If You’re Ready to Retire But Can’t Because You Lack Money, Safety, or Time:

“Copy-Paste” This Portfolio Into Your Trading Account (for Easy, Lifelong Income)

“My wife was able to quit her job and stay at home with our son. Without this [easy income], this would not have been possible!” – Mark P.

No more risky investing strategies or tiny dividend payouts — this portfolio is your shortcut to easy retirement income that will pay you hand-over-fist for life.

From: Tim Plaehn

Chief Income Strategist, Investors Alley

If you’re at or near retirement age…

… this will be the best news you’ve heard in a long while.

It’s the quickest, easiest way to tap into a big retirement income stream…

And I guarantee it’s unlike anything you’ve ever tried or seen before…

In fact, within minutes of signing up, you’ll suddenly have…

Here’s why…

“Copy-pasting” this portfolio into your trading account will change your retirement forever — because it’s working for regular folks right now…

As I write this, even absolute beginners are enjoying easy income simply by using what I’m about to show you.

I’m talking consistent income delivered into their accounts multiple times a month.

Sound like something you’d be interested in? If so, great!

You’re in for something special…

Because with this “copy-paste” portfolio, you’ll have instant access to the best income-paying stocks available in the markets…

These stocks have all been pre-selected to deliver you income no matter if the market is moving up, down, or sideways… so that now you can finally…

Relying on Social Security

‘Breadcrumbs’ for Income

In fact, moments after signing up…

You could be set up to now collect $5,000… $25,000… even $100,000 extra in the years to come…

Without any guesswork… and without risking money and precious time trying the latest trading strategy.

To put it bluntly:

Every trading or income strategy you’ve tried up to this point has probably done more harm than good to your retirement…

This portfolio is built from the ground-up to fix that as fast as possible.

Just ask Tom, Gayle, and so many other regular folks seeing big results…

I have now been retired for a full year – ⭐⭐⭐⭐⭐

“I have now been retired for a full year and I just wanted to let you know that I have had great success investing my retirement nest egg using [this strategy]. My wife and I are living off of the dividend payments and have seen a total portfolio return of 23% over the past year.” -Tom and Gayle H.

God bless you and keep up the excellent work – ⭐⭐⭐⭐⭐

“Please note that I enjoy your service tremendously, and have and continue to recommend your [method] to many of my friends. God bless you and keep up the excellent work.” Louis P.

My portfolio is up $75,000 – ⭐⭐⭐⭐⭐

“My portfolio is up $75K since Jan 2016 after instituting your investment philosophy.” -Thomas B.

The portfolio I’m about to give you — takes “guesswork” out of the equation.

It doesn’t matter what amount of previous investing experience you have…

Even if you’re a flat-out beginner.

That’s how easy setting up this income stream is.

And it couldn’t have come at a better time.

Because nowadays, every American at or near retirement age needs extra income, there’s no way around it.

America’s Retirement Crisis

Let’s cut right to the facts…

One-in-three working-age Americans have less than $5,000 saved for retirement.

Three-fourths of Americans say they won’t be able to achieve financial security in their lifetimes.

Worse, the U.S. Census Bureau reports that 57% of working-age adults have no 401K assets at all.

And those that do have savings aren’t much better off.

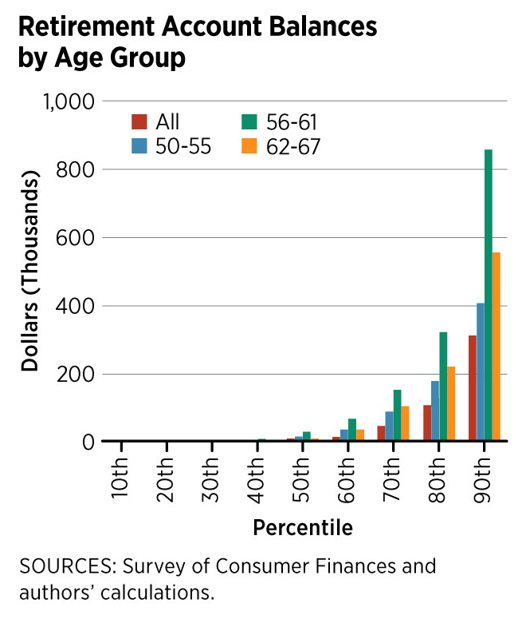

Right now, the average 401K balance for Americans ages 50-59 is $152,700 – not enough to live off of in retirement.

Right now, the average 401K balance for Americans ages 50-59 is $152,700 – not enough to live off of in retirement.

Even when you include Social Security.

And let’s face it, for most of us, employers aren’t much help either.

According to the Social Security Administration, 20% of American workers have access to a pension. That’s down almost 50% from 1980!

But if you think this won’t affect you, think again…

Will Be Affected by This Crisis

Starting in 2011, more than 10,000 Baby Boomers started to leave the workforce every day.

By 2013, that figure rose to 11,000.

Since then, this massive retirement wave has only accelerated.

A process that will continue for the next decade.

Not only will this strain Social Security and Medicare.

It’s also occurring at the worst possible time for anyone counting on the stock market for a comfortable retirement.

For the past decade, the stock market has been a bonafide money-printing machine.

Averaging 14.2% per year.

A $500,000 nest egg invested in the S&P 500 March 2009 would be worth almost $2 million at the turn of the decade

But what typically follows years of above-average returns is… that’s right you guessed it… years of below-average returns.

It’s how the market works.

Some time periods are above average.

Others are below average.

That’s the definition of a long-term average return.

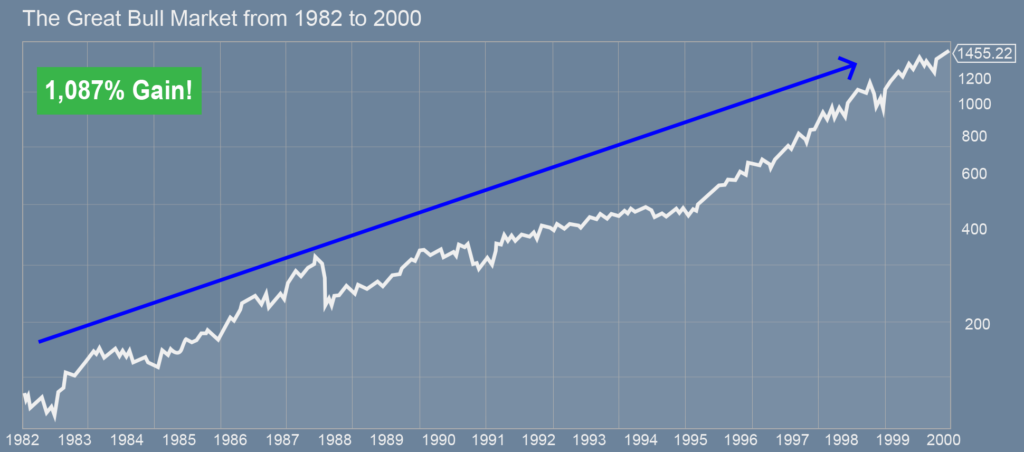

Take the 1990s – the previous stock market ‘Boom Period’.

Fueled by tech stocks and a roaring economy, the stock market surged to unprecedented heights:

Even at the peak, there was no reason to think the good times wouldn’t keep on rolling…

But we all know how this story ended.

The “tech-wreck” followed and investors got hit hard.

Had you been fully invested at the market peak, you would have had to wait 15 years to get back to even.

Probably not.

In fact, doing what Wall Street advises, there’s a better than likely chance you would NEVER have gotten back to even.

Every year you would have been drawing down your nest egg.

In other words…

The day you retire is the richest you’ll ever be.

I call it “Peak Net Worth.”

And the same thing happened to anyone that retired in 1968.

Average returns across these years would have devastated investor savings.

Back then retirees could have survived.

They had pensions and Social Security to fall back on.

Today’s retirees won’t be so lucky.

Because the charts all show…

A “lost decade” is a decade, or more, when stock market investors see 0% total returns.

It’s devastating to anyone at or near retirement age.

Just when retirees need the market to continue rising the most.

Ask yourself: What if you had just entered retirement in 1968? Or in January 2000?

Not only would your nest egg have suffered….

You would have made the problem worse by withdrawing from your principal at the worst possible time.

Imagine, watching your life’s savings dwindle…

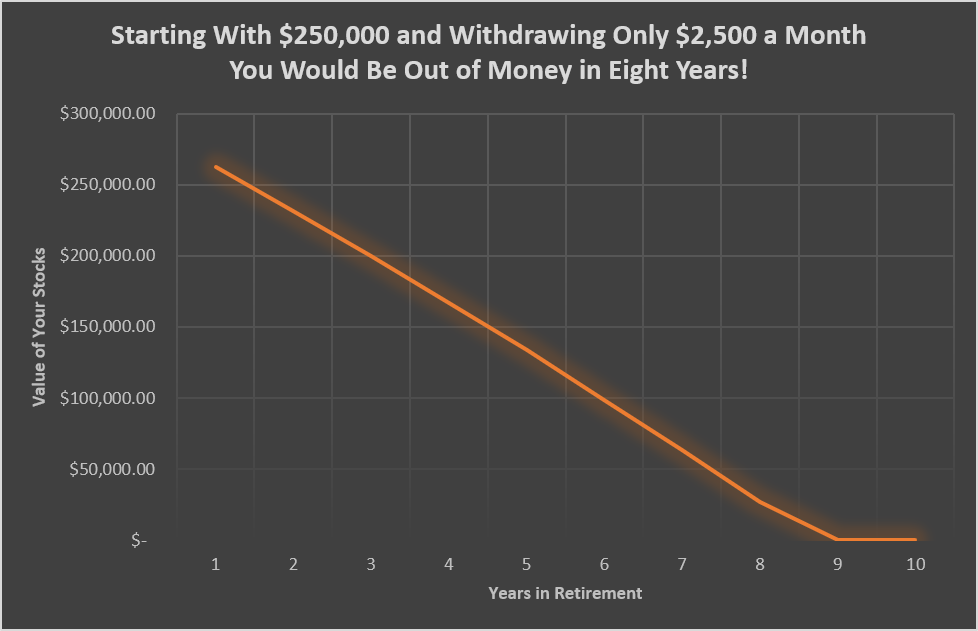

Starting with $250,000 and only withdrawing $30,000 a year (I’d say this is a minimum to live on) you’d be…

In fact, you might not have to imagine…

Most trend experts forecast the 2020’s to be a “lost decade”.

So the crux is this, over the ultra-long-term, the stock market is your friend.

But there are periods, even decades, where it’s not.

In other words…

Anyone without safe streams of income now is in trouble.

Or put more simply…

Kiss Your ‘Dream Retirement’ Goodbye

Because even if you do everything right…

And make the tough decisions to reach the ‘Promised Land’…

It’s still not enough.

AARP recently made the situation crystal clear, saying…

“…for a retiree to generate $40,000 a year after stopping work, he or she will need savings of about $1.18 million to support a 30-year retirement…”

Even if you plan on living simply one thing is for sure: It’s getting harder and harder to retire in America.

What you need is a built-like-brick portfolio…a way to achieve the kind of retirement you deserve easily…

The solution to all the headlines we’re seeing more and more these days…

This portfolio gives anyone the power to take control of their financial future.

I’ll walk you through the all-star stocks inside of it… and how you can easily sign up just a few moments from now…

But first, I need to fill you in on something sinister I mentioned earlier.

Because if the lack of savings wasn’t enough…

There’s something even bigger standing between you and the retirement of your dreams…

For decades, financial planners have been preaching “The 4% Rule.”

It’s based on an economic study conducted in 1994 by Financial Planning Guru Bill Bengen.

He wanted to answer a simple question.

How much could you withdraw from a retirement account

and have it last for 30 years?

After some number crunching, he got his answer: 4%.

It sounds reasonable enough…

But to get that number, he had to make some assumptions.

Including:

- Modest inflation.

- Average stock market returns of 8% per year.

- At least a 90% chance of your money lasting your lifetime.

It’s a powerful idea.

One that millions of retirees follow today.

One that became all too clear earlier this year:

Why would a large number of Americans suddenly lose their millionaire-status?

Surprise, surprise — the stock market tanked.

And that’s the great flaw of the 4% Rule.

Just imagine…

You’ve worked your whole life to build a retirement nest egg.

Then one day, it happens: You are a millionaire!

Mission accomplished, right?

Wrong.

Because while for most of the 2010s, the stock market has been the place to be:

53,600 soon-to-be retirees around the start of the year had their nest eggs affected, some even wiped out, this year.

Imagine watching your retirement disappear in an instant…

Maybe you don’t have to imagine, maybe that’s exactly what happened to you back in March…

That kind of shakeup will make your stomach churn…

…especially if you’re counting on those returns to pay your bills.

Which is exactly why I say my next point with full confidence:

The real truth is that the 4% Rule is just about the riskiest ‘retirement plan’ out there.

I’ve seen it over and over.

Stretching all the way back to my days as a stockbroker at a regional bank, to the corona crash we experienced in March.

Because the 4% Rule ignores a long list of flaws like…

- How do you retire if you don’t have $1 million or more saved?

- What if you live longer than 30 years past retirement?

- Will there be enough to leave something for your children?

- Where do you go if inflation picks up, which was a major problem in the 1970s?

That’s why I created this copy-paste portfolio I’ll be sharing with you today, to safeguard you against this.

Including the biggest flaw of them all…

or tanks before the election?

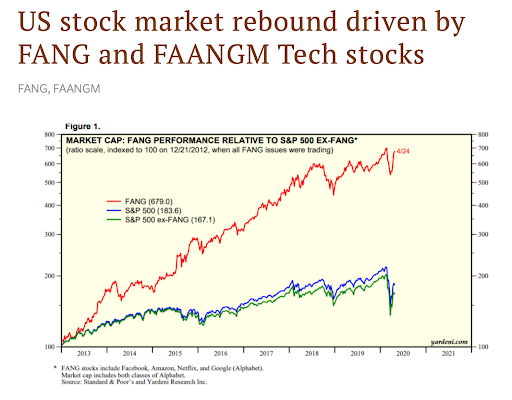

As I write this the S&P 500 has rebounded slowly since the corona crash…

But as you and I know far too well, nothing lasts forever.

There’s no telling what can happen between now and November.

And most people don’t consider two things…

Firstly, this much-hyped recovery is basically all tech stocks.

25% of the S&P 500’s recovery is all thanks to just six big tech stocks — it’s another bubble waiting to burst.

And secondly, the market doesn’t even have to go down to have a devastating effect.

Were stocks to simply stay flat for 10 years and you withdraw 4% of a $1 million next egg per year you’d be down to $600,000!

The worst part… you’d have to make that money last for the rest of your life!

Now you see why I call it the “4% Problem” instead of the “4% Rule”

Everyone knows the stock market goes up over time.

And that’s true – over the long run.

But you don’t get to make decisions over the long-run.

right here, right now

For example, imagine saying to the electric company you’ll pay your bill once the market rallies back from a selloff.

They’d laugh right in your face.

And yet —

Whenever a Financial Advisor talks about the market going up over time, they always refer to periods like 1982 – 2000:

What they fail to mention is what happened right before the boom years:

Or more recently…

As the old saying goes, “The devil is in the details.”

And “lost decades” are a fact of life your financial advisor is happy to brush under the rug.

Fortunately, all is not lost.

is Your Solution

The moment you buy the stocks inside and add them to your trading account…

You’ll be set up to generate lifelong income without ever having to sell off your nest egg.

And to go along with it…

I’ll also give you a 5-part masterclass for navigating your retirement…

And adding onto the foundation you’ll have thanks to this “copy-paste” portfolio for even more income.

The timing for you could not be better…

Because if history is any guide, we’re about to experience a period of low returns for the foreseeable future…

So without further ado, let me properly introduce myself, and show you how to “copy-paste” this winning portfolio.

Hi, my name is Tim Plaehn.

Hi, my name is Tim Plaehn.

I started out studying mathematics at the Air Force Academy.

That’s me during my fighter pilot days. Loved flying the F-16 and proud to serve my country.

And went on to serve as a U.S. Air Force Fighter Pilot.

It was only after my stint as a fighter pilot that I turned to the financial markets.

As a stockbroker and financial planner, it was my job to help my clients retire.

It was at this point in my career I realized that most of the ‘advice’ out there was useless for building a leisurely retirement…

We had all sorts of ways to pick stocks.

Strategies that used…

- P/E Ratios

- Technical Analysis

- Fundamentals

- Market Betas

I knew even then that none of these metrics would help my clients retire.

Because they all target capital gains and the 4% Rule.

Everyone’s goal is to retire comfortably – and you can’t do that by selling off your assets.

I noticed that the wealthiest people I knew all invested differently. They always bought dividend stocks.

It sounded so simple.

They focused on streams of dividend income instead of what the market was doing.

They knew that you can’t always count on the stock market – but you can count on dividends.

I decided that I wanted that for myself.

I wanted the freedom that comes from having my own portfolio that provided me with endless income.

Since then, I’ve never looked back.

I ‘retired’ long ago.

But I’ve continued to work thanks to a “love of the game” and a desire to share all I’ve learned.

Believe me when I say, there’s nothing better than knowing you have a stream of endless income arriving like clockwork.

In other words, while everyone’s up early watching the markets…

That’s what you can do with this portfolio.

You can finally ignore the market.

Instead of focusing on this…

You can focus on this…

Instead of hunting for home-run stocks and capital gains you should always be on the hunt for dividend income.

And there’s no better way than “copy-pasting” this start out portfolio into your trading account.

The Start Out Portfolio features my best ideas.

Dividend stocks that…

- Pay a high current yield.

- Features payouts that are all-but-guaranteed to keep happening, no matter what.

- Offer the potential for meaningful dividend growth in the years ahead.

Right now the average yield of the Start Out Portfolio is a juicy 8.8%.

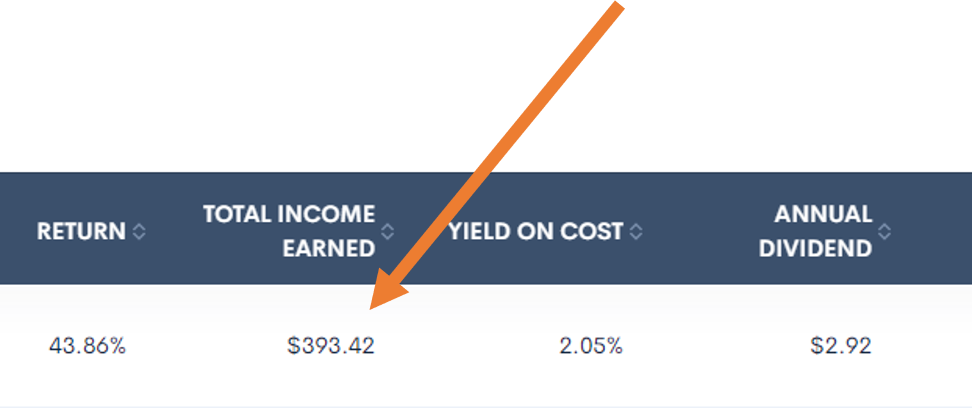

As icing on the cake, because these are my best ideas, these stocks also offer the chance for capital gains.

Here’s just a taste of what’s inside:

- The first two Starter Portfolio picks are my top two REIT plays — one of which currently yields a whopping 12.7%.

- Next you’ll find two commercial mortgage lenders, with the highest yielding paying investors a juicy 9% per year.

- No retirement income portfolio would be complete without an energy infrastructure play, with my top pick in the sector paying out an incredible 17.5% per year.

Right out of the gate… you could be making 8% or more.

Which is incredible, if you consider the market’s average return for the past 100 years has been exactly 8%.

Just imagine…

That would allow you to live the retirement you dream of.

Quality time with family…

Trips to the beach…

Or simply kicking back and enjoying life…

How’s that sound?

If it sounds like the life you want, congratulations!

Turn off the TV.

Forget the talking heads in the financial media.

And prepare to become a Dividend Hunter.

Because this is your chance to choose the kind of retirement you desire.

As you saw in the beginning, I’ve already taken countless investors on the path to this dream retirement…

For them, investing is fun…and profitable.

That’s what I want for you.

Because it works.

And the best part of all this is you can start investing just like me and my readers TODAY.

You can have full access to this start out portfolio and

my investing knowledge right now at NO COST TO YOU.

I’ll tell you how in a few moments.

But first, I mentioned earlier I would also be giving you a free 5-part masterclass for navigating your retirement.

I’d like to take a moment now and walk you through each part so that you know the value of what you’re getting.

To do anything well, you first need to understand it.

And if you want to enjoy a dream retirement you’ll need the ‘Becoming a Dividend Hunter’ dossier.

And if you want to enjoy a dream retirement you’ll need the ‘Becoming a Dividend Hunter’ dossier.

It serves as a primer for what it means to be a Dividend Hunter.

After all, change doesn’t happen overnight.

I’ve already shown why you need to become a high-yield investor to enjoy a real retirement.

This dossier is the “how.”

I’ve seen it time and time again. Someone takes charge of their retirement only to stumble right out of the gate.

It doesn’t have to be that way.

What they forget is that you have to walk before you can run.

Which is why I created part #1.

Inside you’ll discover…

- An in-depth overview of The Dividend Hunter Philosophy so you’ll know how to succeed.

- A review of who can benefit the most from my approach to income investing.

- Why The Dividend Hunter is unlike any other investment advisory publication and what it means for your wealth.

- What you can expect once you’ve made the decision to invest for dividends instead of playing the “Capital Gain Game.”

- The reasons why investing for income is the best way to set yourself up for a lifetime of wealth and security.

And best of all…

- A step-by-step plan for building your own Endless Income Portfolio.

I’m with you every step of the way.

With this report as a primer, you’ll see why going hunting for high-paying dividends is the best path to your dream retirement.

But it doesn’t end there…

Once you’ve gone through part #1, this is where you go next…

I call it the “Building an Income Portfolio That Lasts a Lifetime”.

I call it the “Building an Income Portfolio That Lasts a Lifetime”.

It contains all the practical how-to’s of scaling your start out portfolio to receive all the endless income I’ve described here today.

Every piece of this kit is a response to a REAL need that readers have expressed.

A dream retirement means having income coming in every single month – and this guide shows you how.

As a bonus, it will show you how to…

- Use the Dividend Hunter’s Payout Calendar to build a monthly income stream.

- Dividend reinvestment strategies.

- Buy and sell rules for long-term success.

- How to put the Dividend Hunter to work for you.

For anyone starting out as a Dividend Hunter, this is a must-have.

One subscriber, Stan P., said it best…

“Thank you for the valuable service you provide… I’ve become convinced that the best investment approach for me is dividend income.”

But it would be incomplete without the next part…

Something big is coming.

As I’ve already discussed, the market moves in waves.

And every so often, capital gains-focused investors can go years without seeing returns.

It’s why one of the biggest fears investors have is a bear market… a market swoon that wipes out their savings.

And if history is any guide, we’re closer to one now more than ever thanks to coronavirus.

Which is precisely why this next blueprint component is so valuable.

I call it…

“Sustaining Your Income During the Next Bear Market.”

“Sustaining Your Income During the Next Bear Market.”

What you do today very well could determine your financial fate for the rest of your life.

Just imagine, trying to retire now, at the start of what could be the next “lost decade.”

Each year you do just as your financial planner advised – selling 4% of your principal to pay living expenses.

And every year, you see your portfolio value shrink.

Down… And down… And down.

This is why I compiled this report.

As we enter our retirement years what we do with our savings becomes all the more critical.

Don’t be one of those investors chasing capital gains hoping the stocks you own go up…

That’s how you wind up continuing to work just to make ends meet well into retirement.

Inside this part of your 5-part masterclass you’ll find everything you need to tailor the Dividend Hunter philosophy to achieve the retirement of your dreams – no matter what the market does.

Every day I get an email from someone worried about what the future holds.

How will they retire if the market falls?

These individuals aren’t crazy.

They’re expressing fear about a very real possibility.

They don’t want to leave their retirement to chance …and neither should you.

“I am very glad I subscribed to The Dividend Hunter”

-Johann R.

a

Dividend Hunters leave nothing to chance.

True “Hunters” focus on how much cash they’re receiving from their investments.

Once you become a Dividend Hunter you’ll find there’s nothing holding you back.

In fact, you’ll discover new ways of making money most investors have no idea exist.

Strategies like…

This is my secret weapon.

Lots of “gurus” have secret weapons.

But believe me when I say, this one is in full alignment with the Dividend Hunter philosophy.

I call it…

The “Income Investor’s Secret Weapon”.

The “Income Investor’s Secret Weapon”.

You see, Wall Street has lots of ways to make money off Main Street.

My secret weapon takes the fight to Wall Street…

And puts the power in your hands to make outsized profits.

Imagine… turning a dividend stock that yields 5%…6%… even 8% and then doubling that income?

Whenever I mention this secret weapon, and it’s potential to make anyone 10%, 12%, as much as 16% in a single year, peoples’ ears perk up.

That’s because this ‘Secret Weapon’ is the best way to live life to the fullest.

And make sure stress-free living…

…is a reality for you and your loved ones this strategy is indispensable.

This strategy is how you go from guaranteeing endless income to becoming wealthy.

“I just want to say what a great system you have introduced me to…”

-Mark C.

“…I made 66% in 45 days’’

-Peg B.

With The Income Investor’s Secret Weapon you’ll be able to turn Wall Street on it’s head.

And start making real income in retirement.

That leads me to the fifth and final part of your masterclass.

One should always know where they stand.

That’s particularly true when it comes to investing.

Every day I get an email from a subscriber asking me what they should do given their situation.

More often than not, they fall into one of three categories of investor.

What you do at each stage is crucial to your long term success.

Which is why I created…

“Your 3 Phases of Being An Investor and How to Profit” report.

“Your 3 Phases of Being An Investor and How to Profit” report.

The end goal of this report is to show you what to do at each stage.

That way you’re on the path to enjoying the retirement of your dreams.

All these reports are worth more than $900.

But you get them FREE today.

In fact, I’m about to tell you how I’m going to sweeten the pot.

We’ve talked a lot about having a ‘stress-free’ retirement today.

For most Americans, that means having the confidence you’ll never run out of money.

And part of being stress-free is having someone in your corner helping you at all times.

An expert who can guide you through this transition.

That’s why I’m inviting you to enjoy these three FREE bonuses and much more inside my most popular flagship investment newsletter, The Dividend Hunter.

The Dividend Hunter is my private members-only community where I reveal how to both profit from top-paying dividend companies and see consistent “paychecks” monthly.

You gain access to my personal Dividend Hunter Portfolio.

It’s comprised of stocks I’ve purchased for my own account —

And today, I have a very special offer for you.

A “Thank You” for listening to this presentation.

I’m sure by now you’ll agree that investing for income is the only way to guarantee the kind of retirement we all desire.

That’s why I created the start out portfolio

You simply have to “copy-paste” it into your account to start earning endless investment income.

Then, once you’re set-up, you’ll be able to use each part of the retirement masterclass to build a moat around your income and multiply your profits year-after-year.

- Masterclass Part 1 – Becoming a Dividend Hunter. Describes the philosophy behind my style of investing and the Dividend Hunter Worksheet that allows you to fully understand your finances. Value: $49.

- Masterclass Part 2 – Building an Income Portfolio that Lasts a Lifetime that dives into the nuts of bolts of building a wealth-generating portfolio that lasts. Value: $99.

- Masterclass Part 3 – Sustaining Your Income During the Next Bear Market contains everything you need to thrive no matter what the future holds. Value: $199.

- Masterclass Part 4 – The Income Investors Secret Weapon is perhaps my most coveted profit-generating secret. Value: $499

- Masterclass Part 5 – The 3 Investor Phases and How to Profit in Them teaches you what to do and when throughout your investing life. Value: $99.

Along with the start out portfolio…

The value of this Retirement Masterclass exceeds $900!

And it can be yours FREE with this special offer.

As we’ve learned, anyone can become a Dividend Hunter with the right tools.

But it takes time, discipline, and dedication to truly maximize your gains.

That’s why I started my investment service.

To allow anyone to benefit from the Dividend Hunter philosophy in just a few minutes a day.

The Dividend Hunter’s “copy-paste” starter portfolio and retirement masterclasses are yours to keep with your Risk-Free Subscription.

Once inside you’ll find everything you need to start earning thousands of dollars per month – a real income that lasts a lifetime.

Get started right now by clicking the button below. You’ll be taken to a secure page to put in your information.

You’ll join thousands of others already benefiting:Steve L. wrote me saying:

“I have invested just under $100k and my return percentage is higher than my financial agent can manage. Go figure.”

-Steve L.

And this message from Vic B. in Colorado…

I just wanted to take a moment to thank you for your wonderful newsletter and dividend tips. I have subscribed to a lot of stock newsletters in the past and found them to be very hard to understand.

I have tried several newsletters and yours is the only one I have stayed with.

-Vic B.

I am glad to have found The Dividend Hunter and all your weekly updates. The dividend calendar is excellent and I have been using it regularly.

I eagerly await all your updates and thank you for improving my income stream with all your great ideas.

– Jack G.

The Dividend Hunter will be your go-to resource for building a lifetime of Income.

Thousands have already joined.

If you’re serious about creating a long-lasting income, The Dividend Hunter is worth every penny.

The going rate for The Dividend Hunter is $99 a year.

And I know it’s worth far more.

Believe me this is not some “money grab” situation like a lot of other financial publications engage in.

It’s my attempt to open a whole new world of investing success to you.

That’s because I know that when you begin experiencing the kind of success I’ve described here today, you’ll be back for advanced investment training.

Ways of making money that few know of and allow practically anyone to kick Retirement A into overdrive.

Plus, the wealth of knowledge in the Endless Income Blueprint is worth $945.

But all of it can be yours for just $49.

You read that right.

Today, you can get a one-year membership to The Dividend Hunter for a mere $49 investment.

More than 90% off!

$49 in the grand scheme of things isn’t much. You’ll pay more for a nice dinner out — and that’s without the wine.

And that’s to say nothing of the thousands you’ll start earnings per month like clockwork!

I’ve been told $49 is far too low for all the monthly issues, the updates, and the sheer amount of income you could make.

Here’s what some of my current members had to say:

I cannot remember just how I became acquainted with your Dividend Hunter newsletter, but I am truly thankful. The dividend payouts are like clockwork. Set and forget… have already made back my subscription fees plus. Consider me hooked!

— Alan F

“Thanks to your advice, we are now getting money that we were missing out on before. Our first month’s dividend checks will surpass $1,250!

-Pedro T

What a privilege to have access to your sage advice-I’m shaking my head in disbelief at how my dividend portfolio is performing. Thanks again.

— John O., New York

To join, all you have to do is click the button below.

For the amount of value you’re getting, I’d be tempted to offer zero refunds. I can’t afford to waste time with investors who aren’t serious.

However, I want to make it a no-brainer decision for you, so I’m offering you a full year money back guarantee.

At any point, if you don’t find The Dividend Hunter to be worth every penny…shoot me an email and you’ll get a full refund.

In fact, you can even keep the Endless Income Blueprint Components as a free gift.

Retirement A may be harder to achieve these days.

But that doesn’t mean it can’t be yours…

That you can’t live the life of your dreams after a lifetime of hard work.

The first thing you need to do is ignore what the Wall Street advisors have to say.

They want you to swing for the fences and invest for stock market capital gains.

Next you need to turn off the TV.

And focus on what’s important – generating real income.

Just like you always have.

Becoming a Dividend Hunter is the easiest way to make it all happen.

You’ll have an Endless Income coach right by your side every step of the way.

I created my service for you and anyone else that wants to guarantee the retirement they deserve.

All for just $49.

Leaving your financial retirement to chance is the sure path to Retirement B…

I’ve seen it time and time again.

Every day you delay is one more day further from Retirement A.

You could be generating tens of thousands dollars in endless income right now.

I urge you to…