Breakthrough Income Strategy Grows Your Dividends Automatically and Passively Every Month Without Lifting a Finger

By Tim Plaehn

By Tim Plaehn

Chief Retirement Strategist, Investors Alley

Imagine your income skyrocketing as high as 152%, 77%, and 51% with one simple tweak in your investments…

Just follow 5 simple criteria I lay out below…

Today, I’m going to show you how to earn up to 152% more income than you did last year.

Meaning, if you enjoy an $18,000 per year income right now…

You could grow that rapidly to $45,360 without lifting a finger.

Think about that…

That’s the difference between buying this used Honda Civic this year…

Or this fully loaded Jeep Grand Cherokee…

If you know me, I like to hit the open roads with my dog, so I know which one I’m picking.

I’ve scoured the world and let me tell you…

Nowhere else can you find a way to increase your income up to 152% both automatically and passively every month than with the 5 criteria I’ll show you today.

With this breakthrough income strategy, you don’t even need to add any more money to your account…

It’s a perfect strategy if you don’t enjoy trading options…

That’s why if you’re looking for an automatic way to see more cash in your pocket without working every 30 days…

You’ll wish you’d found this monthly income multiplier strategy years…even decades ago.

Because I don’t know about you, but I’m not getting any younger.

And unlike my parents, I don’t have a golden pension waiting to supplement my retirement income.

That means I am left alone to not only save enough money to retire, but to make sure that money lasts for my entire lifetime.

It’s no easy task, and more Americans are in this same place than ever before.

I bet you’ve had at least one sleepless night worrying about…

“Do I have enough money to retire?”

“Will my savings last the rest of my life?”

“What happens if inflation strikes the US but my income stays the same?”

I know after talking with you and other subscribers, you want an income that makes sure you not only never run out of money, but also have plenty leftover to enjoy life.

Whether that’s to travel more…

Buy that house by the lake or beach you’ve always wanted…

Or, finally do the stuff you love to do, whether it’s a hobby or, like me, it’s work you want to do, not ‘have to do.’

And I’m here to tell you that I have a solution.

A solution that takes your nest egg and turns it into a perpetual cash machine.

One that makes sure:

- Your nest egg never runs dry…

- You have a growing income that far outpaces the cost of living…

- You spend your time enjoying the retirement you dream of

My breakthrough income strategy made it possible for early users to turn an $18,000/year income into as much as $45,360 per year.

This monthly income multiplier strategy will let you create a growing income that far outpaces living expenses…

You’ll also be able to do it passively…and it happens automatically for you.

Countless Others Are Retiring Using this Automatic & Passive Income Strategy

One guy, Mike, retired from his corporate gig at 35 with his wife and two kids. He travels the country with them, including jumping in an RV and driving all of North America and Central America with his family.

Mike isn’t alone in retiring early…

Another guy is a real “average Joe.” His name is Joe and he retired from his engineering career at 38.

His wife wasn’t on board at first. But when Joe showed her how with these special income investments and other efforts, they could continue their lifestyle, her eyes were open.

Now, he gets to spend his time with his kids, he gets to write every day which he loves, and he watches his income grow each year. Since 2010, he claims he’s moved most of their wealth into this income strategy.

He claims, “They’re the best [for] passive income…. This strategy will ensure our income will grow even if we don’t add any new money.”

That’s what you’ll discover today…

Your money is continuing to grow each month automatically without lifting a finger and without investing another penny.

I like that.

But not only that…

Rapidly Rising Income is More Important Than Ever for Retirees

If you don’t recognize me, my name is Tim Plaehn.![]()

You may know me as the editor of The Dividend Hunter. It’s my flagship product guiding readers to a regular cash flow through high-yield dividends.

Over 13,700 people are enrolled including yourself, and that number is climbing by the hundreds every month.

You currently have a subscription to my newsletter. And the goal of The Dividend Hunter is to earn income TODAY, and it does an amazing job.

One of my readers wrote in about a cruise he went on thanks to my dividend picks.

But, according to my surveys and talking to readers, most people retiring today aren’t earning enough income yet to fund the retirement they desire. Nor do they feel comfortable that their money will last.

That’s why I’m talking with you today.

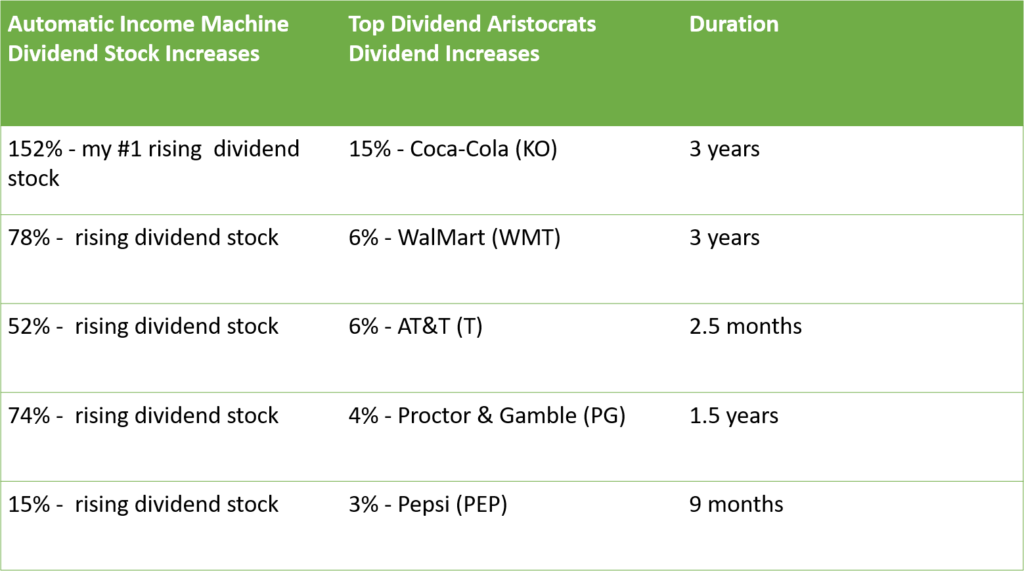

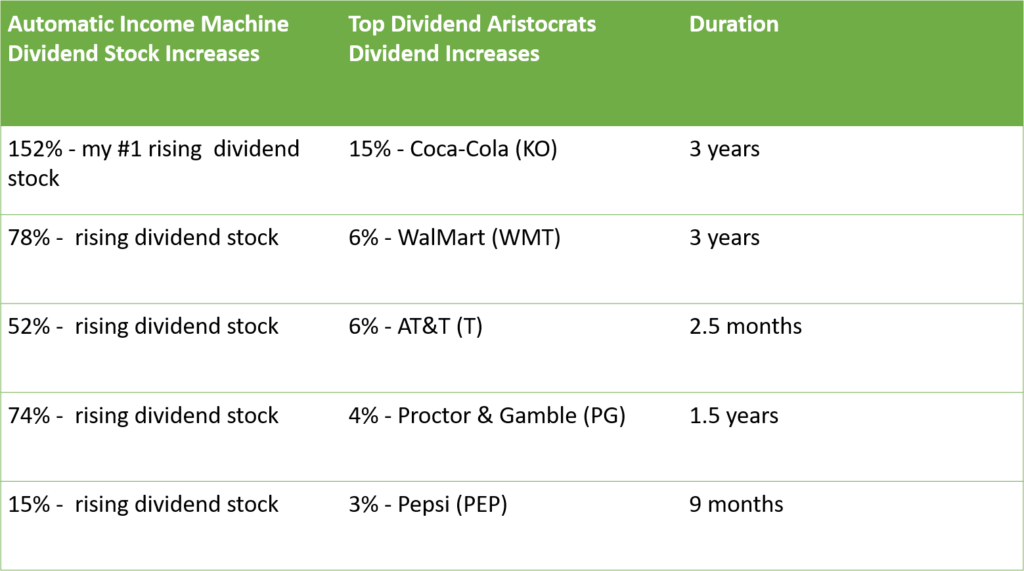

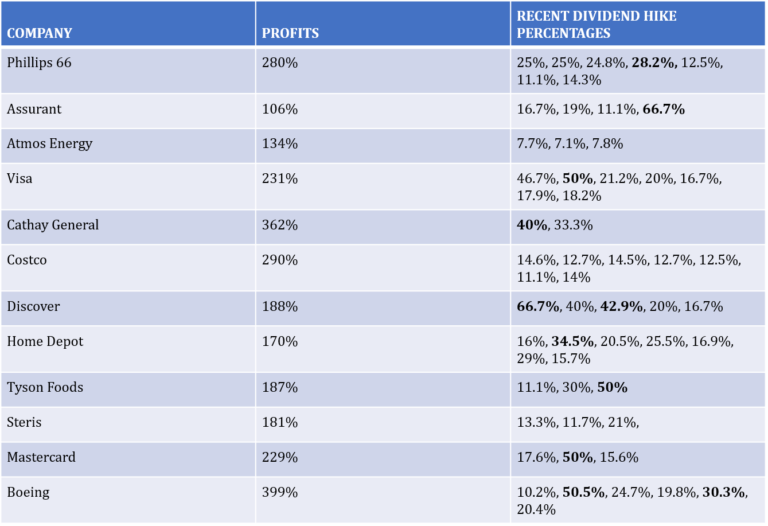

Take a look at some of the income increases I’ve already shown readers compared to some of the most well-known dividend stocks in the world.

You could’ve grown your income 152% over 36 months…in that same period, Coca-Cola, one of the pillars of dividend stocks, only grew their dividends 15%.

One of the opportunities grew 52% in just two and half months…while AT&T…another media darling…grew only 6%.

Meaning, you could’ve automatically and passively collected more than 8X more income than one of the most popular stocks on the market.

We’re not taking huge gambles.

We’re not speculating.

We’re investing in a specific, income-building opportunity.

It’s the ‘secret sauce’ of a retirement that gets better and more abundant every month.

And I believe my work has never been more important than it is today.

Because…

We’re Running Out of Great Options to Create and Grow Income that Lasts Forever

Here are your current options to generate income in our low-rate world:

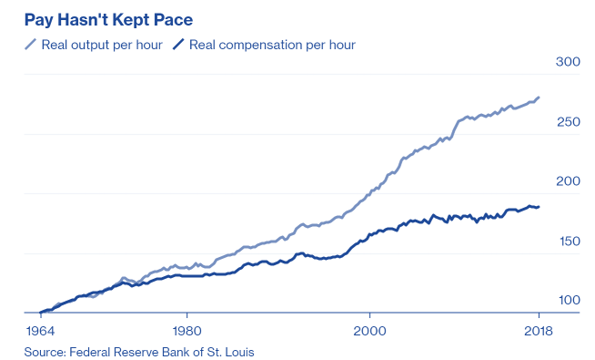

Number one: Continue working your job or business. According to Investopedia, the average pay increase in 2019 was 3.1%.

Annual inflation in 2019 was about 2%, so you’re only scraping by if you continue on this path.

Not even wages have kept up according to Bloomberg.

Number two: Invest in bonds: This is maybe your worst option for growing income. Current rates for a 5-year bond at this time are around 1.43% and heading lower. That’s LOWER than inflation, so you’re actually losing money. Bonds do not pay enough unless you go far out into more risky options… Not for me.

Number three: Invest in blue chip dividend stocks: Since 2013, Walmart has increased its dividend 13%. That’s averaging a little over 2% per year. Your income barely keeps up with inflation at that point. The stock is up 50% in the past five years. But from 2014-2017, the stock only went up 4%, or about 1.3% per year.

Could you survive three years on 1.3% stock returns and 2.5% annual increases? I’d think you’d find a better place to park your money.

Number four: Invest in high-yield stocks like in The Dividend Hunter. These produce nice incomes each year. With my plays you’re getting there, you’re receiving a steady income.

But not one that grows at a rapid rate.

If you are not already earning enough income to feel comfortable, you should not rely only on The Dividend Hunter.

Number five: An annuity or reverse mortgage: These are more controversial methods to generate income. Annuities require large sums of money upfront for them to provide any meaningful income.

Reverse mortgages are simply a new method for banks to take your house from you.

Both options I would never take in a million years.

These five options won’t grow your income each month passively…

You could keep working to keep up with your standard of living…

Or sucking it up and making 0.05% in a savings account.

But that’s no way to retire.

So maybe you’re ready to look for something else.

Let me tell you what I found was the best way to create a growing income:

- It’s an automatic, low-risk way to increase your income every single month. You make one simple investment following my five short rules and watch your income grow automatically and passively. But not just raising a few percentage points per year like Walmart stock. I’m talking 52%…71%…even 152% bumps over a couple years.

It sounds great, but I didn’t find this secret surfing the web

How did I uncover all this?

Let me tell you a story.

Receiving Automatic Income Boosts Each Month Is Straight From Wall Street’s Playbook!

A few years back, I attended an interesting closed-door event. It was a contest pitting top Charles Schwab wealth managers against each other.

The goal was simple…design a system or strategy that would make their clients the most money over the long-term.

Before I attended, I guessed what strategies would be shared…

…options…value stocks…income-focused portfolios, momentum plays and others.

I expected to see some complicated strategies. That’s not how I invest, but I was curious.

You won’t believe what I found out.

A full two-thirds of the Schwab managers invested in the breakthrough income strategy I’ll show you today. They believe it’s the most profitable and conservative way to make money, keep your money, and grow your money each and every year.

Do they tell all their clients this? I’d bet not.

Yet, here was Wall Street tipping their hand to me…

I couldn’t believe I didn’t know the power of this system. And I used to be a Certified Financial Planner helping families plan their retirement.

Again, imagine receiving up to a 152% increase in your dividends paid, without lifting a finger

So, if you’re making $18,000 per year right now…

If you could land a 152% increase in the next 40 months…you could be generating $45,000…

But 36 months is a short timeframe…

Say that happens again three years later…

Then your $45,000 could shoot up to $113,000 per year.

Without options.

Without even touching your stocks.

Without worrying about the stock market, volatility, or who becomes President.

You take action today. Then you automatically receive double-digit bumps each year.

Now, I can’t promise a 152% bump every 40 months.

However many of my readers have seen multiple double-digit boosts as well.

Check out again our results since 2016 and how they match up against popular dividend stocks.

Once you discover it’s possible to earn up to 152% more every few years…you’ll never look at your income the same again.

From here on out, settling for 2-3% dividend increases will be a distant memory.

It’s the difference between a good job and a dream job.

At a good job, you worked hard and maybe you were granted annual 2-3% ‘standard of living’ raises.

Every so often you’d land a larger payout, but it was normally pretty steady. They only gave you a raise because they had to due to inflation.

If you made $100,000…you received a ‘generous’ $2,000 salary increase.

Compare that to your dream job.

At your dream job, you excel. They give you the tools to succeed and get better.

Imagine if instead of calling you in for a 2% bump…they increased your $100k salary a whopping 152%.

Now, if you made 152% more…suddenly you’re at $252,000. And they don’t stop there. They do it again and again.

The year after that, your salary explodes to $655,000…then $1.2 million…and so on.

That’s a pretty good career you’d have.

It’s possible to start seeing these opportunities with your own investments…

You’ll need this secret as a Dividend Hunter subscriber.

The Dividend Hunter shares the best high-yield stocks in the world.

But it’s only HALF of the equation.

AMZA…as of this writing produces a 14% yield. That’s pretty good.

AMZA…as of this writing produces a 14% yield. That’s pretty good.

NRZ…as of this video is around a 8% yield. Still great.

MAIN…one of the rocks in our portfolio…is also a nice 8% yield.

Your subscription to The Dividend Hunter is designed to pay you a high income today. It’s excellent for steady income year after year.

Compare it to earning your first steady paycheck.

You know it will show up every two weeks, and you can count on it to pay the bills.

At some point, though…you wanted to make more money. You wanted to upgrade your home and start a family.

To make more money, maybe you had to take on more responsibility, change job titles, whatever it was.

Point is, you had to change what you were doing.

Right now, just investing in Dividend Hunter stocks, you’ll receive that same paycheck over and over.

The income will not grow very much, maybe a couple percent a year.

So if you’re NOT earning enough money to live off of for the rest of your life with The Dividend Hunter today…

You need to complement your high yields with another stock.

You need to own stocks with rapidly rising dividends.

Like my #1 rising dividend stock which increased its payments by 152% in 40 months…

That grows an $18,000 annual income to $45,360 …

Growth like that would only happen if you invested tens of thousands or more dollars into current Dividend Hunter stocks.

AMZA you’d need about $324,000. NRZ and MAIN you’d need around $565,000.

If you can afford to drop half a million dollars into MAIN to attain a $45,360 annual income stream and not break a sweat, then you’re free to do so.

But my guess is you don’t want to do that.

And that’s not to mention the massive risk of putting all your eggs in one basket…

Rising Dividend Stocks are the Perfect Complement to Your High-Yield Dividend Hunter Investments

I received an email from Cal…a Dividend Hunter reader.

“[Tim], I’ve been with you for over three years now and very happy with what I’ve been able to build. I’m a 49 year old Police Officer with 23 years on the job. I wanted to build a supplemental income to go along with my retirement (sometime in the next 2-3 years). My average monthly dividends are over $1,500 a month now. “

I love getting emails like this from my subscribers because it gives me a chance to help them even more.

What I say to everyone who is in Cal’s position is this…

…especially if you want to retire in 2-3 years.

It’s time to start growing that income faster.

Faster to $2,000 per month…then $3,000 a month and higher.

I believe Cal can grow his income to as much as $45,360 per year using rising dividend stocks.

If Cal only continues to invest in Dividend Hunter stocks, he’ll take that $1,500 to the bank every month… that’s $18,000 per year.

However, what if instead, he increases his income an extra 51%…75%…152% in the next three years?

$1,500 per month ($18,000 per year) becomes an incredible $45,360 per year.

And it’s entirely possible if he begins investing in the rapidly rising dividend stocks I’m sharing today.

This allows Cal to collect more income over time without having to invest another penny.

I’m revealing the top three stocks I’ve found to increase your income by double-digits.

One of them has already increased our income 152% in three years.

And you’ll collect these ‘better payouts’ without any extra work or trading options.

Don’t get me wrong… still invest in Dividend Hunter stocks. That’s just one tool in your toolbelt. It’s your steady source of income.

Then, layer on my rising dividend strategy and you get growing income…perfect for having more cash in the bank automatically.

Others have started investing in my automatic and passive strategy of rising dividends

and the results have been incredible!

John says “I am a little over ⅔ of the way to my goal of generating income from my investments to 100% support me. I am enjoying returns of $90,000 [per year.] I anticipate I’ll reach my goal in 24 months.

Thank you for your guidance.”

David wrote me an email claiming: “I am months away from retirement. Your [system]…is allowing me to achieve an income that permits a continuation of the lifestyle I’ve established.”

Keeping that same lifestyle is important, as it keeps you comfortable and quite frankly…sane.

Maybe this all sounds too simple.

Maybe you’ve heard about rising dividends before.

But maybe you haven’t seen how I find these plays.

Because while anyone can go and invest in popular dividend stocks and earn 3%, 4%, or 5% increases a year…

I’m shooting for dividend increases as high as 43% in a single year.

Every rising dividend stock must pass a FIVE core criteria test.

These criteria are important to make sure you invest in rapidly rising dividends and don’t invest in a stock about to cut their dividend.

Cut dividends equal less income…and usually a sinking stock price,

To give you a headstart, I have my #1 rising dividend stock pick to show you for free.

Plus, I’ve found two others with tremendous dividend growth potential in the coming years

They aren’t speculative plays.

You won’t have to trade options.

Just click ‘buy’, sit back and collect.

Those three stocks are free for you to get today.

And rising dividends are more important now than ever before.

Rising Dividend Stocks Help You Survive During Stock Market Volatility…

…Because They are the Least Volatile Stocks!…

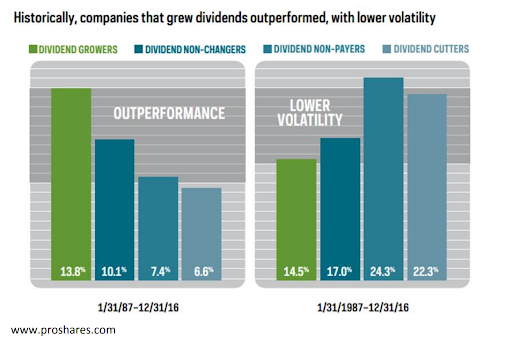

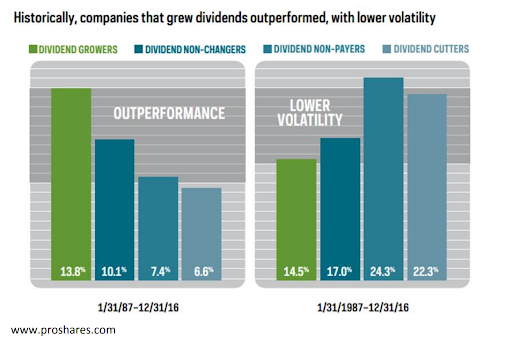

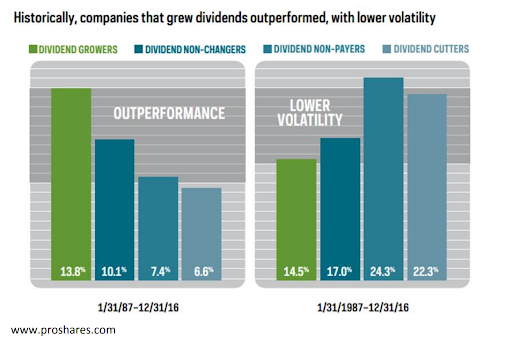

#1 – They are more stable than other stocks. Including other dividend stocks.

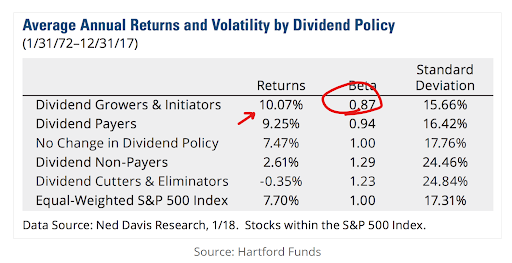

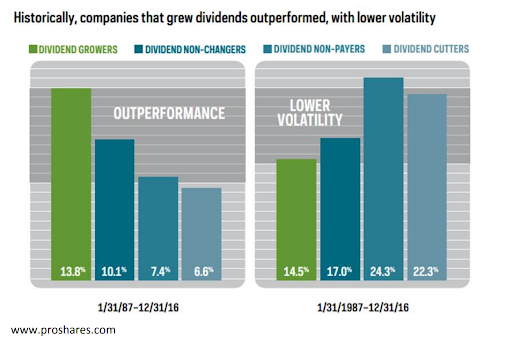

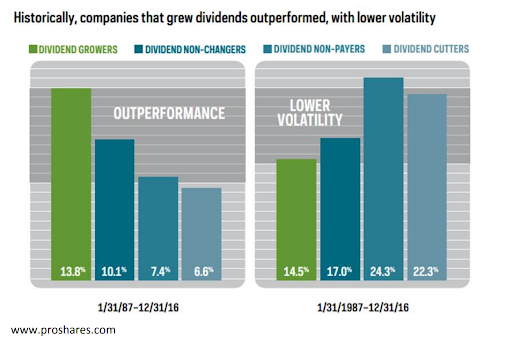

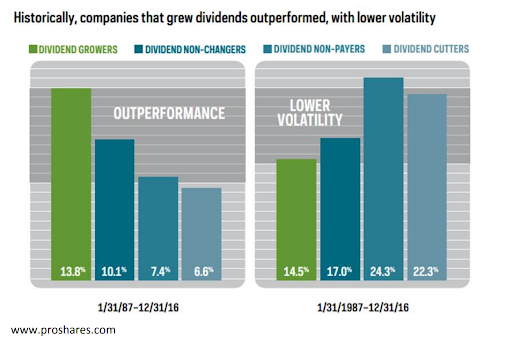

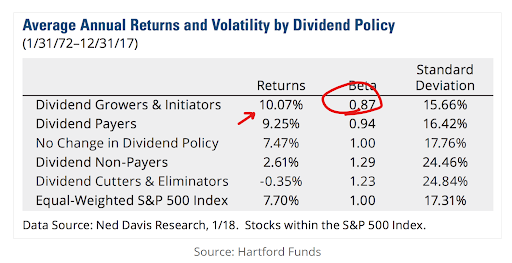

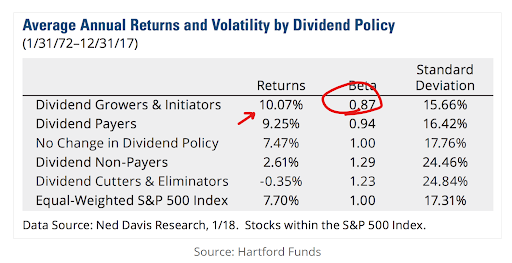

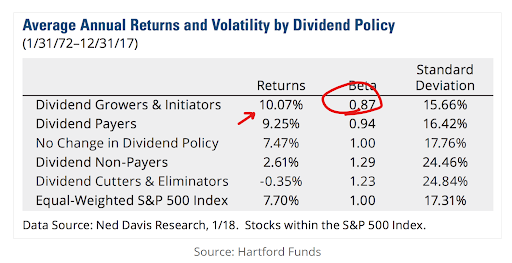

Check out how they measure up. This is from a study from the Hartford Funds.

Beta measures volatility in relation to the rest of the market. Under “1” means they move less than the stock market.

Meanwhile, non-dividend payers are a full 42% more volatile than dividend growers.

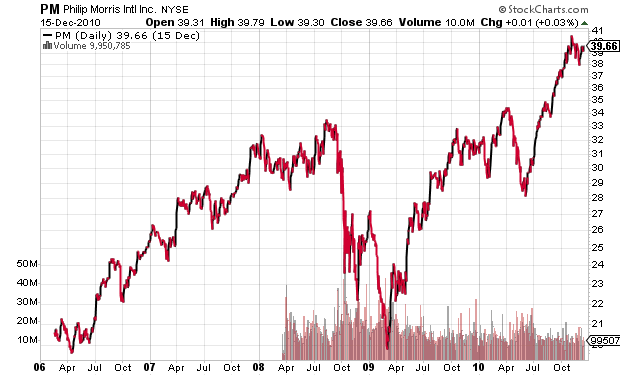

If you want a good example of a ‘dividend grower’ bucking volatility, check out Philip Morris. During 2008-2010, PM sunk about 40% from its highs, which is a pretty steep drop.

However, check out the chart.

Within 12 months, the stock was back at its highs.

The S&P 500, in comparison, took four years to get back to ‘net zero’ from their highs in 2008. One year vs. four years is a lot of time especially when trying to recover losses.

In the meantime, Philip Morris continues to hike its dividend. They raised it 7% from last year. Not great, but since it’s bounced off its 2009 lows, the stock increased 228% and steadily increased their payments.

Which brings us to a second reason to love rising dividend stocks.

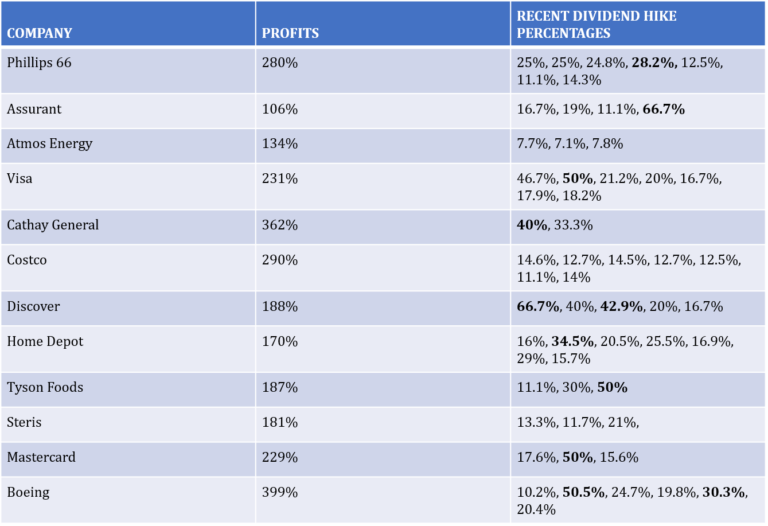

#2 Rising dividend stocks return more profit over time.

Here’s a study from the wealth management firm, McKinley Carter, who discovered that rising dividend stocks outstripped all others.

In their 30 year study, stocks with rising dividends produced 86% more profit than non dividend payers.

You’re pocketing more income because these stocks are better at earning more profit.

I have three stocks to add to your portfolio to automatically collect more and more income…including one that has raised their dividends 50%+ the past few years…

But I have even more to show you that will help you stay retired.

First, let’s look at the third reason for investing in rising dividends right now:

This could be the secret weapon to earning more income going forward, especially if you’re still a few years for retirement…

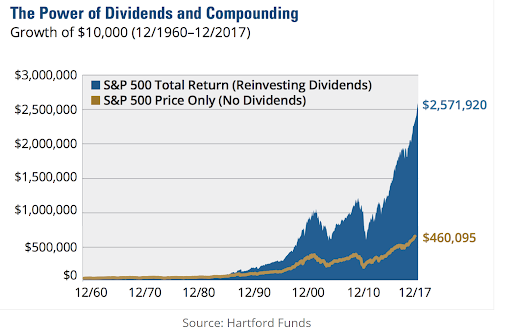

#3 Reinvesting increasing dividends each year has a multiple compound effect.

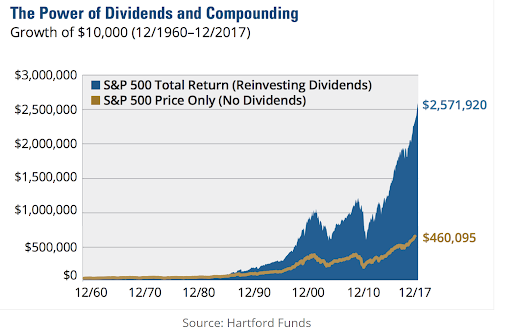

Take a look at the power of reinvesting dividends.

Over a long term study, you’d make 458% more profit than if you just invested in the SPY.

This compound effect is how we ramp up your income even faster.

If you’re still a few years from retirement, my best advice is to find those stocks raising dividends at a rapid rate, reinvest the dividends, and watch your income pile up faster as you roll into retirement.

But not all stocks who have raised their dividends qualify…

Here are:

Five Key Criteria Every Rising Dividend Stock Must Pass Before We Allow it into Our Portfolio

Let me run through what you should look for:

#1: The company has a history of rising dividends.

If you’re investing in the market’s fastest rising dividends, there’s no room for guessing. Find stocks that are increasing their dividends at a double-digit rate and pile in.

That comes with a caveat.

#2: Make sure you’re investing at a great price.

A stock may be raising their dividend, but that doesn’t mean you should invest in that particular stock.

Take a look at Boeing. It’s had some really great dividend growth in the past few years, but the stock historically has been expensive.

For a while it traded over $350 before the pandemic. And that’s after pulling back from nearly $450.

And with the recent bad news surrounding global travel, this stock quickly gets tossed out.

#3: Look for companies with increasing cash flow and paying out dividends from profits, never debt.

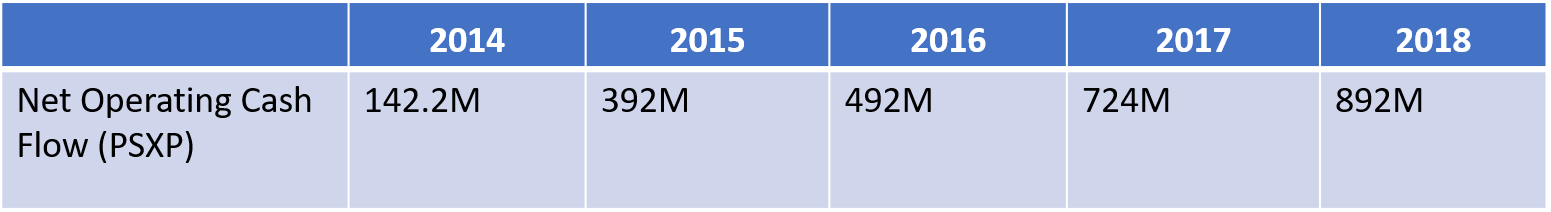

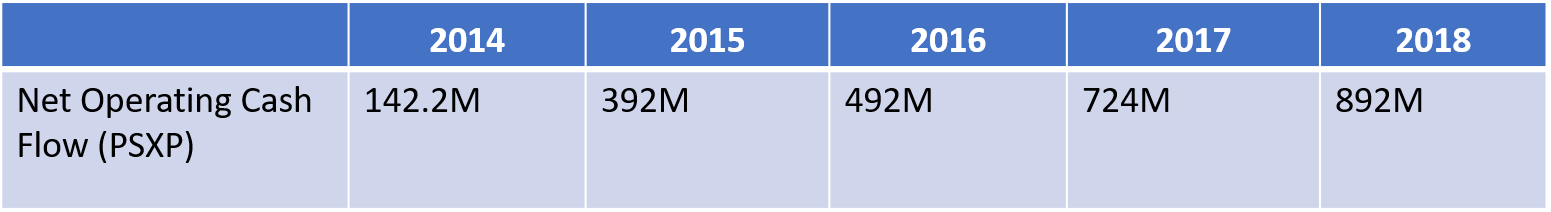

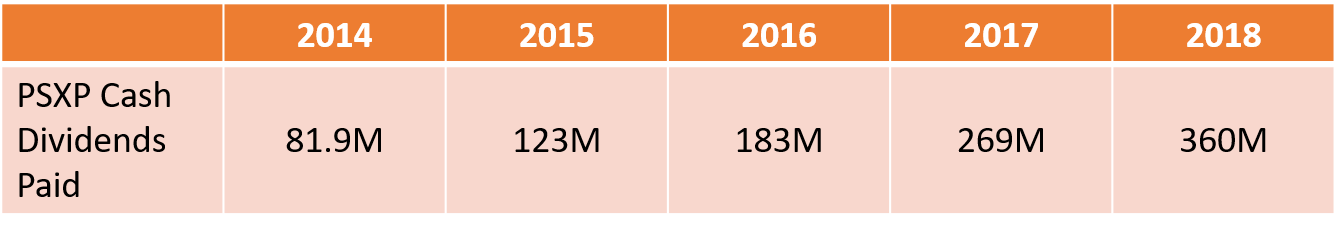

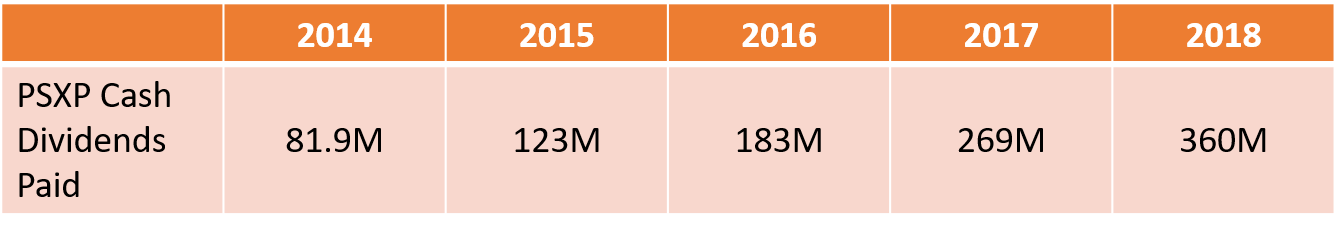

Take a look at Phillips 66 Partners and you’ll get an idea why I recommended them.

Their operating cash flow had increased 528% in five years. That’s six times more cash flowing into their bank accounts.

As you can imagine, dividend growth would follow.

They went from paying out $81.9 million to shareholders, to $360 million to common shares in just five years. That’s 339% more.

That’s a good stock to hang your hat on.

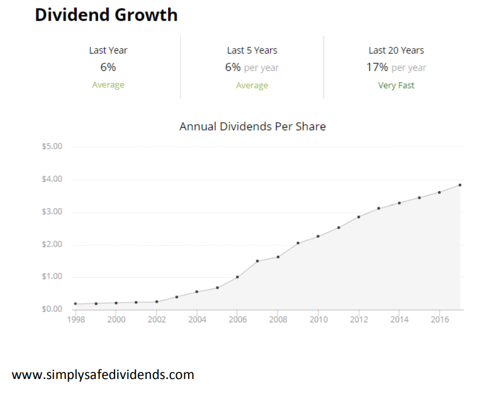

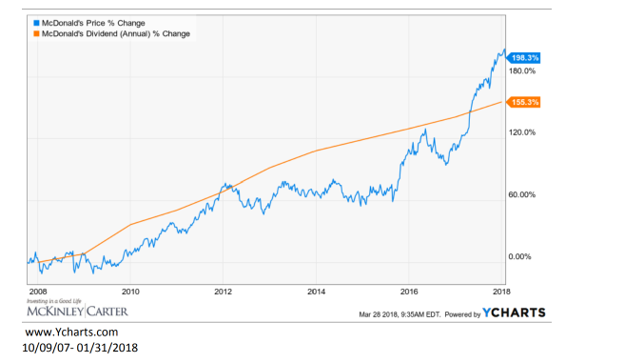

The dividend has nearly tripled in 6 years…and all you had to do was buy it and hold it.

On the flip side…

#4: Watch for signs of a dividend cut…and get out.

Remember that chart I showed you about volatility.

Stocks that cut their dividend are the second most volatile stock to own.

The telltale sign of a dividend cut is when the company’s financial situation begins to unwind.

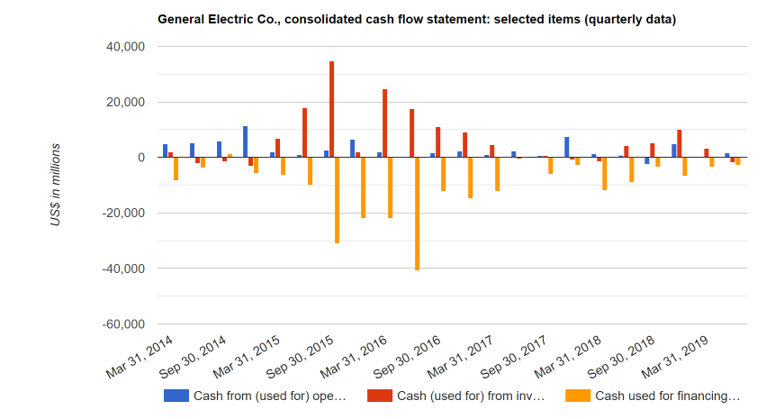

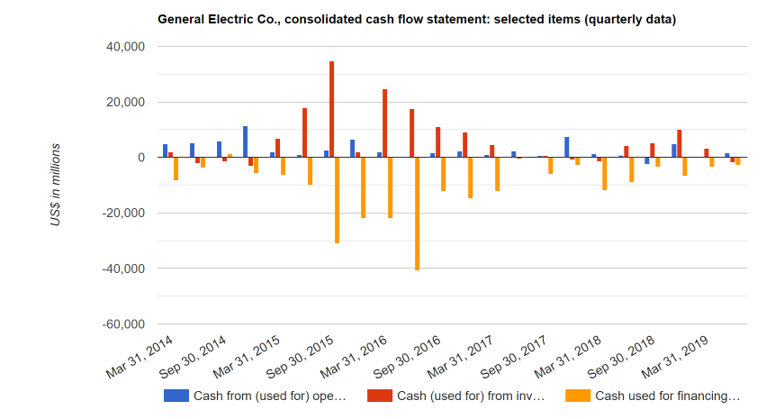

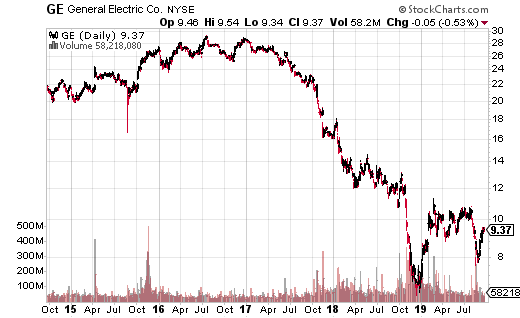

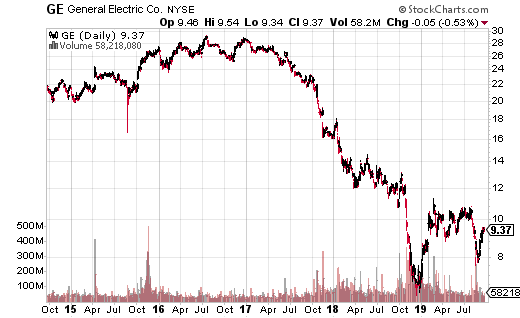

A mainstream example would be General Electric. In December 2017, they cut their dividend for the first time since the Great Depression.

For the news outlets, they were shocked.

If they followed the company’s cashflow at all…they would’ve noticed something peculiar.

See how the blue and red lines get shorter and shorter as we get closer to 2018? That means GE was making less and less money…meaning less and less money for your dividends.

GE had a lot of debt they were servicing. Paying out their standard dividends would only result in more debt and even lower cash flow.

I was not surprised when they cut their dividend by 50% in Q4 2017.

And not even that stopped the bleeding. Their cash flows continued to unwind and they eventually cut their dividend to $0.01 where it remains today.

Following their cash flow would’ve gotten you out almost a year earlier than the dividend cut.

Since that 2017 cut, the stock has plummeted over 65%.

So what’s the flip side of that?

#5: Look for companies with high cash flow in high growth sectors

I don’t normally recommend mainstream stocks, but this is an example too good to not show you here. It’s a freebie.

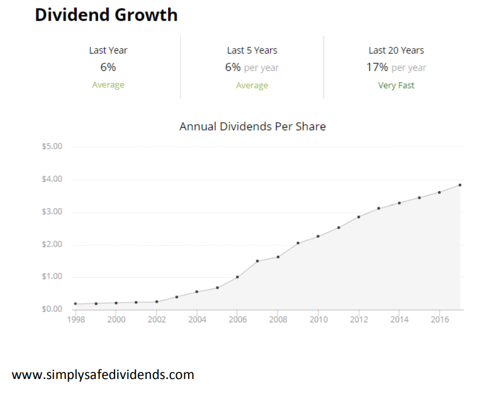

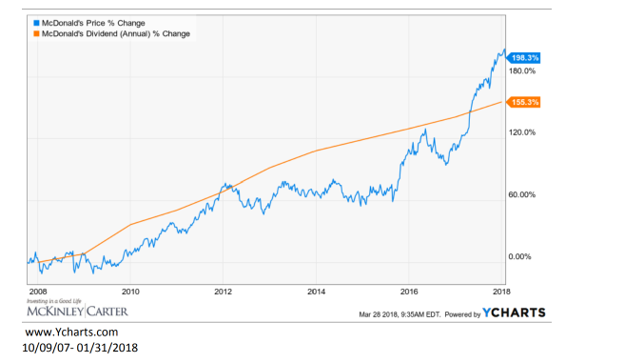

McDonalds has raised its dividend by an average of 17% each year. They’ve increased it every year since 1977.

During the Great Recession, you’d be hard pressed to find any good dividend growers.

However, when you dig into the stats, Americans were cutting back on fine dining to save money and instead opting for fast food.

Enter McDonalds. During the downturn, they increased their earnings by 35% and grew their dividend 34%.

Pretty impressive when the S&P 500 saw their earnings sink 34% and dividends crater 19%.

As a result, their stock price boomed 193% since the recession, and their dividend increased 155%.

If you can pinpoint these kind of growth opportunities, you will watch your income double, triple or more with the right stock.

Like I mentioned before, it’s like getting a 25%…50%…salary bump at work without doing any work.

This is automatically happening. You just need to be invested.

Check out one more early retirement story thanks to rising dividends:

Jason left his job at 33 and now lives abroad off his rising dividend portfolio. Jason didn’t start off rich.

He grew up in a rough part of Detroit in a broken home. At 21, he was broke and unemployed. After landing a $40,000/year job, he started saving and investing aggressively in rising dividends stocks.

He says “dividend growth investing [is] the best long-term investment strategy to become financially independent.”

Jason’s proof now as he does what he wants and is still very young.

I wish I had found out about rising dividends when I was 21.

But what I’m about to give you for free could help you make up a lot of ground.

I have three stocks that I recommend you buy today, then sit back and automatic income will continue to hit your account every month. The most important part, the income will keep growing without you lifting another finger.

Invest. Go to the ballgame. Go fishing. Whatever it is. Enjoy life and your dividends will continue to grow.

You can find my top 3 rising dividend stocks inside my special report, The Final and Automatic Retirement Plan.

I call it the “Final Retirement Plan” because I believe this is the #1 strategy to use for retirees.

Those who are on their way to retirement…

And those already retired.

That’s because more and more income is hitting your bank account each year without doing anything.

It’s quite the dream.

I’ve built my career and reputation as your editor of The Dividend Hunter. I’ve been looking for high-yield stocks to hand you income right now.

It’s time to take that next step and secure your retirement for life.

As I showed you, I’ve used rising dividend stocks to grow my dividend income up to 152% within 40 months.

That can turn a $18,000 per year income into as much as $45,360 per year.

You can claim that income without options, without day trading…frankly without lifting a finger.

If you want to keep your income as it is, The Dividend Hunter can continue to produce a steady stream of cash for you.

If you want your income to grow every year at an extremely fast rate so you can live off your dividends and retire for life…a copy of The Final and Automatic Retirement Plan is a must to pick up right now.

Waiting another minute may have you miss out on the next 152% bump, and you might have to wait another 12 months for the next one.

This report is valued at $199.

Inside you’ll get:

- The best three rising dividends I’ve found in the stock market to date

- How the Final Retirement Plan can help you land up to $100k per year in income

- Plus, the details behind our three winners and how you can use that intel to spot the next big income winner for your portfolio

My aim with this report is pretty simple. Supply you with enough income to retire comfortably.

But you must be nimble and on top of your holdings to know if they will continue to raise their dividends.

Or, worse, be ready to pack your bags and move your money out of the stock if they’re about to cut their distributions.

That’s why if you want to retire well and stay retired, you must be willing to adapt to changing economic times.

And that’s the reason I don’t just want to just give you the stocks that will raise your income…

I want you to have the strategies to retire and stay retired for decades to come

That’s why I’m excited to release the most comprehensive retirement income service on the planet.

This brand-new service is called the Monthly Dividend Multiplier.

It’s a service going above and beyond normal stock newsletters.

It’s a service going above and beyond normal stock newsletters.

It’s goal is simple.

To increase your dividends every single month without any trading or ‘work.’

I believe we will see at least one of our stocks raise dividends every single month.

That’s why I’m calling it the monthly dividend multiplier.

However, this is a full retirement product.

For one…

The educational arm of Monthly Dividend Multiplier is called “Retirement Forever.”

Inside will be resources covering multiple topics. Topics on rising dividends and increasing your income, but also:

- How to make your Social Security check as large as possible

- Step-by-step how to turn the equity in your home into a cash flowing machine

- Alternate (and easy) ways to add more side income without a lot of stress or work

And that’s just the beginning.

We’re prepared to invest hundreds of hours…and, more importantly, tens of thousands of dollars into “Retirement Forever” the ultimate retirement product for you.

When you think of a financially free retirement with your dividends…not only will you think of investing in rising dividends, you’ll also think of Monthly Dividend Multiplier.

Because it is my goal to cover every facet of retirement for you:

- Should I consider a reverse mortgage?

- How much can I actually spend each month without going broke?

- What steps do I take in my 401k if there is a market downturn so my hard-earned wealth is protected?

Those are just a few of the questions I want to answer for you.

But don’t think I’m doing this alone.

I said we would invest money and that’s happening now.

Because I’m bringing on world-class experts who specialize in various areas that you need to know about:

- What kind of life insurance do I need?

- What are the new tax strategies I can implement with the updated tax laws?

- Is there a benefit to putting my assets in a trust?

Those are detailed questions I honestly am not an expert in. But I know you’re interested in them.

That’s why inside Monthly Dividend Multiplier

You’ll Get Access to “Retirement Forever” Where World-Class Retirement Experts Share Their Insights

When you join the Monthly Dividend Multiplier you’ll get access to world class experts who specialize in various areas that you need to know about.

A few times per year, we’ll bring in these experts…the next one is very soon…and details are on the next page.

Our last session was one of the most unique you’ll find in the publishing space.

I brought on a specialty wine company from Europe…

They shared incredible insights on how wine is one of the top performing assets of the last 5 years…so much so, that even Warren Buffet is recommending to invest.

You could’ve invested in a private company…and learned about the potential of this little-known niche. The recording is inside the Monthly Dividend Multiplier portal, so you can go take a look.

Those opportunities will happen multiple times per year…

But I don’t want you to wait…

When you pick up a copy of the Final and Automatic Retirement Plan, you’ll also receive this special book from my friend, Dennis Miller.

Dennis has been a guest expert on Investors Alley for years.

He’s also the “RetireMentor” over at Marketwatch regularly. He’s authored the book “Retirement Reboot” selling on Amazon.

Before that, he consulted executives at some of the largest Fortune 500 companies in the world including IBM, HP, Exxon and many others.

Dennis is one of many experts to share their knowledge with you.

The book you’ll get from Dennis FREE with your Final and Automatic Retirement Plan report is called When Should I File Social Security.

Inside, discover:

- The $157,297 secret I found after determining when to take my Social Security benefits

- 5 critical steps to complete NOW to shore up your income in case Social Security sees cuts

- The #1 website that spits out when is the absolute best time for you to start requesting Social Security

That report is just one of many research reports to arrive in your inbox thanks to your new “Retirement Forever” service.

This comprehensive research covering all aspects of retirement comes FREE with your Monthly Dividend Multiplier subscription.

In the Air Force, we had a partner that flew with us on missions. We didn’t do it alone.

Well, your financial future is a mission in itself. And I can’t let you go at it alone.

So, I welcome you into Monthly Dividend Multiplier for the first time.

Here’s everything you get now:

GETTING STARTED WITH Monthly Dividend Multiplier

*SPECIAL REPORT*

It’s the true first step to success to put the entire increasing-income system into action which is what Monthly Dividend Multiplier is programmed to do.

This report is a comprehensive guide to how the Monthly Dividend Multiplier will work for you.

Inside the Getting Started report, you’ll uncover:

- 10 more rising dividend stocks that diversify your money and protect your downside

- Where to invest your dividends if you’re not using a reinvestment plan

- The rapid exit strategy we take for every stock so you keep losses small, plus

- Where you can find the next rising dividend superstar to add to your income-building portfolio

You’ll want to read this report right away.

After that, I’ll show you how to follow my system.

Finally, I have one more service for you to take advantage of.

You will also get access to

a Private Members call.

Every month, I’ll hold a live call with all my Monthly Dividend Multiplier subscribers.

On these calls, I walk through the current economic climate, our portfolio positions, and then, most of my subscribers’ favorite part, I answer questions. Sometimes, 60 minutes of the call is just me answering questions. I really enjoy it.

These calls are meant so you can rest easy knowing you’re doing the right thing for your retirement.

They’re the perfect first step to making sure your retirement is covered for life.

When the market drops, you don’t have to go through that alone. Monthly Dividend Multiplier members get together and I help walk you through those rough patches.

Your family will appreciate how much dedication you’re putting in to get retirement right. That way you won’t become one of the “40% of Americans at risk of going broke” as Marketwatch reports.

This is a free service for subscribers.

I’m here to walk you through retirement step-by-step.

Plus, you don’t pay me a penny more no matter how many questions you ask, emails you send, or webinars you attend.

It’s all-inclusive.

This is the lowest price Monthly Dividend Multiplier will ever be offered

On top of all the features and rising dividend stock picks…

You also will receive for a limited time…the lowest price ever offered for Monthly Dividend Multiplier.

Advisors on Wall Street charge 1% plus 20% of your profits.

If you have a $150,000 portfolio, right off the bat you’re paying $1,500 each year and that’s just to retain their services.

On top of that, if you make 15% on your money as the Monthly Dividend Multiplier already has done, you’d pay them $4,500 on top of that. That’s $6,000 a year and your fees only go up as your account goes up.

With the Monthly Dividend Multiplier, you get two benefits:

- You only pay the same amount each year even when I raise the price in the future

- Your investment is much, much less than $6,000 per year.

The retail price for Monthly Dividend Multiplier is $1,997. That’s already 66% less than Wall Street charges.

And it will hit that price again in the future…I guarantee it.

Today, you can get 76% off your subscription to Monthly Dividend Multiplier for a mere $595 investment right now.

That’s 91% less compared to what Wall Street charges.

I’m not sure the next time I’ll open up enrollment, so don’t miss this opportunity. Click the button below right now. Put in all your information and get the full details on the next page.

Let me assure you, this is a long-term solution for your retirement.

Monthly Dividend Multiplier isn’t a static system. It’s dynamic and changes as we need it to best serve you…a dedicated dividends investor.

I’ve been in the market for over 30 years.

I tried to take shortcuts before and it didn’t work. It wasn’t until I put a long-term plan into place that I exponentially grew my income.

Monthly Dividend Multiplier is the answer to your long-term income plans.

Let’s quickly go through everything you get today:

- The Final and Automatic Retirement Plan ($197 value)

- A 1-year subscription to the Monthly Dividend Multiplier ($1,997 value)

-

- Monthly calls with me where you can ask anything and get updates ($397 value)

- Getting Started Report ($97 value)

- Dennis Miller’s REPORT ($197)

- [BONUS]: “Retirement Forever”: Ongoing experts and research covering every retirement need you can think of to help you stay retired for life. ($995)

That’s $4,077 value for a relatively small investment of $595 today. That’s 88% savings right away.

Wait! there’s one more reason…(maybe the most important for your portfolio)…for investing in rising dividends…

I shared three reasons to invest in rising dividend stocks today. One of those reasons is because they produce more profit.

I showed you this chart.

Not only with rising dividends can you increase your income quickly, but sometimes those rapid increases can lead to spikes in the stock prices.

After all, if a stock is raising income fast, more people will want to pile in.

Check out the success of a few companies.

More income…check.

More profit…you can check that too.

Safe, conservative plays. I like it.

We have a shot at these gains too.

Check out a few winners I’ve showed my readers as part of this system:

- 107% profits in 4 months

- 45% profits in 6 months

- 69% profits in under 2 years

- 42% profits in under 2 years

These potential triple digit profits are included as part of your Monthly Dividend Multiplier membership.

And now, I’m offering it for the lowest price ever!

Couple this product along with The Dividend Hunter for income now and later.

The return on your $595 investment is limitless. Because the right plan for your retirement portfolio pays dividends for years.

The success of my Monthly Dividend Multiplier and all my strategies is growing.

Check out a few of these…

- Thomas said: “My portfolio is up $75,000!”

- Brad told me: “Thanks for what you do, my account balance hasn’t looked this good ever, and I’ve only been onboard a few months.”

And there’s more…

- Dan says: “I am using your dividend growth recommendations to build my retirement portfolio. For the price of your newsletter it is a real bargain. I have made money on share price and yield so thank you.”

- Donald wrote: “I am very pleased with the returns I am receiving. I have invested in various services in the past, but so far yours is the only one I feel satisfied with and would recommend to others. I really like the approach you are using in determining which stocks to buy and sell and when to buy/sell.”

- Pedro wrote: “We are now getting money we were missing out on before.”

- Jerry claims: “Your advice and information, along with some other research, have been a key source of help in this ongoing process [of building our system].”

To join them, click the button below to start.

As a bonus for starting today, I’ll include NINE more stocks that follow this wealth-building system

That’s right.

Instead of just three to start your journey, how about 12?

I’ll include them at no extra charge inside your Monthly Dividend Multiplier subscription..

That’s nine more plays to diversify your portfolio, but also give you more income pipelines.

As famous investor, Sir John Templeton said: “Diversify. There is safety in numbers.”

I agree. These 12 plays will make your retirement less stressful.

If you’re worried 12 stocks is too many to manage, just start with a couple and build from there.

Financial planning for retirement doesn’t need to be complicated, difficult, or expensive. Many would make you think it is.

Don’t spend countless hours trying to figure this all yourself.

I already spent years doing that. Let me show you what to do now inside Monthly Dividend Multiplier.

I believe this is the only income-building system you will ever need.

The best thing to do right now is click the link below and start with Monthly Dividend Multiplier today.

You’ve worked hard your whole life.

Now, you have the choice to own stocks that are raising their dividends at a rapid rate.

All you need to do is buy.

If you decide to take this step, I’ll include all the retirement education you can want…a $10,000 value…absolutely free.

Join me and hundreds of other Dividend Hunter investors inside Monthly Dividend Multiplier.

Click “Join Now” button below and complete your order.

Thank you,

Tim Plaehn

Editor of Monthly Dividend Multiplier