A Little-Used “Options Loophole”…

Easiest Time in History

to Upgrade to Your Dream Retirement

…Starting with just $2,500…

…upgrade the Lexus to a Porsche…

…supercharge those ragged golf clubs to premium PXGs…

…rather than one small trip a year, splurge on four big ones for the whole family…

…fly first class over coach every single time…

The tipping point between an ordinary retirement and a dream retirement isn’t as drastic as you might think.

Rather than sending out for a cheap pizza each week …

Maybe you retire and spend more days visiting the premier steakhouse of your choice.

Rather than downsize after the kids move out to save money…

You retire and purchase that sprawling estate with the outdoor pool you’ve envied.

Do you see where I’m going with this?

Rather than land season tickets in the top deck for your favorite team this year…

How would you like to sit club level every game. Watch the game from plush seats while enjoying five-star foods.

We’re not talking about getting rich quick or anything.

It’s a simple upgrade from a ‘coach’ retirement to ‘first class’ retirement.

If that sounds like what you want…

Now may be the easiest time in your life to retire and feel rich…

And guess what…you can start with just $2,500.

“That’s impossible. Everything is so expensive nowadays. $2,500 is nothing.” someone told me.

You know what…stuff is expensive.

Healthcare, homes, iPhones. Too expensive.

You know what’s not expensive?

Options aren’t.

They’re dirt cheap right now in fact.

So cheap that I’ve found an “options loophole” that could allow you to pick up options at fire sale prices.

If you’ve ever heard the phrase “buy low, and sell high”…well, this is as ‘buy low’ as you can get.

Investopedia claims “it has never been cheaper” to buy options.

Reuters blares “it’s time to buy options.”

Goldman Sachs see “historic opportunities” to buy options in the coming weeks.

And those fire sale prices give you possibly the greatest (and fastest) opportunity to upgrade to your dream retirement with little money.

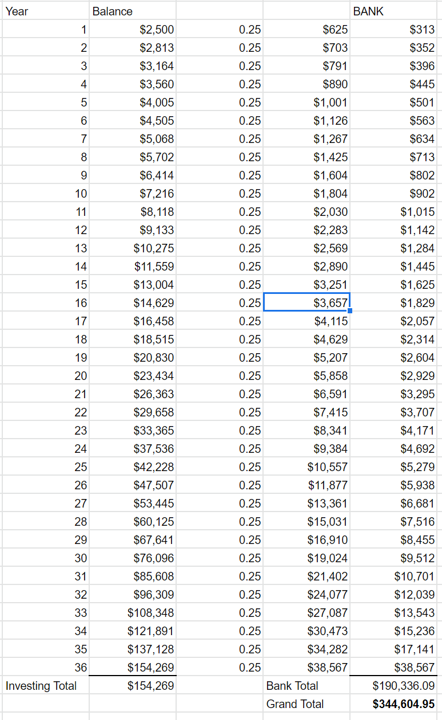

That’s why if you give me a short 36 months and 10 minutes, I’ll prove to you:

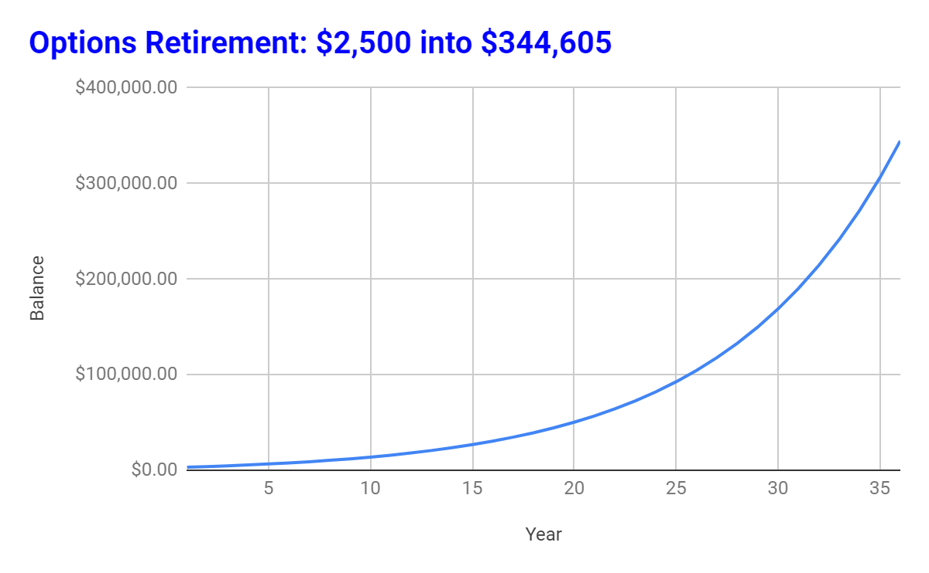

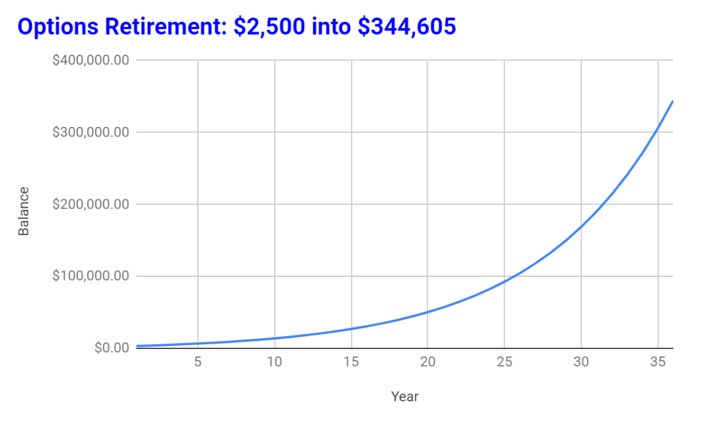

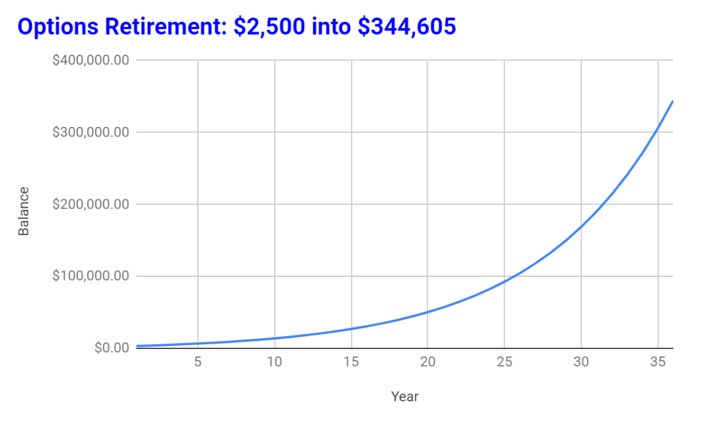

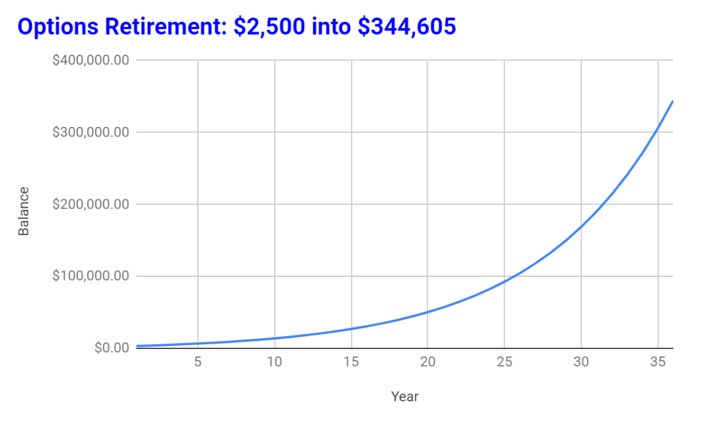

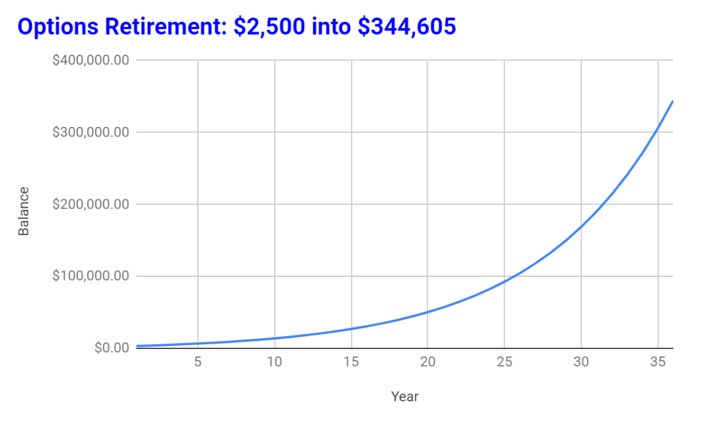

- Anyone — even beginners — could turn $2,500 into as much as $344,605

- How now’s the easiest time in history to use an “options loophole” and pocket massive gains from the market

All it takes is trust, following my options blueprint, and the discipline to execute it.

Even if you’ve never touched options before… you can do this.

Maybe options confuse you…

Maybe you don’t trust them…

Well — like them or not — mark my words, those who take the time to learn my options blueprint today could create a lot of money really fast.

Others have just started using what I’ve taught them and check out their results:

“I have made 11 positive trades and two negative trades. Positive, net returns are $2,880 after deducting commissions.

Thank you for your advisory service.”

– Don

“I’ve won about 85% of the trades.. So your service has been a great learning tool for me and my trading.

I try to do about $1,400 -$1,500 each week in revenue. More as my cash balances grow.

– Scott

“Just closed out the NFLX [trade] for 5.10, an over 260% gain! Thanks for a great trade!!

– John

“Thank you for the advice. Your call on Square (SQ) was right on. With a [bearish option] with QQQ and a [bullish option] with VIX,

I profited about $2,000.

– Hunter

You could join them into adding more money and experiences to your retirement in the next 10 minutes following my 36-month options blueprint.

Now, let me be clear…

This blueprint is only eligible for those who have a nest egg already.

It’s a blueprint to help you create more money on top of what you have.

This is get rich quick…

And if you only have $2,500 to your name…this won’t work. Because trading from a place of desperation only leads to failure. Guaranteed.

This is only meant to upgrade your retirement.

How you use my blueprint and stick to it determines the type of retirement you want.

If you only use the blueprint for a few months…you could enjoy a few extra vacations each year.

If you use it for a year or two…you’ll have some options of upgrading that car, spending more time at nicer country and golf clubs.

If you follow the options blueprint from start to finish…you could be well on your way to doing whatever you want, no expense spared:

Donate to your church and charities, be on the board of a non-profit, start that small hobby shop you’ve dreamed about for years. One guy I know finally joined a classic rock group. He could never afford to do that before due to family responsibilities plus his job.

It’s your choice which path you choose.

I can’t think of any other asset where you could take $2,500 and turn it into mountains of cash…

Options are it.

For the average American, they’ll spend 40, 50, 60 years cobbling together $300,000…

Even then, they’ll wake up everyday afraid of running out of money.

Meanwhile, I’ll show you how starting with just $2,500 you could easily upgrade your lifestyle.

And add up to $344,605 in your bank accounts…

All within 36 months.

Now, I’ll be honest:

This will take some luck.

It will take you learning some new trading skills.

This will require putting aside 30-60 minutes per month to trade options.

Plus…and I mean this with my whole heart…

You must stay the course even when everything isn’t as smooth sailing as you hoped.

Because it won’t be smooth. Nothing worthwhile in life is. Some months, your trades will flat out stink.

You’ll think about giving up.

You’ll remember what others have told you… “oh, options are a scam”…

And you’ll throw in the towel.

Only those willing to put aside their prejudices will last.

Because I believe it’s easier than ever to succeed with options.

Like I said, there’s an “options loophole” in the market at this moment…meaning, the odds have tilted in your favor.

How long this loophole will be open is anyone’s guess.

All I can do is alert you that you have a unique opportunity…perhaps one no one in history ever had…to take just $2,500 and retire on it.

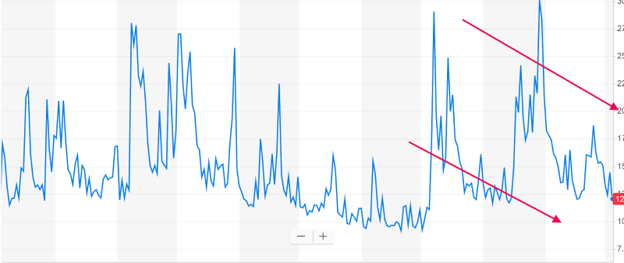

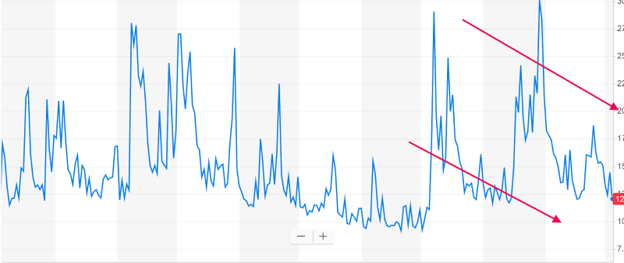

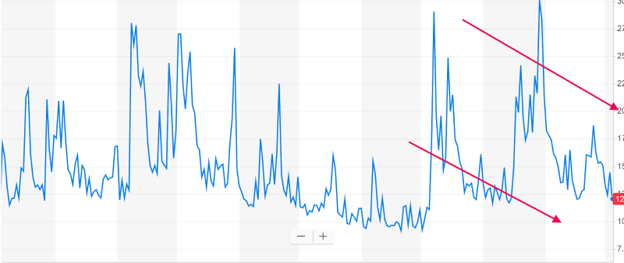

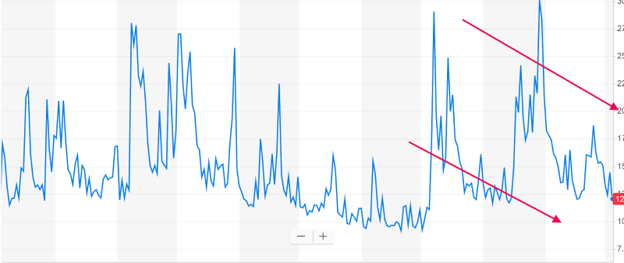

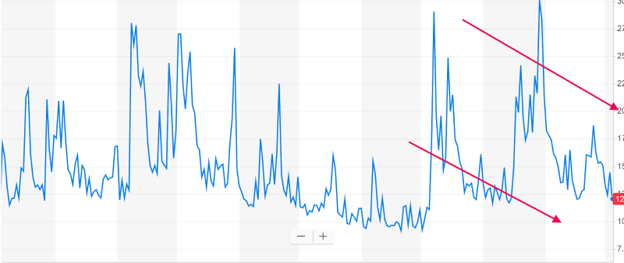

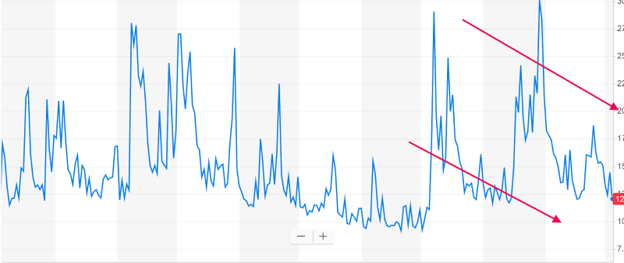

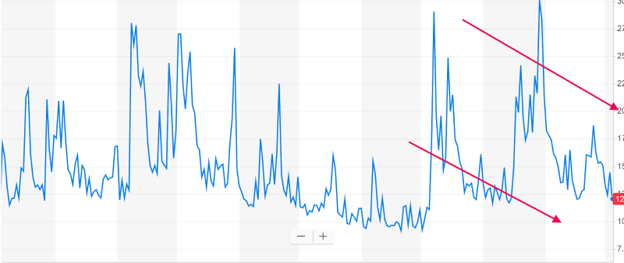

You’ll understand the “loophole”

when you understand this chart.

It looks like a bunch of squiggly lines right now.

But in just a few moments, you’ll discover how amazing this opportunity really is.

This chart is extremely important if you wish to succeed at trading options.

If there’s anything I learned from trading on the floor of the largest options exchange in the world…the CBOE…

And from controlling the order books of some of the most valuable companies in the world as a Market Maker…

It’s that most individual investors get slaughtered in the options arena.

They know options can create immense wealth, and they’ll die at their trading desks to reach that goal.

The average investor dabbling in options has little skill, little research, and little guidance on what to do.

So, they get roasted like a Thanksgiving turkey.

All jokes aside, you could lose a bundle quickly if you’re not careful.

You know this to be true if you’ve ever purchased an option before…

Maybe, you thought you’d give options a chance…

You desperately wanted them to work for you because of how much profit they can produce…

Yet, you logged in the following days and your options had lost 10, 20, 30% of its value. You felt like a sucker.

That’s why most investors…and stock-trading gurus…absolutely hate options.

Well, let me peel back some layers for you today. Because I traded on the floor of the CBOE.

I know how to succeed at options learning from high-powered traders.

Many I still catch up and share ideas with.

That’s why if you’ve already written off options…you’ve tried and failed with them…or, you’re straight confused by how to trade them and the terminology…

This might be the most profitable options presentation you may ever read.

With the right strategy, you could upgrade to your dream retirement starting with $2,500.

On the other hand, let me be perfectly clear:

You must be committed to put $2,500 on the line to make this happen.

If you have that mindset, you can do it.

If you have 30-60 minutes minimum per month to give options 100% of your focus…you’ll be on your way.

Thanks to an “options loophole” in the stock market, now could be the easiest time ever in history to do this.

So, listen up.

Because if this all seems like a stretch, it’s not as hard as you think when you do the math.

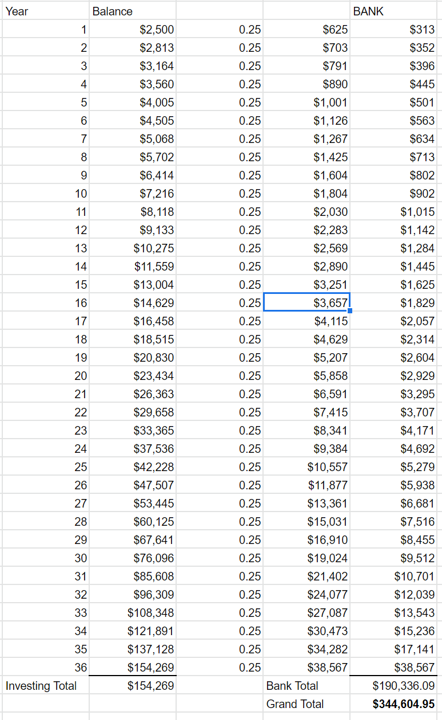

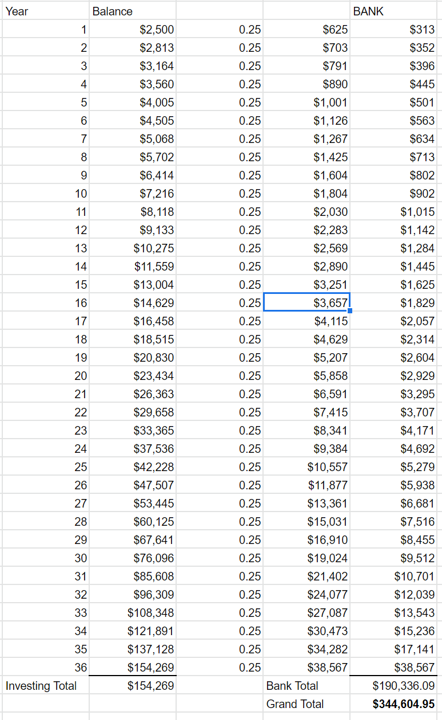

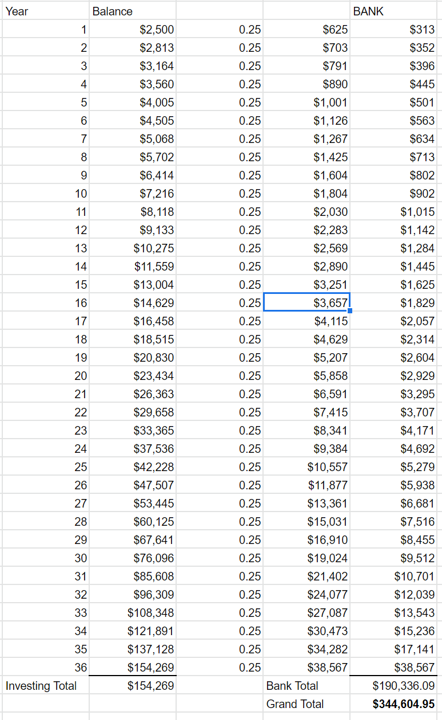

Take a look at this spreadsheet.

Don’t let your eyes glaze over from my Excel sheet.

This 36 cell chart could be the golden ticket for your retirement.

I’ll explain every line today.

Watch closely as the “options loophole” could close any second…that’s why this presentation is so urgent.

So, I won’t wait another second either.

First, let me introduce myself and why I am qualified to share the secret to retiring on options.

For over 21 years I’ve traded options. It’s my speciality and the only thing I show others how to trade.

The extremely popular Money Show held each year added me to their “All-Star of Options Trading” panel.

I tend to shy away from this kind of flattery.

That’s why you won’t find me on the ‘network circuit’ spending my precious hours in front of a camera either at CNBC or Fox Business.

I don’t do this for fame or attention.

Although, once a year or so you’ll find me giving a talk about options. And it’s not unusual for 500 people or more to attend.

But, most of the time, I keep to myself.

I spend time with my wife and 2 kids, I read fiction books, and browse Twitter.

It’s through Twitter I keep in contact with my deepest connections in the industry. I’m talking hedge fund managers of $100 million dollar accounts.

I’m talking pro option traders making a fortune from the market.

I’m collaborating with them back and forth throughout the week. Twitter gives us the most up-to-date happenings in the market. It’s like my own ‘underground line’ to the trading floor.

Some of these connections are new contacts.

Others I’ve known since my days on the floor of the CBOE.

The CBOE is the Chicago Board of Options Exchange.

It’s the largest and most famous options exchange in the entire world. Most options exchanges get swallowed up by them, that’s how dominant they are.

Here’s me as a young trader cutting my teeth.

Wanna know the fastest way to learn about options?

Not by reading books.

How about running back and forth between traders filling orders and creating a market.

Yes, creating a market.

I was a Market Maker at the CBOE.

I acted as the ‘‘invisible hand’ that provides liquidity to traders and priced options.

If you ever wondered if there was a man behind the curtain pulling the strings of the market, that was me.

I could see who was buying…

Who was selling…

What stock option was gaining momentum…

The whole house of cards sat right in front of me. I helped to build it every day.

That means I had information every retail investor would kill to get their hands on.

Because as a Market Maker, you know every little thing about the markets.

I saw enormous pension funds buying millions of shares at a time.

These groups could move stock prices of multi-billion dollar companies in a flash.

And I also saw the opposite.

Big firms dumping stocks with massive block trades as they tried to escape a bad position.

Here’s what all professional traders know…

90% of options expire worthless. The 10% that don’t…someone knows something.

If you’ve lived behind the scenes as I have…you would’ve seen how the 10% are doing it.

Honestly, I could write an entire book about what Market Makers do and how you could profit from that knowledge.

Because I believe unless you’ve actually seen in person how the options market works, you never get the full picture.

Meaning, if you’re a retail investor, you’re at a disadvantage. You’re trading options with ‘incomplete’ information.

That’s why it’s time to reveal to you the fastest way to retire wealthy on options.

Because there are a few “breadcrumbs” out there that can tip the scales in your favor.

For many investors, to find these ‘breadcrumbs’ you’d have to shell out a whopping $3,000/month for a Bloomberg terminal subscription.

That’s where I’ve stepped in.

Even though I’m over 1,700 miles from the CBOE, I can still read what the markets are doing.

For the last 10 years, I’ve been showing readers like you how to profit from options.

My ‘secret sauce’ is doing exactly the opposite of what the so-called ‘options experts’ are telling you to do.

One of those ‘opposites’ is focusing much of your strategy on this chart here.

This chart is the “loophole” I’ve talked about the last few minutes.

If you’ve followed options in any capacity…you’ve likely seen this chart.

This is a chart of the VIX.

It measures volatility in the market. If you’re new to the stock market, volatility is high when stocks move up and down quickly. And volatility is low when stocks are more predictable in their direction.

Right now, volatility is incredibly low.

Historic lows.

The Street claims “stock market volatility on record low streak.”

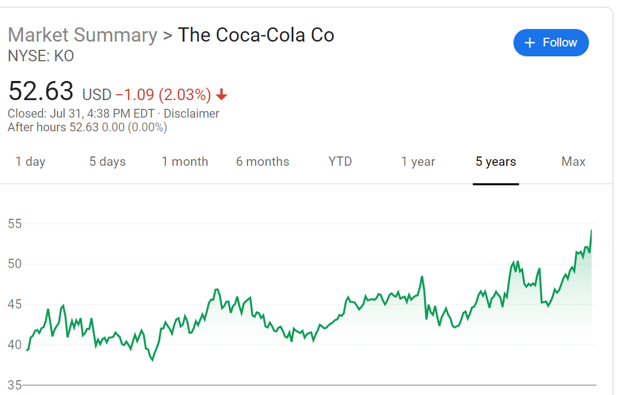

This is a 5-year chart and you can see the volatility inching downward once again.

Every so often — and this is how the market saves face — it’ll have moments of wild swings that cause the VIX to spike.

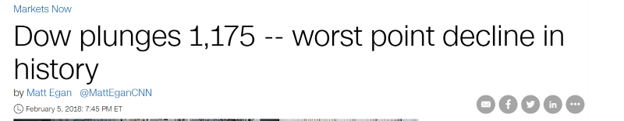

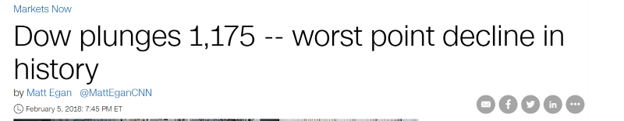

The largest two recent spikes happened in 2018.

You can guess what happened then.

That’s right.

One big stock drop in February.

Another market crusher from October to December.

The first six months of 2019 were then straight up for the Dow except for a minor hiccup for a few weeks in the spring.

As a result, volatility plunged because the market became predictable..

There’s a few things to cover here with the VIX, so stick with me.

Why today is the best time to buy options.

#1: The higher the VIX, the higher option prices go

This is where my experience as a Market Maker plays out big. When you go to buy an option…you buy or sell a contract. That contract controls 100 shares of a stock.

A few elements are built into calculating an option’s price, which I won’t touch on here.

It’s not like stocks that are priced based on the last sale.

Options are priced based on multiple factors.

However, a critical piece of that algorithm is the volatility measurement.

As a Market Maker back in the pit, I had to make quick calculations in Excel (of all places) to update the option prices due to volatility movement.

When the stock market starts moving violently up and down, the VIX jumps higher and higher.

That means option prices go up as well. They get more expensive.

With volatility nearing record lows, option prices are much lower.

It’s why Investopedia claims “it has never been cheaper” to buy options.

If you don’t believe you can retire on options after reading this presentation…

At least take this away with you…higher VIX = higher option prices.

But, that doesn’t mean go out and buy options on Tesla or Netflix because…

#2: Each stock has their own volatility measurement

Some stocks are more volatile than others. Tesla trades more erratically than say Coca-Cola.

(Tesla = stock range between $150 and nearly $400 >>> more volatile)

There’s a way to pinpoint which options to buy. I’ll even show you what options to buy when you read until the end.

#3 Volatility is down now because the stock market continues to go up

If the stock market just continues marching upwards, then it makes sense volatility goes to record lows.

There are less wild swings…ergo…less volatility.

This complacency makes volatility get jumpy when we have months like February and October 2018.

It’s like waking up a sleeping bear. They get up and you don’t know what to expect…hence, spikes in volatility.

Then, the waters calm…

And, the market chugs higher.

Why it’s going up is a whole other conversation you and I won’t have today…the only important piece to remember is that with volatility down, options are cheaper…

Bottom line.

So if you’ve sat on the sidelines with options, today is the best time to test them out without taking too much risk.

If you’re disciplined enough…

And you stick to following the rules I’ll outline for you…

You could well be on your way turning a normal retirement into a first class one.

I’m talking turning as little as $2,500 into as much as $344,605 in 36 months.

Low volatility could end in 6 months…12 months…maybe not for another few years.

You can’t try and time the market.

Those that moved all their money into cash in 2009, 2010, 2014, 2016, 2018…they all missed out on huge gains in the stock market.

Options are the same way.

Don’t try and time the market, just go with it.

And you aren’t selling off your 401(k). Start with just $2,500. A mere fraction of your portfolio. Those bagging groceries at the supermarket take home that much…I know you can set that aside too.

If you’re on board…

Are you ready to start using my 36 Month Options Blueprint?

Take a look at the potential again.

If you’re ready, let’s go through the blueprint.

Here’s a summary of the entire blueprint quickly for you.

- Start with $2,500

- Every month shoot for a 25% return on that money with low-priced options

- Take 50% of that profit and put it in a bank

- Take the other 50% and reinvest

- Repeat steps 2-5 for 36 months

I’ll break down each of these steps.

Step #1: How much do I need to start?

Start with $2,500. If you have more, great. If you only have $500, you can still follow this blueprint, it will just take a lot longer.

Step #2: How is it possible to gain 25% per month and find low-priced options?

With stocks, this is normally close to impossible.

Options?

I work with traders who wake up in the morning and they’re up 100% overnight.

I admit. No path to success is a smooth, straight line. You want to gun for an average of 25% with this blueprint. Some months will be less…some a lot more.

In May 2019, I closed a trade in 5 days for a 92% gain.

Another was up 110% in less than a month.

In 2018, when the markets were volatile, I was throwing off triple digit winners.

- 127% in 23 days on GLD

- 148% in 28 days on SQ

- 229% in 36 days on SMH

- 213% in 13 days on Netflix

- 79% in 22 days on SPY

- 63% in 24 days on SPY

- 117% in 21 days on SPY

- 96% in 36 days on QQQ

- 114% in 42 days on MRVL

All you need to do is make 25% per month.

As you can see, just one of these picks will take care of almost a full year in some instances.

But I’ll be straight with you.

25% per month is a pretty aggressive number for us to hit.

But with the strategy we will use, it’s quite possible.

And I’ll show you where to find these low-priced options.

Step #3: Put 50% of profit in the bank!

Absolutely do this. Never keep all your money in the markets, especially when it comes to options.

Like I said, you’ll have some sub-25% months. This money in the bank can boost your account to keep you on track to retire in 36 months.

Doing this also helps you practice good portfolio management and discipline.

It’s tempting to cash out a 229% winner and feel so confident to dive right back in. In my 20+ years trading options, this is always a bad decision. Put a lid on some of those profits.

Step #4: Reinvest the other 50%!

This is how you’re going to compound your account faster from $2,500 up to as much as $344,605.

Compound those profits.

You do that by rolling 50% of your profits on the trade into the next month trades.

What makes this strategy even more remarkable…

Is that your risk could actually go down as your account balance grows.

As you hit $40k, $50k and beyond, it would be foolish to put all of that into one single options trade.

Instead, you’ll want to spread your money out across multiple trades.

This does two things…

#1 Gives you more shots on goal to knock it out of the park with not a 25% gainer…but a 250% gainer potentially…

#2 You can weather losses when a trade doesn’t go your way.

And — by the way — you WILL have losing options trades. It’s darn near impossible not to have them.

But that’s why we’re starting with $2,500. It’s a small amount. It’s easy to manage. It doesn’t hurt if you lose some of it.

If all you have is $2,500 then you should not be investing in options. Rather, invest in stocks and build up your account balance.

Alright, back to the 5-step process.

Step #5: How long do I repeat this?

The answer is easy.

Repeat as long as it takes until you can retire. Simple as that.

It could be longer than 36 months…but maybe it’s shorter.

Either way, you’ll want to get started as soon as possible.

Because now might be the easiest time in history to retire on options.

That’s because there’s a unique “options loophole” in the market right now.

It all centers around this special chart.

Because of the direction of this chart…down if you follow my arrows…another window has opened up for you to become wildly successful trading options.

How can I be so sure?

Because I’ve been an options trader for 21+ years. The math behind this chart was and still is my bread and butter when it comes to trading.

Most will give up…

Many will give back the profits they land due to lack of patience and discipline…

But because you’re reading this far, you’ve already set yourself apart from others. You’re investing in your education.

You don’t seem like the type to abandon a plan when it hits rough waters.

Because like I said…we will have losing trades. We will have losing months. That’s why we take out 50% of our profits. We keep those for back-up capital when we hit a rough month.

Other months, we will hit some home runs.

Readers notched 92% and 110% winners in just one month.

Plus, they also could’ve scored these gains in 2018:

- 127% in 23 days on GLD

- 148% in 28 days on SQ

- 229% in 36 days on SMH

- 213% in 13 days on Netflix

- 79% in 22 days on SPY

- 63% in 24 days on SPY

- 117% in 21 days on SPY

- 96% in 36 days on QQQ

- 114% in 42 days on MRVL

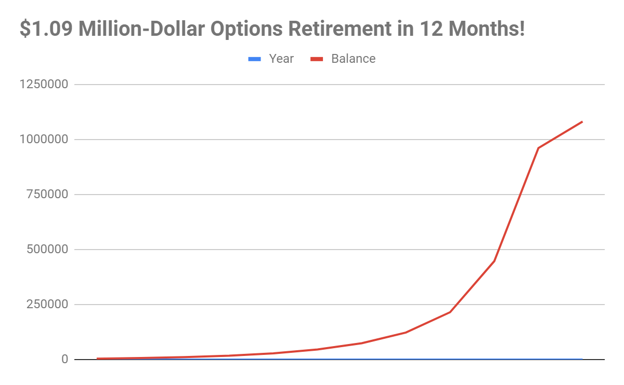

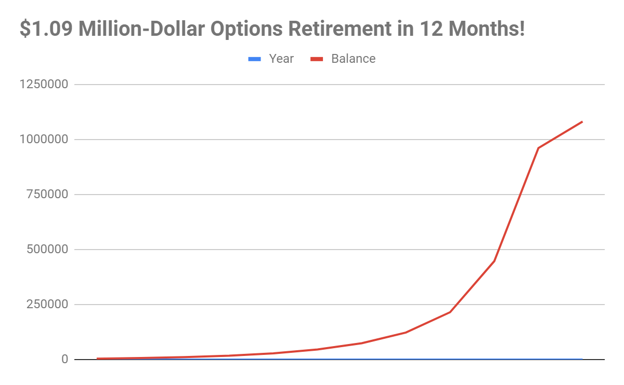

Just for fun…let’s say you could nab each of these gains once per month for the next year.

Check out how much that would amount to:

$1,081,207 to be exact.

Now, I don’t expect that to happen. It’d be pretty rare.

However, I simply want to show you how powerful options can be…and let you really see the potential of what I’m talking about here.

Options can make you extremely wealthy.

And now may be the best time in history to start trading them.

If you’re ready to do this…

There are two keys to your success with this blueprint…

These are bonus tips straight from the floor of the CBOE.

SUCCESS KEY #1: Manage Your Risk

When stocks go up 7%, your options can go up 127%. That’s because options are stocks with up to 10X of leverage.

These profits are great.

As you can imagine, the flip side is true as well.

That’s why you must…without exception…limit your downside.

Managing your risk means keeping a tight lid on a trade when it doesn’t go your way.

That’s the rule I followed when I bailed on these recent losing trades:

- -10% loss on Goldman Sachs

- -5% loss on Lam Research

- -14% loss on Nvidia

- -7% loss on FireEye

- -7% loss on XLF, even a

- -0.2% loss on Wynn Resorts

Pretty small losses compared to the upside.

One winning trade for 127% in 23 days not only makes you money, but even if you trade all six of the losing trades I just showed you, it still makes money.

You don’t even need 50% of your trades to be successful!

Buying options gives you limited downside, with an unlimited upside.

Preserving capital is how you get to fight another day. I’ll teach you how to hold on tight to your capital while also allowing enough breathing room for your option to soar in price.

However, I may break that rule just a touch with this last rule.

SUCCESS KEY #2: Trade like the Institutions

As a Market Maker on the floor of the CBOE, I had a ‘behind the scenes’ look at the options market.

Think of it like you’re at the doctor’s office.

He puts that massive eye mask on you and flashes some letters and numbers on the wall.

Sometimes, the images are fuzzy but you can still make it out.

Others are as clear as daylight.

That’s how it is when you trade on the floor. Other traders outside the CBOE can see a little, but they don’t get the full picture.

Here’s the secret to how institutions trade options.

…and this is where most gurus get it wrong…

Those outside of Wall Street use fundamental and technical analysis to find opportunities and then look at the options last.

Institutions do the exact opposite!

They look at what options are ‘on sale’ and then look at the fundamental and technical analysis last.

Compare it to how one might go about investing in art pieces.

Odd example, but stick with me.

Most gurus would approach art buying by first looking at what’s hot now, finding those art pieces, then determining if the price is worth it. They hope to catch the price at the right moment where it still goes up and they profit.

If they’re wrong, they could lose a ton of money if the piece goes out of style and plummets in value.

That’s how most gurus approach buying options. Look at a hot option then determine if the price is right.

Here’s how I do it…

And how the large institutions do it too…

Back to the art example:

Rather than look at ‘what’s hot’ on the art scene, we do the opposite. We look at a piece that has proven valuable before and is now ‘on sale.’

Only after finding those art pieces do we look at the broad market to see if this piece will ever become valuable again.

We buy it.

If we are wrong… we bought the art on sale and don’t lose much.

If we are right… we could reap double, triple-digit maybe higher profits when the piece becomes valuable again.

See the difference?

We’re trying to ‘buy low and sell high’, while most option buyers are trying to ‘time the market.’

At this moment, with volatility down, you could be buying low on many underlying stocks.

I believe it’s a true “options loophole” that could close any moment.

That’s why I urge you to give options a long-term try today.

It’s your choice what you’d rather do.

All you need to start is:

- $2,500

- My blueprint (free above)

- The right low-priced options

If you’re interested, I’ll show you how to find these ‘low-priced options’ right now.

Everything is contained in my brand new report…fresh off the digital printer…called

The 36 Month Options Retirement Blueprint

- My entire options blueprint to upgrade your retirement with as much as 6-figures in profit in 36 months

- Where to find the best trades right now to execute

- My #1 options strategy that any beginner can use with just 30 minutes per month

This report is valued at $99…but I’m giving it to you for free.

If you’ve dreamed of retiring with a fortune…

You could continue dumping money into stocks for the next 10-20 years. If you’re savvy enough, you could eek out a return that beats the S&P 500.

But, I can get impatient.

Life is too short.

Maybe if I was 21 again, this would be a plausible strategy.

I’m well beyond college. Others seem to ‘cut the line’ in terms of going from average to great wealth.

Why can’t you and I do that?

It’s possible.

I’ve created this free resource to be an avenue for you to consider…because you deserve it.

Still, I’m not going to leave you with just a special report.

How about if you learn all my secrets from decades of trading right on video.

Look right over my shoulder as I make a few trades.

Today, you can get access to my free video series:

The Extra Cash Masterclass for Options.

Options are the best way to turn a little money into a lot.

I like to think you could turn extra cash around your house into thousands.

That’s when this new masterclass was born.

This video walks you step-by-step how to begin trading options. If you’ve traded options before, I bet you will still find something new to learn.

Inside, you’ll discover:

- The little-known equation that reveals when a stock is ‘mispriced’

- The #1 option trade to protect your portfolio if the market tanks tomorrow

- How to buy a call and a put in 5 minutes

- The ‘crystal ball’ indicator to signal the chances you make money or not

- My LIVE trade of Apple stock right in front of you

And that’s just the beginning.

I’ll also walk you through my top four buying options strategies.

These are strategies I’ve traded for years, and by following them, you’ll be an expert at making money when:

- Stocks go up

- Stocks go down

- Or, when we don’t know which way stocks will go

You’ll get all this inside The Extra Cash Masterclass for Options.

This class alone could retail for $199.

In total, both the masterclass and your special report would go for $249.

This information is from someone who knows the inner workers of the options market.

Again, my name is Jay Soloff. “Mr. Options” as one fund manager called me.

You’re not only getting 21 years of options experience packed into this brand new masterclass….

You’re also receiving my insider knowledge from my time spent as a Market Maker on the floor of the CBOE…

Plus, all the tips and strategies I pick up from hedge fund managers, professional traders, and my entire network.

However, I don’t want to leave any stone unturned.

I want to help you every step of the way including where to find the cash to start.

If you’re still unsure you want to put $2,500 aside to try this.

Don’t give up. I’ve created a bonus for you

26 Places to Locate “Extra Cash” in the Next 30 Days.

(maybe locate up to $2,500)

These are tips and tricks I’ve gathered through the years to find quick cash, including:

- The goldmine website online to generate $100…$200…even $500 bucks in a single weekend

- How to make an extra $20-$50 per month just from watching TV

- The $100’s of dollars stashed in your car (you just need to know where to look)

- Items around your house that buyers fall over themselves to pay you for

- A “cleansweep” trick that could bring $60-$100 to light in one evening

- The one call to your bank that could add a surprise $1,000 in your savings account this year

And that’s only five of them. I have many more inside this special briefing.

If you’ve already looked in the seat cushions for cash, this special report could hand-deliver you the capital to start trading.

Imagine finding $100’s of dollars all over your house and on online. It’s there for the taking.

Just last night, my friend found $60 in a messy closet he didn’t know he had.

But that’s only the beginning.

Because you can then turn all that newfound money into potentially a retirement fortune.

Our goal = $2,500 into $344,605.

If you had landed these gains each month in 2018…

- 127% in 23 days on GLD

- 148% in 28 days on SQ

- 229% in 36 days on SMH

- 213% in 13 days on Netflix

- 79% in 22 days on SPY

- 63% in 24 days on SPY

- 117% in 21 days on SPY

- 96% in 36 days on QQQ

- 114% in 42 days on MRVL

With a little luck, you could’ve made much more than $344,605.

That’s obviously a best case scenario.

You start compounding just 25% profits over the months…

Then 36 months…

You can see how it’s possible to turn a small stake…into a surprise upgraded retirement.

You may not need to even touch your 401(k) or IRA or your Social Security once you get going. I’ll leave that to you.

Just 30 minutes or so per month and you’re set if you follow my lead

Because I want to make this as easy as possible for you to find low-priced options.

In every way imaginable.

That’s why I’m inviting you to become a member of my brand-new beginner options newsletter…

Options Floor Trader PRO

This premium newsletter is your entry point to your first profitable low-priced option trades.

You’ll be using strategies I used myself on the floor of the CBOE.

My goal for this breakthrough publication is simple —> take you from a beginner option trader with a small account and grow it to a larger account.

This newsletter is for you if:

— > You see the potential to make money with options but are worried about doing it yourself…

— > You’ve traded options before but go boom and bust. Some months you’re up big, others your account is wiped out…or,

— > You’re looking for another money stream on top of how you make income now…

Every month, I plan to have at least TWO trades for you.

We’re aiming at growing our account fast, so we won’t be selling options for income. Only buying.

Everything will be shown to you inside the The Extra Cash Masterclass for Options in terms of “how” to make the trade.

With your two trades per month, there will be a TON of education. I’ll tell you the ‘whats’ and ‘whys’ of the trade, plus the strategy we will use.

There will be four strategies we pick from. Those are outlined in the Masterclass.

Here’s everything you get with your 1-year subscription to Options Floor Trader PRO:

- The 36 Month Options Retirement Blueprint ($99 value)

- The Extra Cash Masterclass for Options ($199 value):

- 26 Places to Locate “Extra Cash” in the Next 30 Days. ($49 value)

- 2 Option Trades Per Month: Every month, you’ll get 2 trades that could skyrocket even 127% in as little as 23 days. The trades take only minutes to execute and their based on my top four time-tested buying strategies. ($299 value)

- 2 Educational Write-ups with Each Trade: Not only will I show you ‘what’ to trade, but I’ll also explain the thought behind each. This gets you onto the fast track of being an experienced trader without doing all the research yourself.

In total, you’ll be getting $646 of value.

However, a 1-year pass to Options Floor Trader PRO only retails for $199 per year.

But, because now is the absolute best time in history to buy options, you’re about to get a massive discount.

Already, this service is well below the market rate for options services.

I promise if you look across the entire financial publication spectrum, you’ll find most options trading services retailing for $2,000…even $3,000 per year.

That’s not doable if you’re just getting started.

That’s why I created this one-of-a-kind publication.

You can get your feet wet with options without breaking the bank or stealing funds from your stock portfolio.

You only need a few hundred bucks to get started and be successful.

Check out a few testimonials from subscribers to my services:

“I have made 11 positive trades and two negative trades.

Positive, net returns are $2,880 after deducting commissions.

Thank you for your advisory service.”

-Don

“I’ve won about 85% of the trades.. So your service has been a great learning tool for me and my trading.

I try to do about $1,400 -$1,500 each week in revenue.

More as my cash balances grow.

-Scott

“Just closed out the NFLX [trade] for 5.10, an over 260% gain! Thanks for a great trade!!

– John

“Thank you for the advice. Your call on Square (SQ) was right on. With a [bearish option] with QQQ and a [bullish option] with VIX,

I profited about $2,000.

-Hunter

And when you become a PRO Member, you become my top priority.

If I fail at this, it will hurt the publication for years if not decades to come. So, the pressure is on.

But all the risk is on my shoulders, not yours.

Because I’m offering an unprecedented DOUBLE Guarantee for you being a new PRO Member

At this critical time for options

If in the next 12 months, you aren’t 100% satisfied with my work. Meaning, you don’t believe I can deliver double digit and triple digit gains regularly, then I will give you a full refund of your entire purchase.

That’s right. If after 364 days, you don’t think the 24 trades you get and education package was worth its weight in gold, call up my team and get a full refund. No questions asked.

You can even keep the $597 of value as a thanks.

However, that’s not enough for this critical time for options.

I also want to put my entire reputation on the line.

Meaning, I’m going to make you a performance guarantee. A 5X Guarantee.

If in the next 12 months, you aren’t served an opportunity to 5X your investment in Options Floor Trader PRO today, then you will get a second year free on the house.

And that’s a lot.

Because the price for a 1-year subscription is only $49.

Meaning, I will give you a $49 gift if you don’t 5X your $49 investment.

I’m so serious, I’ll even be trading with my money too a few of my recommendations.

I eat my own cooking.

This 5X guarantee is one you’ll find nowhere else.

Because I opened this publication for someone like you. Someone who wants more money without risking their portfolio and life savings.

This is a simple way to potentially retire on options.

I believe it’s possible with the “loophole” in the stock market right now.

Of course, you can try and do this all yourself.

You can study until the dead of night…

You can buy the books…

FYI, many of the top option books go for $30 – $50 bucks.

Lawrence McMillan’s options books is hailed as “the top options book for 2018” by Benzinga.

It’s $48.50.

And he’s not there to help you every single trade.

That’s the problem with trying to do it alone. With options, if you don’t know what you’re doing, you could see disastrous results.

I’ve given you my options blueprint and revealing the very best low-priced options on the market today.

I’m teaching you…giving you the trades…and helping you for the same price as his book!

That’s important when starting out.

It’s something I wish I had when I first started trading on the CBOE floor. I started Options Floor Trader PRO to be that ‘something’ I wish I had.

Now, you have it.

Click the button below to get started. You’ll be transferred to a secure page to fill in your information.

I also have 2 more bonuses to give you as well.

Look, if you see your retirement going smooth for the next 30 years…great. I congratulate you on a good job working hard and saving.

But I promise there will always be a lingering thought in your head ‘did I leave any money on the table?’

It’s an awkward thought. Unfortunately, most people don’t think it until it’s too late.

Wouldn’t you like to treat your family to an expensive night out more often…you could pay for everyone’s flight so there’s no excuses.

That’s what I’m talking about. Upgrade your retirement. You don’t need to be a multi-millionaire many times over to live your dream retirement.

That’s what I want to help you achieve.

Become a PRO member right now.

Click “Join Now” below.

Normally, I get similar questions when I release presentations like this. Rather than have you take time to email them. Let me address a few of them now.

“Will I really make $344,605?”

Honestly, like I say above, this is our ideal goal. No doubt, it’d be a tough number to hit. However, I simply want to show you what’s possible. Unfortunately, trading (especially options) can get very emotional. Following my blueprint means strict diligence, patience, money management and that’s only the beginning. It’s not easy. Most traders aren’t up for the challenge.

So, don’t worry about making $344k. What if you could make an extra $100,000? It’d change your life.

I’m a ‘buy and hold’ investor. I don’t have time to check my account everyday.

I hear this a lot from traditional stock investors. You don’t’ want to be “in” the market all day. I admit, with options, you do need to give a bit more attention to your positions than a normal stock purchase (remember, no dabbling). But, that doesn’t mean you can’t purchase an option with a few months until expiration and let it sit for awhile. That’s what I recommend.

That would only take you 30 minutes per month on average.

If you don’t understand what expiration is with an option, make sure you join me today so I can explain everything inside my reports and videos.

Options are too confusing. I don’t understand the terminology and what the difference is between different options strategies?

You’re not alone here. Many investors shy away from options because it appears too confusing. If it’s confusing, how can you win, right?

Well, when I looked around the marketplace, all I saw were super expensive $2,000, $3,000, $5,000 options services. There were very few low-cost options for beginners to get their feet wet.

Options Floor Trader PRO isn’t a dictionary of all options terms. However, I can help you learn the basics of options. As you master those, you’ll be ready to progress to more advanced strategies which I can show you in the future.

I tried options before and lost my entire investment. Why would it be any different this time around?

I can’t speak for you or know exactly your situation. I can only take a stab at it. My guess is you didn’t give your option enough time to breathe. Many new traders buy an option set to expire in 1-2 weeks. That’ll hurt your balance fast.

Next, you might not have followed proper portfolio management. You don’t want to put all your eggs in 1-2 baskets.

Third, you probably traded options like they were stocks. While I do look at charts of stocks for picks, I also look at volatility. This is the secret of the pros. Low volatility stocks tend to go up in the future thus increasing their price.

Right now, the VIX index is at near record lows. Meaning, now is the perfect time to ‘buy low’ with options and retire faster.

To help you out, I’ll include on more special report here.

It’s called: 7 Reasons Options Traders Fail (and 11 Ways to Help) .

This is a perfect complement to the masterclass to help you get off the line faster than most beginners.

Inside, you’ll discover:

- How to lose before you’ve made a single trade

- Why sometimes it’s better to overpay for an option

- Why you should never ‘leg in’ to a trade

- The one person NOT to listen to about options

And much more.

Get it free with your subscription today.

What makes Options Floor Trader PRO different than other options publications?

Most option products will go for thousands of dollars. I believe most individual option traders need as much help as possible. Hence, I started this service.

You also receive intel from someone who actually traded on the floor of the largest options exchange in the world. I’m sharing tips and strategies used by professionals, not back-tested theories.

All of that for a low, low price…it’s a win-win.

Do you have any guarantees?

I guarantee you’ll make 5X your investment today or I give you a second year free. I’ve already shown you multiple triple digit winners…a few this year, in fact…that I can make this guarantee with full confidence.

If that’s not enough, I give you a full 12 months to try out the service. If after 11.5 months, you aren’t satisfied, simply call us up and get all your money back. Every penny. Hopefully, if you do that, you’ve at least tried a few trades and saw how you could make money with options first!

Why should I work with you?

My name is Jay Soloff. I’m one of the few in financial publishing that actually traded on the floor of the largest options exchange in the world. (the CBOE). That is where the very best in the world trade options and I gleaned all my strategies from there. In fact, I still keep in touch with many professional traders and gain their insights.

I’ve dedicated over 21 years of my life to only options. Trading them. Managing. Educating. I’ve done it all. You’ve seen my track record above just within a few months. I’m not a ‘dabbler’ in options. This is my life. And I want you to join me and I can help you profit.

Hopefully, I covered many of the pressing questions.