We’ve recorded small-cap gains of 83.73%, 41.09%, 66.75%, even 159.65%, among others…

And this year is looking even hotter for small-caps…

Starting with this $5 stock to buy NOW:

I’m about to show you a dirt-cheap $5 stock that insiders are buying up thousands of shares this year.

The company has zero debt…

It’s been around since 1972 lasting through 7 recessions…

And it’s set to grow triple digits.

Yet, the stock still trades for just $5…

If you pick up shares right now… you’d be paying for the price price of the cash they own, the inventory on hand and the real estate they own. That’s it.

Meaning…

You’re essentially buying a long-time great business for free.

Guys, this is an amazing time to buy this stock.

And every time it hits a low in a recession… their stock goes absolutely bananas like my granddaughter after I sneak her another chocolate shake.

Take a look:

Coming off the early 90s recession… this stock saw 587% gains in under 2 years…

In 2001, after the tech bubble crash… this stock rallied 992% off its lows.

And many compare what’s going on now with 2001. Tech Bubble 2.0 they say.

Well, watch what happened during the 2001 Tech Bubble 1.0.

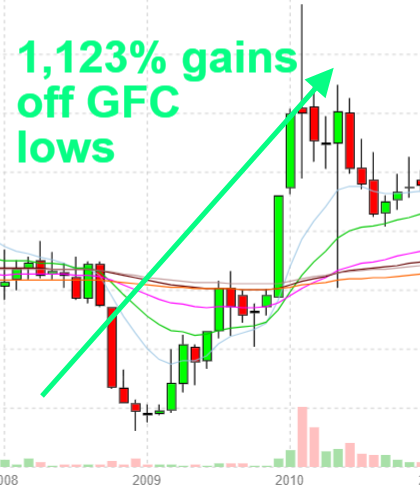

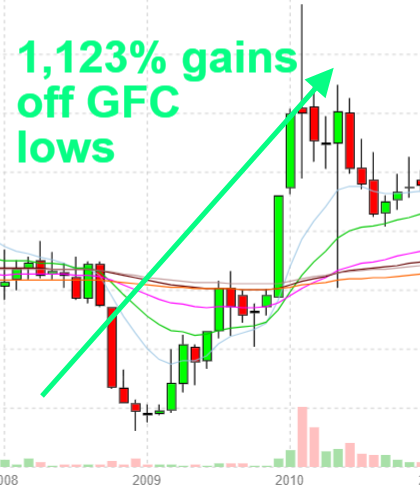

The gains got larger with 1,123% gains off the March 2009 lows…

And that occurred in just 12 months.

Check out the bounce in 2009.

Then, the brief drop during Covid saw a 205% quick pop off the bottom in 9 months.

Right now, the stock sits at near the 2009 lows!

If this thing moves like it has in the past recessions, you could see as little as 205% gains… or up to 1,123% like it did in 2009.

Just $5,000 could turn into as much as $61,150 in as little as 12 months as it happened in 2009.

Now, of course, I’ll tell you this isn’t a guarantee the stock will go up. Nothing is guaranteed in stocks, of course.

I’m simply telling you about this stock located in a building you would never think to look at.

Yes, that one. One in a dusty industrial park in North Carolina.

And all they do is manufacture mattress fabrics and upholstery.

Sure, not that exciting.

But you may be sitting on one of their products right now reading this as they work with places like Ashley Furniture, Serta Mattresses, Tempur Sealy, and others.

We aren’t moving to the metaverse anytime soon… so you’re safe to assume I’ll be sitting my tired bones on sofas and mattresses at least until I’m pushing daisies.

And, until we can figure out how to get kids from not spilling juice and tracking dirt onto furniture, this company is pretty safe to keep rolling out more and more furniture coverings.

They aren’t going anywhere.

And, if you’re wondering…

No, it’s not a penny stock just because it’s $5. Under Armour, Lyft, ADT and many other strong companies trade for low stock prices.

This is a generational family business passed down from founder to grandson and counting.

Penny stocks are usually shell companies trying to raise money fast… many unsuccessfully.

This stock has been around longer than I’ve been investing… and I’ve been investing for three decades.

But, I didn’t share the best news…

This $5 mattress stock is just one of dozens of similar opportunities with small, little-known companies

And one of the best opportunities to buy these stocks

since the 2009 bottom

Guys, we’re looking at an absolutely incredible time coming in the stock market.

Yeah, it’s been a little bumpy for my personal taste…

But, I gotta tell you, if you keep your seatbelt on, I promise the ride is going to get a heck of a lot more fun.

Yes, it’s easiest to just sit on the sidelines or log off from your brokerage account and not look at it until 2025.

If you do that… and I hope you don’t… you’re going to miss out on some major, major gains.

And not from big name tech stocks like Tesla or Netflix.

I mean, from strong, fundamentally sound companies like the one I just shared which are resilient through any economic storm.

We’ve been in this bear market for over 15 months… the average bear market lasts 9.7 months.

We’re closer to the bottom than the top and I’ll show you why in a minute.

And when these small stocks emerge from the economic rubble, they are huge winners.

Winners that can transform not just your gains today or this year…

But set you up for an incredible retirement.

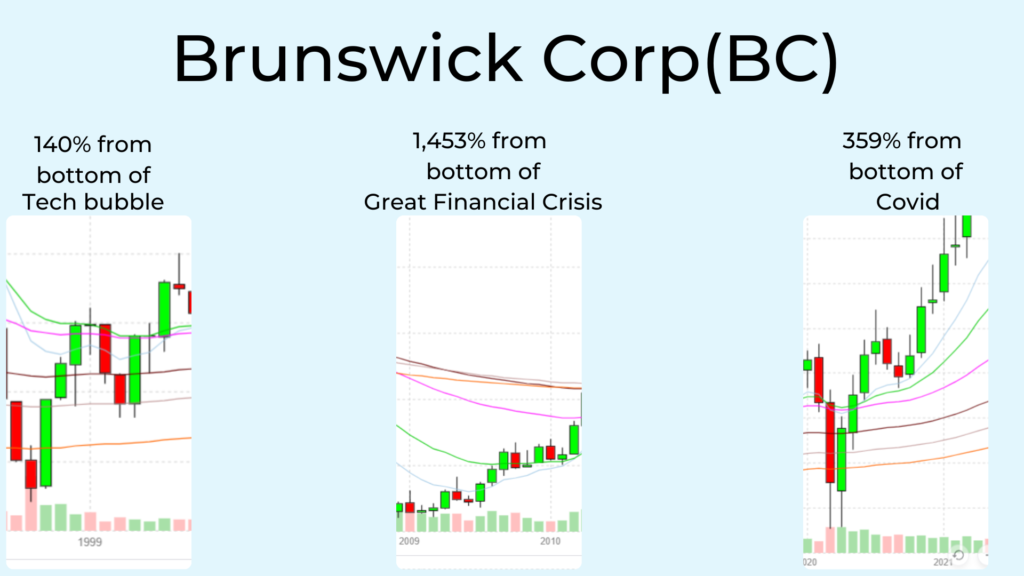

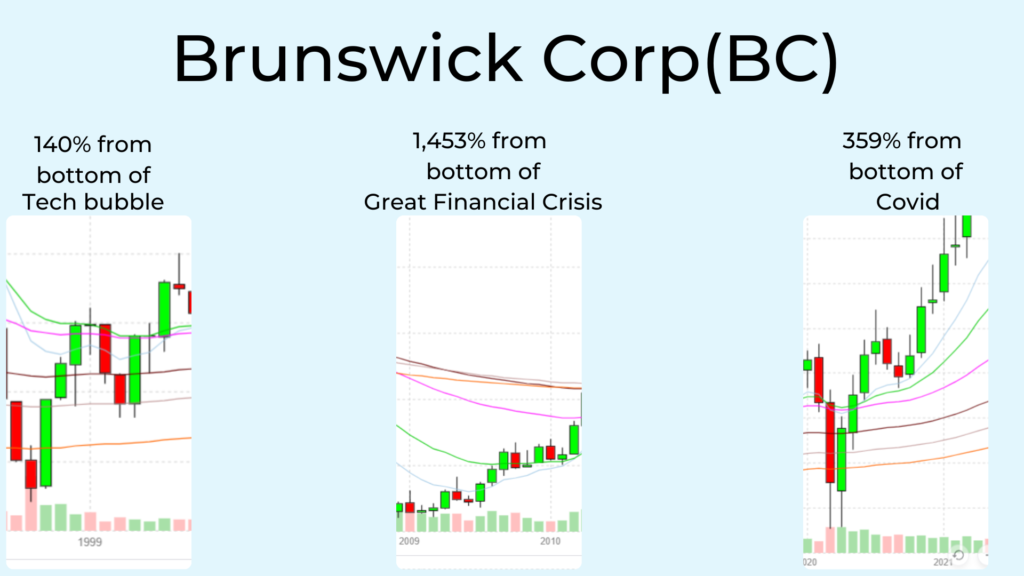

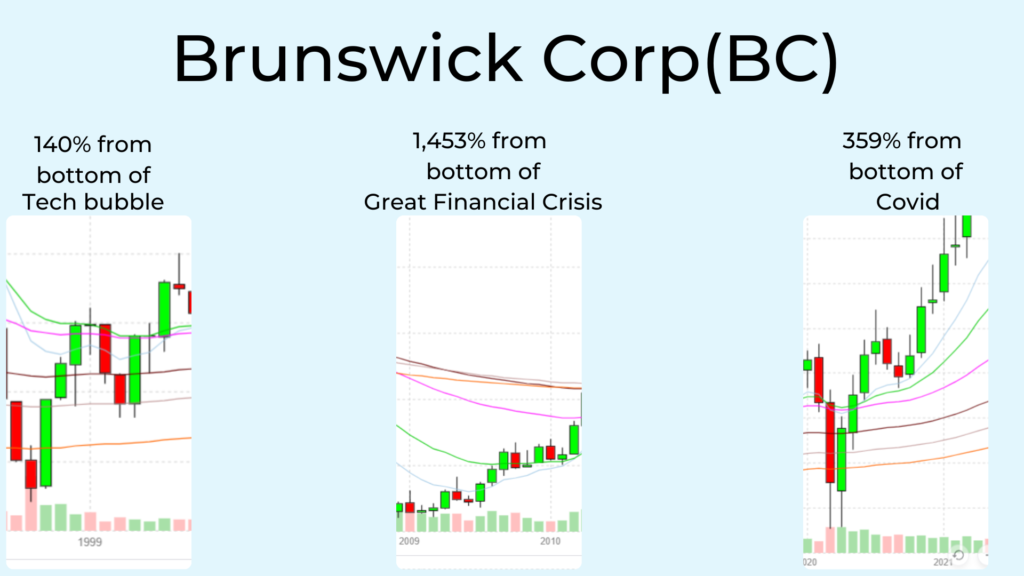

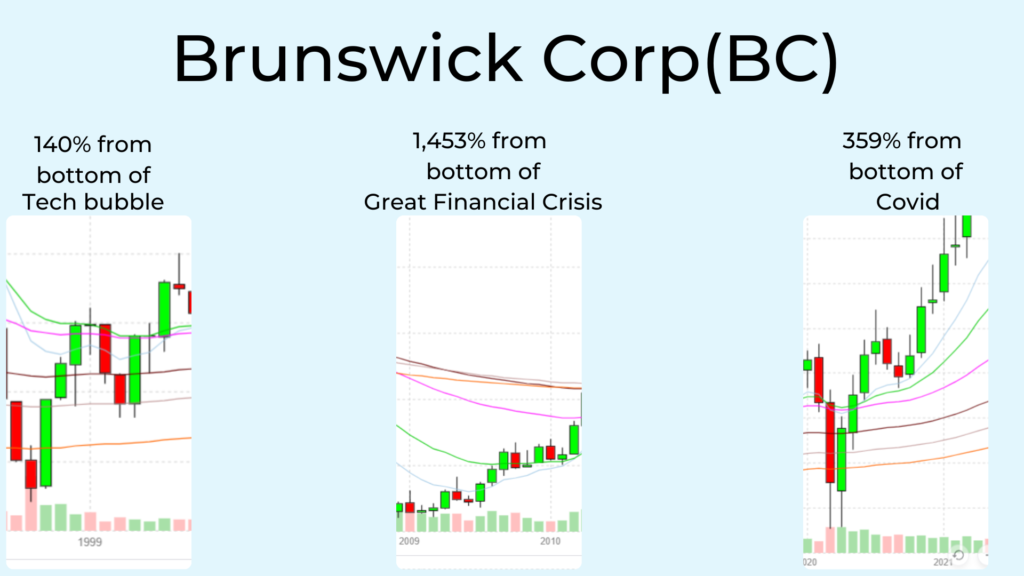

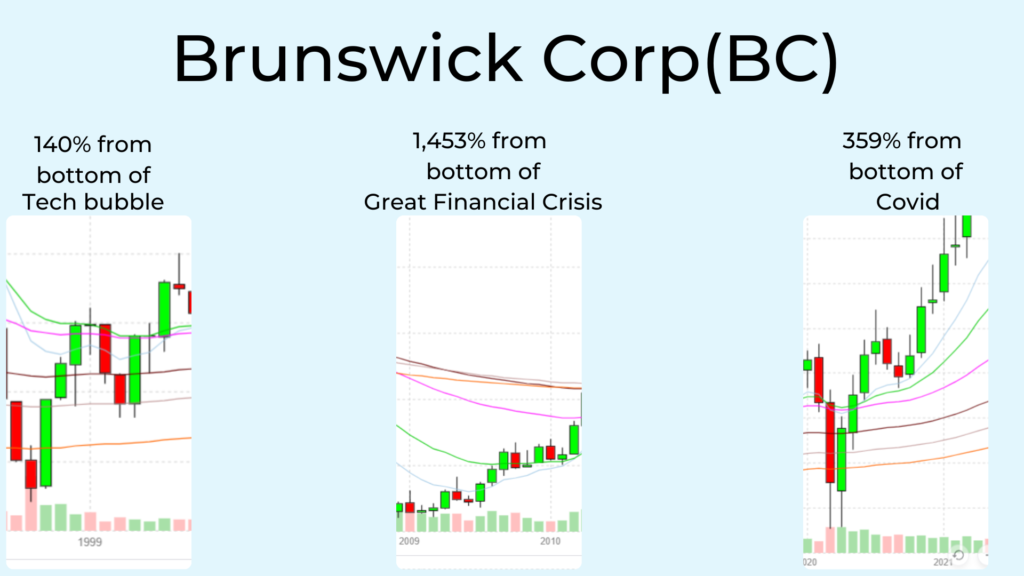

Like Brunswick Corp (BC), a company that provides parts and service for the marine and boating industry.

From every low of the market in the past 3 decades, they shot up fast.

359% in 12 months from the Covid lows…

1,453% in 12 months from the Great Financial Crisis lows!

This is an unknown company that has tripled their profits in the past 5 years even with Covid… and bought back shares.

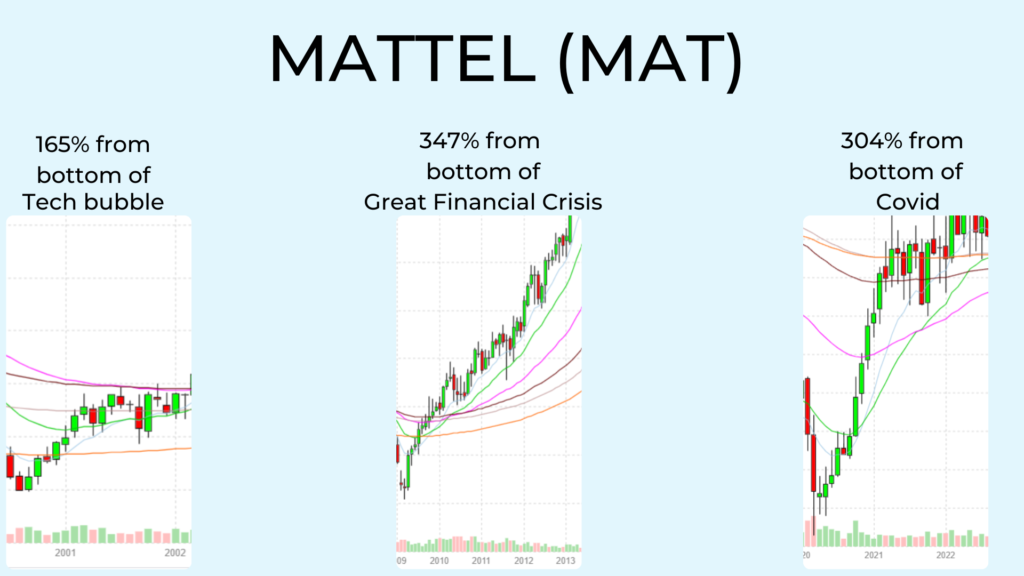

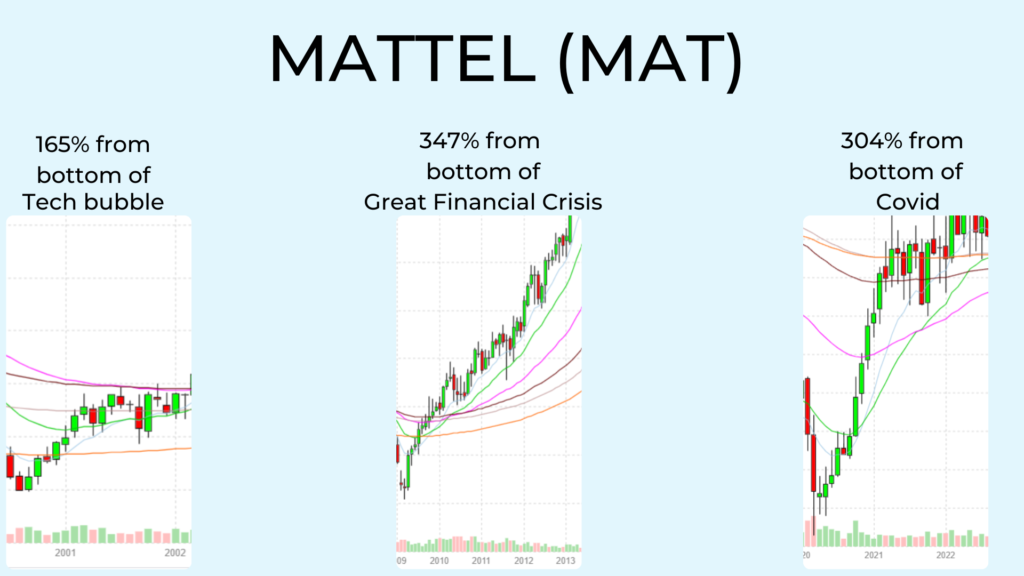

Look at Mattel… the game-makers.

Triple digit winners off their lows in all recessions in as little as 12 months.

Insight Enterprises provides IT and software service and hardware.

They’ve doubled profits in recent years and shot up as much as 555% from the 2009 lows. Meanwhile, inside execs are still buying shares despite the volatile stock market today.

Aerojet — ticker AJRD — is sitting at all-time highs right now despite other stocks breaking below 2020 lows.

Huge bounces off all recession lows and has gone straight up from 2009.

FirstCash Holdings, a credit service company, has tripled revenue in the past 5 years and spits out cash.

From the Tech Bubble bottom, they rocketed as high as 1,026% in just 15 months!

That would’ve turned $5,000 into $56,300. Stock still near all-time highs.

Louisiana Pacific — ticker LPX — produces siding and subfloor for new construction homes.

Not that exciting.

Not also surprising profits have 5X’d in the past 5 years.

What is surprising is that even after the real estate bubble popped in 2009… this company still churned cash and the stock jumped 781% off the lows.

Belden Inc. is a company that provides communication transmission of 5G and internet thanks to copper and fiber.

A business that will only get better.

It’s jumped triple digits in 12 months after all 3 of the last major recessions. Stock right at all-time highs.

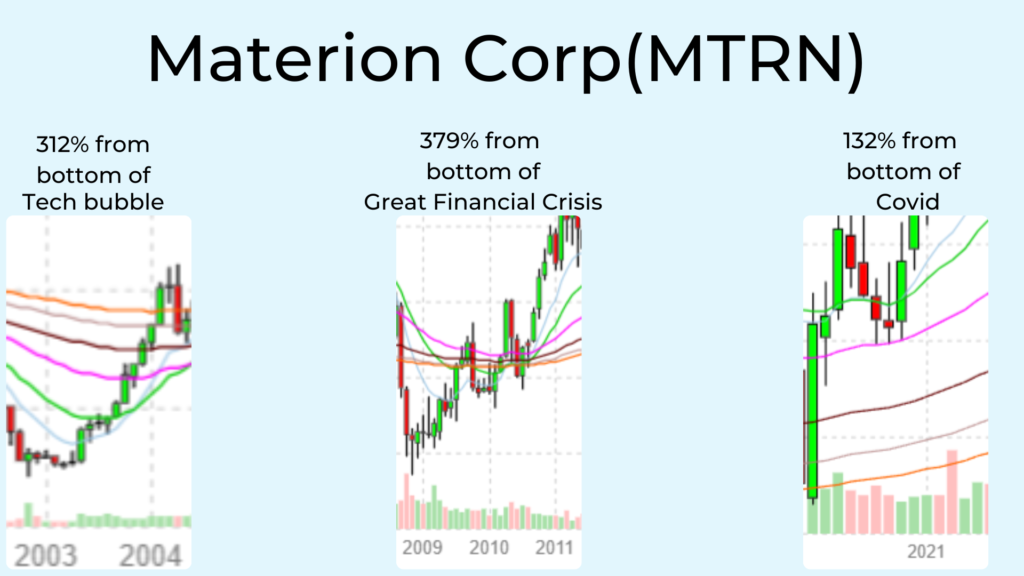

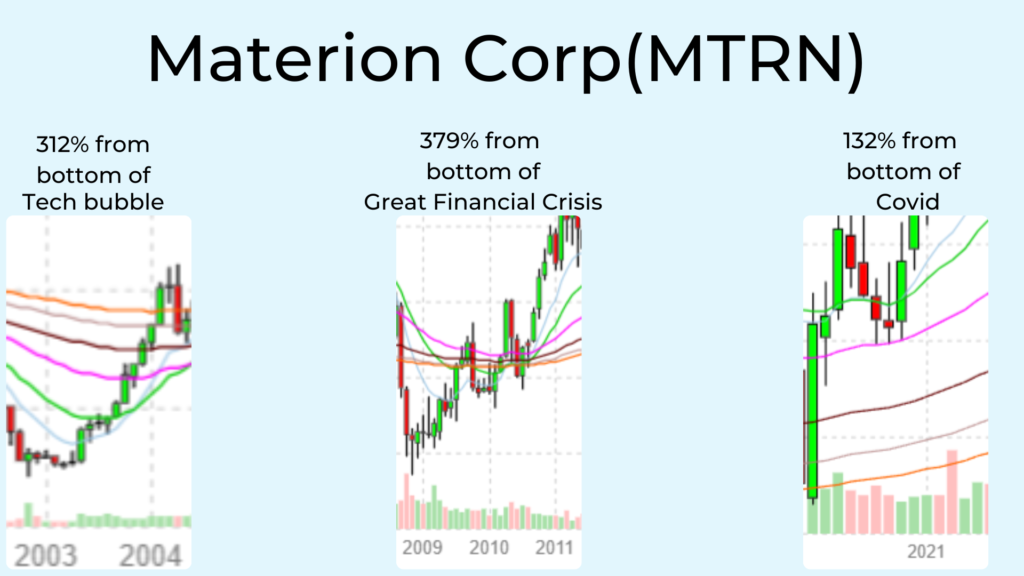

Materion Corporation — ticker MTRN. They produced advanced engineered products for semiconductors.

They’ve doubled in the past 6 years. Profits up 10X.

After the tech bubble popped, they survived while others sunk. They shot up 312% off those lows in 12 months.

Their stock sits at all-time highs, while other similar companies like Intel (INTC) is more than 60% off their 2000 tech bubble highs!

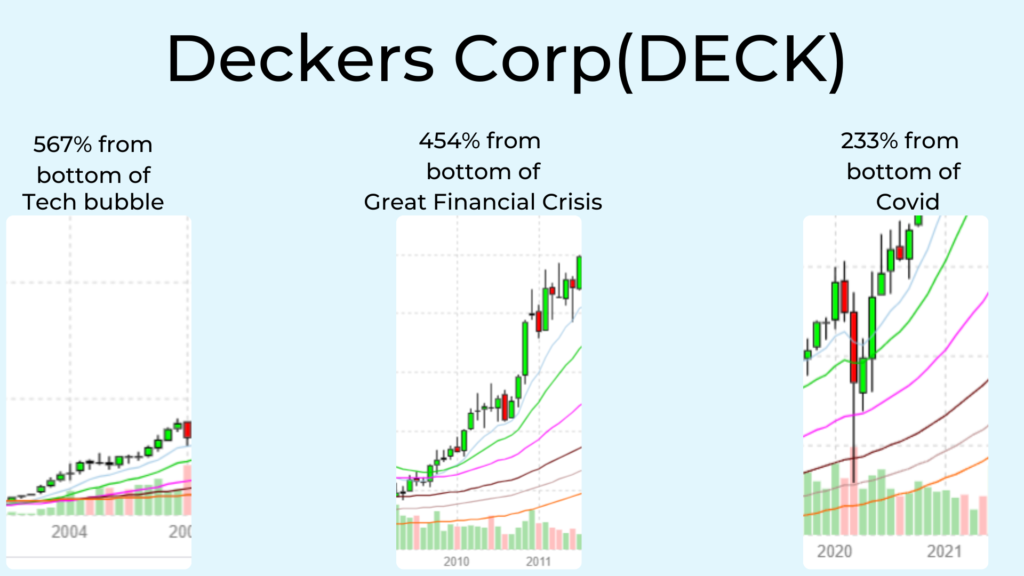

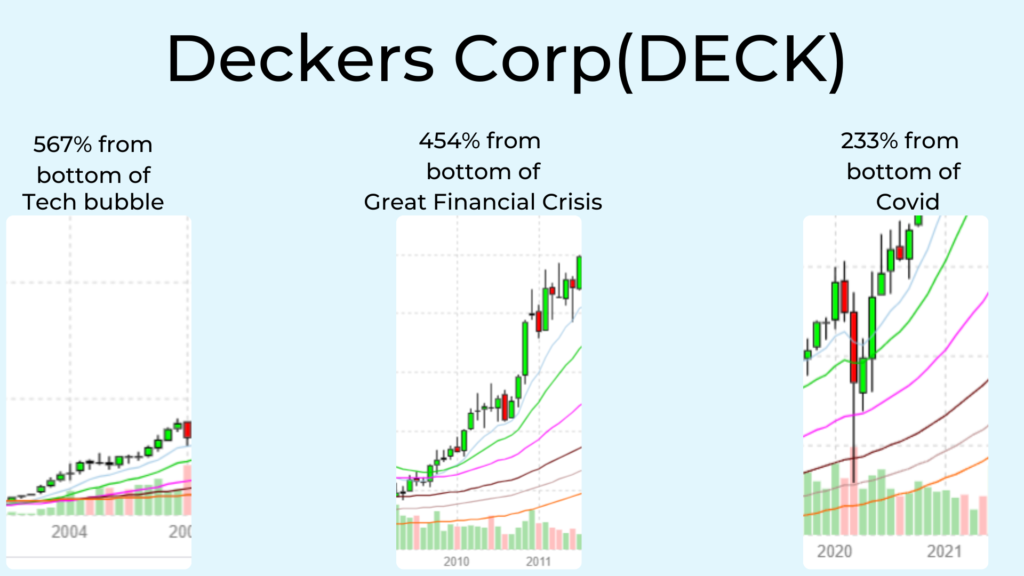

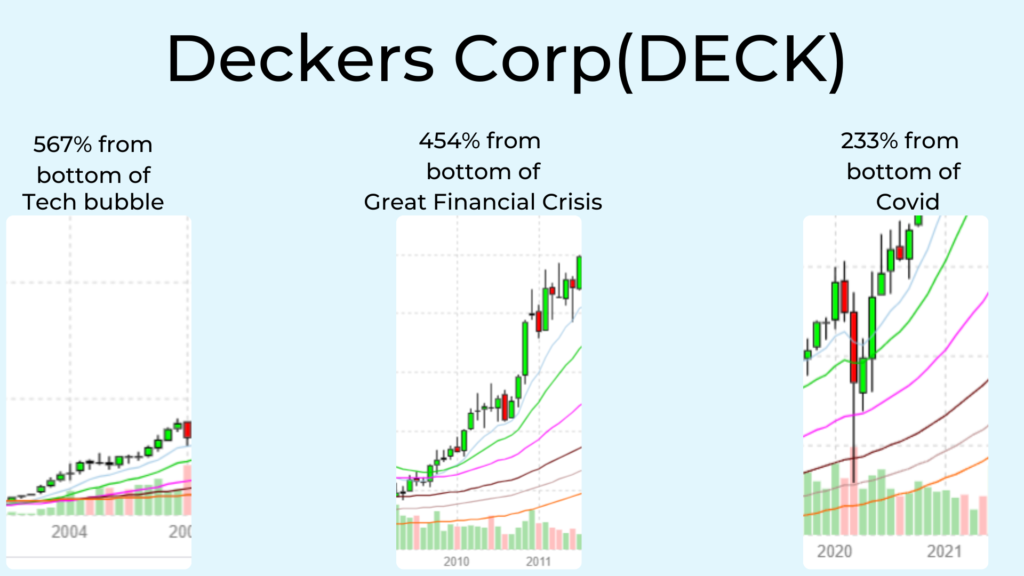

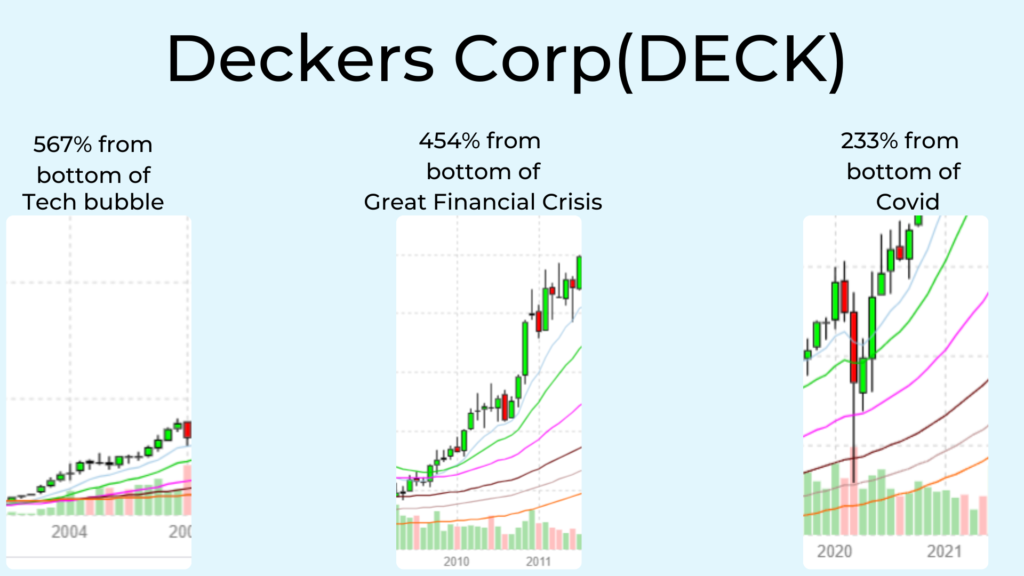

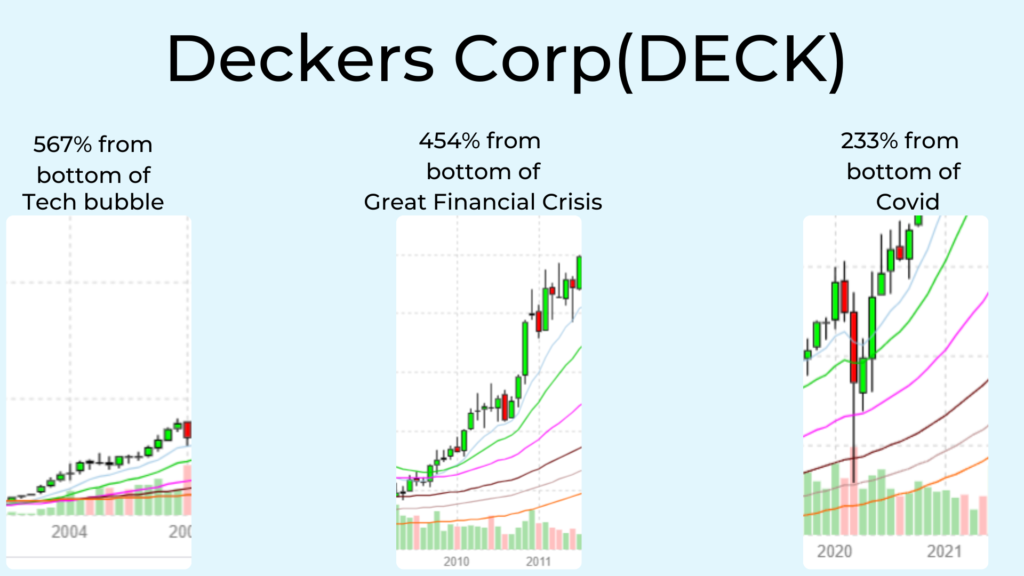

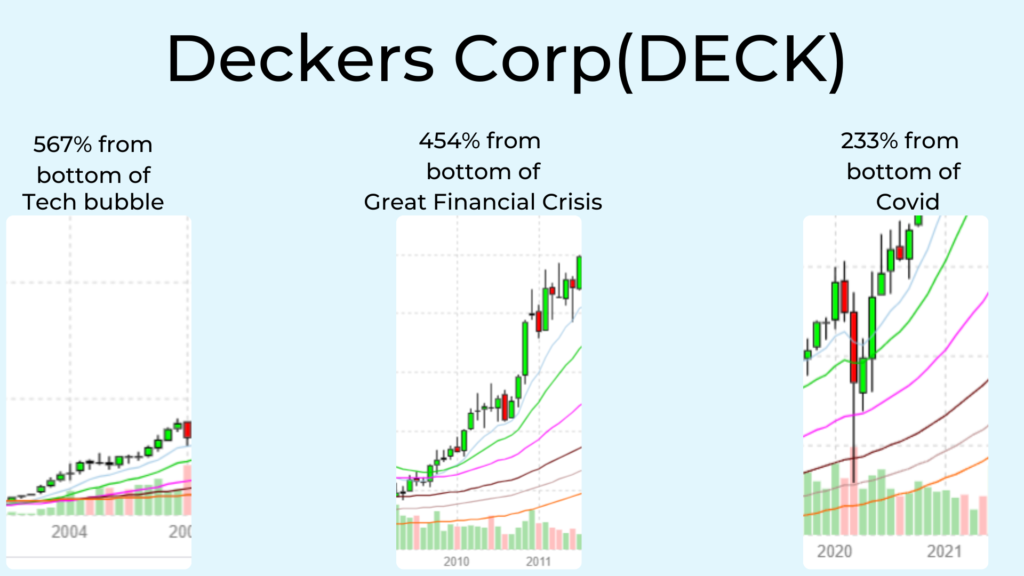

Deckers Outdoor (DECK) designs and sells shoes and apparel.

Other retail stocks have been hammered, meanwhile, they’re sitting at all-time highs. Profits have tripled the past 5 years.

From the bottom of the Tech bubble and GFC, you could’ve banked up to 567% gains in 12 months.

That turns $5,000 into $33,350 in a year.

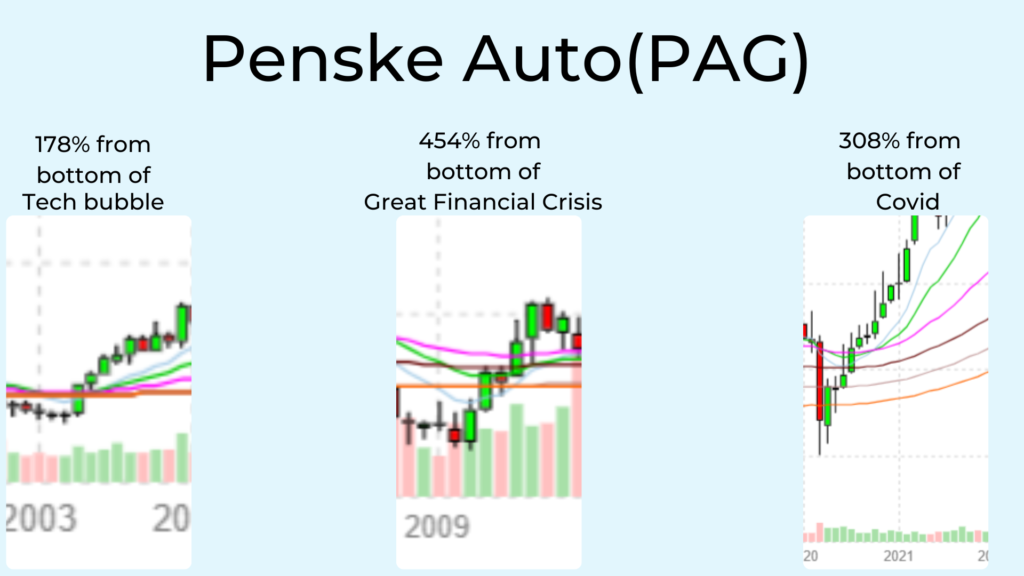

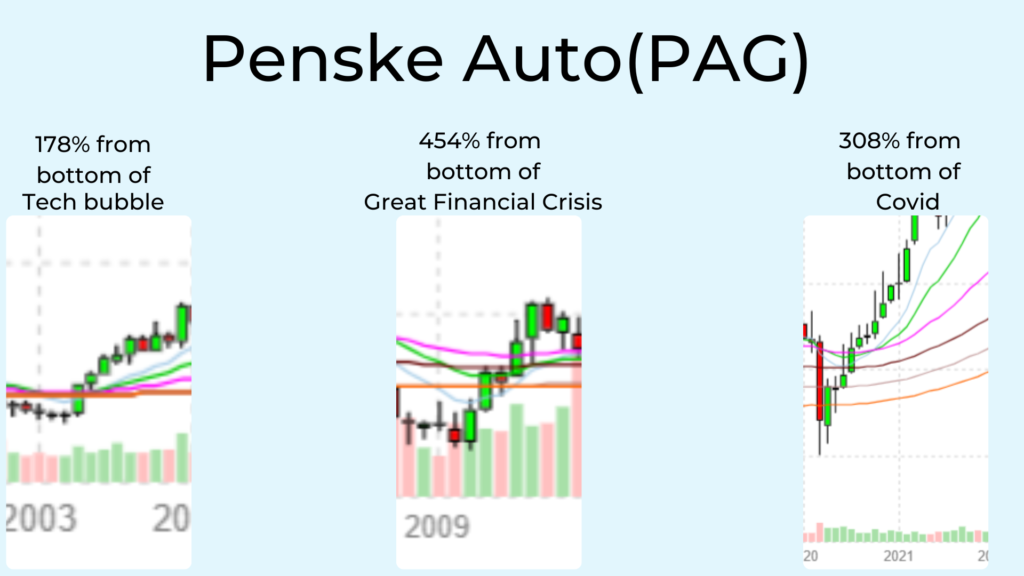

Penske Auto (PAG) operates automotive and commercial truck dealerships.

Profits have nearly 4X’d in the past 5 years… and insiders are holding 21% of the stock! That’s unheard of as ‘darling’ stocks like Google, insiders only own 0.28%.

Stock hit all-time highs in February 2023 while the rest of the market dropped like a rock.

Despite recessions, this stock has popped in 12 months from every recessionary bottom.

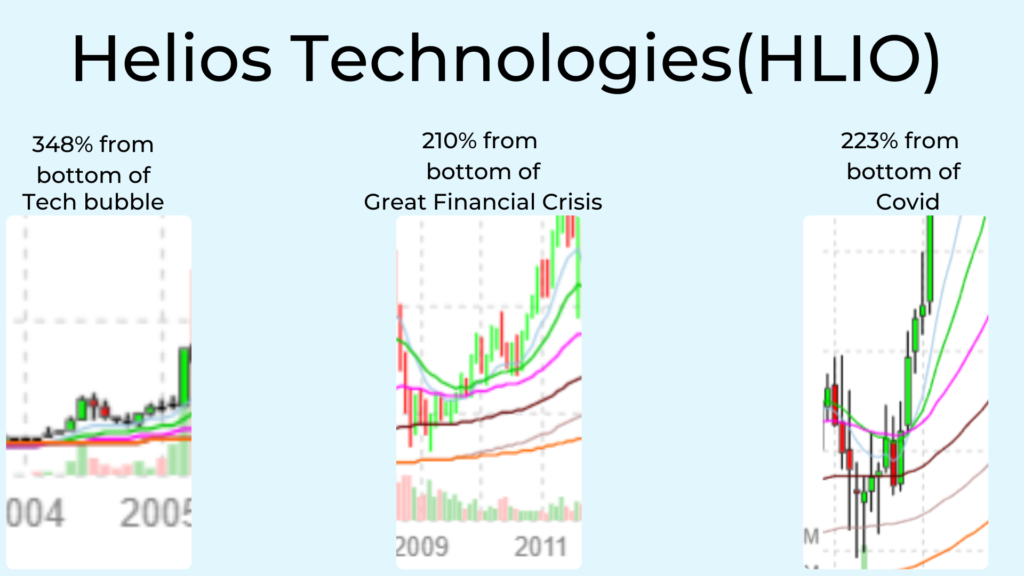

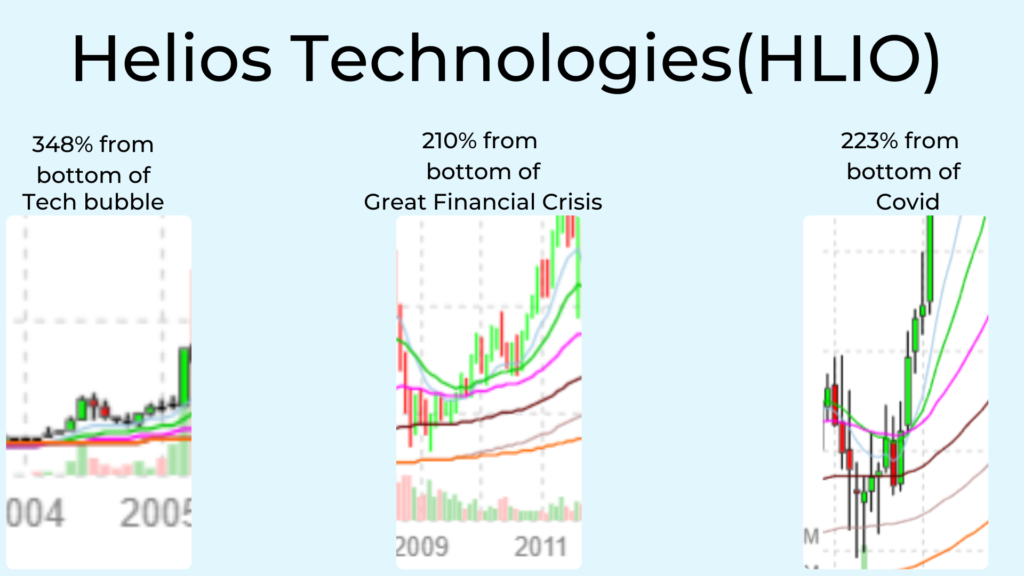

Helios Technologies — ticker HLIO — produces engineered hydraulics and electronics.

Profits have doubled and revenues are at record highs.

12 months after every bottom, the stock has jumped over 200%.

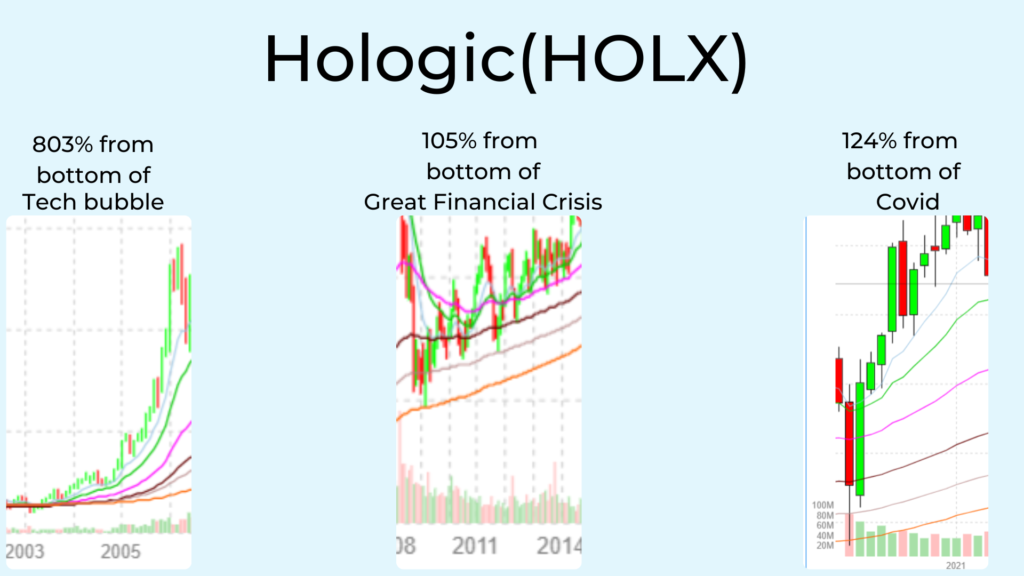

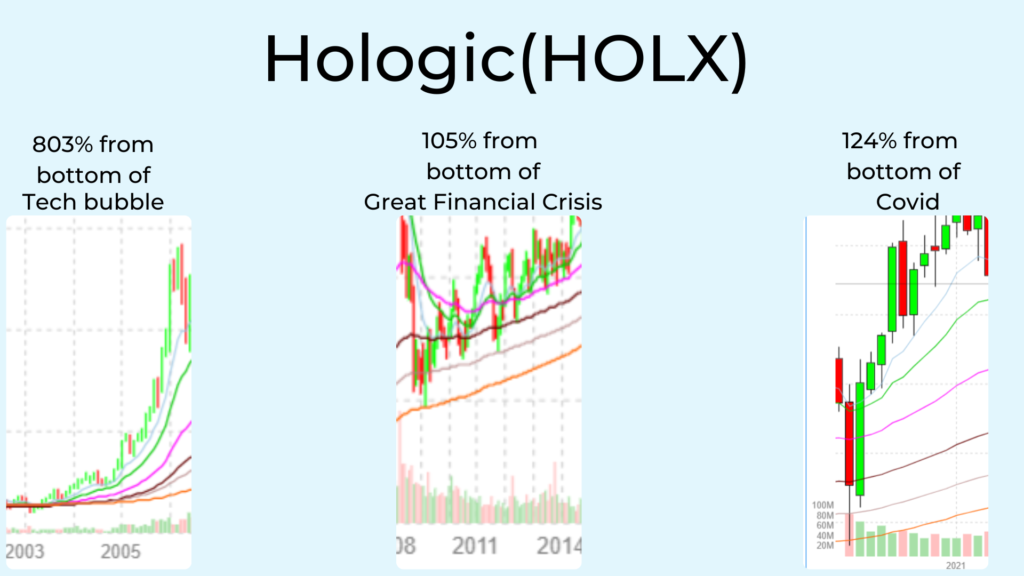

Hologic (HOLX) provides medical devices and imaging systems for women’s health.

They’ve grown tremendously in the past 2 years and became immensely profitable in the past 3 years.

The stock rocketed off the Tech Bubble lows to go as high as 803% in 24 months.

Stock is near all-time highs now.

Now, I’m NOT recommending any of these stocks right now.

Why?

One of the reasons is many of the large returns you hope to get, you likely won’t see again.

Take a look at Hologic again. The biggest gains were back during the Tech bubble.

Since then, the stock has seen less gains coming off the lows.

That doesn’t mean it’s a bad stock.

But

The bigger a company gets, the harder it gets to make the larger returns and you’ll see why in a second.

That’s why I only want to invest in companies

right before they hit a certain size

What do these 12 companies all have in common? (And I could’ve shown you about 50 more)…

- They’re all fundamentally sound. Produce tons of cash. Dropped down to value-buy status during recession.

- They all were small-cap stocks that became mid-cap stocks

What is a small-cap and mid-cap stock?

Simple.

- A small-cap stock is one that’s valued below $2 billion dollars.

- A mid-cap stock is one that’s valued between $2 billion and $10 billion.

- You then have your large caps such as your McDonalds and Disney.

- Then, mega caps which house your Apple’s and Microsoft’s.

If you truly want to build wealth, you need to be playing in the small-cap stock pool.

Yes, there’s nothing wrong with buying mid-caps up to mega caps.

However, unless you’re sitting on $20 million dollars or more…

It makes sense to invest a nice percentage of your portfolio into small-cap stocks.

Warren Buffett himself recommends it and I’ll talk about him later… as he actually built his fortune off the back of small-caps.

Small-cap stocks outperform

the market over 98 years

And they bounce back faster

than the big stocks

Here’s just a look over the last few decades.

The Russell 2000, which follows small-caps… beats the S&P 500 by a decent margin. Look at the big gap from 2010 to 2020.

The gaps only closed recently as small-caps are now trading for historically high discounts.

Small-cap stocks, measured through the Russell 2000, just came off their worst year since 1978.

According to Franklin Templeton, small-caps “absorb” the losses of the markets stronger than others.

But, like a rubber band pull… they snap back faster.

They report, “We think of small-caps as being like a coiled spring in these periods of high investor anxiety, contracting more as fear builds and bouncing robustly back as fear recedes.”

After poor periods of small-cap returns…

30 out of 31 times… small-caps bounce back beating the market with average and median returns around 63%!

“Small-cap recoveries have historically happened very quickly.”

Barron’s reports small-caps “could be the next winners.”

They report that when Small Business Optimism is low, small-caps tend to beat the S&P 500 by 55%.

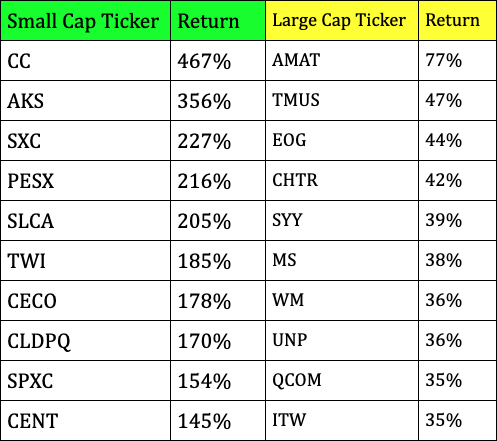

According to Investor’s Business Daily, in 2022, they shared the top 100 performing stocks of 2022.

9 out of 10 were small-cap stocks!

And that’s not just during 2022 when other sectors, like tech, were taken to the woodshed.

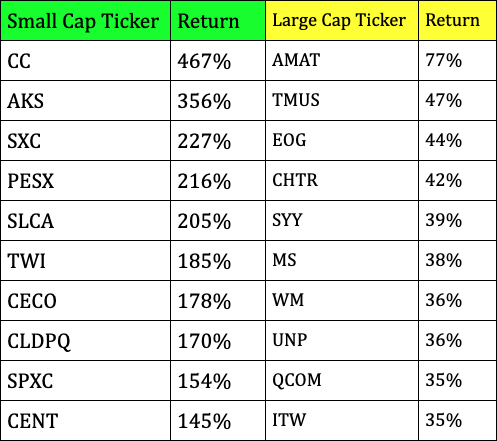

Let’s look at a 3 year timeframe from 2016-2018 when the markets did relatively well.

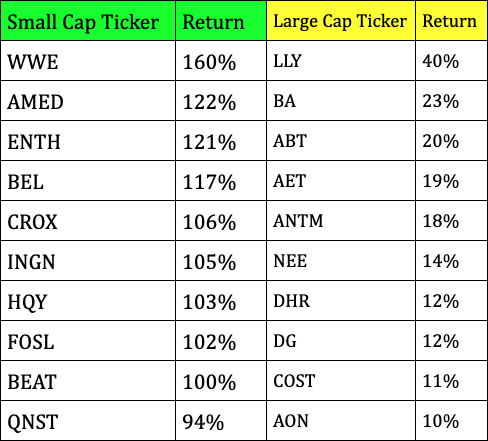

2016: Top Performing Small-Cap vs. Top Performing Large Cap

2016 saw the markets drop in the beginning half before catching up to close out the year strong.

Here, you have The Chemours Company (CC) handing investors a 467% winner in 12 months.

Meanwhile, the guys on CNBC are talking about T-Mobile (TMUS) or Applied Materials (AMAT) with their “record returns” of 77% per year.

77% isn’t even half of what the 10th best small-cap did!

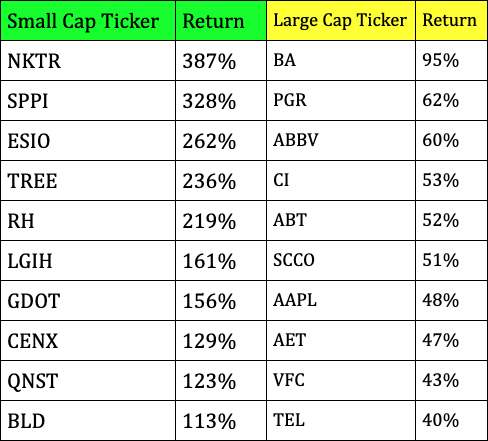

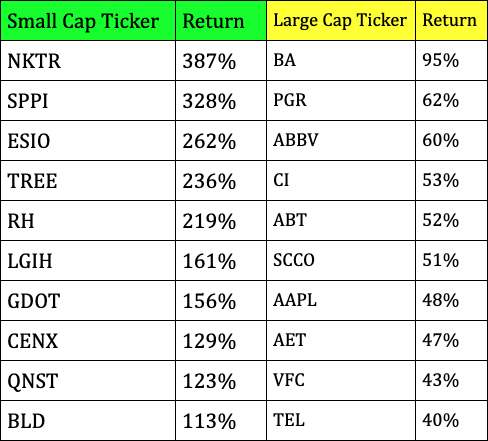

What about a bullish up year like 2017?

Take a look at these numbers.

2017: Top Performing Small-Cap vs. Top Performing Large Cap

You probably recognize some of the large cap names.

Boeing (BA), Apple (AAPL), AbbVie (ABBV), Progressive Insurance (PGR)…

What about the small-cap side?

I’d guess you may know 1 or 2 of these names.

Well, you have Lending Tree (TREE)… a company making it easier to find funding among banks. Also, a company that really started gaining traction in 2017 as they invested in more of those commercials with the puppet guy.

There’s also TopBuild (BLD). This company installs insulation to construction sites.

I love niche companies like this.

Their profit has 4X’d the past 5 years… their stock is near all-time highs. From the lows of 2020, they shot up 267% in 12 months.

They’ve now graduated from small-cap to mid-cap size thanks to their growth and stock appreciation.

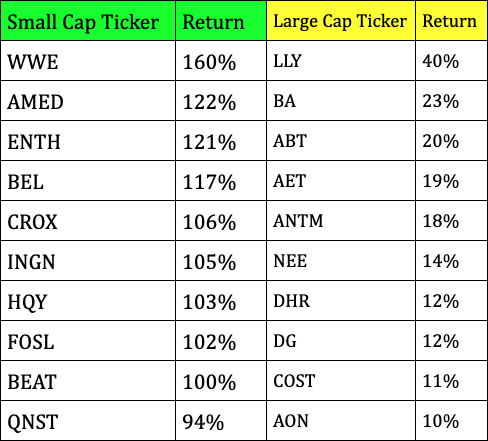

Look at another bumpy year… 2018.

2018: Top Performing Small-Cap vs. Top Performing Large Cap

We had a big drop at the end of 2018.

Still, Eli Lilly (LLY), the top performing large cap, is more than half the profits of the 10th small-cap QNST.

The WWE saw a record year and also graduated from small-cap to mid-cap with their move in 2018. Their stock is still hanging around that price and has seen diminishing returns since.

Like I said, once a stock moves from small-cap to mid-cap, the returns start getting smaller…

Until they’re a large cap… and they get even small each year.

Small-cap companies always have a connotation that they’re “more risky” than other larger companies.

In some ways, they can be if you don’t know what to look for.

I look for simple, simple metrics, folks. Here’s 3 pieces for investing in small-caps:

- Find companies trading for less than what they’re worth. The #1 company I share is trading for the cash, inventory, and real estate they own. There’s zero value given to the cashflow it generates and has generated for over 50 years. That’s an opportunity.

- Eliminate overleveraged companies: High interest rates break companies. The famous quote, “When the tide goes out, you’ll see who’s swimming naked” applies to companies too. It applied to Silicon Valley Bank and undid them as high interest rates killed their portfolio. My #1 stock has zero debt on the books.

- Avoid companies with potential financial distress in the future: Only buy companies that are cash flowing like mad. If they have toxic assets on the books, fancy accounting tricks, companies robbing Peter to pay Paul to cover bills… these are poorly run companies no matter how well the stock does. My #1 small-cap has a great business in an industry that’s not going anywhere anytime soon (furniture)… with customers that are massive i.e. Ashley Furniture, Serta, and others.

I do all the digging to find out these opportunities.

The big opportunity isn’t just with my #1 small-cap stock in this musty building…

It’s with small-caps in general.

As small-caps are set to bottom very shortly… and when they do… we’re looking to cash in on some of the biggest gains of our life.

How do I know?

Well, I’ve been at this stock thing for over three decades.

I’ve been around the block a few times… and made some big calls.

I called the bottom of the market in 2009. I recommended buying into the Covid scares of March and April 2020. I called the bottom in 2022 before the dead cat bounces.

Over 27 years…

I’ve tested more than 2,917 stock strategies for the biggest financial companies in the world to find what makes money.

I’ve also managed money for some of the world’s wealthiest.

My name is Tim Melvin.

I’ve been in the financial services industry for over 34 years serving as a portfolio manager, broker, and advisor.

Now, I’m not like many of the stock guys out there.

I’m old school.

I’m not trying to find the next landmark medical breakthrough, or deciding if Tesla is going to be the biggest company in the world.

I don’t leave my investing to chances.

I have one goal —> Look for inefficiencies in the market.

Where is an asset trading for less than what it’s worth?

We’re talking some real good, old school Benjamin Graham, Peter Lynch, Warren Buffett stuff.

Find the diamond among the rubble and buy it.

My small-cap targets are trading at incredible prices right now.

This is what I find.

That doesn’t mean I’m necessarily buying stocks left for dead.

It’s instead looking for arbitrage opportunities..

Good, sound businesses with great cash flow and a bright future…

But they’re unpopular because they don’t fit in with the current “fad” in investing.

I’m also looking for them to pay a nice, fat, juicy dividend.

If I can buy an asset trading for less than it’s worth… and turn it around and make money… plus, collect dividends… I’m as happy as a guy at the bar on payday.

Finding these perfect dividend stocks takes work.

The work starts before I buy anything.

I’m up late reading financial statements, studying SEC filings, on top of learning about the overall market.

I’m doing this literally every single day.

After taking my granddaughter to the zoo, I drop her back home and I’m off to read SEC filings on a Sunday afternoon.

Studying financials and SEC filings isn’t unique in itself…

It’s knowing how to dig up a value opportunity in the market.

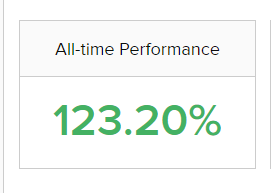

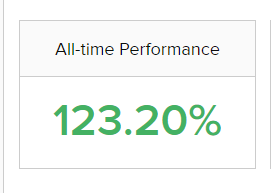

Here’s my tracked return over 8 years

In just one sector of the market:

I recorded these winners on small financial banks:

- A 165% winner on MFNC over 8 years

- A 100% winner on EVBN in 19 months

- A 150% winner on BOCH in 5 years

- A 163% winner on SVBI in 8 years

- A 192% winner on SLCT in 7 years

Those are just recent trades closed in 2021 and 2022.

Not all my trades were winners… but the last 10 trades closed were all 50%+ winners. Even in this bear market!

- 194% win on GNBC

- 192% win on SLCT

- 184% win on NBN

- 181% win on SSFN

- 166% win on MFNC

- 163% win on SVBI

- 152% win on CWAY

- 150% win on BOCH

- 143% win on PBIP

- 133% win on BYBK

- 130% win on ACFC

- 129% win on RBPAA

- 126% win on CHFN

- 123% win on ASBB

- 120% win on UCBA

- 117% win on MGYR

- 107% win on ASBI

- 107% win on WBKC

- 104% win on SBCP

- 100% win on CHCO

- 100% win on EVBN

I called the top in 2007

I called the bottom in 2009

I told you to buy more

real estate in 2019

(before prices jumped 50% in 24 months)

![]()

![]()

I warned you to get out of tech stocks in 2021

All of these calls would’ve saved you a ton selling at the top…

And then you would’ve bought at the bottom.

But I’m no ‘blind squirrel who finds a nut’ guy.

I called a short-term bottom on the

exact day in June 2022

On June 20, 2022… after the S&P had fallen 23.4% from November 2021 highs…

I called that we would have a “rip-your-face-off” rally.

Sure enough, the very next day, stocks gapped up and took off the next 30 days. The S&P 500 gained 17% in one month. Some stocks, like Apple, shot up 32%.

But, I didn’t stop there…

I called the market to drop in September 2022

(dropped 1,000 points one week later)

I told folks, “Things will get a lot worse” despite the bear market rally I just called.

That was early September.

Just a week later…

Called this big drop the week before

Worst day since 2020.

I’ve been featured in Benzinga, Nasdaq, Marketwatch and others.

Business Insider reached out to me for an exclusive when Silicon Valley Bank and Signature Bank failed.

I’m well-known working in finding value opportunities.

I’ve compiled strategies that would’ve made you millions in the past decades.

I told investors to buy small-caps in January 2023

They shot up as high as 22%+ in 30 days

At the beginning of 2023, there was a lot of fear in the market… much like we’re feeling now…

But I told investors to pile into a select few small-caps.

The results were spectacular over the month.

…one play went up 11%

…another went up 13%

…a third went up 19%

… a fourth shot as high as 22%

Annualized over the year, that’s a 264% winner.

And that wasn’t even in the bottom of the market. Once the bottom of the market hits… much like you’d see with a stock like a Brunswick Corp at the bottom of the 2009 market…

These stocks could shoot up to triple digits… if not 1,000% wins!

The biggest gains happen when you buy in right now.

I’m telling you now that we are closer to a stock market BOTTOM than a top.

That’s why this message about investing in small-caps is so urgent.

We’re well over a year into this market… banks are going under…

The Fed will eventually be forced to cut rates… and when they do, we’ll likely already BE PAST the bottom.

So if you’re hearing the Fed will start cutting rates aggressively, it means you’ll need to buy in.

Inflation is slowing down as numbers are up much slower than before.

You can’t wait until it’s too late.

You want to be there when the market bottom… especially with rate cuts potentially around the corner.

And I’ll show you the $5 stock that could go up triple digits after it bottoms… much like it did for the past 7 recessions.

Even Warren Buffett wishes he could buy in. It’s how he first began amassing millions of dollars.

Here’s the “Duck Hunter” small-cap stock that made Buffett a fortune when he first started

This story happened well before he founded Berkshire Hathaway. Well before he was the rich, famous investor he is now.

Yet, this investment, no doubt, laid the capital groundwork for his career going forward.

Here’s the story:

98 St. Louis duck hunters purchased a plot of land in Louisiana for their duck hunting adventures.

They each got 1 share totaling 98 shares together.

One day, while ho-humming around their land and hunting, one of the 98 accidentally shot into the ground.

Well, his terrible shot turned into the greatest wealth-builder of their lives.

Out of that dirt ground gushed gallons and gallons of oil.

A true Jed Clampett story ripped from the TV.

The literal dirt cheap plot of land became a gold mine overnight.

The 98 shares went from being worth a few hundred bucks to around $29,000 each. The company had $20,000 of cash on the books and annual royalty payments around a whopping $1 million dollars.

Remember, this is the mid-1900s.

1 of the 98 duck hunters wanted to sell their 1 share… so the broker called up Warren Buffett.

At the time, Buffett was young, new to the investing profession, and also short on the cash required.

So, Buffett went out, hat in hand, and borrowed the money to acquire that 1 share.

This small company became a small-cap, but still the majority of the investing world would never have heard of them.

In the end, the duck hunters agreed to sell their shares to a big oil company and Buffett made a small fortune.

One of many he’d make in his career.

And this is the type of investing he’d love to always do forever.

Buffett’s repeated this at many of his annual Berkshire Hathaway conferences.

Buffett says he wishes he could buy small-caps forever

“There are always inefficiencies” when it comes to small-cap companies. “They get overlooked. You can find out about them but no one is going to tell you about them.”

“You can make VERY significant sums”, but it requires work digging in to find these companies.

But, because he’s too large of a company now, he can’t invest anymore.

He has too much money and putting $50,000 into a small company doesn’t make sense for his time when he can simply drop billions into Coca-Cola and make 9 figures in dividends.

However, for small time investors, he recommends putting as much cash as you can into small-caps.

In 1999 he told Business Week:

“If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling.

The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that.”

During his early periods investing in small-caps up to 1969… Buffett recorded a compound annual return of 31.6%.

Imagine settling for 8% like everyone else does… when you can make 4X and more from small-caps.

Yes, it takes hours of research…

And years of understanding WHERE to look to find a $5 stock like my #1 small-cap.

You’re not going to hear about Louisiana Pacific watching CNBC or Fox Business.

You’ll need to dig into financial reports, read industry magazines, organize stock screeners, and more.

Nobody expects anything from these companies.

So bad news gets priced in fast.

However, when good news breaks through and reaches the airwaves… the stocks skyrocket.

Warren Buffett wasn’t the only famed investor to make a fortune starting out in small-caps.

John Templeton made 4X his money buying

small-caps during uncertain times

There were 140 of these small-caps under a buck and he bought every single one.

After 4 years, only 4 of the 140 failed… the rest went up.

Templeton made 4X his money meanwhile the Dow Jones fell 19% in that same four-year time frame.

“If you want to have better performance than the crowd, you must do things differently than the crowd.”

Templeton became a billionaire following his value investing approach his entire career.

Peter Lynch made 500% in a few years buying small-caps

One of his other famous small-cap investments involved women’s pantyhose. Lynch first noticed Hanes as they had a pantyhose product, “L-Eggs”, that sold in egg shaped containers in supermarkets. His wife loved them.

Lynch bought shares when Hanes was worth about $40 million. (That’s about $165 million in today’s dollars).

Hanes was sold to Consolidated Foods and Lynch made a 500% return on his money in a handful of years.

Walter Schloss beat the market for 47 years investing in small-caps using a similar strategy I do

Walter isn’t as well-known… but is famous in investing circles for throwing off 20%+ annual returns over 47 years!

He didn’t have a fancy office and usually didn’t have a computer. Just a big ol’ Moody’s business book he would devour looking for small-caps to buy.

Schloss, like me, looked for small-caps with no debt and could be purchased for less than their asset value.

Warren Buffett talked about Walter Schloss saying:

“He knows how to identify securities that sell at considerably less than their value to a private owner. And that’s all he does. He simply says, if a business is worth a dollar and I can buy it for 40 cents, something good may happen to me. And he does it over and over and over again.”

Shelby Davis turned $50k into $900M buying small-caps!

Shelby left his job in 1947, borrowed $50,000 from his wife and started buying cheap insurance stock small-caps.

By the mid-1950s, Davis was a millionaire…

And by his death… he turned $50,000 into over $900 million!

Today, his sons follow the same investing approach and now manage over $27 billion in assets.

You don’t need to be some fancy-pants fund manager to see big returns.

Sure, you may not turn $50,000 into $900 million…

But there’s no reason you can’t start buying small-caps and generating triple digit wins over the next 9-12 months.

This isn’t day trading or even swing trading.

You’re buying strong companies at beat-down prices… many times lower than what their asset values are.

That’s where the real money is made, folks.

Not chasing meme stocks, trying to buy options, or any of that risky nonsense.

You can value invest and make incredible, incredible returns without the major risk.

Right now, small-caps are setting up for the biggest moves in 30 years.

Barron’s reports small-caps are “set for big gains.”

Even reporting they should outstrip large cap gains over the next 12 months.

Here are 3 main reasons they’re huge buying opportunities right now:

#1. The stock prices themselves for the best plays are under $20

Seriously, you could buy my entire small-cap portfolio for under $100.

That’s how low the prices are right now for the very best small-cap stocks.

Meaning, you can scoop up hundreds of shares for, say, $1,000.

My $5 stock play right now, you can grab 200 shares at that range. I love not having to pay $500 for a share.

At those lower stock numbers, it’s much easier for a stock to double or triple.

And that’s a huge advantage for us. It’s much harder for a $500 stock to double than a $5 one. That’s simple math.

Since the large institutions don’t even play in this pool, we can get in for cheap…

Then — when they finally do take notice because there’s interest in the stock… there’s more momentum behind the move.

More momentum means the stock prices can make big jumps and that’s good for you.

Bottom line, you don’t need to break the bank to start investing. Carve out $1,000 or $10,000 and you’re set.

With my $5 play, if the stock moves like it has in the past recessions, you could see as little as 205% gains… or up to 1,123% like it did in 2009.

Just $5,000 could turn into as much as $61,150 in as little as 12 months as it happened in 2009.

But, we may even see bigger gains than we did coming off the tech bubble or 2009 lows.

Here’s why:

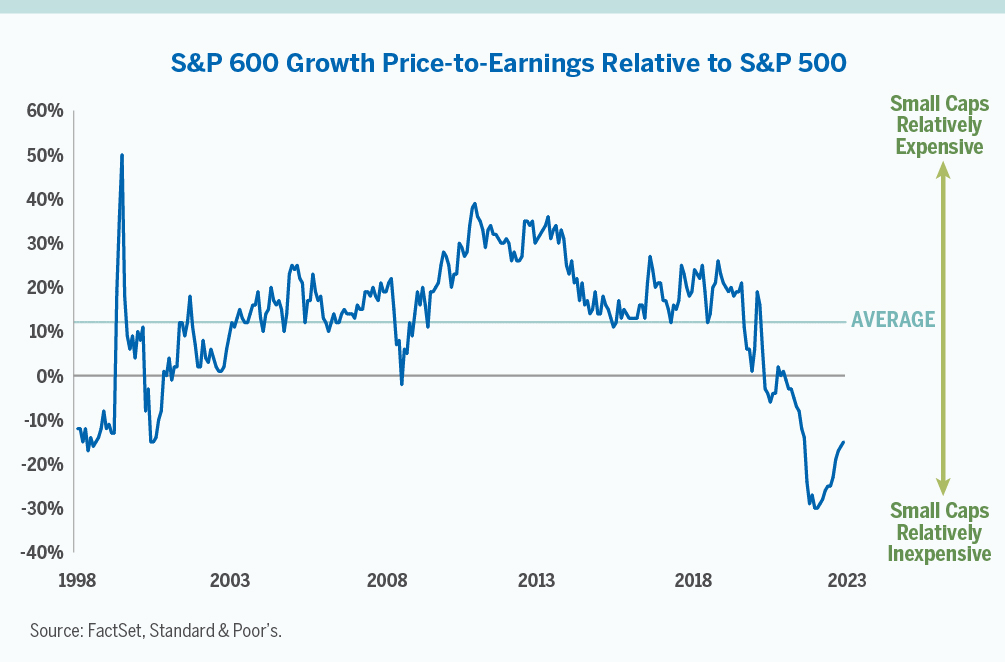

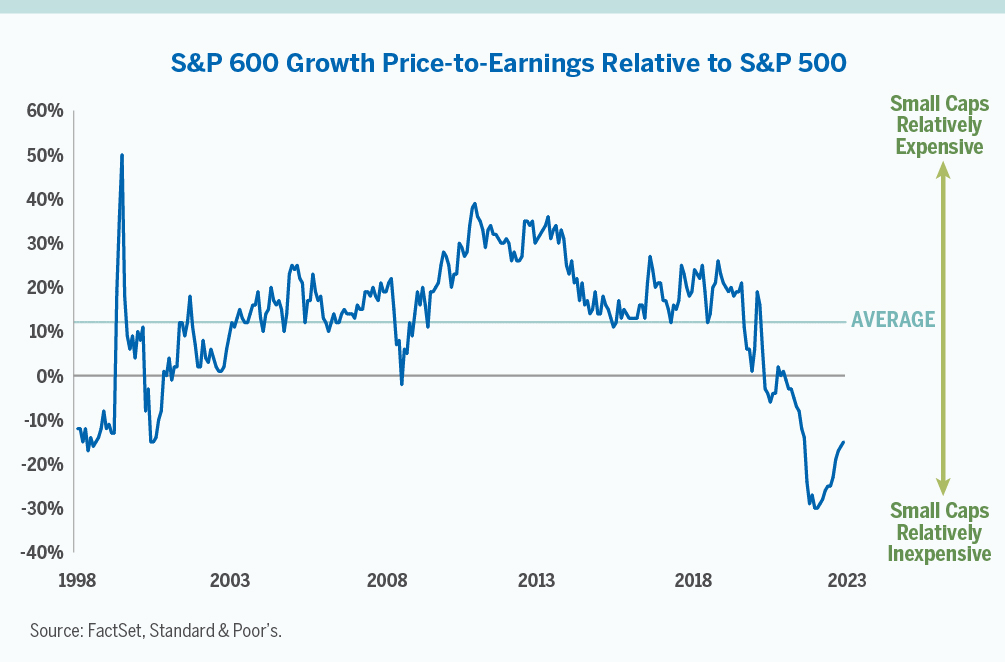

#2. Small-caps are trading at the lowest values in 3 decades.

We’re not talking about the stock price this time.

We’re talking about valuations.

Historically, small-caps trade at a price-to-earnings 12% higher than the S&P 500.

You’re buying a 12% premium because small-caps can make the biggest moves as I’ve shown you.

However, take a look where we are right now…

At the moment, small-caps are trading near a -18% discount!

Meaning, just to get back to 12%… they’d need a wild move upwards.

What kind of wild move?

Take a look at 1999 when they moved fast around 2001-2002.

I already showed you a few small-caps how they bounced off the Tech Bubble low.

Like Deckers, which shot up 567% from the Tech bubble lows.

Except…

Small-caps are at an even DEEPER premium than any of these last 3 recessions!

Meaning, the move upwards has to be even more prominent to get back to historic averages.

Everything always reverts to the mean.

That’s why I buy value. When stocks trade for a discount to their assets and cashflow… like the $5 stock I’ll show you…

Everything reverts back to the mean. Eventually, the market catches up and gets wind that “hey, this stock is on sale.”

With large cap stocks, these arbitrages are found pretty swiftly.

Small-caps, not so much and that’s where you can make a lot of money. That’s how Buffett made his initial fortunes. Finding the plot of land spouting oil before others.

That’s what you can do starting today with this $5 stock I’ll show you.

And that leads to the third reason.

I touched on this before.

#3. Small-caps always rebound faster than other stocks after they drop

Coming off the 2009 lows…

After 24 months, these large cap stocks showed these gains:

- Walmart – 20%

- McDonalds – 47%

- Microsoft – 75%

- Apple – 360%

- Netflix – 243%

- Amazon – 210%

Meanwhile…

I’ve shown you small-cap stock gains already coming off the 2009 lows:

- Brunswick (BC) – 1,143%

- Penske Auto (PAG) – 454%

- Mattel (MAT) – 347%

- Louisiana Pacific (LPX) – 781%

- Aerojet (AJRD) – 320%

And those are just to show a few examples.

The gains come fast and quick.

With small-caps trading at even steeper discounts to the S&P 500 than in 2009…

I expect the gains coming off these current lows to be 10-20% better than the small-cap gains coming off the 2009 lows.

That’s not a guarantee or promise.

Small-caps are simply stretched so far… remember, like a rubber band… they definitely will snap back soon.

Right now, my #1 $5 small-cap stock is trading around 2009 lows.

Comparing 2009 to today…

- Their revenue is 45% higher

- Income is 10X higher

- 8% less shares outstanding (making 1 share more valuable)

- Executives bought thousands of shares March 2023

The last time it bounced from 2009 lows… the stock shot up 1,123%.

I’m not saying it’s set to go that high as I can’t promise anything.

But, with the stock trading at the valuation of its cash, inventory and real estate… it’s a bargain as the business turns a profit.

My $5 small-cap stock has room to make a big move upwards.

And I’m ready to share it with you in my special report, The $5 Small-Cap Stock set to 5X.

- The Ticker Symbol of the stock

- My entire analysis on why this company is a winner

- The “Buy up to” price so you don’t overpay

The report can be yours in the next few minutes.

However, like I said, there are dozens of small-cap opportunities appearing as I write this.

It doesn’t make sense to ever put all your eggs in one basket. That’d be foolish and I’d never tell you to do that.

I would never tell you “one stock will make you rich.”

Like Buffett says, if you already have $20+ million in the bank, buying small-caps likely doesn’t make sense as you can make smaller returns and still generate a ton of cash.

Small-caps are for those with less than that looking for outsized returns especially in this tough market.

And you should always diversify among many plays.

Remember John Templeton diversifying among 140 small-caps during World War II. He 4X’d his money across his portfolio.

Now, you don’t need 140…

But I can show you 4 more right now to add to your portfolio today.

BONUS SMALL-CAP #1:

A 24% dividend yielding small-cap

(as of this writing March 2023)

At the same time, they’ve 8X’d their dividend in the last 12 months. Meaning, there’s a huge yield sitting out there right now.

As of right now, it’s on pace to be a 24% dividend yield!

This company is an oil producer and has 3,147 producing wells in the western US. They’ve been around since 1909.

Except, they’ve only IPO’d in 2018!

This is like Warren Buffett finding the duck guy’s Louisiana oil plot of land.

No one is talking about this 113 year old oil monster as it’s so new… and so small for big players.

The market cap is less than $1B which won’t even hit the radars of the Wall Street suits.

This is a good business, guys. The price-to-earnings is a wild 2.3. (Exxon goes for 8).

80% of debt reduction will go to stock buybacks and debt reduction (remember, we don’t want debt). They’re also stockpiling cash for a big special dividend coming.

If we get an oil shock in prices up… this stock will go bananas. Occidental’s CEO, Vicki Hollub, spoke for the entire oil industry back in March 2023 saying “high oil prices are here to stay.”

Oil is a great place to be.

You can buy this stock up to $10, it’ll still be an incredible price there.

I’ll show you the stock inside my special report, A 24% Dividend Yielding Small-Cap

BONUS SMALL-CAP #2:

Steel play set to double

This stock is priced like no one will ever use steel again!

Its price-to-earnings is a mere 3… which is almost as low as you can go for value buying.

They’ve bought back shares every year for the past 5 years and they plan to buy back nearly 10% of all their shares going forward.

This company is a picks-and-shovels play providing electrodes that are necessary to produce steel. Their main business has been around 140 years. They’ve weathered recessions and world wars… I see them holding up just fine.

They’re using cash to pay dividends, buy back shares and reduce debt. All things you want to see from executives.

The stock could easily double in 9-12 months. That’s not a promise, just what I see could happen with how fundamentally sound they are.

Again, the stock is only $5.

Buy this stock inside my new report, The $5 Steel Stock Set to Double.

BONUS SMALL-CAP #3:

Real estate small-cap with

50% gains already built in!

This 3rd bonus small-cap is in the mortgage and real estate business. They provide that pesky mortgage insurance you pay if you don’t put down enough buying a home. However, they also provide services and products to real estate brokers and lenders.

They returned 22% on their equity in 2022… that’s as good as most tech stocks.

Their book value is HIGHER than their stock price… meaning, you’re buying the stock for less than the assets they own.

That’s the way of value investing that makes you rich. Because this business also cashflows… the highest profits in years last year.

They used that wonderful cash to buy back more than $400 million in stock… and about to buy another $300 million. That’s nearly 20% of the stock in total they’re buying back.

And still, the stock is trading at 4.5 price-to-earnings.

Analysts expect future P/E to be 50% higher… meaning a 50% bump is already planned… it’s just no one has seen this yet.

They also pay a tidy 4% dividend kicker… nearly doubling the dividend since 2020.

Find this stock in my brand-new report, Small-Cap Real Estate with 50% Gains Already Priced In!

BONUS SMALL-CAP #4:

Shipping stock with a massive moat

The last bonus play may be the best play of all these bonuses. Another $5 stock.

They have specialized vessels that allow them to charge 42% more than others and vendors have to pay it.

That’s allowed the business to increase cash flows by over 40% year-over-year.

Their revenue has doubled in two years…

Profits have gone up 588% in that same timeframe.

They’re using those profits for… what else? Stock buybacks and paying a hearty dividend.

The current dividend yield is around 7.2%.

The dividend has doubled in 12 months… and could keep going.

Insiders of the company own 29% of the stock. Compare that to Tesla where insiders own 0.1%. Yet, everyone talks about Tesla and not this company.

Price-to-earnings is just 3.2… and you’re buying shares at a price of 84% of their book value.

Buy this small-cap now inside The $5 Shipping Stock Doubling Fast.

All 5 of these small-cap reports can be yours today.

I’ll send them right to your inbox.

And this is just the beginning, guys.

I am building a portfolio of 24 of the very best small stocks. Meaning, I have another 19 to go to show you.

Almost all of these 24 stocks will have low share prices… meaning, you don’t need 6-figures to buy into these.

If you started with just $10,000…

You could see life-changing gains.

I’m putting all my small-caps into one service.

That service is called

The Momentum & Value Portfolio Letter.

M.V.P. is the premier small-cap newsletter on the market. Unlike other small-cap newsletters looking for risky ‘penny-stock-like’ movements and trades…

I’m looking for opportunities to buy assets for less than what they’re worth. You can’t go wrong with that strategy as I’ve shown you the greats today who do it.

Every week, I’ll be producing updates and content for you inside M.V.P. I don’t share this anywhere else.

My publisher, Investors Alley, already produces three other of my services. Those center around the finance and real estate niche.

M.V.P. Letter is about buying the deepest value plays on the market to generate triple digit gains in 9-12 months.

And that’s not an exaggeration.

I’ve shown subscribers those types of gains in the past in the small-cap space.

Here’s just a few:

- 194% win on GNBC

- 192% win on SLCT

- 184% win on NBN

- 181% win on SSFN

- 166% win on MFNC

- 163% win on SVBI

- 152% win on CWAY

Now, you too can start going after these types of gains today with the M.V.P. Letter.

Now, the service is called Momentum & Value.

I talked a lot about “Value” today.

But what’s the Momentum about?

Well, I didn’t share the entire strategy with you today. It might be the most important part and could generate you the outsized returns you’ve been looking for that no other newsletter could ever provide you.

This is the #1 small-cap investing strategy out there and it’s this.

The #1 Small-Cap Investing Strategy (behind M.V.P. Letter)

Beats the Market by 1,705% over the past 31 years

Billionaire fund manager Cliff Asness discovered a unique correlation investing in small-cap funds.

It’s a way to also temper the volatility you might see in small-caps… which reduces your risk.

And here it is:

Many invest their portfolio in one way — either long-term or short-term investments.

Well, Asness discovered with small-caps, if you divide your small-cap portfolio into two parts… 50% long term value small-cap stocks and 50% MOMENTUM small-cap stocks…

You can produce returns that are 1,705% HIGHER than investing in the S&P 500.

If you invested in 50% long term small-caps and 50% momentum small-caps from 1992 to 2021…

- $1,000 in the S&P 500 becomes $4,621.

- $1,000 into this Momentum & Value Portfolio is $66,389!

That’s 18X more cash in your portfolio over 30 years.

That’s the difference between golfing at your local community rec course or being at the top country club in the land.

Because if you started with $25,000… you would have a portfolio worth $1,659,725 at that same pace following my #1 small-cap strategy

Meaning, this works in good and bad markets. It works all the time.

Why does it work?

Because when long-term value plays are down… usually the momentum side is up.

When Momentum starts slowing down, VALUE then becomes more prominent.

In this way, you’re essentially hedging your bets against each other.

In 2022, here are some small-cap value winners:

- 94% on PBFX

- 59% on VOLT

- 108% on USAK

- 94% on ULH

- 33% on DXLG

Now, check out some of the small-cap momentum winners:

- 208% on AMOY

- 408% on NINE

- 249% on RCMT

- 272% on HDSN

- 184% on HNRG

I recommended one small-cap in January 2023 for the momentum side of the portfolio for M.V.P. Letter…

It jumped 33% in 2 months!

This “50/50” portfolio is the #1 small-cap strategy we use inside M.V.P. Letter.

I’ll share everything about it FOR FREE inside M.V.P. Letter

Start investing with just $10,000 in your portfolio

Remember, these stocks are usually below $20. You can buy a lot of them right now.

The 5 stocks I shared with you already are value plays I expect to triple in the next 9-12 months.

You could even turn $5,000 into $10, 20, 30k potentially if everything works out as we hope.

That’s not a guarantee or a promise, only a projection based on my three decades in the market.

And you’ll have me to guide you every single week.

Because as a subscriber to M.V.P. Letter, I hold a Weekly Mailbag Video to answer all your questions.

Recent Mailbag questions, I answered:

- What’s going on with oil prices and how you can profit

- What happened with the banks from conversations I’ve had with bank insiders

- What bonds could produce massive dividends for you right now

- What defense tech stock I see with potential that’s trading at a huge discount at the moment.

…and much more.

I answer every question that comes in and share more based on my research and discussions with insiders.

I also discuss any new trade alerts, how our positions are doing and any breaking news on our small-cap holdings.

That’s every single Tuesday, you can expect that in your inbox.

There’s no pitch that comes along with it. Pure 15-30 minutes of content from me. The recording is up on the website like clockwork. Our team here at Investors Alley runs a tight ship.

Then, you can also go LIVE with me every

month for our monthly call.

These monthly calls you can join (they are also recorded and posted).

This is where I speak openly with you and answer your questions live.

I also have a presentation going through various topics that month.

Here, I shared my forecast on our economy.

I talked about where inflation could be going, when I see a bottom coming, and more.

This is the type of unbiased, deep content you’ll expect as a subscriber.

You won’t find this research on Seeking Alpha and CNBC.

These monthly calls are where you can get to know me more personally. I’d love to chat with you LIVE.

As you’ve seen…

You’re getting a lot of value here.

5 value plays to add to your portfolio…

A growing list of small-cap investments to make up to 24…

My #1 small-cap strategy to beat the market by 1,705%…

Weekly mailbag updates and deep dives…

Monthly LIVE calls…

These total up to $7,997 in value to you and counting.

Once the market bottoms and small-caps launch, you have the potential to see triple-digit winners in as little as 9-12 months.

If the $5 mattress stock does what I think it could… you could make thousands in profits off a small $2,000-$5,000 investment.

You could possibly pay off your entire subscription cost if it was $7,997.

But you’re not going to pay anything close to $7,997.

I want you to join the M.V.P. Letter for much, much less.

The price?

Just $1.63 per day.

Join M.V.P. Letter for less than $50 per month.

That’s to get 24 small-caps in the portfolio at one time. You don’t need a lot of money to start with.

I recommend a minimum of $10,000 invested.

If you can hit 1,000% gains as some stocks did at the bottom of prior recessions, that’s 6-figures in profits.

That’s not a promise that’s going to happen… just the potential based on the past recessions.

The $50/month is billed annually at $595/yr.

An incredible bargain for almost eight thousand dollars of value.

And it doesn’t stop there.

Join today and get a 60-day money back promise.

Give my small-caps a test.

Join and see all 5 of my very best small-cap picks. If you don’t feel you’re getting true value for the stock picks…

Call us up or send an email and get a 100% refund of your subscription fee within 60 days.

Keep the reports as a free gift.

Guys, this is the very best time to buy small-caps.

The Federal Reserve has sold the armor and let the horses out to pasture. They ain’t coming to rescue tech stocks and unprofitable companies from the abyss.

Money is going back to where it should be when I started investing: Valuable companies with strong fundamental positions that can weather a recession.

The time to invest in small-caps is NOW.

The biggest gains are coming very soon when small-caps bottom.

You’ll know when it’s happening as the VIX will hit 40+, more banks will go under.

But, by then, you’ll be too late.

Small-caps are already at historic lows.

You don’t want to wait when they start moving up as you could miss a bulk of the gains.

As money still rotates out of large cap tech and now banks… they will need to find a landing spot…

Small-caps will be there soon.

My $5 stock has been through seven recessions… and will likely be around for another seven.

Each time, they bounced at the bottom of the market and made investors triple digit profits.

I believe we’re right there again.

I called the bottom of 2009… called the bottom in 2022 for the year… told you to buy real estate a few years ago…

I’m telling you now not to spend time in the large cap pool. They had their moment to shine the past decade.

Inside M.V.P. Letter, you’re buying into resilient small-caps that have huge upside potential.

Many of the stocks trade for under $20. A quick move in the market can send them doubling fast. It’s much easier to double a strong $5 stock, then a weak $100 company.

When the markets bottom, our small-caps will lead the pack again.

They had a semi-rough year in 2022.

Small-caps tend to outperform all large caps after a lagging year.

They’re setting up nicely right now trading at price-to-earnings as low as 3-4 as you’ll invest in today.

Click the button below and you’ll be taken to a secure page to join.

You’re backed by a 60-day money back policy.

All for less than $50/month billed annually.

Click the link below now.

Tim Melvin

Editor of M.V.P. Letter