We haven't stepped into the Twilight Zone, but it certainly seems that way when stocks are hitting historic highs yet the economy is still so weak that the Federal Reserve is printing money like a Third World nation.

It has the makings of a great prize fight between the largest market in the world and the largest economy in the world.

Can we keep this up? Is this titanic battle going to last like the decades-long Japanese recovery? Will stocks punch themselves out? Can slowing earnings keep stocks soaring?

Creating Value in the Stock Market

Let's address one of the most fundamental inputs in this situation: stock prices. Company valuations and their stock prices are a function of several inputs; the most important of which are earnings growth expectations and dividends.

One way to look at the price of a stock is to look at the present value of the expected future stream of dividends the company is supposed to pay out. In other words, when you get income from this company in the future, what's that worth to you now?

You don't have to apply any modeling to get to your valuation; the market basically does that for you by arriving at a consensus price that incorporates the discount model math.

Most companies that pay solid, steady dividends don't see their stock price fluctuate too much because they are yield-based investments more than go-go growth investments.

Prices of high-yielding stocks have risen and been strong because investors starved for yield in the fixed income markets have turned to these equities for the income they deliver. And growth investors that were burned in the 2008 meltdown have sought out yields for safety and steady growth.

"I subscribe to a number of investment adivsories. This is by far the best letter that I have seen." – Dennis Gibbs, Connecticut |

||

That's making income investments very popular across all investor classes.

Dividends come out of earnings, so earnings are important. But for stocks that don't pay a dividend, earnings (or in the case of crazy Internet-type stocks, would-be earnings) are everything.

Earnings: Good News vs. Bad News

Steady-state earnings don't do much for stock prices. Earnings growth is the Holy Grail. The good news is that stock prices have been rising, justifiably, on better and better earnings.

The bad news is, those earnings, upon a deeper look, aren't sustainable if economic growth doesn't pick up.

Since 2009, earnings on stocks in the S&P 500 have risen collectively some 200%.

Most of those higher net earnings have resulted from cost-cutting, layoffs, productivity increases, favorable tax carry-forwards, refinancing old debt with cheaper low-interest loans, a weak dollar, and accounting gymnastics.

The bad news is over the same period top-line revenues have grown only about 10%.

In other words, in spite of deathly slow domestic growth in the U.S. and slow global growth, American corporations have benefited by leaning themselves out, globalizing their sales to where the growth is, and enjoying a positive currency translation when they account for overseas earnings in terms of cheap dollars.

Love this special report? Hate it? We want to hear from you! Tell us what you think of this report and what you'd like to see on Investors Alley in the future. Click here to email us your comments and feedback. |

||

Central Bank Steroids

Besides inherent valuation measures, stocks are subject to supply and demand equations. If there are more buyers than sellers on any given day, stock prices will rise.

The Federal Reserve and central banks around the world have been providing an extraordinary amount of buying power to short-term investors by flooding banking systems with trillions of dollars, as well as keeping interest rates at rock bottom levels, which adds to investor buying power.

All the stimulus money floating around the world means there's plenty of money to buy stocks, especially for financial institutions. And when there are more buyers than sellers, stock prices, and this has been happening worldwide, will rise.

So far that's all been well and good. GDP growth hasn't had to be the prime mover of stocks. Inherent factors and superficial stimulus have provided the market's fuel.

But, without strong economic growth, sooner or later, demand alone will prove inadequate in supplying top-line revenue and net earnings growth and stocks could fall.

The Reckoning

The market, which can still be saved hopefully long enough for GDP growth to kick in, and if sidelined investors keep pumping money into new positions, is nonetheless facing another headwind.

Share ownership and investor participation is dwindling in the U.S. as a stagnant economy is reducing the middle-class and their ability to invest in stocks.

According to Federal Reserve data from 2010, while 47.8% of the top 10% of income earning households in America owned stocks directly and 90.1% had retirement accounts averaging $277,000, in middle-income (the 40-60 percentile) households only 11.7% owned stocks directly and 52% had retirement accounts worth an average of only $22,800.

"Great advice! Finally someone who helps people without either a long newsletter with no real advice or a really long video where they ask for a lot of money. You are the best and I am recommending you to others!" – James Burston |

||

That's worrisome for the middle-class, the stock market and America.

Entering the 12th Round

The Great Discrepancy has been bridged so far. But, if U.S. domestic growth continues to be lackluster and global growth, which is already slowing, doesn't pick up robustly it's unlikely that soaring stocks can keep fighting against what looks like a rope-a-dope opponent.

Is the fight over? By no means. GDP growth can pick up if housing continues to recover, if energy prices keep falling, if manufacturing jobs get repatriated back here, if the Fed stays its easy money course long enough for growth to get to its knees, stand up and start swinging.

Then again, I watched the famous Muhammad Ali-George Foreman fight where Ali took a beating on the ropes from a wildly punching Foreman, until Foreman ran out of gas and Ali outlasted the opponent he called a dope.

That means, don't be a dope. Ride the rising market but use protective stops to take profits on the way up so you have a sack full of money to buy from the dopes who've forgotten that what goes up, must come down, when the big market hits the canvas.

Another Troubling Fact: Margin Buying Surpasses 2007 Danger Levels

There's nothing like buying securities with money you don't have - or, more precisely, with borrowed money from your broker, with your investments as collateral.

It's called buying on margin, and it's soaring as the market continues its tear and speculative investors seek a piece of the action. As your stocks appreciate you can borrow even more. A market rally lets you expand your portfolio by piling on more debt.

But it's potentially dangerous and could portend a stock market crash.

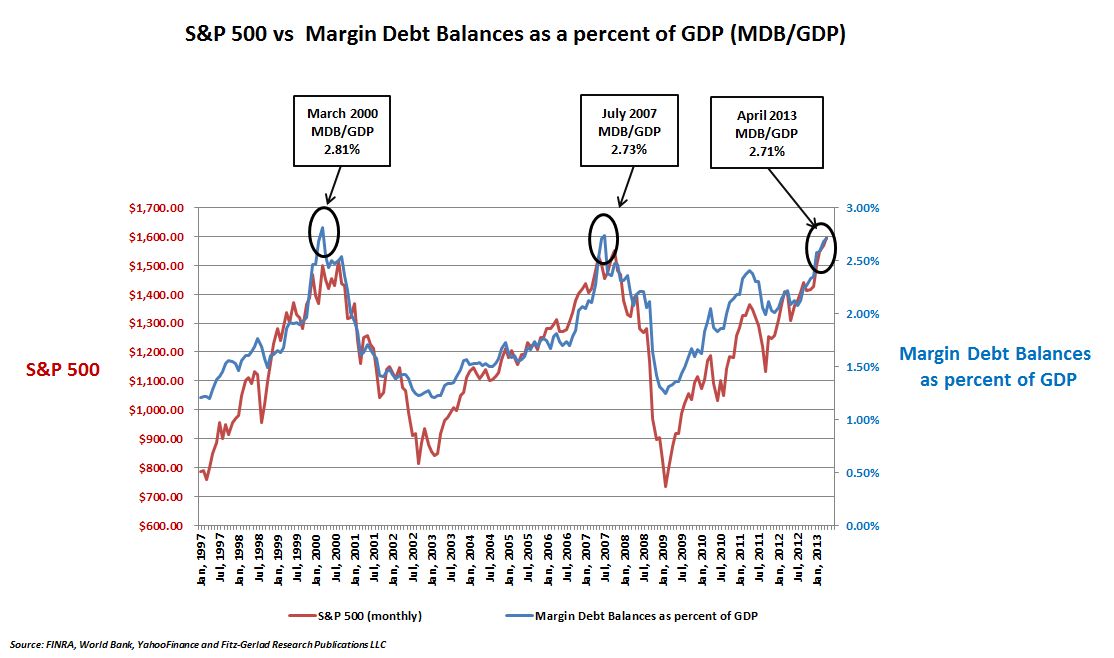

As the accompanying chart shows, historically there has been a direct link between a surge in margin loans and corresponding stock market peaks - followed by sharp declines in the markets.

So it's no small matter of concern that the Financial Industry Regulatory Authority reports the amount owed on loans secured by investments climbed to a record high $384 billion at the end of April.

That topped the previous high - $381 billion in 2007, not coincidentally, just before the financial meltdown and the Great Recession.

As a percentage of the economy, the latest margin borrowing totaled 2.71% of gross domestic product.

By comparison, margin borrowing hit 2.73% of GDP in July 2007, during the housing bubble, and 2.81% in March 2000 during the tech bubble, which was followed by a stock market crash.

"Very Much a Danger Sign"

So how should investors view the latest figures on margin borrowing?

"They're very much a danger sign," Money Morning Chief Investment Strategist Keith Fitz-Gerald said. "From a technical perspective, margin borrowing has risen to levels that we know are consistent with major corrections."

But Fitz-Gerald pointed out, "Investors need to learn to review the figures just like a big road sign. It doesn't stop you from driving down the road. It just says 'potential hazard ahead.'"

In margin lending, investors who take out margin loans get cash from their broker, with their investments as collateral, and can use the cash to pay for other investments.

Brokers set a minimum value of equities an investor must keep in an account, and if the account dips below this level as stocks depreciate they can issue a margin call requiring the investor to put more money into their account - or force them to sell securities to cover the margin.

"Great articles that are to the point. I am dropping most other newsletters, but Investors Alley will most certainly remain." – Guy Caiazzo, Maryland |

||

"The problem with margin is that it magnifies the risks you take," Fitz-Gerald said. "Your profit potential is huge but then so is your loss potential unless you know how to manage that risk properly.

"Most retail investors simply do not understand what it is they're getting into and they fall prey to these very seductive investment ads coming out of Wall Street that are designed for one purpose and one purpose only: to separate them from their money."

Depression-Era Margin Calls

Today, an investor's minimum margin requirement - set by the Federal Reserve - is 50%, much higher than margins that had been as low as 10% during the 1920s. This means today you can buy $10,000 of stock by borrowing $5,000 from your broker on margin.

Back then, when the market started to contract and investors got margin calls they couldn't cover, their shares were sold, leading to more market declines and more margin calls.

This phenomenon was a major contributor to the 1929 market crash and the Great Depression, Fitz-Gerald noted.

"Investors started taking assets that they needed and they started leveraging them into investments that they arguably didn't need," he said, "and when we had the big crash, people found out the hard way that it's awfully hard to pay back loans you have with assets that depreciate in value."

Magazine Covers: Stock Market Crash Indicator?

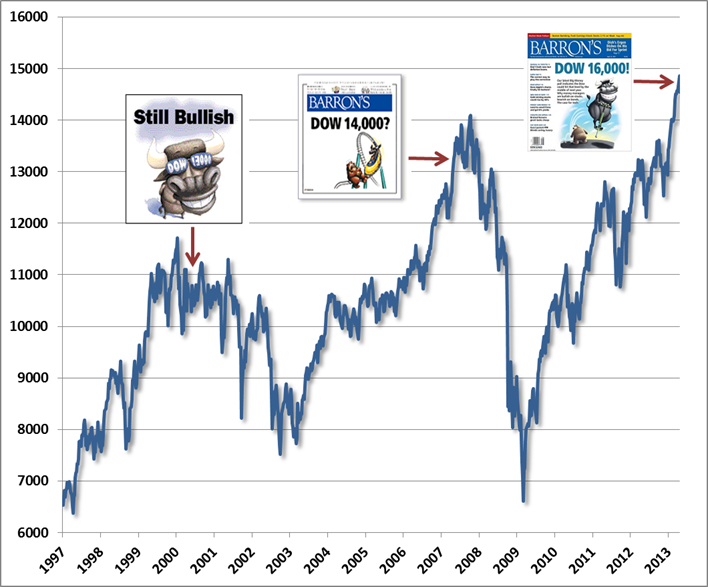

If you're contrarian, then Barron's latest "Big Money" poll and its magazine cover just gave you reasons to be on the lookout for a stock market crash.

"So nice to read straight forward recommendations without obsification (never really telling the name). You are one of my top reads." – Gene Uhler, Colorado |

||

The semiannual poll of professional investors found that 74% of money managers are bullish or very bullish about the prospects for U.S. stocks - an all-time high for Big Money, going back more than 20 years.

Barron's drives the point home with its over-the-top cover titled "Dow 16,000!"

But not everyone feels as confident as these polled investors - especially since the issue follows 2013's worst weekly performance for stocks.

"Rule o' Thumb: When the cover of a major financial magazine features a cartoon of a bull leaping through the air on a pogo stick, it's probably about time to cash in the chips," mutual fund owner John Hussman wrote on his Hussman Funds website.

Dow 16,000, or a Stock Market Crash?

In its more than 20-year history, Barron's Big Money poll has a history of making overly bullish calls at precisely the wrong time.

"Still Bullish! (Dow 13,000)" was published May 1, 2000, with the Dow Jones Industrial Average at 10,733.91. The Dow had already fallen almost 1,000 points from its high in January 2000 and would go on to lose about 40% of its value in the 2000-2002 bear market. The S&P 500 and the Nasdaq performed much worse.

"Dow 14,000?" was published in Barron's May 2, 2007, with the Dow at 13,264.62. The Dow did actually hit 14,000 by October 2007.

In that year's second Big Money poll, released in November, the headline read, "The Party's Not Over," and bulls outnumbered bears 2-to-1.

But as we know, the market had already peaked and would go on to lose over half its value in the 2007-2009 bear market.

This graphic from Hussman sums up the "Barron's Cover Jinx:"

Think of this as the investing equivalent of the "Madden Curse," in which the NFL player on the cover of the Madden video game every year suffers a serious injury or dramatically underperforms.

Hussman's not the only market analyst who likes to use magazine covers as potential contrarian indicators.

Money Morning Chief Investment Strategist Keith Fitz-Gerald pointed out last year, "Magazine covers help me to latch on to important market shifts and trends that others either miss or simply don't see coming."

Looking at these bold headline predictions from the past helps you see why.

"The Death of Equities" adorned the cover of Business Week's Aug. 13, 1979 edition - and the headline could hardly have been more wrong.

The Dow shot up 1,153.76% over the next 20 years. The S&P 500 tacked on 1,135.97% and the tech-heavy Nasdaq rose 1,705.9% over the same time period. The investors who went to the sidelines got left behind.

Then in 1999, Time magazine named Amazon CEO Jeff Bezos "Man of The Year."

Within 24 months, the Internet bubble had burst and shares of Amazon (Nasdaq: AMZN) closed below $6, shedding 94.32% from a previous high of $105.06.

In 2003, after the price of a barrel of oil had fallen to between $20 and $30 a barrel, The Economist ran the headline "The End of the Oil Age."

You guessed it: Oil took off on a triple-digit run, finally peaking in 2008 at $141.71 a barrel.

While investors shouldn't base decisions purely on magazine headlines, they do help give a sense of when markets may be too euphoric or fearful.

History has shown us that much.

Stock Market Crash Protection for Your Portfolio

Thanks to billions of dollars in quantitative easing from the U.S. Federal Reserve, fears over a looming stock market crash have been put on hold lately.

The Standard & Poor's 500 Index is up 15% this year. The market's outstanding performance has shrugged off weak earnings reports, slowing growth in China, and continued weakness in Europe.

It seems that zero interest rates really do trump all. Even Warren Buffett is unsure how all this ends, telling shareholders at the Berkshire Hathaway (NYSE: BRK.A, BRK.B) annual meeting "it's really uncharted territory. It's a lot easier to buy things sometimes than it is to sell them."

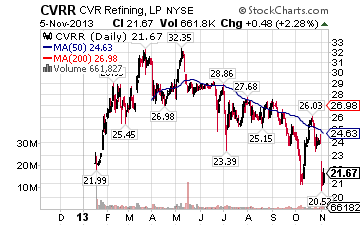

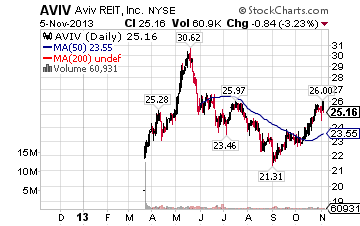

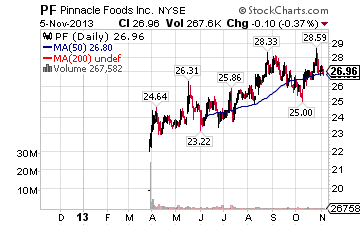

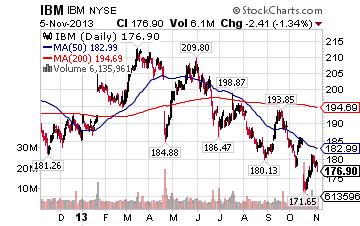

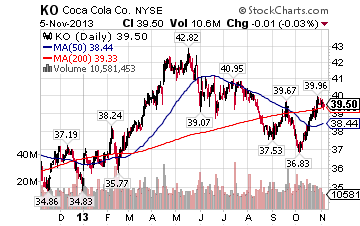

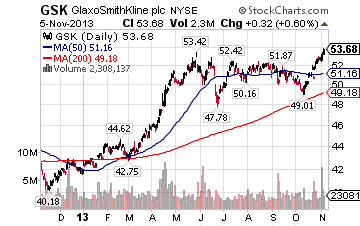

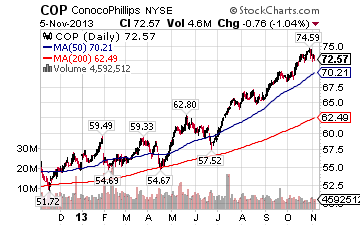

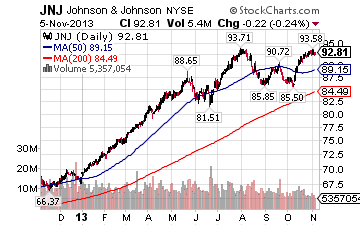

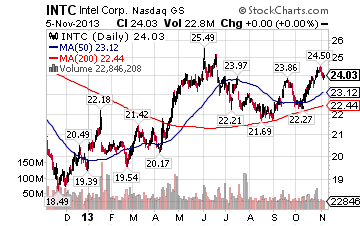

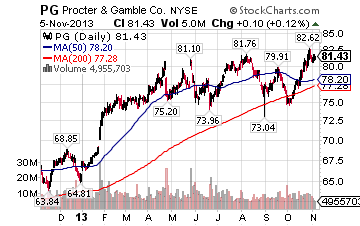

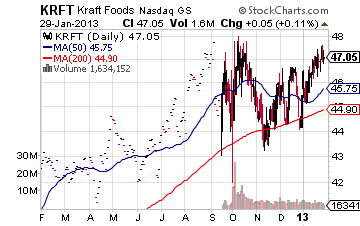

Short Term TradingHere are five things you should look for on the DAILY charts to help you understand when a stock or index chart is bottoming near term:

As many of these things that you can get to come together on the daily charts is when you want to buy, even though it won't feel good to buy there. Clearly there's more to buying or selling than this, but this is what I can teach you online without doing an entire seminar. There's so much more but if you follow these simple rules your trading should improve quite a bit. |

||

And I recently heard legendary real estate investors who at a conference compared the market to a game of musical chairs where everyone keeps playing because the music - QE - is still going.

But they cautioned that investors who aren't careful will be quickly left without a seat.

That's why investors should take steps to protect their portfolio from a possible severe decline in prices. Whether it's a stock market crash or a more mild price pullback, you always want to make sure you're prepared.

It's time to sit down and go through your holdings stock by stock and ask some key questions:

- Is the reason you bought the stock still true?

- Do you have stocks that have experienced strong gains and now sell at very high valuation based on earnings, sales, and asset value?

- Has the company's business or financial position changed for the worse since you bought the shares?

- Would you buy the stock again today at the current price?

This type of prudent pruning can help you accomplish two things that will help protect you against losses from a market crash or sell off.

First, getting rid of overvalued stocks and underperforming companies will reduce your overall exposure to the market. Increasing your cash holdings may lower your return in the short term, but cash does not decline in a sell off.

It also gives you dry powder in your arsenal that can be used to scoop up bargain issues after a steep decline.

If you want more protection than pruning provides, you can buy insurance against the decline; here's one way to do that...

Using put options on the S&P 500 Spyder Exchange Traded Fund (NYSE: SPY) gives you "stock market crash insurance." You can even pick your own deductible based on how much risk you feel you can endure.

If you are worried about a decline in the market of more than 10% or so, you can buy a put option at $150 on the SPY that expires in January 2014. Each contract will cost you about $378 or about 2% of face value. If the SPY falls below 150, the puts will rise in value protecting you against steep losses.

Each contract represents roughly $16,000 of market value right now so you will need seven contracts for every $100,000 of portfolio value for full protection. If you want a longer term insurance policy, you can buy the same option for about $676, or 4.5% of face value that expires next June.

If you prefer more protection, you can protect against a loss of greater than 5% by purchasing options with a strike price of $157. This will cost about $550 for each January contract.

Just like all insurance policies you buy, the more protection you want, the higher premiums you pay for coverage. If the stock market falls you will enjoy the offsetting gains in the put options to keep your portfolio value relatively steady.

Of course if it does not, you lose the premiums paid just as you do with auto or homeowners insurance.

Danger Ahead: Sell (or Short) These Stocks

There are events unfolding right now that show you need to know how to invest in a market correction...

First, this bull market - the most unloved bull market in history - has continued for 54 months now. That's a full 11 months longer than the average bull market run since 1953.

Second, the forces keeping this bull market going are almost completely divorced from any economic reality.

Unemployment and underemployment - the sheer number of Americans who've flat out given up looking for work - remains appallingly high, at 14%. Economic growth, limping in at under 2% per year, is anemic.

Yet, the markets have surged for more than four and a half years... hitting as high as 15,628... shattering all records as they go.

Now market crash indicators like the Hindenburg Omen are alerting investors to prepare now. And the rising yield on 10-year Treasuries could trigger a selloff.

But a market correction, crash, or downturn is nothing to fear if you know how to invest for that scenario. A good investor is prepared to stay in - and make money in - any market.

In fact, the only sure way not to make money is to be out of the market.

So, here's where to start.

How to Invest When Markets Fall

How to Invest When Markets Fall

Inverse exchange-traded funds (ETFs) can be a powerful hedge against a downturn or crash. Even more than a hedge, they can be a tool to make money while everyone else is losing theirs.

Bearish investors nowadays have a truly staggering array of short plays to make using ETFs. If you can think of it, there's an inverse ETF to short it: commodities, market cap ranges, precious metals, indexes, entire sectors, whole national economies, currencies - nearly anything.

Inverse ETFs can be a bit more expensive than "traditional" ETFs, but they allow investors easy access to the short game, without the hassle and expense of maintaining a margin account.

Inverse ETFs can be a bit more expensive than "traditional" ETFs, but they allow investors easy access to the short game, without the hassle and expense of maintaining a margin account.

If you're expecting any of the major indexes to go through a correction, you would naturally target an inverse ETF. You can always use an ETF that returns a one-to-one inverse of the daily return of whatever you fancy:

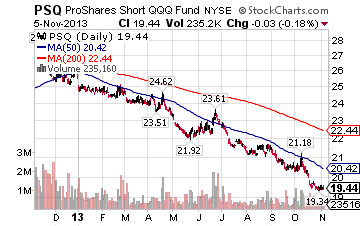

ProShares Short QQQ (ETF) (NYSE Arca: PSQ) will return the daily inverse of the Nasdaq.

ProShares Short QQQ (ETF) (NYSE Arca: PSQ) will return the daily inverse of the Nasdaq.

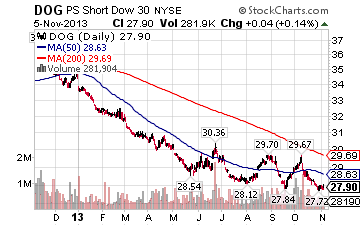

ProShares Short Dow30 (ETF) (NYSE Arca: DOG) returns the daily inverse of the Dow Jones Industrial Average.

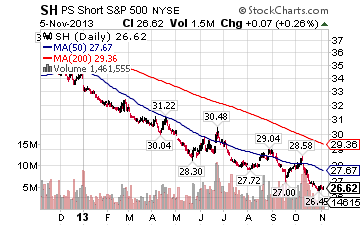

ProShares Short S&P500 (ETF) (NYSE Arca: SH) returns the daily inverse of the S&P 500.

For more aggressive investors, or those with a higher risk tolerance, the UltraShort and UltraPro class of ETFs can provide multiples of the inverse of the Dow Jones Industrial Average, the Nasdaq, the S&P 500, and even the Russell 2000. (Word of warning - those considering leveraged ETFs would do well to remember that multiplied gains can turn quickly into multiplied losses.)

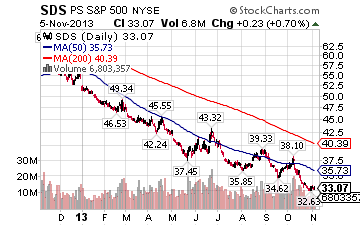

The ProShares UltraShort S&P500 (ETF) (NYSE Arca: SDS) is perhaps the largest inverse ETF in existence, with $2 billion in assets. It's also the best-selling inverse product of 2013, with $1.1 billion in inflows this year. SDS is geared to provide 200% of the inverse daily return of the S&P 500 (before fees and expenses).

The ProShares UltraShort S&P500 (ETF) (NYSE Arca: SDS) is perhaps the largest inverse ETF in existence, with $2 billion in assets. It's also the best-selling inverse product of 2013, with $1.1 billion in inflows this year. SDS is geared to provide 200% of the inverse daily return of the S&P 500 (before fees and expenses).

You'll be in good company among the other bears in the woods. ProFund Group's alternative ETF unit, ProShares, is one of the country's largest alternative ETF managers.

ProShares has reported inflows of around $3.8 billion into inverse products, so far, in 2013.

A Whole Wide World of Shorts

Far from just indexes, investors can take short bets on a variety of currencies with inverse currency ETFs. Although costs for these tend to be higher than index ETFs, the rewards can be just as nice, and there's nigh unlimited opportunity for speculation.

Technology, basic materials, consumer goods, real estate, even semiconductors are available for one-stop short selling. Wherever your bearish sentiment may lead, ProShares offers an ETF to short - with varying liquidity, assets under management, and costs, of course.

Technology, basic materials, consumer goods, real estate, even semiconductors are available for one-stop short selling. Wherever your bearish sentiment may lead, ProShares offers an ETF to short - with varying liquidity, assets under management, and costs, of course.

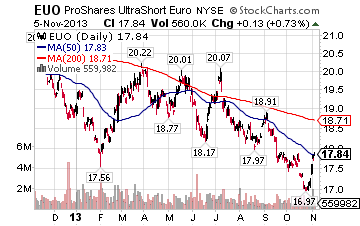

For instance, if you believe that the euro will decline relative to the dollar, you want to take a position in ProShares UltraShort Euro (ETF) (NYSE Arca: EUO). This will return twice the inverse of the daily decline of the euro to the dollar.

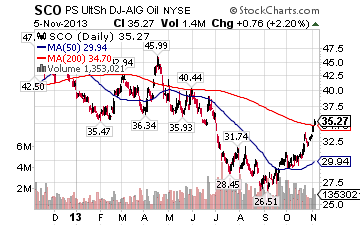

Or if you have a notion that oil might tank, but don't know the best way to parlay those depressed prices into gains, you can buy ProShares UltraShort DJ-UBS Crude Oil ETF (NYSE Arca: SCO). This is one of the most popular inverse oil ETFs around, albeit with higher costs than most inverse index ETFs. It gives twice the inverse daily performance of West Texas Intermediate (WTI) crude.

Or if you have a notion that oil might tank, but don't know the best way to parlay those depressed prices into gains, you can buy ProShares UltraShort DJ-UBS Crude Oil ETF (NYSE Arca: SCO). This is one of the most popular inverse oil ETFs around, albeit with higher costs than most inverse index ETFs. It gives twice the inverse daily performance of West Texas Intermediate (WTI) crude.

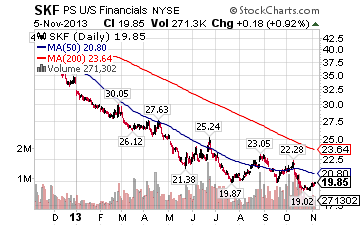

If you feel a correction or a crash is in the offing, you could play that for profit by shorting the entire financial sector. The ProShares UltraShort Financials (ETF) (NYSE Arca: SKF) will return twice the inverse of the daily Dow Jones financials sector.

Warning to the Down-Market Profit Hunter

Warning to the Down-Market Profit Hunter

Before you get into trading inverse ETFs to invest in a market correction, there are some important things to consider...

It's very important to note the use of the word daily in relation to the inverse index ETFs. That's a crucial caveat.

It means these are by no means buy-and-hold investments, and treating them that way is dangerous. It's not wise to let these simply "ride out" a market downturn or crash, because your holdings of inverse ETFs can take a hit on a rally, no matter how brief.

As we've reported before, one must always remain vigilant and attuned to their portfolio performance to succeed, and this rule of thumb definitely applies to inverse ETF speculation.

These are better thought of as trading vehicles or tactical tools. You'll need to make continual adjustments to your position should a trend emerge.

That being said, if you want more on how to invest in a market correction, ETFs are just one way that you can have your fill of short plays - and make a killing while all others are being killed.

More Than One Path to Post-Crash Riches

There's also the Chicago Board of Options Exchange Volatility Index (VIX). Some call it the Fear Index, and it's held to be the best gauge of volatility around. In fact, it may be one of the best contrarian indicators in the world.

When volatility takes hold and drives down the price of options on the S&P 500, the Fear Index almost always enjoys a healthy bump. During the recent broad market downturn, the VIX saw some powerful, historic upward surges. For instance, August 21, 2013, saw the VIX jump by 6.91%. And for nearly all of this August, money has been pouring into call options on the VIX to the point where open interest has peaked to its third-highest volume in history.

Avoid These Stocks At All Costs

Speaking of ETFs, prudent investors will best avoid any exposure to real estate investment trusts (REITs), and mortgage REITs in particular.

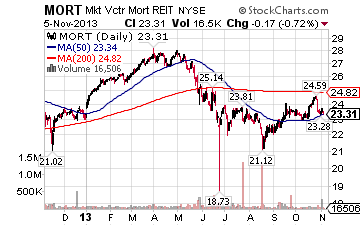

The Market Vectors Mortgage REIT ETF (MORT) is down 24% in less than five months. And a number of its components are down more than 30%.

The Market Vectors Mortgage REIT ETF (MORT) is down 24% in less than five months. And a number of its components are down more than 30%.

But it's going to get worse. A lot worse. And that's why I'm issuing a warning, because practically every "properly diversified" portfolio in America cashes these REIT checks.

Many people depend on them.

This is dangerous, especially when two of the most widely held mortgage REITs also happen to be two of the worst.

To be sure, aside from the one (big) exception you'll see today, a longtime high-yield darling is about to get crushed...

The REIT Spoiler

You can pin this one on the U.S. Federal Reserve, too...

Thanks largely to its pernicious tinkering of monetary policy - first via artificially low interest rates and then via direct injection of capital into the financial system to the tune of $85 billion per month of direct bond buying ($45 billion specifically spent on mortgage-backed securities) - the Fed has created an environment in which interest rates are destined to rise.

In fact, the mere mention by Ben Bernanke back in May that the Fed will soon "taper" its bond-buying program now has caused interest rates, as measured by the benchmark 10-year Treasury Note, to rise to their highest levels in more than two years.

With the biggest buyer moving out of the market, MBSs are sure to take a hit. Moreover, the pace of rate increase has been anything but subtle, with the 10-year yield spiking to 2.90% - a 40% jump in three months.

Because mortgage REITs generate income by essentially borrowing money at short-term rates and then investing in higher-yielding MBSs, any significant increase in the cost of borrowing can devastate mortgage REIT book value.

And they're about to lose their safety net...

As the Fed has basically, and repeatedly, told the markets that tapering is a fait accompli, it means that the buyer of last resort for MBS is about to remove - or at least slowly pull back - the MBS safety net.

Adding more uncertainty to the mortgage REIT equation is so-called "agency risk."

Adding more uncertainty to the mortgage REIT equation is so-called "agency risk."

The current debate over the fate of mortgage-related agencies Fannie Mae and Freddie Mac, and the future limited role these embattled agencies could play in the MBS space, also has caused the smart money to jettison mortgage REITs.

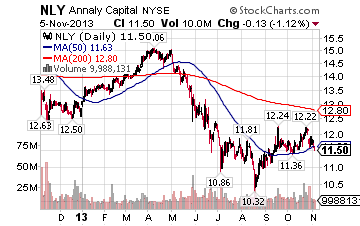

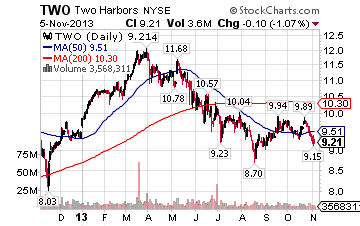

Two of the worst mortgage REITs to own right now also happen to be two of the most widely held ones, and they are Annaly Capital Management Inc (NYSE: NLY-C) and Two Harbors Investment Corp. (NYSE: TWO).

In the case of Annaly, the fund invests primarily in MBSs guaranteed by Fannie and Freddie, so it's little wonder why the exodus from this fund has sent NLY cascading some 25% over the past three months. As for Two Harbors, the spin-off of its equity-REIT Silver Bay Realty operations in May turned it into much more of a conventional MBS play. The market saw this, got spooked, and the result was a 20% smackdown over the last three months.

In the case of Annaly, the fund invests primarily in MBSs guaranteed by Fannie and Freddie, so it's little wonder why the exodus from this fund has sent NLY cascading some 25% over the past three months. As for Two Harbors, the spin-off of its equity-REIT Silver Bay Realty operations in May turned it into much more of a conventional MBS play. The market saw this, got spooked, and the result was a 20% smackdown over the last three months.

So, are there any REITs that still are okay to own these days? The short answer is yes...

The REIT Exception: Safe and "Substantial" Income

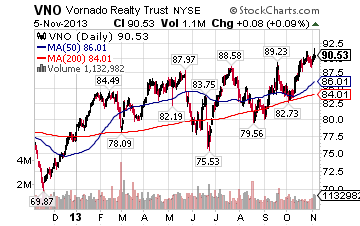

Vornado Realty Trust (NYSE: VNO) is a traditional REIT.

Vornado Realty Trust (NYSE: VNO) is a traditional REIT.

Unlike mortgage REITs, Vornado actually invests directly in prime real estate properties such as office buildings, and the rents from these properties are what Vornado uses to generate income for unitholders.

That income is substantial, as the company owns buildings in the best, highest-rent locations around the country, including economically vibrant New York City, San Francisco, and Washington, D.C.

Vornado doesn't pay 10%-plus on your principal, of course, like NLY and TWO. It gives you something much more powerful: the ability to keep your principal, just in case you ever want your money back.

How to Identify Other Stocks to Sell

Sometimes it's easy to mislabel fantastic companies as great stocks to buy, but the two attributes don't always go hand in hand.

That's because sometimes these great companies watch their share prices climb faster than the underlying fundamentals.

This is often the case with companies/brands that are a big hit with consumers, like Lululemon Athletica Inc. (Nasdaq: LULU) and Chipotle Mexican Grill Inc. (NYSE: CMG).

Since these companies are overpriced, they are usually most vulnerable to a market correction.

Investors should sweep their portfolios now to make sure they aren't holding any of these "high-risk" stocks.

To identify them, investors should look at the price/earnings ratio and price/earnings/growth ratio of the companies they hold.

High P/E and P/E/G ratios often indicate companies whose share prices have been bid up to a point that is no longer justified by fundamentals. The companies themselves might be good investments, but not at the current share price.

Sell These 5 Overvalued Companies

Here are five companies that fall into this category right now:

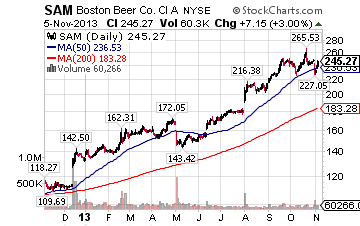

Boston Beer Co. Inc. (NYSE: SAM) - This is a fantastic company that brews craft beers and has done a great job of creating and marketing new products to complement its core Sam Adams lager product. The stock is up more than 50% in the past year and has risen eight-fold since the 2009 lows.

Boston Beer Co. Inc. (NYSE: SAM) - This is a fantastic company that brews craft beers and has done a great job of creating and marketing new products to complement its core Sam Adams lager product. The stock is up more than 50% in the past year and has risen eight-fold since the 2009 lows.

All of this appears to be more than priced into the stock with a price to earnings multiple of 36. Sales growth is slowing and earnings for the fourth quarter and full year of 2012 were slightly less than 2011. The PEG ratio now stands at 1.89, a level that many market observers consider to indicate overvaluation based on earnings. Insiders appear to be wary of the stocks prospects as officers and directors have been consistent sellers of the stock since November.

Should the market correct this stock could experience a meaningful decline.

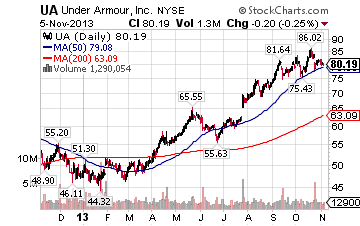

Under Armour Inc. (NYSE: UA) - Any investor concerned about market risk should avoid this popular athletic apparel company. This is a fantastic company with great products but the truth is the shares are too highly valued for the current economic environment.

Under Armour Inc. (NYSE: UA) - Any investor concerned about market risk should avoid this popular athletic apparel company. This is a fantastic company with great products but the truth is the shares are too highly valued for the current economic environment.

The stock has advanced over the past several years where the valuation does not appear to be sustainable. The stock is up five-fold since the 2009 bottom, but this year investors are already becoming concerned about the steep earnings multiple of the stock. Under Armour trades at more than 40-times current earnings and has a PEG ratio of 2 at the current price.

Given the high multiples and developing price weakness this stock could easily become a casualty in a sell off or correction in the stock market.

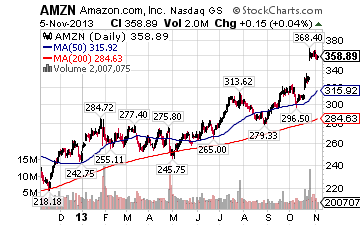

Amazon.com Inc. (Nasdaq: AMZN) - At $270 Amazon has a P/E ratio of 3,375, making it technically the most overvalued stock on the list. Amazon is up 43.6% from a year ago and last week it reached its all-time high of $284. That price could be the peak for AMZN stock as the company's low-cost advantages are starting to decline.

New tax laws in Pennsylvania, Texas and California are now requiring Amazon to start collecting a sales tax from its customers, and more cash-deprived states should follow in that trend. Higher energy costs could cause Amazon to charge more for shipping, further angering customers. Amazon is also facing stiffer online competition from retailers such as Wal-Mart and Target. And some retailers, including Target, are matching or beating the price of Amazon products in its stores. These factors should help bring the company's P/E, and stock, down to realistic levels.

Amazon.com Inc. (Nasdaq: AMZN) - At $270 Amazon has a P/E ratio of 3,375, making it technically the most overvalued stock on the list. Amazon is up 43.6% from a year ago and last week it reached its all-time high of $284. That price could be the peak for AMZN stock as the company's low-cost advantages are starting to decline.

New tax laws in Pennsylvania, Texas and California are now requiring Amazon to start collecting a sales tax from its customers, and more cash-deprived states should follow in that trend. Higher energy costs could cause Amazon to charge more for shipping, further angering customers. Amazon is also facing stiffer online competition from retailers such as Wal-Mart and Target. And some retailers, including Target, are matching or beating the price of Amazon products in its stores. These factors should help bring the company's P/E, and stock, down to realistic levels.

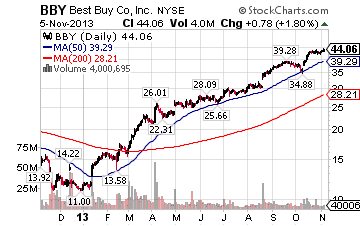

Best Buy Co. Inc. (NYSE: BBY) - The consumer electronics giants has been one of the best performing stocks so far this year. Much of the increase in the stock was initially associated with rumors that the founder would partner with a private equity firm to take the company private. No bid materialized by the deadline, and this now looks unlikely.

Best Buy Co. Inc. (NYSE: BBY) - The consumer electronics giants has been one of the best performing stocks so far this year. Much of the increase in the stock was initially associated with rumors that the founder would partner with a private equity firm to take the company private. No bid materialized by the deadline, and this now looks unlikely.

In spite of beating analysts' estimates by a small margin, the company is still not performing well. Sales are projected to continue to decline over the next two years. Best Buy has an enormous amount of store and employee cost dedicated to an industry that is transforming into a primarily online industry.

In order to stay competitive the company will have to lower prices to the point already-thin profit margins disappear. If you have been lucky enough to enjoy the more-than 100% price jump this year, it is a good idea to take your profits before reality drives the stock price down over the next few months.

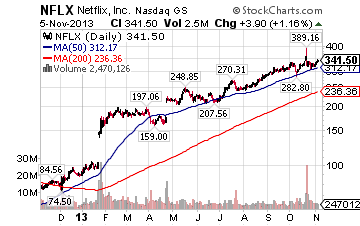

Netflix Inc. (Nasdaq: NFLX) - In the last year Netflix has been on a tear, gaining 242%. At $215, NFLX is far from its all-time high, which is just below $300. But with a P/E of 527, its stock is certainly overrated.

Netflix Inc. (Nasdaq: NFLX) - In the last year Netflix has been on a tear, gaining 242%. At $215, NFLX is far from its all-time high, which is just below $300. But with a P/E of 527, its stock is certainly overrated.

This company is doing a lot of things right, such as developing original content and expanding internationally, but this is a competitive business and all the good news appears to be reflected in the current stock price.

Netflix trades at more than 500 times earnings and is at almost 60 times the optimist analyst estimates for 2013. Should it fall short of analysts' expectations, or we endure a broader market tumble, this stock could easily give up its 2013 gains. If you have ridden the stock higher, it's probably time to step off the train before it reverses direction.

The only way these stocks would be "Buys" again is if there was a steep sell-off. With all trading at more than 30 times earnings, they have a long way to fall before making it back into the "stocks to buy" category. Investors should be cautious if they recently purchased shares.

A Quick Primer on Shorting Stocks

Besides simply selling a stock and avoiding a fall in price, many investors short stocks to profit as they drop. If you've never heard the term before - and many investors still haven't - shorting stocks involves selling stocks on margin and reaping the rewards as the share price decreases.

Why would you do that?

Shorting overvalued stocks can lead to profits when others are crying in their beer. It's a way to keep you fully invested or otherwise in the game, especially when the markets are as unsettled as they are right now.

But you have to be careful. Despite the fact that shorting stocks can be a quick path to riches, not all stocks are the same when it comes to betting against them.

In that sense, short selling (at least the way I encourage investors to practice it) is no different than regular upside investing.

You want to diversify your holdings and use very strict risk management to control your exposure by not having more than 2.5% of your assets in any one position or 20% of your holdings in any given sector.

"Finally a site with info worth looking at without a 10-minute "I said it 3 times" commentator trying to sell something. I want a letter that will give good sound reasons to buy or sell whichever stock is highlighted. I've found just that with Investors Alley." – Ken Berscheit, Wyoming |

||

You want to short stocks in conjunction with the rest of your holdings, not in lieu of maintaining a properly concentrated portfolio. Despite what you may think, shorting stocks is not a game for market-timers or an exercise in timing.

As for how you select your target, that's not really different either.

How to Find Short "Targets"

For example, you don't ever want to bet against a stock just because it's expensive or even overvalued. Instead, you want to find a compelling reason for failure or a lower valuation.

I laid out seven of them last year when I suggested that Apple (Nasdaq: AAPL) may be the short of a lifetime rather than the next best thing since sliced bread.

At the time, I reasoned that:

- Apple was a bubble based on technical parallels to the Nasdaq bubble of 2000.

- Its products were faddish and driven by new product launches rather than sustained production.

- A change in leadership may produce slower or greatly varied product development.

- Short interest was an ultra-low 9.8 million shares; it seemed logical to take the other side of the bet if everybody was so bullish.

- Analysts were almost uniformly bullish which is a very bearish sign, according to past corrections.

- Apple's profit margins were disproportionately high in its industry.

- A carrier failure or subsidy change may soften the company's fundamentals.

Apple rose a bit further to a peak of $644, then fell 17.68% over the following few weeks to $530.12. And now it's down just above $400.

"I like Investors Alley because you actually give the names of the stocks. One can research and inspect them. So many of these sites just tease but never give the names. It's a waste of time even looking at the articles. Thank you so much. I just wanted to express my appreciation for your info." – Natalie Giroux, Canada |

||

Other negative attributes I look for include insider selling and problematic accounting. Both can be hard to spot in a timely fashion but that doesn't mean you shouldn't look.

Armed with a good dose of skepticism, you can find companies that are likely to fall apart in pretty much any market anywhere in the world if you look hard enough.

Take action on strong up days when the believers are pushing the stock for all it's worth - every stock has them. Some brands like Apple (Nasdaq: AAPL), Harley Davidson (NYSE: HOG) and Facebook (Nasdaq: FB), for example, are particularly well defended by brand loyalists.

That's why you've got to have a thick skin when you are shorting stocks because you're essentially betting against the success so many people hope for.

Your friends will accuse you of being un-American or a vulture - mine certainly have over the years. Worse, any butthead with an Internet connection can take a potshot at you in today's socially driven media age.

Stick to your guns. They'll get over it when they figure out how much money they could have made and how they can get in on the action.

Love this special report? Hate it? We want to hear from you! Tell us what you think of this report and what you'd like to see on Investors Alley in the future. Click here to email us your comments and feedback. |

||

The typical turnaround stock has stumbled badly, with the share price punished severely for overblown media mishaps or trouble in the sector.

That's why finding turnaround stocks to buy is not for everybody. There are some reasons people tend to shy away from it...

First, finding the best turnaround investments requires more patience than trading or flipping stocks over the short term. A turnaround stock usually takes a year or longer to show results.

Second, you have to be prepared to live with price volatility. There's often high volatility during the turnaround period.

Also, it's highly unlikely you will time things so perfectly that the stock doesn't slip more before it climbs higher.

However, if you have the patience and money to play with, turnarounds can be some of the best investments you'll ever make - and provide the type of returns most short-term investors will never realize.

But there's more to it than a rebound in profits and revenue - the best turnaround stocks to buy also have undervalued share prices.

For example, investors wouldn't want to buy stocks like Tesla Motors Inc. (Nasdaq: TSLA) and Delta Air Lines Inc. (NYSE: DAL), even though they indeed have analysts' blessing and are likely about to see their bottom line substantially improve.

But these are not ideal stocks to buy for individual investors for two reasons: 1) They have both seen share prices skyrocket this year, with their stock up 444% and 102%, respectively, and 2) are already heavily owned by institutional investors.

Plus, Tesla-type stocks are far more likely to suffer an earnings shock than an earnings pop at this point because everyone expects them to turn profitable and enter a growth phase. If their earnings disappoint even slightly, investors' exit will be abrupt as large funds withdraw.

So, investing in rags-to-riches stocks means choosing those that are not mainstream.

That means look for stocks that are braced to enter a strong growth period but are under-owned by the large institutions. Then, when the larger institutions do recognize their financial strengths, your portfolio will be well positioned to enjoy the surge in stock prices.

Looking at the market now, here are a few companies that have the potential to be the next best "turnaround" investments out there.

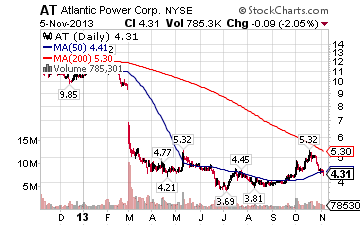

- The first such candidate right now is Atlantic Power Corp. (NYSE: AT).

The company has seen its stock slashed this year from more than $10 a share to less than $5. A weak economy and high leverage forced the company to cut its dividend by more than 60%. AT fell off a cliff after the payout cut announcement on Feb. 28, slipping 40.7% by Mar. 4.

The company has seen its stock slashed this year from more than $10 a share to less than $5. A weak economy and high leverage forced the company to cut its dividend by more than 60%. AT fell off a cliff after the payout cut announcement on Feb. 28, slipping 40.7% by Mar. 4.

But the reason this is a potential turnaround stock to buy is that this company appears to have the means to weather the storm and get back on a profitable track long term.

AT has a strong collection of electric power generation assets, with 29 plants capable of producing more than 2000 megawatts of electricity. The majority of its plants produce clean energy using solar, wind, biofuels, and natural gas to produce power. All of the plants are located in major markets across the United States and Canada.

The company is focusing on paying down its debt load to reduce the chance of future financial problems. In the last quarter it paid down more than $170 million of long-term debt and is looking to sell non-core assets to further reduce indebtedness. Even after cutting the dividend, the shares still yield more than 8% at the current price. Atlantic Power shares sell for about one-half of book value and appear to have substantial recovery potential over the next few years.

Patient investors could easily see the stock double back to where it was before the dividend cut.

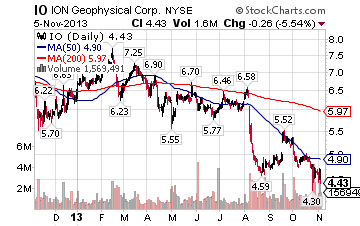

- This next potential turnaround stock to buy has ties to the lucrative oil and gas industry - ION Geophysical Corp. (NYSE: IO).

The company provides advanced seismic acquisition equipment, software, seismic data-processing services, and seismic data libraries to the global oil and gas industry. These are used by exploration and production companies to generate high-resolution images of the Earth's subsurface during exploration, exploitation, and production operations.

The company provides advanced seismic acquisition equipment, software, seismic data-processing services, and seismic data libraries to the global oil and gas industry. These are used by exploration and production companies to generate high-resolution images of the Earth's subsurface during exploration, exploitation, and production operations.

This is a business that should see strong growth in the years ahead as oil and gas companies scramble to boost production to meet increasing demand.

The short term has been a little more difficult for this company. The stock price has been punished for missing Wall Street's earnings forecasts. Now shares have slipped more than 25% in the last few months.

In spite of the short-term difficulties, the company has exposure to what will be the fastest-growing segments of the energy exploration industry.

With 20 locations around the world, ION is providing data for companies looking for oil and gas below the oceans, in the Arctic, and in the unconventional fields in the United States. The company also just added several data libraries, including portions of the Arctic, Latin America, Africa, and Australia, that should see strong demand and improve the top and bottom line.

Increased exploration and production activity in the Gulf of Mexico should also help the company regain footing in 2014. Analysts expect earnings to double next year and grow more than 15% annually for the next five years.

If they are close to right, this stock has the potential to soar as oil and gas demand picks up.

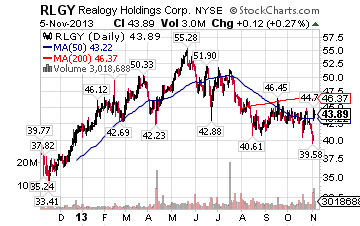

- Realogy Holdings Inc. (NYSE: RLGY), a real estate services company, is a perfect example of a turnaround stock to buy that could soon welcome a surge in institutional appetite that would drive its shares higher.

Realogy offers real estate and relocation services in the United States and internationally. The company franchises some of the leading names in real estate brokerage, including Century 21, Coldwell Banker, Coldwell Banker Commercial, ERA, Sotheby's International Realty, and Better Homes and Gardens Real Estate.

Realogy offers real estate and relocation services in the United States and internationally. The company franchises some of the leading names in real estate brokerage, including Century 21, Coldwell Banker, Coldwell Banker Commercial, ERA, Sotheby's International Realty, and Better Homes and Gardens Real Estate.

Reology has 3,600 offices worldwide in 102 countries and territories and about 238,900 independent sales associates worldwide.

The company also owns a real estate brokerage division that operated under the Owned Real Estate Brokerage Services segment. It owns and operates a full-service real estate brokerage business under the Coldwell Banker, Sotheby's International Realty, ERA, Corcoran Group, and CitiHabitats brand names.

Realogy has been losing money lately, but analysts expect it to show positive earnings next year. The consensus analyst estimate of five-year earnings growth for the real estate firm is 22%, and the company appears ready to enter a boom phase as real estate markets improve. In spite of the anticipated strong growth, institutional investors own just 54% of the shares outstanding.

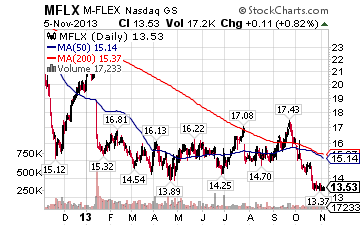

- Multi-Fineline Electronics Inc. (Nasdaq: MFLX) is another one of these ideal turnaround stocks to buy. This company is anticipated to stage an earnings breakout and enter a strong growth phase, analysts say.

Based in California, Multi-Fineline engineers, designs, and manufactures flexible printed circuit boards and related component assemblies for the electronics industry. It works with original equipment manufacturers and electronic manufacturing service providers in the electronics industry for applications such as mobile phones and smartphones, tablets, consumer products, portable bar code scanners, data storage, and medical devices.

Based in California, Multi-Fineline engineers, designs, and manufactures flexible printed circuit boards and related component assemblies for the electronics industry. It works with original equipment manufacturers and electronic manufacturing service providers in the electronics industry for applications such as mobile phones and smartphones, tablets, consumer products, portable bar code scanners, data storage, and medical devices.

So, Multi-Fineline is among great rebound stocks to buy because it's ready to benefit from increased consumer spending for consumer electronics and pent up demand for business IT products over the next several years.

In fact, Multi-Fineline is expected to turn a profit in 2014 after losing money this year. And its earnings growth for the next five years is anticipated to be 20% annually.

Yet in spite of this bright outlook, large institutions and other big funds own just 33% of this stock outstanding right now, making it the perfect time to add it to your list of stocks to buy now.

As the improvement at Multi-Fineline attracts more attention, the buying pressure from these large investors could easily push the stock price substantially higher in 2014 to provide savvy investors with a nice return.

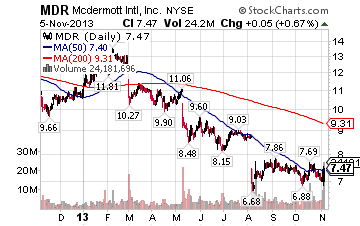

- The next turnaround investment is an engineering and construction company that builds complex offshore platforms for the oil and gas industry. It constructs floating and fixed facilities, as well as pipelines.

The company is McDermott International (NYSE: MDR).

The company is McDermott International (NYSE: MDR).

The company has seen earnings fall since 2007 from $2.66 to what might be $.40 per share this year.

The stock has fallen over the same time from above $60 per share to less than $8 today.

The near-term outlook for business is moderate, with backlogs staying fairly stable at around $5 billion.

However, here's why I'm keeping my eye on this one...

Global demand for oil and gas is going to increase over the next five years as will demand for offshore drilling and storage facilities.

Earnings should better than double in 2014 and could easily be back above the $1.50 mark in five years. A stronger economy that leads to higher oil and gas prices could push that number closer to $2.00. The stock can easily sell at three to four times the current price at some point over the next five years, giving patient investors a solid return on their investment.

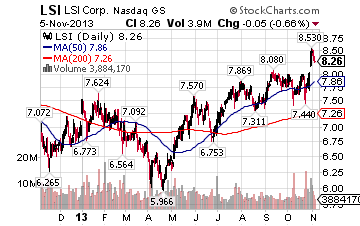

- LSI Corp. (Nasdaq: LSI) is another company with results suppressed by a weak economy. It currently trades slightly above $8 a share.

The company makes semiconductors for the storage and networking markets. The continued contraction of the personal computer and hard disk drive markets has continued to hurt LSI's earnings.

The company makes semiconductors for the storage and networking markets. The continued contraction of the personal computer and hard disk drive markets has continued to hurt LSI's earnings.

There are signs now that excess supply in these markets is being worked off and the business will stop declining. Sales should finally begin to grow again in 2014 according to most analysts and industry observers.

This combined with LSI's renewed focus on the fast growing flash drive market should allow them to resume stronger earnings growth over the next few years. The company's new hybrid drive products are expected to be well received by cloud computing, Web providers and other segments of the industry.

As the company continues to introduce new products and the PC markets stabilize LSI should be reporting record profits. After several years as a lagging issue the company could become a growth leader over the next market cycle and reward patient investors.

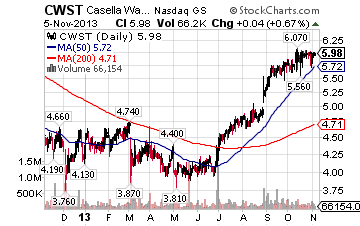

- Finally, Casella Waste Systems Inc. (Nasdaq: CWST) remains a favorite of many turnaround investors.

The company has seen weak results as a result of the fragile economy in its operating regions. Landfill volumes have been down, and the pricing of recycled products has been very weak.

The company has seen weak results as a result of the fragile economy in its operating regions. Landfill volumes have been down, and the pricing of recycled products has been very weak.

At about $6 a share, the stock is about one-third of where it was in 2008.

But as the housing market recovers and new construction and home refurbishing picks up, so will Casella's business. Increased building will generate substantial waste volumes.

Consumer spending growth will also help.

The company has a valuable collection of assets, including 17 recycling centers, 10 landfills, 31 transfer stations and four waste-to-energy operations.

If an improving economy allows management to focus on their goals of producing free cash flow and paying down debt, shares of Casella could provide patient, disciplined investors with monster returns. This stock could easily double or more over the next several years.

Best Stocks for 2014: Cheap Stocks with a Dividend

Individual investors have always had a soft spot for cheap stocks to buy, but get scared away because traditional Wall Street dogma would have you believe that these stocks are too speculative and dangerous for most individuals.

But cheap stocks can be among the best stocks to buy because they bring several advantages to a portfolio.

For starters, if you're buying a quality low-priced stock, you're getting high value for a discount. That's an obvious benefit.

There is also a not-so-obvious benefit...

Large institutional investors such as pension funds and some mutual funds are prohibited from buying stocks that trade below $5. As stocks slip below that price, analysts often stop covering the company due to a lack of interest from larger investors.

The lack of analyst coverage gives you a chance to buy before the stock comes to the attention of large institutional buyers. With cheap stocks, investors are less likely to be trading against the high frequency and short-term traders who need higher-priced, more liquid stocks to conduct their routine business.

Another note about cheap stocks: Hunting for cheap stocks to buy will often take investors to foreign companies' stocks trading in the United States.

Some investors avoid these shares - but you shouldn't. There are very profitable and affordable opportunities in this space. They can also offer a nice balance in your portfolio to shares of U.S. companies that haven't tapped into overseas economic growth.

Using the widely available web-based stock screeners, an investor can quickly compile a list of international low-priced stocks that trade at discounted valuations and have outstanding long-term potential.

I put together a couple cheap stocks to buy now that are both under $5, are benefiting from economic recovery, and have more than 4% dividend yield...

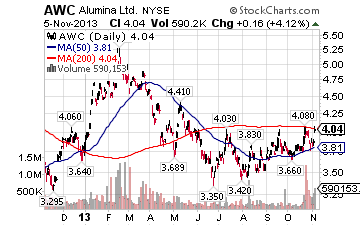

- One such company is Alumina Limited (NYSE ADR: AWC), an Australian aluminum company.

Alumina, which mines and refines aluminum, operates eight refineries and two aluminum smelters and owns or has interest in seven mining operations. It has a shipping operation that transports aluminum-related raw materials.

Alumina, which mines and refines aluminum, operates eight refineries and two aluminum smelters and owns or has interest in seven mining operations. It has a shipping operation that transports aluminum-related raw materials.

Alumina has a 40% stake in a joint venture with Alcoa (NYSE: AA), Alcoa World Alumina. Aluminum prices have been falling in the face of weak global demand, and inventories have piled up over the past couple of years. But as excess inventory is pared down, aluminum companies are stocks to buy now. These companies will see their bottom line and stock price increase fairly rapidly.

Along with other global aluminum producers, Alumina has been reducing capacity and lowering its cost structure by closing unprofitable facilities.

The company also sold stock earlier this year and used the proceeds to pay down debt levels and reduce interest expense. This reduced cost structure will add to the company's earnings growth potential when the markets do recover.

The few analysts who watch Alumina estimate that earnings should average gains of 15% annually over the next five years - but its stock could soar much higher.

Now Alumina stock is trading at 90% of book value, so the growth potential does not appear to be reflected in the current stock price. Alumina looks like a bargain stock that could easily double over the next five years.

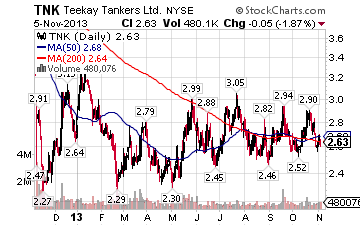

- Teekay Tankers Ltd. (NYSE: TNK) is another cheap foreign stock to buy now that appears to have enormous recovery potential over the next few years.

The Bermuda-based company has a fleet of 27 double-hulled vessels of various sizes and has seen its stock price decline as the shipping industry suffered from overcapacity and a weak economy. It's among the ideal shipping stocks to buy as the global economy improves.

The Bermuda-based company has a fleet of 27 double-hulled vessels of various sizes and has seen its stock price decline as the shipping industry suffered from overcapacity and a weak economy. It's among the ideal shipping stocks to buy as the global economy improves.

The recovering economy should help increase oil demand and the need for shipping crude oil and refined products worldwide. Overcapacity is a rampant problem in the shipping industry, but some older vessels are being scrapped, and new orders have slowed. Eventually the overcapacity problem should ease.

However, shares of Teekay Tankers are priced in a way that ignores the likelihood of improved capacity. The stock trades at just 80% of book value and is down more than 30% over the past year.

Although there are very few analysts that follow the stock, those that do think it will turn the corner next year and report profits for 2014. The company has paid a dividend for 22 straight quarters now, and the shares yield 4.38% at the current price.

TNK traded at $12 before the global recession set in, and a recovery to even half that amount over the next few years would double the money of those who purchased the stock now.

Best Stocks for 2014: IPOs

After Facebook's disaster, the IPO market looked bleak.

But thanks to a string of successes in 2013, the IPO market is heating up again.

In fact IPOs that debuted in 2013 are up a combined 35.29%, with a 3-to-1 ratio of positive to negative offerings out of the more than 100 IPOs this year.

As we conclude 2013 and enter 2014, the overall pessimism that engulfed the IPO market since Facebook went public has certainly disappeared.

Before we show you which IPOs to look forward to, here's a recap of some successful debuts.

The IPO market started rebounding at the end of 2012.

After the big hiccup with Facebook, there was pent up activity. Investors started moving toward anything with growth, and things started to return to normal.

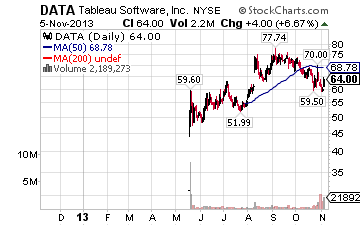

One of the better recent IPOs was Tableau Software Inc. (NYSE: DATA). The Seattle,WA-based firm is a provider of cloud-based applications and its list of over 10,000 clients includes Apple and Coca-Cola.

One of the better recent IPOs was Tableau Software Inc. (NYSE: DATA). The Seattle,WA-based firm is a provider of cloud-based applications and its list of over 10,000 clients includes Apple and Coca-Cola.

Tableau went public in May with a $31 price tag and closed above $50 on its first day of trading. It recently traded 132% higher than its offering price, at $72.

Tableau's IPO is part of a successful trend in cloud-based companies going public.

In addition to Tableau, these include Workday, Demandware, Splunk, ServiceNow, Guidewire Software and Palo Alto Networks - and high-end branded goods such as Michael Kors Holding Ltd. and Prada that appeal to consumers in emerging markets.

Based on the performance of the above companies, there are plenty of reasons to be excited for upcoming IPOs.

And by following these rules, you will be ready to profit.

The Secret to Playing IPOs

Ever since the Dutch East India Company became the first to issue stocks and bonds to the public in 1602, investors have seen initial public offerings (IPOs) as the road to riches.

Think back to the dotcom craze of the late 1990s. You'll remember it spawned a feeding frenzy among investors chasing after internet IPOs on an almost daily basis.

It wasn't long before investors on Main Street took the bait after watching hordes of new college graduates in Silicon Valley become instant millionaires.

But as companies with unproven business models executed massive IPOs with sky-high prices, many investors who succumbed to the siren call got clobbered.

Pets.com for instance, raised $82.5 million in an IPO in February 2000 before imploding nine months later. And EToys.com stock went from a high of $84 per share in 1999 to a low of just 9 cents per share in February 2001.

In both cases, small investors were left holding the bag. The point is IPOs have always been high-risk, high-reward.

Here's what you need to know...

First of all, most companies go public to raise capital, either by issuing debt or stock. After all, being publicly traded opens the door to potentially huge returns for the owners.

But that's not all.

Public companies pay lower interest rates when issuing bonds. They also can issue more stock to grow through mergers and acquisitions.

Then there's the prestige factor, the pure ego satisfaction of hobnobbing with the fat cats on Wall Street.

But from an investor's point of view, the road to prosperity with companies going public is often fraught with peril.

You see, most IPO s leave retail investors completely behind. Typically only the biggest clients with the deepest pockets are going to get in on a hot IPO.

These institutional clients usually have a cozy relationship with one of the underwriters - such as investment banks Goldman Sachs, JPMorgan Chase or Morgan Stanley.

The underwriters work behind the scenes with the company to compile the proper regulatory filings with the Securities & Exchange Commission, handle the paperwork and determine the offering price of the stock.

|

||

Market Timing & Trading Months 3 Best Trading MonthsJANUARY: Absolutely our favorite month as the "January Effect" takes place. The "January Effect" is essentially buying in stocks that were heavily sold for tax loss reasons at the end of the year. This is especially true in small caps and speculative stocks. January is also often a very strong month for the markets as post holiday sales figures are released. Even in a bear market, January will always provide us with a strong performance. JUNE: Summer doldrums? Not a chance. June is typically the month traders try to make enough to compensate for the doldrums of late July and August. More importantly, it is Russell re-constitution, and positioning in small caps prior to the institutional buying that occurs when new stocks are added to the Russell 2K can result in exceptional short term percentage gains. NOVEMBER: Typically, October is the worst month for the markets, and November is a rally month as the "Santa" rally begins and mutual fund tax loss selling is over since their fiscal years typically end October 31. Market lows are often set in October, with rallies out of those lows in November. 3 Worst Months for Trading and Why:Our final three months are our least favorite for trading. While they sometimes produce strong performance, these are typically our lowest percentage months for gains. OCTOBER: Historically, the worst performing month for the markets. Combine that with mutual fund tax loss selling, which ends October 31, and you get one of the most difficult months for trading. We typically enter more shorts in October than any other month, and try to position in stocks that were hit by fund tax loss selling for a little rebound in November. |

||

If the underwriters know the IPO will be in great demand and the price is likely to jump, they'll shower their favorite institutional clients with an allocation at the initial price.

But retail investors can still make money on companies going public. You just have to do your homework.

For instance, Amazon.com (Nasdaq: AMZN) went public on May 15, 1997, with an IPO valuation of $441 million. Today it's $138 billion.

EBay Inc.'s (Nasdaq: EBAY) IPO valuation on Sept 24, 1998 was $2 billion. Today it's $67 billion.

Just remember, don't buy a stock just because it's an IPO -- buy it because it's a great investment. 99% of the time, the success of an initial public offering (IPO) is determined by the firm - or firms - who sponsor it, and how early you can get in.

And the best time to buy IPOs is AFTER the initial mania settles down.

This could be weeks or months after the initial offering. The key is to be patient.

There are two reasons these delayed entries into IPOs can be golden for those who jump in at precisely the right time:

- You have a better idea of what the business is... and what its true potential can be.

- The price is usually settled or even deflated.

Top 8 IPOS to Watch

1) Square - Last August Starbucks partnered with Square in a $25 million deal that lets the mobile payments company process all of the coffee giant's debit and credit transactions. Square should continue gaining popularity as the "mobile wallet" industry takes off. Besides being a major player in this up and coming industry, Square is often thought of as a takeover target.

2) Chrysler - After a 15-year hiatus from trading on the markets, Chrysler will once again trade publicly. In the second quarter of 2013 Chrysler saw its profits rise 16% year-over-year. What's more, the Auburn Hills, MI-based company now has annual net profits of $750 million.When Chrysler has its IPO sometime in late 2013 or early 2014, it hopes to have the success that rival carmakers GM and Ford have had lately, up 45% and 70% respectively this past year.

3) Aerie Pharmaceuticals - Aerie is a NJ-based developmental drug producer primarily engaged in developing glaucoma treatments. In May the company successfully completed a Phase 2b clinical trial for its leading glaucoma drug AR-13324. Like many bio-techs the firm does not earn a profit, losing $10.4 million the first half of 2013. Yet, glaucoma, which affects 2.2 million Americans and is the leading cause of blindness, has no known cure.

4) Glam Media - Glam Media is a vertical-media company with entertainment and lifestyle Websites and blogs mostly geared toward a female demographic. The New York, NY-based company generates revenue through ads and has been profitable since 2010. Glam continues to grow through acquisitions and currently has 356 million unique visitors per month to its site. In June of 2012 Glam was rated the #1 digital lifestyle Website in the world by comScore.

5) Rapid7 & 6) WhiteHat Security - One or both of these companies could be the next huge cybersecurity play, as both are thought to go public in 2013. Rapid 7 saw its revenue grow by 75% in the third quarter of 2012 and continues to expand its product portfolio. WhiteHat was founded by a former Yahoo! Inc. (Nasdaq: YHOO) information security chief, and dozens of Fortune 500 companies rely on WhiteHat for protection. As the world becomes more complex, uncertain, and digital, expect cybersecurity companies to grow in importance and value. Plus, both of these are prime takeover targets by larger security and defense firms.

7) Dave & Buster's - Last October it pulled its IPO off the shelf, but keep an eye out for an offering some time in late 2013/early2014. The company provides the best arcade and gaming experience for adults and was hoping to join other restaurant companies such as Bloomin' Brands Inc. (Nasdaq: BLMN) and Chuy's Holdings Inc. (Nasdaq: CHUY) that have had successful IPOs this past year.

8) Twitter - When this San Francisco-based social media company goes public it will be the biggest IPO since Facebook's. While some say Twitter is not prepared for Wall Street, it has filed for an IPO and will trade under the ticker TWTR. In 2012 the company posted revenue of $317 million. That's 10 times less than the $3.7 billion Facebook reported its full year before going public. For now, investors will have to wait and see what TWTR is priced at before even thinking of buying.

3 IPOs to Avoid

All three of these companies present huge risks for investors and should be avoided.

1) Pinterest & 2) Tumblr - Both of these companies face issues similar to Facebook's in terms of generating profits and revenue from their user base, as well as monetizing mobile users. Pinterest has not proven its business strategy is legitimate and has even admitted it does not know how to turn its user base into profits. While just as popular as Pinterest and Facebook, Tumblr is an even riskier IPO to consider, and generates minimal revenue. Even though both sites are incredibly popular, their fate as public companies could easily follow Facebook's path.

3) Living Social - The vouchers Website might go public in 2013, but its business structure is too similar to Groupon Inc.'s (Nasdaq: GRPN), which has done awful since its IPO. After touching $30 on its IPO day, GRPN immediately began to sell off and currently trades around $8. If Living Social has an IPO make sure to avoid it.

Best Sector of 2014: Energy

Right now, many investors are getting swept up by trendy, headline-making companies like Facebook (Nasdaq: FB) or Twitter.

Investing in stocks like these can be risky if the timing is wrong. That's especially true now, when U.S. budget battles can trigger stock market volatility that sends trend-based stocks like Facebook into a free fall.

Instead, investors should look at low-risk, high-gain "must-have" markets.

The best must-have markets are in front of us at all times - so necessary to our daily lives that they will not disappear.

Love this special report? Hate it? We want to hear from you! Tell us what you think of this report and what you'd like to see on Investors Alley in the future. Click here to email us your comments and feedback. |

||

Even better: They're largely immune to Washington's hijinks.

And they're flooded with money.

That's why it's the perfect time to invest in energy.

Money Morning Chief Investment Strategist Keith Fitz-Gerald says energy is a "$12 trillion market that isn't going away any time soon."

These Billion-Dollar Numbers Say it All

You see, the world's population is growing at an astounding rate.

Today, there are 1.8 billion middle-class consumers in the global economy. By 2030, we can expect 3 billion more - that's a 266% increase.

And the existing power infrastructure can't keep up with that rate of growth.

For instance, power quality issues in the Unites States already cost more than $250 billion a year to resolve. In South America, the demand for electricity will double by 2020, and it completely lacks the grid to support that kind of growth - so outages will become commonplace.

That means there's going to be major investment in increasing energy supply to keep up with soaring demand. And those are just energy infrastructure problems facing the Americas.

The accompanying map shows how much global energy investment is needed in the coming years to keep up with demand.

This is why investing in energy will deliver gains far longer than any of today's trendy stocks.

Just look at these shocking numbers that reveal how big of an investment opportunity the energy market is (numbers courtesy of McKinsey Global Institute):

- The U.S. will spend at least $540 billion per year in order to meet energy demands from 2013 to 2030. Worldwide, that number is roughly $700 billion per year. And energy is not an expense that will get slashed by cost-cutting governments. "There's not a government in the world that can't afford to keep the lights on. This spending is absolutely at the top of the priority list," Fitz-Gerald said.

- On the low end, that means the world will spend approximately $12 trillion on energy needs by 2030; Fitz-Gerald believes we are looking at a figure closer to $15 to $17 trillion. To put that figure in perspective, there is approximately $1.22 trillion of U.S. currency presently in circulation, of which $1.17 trillion is in Federal Reserve notes.

- Oil demand will increase with population growth, but the oil we need is increasingly challenging to access. The last decade has seen a doubling in the average cost to bring a new oil well on line. "We've got to drill deeper, we've got to drill horizontally, and we've got to use new technology to get the same amount of oil to the surface and in production," Fitz-Gerald explains.

Plus, there's going to be more reliance on these hard-to-reach, unconventional energy sources as a growing percentage of the world's oil fields are down for repairs, are badly in need of capital investment, and are increasingly subject to terrorist and military action.

- Up to $1.1 trillion is spent by governments annually on resource subsidies. Several countries commit at least 5% of their gross domestic product (GDP) to energy subsidies.

For instance, in 2011, the United States government spent $24 billion on energy subsidies. To break it down even further, renewable energy and energy efficiency accounted for $16 billion, and the fossil-fuel industry received $2.5 billion in tax breaks, according to the Congressional Budget Office. "I think that the percentage of GDP spent on energy subsidies is going to rise because the trade-off is between supplying energy and massive civil unrest; governments will obviously choose the former," Fitz-Gerald notes.

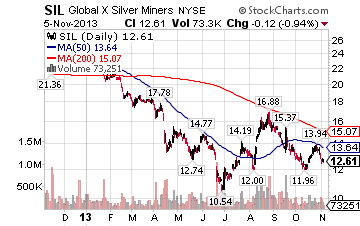

7 Bullish Cases for Silver in 2014In this time of economic uncertainty, investing in silver and other precious metals instruments is a must.By devoting even a small portion of a portfolio to precious metals, investors gain valuable protection against inflation, stock market drops, and any other repercussions from Washington's debt-ceiling drama. So far in 2013, investing in silver has been rocky. Silver prices have dropped nearly 30%, likely under pressure in the short term due to sluggish key factors in global markets. But despite the short-term performance, silver prices are still a whopping 250% higher than its 2008 lows. And long-term prospects look particularly bullish. The growing demand for emerging products, China's introduction of silver futures, new movement in India, and continued U.S. government dysfunction all point toward silver market growth. Taking these factors into account, plus 2013's fresh lows, means right now is a great time to get on board with silver. Here are several important factors that will push silver prices higher in the year ahead.