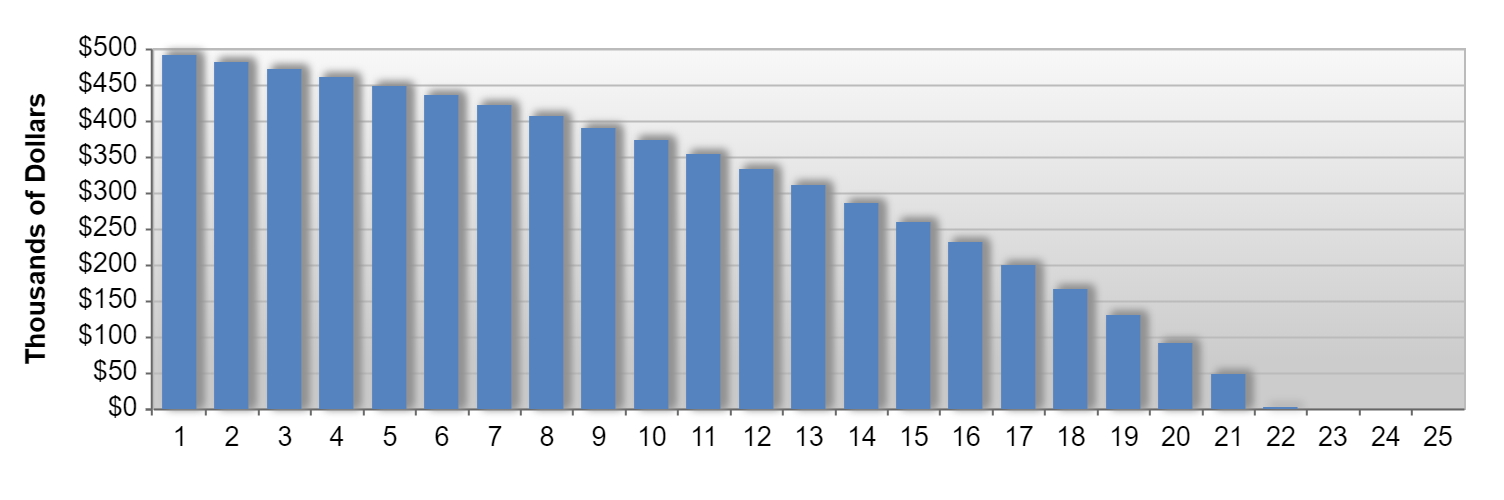

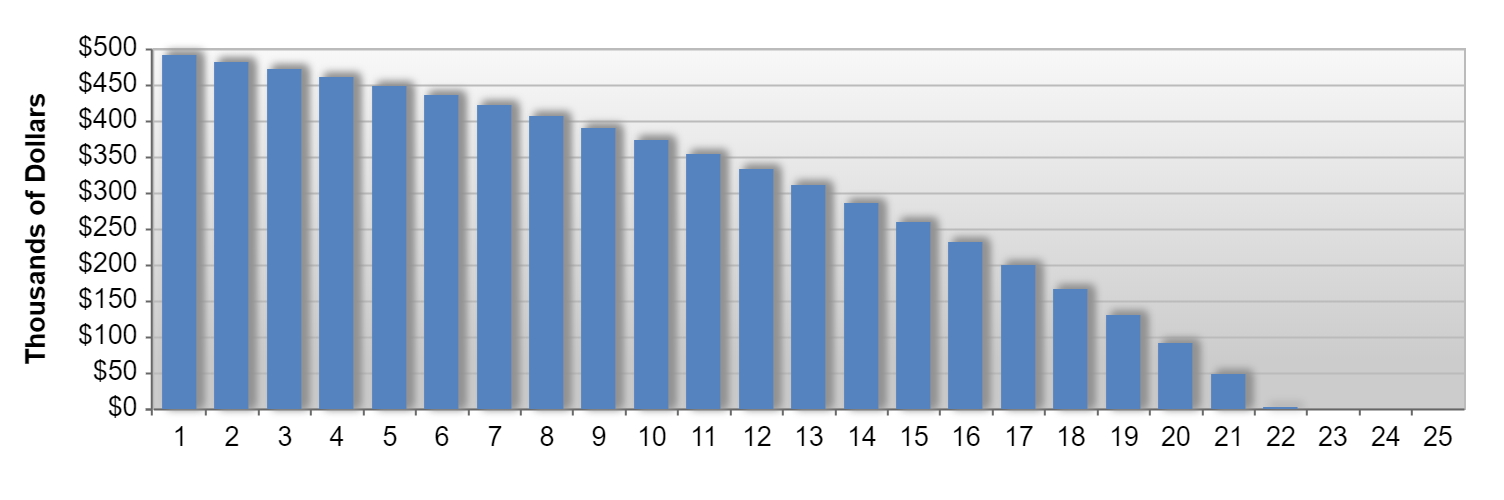

Check out all of the other opportunities that would have delivered $10,000 plus in income every year:

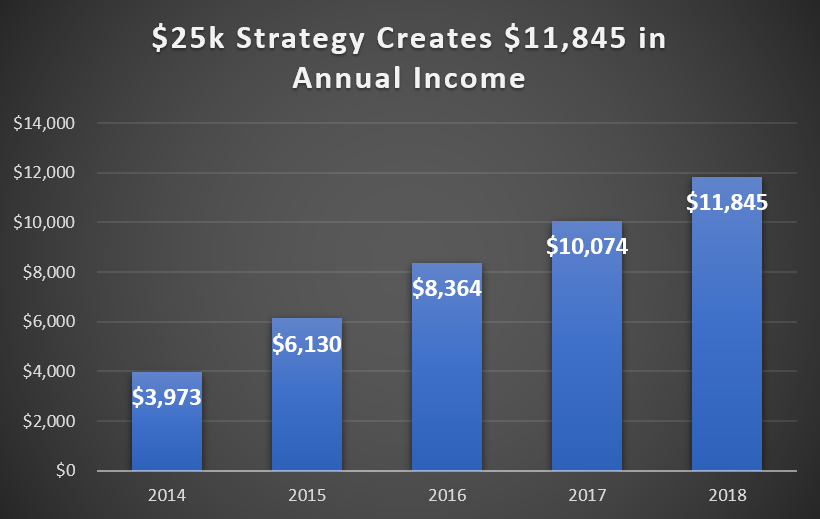

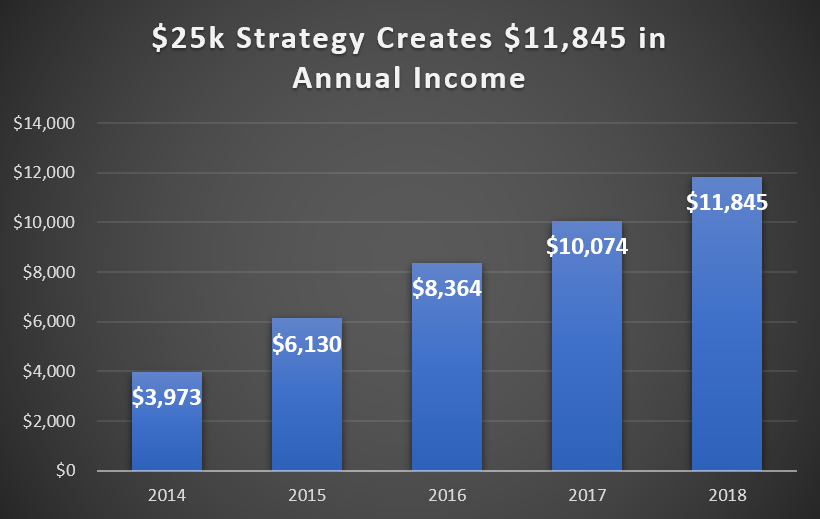

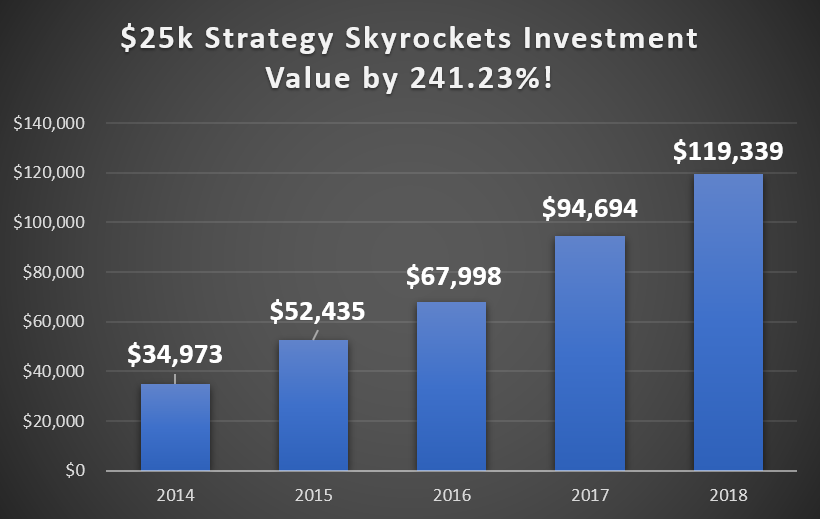

One from my own portfolio would’ve turned a beginning balance of $25,000 into an $11,845 annual income stream. I can’t share the name out of respect for my current readers.

At this rate, $15,000 per year by 2023 would’ve not been out of the question here.

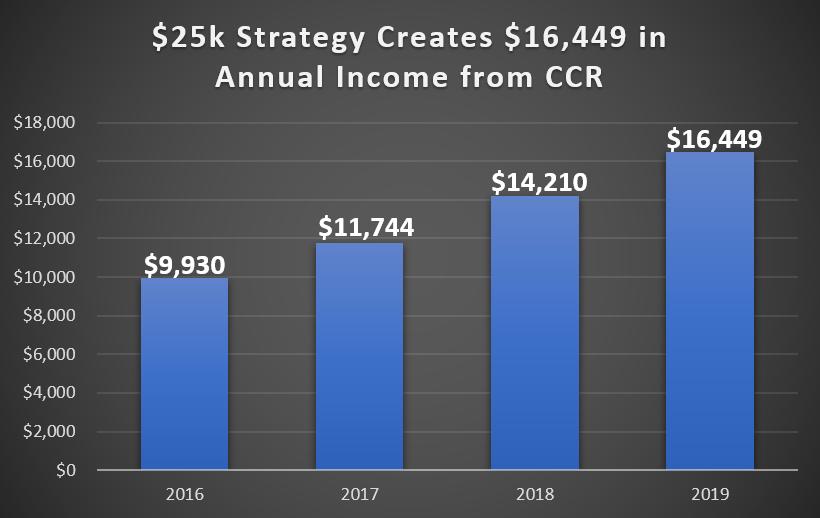

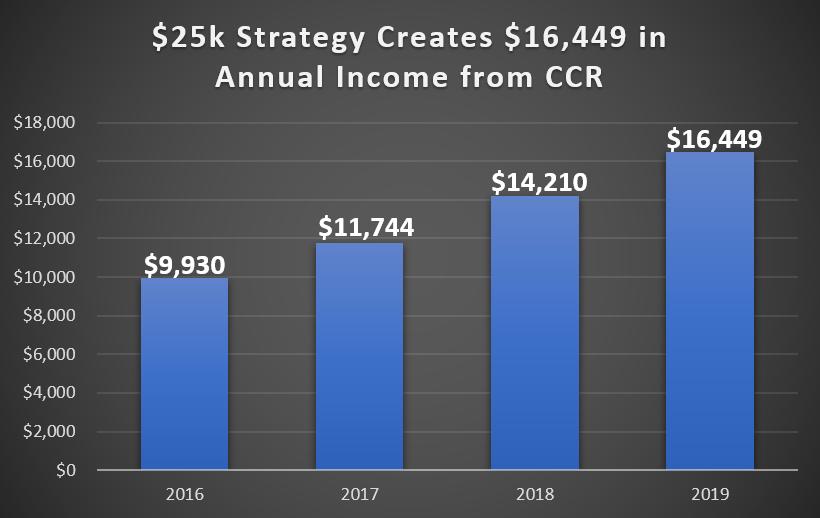

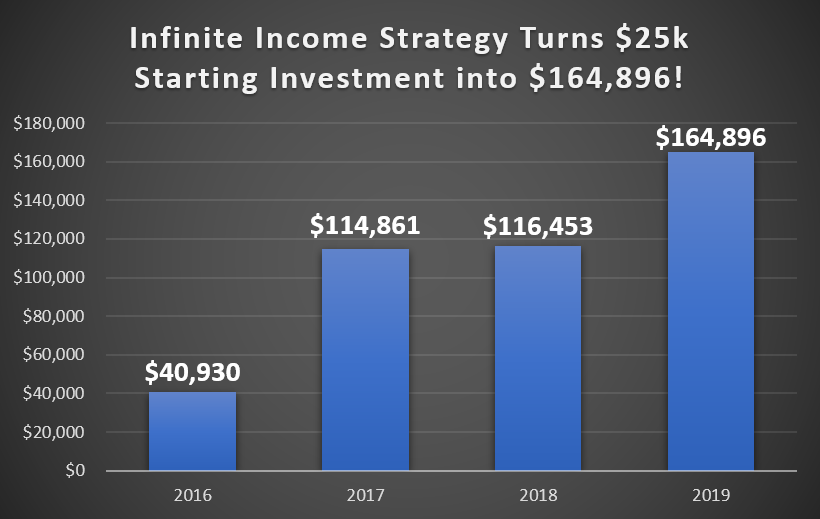

Consul Coal… a thermal coal producer… could’ve turned $25,000 into a $16,449 annual income.

By 2023? You can probably imagine $20,000 or more per year from this stock.

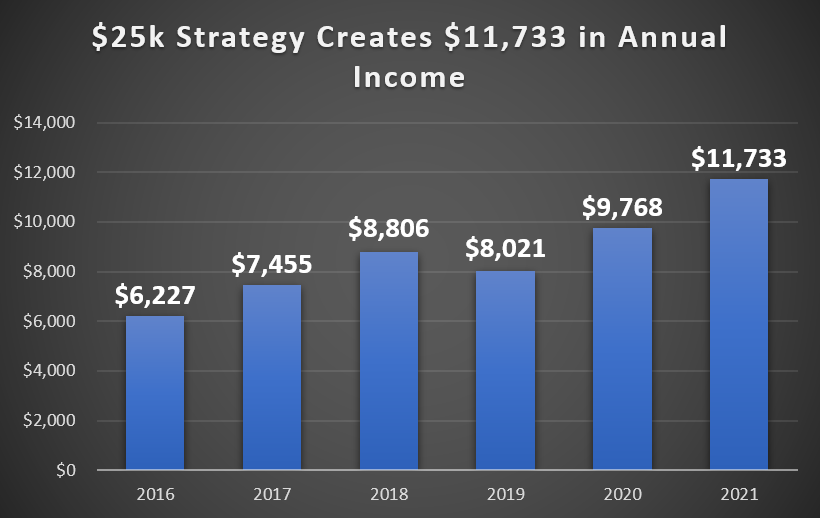

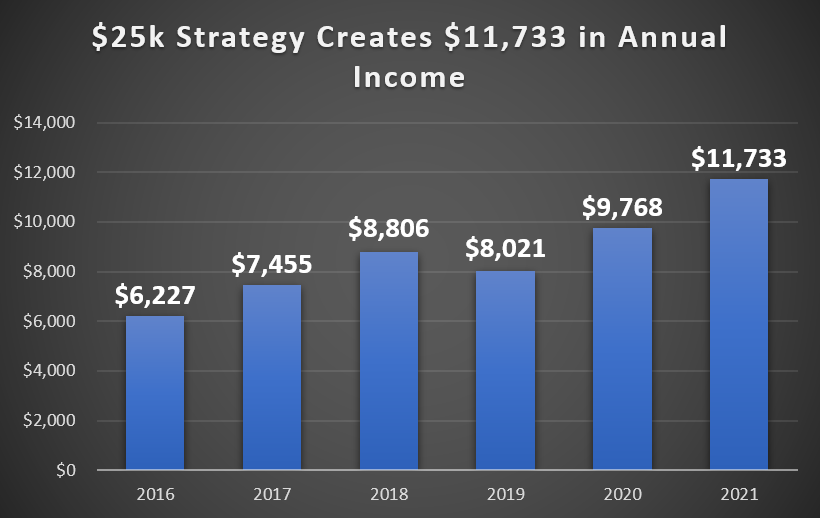

Another stock from my portfolio is on pace to turn $25,000 into an annual income of $11,733, far more if you would keep the income flowing this year and beyond.

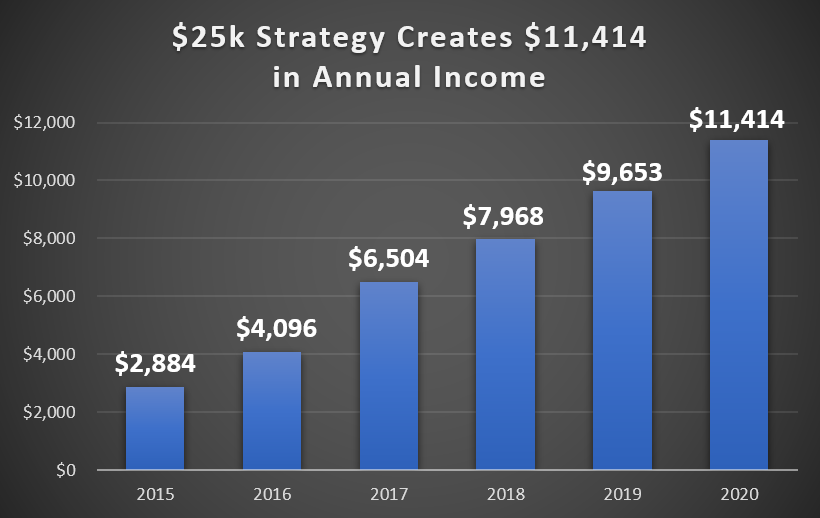

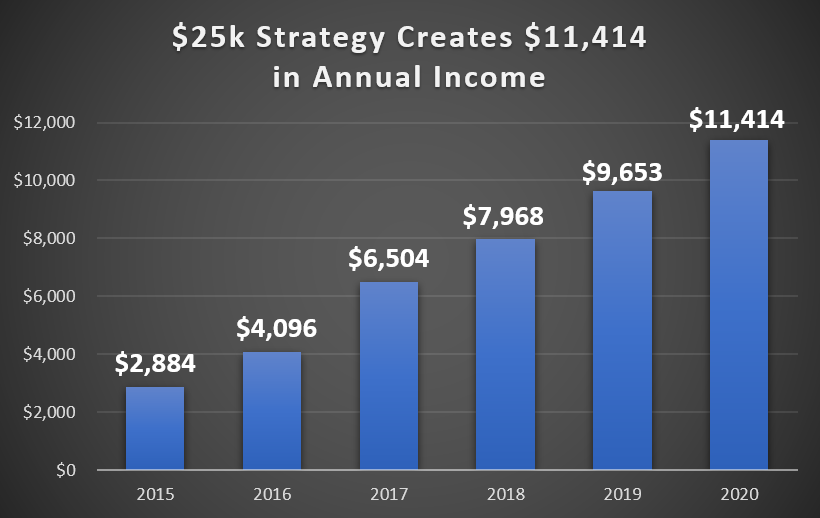

A third stock from my portfolio is on pace to turn $25,000 into an annual income of $11,414. Today you could very well be collecting $15,000 from this stock:

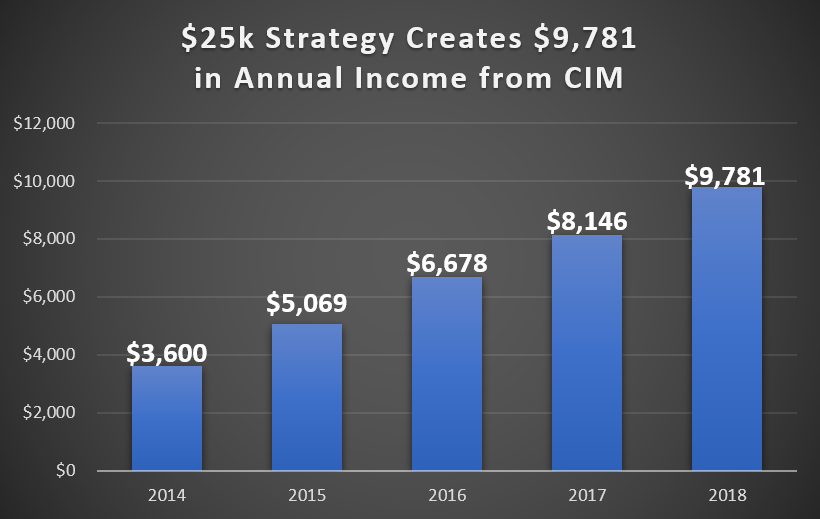

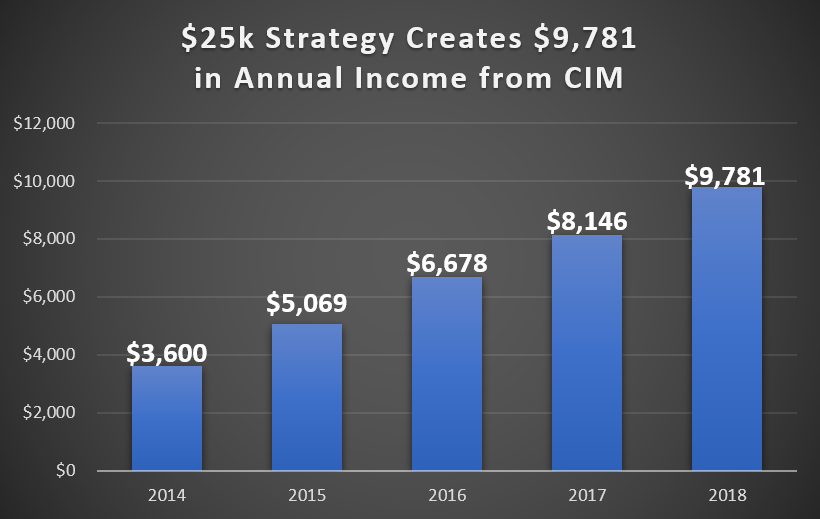

Chimera Investment Corp. would’ve turned your $25,000 into a $9,781 annual income.

A few more years of similar growth and I’d be fair to say collecting $12,000 per year would be a conservative estimate.

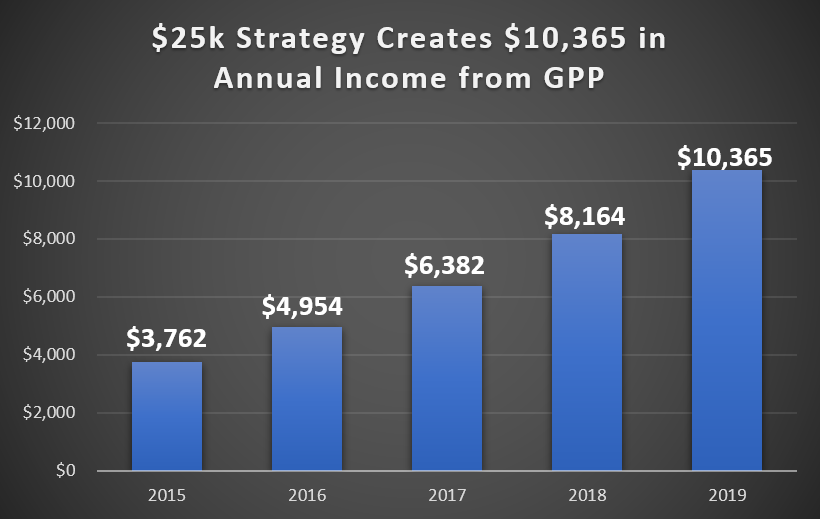

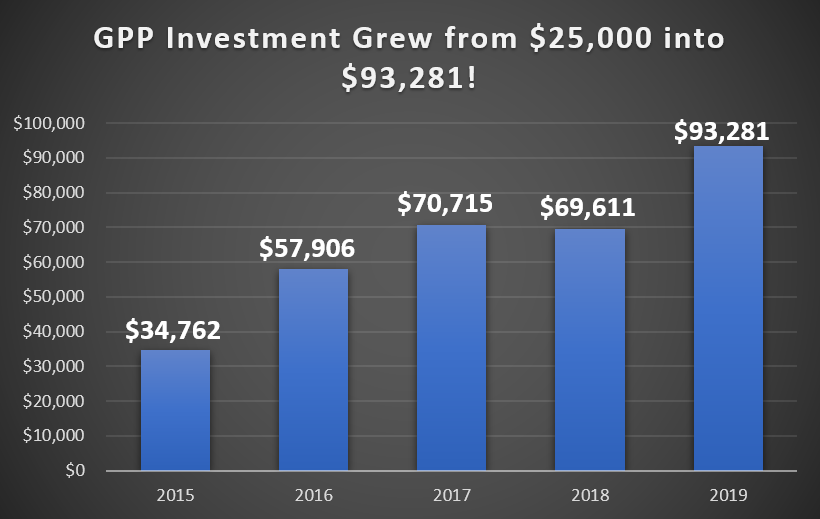

Green Plains… a renewable energy company… could’ve turned a starting amount of $25,000 into a $10,365 annual income.

And that’s if you stopped in 2019—by 2023—this could’ve been another $15k/year pick.

But, perhaps the most impressive of all…

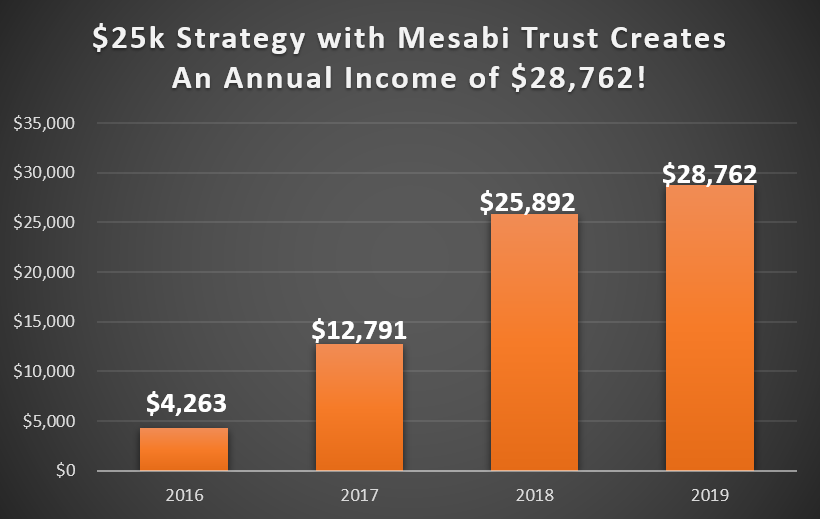

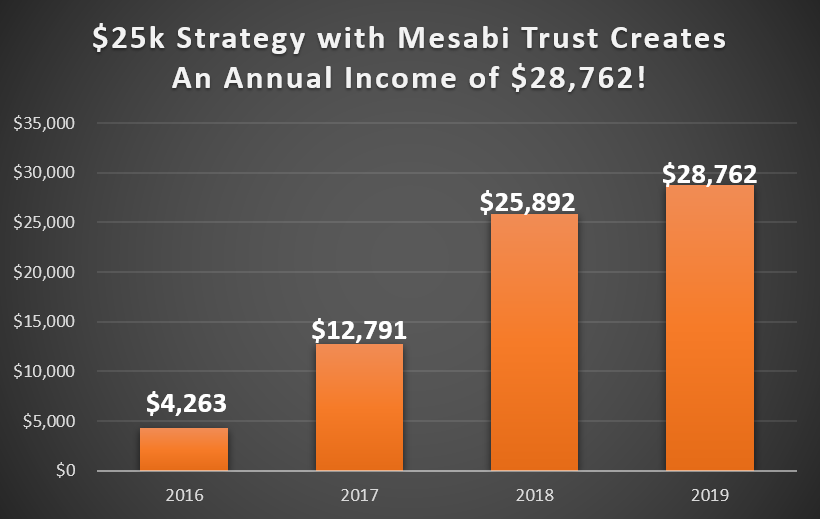

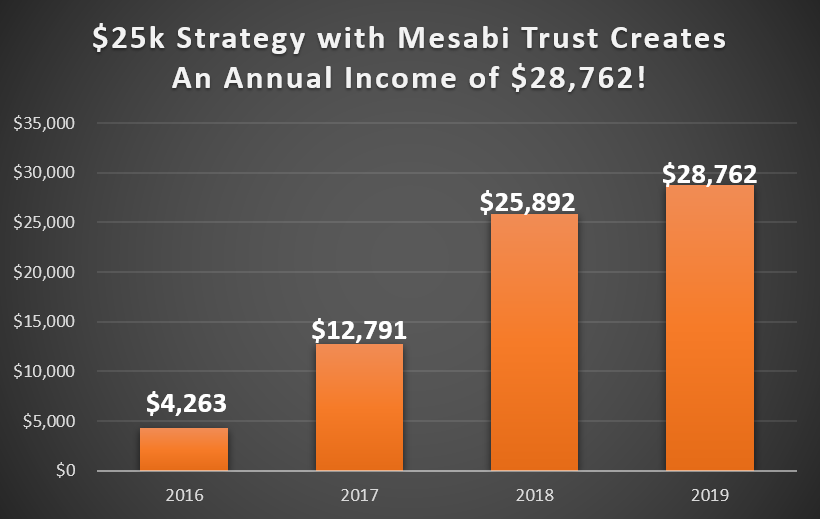

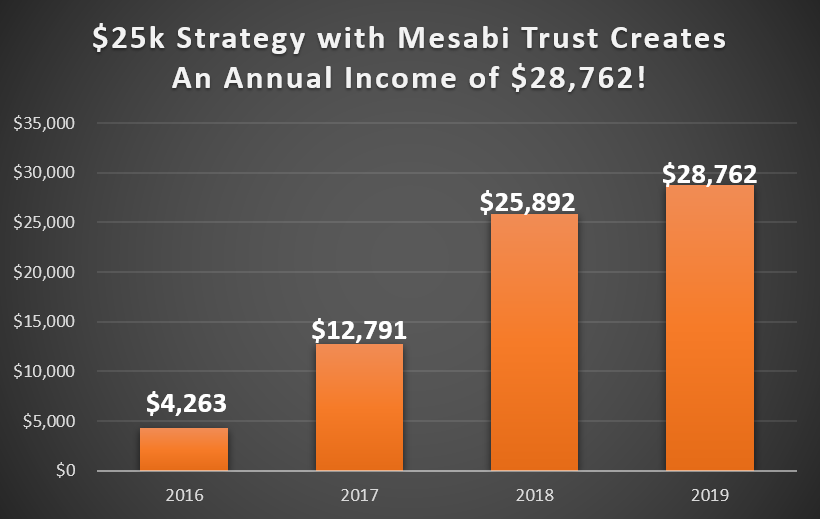

Mesabi Trust… a company that collects royalty checks from miners and distributes them to shareholders…

They could’ve turned a starting $25,000 deposit into an incredible $28,762 annual income in just 48 months.

All you had to do was start the $25k strategy in 2016.

And by 2023?

You could’ve now been collecting passive income that’s more than most full-time jobs.

Again, these are hypothetical results based on the dividends these companies have paid out over the last few years. Had you actually invested in them, your results may have been different based on timing and other factors.

And of course, there are no guarantees in investing – the future may look different than the past.

But there’s no denying the potential.

And the thing to remember is, the $25k strategy is not a one and done investment.

You can keep investing $25,000 into each new opportunity until you’re set for life.

You’ll now own multiple income streams that support your entire retirement.

Because these massive income opportunities are always available if you know where to look.

Here’s the main point, the $25k strategy will show you the fastest way to collect up to tens of thousands of dollars every single year for the rest of your life.

It’s a proven strategy that can work over and over again.

And, the longer you use the strategy, the more income you’ll receive every single month.

That’s money for a new car. College tuition for a loved one. Added donations in the Sunday basket. A major kitchen or bathroom renovation… maybe both.

All these expenses covered without tapping into the nest egg you’ve spent your entire life accumulating.

Whatever you do with the extra tens of thousands of dollars you’ll collect, just know that it keeps coming.

Because when you set up the $25k plan, the money will keep flowing.

And in the next five minutes, I’m going to show you exactly how to use this rock-solid, repeatable strategy to create an income that lasts for your entire life…

Without ever having to sell a single share of stock…

Invest in anything high risk…

Or use some complicated strategy.

I’ve decided to share this simple, proven strategy with you today because…

in American history

For years… decades even… financial ‘gurus’ have spread two lies to the American public about retirement.

#1 You can save for 40 years, then live off those savings in retirement.

#2 You have to save enough so that you don’t run out of money before you die.

We’re told there is some ‘magic number’ you need to hit in your savings before you can retire.

I remember it used to be around $250,000 or something.

But now, CNBC claims you need at least “$1,000,000” to retire well in America.

And famous money guru Suze Orman came out in 2019 saying she believes Americans need “$5,000,000” to retire comfortably.

Yes, five MILLION dollars saved. And that’s without factoring in the value of your home.

Most Americans aren’t within a hundred miles of this.

According to the Economic Policy Institute, their expert researchers estimate the average retirement account has around $95,766 in it.

For those over 60, Transamerica calculates median savings to sit around $172,000.

That’s 83% less than the “$1,000,000” magic number…

97% less than one of the most popular money experts on the planet suggests.

No wonder most Americans are sweating, trapped by the idea that they “don’t have enough to retire.”

And as of 2022, she now suggests you shouldn’t retire early unless you have $20 million or more!

I’m here to tell you it’s a bunch of LIES!

If you have $25,000 saved today, you can get started with my infinite income plan.

If you follow the typical retirement planning strategy and don’t have millions saved, your likelihood of running out of money skyrockets.

Which leads you down the path of uncertainty, stress, and anxiety.

No one likes living with a dark cloud of uncertainty over their head.

But it’s where most are heading if they do not heed the advice contained in this presentation today.

For most people, the day they retire – whether at 60, 65, 70 – will be the richest they’ll be for the rest of their life.

Why?

Because if you follow traditional retirement planning strategies, you must start selling your assets to fund your expenses…

And hope you have enough saved.

Say you have $250,000 saved. On the day you retire, your paychecks stop and Social Security begins.

So how do you replace your lost income?

The traditional way: start selling off the nest egg you’ve spent your entire life building.

Each and every month your net worth decreases as you pawn more of your investments to pay your bills…

Down and down your savings go until…

Well, let’s hope you never get there.

Traditional retirement planning today is the exact opposite of the $25k infinite income plan.

With traditional retirement planning, you’re selling assets while your savings head towards $0.

You don’t know if or when you’ll ever hit $0, but you know the direction you’re heading.

You hope – as gloomy as it sounds – that you die before you go broke.

I’ve seen this countless times. People are stressed, anxious, and uncertain.

They’re left alone to puzzle… how much do I take out each year to live on?

How much stock can I afford to sell to fund my expenses every month?

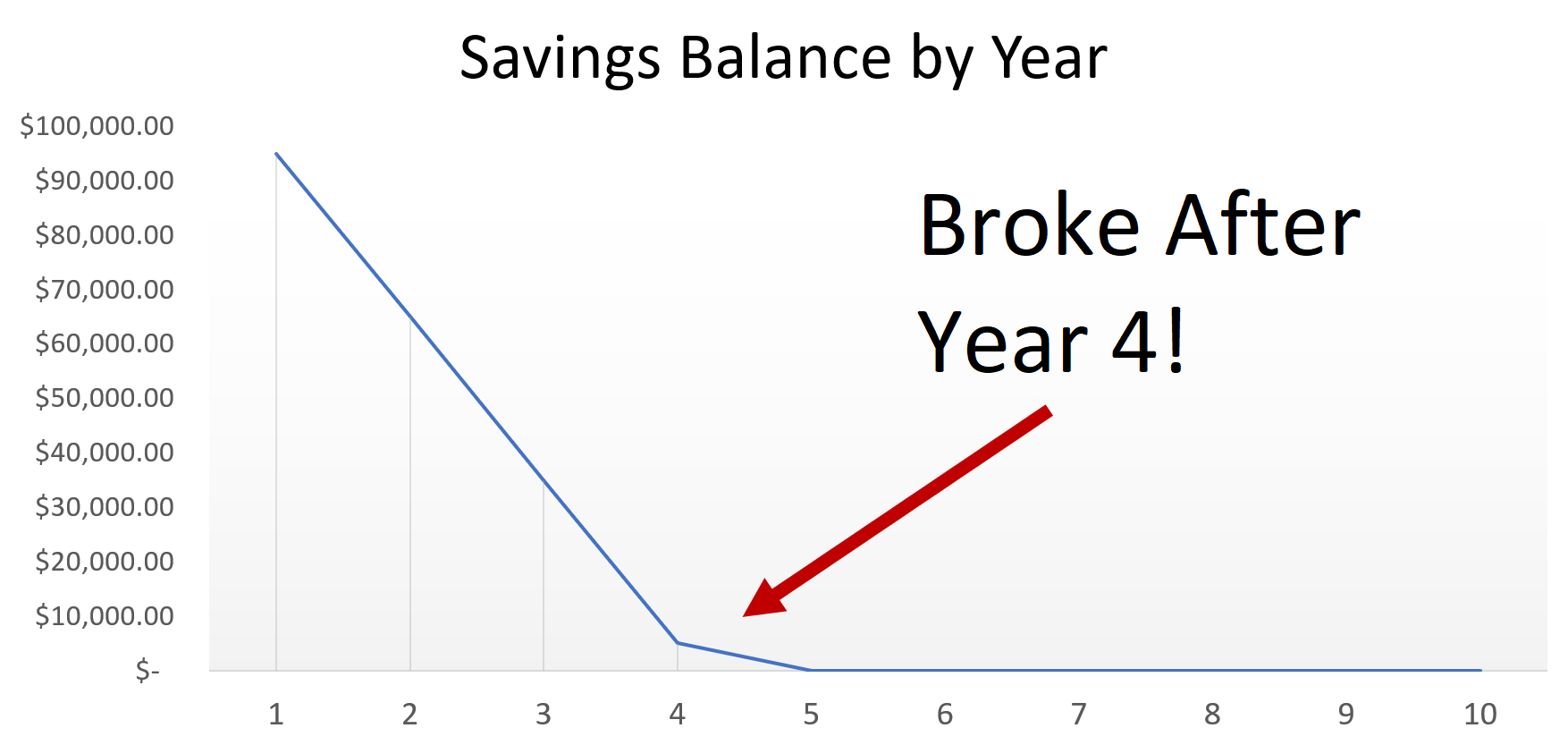

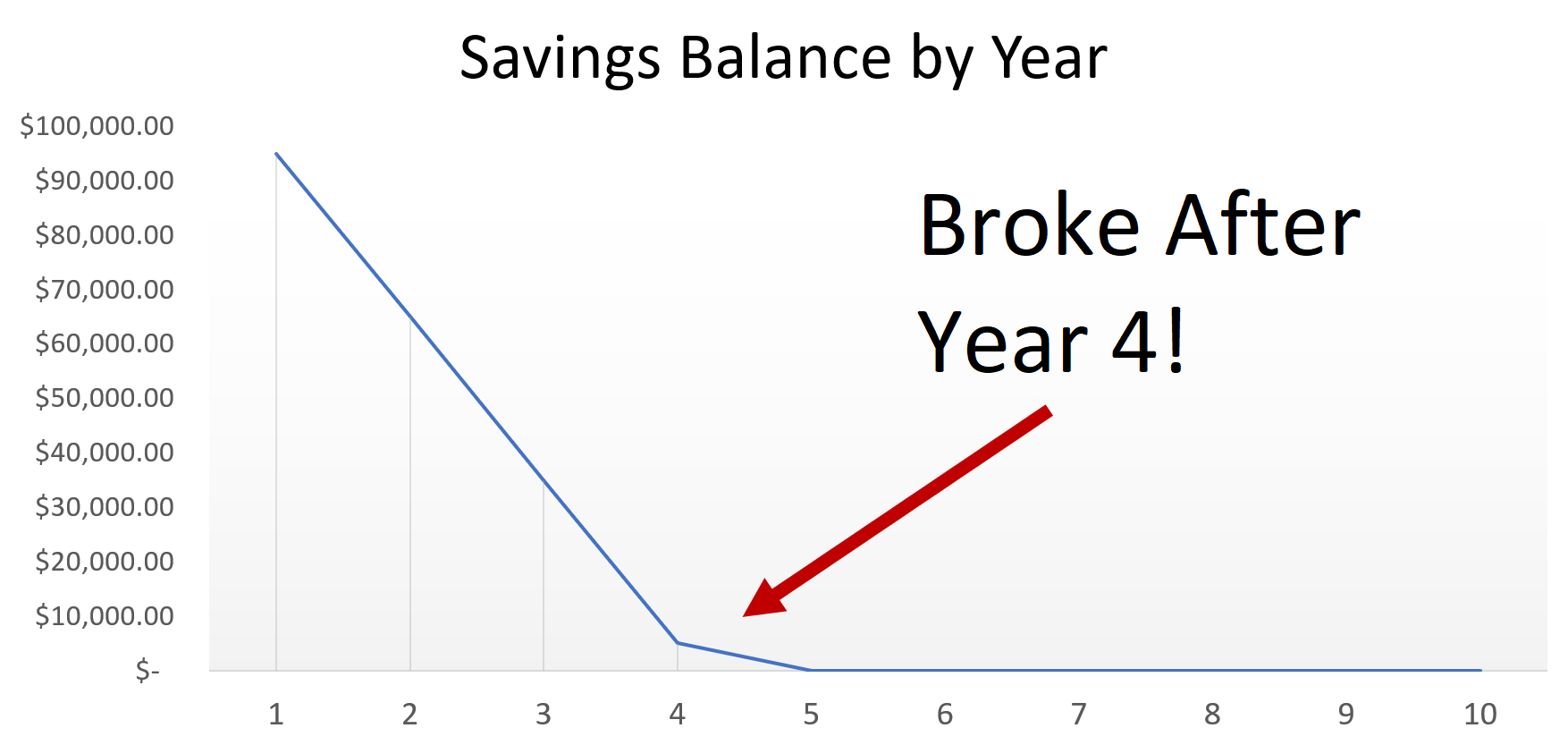

If you have a 401(k) that’s worth $100,000 and you withdraw $2,500 each month to live on, check out what happens.

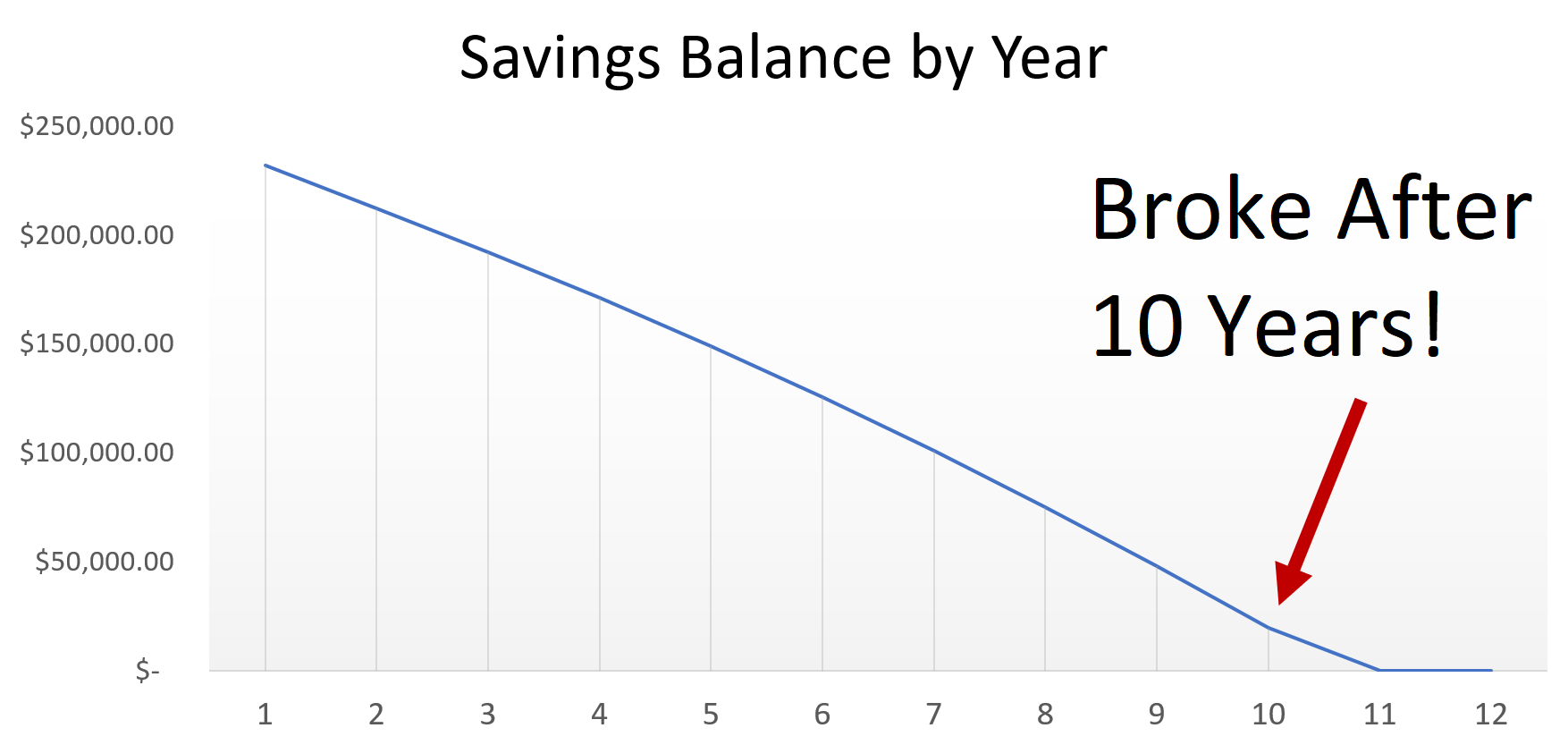

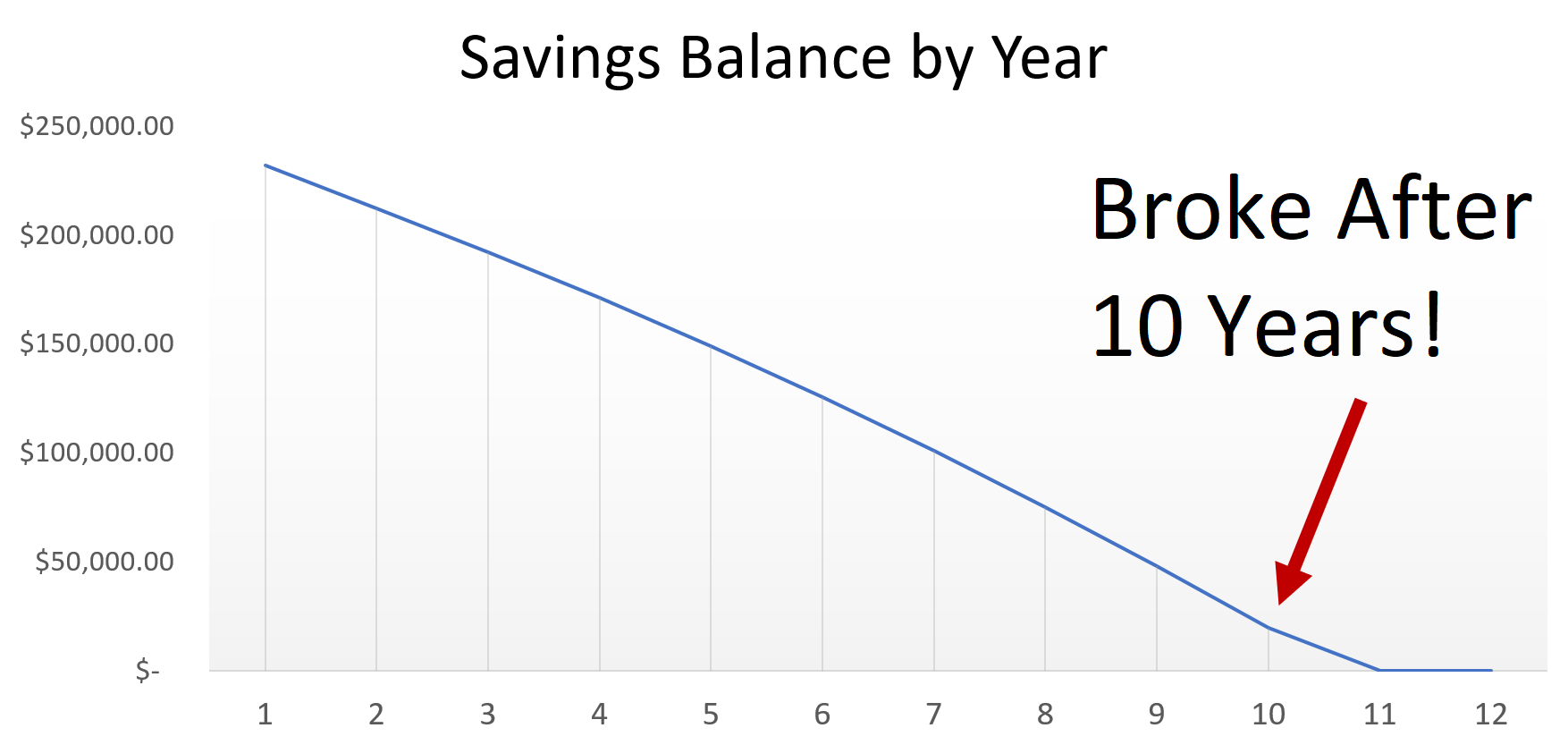

If you managed to amass a $250,000 war chest and pulled out the same $2,500 per month, here’s where you’d stand:

Even worse news…

In this scenario your portfolio makes 5% in annual returns each year.

In 2022, the S&P 500 returned 18%… so your savings would’ve declined far more that year.

It’s no wonder why the experts say you need $1 million to $20 million dollars to retire on.

If you are going to follow the traditional advice and tap into your nest egg in order to pay off your bills month after month, you need a huge nest egg to begin with.

Forget traditional retirement planning. I’ve come up with a better way.

A way where your net worth can keep growing every year…

And you will never have to sell a single share to fund your retirement.

It won’t make you millions…

But it may do something even better. You’ll have peace of mind in retirement.

Because if you knew for certain you’ll take home up to an extra $10,345… $15,508… or $16,517… in consistent annual income this year without lifting a finger, would you be worrying about running out of money?

I don’t think so.

Plus, you created that income stream with only a slice of your portfolio ($25,000).

You still have the rest of your portfolio to grow as you like.

Go ahead and keep investing in Amazon, Netflix… enjoy the profits.

You can even double down on this income strategy once you get the hang of it.

Whatever you do, the point is your portfolio can continue growing.

Your net worth keeps growing with the market because you’re not required to sell your hard earned savings to live.

After putting the $25k Infinite Income Strategy into action, you’ll discover:

- It’s the only roadmap to delivering a consistent… and growing… income that lasts for the rest of your life

- You can retire on far less than both you ever thought possible

- You have the option not to sell your shares in order to fund your lifestyle, plus

- Income will continue to flood your account no matter what’s happening in the world

Before I reveal the $25k strategy…

First, it’s important you hear my story and

I’m a dividend investor who now leads over 200,000 people on how to create multiple income streams to retire on from the stock market.

That’s not what I always did, though.

I used to be a Captain in the Air Force. I was stationed as far as Korea and was seconds from death more times than I could count during missions.

As a trained F-16 pilot, we’re taught even in near-death instances… like one mission when I careened towards the ground in the middle of a thunderstorm… that we must keep calm and focus on where you need to go.

As I meet more of my thousands of readers, I find they are not calm about their retirements.

They are panicking. They saved and saved but didn’t think it was enough…

Plus, they had no idea how to use their savings in retirement.

Some even had the $1 million dollars experts suggest and were still clueless.

That’s why I live by this simple fact…

You need income to live and the more income you receive the more peace of mind you’ll have.

That’s why I’m sharing the ‘$25k Infinite Income Strategy’ with you today.

Because I know you need it.

For decades, you worked hard to generate income to live.

And when you retire, that income stream gets replaced by Social Security. For most of us, that’s not even half of what we used to earn.

That’s why I’ll show you how to replicate your old income stream in retirement.

And once you see how simple the $25k Infinite Income strategy is to execute…

You will never have to worry about how to fund your retirement again.

You’re going to train your savings how to work for you.

You become the boss.

And you’ll never have to step foot into an office to collect a check again.

That’s why I created the $25k strategy.

Because when you use this strategy, you will collect more income, retire more comfortably, and receive more peace of mind.

And all of that without the millions of dollars “retirement experts” claim you need.

I’ve already shown you 10 ‘Infinite Income’ investments I’ve given to my readers:

And I’m sitting on a new ‘Infinite Income’ opportunity that I’d like to share with you today.

One where I’m confident you can take your initial $25,000 investment…

And turn it into a five-figure income stream you can rely on for the rest of your life.

I’m more driven than ever to share this strategy after watching what happened to my own parents.

They did exactly as they were told.

Lived, worked, and saved until they retired with a good chunk of money.

But there’s one catch. They planned on dying at the age of 75.

So their financial plan stopped there.

Today, they’re over 90 and with my help they’re making it work.

But for some the uncertainty is daunting.

Let me show you:

Let’s say you retire at 65 with a $500,000 portfolio.

And let’s say you’re earning 8% returns per year on that portfolio (the long-term average of the S&P 500 is only 7% so we’re being optimistic here).

Then you withdraw $4,000 a month to live off of… that’s just $48,000 per year.

Hardly living the dream retirement with that budget.

But let’s see what happens.

21 years later, at age 86, you have nothing. You’re out of savings.

And that’s with the very optimistic 8% annual returns we factored in.

After watching the Great Recession devastate friends and family…

And the Covid crisis, the Tech Crash, and the recent battle with inflation, cut retirement accounts in half…

And watching my own parents navigate retirement using their own savings…

I felt compelled to use my knowledge as a former CFP and stock broker to begin searching for answers…

And after countless hours of research, I discovered the perfect investment…

One that could produce sky-high income month after month, year after year.

These assets throw off truckloads of income…

And, when utilized correctly, can turn a relatively small amount of retirement savings… $25,000… into a cash flow machine that lasts forever.

After realizing the potential, I began showing a small group of people my findings.

Those who followed my advice are very pleased with the results:

“Tim is the best investment advisor I’ve seen for the novice investor. He always has good advice and really bailed us out during the COVID crash. Keep up the good work.”

-Don H.

“Since joining you in late 2016, we have done well with your recommendations. With this much extra income, life is good. (We are leaving on a 10-day Caribbean cruise today!)”

-Mel G.

“I cannot remember just how I became acquainted with [you], but I am truly thankful. The dividend payouts are like clockwork. Set and forget… Consider me hooked!”

-Alan F.

My readers are enjoying this new income stream…

… without drawing down their nest egg…

… without investing in risky stocks… and,

… without having to day-trade or time the market.

Think of it with this analogy.

Traditional retirement experts see your nest egg as a giant forest of trees.

One that you’ve been growing and tending for your entire life.

Then, when you retire, everything changes.

You’re no longer planting and growing trees (saving and investing your income).

You’re now asked to cut down the same beautiful, strong trees you’ve spent your entire life growing (selling your investments to pay for your expenses).

It’s a dangerous trap.

Because at some point, you’ll pull the last tree up by its roots.

And what you’ve spent an entire lifetime saving for could be gone in as little as 10 years… 20 years… 30 years… hopefully never.

And you’re left wondering “How much do you withdraw?”

Followed by wondering “Am I withdrawing too much?”

If these are the thoughts lingering in your head…

You’re not alone.

That’s why I ask you to look at your nest egg in a different way.

Your nest egg is not something to cut down and spend.

Rather, turn your ‘forest’ into an apple orchard.

When you pick the apples, you don’t have to cut down the tree to enjoy its benefits. The apples grow back every season!

On top of that, it’s even possible to replant the apple seeds to produce more apple trees.

No trees are chopped down…

You actually grow your ‘portfolio’ of trees rather than cut them all down.

Everything ‘experts’ tell you is based on depleting your savings.

Instead, the ‘$25k Infinite Income Strategy’ turns your savings into an ever-growing stream of income.

Maybe $16,517 each year…

Or even $28,762 per year…

And keep in mind, these are historical examples—if you continued collecting income from these stocks until today, you’d likely be enjoying even more income.

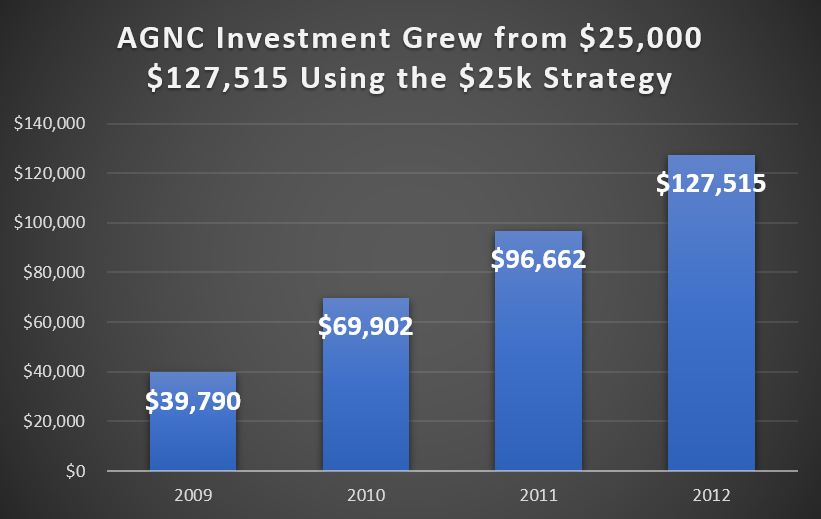

That doesn’t mean the $25k strategy won’t increase your wealth.

Like I said, the strategy is specifically designed to grow your ‘portfolio of trees’ every year.

Here’s what I mean.

And this is something I didn’t share with you earlier.

See, I already showed you 10 opportunities that could’ve turned $25k into tens of thousands of annual income…

But what I didn’t share is that these opportunities grew your wealth at the same time.

Let me show you.

Using the same hypothetical as before, AGNC Investment Corp. could have turned $25,000 into an annual income of up to $16,517… and also ballooned in value from $25,000 to $127,515.

Today, after 11 more years of investment, I’ll keep things ultra-conservative and just state that you’d likely be sitting on far more than this amount.

Dorchester Minerals could have turned $25,000 into a $10,345 annual income… and grown in value from $25,000 to $98,721.

Again, just think how much more this would be worth today.

New York Mortgage Trust could have sent you $15,508 in annual income while also turned $25,000 into $131,817.

From 2021 to 2023 you’d likely tack-on even more bonus wealth.

Meaning, your wealth, nest egg, savings, whatever you’d like to call it…

Isn’t peaking. It’s growing. And it’s growing quickly.

And you started with only a $25,000 slice of your portfolio.

My previous recommendation that turned $25,000 into an $11,845 annual income could’ve also turned your $25,000 investment into a $119,339 war chest.

Even more in 2023:

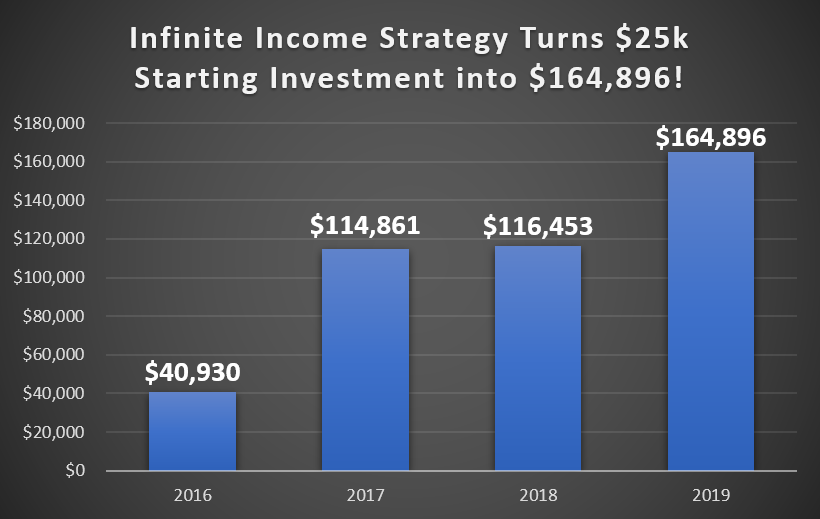

Consul Coal could’ve turned your $25,000 initial investment into a $16,449 annual income… while also turning your $25,000 into a $164,896 balance.

Continue collecting into 2023, and I’d be shocked if it wasn’t over $200,000.

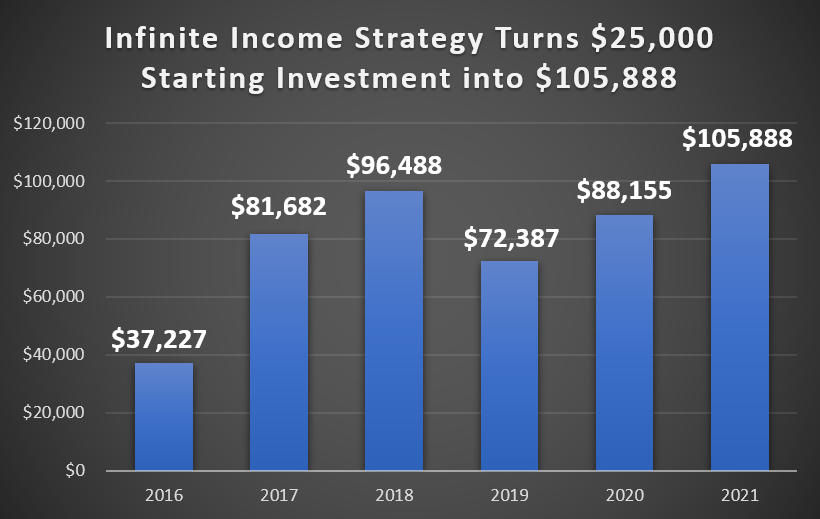

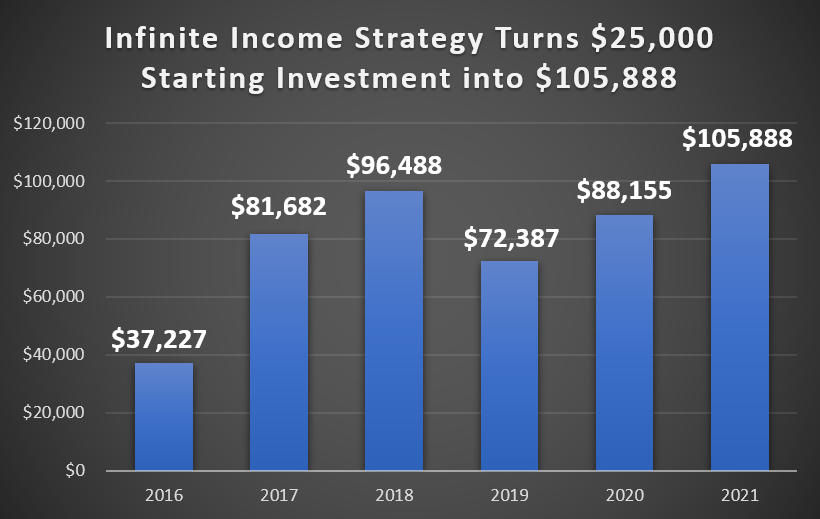

Another previous recommendation to my readers is on the path to generating $11,733 in annual income… and could be worth $105,888 and I believe a $150,000 value today would not be out of the question…

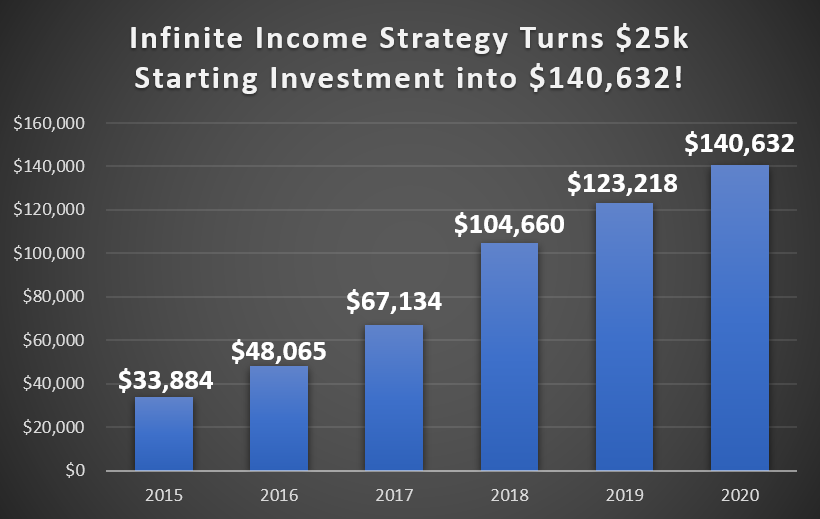

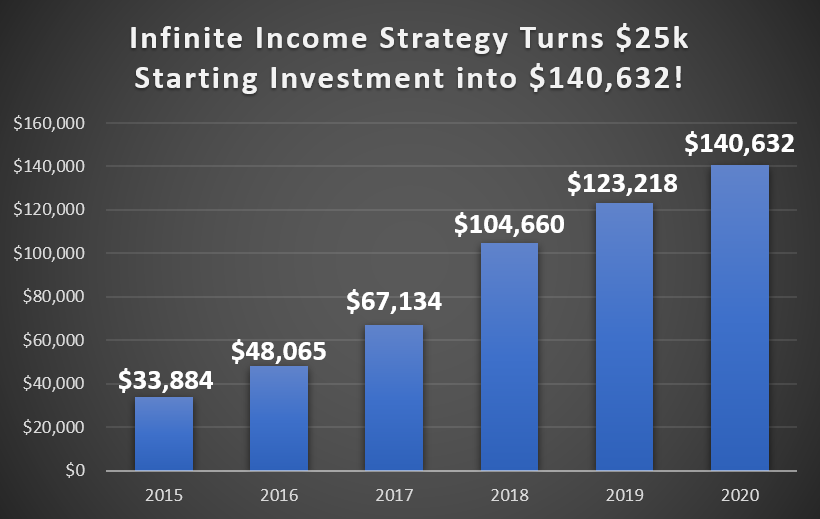

The last of my private recommendations to my readers could crank out $11,414 in annual income… while at the same time growing all the way up to $140,632 in value.

There’s a good chance you’d be approaching $170,000 now:

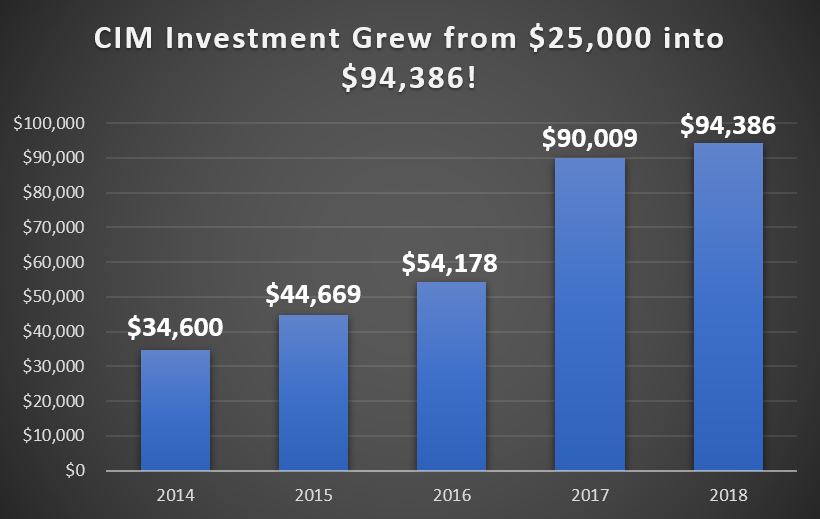

Chimera Investment Corp. could’ve turned your $25,000 into a $9,781 annual income, and also your investment would be worth $94,386—likely well beyond 6-figures today.

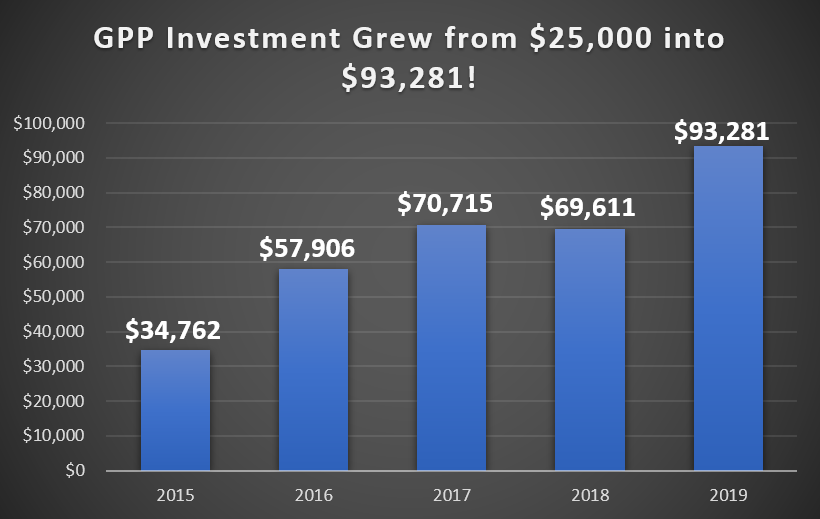

Green Plains could’ve turned a starting amount of $25,000 into a $10,365 annual income. Plus, your investment could be valued at $93,280.

Again, it would likely be well beyond 6-figures today if this same scenario continued:

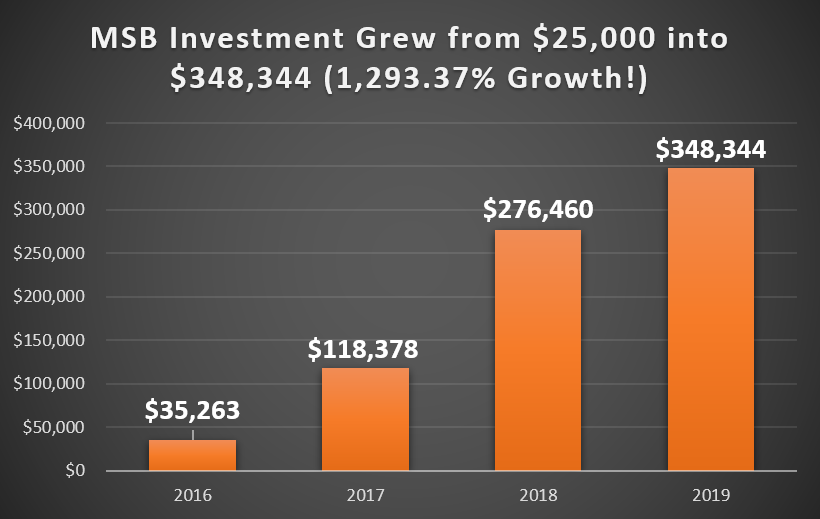

Mesabi Trust takes the cake, though.

After implementing the $25k Infinite Income Strategy, you could’ve enjoyed a $28,762 annual income stream…

Meanwhile, your portfolio could have ballooned from $25,000 to an incredible $348,344.

That’s pretty remarkable—more so when you imagine what it would be worth in 2023, a potential sum so large that it could’ve changed generations of wealth for your family.

Even while you’re withdrawing the income… your ‘apple orchard’ continues to flourish.

Again, these are hypothetical results based on the dividends these stocks paid and their share-price growth. Anyone who actually invested in these companies may have gotten different results due to timing and so on. And of course, there’s no guarantee future results will match these ones.

But you can see the power of my ‘Infinite Income’ plan. The $25k strategy makes sure our money lasts forever so you never have to draw down your nest egg.

You can receiving this strategy in its entirety today.

To follow it, there’s just a few easy success tips you must know before you start.

$25k Infinite Income Strategy Success Tip #1:

The plan relies on you investing in high-income dividend stocks that produce healthy cash flow. There are around 800 high-income dividend companies trading in the U.S. today.

However, NOT all of them are created equal.

The right stock for your $25k Infinite Income Strategy has a high positive cash flow and no danger of cutting their payout.

We want high yields. We don’t want well-known, low-yield stocks like Apple or even a low-yield index fund like the SPY.

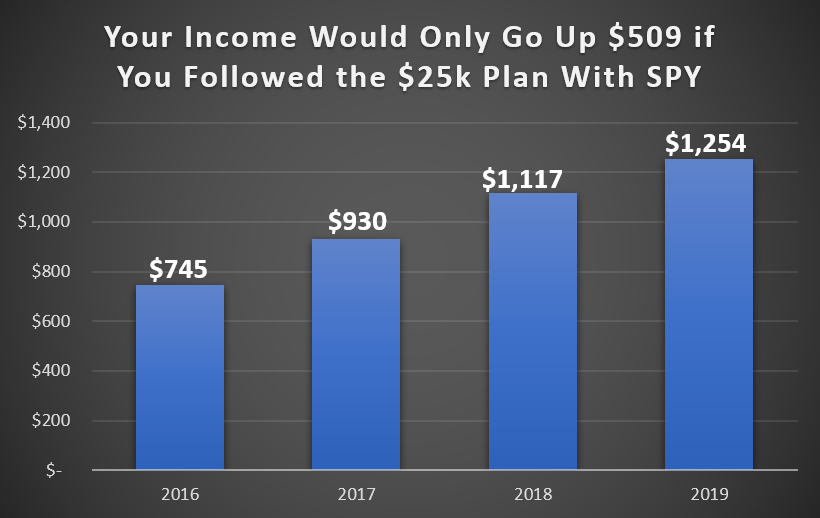

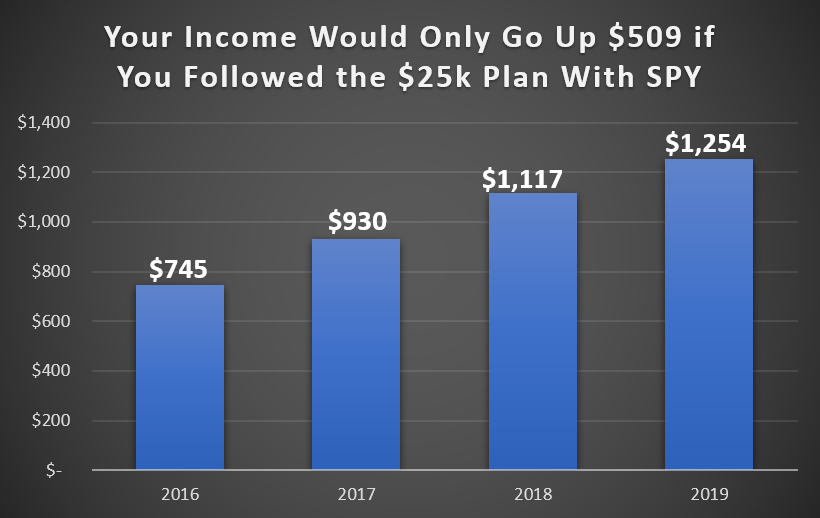

Check out what could have happened, based on backtested results, had you followed the $25k Infinite Income Strategy with just the SPY index fund from 2016 through 2019:

Even following the $25k Income Plan step-by-step, your $25,000 would yield only around $1,254 in annual income after 48 months.

Your investment would grow from $25,000 to just $66,387.

Compare that to Mesabi Trust instead of SPY, over the same timeframe. In a few years, you could’ve generated $28,762 in annual income… plus, turned $25,000 into an amazing $348,344.

Both stocks went through the bull market of 2017 and the panics in 2018.

Yet, Mesabi generated 2,194% more income than the popular Wall Street favorite, SPY.

And your Masabi investment could have ended up being worth 424% more money.

You can imagine a similar scenario playing out in more recent years, especially after a year like 2022—both stocks went down, but Mesabi still yields a whopping 23%!

That’s the power of finding the right high-income dividend play.

Still, this step requires a lot of time and research.

Don’t worry, in a minute, I’ll show you how to automate your research so you never have to read a company’s annual report.

$25k Infinite Income Strategy Success Tip #2:

A surefire way retirees kill their nest egg is buying high and selling low.

For high-income stocks, we would rather buy when stocks go on sale and hold until they show us their income payouts could drop.

You’re not trying to time the market.

However, the better price you get for your shares, the more shares you can purchase with your $25,000, and the more income you make.

In one moment, I’ll show you an opportunity that’s trading for just $30 and you’ll be able to pick up thousands of shares today.

$25k Infinite Income Strategy Success Tip #3:

Invest in dividend stocks that have a history of increasing their payouts. If their cash flow is going up and their monthly to quarterly payouts are increasing, that’s a positive sign.

Increasing payouts means your shares will produce more income next year than they did this year.

It’s like getting a huge raise each year while doing nothing.

Follow these three steps and you’re set to start the $25k Infinite Income Strategy.

Now all you have to do is locate your first investment start your plan with.

You could do that yourself, or I’ve gone ahead and done the work for you.

I’ve searched through the entire database of 800 or so high-income stocks to locate your…

This company has the firepower to generate tens of thousands of dollars a year for the rest of your life.

And at the moment you can pick up shares dirt cheap.

It’s less then $40 a share… which means $25,000 goes a long way.

See this is a special company that pays out monthly checks to their shareholders.

Not only that:

- The monthly dividend has increased over eleven times, from $0.165 per share to the current $0.23. That works out to total growth of 33%.

- An investment in its shares on July 1, 2014, has produced an over 81.46% total return. With dividend reinvestment, the total jumps to 112.06%. That works out to a 9.56% average annual compounding return. Dividends accounted for 82% of the total return.

- The share price still sits 15% below its pre-pandemic high. As the economy continues to recover, so will the stock price

This is a stock I tell everyone to buy ASAP while it’s cheap.

With all that said…

I fully expect my #1 opportunity to produce enough income for you to generate a never-ending stream of cash.

In fact, this is how I predict in playing out for you.

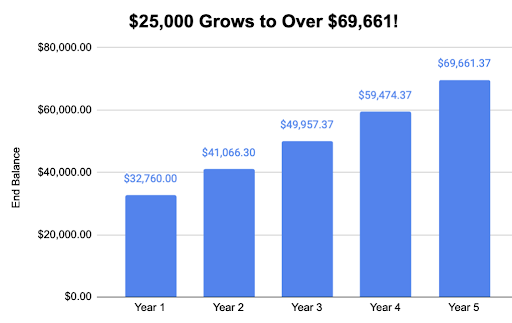

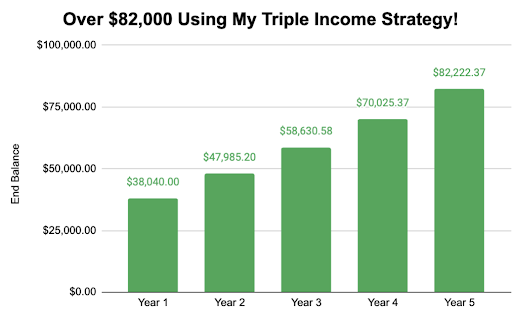

Remember, this is starting with just $25,000…

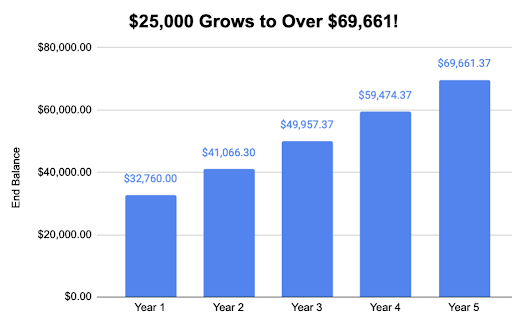

After 60 months, this is what I believe could happen:

You could enjoy a $4,187 annual income…

Plus, your investment could be worth $69,661

That’s without investing a life changing sum.

Without buying and selling stocks all day…

Without stressing about the markets…

Without worrying you’ll run out of money.

This play can turn your forest into an apple orchard in the next 10 minutes.

You can find the ticker symbol inside my newest report:

- The #1 opportunity that could create up to $4,187 in annual income

But, I’ll also provide a full, detailed write-up on the $25k strategy, including:

- How to trade commission-free throughout the entire $25k strategy.

- The 10-minute road-map to automate the plan so you never have to touch it again, just spend the income

- The ‘pouring fuel on the the fire’ strategy that ratchets up your income faster and cuts your timeline down by 48 months. Ever number I showed today includes this ‘fueling’ piece.

- How to keep the $25k strategy working even if the market crashes or there’s a shakeup in Washington

You’ll receive a full, step-by-step write-up of the $25k strategy inside.

As a bonus, I’ll even include two more opportunities to include for multiple “$25k” income streams.

I already showed you the power of having multiple $25k investments going at the same time if you have the capital.

I’ll include inside your special copy of The #1 Strategy to Turn $25k into an Income for Life these three plays as added bonuses:

- BONUS $25K PLAY #1: This first company is special. It focuses on making large loans with specialized terms. This gives them a competitive advantage over banks and smaller commercial finance REITs Since I first recommended this company, they’ve increased their payouts multiple times. I expect many more coming in the future.

- BONUS $25K PLAY #2: This company has consistently yielded 10-12% for years, and that’s because this company is involved in one of America’s pride and joys… the homeownership space. This company gets monthly payouts from anyone with a mortgage on their home – which is around 70% of homes in America and worth $10 trillion dollars. When interest rates climb back up again, expect payouts to you to absolutely skyrocket.

You’re getting not one… but three of my top plays free right now to start your $25k strategy.

And this couldn’t come at a better time.

Right now, the media’s bombarded you with bad information about what you need to retire.

Suze Orman says “$5 million” is the magic number to retire comfortably. CNBC recommends “1 million.”

I’m here to tell you they are dead wrong. That’s a lie. A lie built on bad strategies.

Because if you invest in the right assets that produce great income…

It’s absolutely possible to create a never-ending stream of income starting with only $25,000.

Your report is available today, but there’s more to see.

In addition to your special report, you’ll also receive two more bonuses right now.

The first is called…

You’ll discover how to add thousands of dollars in extra income without buying another share of stock.

Instead, I can show you how to collect ‘rental income’ on the assets we already own. Much like renting out your house.

I’ve used this incredible strategy dozens of times the past few years to add even more income into my accounts.

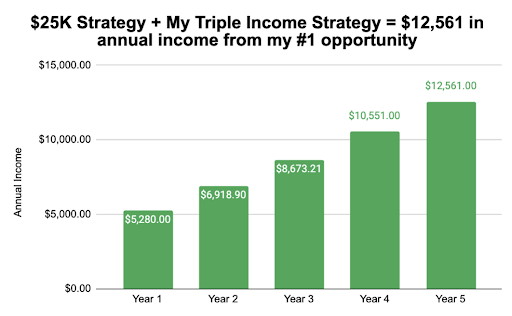

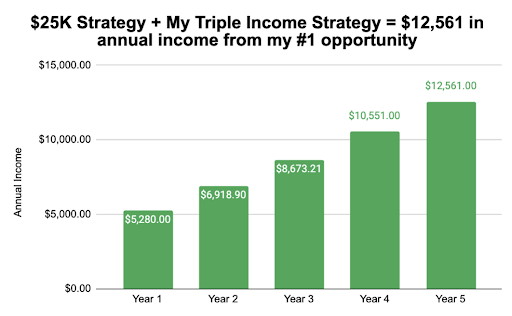

In fact, here’s what it would like if you used this strategy with the $25k Plan.

You could hypothetically go from a $4,187 annual income with my #1 opportunity…

To almost 5X-ing your income with this one strategy to $12,561 income per year.

That’s with reinvesting all your income like we do with the $25k plan. Actual results may end up being different because of timing and so on. In this instance, with how much you could make, I’d recommend withdrawing some or diversifying.

But if you stuck with it…

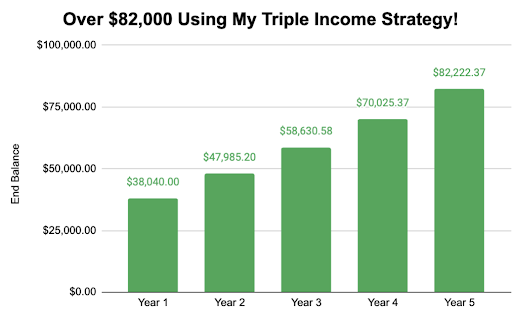

Your portfolio with reinvestment could hypothetically go from a potential $69,661…

To as much as $82,222.37

Think of it as a way to magnify your income instantly.

Again, the numbers will never be exactly how these charts read. This is just our prediction based on data. Share prices change every day. Dividends may be slower or faster to grow. The key point is to stick to the plan, and you’ll be in position to make tens of thousands of dollars for life.

Either way, the strategy inside How to Triple Your Income in 10 Minutes only takes 10 minutes to do, and simple to follow.

I’ll show you the complete strategy inside the report.

These two reports,

- The #1 Strategy to Turn $25k into an Income for Life

- How to Triple Your Income in 10 Minutes

Are valued at $197.

We’ve talked a lot about having a ‘stress-free’ retirement today. For most I know that means having the confidence you’ll never run out of money.

And part of being stress-free is having someone in your corner helping you at all times. An expert who can guide you through this transition.

That’s why I’m inviting you to enjoy these three bonuses and much more inside my most popular flagship newsletter, The Dividend Hunter.

To Make the $25k Strategy a Cinch to Follow

Several of the opportunities I’ve talked about today were from The Dividend Hunter portfolio.

On top of that… not only do you receive strategies like the $25k method you discovered today…

But you also receive in-depth monthly updates on the companies. These updates are critical to keep you on track to hit your dream annual income number.

My goal is for you to create as much income as possible…

Plus, to guide and lead you by doing all of the heavy lifting on a topic you’re likely not an expert in.

I’ve been doing this for almost 30 years now. I know exactly what to look for in high-income dividend stocks.

I reinvest a lot of my dividends so I can rapidly grow my income.

Doing this has helped me enjoy my life so much more.

Today, I travel with my wife anywhere we want on short notice.

We frequent our favorite dining spots where they know us well.

We enjoy our life. It’s relaxed and adventurous.

Not to mention, we only… and I mean only… do what we choose to do.

Instead of you first learning how to find the right information (there’s more bad info out there than ever), filtering through the junk, and then actually making the decision on what to do, you can now outsource all of that work to me, an income investing expert.

When I was in the Air Force, we always had more experienced pilots training us on how to improve after each mission.

Those leaders helped me learn faster in less time.

Today, I now lead over 200,000 investors like yourself how to create an income stream from the best dividend stocks around.

When you do, here’s what you get with your subscription:

- Access to 30+ dividend opportunities in addition to my #1 $25k play: It’s a complete portfolio with both high-income plays, conservative, and fixed income opportunities. You won’t have to tailor your portfolio alone, because you also get

- 12 Monthly Issues of my popular Dividend Hunter: In each publication, I discuss our portfolio stocks, economic outlooks, and new opportunities I see coming. (You also get access to over 39 months of past issues).

For those looking for just a few dividend plays, I’ve recently built my:

- Dividend Hunter Start-up Portfolio: These are the ‘must own’ portfolio picks. I recommend 5 to get your feet wet in collecting regular checks. My top income play is one of the plays to invest in immediately.

- BONUS #1 Stock of the Week recommendations. Every Tuesday I’ll send you an update on the current ‘best buys’ in the portfolio so you’ll know where to put any new or additional investment funds so you can rein in even more cash.

- BONUS #2: How to get the most out of your Dividend Hunter subscription. This 75 minute presentation gives you step-by-step details on how to best utilize your subscription, plus answer your most pressing questions on the service.

Get started right now and claim your three bonuses by clicking the button below.

When you do, you’ll be taken to a secure page to complete enrollment in your subscription.

After that, you’ll receive an automatic email with your login credentials to my private site to access The Dividend Hunter.

When you do, you’ll join thousands already happy with my service:

“I am glad to have found The Dividend Hunter and all your weekly updates. I eagerly await all your updates and thank you for improving my income stream with all your great ideas.”

-Ronald P.

“I am a satisfied customer of yours, having finally found an advisor who reflects my view on investing for income. I’m 66 so income is my primary goal but I want stable vehicles as well. Thank you!“

-Wade J.

“I just wanted to send you a note to thank you for your excellent investment guidance! I really appreciate the effort you put into the programs. Your service is unique, personal and geared to beginning investors and I feel comfortable with it. Please keep up the great work with the mailbag videos and live sessions and newsletter etc. I imagine it’s a lot of work, but you are impacting lives for the better.”

-Lenae S.

I promise The Dividend Hunter will be your go-to resource for income.

If you’re more interested in the latest investing craze, like pot stocks or risky cryptocurrency… then you definitely aren’t a fit for The Dividend Hunter.

We’re not investing in high-flying stocks.

These are boring, ‘salt of the earth’ companies that form the backbone of American industry.

And best of all, they’re up to their elbows in cash! The more cash they acquire, the more that’s sent to us as dividends.

That’s something you can brag about for sure.

You’ll have checks showing up monthly and quarterly. The Dividend Hunter recommends a whopping 30+ companies which means you could cash checks from 30 companies this year alone.

That’s a lot of income in one place, and you now have the key to unlock it when you join right now.

I’ll even show you when you can expect your first checks.

It’s a special bonus surprise I include for Dividend Hunter subscribers, but I’ll tell you about it here.

It’s called…

It’s easy to lose track of when your dividend income will hit your brokerage account.

The Monthly Dividend Paycheck Calendar is your future. I expect you’ll hang it up on your refrigerator.

Because I’ll map out, like a 5-star general, when each company pays their royalties and dividends. You’re then able to create a calendar for yourself that pays you on those days.

You’ll know ahead of time exactly when your income payments will hit your account in the next 30 days.

Every month you could be supplementing your Social Security or salary with dividend income.

Starting right now.

And the investment for The Dividend Hunter is a steal if you’re curious.

The sticker price for a 1-year subscription to the service is $99/year.

I believe it’s worth double that.

You’re already receiving $197 of bonus materials, including the $25k Strategy.

The Monthly Dividend Paycheck Calendar is updated every single month, which is why I place a $99 value on that as well.

But the most important piece is the income you can generate starting as early as this month.

If you carve out $25k of your portfolio as I mentioned and drop it into my #1 opportunity…

With the potential my #1 opportunity has for you over the next few years…

You’re looking at a drop in the bucket. Heck, if The Dividend Hunter was $1,000 per year, with the value you’re getting… thanks to your newfound income… it’d be a steal.

A run of the mill advisor would charge you a 1% fee on your $25k, which is $250. I charge 61% less than that.

However, I’m willing to go even further to make this decision as easy as possible for you…

And to further distance myself from Wall Street…

If you join me today, I’ll chop the price in half for you.

That means for a 1-year subscription, you only need to invest $49 right now.

$49 in the grand scheme of things isn’t much. You’ll pay more for a nice dinner out — and that’s without the wine.

The Dividend Hunter is worth much more than that.

See what my long-time readers have to say:

“Thanks for all your hard work researching the many stocks you look at and choosing the best of the best for your subscribers. So, I’m no longer subscribing to other investment advice publications. Life is much simpler just following your recommendations, enjoying retirement and not having to worry so much about how my portfolio is doing. It doesn’t get any better than that. I just wish I had started investing in dividend stocks 25 years ago.“

-Kris B.

-Gerald C.

-Philip H.

To join, all you have to do is click the button below.

First… continue on like you’re doing.

Continue living by selling off your nest egg and hope it will last your entire retirement. I’ve known plenty of millionaires, and I can promise that peace of mind never comes when you are watching your balance go down, down, and down each month.

That’s why I’m offering you choice #2…

You’ve seen the power and the proof of how to create a lifetime of income starting with a mere $25,000.

Even more than that, you’ve discovered there is a lot of opportunity in the markets to create even more income without even laying a figure on your nest egg.

Join The Dividend Hunter. Start with just $25,000. Leave the rest of your portfolio alone while you get comfortable with the service.

Actually, on that thought, let me give you an entire year to feel comfortable.

Because I’ll offer you a:

12-month money back policy

If at any point, you don’t feel The Dividend Hunter is right for you and your family, you can ask for a refund.

That means if after 364 days, you haven’t received the value I promise, shoot us a message and your entire subscription fee will be refunded.

And as a token of good will to your future, you can keep all my special reports, including my special $25k report and strategy.

However, I don’t think it will ever come to that.

I have subscribers to The Dividend Hunter who have been around for awhile. They look forward to my emails and updates.

Listen to this:

-Larry S.

Now, you’ve seen what’s possible…

You don’t need as much as you think to create tens of thousands of dollars in income every year.

Are you going to continue on as you have, or will you make a change?

If you do join The Dividend Hunter, I challenge you to do it with the full intention of putting the $25k plan into action.

But your journey can’t end with one step today.

You’ve seen what could hypothetically happen to your income and how fast it can pile up.

From $16,517 in annual income…

To as much as $28,762 in income per year.

And these historical examples would likely be worth far more today.

All you need to do is carve out a slice of your portfolio and put it to work today.

The right strategy could change your life.

In this case, starting with just $25k could remove one of the biggest stresses of your retirement… how to never run out of money.

Don’t sell off your assets to live…

You’re not at your ‘Peak Net Worth.’

You’re only at the beginning as you can make much more in the years ahead.

Join The Dividend Hunter today and see how your retirement could change.

Focus on income first.

You only need $25,000 to start.

Click the button below and the next page shows everything you get,

Thanks for reading,

Land, Fly, or Die,

Tim Plaehn

Editor of The Dividend Hunter