Don needs $800,000 to retire in New York.

He has 5 years to get there…and it felt impossible

Until he started doing this…

In 2019, I met Don Martin from Long Island, New York.

…Or rather, he found me.

See, Don was looking for a solution to a BIG problem.

He’d worked in defense manufacturing his entire career – a solid job.

Decent pay, good benefits. Don was doing well by middle-class standards. Looking forward to a comfortable retirement just 10 or so years away.

Then, he was diagnosed with multiple sclerosis.

In almost an instant … Don lost his job, his income, pride and way of life.

He was relegated to living on disability payments for life. Or so he thought.

But a few years ago, Don got a letter from his insurance company:

“Don, your disability payments are set to expire in 2026 when you turn 67. After this, your insurance policy will automatically terminate as well as your benefits.”

Don knew he had to take action. But where to start?

Don told me — “It was from that moment knowing I’d run out of benefits, I realized I’d have to make my own income.”

For a couple years, he tried another newsletter service.

But found he was only generating 4% returns per year. “That wasn’t going to get me to my goal,” Don said.

In 2019, he found my work.

My name is Tim Plaehn and my sole goal is to help investors like Don retire on their dividend portfolio.

Since 2019, Don says he’s generated “in excess of 30% returns” in his first year following my strategy.

Meaning, he’s collecting 7X more than he used to…

And on pace to double his portfolio in 4-5 years.

Exactly when he needs it to!

Don’s now resting easy when he goes to bed.

While his old company and the insurance industry has abandoned him…

Using my #1 dividend

wealth building strategy,

Don will be able to

retire and stay retired.

Don’t take my word for it… here’s what Don had to say:

“ I’ve loved my results with Tim. He lets me know what he’s thinking.

I really like Tim’s invested in the stocks alongside me. Since Tim looks close to my age, he relates to me, and I trust him a lot. “

I can’t promise you the same results as Don…

However, like you, Don’s investing in high-yield stocks…

But I’ve also shown him a new strategy with dividend stocks… and it’s how he’s changed his entire trajectory on life.

And Don’s story isn’t an outlier.

Meet Joe P.

Joe says he’s “3-5 years from retirement.”

He’s a pharmacist who was on a smooth ride to retirement…

…then everything was disrupted (like Don) overnight.

In 2018, he was abruptly laid off from his job.

At the same time, he and his wife were hit with a medical issue and bills climbed to $20,000.

Being unemployed, you can imagine Joe was a bit nervous.

He hoped trading stocks would help. Joe had heard others make big bucks doing it, and thought he could take a stab at it.

Well… he lost “$15k” quickly… and was even more in a hole.

A little panic set in…

In the interim, Joe picked up a part time job to fill in the budget gaps.

Retirement plans were put on hold.

At the time, he was collecting dividends and reinvesting them. But his account wasn’t growing fast enough.

In order to enjoy the type of income he’d need to feel comfortable retiring and ditching his part-time work…

Joe claims he’ll need “$100,000/year” to sleep soundly.

Much like Don, Joe is trying to retire in 3-5 years.

Joe, however, is feeling better.

3 years into following my #1 dividend wealth strategy… he’s happy.

Today, he says:

“I’m confident that with Tim’s help, I’ll be able to hit my retirement income goal. I can’t wait.”

Joe’s strategy is to pursue capital gains… then increase his high-yield holdings once he lands at that number.

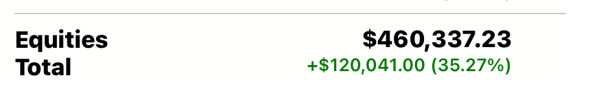

Using my #1 dividend wealth building strategy, Joe’s “averaged 17.69% returns annually” over 3 years.

He even sent me over this screenshot of his current gains:

I’m not allowed to promise the same returns going forward, but it’s incredible to see.

Meaning,

At this rate, Joe will double

his account in Year 4.

Right on schedule with what he needs.

What are Don and Joe doing differently from you… a high-yield dividend investor?

Don and Joe are invested in high-yields too…

But I’ve shown them a new strategy that’s focused on building wealth and income at the same time.

It’s a dividend strategy I’ve used successfully for years.

In fact:

- In 2020, my dividend wealth building strategy returned 21.49%

- In 2021, so far, we’re up 30% (and climbing)

With this track record, it’s possible to double an account in 4-5 years. Not guaranteed, of course, but that’s the math for you.

My baseline goal is to double in 5-7 years.

That means an average return of 10% per year.

Well… right now, I’m tripling that benchmark.

Joe P says “My goal [return] was for 8%… and I’ve doubled my expectations!”

Average advisors shoot for that 8% mark Joe wants.

But it’s hard to rely on these slick suit guys.

Joe told us about how in his 20s and 30s he was “burned” by advisors… which forced him into self-managing his money.

Now, he’s been a long-time reader of mine —>

“ Today, I put a lot of trust into Tim. I love his updates and he helps me through drawdowns in the market. Tim’s taught me to see those as opportunities to buy, and it’s worked out.”

What you’ll discover today is the exact dividend blueprint to double your portfolio which investors

like Don and Joe are following.

It isn’t hard.

And don’t abandon what you’re already using inside The Dividend Hunter.

I’m ready to simply show you the next step beyond high-yield dividend stock investing.

…there’s no day trading

…there’s no buying or selling options

…there’s no complicated K-1 tax forms

You’re buying dividend stocks like you’ve always done.

But these dividend stocks are different from what you’re used to.

Look, I put my own hard-earned money into my Dividend Hunter picks.

But a few years ago, I began moving more and more money into my dividend wealth portfolio.

You’ve seen the results already… including a 30% return YTD in 2021 so far.

That’s 2x the return of the Nasdaq 100.

All with dividend stocks…

A certain type of dividend stock you won’t find in the high-yield space at the moment.

That’s what I want to show you today.

You’ll receive the complete road map on how to potentially double your portfolio faster than you think…

And your first 5 stocks

to set up your nest egg

to appreciate for years to come.

My name is Tim Plaehn,

like I mentioned.

You already know me for being your editor of The Dividend Hunter.

Inside The Dividend Hunter, my goal is to research and recommend the best high-yield dividend stock plays in the market.

With these stocks, you can rely on steady 8-10% dividends every single year. Some of our dividend yields are 12%+.

So what is Don, Joe and hundreds of others doing differently?

They realized — as I did — that high-yield dividend stocks are more for cashflow NOT for capital gains.

You can manufacture capital gains by reinvesting your dividends…

But most of our stocks simply have the goal is to send out cash payments every month, end of story.

If you stuck with The Dividend Hunter’s 8-10% returns… you can expect to double your money every 9-10 years.

For some of my readers, they’re happy with the income and not looking to grow their portfolio.

Many others, however, hope to grow their nest egg while collecting their dividends.

Every story you’ll hear today is from one of my paid subscribers, like yourself.

They joined The Dividend Hunter… and continue to collect income.

But they’ve also added a new strategy to their arsenal.

An opportunity to both grow their wealth AND income at the same time.

It’s my #1 dividend wealth building strategy.

And, like I said, I continue to move more and more of my money into this strategy.

Even though I don’t plan to retire any time soon, having a growing nest egg is extremely important to me.

Especially if something sudden ever happens… I want my wife to be taken care of. As she doesn’t give a darn about dividend stocks and investing.

My #1 dividend wealth building strategy has outperformed my

high-yield portfolio by 3-4x.

In 2020, I returned 21.49% for those who followed me.

The S&P 500 only returned 18.4%.

That 3% doesn’t sound like a big difference… but when you’re compounding cash, it’s extremely important.

In a $500k portfolio, that extra 3% return compounded over 10 years adds up to an extra $171,958 in profit.

Pushing that $171k into high-yields generating 10%… that’s an extra $17,196 in income each year.

In 2021, so far my dividend wealth building strategy is returning 30% YTD…

The S&P 500 is around 24%.

That 6% difference compounded can add up to an extra $340,000+ in profits over 10 years using the same example as before.

Even better…

What many like Don and Joe like about my #1 dividend wealth strategy is it’s less volatile holding the positions than high-yields, tech stocks and other companies.

That lack of volatility is incredibly important especially if another crash happens. And it will. When? I don’t have a crystal ball… I wish I did.

All I can do is help prepare you by showing you high-yield income opportunities… and now (today) revealing my top wealth building strategy to add to your arsenal.

Even though Don is living off disability due to his MS…

He’s managed to build

a nest egg of $400,000.

In just 9 months, he’s generated “in excess of 30%” in his IRA.

Meaning, he’s on track to double his portfolio to $800,000 in the next 3-5 years.

If he then moves some of his portfolio into high-yield plays throwing off 8-10%… he’s potentially collecting up to $80,000 per year… on top of his Social Security payouts.

The worries about his disability insurance lapses will soon be a distant memory.

He’s put a lot of trust in me… and I’m honored frankly.

The biggest reason being:

“When the March 2020 crash happened, I was calm and didn’t panic. Everything recovered and I wasn’t hurt by it. Even if the market drops 20-30%, I trust Tim to guide us through it. He has taught me to see the market in different way.”

With my #1 dividend wealth strategy, Don’s no longer worried about the volatility in the markets.

I’ve been in the market 60 years and only seen one 50% drop.

With low volatility stocks and keeping dry powder investing in your nest egg…

It’s possible to grow a large portfolio you can live off… or keep as a security blanket (“legacy wealth” as one subscriber told me) for years to come.

And now is the time to be growing your nest egg quickly if you haven’t started.

Retirement is changing as we speak.

Pensions are slowly drying up.

Inflation is running hot.

More importantly, you can’t simply rely on your current job’s income to ride you into retirement.

Think of Don… his time in the workplace was cut short at 50.

Think of Joe… he was abruptly fired 3 years ago from a career he’s practiced for decades.

For me…

I used to think having active income was enough.

Have you ever heard my story of when I moved to Uruguay?

The plan was to retire for good.

I had a good job generating income.

My “plan” was to live frugally, get a job to make ends meet, perhaps start a small business, and retire comfortably.

Again, that’s what you’re taught to do. Work hard. Save. Retire comfortably. Live off what you saved.

I was a CFP, it’s what I recommended to clients for years. Maybe you have an advisor who sings the same tune.

And, in the beginning, everything was playing out exactly how I envisioned it.

Well…this retirement dream…(the same one I taught my past clients)… turned out to be a huge lie.

I figured this out myself when I got to meet many wealthy folks in Uruguay. They owned fancy cars and probably carried a 7-figure balance in their accounts.

We dined out together, swapped stories, I met some of their families. These were successful people who always had money to spend. You probably wouldn’t catch them dead cutting coupons.

Here’s the even more interesting part…

They were 40, some 50-years old… all well below the normal retirement age. Yet, they were set for life.

They weren’t lucky.

Their secret to building wealth was what set them apart…

It was nothing I heard before as a financial planner.

But it’s the key to my #1 dividend wealth building strategy which could double your portfolio in the next 5 years.

I realized that, as a CFP, I taught clients how to not lose money. Because CFPs aren’t there to really grow money, but rather help you hold on to what you got.

Their strategy? Sell your assets to pay for your cost of living.

The problem is you’re trapped.

You’re trapped because the only way to survive is if the stock market keeps going up forever.

It’s why the New York Times reported many retirees went “back to work” after the Great Recession.

The stock market dropped. They had already sold assets to pay their groceries and now their assets were worth less.

Meaning, they’d have to sell MORE shares to pay for the same groceries as last week.

If you think of your 401(k) like your house, it’s like selling off a room one-by-one. Soon, you have nothing left.

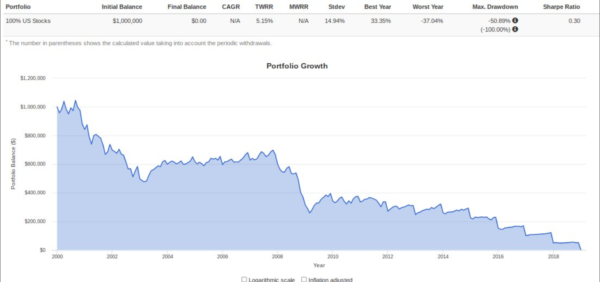

I saw this graphic recently on social media:

If you started with $1,000,000 in 2000. And you withdrew a modest $50k per year (5%)…

You’d be out of money by 2018.

Can you see the lie?

After you’ve done a great job saving for decades, your money tree can’t grow anymore because we’re told to cut down every month to pay your bills.

It wasn’t until I started listening to these wealthy folks in Uruguay that it all made sense…

The incredible secret of these wealthy Uruguayans was simple.

CASH IS KING.

And I don’t mean stashing cash under the mattress.

Instead…

Get cash…

Keep cash…

Generate cash without a job…

Cash on hand at all times does two things:

- Pays for a lavish lifestyle with no worries, and

- Allows you liquidity to get into cheap assets that can grow your wealth quickly

Here’s my secret to

retire comfortably and

for good with a lot of income

#1. Build up your nest egg to double in 3, 5, to 7 years

#2. Rotate that newfound capital into more high-yield positions which can generate 8-10% cash to pay your bills.

Think of #2 as what you currently do inside The Dividend Hunter.

If you have a $500k portfolio… and double it in 5 years… that’s a $1,000,000 portfolio.

Imagine then having an opportunity at $80k-$100k in dividend income each year on top of your Social Security and any other pensions you may have.

I didn’t think about this when I moved to Uruguay.

I figured “make income… I’ll do fine.”

What happens when that income gets shut off suddenly like Don experienced when he was diagnosed with MS?

That’s why if you can build up a solid nest egg… double your income every 3, 5 or 7 years…you can then turn those investments into income for life.

You first have to fast track your wealth…

Imagine your money working for you all day… every day.

Have you ever seen a hydroelectric complex like this one

Water is funneled in from a source… whether a standing pool… or captured water from melting ice.

The H2O is passed through generators to produce electricity daily.

Here’s the magic —> the same water is used again and again. It’s called the “hardest working water in the world.”

That example isn’t from me… but from another of my readers who is using my wealth-building strategy to retire well.

Glen C. worked in a utility job before retiring 16 years ago. He saw this recycled water concept up close.

And it’s exactly how my #1 dividend wealth strategy works

“I see that same phenomenon with Tim’s way of investing. My money is working for me all the time — growing in capital gains and dividends growing then reinvested. I’m recycling my money over and over and it’s growing.”

Glen has over $765k at work inside my recommendations.

“In 30 months, I’ve seen a 32% return! Tim’s an average guy I can relate to, I tell my friends… follow Tim!”

Much like me when I struggled in Uruguay…

Glen was selling off his assets to live.

Then, he saw a family member was essentially living off Chevron’s stock dividend.

That’s how Glen stumbled on my work.

Today, Glen is building a nest egg… but is also living off his dividends as well.

“My wife and I now do volunteer work and use our dividends to cover our expenses and travel including a trip to Disney World with our grandkids coming up.”

With Glen’s 30% return in 30 months… he’s on pace to double his portfolio in under 5 years.

I can’t promise you these returns… but see what is possible when following my #1 dividend wealth strategy.

If you’re building a nest egg you won’t have to touch it for years to come…

The stocks following my #1 dividend wealth building strategy are ones that make the most sense

in these changing times.

Because the 2020 pandemic has altered how many view their retirements.

Walt J — one of my wealth-building subs — was a physician assistant in the private sector for 24 years.

Everything was going smooth… until his brother died at 66.

Walt wasn’t much younger than his brother… so it was a major wake-up call.

Did he want to keep working hard and not enjoying his life in his later stage like his brother? What if he doesn’t get to do all the traveling he’s wanted to do?

Walt was using The Dividend Hunter for 4 years before he made the decision to seek retirement in 2020 during the pandemic.

At that time, he started using my dividend wealth-building strategy to build a nest egg that will last.

See, Walt was in the Air Force, meaning he receives a pension on top of his Social Security.

That helps with his income needs… but he wasn’t seeing much in capital gains.

Since just August 2020… he’s done well following my wealth building approach.

“Two of my stocks are up over 100% from

August 2020 to September 2021.

I made over $11,770 in profits in that time frame despite 2021 being up and down for many stocks.”

*These gains are not guaranteed for anyone reading this*

In June 2021, Walt pulled the trigger and left the workforce for good.

Here’s what he thought about the dividend wealth stocks I dive into…

(including 5 I’ll show you in a minute)

“I’m only a part-time investor. I check the markets at the end of the day, but Tim’s recommendations I can honestly leave them alone. If they go down, I know they’re strong companies that can come back.”

Walt then wants me to relay this message to you:

“Join [Tim] to collect dividends and enjoy capital gains too for growing your wealth. I’m really enjoying it so far.”

With Walt, 2020 changed his entire perspective on life.

It’s also changed how much people think they need to retire.

Bloomberg reports even those with large portfolios over $450k… even $1.7M believe they won’t be able to retire.

At the same time… we’re seeing folks like Walt pull the plug on their active income.

And I believe we’ll see more of this in the next 12 months.

Those 50+ are retiring in record numbers.

It’s not just in the US either…

My team and I talked with Tim S. — another of my paid subscribers.

But Tim S. isn’t in the United States. Him and his wife are from England… but, in 2020, they decided to hang it up and move to their dream location in Spain.

“Right when we retired, we went all-in on Tim’s (Plaehn’s) recommendations. [He] has been an incredible resource for us.”

Tim S. used to be an accountant and he says “I realized when I wanted to retire, it also meant I’d need to learn how to self-manage my own and my wife’s investment portfolio.”

He found my dividend research and (as he says) went ‘all-in.’

“I personally have about $380,000 in the service and have made about $67,000 in just one year. Some of the opportunities are up over 100%.” (I am not promising these returns, just relaying what Tim S. told me)

On one hand…

We have the majority of folks believing they need a larger-than-normal chunk of cash to retire…

On the other hand…

We have folks retiring in record numbers.

Meaning, most retirees believe they will see their retirement accounts grow enough.

But can you rest easy at night if your money is all tied up in volatile growth stocks?

I just saw a few weeks ago this pandemic-darling – Chegg (they help college students study)

Their stock did a full circle from pre-pandemic to post-pandemic.

In hindsight, it’s easy to say you’d sell at the top… but that’s a tough gamble.

The dividend stocks following my #1 wealth strategy are:

- Not volatile

- Consistent winners (all current stocks are green over the last 12 months)

- Pay dividends unlike many growth stocks

- Generate more profit than regular dividend payers

I have 5 stocks to show you to kick off your dividend wealth building journey.

Think if you started with

$400,000 like Don.

Don’s plan is to double it to $800,000 in 5 years then draw

income from dividends.

But what if you could let it sit.

$800,000 perhaps turns into

$1.6 million in 5-7 years…

After that… maybe $3.2 million 5-7 years after that.

15 years from now, it’s not unheard of to have a multi-million dollar portfolio.

A $3.2 million portfolio could technically generate $256,000+ in income per year for life, maybe more.

Those are just examples of what’s possible.

A key to a stress-free retirement is not only knowing your bills will be paid but that you have a portfolio which will continue to grow.

With my dividend wealth strategy…

You’re collecting dividends but also seeing appreciation at the same time.

It’s the best of both worlds.

For example…all these stocks are dividend payers I’ve recommended, but check out the capital gains:

A mortgage co. – up 124% since the lows of March 2020… up 54% since 2019.

An oil midstream play – Up 382% from March 2020…up 158% since 2019.

A housing stock – Up 48% from 2019

A storage stock – Up 99% since 2019

An energy stock – Up 65% since 2019 — 117% from March 2020 lows

A regional bank stock – Up 62% since 2019 — 199% from March 2020 lows

A transportation play- UP 55% since 2019 — 271% from Mar 2020

A commercial real estate co. – Up 207% from March ‘20 lows

A retail store stock – Up 372% from March ‘20 lows

Another energy stock – Up 64% in 7 months in 2021

A manufactured home co.- Up 33% in 6 months in 2021

Since November 2020… NONE of my dividend wealth recommendations have been a loser

(even with a volatile 2021)

That’s why none of these opportunities you would find inside The Dividend Hunter. But they’re a perfect complement.

Lower volatility… lower yield… but a higher shot at capital gains down the line.

Look — there are plenty of so-called ‘experts’ out there who will share their top tech stock or cryptocurrency play.

That’s not who I am, nor will I ever try and be that person.

You come to me for dividend stocks.

Which ones you should buy… and the research behind it.

You can join Don, Joe, Tim S. and hundreds of others to build wealth with dividends.

I wouldn’t jump all-in at first.

Start with a few stocks… the 5 I’ll show you here… then build your nest egg faster from there.

It’s all contained in my brand-new report Forever Retirement Portfolio.

Inside — you’ll receive all 5 ticker symbols. All the stocks are ones you can buy in any brokerage or IRA.

You won’t need to do any research yourself.

This is as simple as pull the 5 ticker symbols… go to your brokerage… and buy the shares. Once you do that, you’ll be on the way to potentially double your portfolio in the next 5 years.

I call it “Forever Retirement” because I believe this is the #1 strategy to use for retirees.

Those who are on their way to retirement…

And those already retired.

That’s because more and more income is hitting your bank account each year without doing anything.

It’s quite the dream.

I’ve built my career and reputation as your editor of The Dividend Hunter. I’ve been looking for high-yield stocks to hand you income right now.

It’s time to take that next step and secure your retirement for life.

As I showed you, I’ve used my strategy to beat the market the last 2 years… with a pace to double any portfolio in 3-5 years.

You can start yourself on this path without trading options, buying volatile tech stocks, investing in real estate, or wasting time on fake cryptocurrency coins.

Join Don, Joe, Glen and hundreds of others on the path to a nest egg doubling again and again.

If that’s what you’re interested in, you don’t need to do anything complicated.

Start by picking up a copy of Forever Retirement Portfolio and buy the 5 stocks mentioned inside.

Waiting any longer and you’re missing out on critical compounding time.

This report is valued at $199, but it’s yours as a bonus add-on.

It is possible to invest in conservative dividend stocks and see incredible capital gains for yourself and your family.

You just need to know the right strategy.

And I’m going to give it to you.

Inside a second bonus, My #1 Dividend Wealth Strategy to Double Your Portfolio I’ll spill my secret.

This is a strategy I saw first-hand that ⅔ of Charles Schwab money managers believe will make their clients the most money over the long term.

Meaning, while they push tech narratives on CNBC, behind the scenes, they recommend my #1 wealth strategy to their clients.

That’s why I’m always telling you to cut through the noise and do what really works.

What you’ll find inside is a complete breakdown of why this strategy works including:

- 5 key criteria I watch for before investing in this specific group of dividend stocks

- Proof these dividend stocks are more stable and produce more profit over time (more than any other dividend payers around)

- How I’m seeing up to 152% bumps in my income without any extra work or investment

No matter if you’re retired, near retirement, or still 10+ years to go…

I’ve tried every wealth-building strategy in the market you can think of.

None have provided better returns with less stress than this one, simple strategy.

You won’t find this in The Dividend Hunter.

You can only read about it here.

Get your hands on this second bonus report now.

Meaning, you can claim access to my top 5 dividend wealth stocks… and the strategy behind it right now.

They’re both included free in my special dividend wealth product.

I want you to have the strategies to retire and stay retired for

decades to come

That’s why I’ve created a product that is a complete “Forever Retirement” service.

It’s called Monthly Dividend Multiplier.

In the last 12 months, I’ve seen more Dividend Hunter subscribers join than ever before.

The goal is simple —> We want to double our portfolio every 5-7 years.

Currently, with 30% YTD returns, we’re on track to double in less than 4.

Subscribers like Don are relying on Monthly Dividend Multiplier to retire themselves comfortably.

Because if you can take the dividend stocks inside the service, invest then reinvest in them, you’ll not only enjoy passive income… you’ll see your stock prices rise over time.

All with less volatility and less time ‘trading’ i.e. spending hours going over your portfolio.

Monthly Dividend Multiplier is a complete service where you can put in a large chunk of your nest egg… whether it’s in a regular brokerage account or an IRA… leave it alone most weeks… automatically reinvest the dividends… and watch your account grow.

This isn’t an active stock service.

You aren’t constantly trading.

There are over 23 stocks in the model portfolio.

You don’t need to invest in all of them. Some of my readers do, others don’t.

I believe you should start with the 5 I recommend in my Forever Retirement Portfolio.

5 steps to use Monthly Dividend Multiplier to double your money every 5-7 years:

- You take advantage of my #1 dividend wealth strategy (in the free report) to invest in these specific dividend stocks

- Reinvest the dividends over time. We’re not looking for active spending income. That’s for later.

- Contribute more of your own capital if you’re still working or have leftover money each month.

- Invest in at least 5 stocks I recommend.

- Buy shares as they dip… trim shares as they run up

It’s really as simple as that.

I’m providing all the stocks, the research… you just have to buy the shares.

“How do I know when to trim, Tim?”

I told you this is a complete retirement product…

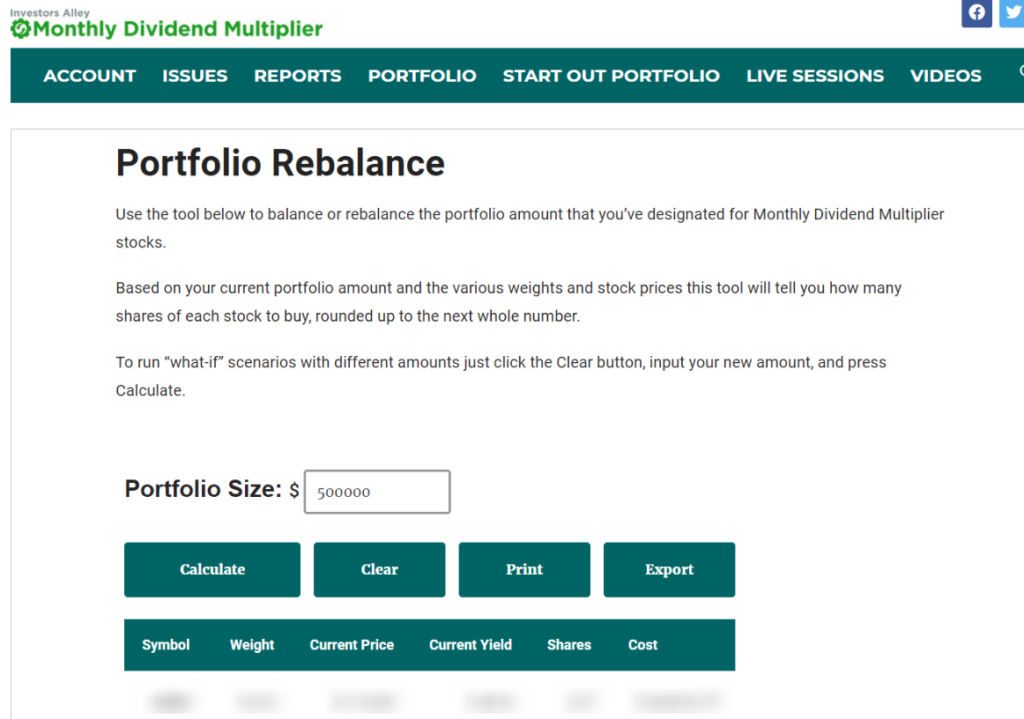

That’s why I’m including as a free bonus my Monthly Rebalancing Tool.

When I talked to subscribers, this was one of their favorite pieces of Monthly Dividend Multiplier.

With the Rebalancing Tool… all you do is put in your current portfolio balance (I recommend you have one account that is dedicated to just Monthly Dividend Multiplier as you might do with The Dividend Hunter)

That’s all. Put in your balance and my program will automatically calculate how to rebalance your portfolio among the Monthly Dividend Multiplier stocks.

This is valuable so if a stock runs up 25%… it could be overheated and make up a larger percentage of your portfolio.

With the Rebalancing tool, it’ll share how much to trim off those positions and perhaps put in stocks that are down at the moment.

That way, you’re picking up shares at a discount, meaning more dividends, more future compounding of your wealth.

There’s no thinking or second-guessing.

Take profits, reallocate your capital. It’s that simple.

I’m taking all the emotional decision-making out of your hands.

I even shot a free video on the Rebalancing page with more ideas on how to use the tool.

Again, free when you join Monthly Dividend Multiplier.

And there’s more.

Much like The Dividend Hunter,

Every month, receive my Monthly Dividend Multiplier issue

Inside, I’m, of course, breaking down all our stocks. Adding new ones, maybe selling ones that don’t fit the strategy anymore.

I’ll breakdown what I’m seeing in the market for our stocks…

I’ll highlight one of our stocks to do a deep dive on as well.

The key is for you not to have to do any of your own research on these plays. Most issues are 10-12 pages.

Sit down for 15 minutes each month, read through it. All of my research is unbiased. I’m not interested or drawn to specific names. If it follows my #1 dividend wealth strategy and checks the criteria, I’m doing more research on it for you.

As a subscriber to The Dividend Hunter, you’re already used to this type of content on the 1st of the month.

Except, I add more advanced research and topics inside Monthly Dividend Multiplier.

Just in recent issues, I discussed:

…Inflation

…history about the stock market (and how that helps you manage your portfolio)

…How I invest in commodities like gold and silver

…I’ll even cover some “Retirement Lifestyle” tips such as how to stay in shape at an older age

…Even some macroeconomic pieces like the European energy crisis

It’s a complete newsletter that’s a perfect complement to The Dividend Hunter.

Now, you have two issues to read on the 1st. Double your research, plus double the amount of stocks you could be invested in.

However, again, Monthly Dividend Multiplier is a complete retirement product.

Meaning, it doesn’t make sense for you to invest for retirement alone.

You will also get access to a

Private Members call.

(even gain access to exclusive investment opportunities)

Every month, I’ll hold a live call with all my Monthly Dividend Multiplier subscribers.

On these calls, I walk through the current economic climate, our portfolio positions, and then, most of my subscribers’ favorite part, I answer questions. Sometimes, 60 minutes of the call is just me answering questions. I really enjoy it.

These calls are meant so you can rest easy knowing you’re doing the right thing for your retirement.

They’re the perfect first step to making sure your retirement is covered for life.

When the market drops, you don’t have to go through that alone. Monthly Dividend Multiplier members get together and I help walk you through those rough patches.

Your family will appreciate how much dedication you’re putting in to get retirement right. That way you won’t become one of the “40% of Americans at risk of going broke” as Marketwatch reports.

This is a free service for subscribers.

I’m here to walk you through retirement step-by-step.

Plus, you don’t pay me a penny more no matter how many questions you ask, emails you send, or webinars you attend.

It’s all inclusive.

Bonus: I’ll bring on guests who have exclusive investment opportunities you won’t find in the stock market. All my Monthly Dividend Multiplier subscribers have had a shot to get in early on a wine investing opportunity, and, more recently, a clean-tech play.

These investments are completely optional, but a lot of fun to see and learn about.

I’ll bring these guests on during the LIVE calls.

Up to now, you’re receiving:

- 12 months of access to Monthly Dividend Multiplier

- 12 monthly issues with all the stock recommendations and research

- 12 LIVE monthly calls to help you through retirement, investing, plus bonus investment opportunities not found anywhere else

- Forever Retirement Portfolio – The first 5 stocks I recommend to be on the path to double your portfolio in 5-7 years

- My #1 Dividend Wealth Strategy to Double Your Portfolio – The secret sauce that is proven to be more profitable than any dividend strategy on the market (Wall Street recommends this strategy for clients to make the most money)

- Portfolio Rebalancing Tool – A product built by my team to automatically rebalance your portfolio when your stocks get overweight. This way you’re selling high and buying low. Very easy to use and a bonus video included.

- *JUST ADDED BONUS* – As I finished writing this, we just released a new feature as well… The weekly Video Mailbag. If you enjoy the Mailbag with The Dividend Hunter, Monthly Dividend Multiplier’s mailbag is a more advanced version. I’ll answer questions and dive into our stocks even more each week. (Yours free with a subscription)

We’ve sold this service at $1,997 in the past and many bought it.

However, I’m willing to cut that price down 76% right now if you join today.

Before you make your decision, let me share two more stories with you.

Both of these stories are from Monthly Dividend Multiplier subscribers… and you’ll get to join them today.

Meet RY.

“I manage my money, my husband’s and children’s totaling over $2 million with $550k in Monthly Dividend Multiplier alone”.

RY’s a retired family physician and admits she didn’t have time to learn about investing while she worked.

“We hired 5 different money managers. We received mediocre results and high fees. I realized I needed to manage my own money, but didn’t have time. Then, in 2017, I stumbled on Tim and have been a subscriber to everything of his since.”

5 different money managers… that’s unbelievable.

Her husband is a nutritionist with his own practice and plans to continue working.

However, Covid’s altered their plans on how they see retirement.

Funny enough — here’s their new plan “we want to be like Tim and travel the country in an RV. Once our grandkids are older, we plan to take off!”

I’m flattered that others want to live the RV life like me. I can’t wait for my next venture.

RY went from knowing little about investing to now being the family money manager with $2 million under her watch.

She found Monthly Dividend Multiplier in 2020 (as many did when all our lives were changed)… and says she’s “returned 28% since then.” These aren’t necessarily the gains you’ll see, just what RY’s reported.

Today, over $550k of her capital she manages is in Monthly Dividend Multiplier.

“I was talking to a friend last week, and they’re sitting on cash needing income. I immediately recommended Tim’s dividend strategies. I think even young, middle-aged people should have a portion of their money in Monthly Dividend Multiplier. Get a subscription to Monthly Dividend Multiplier, you’ll love it!”

RY is using the service to build ‘legacy wealth’ for her family.

How you use Monthly Dividend Multiplier is different for everyone’s retirement needs.

I told you Don’s story who needs the service to double his money in 5 years and live off that.

RC has other income, so Monthly Dividend Multiplier is a long-term wealth play. Call it a security blanket.

When she reaches a certain portfolio size… she may transfer that capital into higher-paying dividend stocks and live off that income.

If she can double her money in 5-7 years… her $550k in the service could jump to $1.1 million… then $2.2 million… and keep going from there.

That’s a lot of potential income in the future as they travel around in their RV!

So is Monthly Dividend Multiplier for you?

I’m giving you a 76% discount from what others have paid…

But

You’re a member of The Dividend Hunter and still may be curious if you need both services.

I’m going to let another fellow Dividend Hunter subscriber tell you the differences.

His name is James K.

James retired in 2019 after being a physician. He and his wife now volunteer regularly at the local hospitals.

Today, he has over $310k in Monthly Dividend Multiplier. “In 18 months, we generated over $35,000 in profit from the service and I couldn’t be happier.” (not promising these returns to you)

James uses both services simultaneously and here’s how he does it:

- “The Dividend Hunter is great for dividends to support our lifestyle if needed. It’s a nice security knowing high dividends are coming in although most of the dividends are either automatically or strategically reinvested. “

- ”Monthly Dividend Multiplier allows me dividend growth plus capital appreciation. My returns are higher in this service overall. I use it for compounding our wealth. If in the future, we need more income, the wealth generated here can be converted into more Dividend Hunter investments to create higher income.”

That’s exactly how I teach subscribers to use both services together.

And I’ll go into more detail with an extra free bonus for you.

It’s called “Monthly Dividend Multiplier + Dividend Hunter = Rising Income for Life”

Very quickly, inside is a simple breakdown of how to use both services together to get the most bang for your buck.

I’ll dive into how you can grow your nest egg with Monthly Dividend Multiplier… then, transfer capital gains into high-yield stocks in The Dividend Hunter to generate active income as you need it.

Let me share what Charles H. told me as he’ll back up James.

Charles:

- “I was in The Dividend Hunter, but I didn’t need retirement income right now, I needed more growth. I joined Monthly Dividend Multiplier and discovered it’s safer than growth stocks. I can set and forget it, then rebalance every few months or so. Growth in your portfolio is important… to get more dividends over time you have to have capital appreciation. Not to put all your eggs in one basket.”

Charles plans to retire in the next couple years, then him and his wife “plan to go to Europe and play a lot of bridge.”

Love hearing that!

Charles is tapping into Monthly Dividend Multiplier’s wealth-building strategy to set his nest egg up to then draw more high-yield income down the line.

It’s a 1-2 punch Monthly Dividend Multiplier + Dividend Hunter.

This isn’t a “one is better than the other.”

I see Monthly Dividend Multiplier as a more advanced product. There are more benefits and features.

I’m giving you a ton of free resources and tools, plus 12 months access.

Like I said, others have paid $1,997…

And that was before I added the Rebalancing tool and the exclusive investment opportunities.

However, I’m not looking to charge that much now.

Probably in the future again… yes.

But today… one payment of $495 grants you 12 months access to Monthly Dividend Multiplier.

That’s a full 76% off.

Advisors on Wall Street charge 1% plus 20% of your profits.

If you have a $150,000 portfolio, right off the bat you’re paying $1,500 each year and that’s just to retain their services.

On top of that, if you make 15% on your money as the Monthly Dividend Multiplier already has done, you’d pay them $4,500 on top of that. That’s $6,000 a year and your fees only go up as your account goes up.

With the Monthly Dividend Multiplier, you get two benefits:

- You only pay the same amount each year even when I raise the price in the future

- Your investment is much, much less than $6,000 per year.

You’ve heard a few stories today about Monthly Dividend Multiplier subscribers ditching their money managers.

Now, you can too.

Click the “Join Now” button below. You’ll be taken to a secure, private page to view everything you will receive in your inbox today.

Monthly Dividend Multiplier is one of my favorite products to run as I move more and more of my money into the stocks (as I invest alongside you).

If you’re serious about doubling your portfolio, join me now and click the button below.

I’m going to let Don have the last word here.

Don’s story is one of the best ones I’ve ever heard from a subscriber.

I’m honored he trusts me to lead him to retirement in 5 years. Many would be panicking… but not Don.

He’s invested in Monthly Dividend Multiplier and set his sights on doubling his $400k portfolio inside the service.

Here’s what he has to tell you —>

“I trust Monthly Dividend Multiplier to build my nest egg and I recommend it to anyone who loves dividend investing and appreciation in their portfolio.”

Join Don and the many other Monthly Dividend Multiplier subscribers you met today.

Click the Join Now button now.

Start on the path to double your portfolio in the next 5 years alongside Don.