Over 10 years, I’ve successfully found 64 stocks that were acquired for up to 194% gains.

In January 2024, I closed out a 70% winner for a stock I said In March 2023 would be acquired.

I just added 5 new acquisition targets and one of them is already up 16% in 2 weeks

Get the acquisitions coming below:

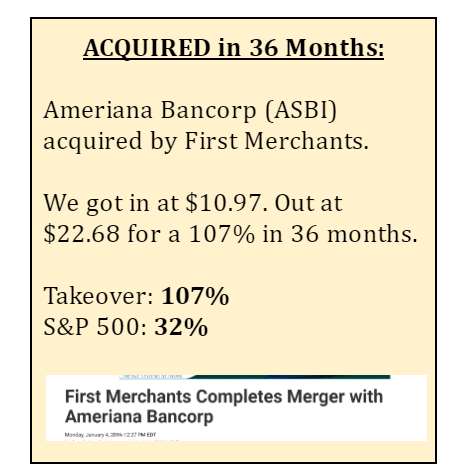

- Guys — I’ve made takeover predictions 65 times… 64 times we made money for a 98.5% win rate

- 32% of my takeover recommendations go for 100%+ gains

- $5,000 into every prediction I’ve made would’ve netted you over $270,593 in profits

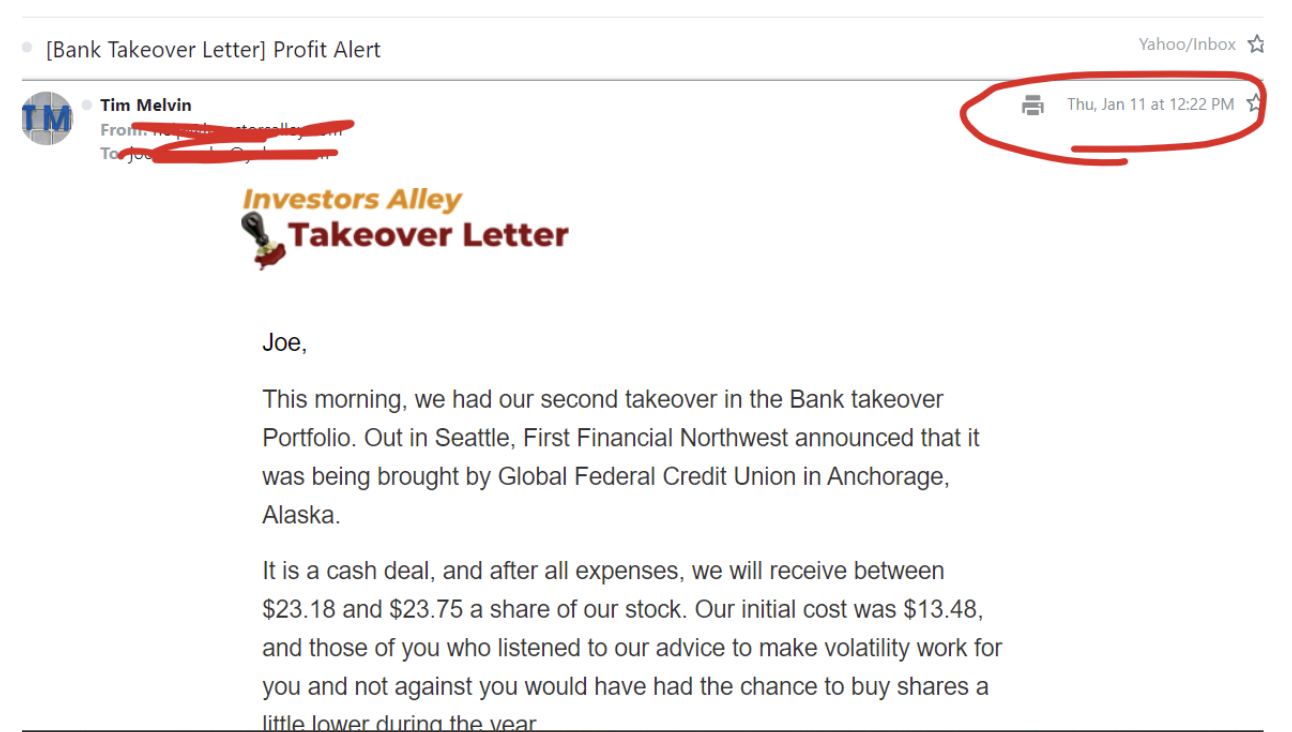

On January 11, 2024…

I sent out this email to my subscribers about a takeover that just happened.

First Financial Northwest (FFNW) was bought by Global Federal Credit Union in Alaska.

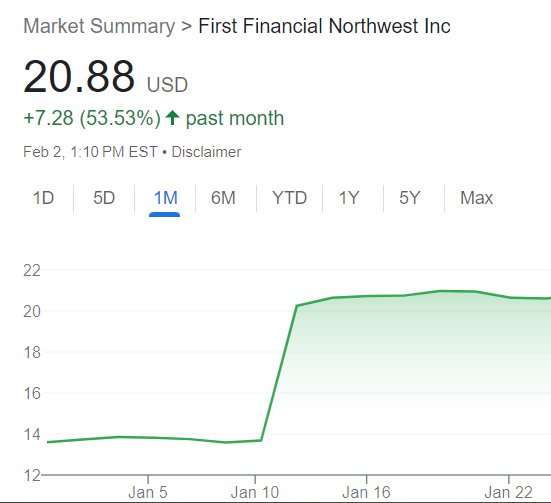

Here’s what the stock did next…

Absolute explosion for over 53%…

At our entry price, we banked around 70%.

I had also recommended buying more shares of FFNW as the entire stock market sunk into October 2023…

Which, if you bought then… you would’ve been up over 105% in three months.

Takeovers are the most exciting play in a stock’s life.

A company spends (sometimes) decades building a viable company… then they’re acquired for a ton of money.

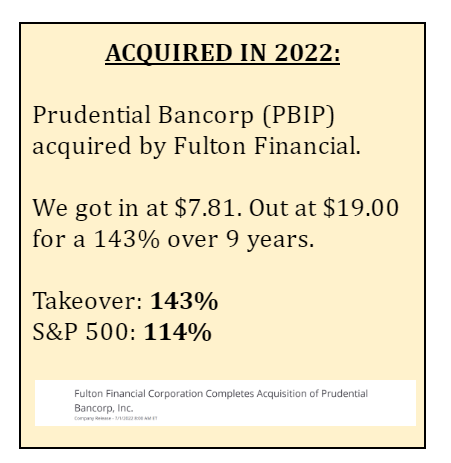

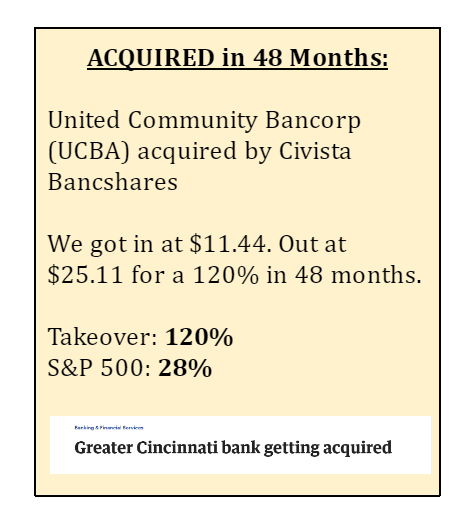

Ones we’ve seen just in the past 24 months…

- Broadcom acquiring VMWare for $61B

VMware shares gained around 40% from announcement to close.

Microsoft acquiring gaming company, Activision for $60B

Activision’s stock also jumped 40% overnight on the news.

These events can mint fortunes for shareholders who can recognize what’s coming down the pipeline.

For me…

These large companies are on the frontpage of the news and splashy…

I like acquisitions few hear about.

No one is talking about FNFW…

But we made 70% while Activision shareholders (who get to be on CNBC) only make 40%.

The gains you get from the ‘smaller’ acquisitions are much more exciting and rewarding.

Right now, I have 5 new acquisition targets. I just recommended them in January 2024.

They aren’t banks like FNFW.

…one is in the industrial space…

…two in the oil and gas…

…another in the insurance arena…

…a fifth in the outdoor living category.

I do have other banks I believe could be gobbled up very soon… especially with all the troubles in the banking sector.

Here are the gains on ones I’ve recommended since the March 2023 banking crisis:

- 14.97%

- -40.40%

- 57.79%

- 10.36%

- 19.46%

- 9.20%

- 17.33%

- 34.36%

- 40.94%

- -9.97%

- 33.73%

- 19.67%

- 11.85%

Returns on takeover targets I recommended in the banking sector since banking went out of style in March 2023.

Not bad.

And that’s BEFORE a potential acquisition announcement.

Small acquisition targets can move fast.

One new one I recommended in January 2024 is already up 16%… and climbing.

You can buy shares today if you wish.

You can buy shares today if you wish.

Here’s how fast these small stocks can move.

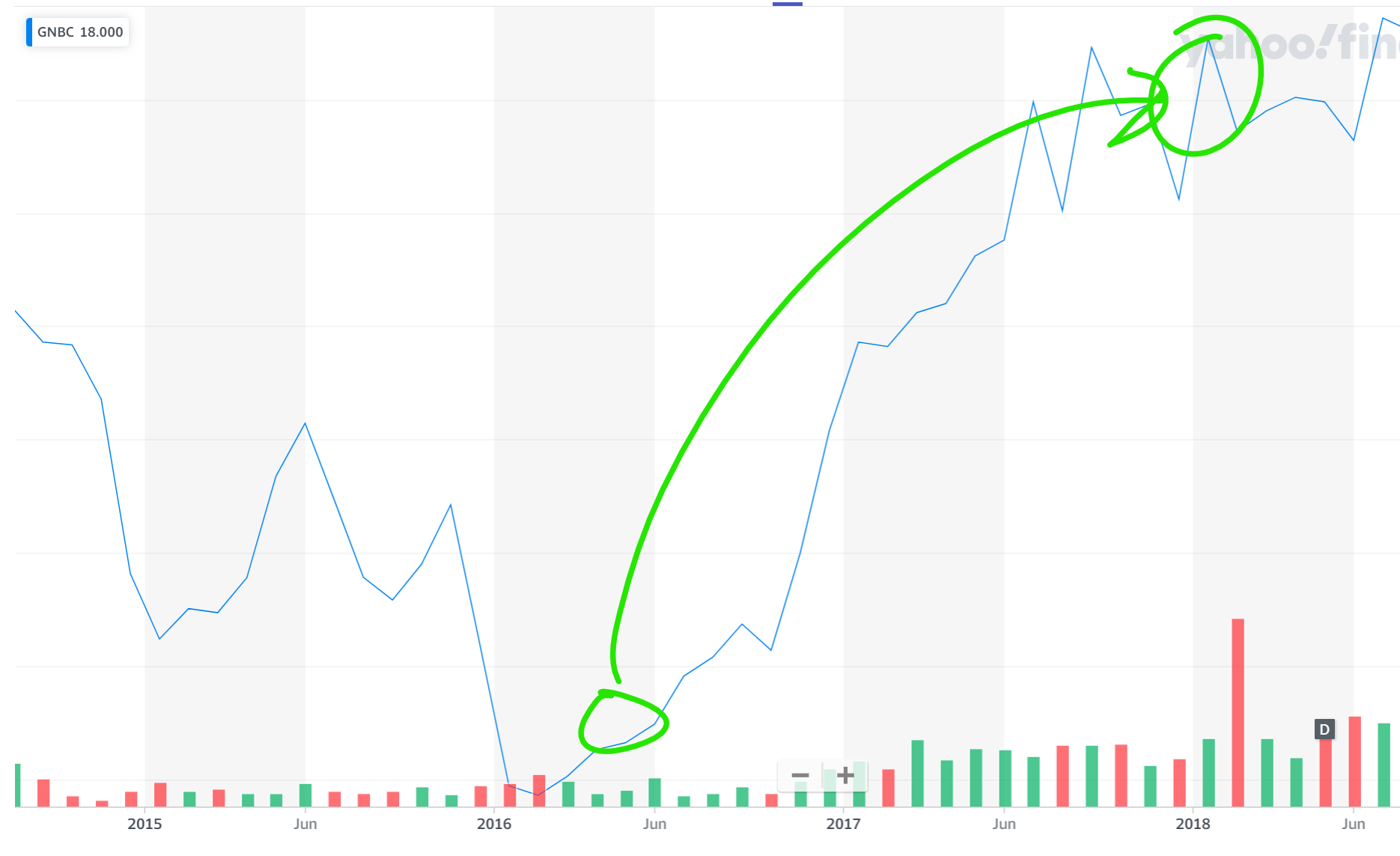

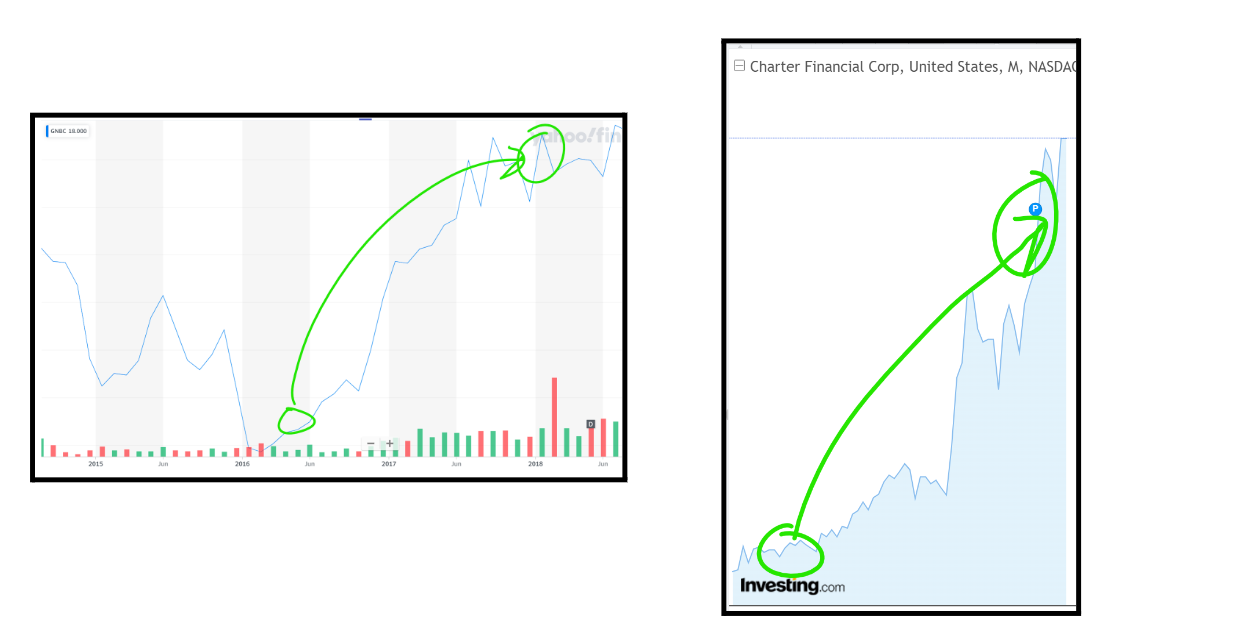

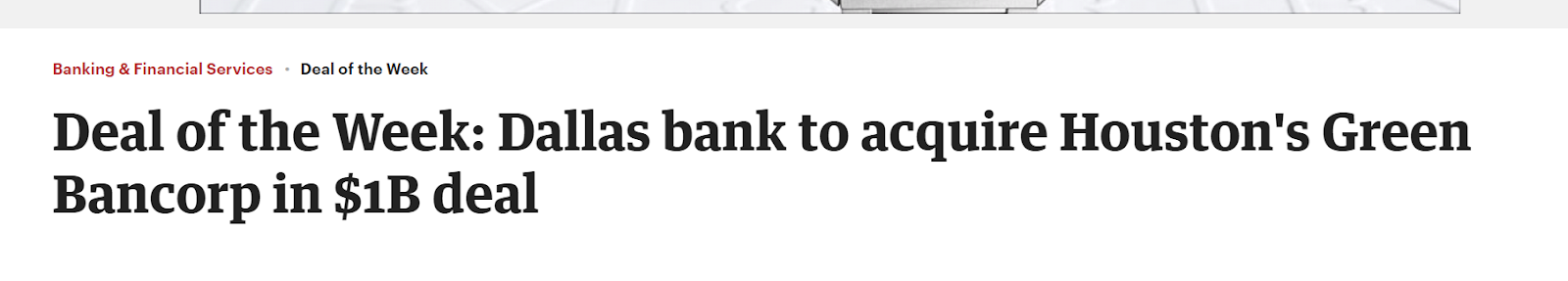

Look at Green Bancorp. It was a 17 year old bank, but was taking a beating after its IPO.

You’ve likely never heard of Green Bancorp.

I found them trading at a steep discount.

You’re going to be buying small banks at dirt cheap prices… BEFORE the big banks swoop in and pay you a massive premium. (here we banked a 194% win)

And, because large companies acquiring move slower than you and me, it took a few years before Veritex Holdings woke up and smelled the coffee on how cheap Green Bank was.

I saw the writing in the sand 4 years prior.

Veritex came in, dropped a big ol’ bag of money to buy Green Bancorp, and you would’ve walked away almost tripling your money.

You’ll get used to reading these press releases for your takeover purchases.

(I have a 98.5% success rate with my recommendations)

However, you can’t wait for a big Texas bank like Veritex to make their move.

The key to making money on these acquisition targets is investing in them before the sale is announced.

Because, by the time you read a press release about the acquisition happening… it’ll already be too late.

Buy shares NOT in the acquiring company… but in the acquired.

The big acquirers don’t usually move much. After all… cash is going OUT of the company.

Microsoft only went up 11% from January 2022 to the October 2023 final close of Activision.

That’s not worth bag-holding the stock while you could generate 70% in 10 months from an acquisition I find.

Finding these opportunities isn’t easy.

There’s no obvious intel when these companies will be acquired.

The CEOs of a small bank like FNFW aren’t on CNBC or Fox Business.

You’ll never hear of them. Some are just regular ol’ small-time businessmen who became CEO for being good at business.

One bank CEO I’ll show you was a long-time attorney.

These aren’t guys going around giving big speeches.

A few CEOs I can call and talk to right now. I have their number and they’d pick up the phone.

They aren’t big enough to have bloated staff.

The industrial company I recommend for acquisition is just a $103M market cap.

The outdoor company… a $115M market cap.

Meanwhile, Amazon is a $1.17 trillion dollar company.

That’s 10,173X bigger!!!

Start with small companies…

Then watch how fast they grow.

If you buy the 5 takeover targets I show you today…

I can’t guarantee you’ll make money…

But

My 10+ year track record of recommending takeovers targets has been spot on.

Hi, this is Tim Melvin.

64 out of my 65 past closed takeover recommendations have been profitable.

That’s a 98.5% win rate.

I have 5 more to share today.

With a 98.5% win rate, there’s a good chance all 5 of these companies are about to be acquired. (Nothing is guaranteed, though).

It doesn’t mean they will be acquired in 10 months like I just showed subscribers…

But I believe eventually they will be.

And the profits to you could be life-changing.

How life-changing?

Well, out of the 65 closed recommendations… 32% of them went for over 100% wins.

Simple math would say 2-3 of the 5 stocks I’m about to show you will be 100% winners.

And when you follow how I buy them (at steep discounts)…

You can get in at all-time low prices…

And cash out for huge gains.

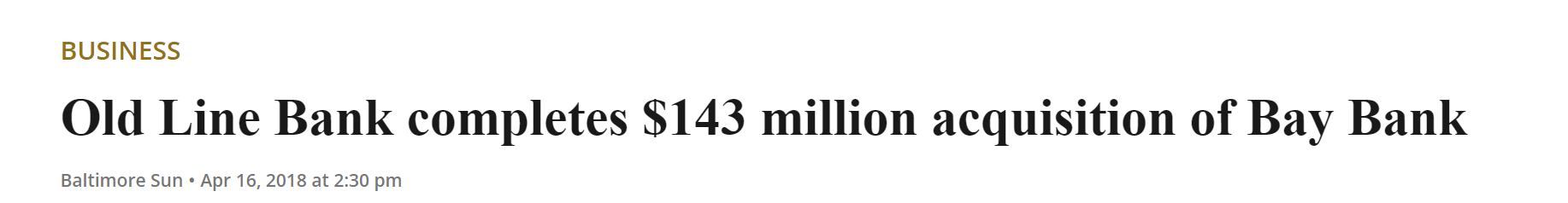

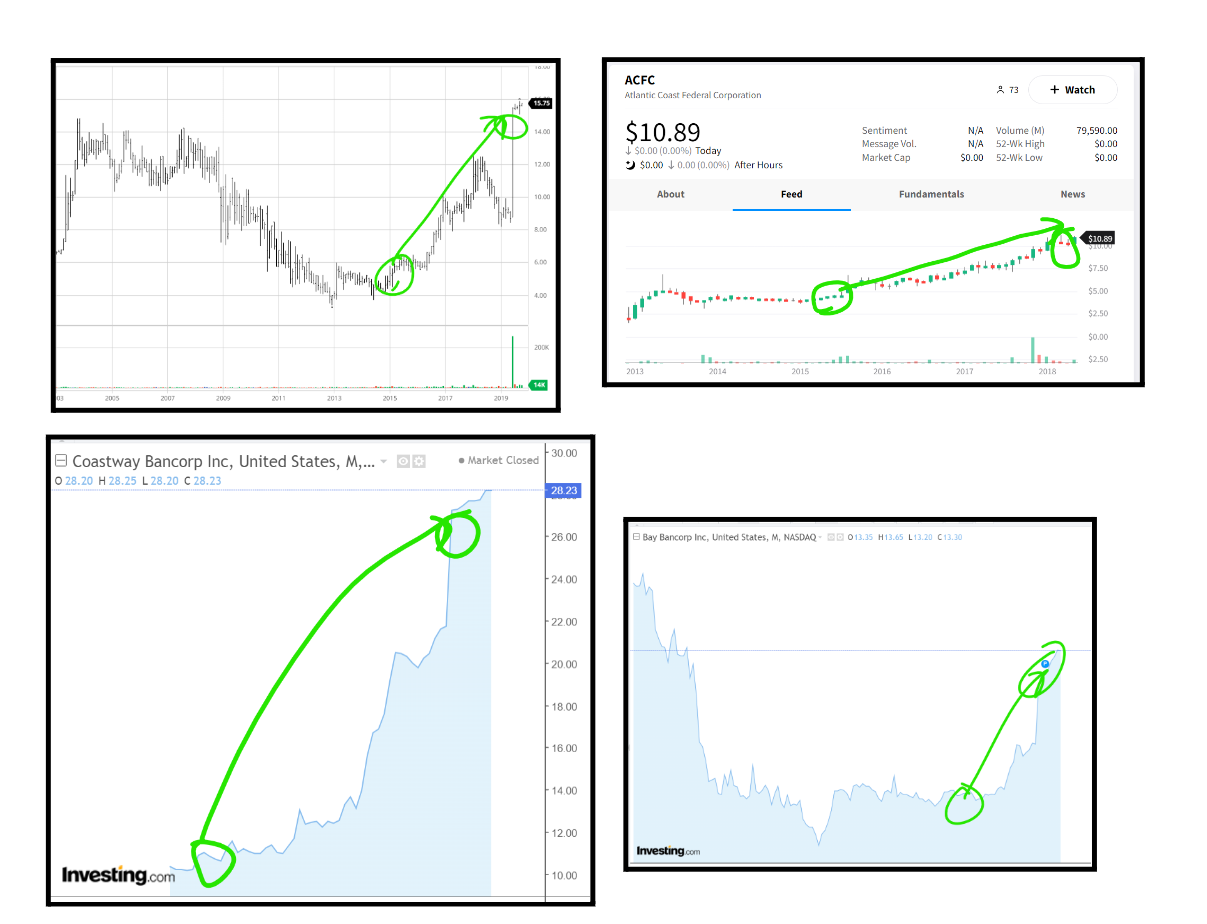

Like Bay Bancorp (BYBK).

Notice how the stock had collapsed from all-time highs to all-time lows.

You’ll be buying bank stocks at cheap prices like this

Following my tips, we got in literally before the acquisition news.

I recommended around $5.14/share. Odd Line Bank saw the incredible fundamentals I did (2 years later) and scooped up the bank for $143M…

Which was a 133% profit on our shares in under 2 years. (doesn’t include the dividends it paid too!)

My average profit on a recommendation is 83.3%.

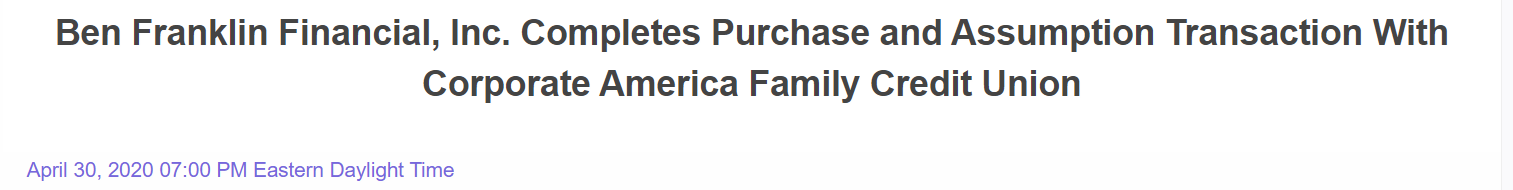

With only 1 loser…

And that loser only was a -2.78% loss.

To make matters more interesting…

That bank WAS acquired, just not for as big a premium as we hoped!

Friggin’ Ben Franklin Financial was bought up right as Covid started… likely hurting our premium! My only loss ever! (for -2.78%)

And these types of opportunities are not going away.

The share prices are super low.

Bay Bank was around $5.

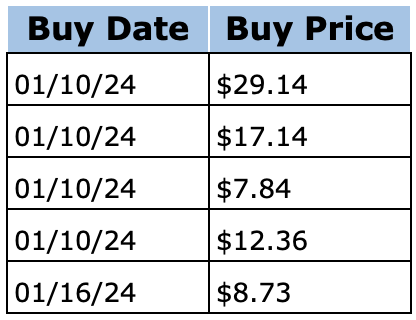

That’s super cheap… and most of these small businesses usually have low share prices…Here are the BUY prices for the new 5 takeover targets I announced in January 2024:

My 5 new takeover targets…

You could grab a share for around $76 total for all 5

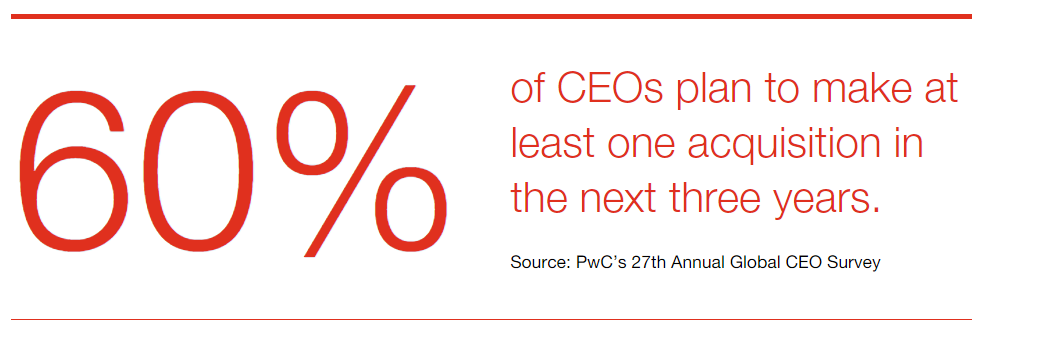

The top 55 largest acquisitions adjusted for today’s dollars have all taken place in the last 24 years

Compared to the prior 100 years from 1900-1999

We saw spiked interest rates in mid-2022 slow down M&A activity.

But now, PWC claims we are hearing the “starting bell for an upswing” in activity in the mergers and acquisitions space.

Here’s where that gets important…

Public stocks need to grow in order to see their stock price grow.

Large companies like JP Morgan or Google… They don’t suddenly explode 10X in one year.

Those days are behind them.

Instead, it’s a 3-4% annual compound.

Well, you can imagine shareholders aren’t too thrilled about this pace.

So, what do these companies do?

You got it —> they acquire to grow faster.

It’s the only way for companies to add levers of growth without having to develop their own new technologies, etc.

Microsoft buys Activision not because they aren’t able to build games.

It gives them faster growth in 1 year vs. a 10-year runway to build.

I love banks… So let’s look at them.

Take Ameris Bank. They’re a publicly traded company with over 100+ locations. (a drop in the bucket compared to the thousands of locations of a Bank of America).

To grow, Ameris can rely on advertising and opening up new branches…

Or…

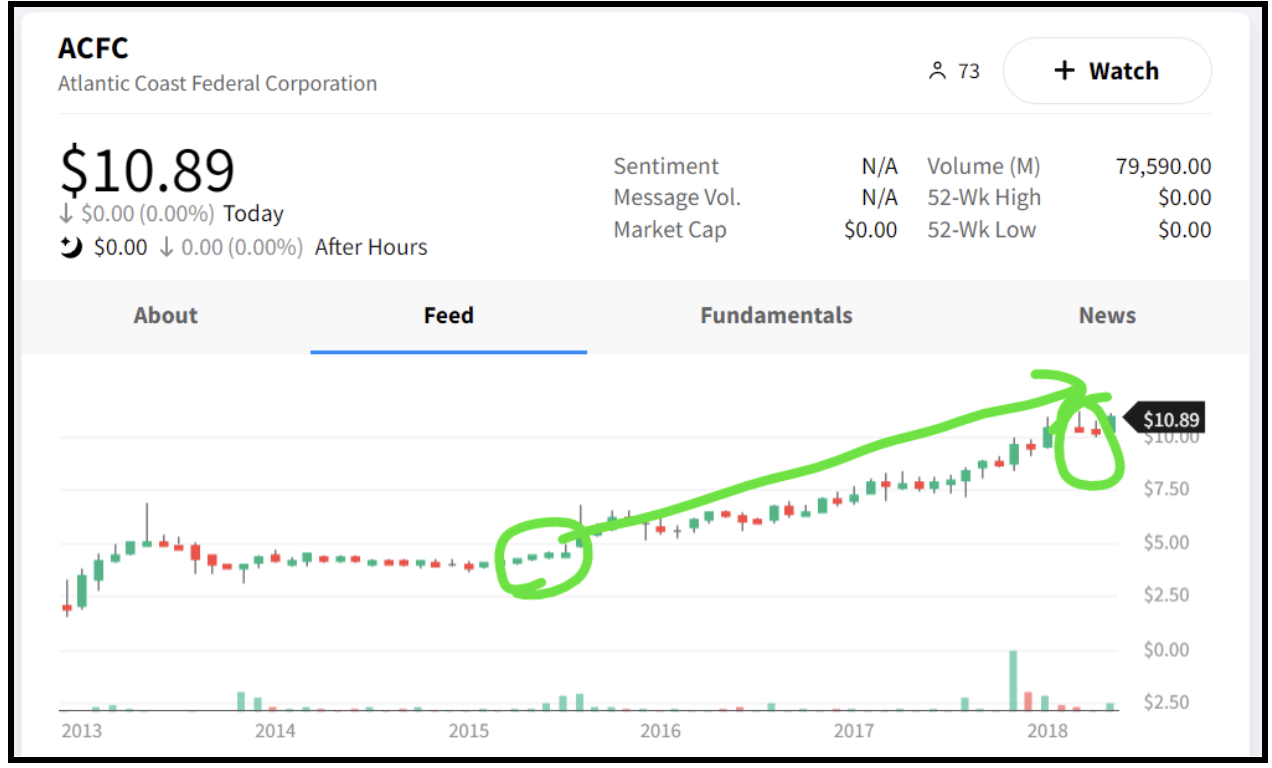

They can acquire a small bank like Atlantic Coast Federal Corporation.

Well…

If you can locate a tiny bank like Atlantic Coast Federal Corporation BEFORE Ameris does:

Recommended right before the stock took off!

Small banks are the cream-of-the-crop targets.

On one hand, because of changing times.

On the other, some smaller banks don’t have a choice.

You’re NOT day trading these

soon-to-be-acquired targets.

You’re buying them for 12, 24, 36 months

(maybe longer)

One publisher wanted me to ditch these investments because they were too “B-oring.”

I told them “Ba-bye.”

We’re not shooting for 1,000% gains here.

Many think that’s ‘unsexy’.

Not me.

As companies look to consolidate faster, they’ll keep paying huge premiums.

32% of my recommendations end up with 100%+ gains.

That’s a pretty sweet premium.

These gains may only take a year… but likely they’ll take longer. Some even 4-5 years.

I used to work at a big-name publisher. They were one of those pubs that promised massive 1,000% gains and all that BS.

I’m not one of those people.

I’m not one of those people.

Even with my stellar track record around acquisitions… they wanted none of it.

They said I was too ‘boring.’ That I needed to make bigger and bigger promises to you.

I stopped working with them.

They didn’t think anyone would be interested in an industrial takeover, or oil takeover, or bank takeover stocks.

So I told them “goodbye,” and now at a 22-year publishing arm that’s only grown while many of the big firms (including my old publishing company) are failing.

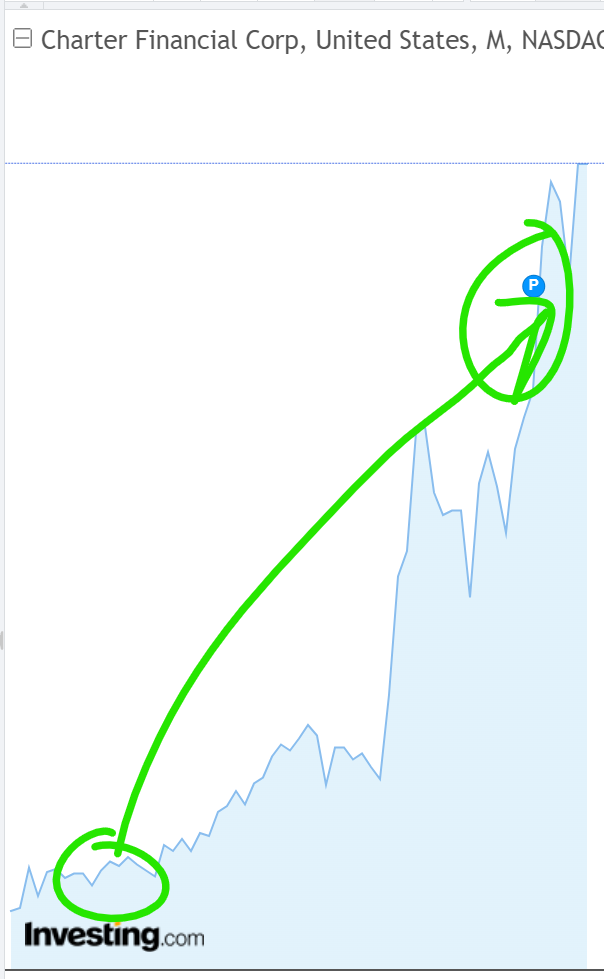

Like when I recommended Charter Financial Corp. It had collapsed after 2008 and never recovered.

I got in right at the bottom…

We’re buying at incredible valuations (and profited 126%)

My recommendation came in at $10.50/share.

4 years later, Centerstate Bank recognized what I did… “Charter is dirt cheap!”

They came in and bought Charter and we profited 126%! (that doesn’t include the 1.4% dividend you were collecting)!

Over 27 years…

I’ve tested more than 2,917 stock strategies for the biggest financial companies in the world to find what makes money.

I’ve also managed money for some of the world’s wealthiest.

Again, my name is Tim Melvin.

Again, my name is Tim Melvin.

I’ve been in the financial services industry for over 34 years serving as a portfolio manager, broker and advisor.

Now, I’m not like many of the stock guys out there.

I’m old school.

I’m not trying to find the next landmark medical breakthrough, or deciding if Tesla is going to be the biggest company in the world.

I don’t leave my investing to chances.

I have one goal —> Look for inefficiencies in the market.

Where is an asset trading for less than what it’s worth?

We’re talking some real good, old school Benjamin Graham, Peter Lynch, Warren Buffett stuff.

Find the diamond among the rubble and buy it.

My top takeover targets are trading at incredible prices right now.

This is what I find.

Tim Melvin is the greatest expert in deep value investing. That says it all!

-Walker

He gives the reader a blueprint for how to find the diamonds. He ensures you will not go away without some treasures for your portfolio.

-Toto

He’s the best and most thorough analyst… five stars.

-Michael B.

That doesn’t mean I’m necessarily buying stocks left for dead.

It’s instead looking for arbitrage opportunities..

Good, sound businesses with great cash flow and a bright future…

But they’re unpopular because they don’t fit in with the current “fad” in investing.

I’m also looking for them to pay a nice, fat, juicy dividend.

If I can buy an asset trading for less than it’s worth… and turn it around and make money… plus, collect dividends…

I’m as happy as a guy at the bar on payday.

Finding these perfect dividend stocks takes work.

The work starts before I buy anything.

I’m up late reading financial statements, studying SEC filings, on top of learning about the overall market.

I’m doing this literally every single day.

After taking my granddaughter to the zoo, I drop her back home and I’m off to read SEC filings on a Sunday afternoon.

Studying financials and SEC filings isn’t unique in itself…

It’s knowing how to dig up a value opportunity in the market.

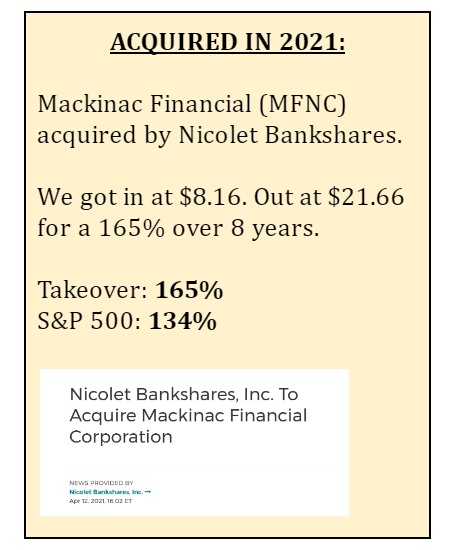

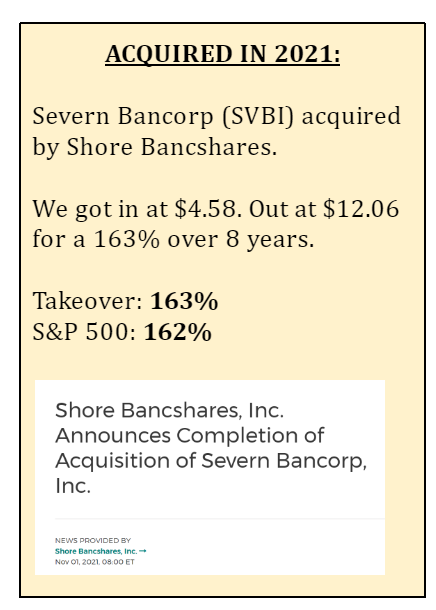

Here’s my tracked return over 8 years:

I recorded these winners on banks:

- A 165% winner on MFNC over 8 years

- A 100% winner on EVBN in 19 months

- A 150% winner on BOCH in 5 years

- A 163% winner on SVBI in 8 years

- A 192% winner on SLCT in 7 years

Those are just recent trades closed in 2021 and 2022.

Not all my trades were winners… but the last 10 trades closed were all 50%+ winners.

Even in this bear market!

I called the top in 2007

I called the bottom in 2009

I told you to buy more real estate in 2019

(before prices jumped 50% in 24 months)

![]()

I warned to get out of tech stocks in 2021

All of these calls would’ve saved you a ton selling at the top…

And then you would’ve bought at the bottom.

But I’m no ‘blind squirrel who finds a nut’ guy.

I called a short-term bottom on the

exact day in June 2022

On June 20, 2022… after the S&P had fallen 23.4% from November 2021 highs…

I called that we would have a “rip-your-face-off” rally.

Sure enough, the very next day, stocks gapped up and took off the next 30 days. The S&P 500 gained 17% in one month. Some stocks, like Apple, shot up 32%.

But, I didn’t stop there…

Called the market to drop in September 2022 (dropped 1,000 points one week later)

I told folks, “Things will get a lot worse” despite the bear market rally I just called.

That was early September.

Just a week later…

Called this big drop the week before

Worst day since 2020.

I’ve been helping thousands and thousands more since with my research including writing for Jim Cramer and James Altucher.

I’ve compiled strategies that would’ve made you millions in the past decades.

Today, I’m showing you my very best… most favorite strategy.

Because banks consolidating is only picking up steam.

You simply need to know which stocks to buy.

I told folks to buy small cap stocks

at the bottom in January 2023…

Small caps went on a record-breaking tear in 2023

I had stocks I recommended run up:

- 72% in 2023

- 53% in 2023

- 162% in 2023

- 82% in 2023

- 54% in 2023

And many others.

Those were buys RIGHT IN JANUARY 2023. I told people to invest with both hands and few actually listened.

This isn’t luck.

It’s following criteria for finding undervalued opportunities.

The criteria for which stocks are primed to be acquired is fairly simple.

You can follow it yourself.

All 5 of these stocks match my criteria…

And they’re set to be snatched up… in as little as a few months.

In many instances, it can take years for a company to be acquired.

Many can pay dividends while you wait. Not all, but a few.

Just know that ‘years’ is the timeline you should bank on.

However, each of these stocks is as intriguing as the next…

There’s two main criteria I’m looking at when I plan to acquire a stock:

Part One: They’re in a sector that’s consolidating

A consolidating sector is one that has takeovers.

Oil is consolidating…

Insurance is consolidating…

Companies with key services for a sector can easily be swallowed up by a competitor (just like Activision did with Microsoft).

I’ll show you with my picks where they might be consolidating.

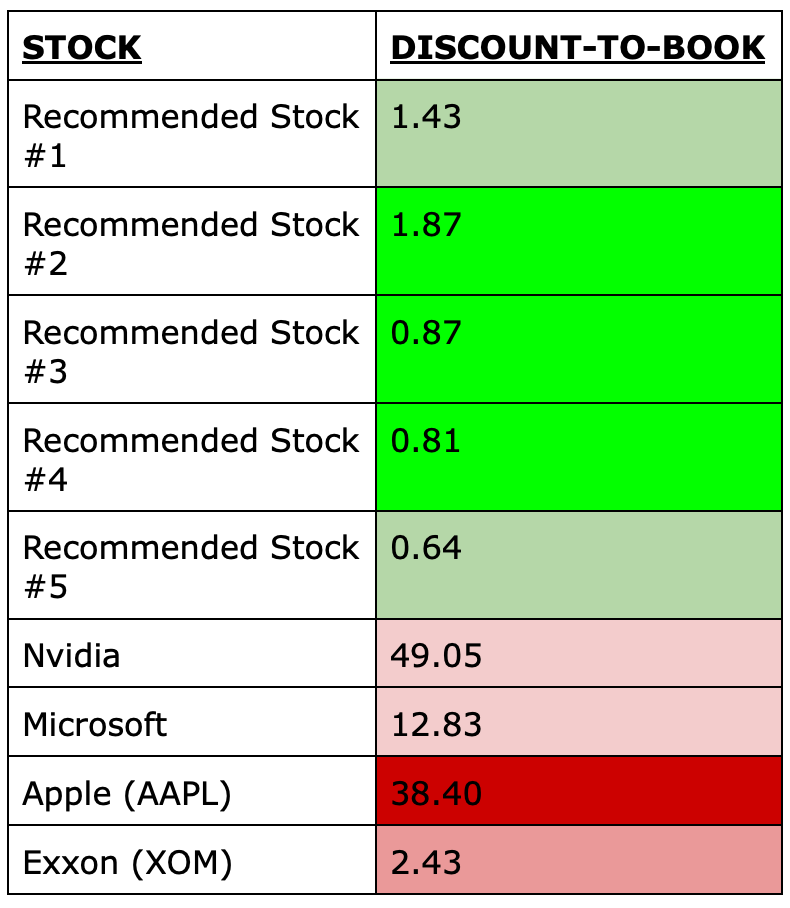

Part Two: Discount-to-book-value is below 2.0.

“Book value” is simply the value of all assets on the bank’s books.

So “Discount to book value” = if the price is less than 2.0, it means the stock trades for a valuation close to… or below 1 it’s LESS than the assets in the bank — which makes no sense!

But it happens, which is why buying companies trading near their asset value that fulfill this criteria is such a no-brainer.

It’d be like you buy this cute house in California that is worth $1,000,000.

But, you buy it for just $850,000.

What a deal!

Imagine buying this house for a 15-25% discount of what its appraised value is!

That’s what we’re doing with our banks

You’re getting $150,000 in “free” assets to what your valuation actually is.

Doesn’t happen much in real estate… but it happens in takeover target stocks ALL the time (as the stock market is more volatile than real estate and more driven by emotion).

If you can find a stock trading for LESS than the assets it holds… you’re making money.

Take a look at the stocks I’m recommending right now, and some big-name stocks:

Three of my takeover targets trade for LESS than what their assets are worth.

Meanwhile, top stocks like Apple go for a premium to book value.

Apple, for example, trades for 38X MORE than its assets! That’s tough to sustain.

That means that if you disbanded the company, you’d only get a small fraction of the price people paid for its stock back.

When you buy assets for cheap… when the company gets bought out… you’re selling at a premium.

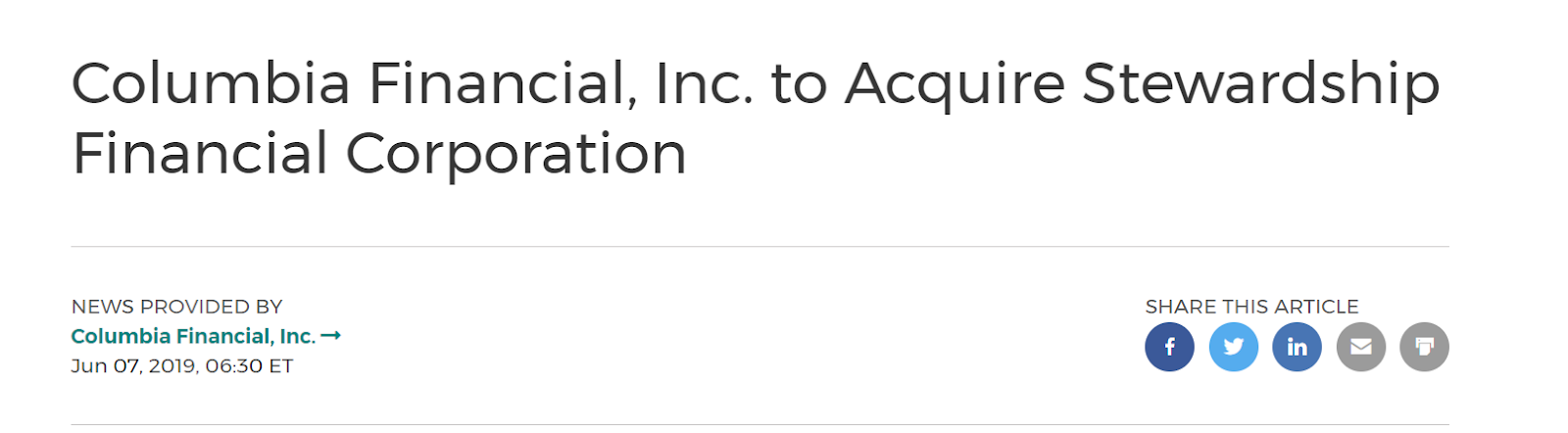

Check out this stock I recommended:

When you ONLY buy stocks trading at deep discounts-to-book-value… you buy the stock at all-time lows like we did here. (and cashed out at acquisition for 181%)

Stewardship Financial had about 12 locations sprawled across New Jersey.

I saw they were strong financially…

But trading at all-time low prices. Look at that chart again.

We bought in at a mere $5.47/share. Less than you’d pay for a #1 meal at McDonalds nowadays.

Within 3 years, acquisition suitors came knocking.

Get used to seeing these headlines

We sold at $15.37… a nice 181% winner.

A $10,000 investment would’ve netted $18,100 in profits.

The S&P 500 only returned around 40% in that same timeframe. Meaning, you would’ve beat the market by 4X!

That’s the power of buying for value.

And you’ll find many small takeover targets trading at big discounts to their book value.

That doesn’t mean they are ‘bad’ businesses.

It means they haven’t attracted the right capital…they have no marketing team… and they’re small potatoes (sometimes).

I also have a stellar track record for recommending companies RIGHT BEFORE they take off…

Take a look:

I’ve shared with you my entire track record…

And what I didn’t mention before…

Take a look at the buy zones of each of these examples I shared…

I recommended these takeover targets RIGHT BEFORE they took off.

They took off and never looked back.

When you buy at massive discount-to-book values… you’re buying incredible assets at a larger-than-life discount.

That is only a positive.

So when I tell you to buy these 5 companies I’m about to reveal…

All 5 could skyrocket in the next few weeks or months.

One already launched 16% in one month since recommendation…

Buy 1 share of each of these 5 companies and you’ll spend less than $76

There are only one buyer type for a bank… other bigger banks or credit unions.

With companies, you have two types of buyers:

- Bigger competitors

- Private equity (they take a public company private with private investor cash)

We’ve seen PE activity slower since 2022… but it’s picking up again.

This first takeover acquisition company is in the mortgage insurance space.

Insurance is as boring as it comes… but M&A activity is picking up quickly.

In fact, as other industries pulled back on M&A, insurance stayed strong.

As home prices continue to skyrocket, you end up paying more for title insurance. It’s an annoying, tiny line item on your closing statement… but it adds up to thousands in mostly unused policies. Think legally printing money. That’s mortgage insurance.

My takeover target in the space has grown 25% year-over-year since 2018.

Return on equity hovers around 19%… competitors? 15%. So the relative strength for my target is much better. Having the lowest expense ratio in the industry will do that.

As home prices stay high, private mortgage insurance is necessary for all mortgages with less than 20% down. The higher home prices are, the MORE folks need mortgage insurance.

I expect mass consolidation with all the free cash flow floating around.

With a P/E ratio lower than 8… while some competitors are as high as 90+… there’s massive un-tapped value there. A price-to-book is around 1.43 which is higher than I like, but they’re hitting record profits and revenue.

They also trade at a low multiple of earnings and cash flow.

You can buy shares for less than $35 as of this writing.

The second takeover target is in the oil space:

Oil isn’t going anywhere. Until 2050, oil is set to stay as the main energy source.

It IS being replaced by renewables. But it’s not happening tomorrow.

The smaller oil and gas and companies will get gobbled up by the big players like Exxon, etc.

As the industry slowly shrinks over the next 30-50 years, size and scale becomes increasingly important.

This is a consolidation breeding ground.

They do fracking and guiding wires to transmit information in the oilfields. They’re a service business.

The company does nearly $500M in revenue. Huge increases in revenue in 2023 despite oil prices dropping.

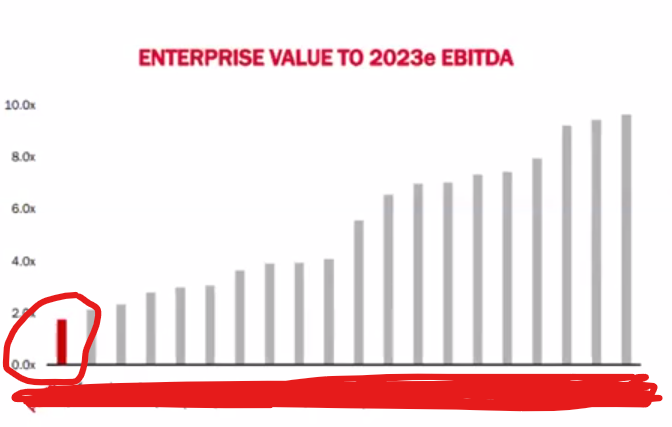

You’re looking at an oil company that is the LEAST expensive on a valuation basis compared to the rest of their peers.

What’s shocking is this business has completed two acquisitions of its own in the last 18 months.

I believe this will set them up to look like the belle at the ball.

Other businesses can then crack open their wallets and pay more as the valuation is already low. I’d expect a bidding frenzy when the time comes.

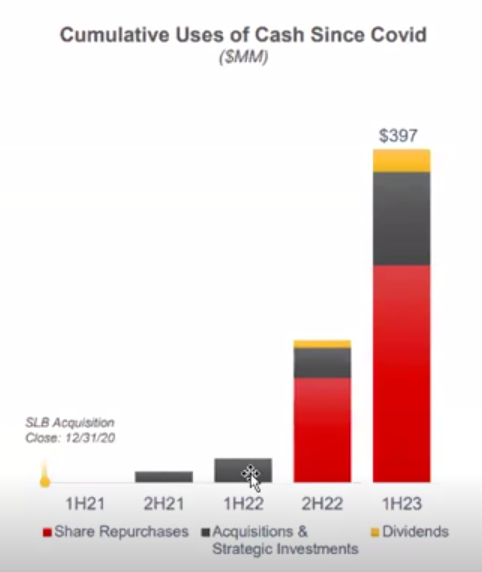

Board is buying back stock… $100M in first half of 2024… and more coming (I suspect). That $100M will remove 13% of outstanding shares.

Shares trade for LESS than 3x the operating cash flows produced by the business.

So, you’re receiving shares for the price of the assets… and getting the business for free! A strong-cash flowing business… yours for no premium.

You can buy shares for less than $11 as of this writing. (They also pay a dividend!)

The third takeover target is also in oil:

Another oil & gas play I see ready for takeover is in the same geographical area of Texas as the play I just showed you.

Exxon, Occidental and Chevron have all done deals in the area recently.

Shareholders are loving them as the board’s returned $260M in share buybacks thus retiring 9% of outstanding shares.

Even better, for those loving income, this oil & gas player reinstituted their dividend… they’ve hiked it 40% from the prior payouts.

Like my other oil takeover target, this company isn’t pulling oil out of the ground. Rather, they manufacture equipment for fracking, transporting… hands in all aspects of the fracking business. A true picks and shovels play.

Employee turnover is lowest in the industry… so they treat their employees very well. Long-term talent is huge for growing a business.

The company trades at less than 5x the cash it produces.

It’s Price-to-earnings is near the lowest vs. competitors. It’s P/E is under 7 while competitors like Valaris trade for 78!

With a price-to-book value of just 0.87… they’re trading for LESS than the assets on their books. A massive value play.

You can buy shares for less than $25 as of this writing.

The fourth takeover target is in the industrial space:

This next company in the industrial space has the lowest P/E ratio to its competitors.

The business trades for less than the business could be liquidated for! Meaning, the business is essentially ‘free’ when you buy shares.

Recently, they’ve paid down vast amounts of liabilities making it leaner and worth more.

Believe it or not, the company’s been around since 1880. It’s long overdue for a larger fish to eat them up.

You likely have some of this companies’ product in your home without knowing as they deal in the tool & accessory space.

The company has excellent credit… in terrific financial shape…

Yet, shares trades for less than 5X free cashflow.

With mountains of debt gone, this company is an easy target for takeover.

At a price-to-book of 0.81… you’re again buying assets at lower than cost. Meanwhile, they just hit record revenue and profit.

You can buy shares for under $16 as of this writing.

The fifth takeover target is in the outdoor space:

The last takeover target is a tiny $120M market cap outdoor company.

Shockingly, an inventory heavy business like this has zero debt on the books. Being lean, the board’s set a goal to double sales over the next 4-5 years.

On a price-to-book value ratio, this company is a top 5 deep value opportunity.

As of this writing, they trade for around 80% of their book value assets. They also trade for less than 60% of their revenue count and just 6X free cashflow.

The free liquidity has allowed themselves to buy back $10M of shares. This is a $120M market cap company… $10M is nearly 10% of their shares now in the hands of the company.

I believe this stock is worth twice the current valuation.

The price-book value is a mere 0.64… that’s a steep, steep discount. Sales have slowed down (as all consumer brands have seen).

A bit vulnerable makes it a high value acquisitions for another large conglomerate to tuck them in under their company.

We’re fine with that.

You can buy shares for under $12 as of this writing.

Get access to my 5 takeover targets in my brand-new product, Takeover Letter.

Our goal with this service is straightforward —> Buy stock in businesses with the potential to be acquired for 100%+ gains.

I’ve shown you my track record.

65 closed recommendations over 10 years.

64 were profitable.

32% went for 100%+ gains.

Even if we don’t hit 100% gains…

A 98.5% win rate is close to perfect. Meaning, at that pace, all 5 of the stocks I’ll reveal to you today could be profitable.

Not a guarantee… but my track record is one of the strongest in the takeover industry.

No hedge fund can match this 98.5% win rate.

Now, you get a front seat with the first-ever Takeover Letter subscription.

After a slower last few years in M&A… the tide is shifting again. You’re buying takeover targets at their bottom.

You will get access to the very best ones every single month inside the Takeover Letter.

This is the #1 letter on the market focusing ONLY on takeover targets.

There aren’t more out there as the majority of financial professionals can’t pick a takeover…

Much less pick a winning stock of any kind.

You can choose to do the research across the thousands of financial stocks out there.

You’ll be:

- Reading the SEC filings

- Reading the financial reports, search for deep discount buys, understand the cashflow of each company, plus which sectors they specialize in

Chatting with the executives at some of these businesses (many of these small companies have execs you can call directly)

Monitoring your positions monthly to make sure no material changes have taken place

It’s a ton of work.

If you hired a professional to do it, you’d be paying them $200/hour… for 40-80 hours per month.

That’d be $192,000/year.

Which is just about what a stock analyst on Wall Street would make.

Well, obviously, you won’t be paying a drop of that even over a lifetime of the service.

I’ll share with you the discounted price in a moment.

Understand that:

These acquisition plays could take years before they’re bought out

You’re buying stocks you won’t hear about anywhere else (and that’s a promise)

The upside to these stocks can double and triple your money. But you MUST buy before the news breaks. That’s the secret.

Fortunately, if you follow what I share today, you’ll be on your way:

Buy stocks in businesses residing in consolidating sectors

Buy stocks with discount-to-book-values less than 2 (one of my recs is 0.61). This guarantees you’re paying close to or even less than the value of the assets the company holds. Like selling your house for 85 cents on the dollar.

When we stick to these strict rules, it’s possible to see huge winners.

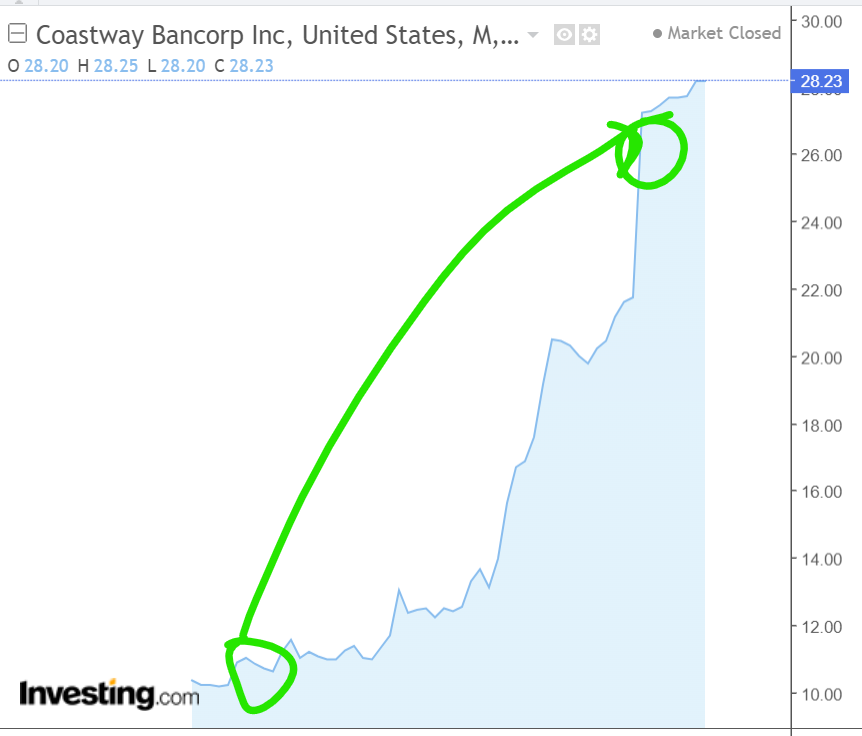

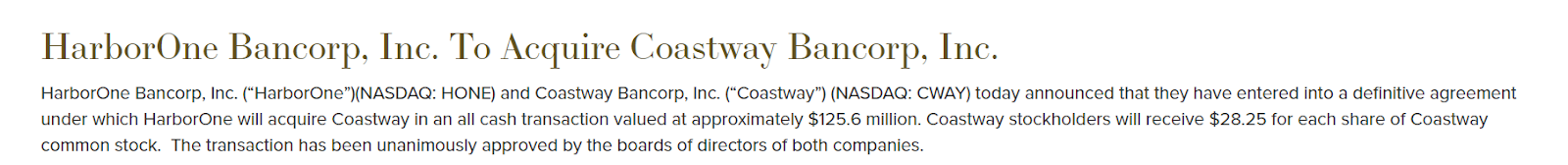

Like Coastway Bancorp:

You never knew small banks could go parabolic like this!

(A 152% winner for us)

I saw at the IPO, it was still vastly undervalued. And I was right.

Recommended buying at IPO around $10.80. Four years later, the stock had never looked back.

Coastway didn’t stay public for too long.

HarborOne saw what I did (that it was a strong bank going for a discount)… and bought it at a 152% premium to what I did!

Imagine these types of acquisitions now happening to YOU!

It’s possible when you buy my recommendations now.

You’ll get access to the first 5 stocks that could be acquired soon right now.

Join the Takeover Letter now and you’ll open your first issue in minutes.

But that’s not all.

Every week, I’ll release a weekly update on our stocks, plus answer your investing questions in the Takeover Mailbag series

I’ve done this with my other services and subscribers love them.

Essentially, you can email me any question you have. Ask about investing, bank stocks, oil stocks, my thoughts on the global economy, nothing is off limits.

I love doing these.

I shoot the videos right in my home in Florida. (Hawaiian shirt and all!).

These videos can go for 20 minutes depending on if I go on a rant!

If you send me a question, I can almost guarantee I’ll answer it on a weekly mailbag.

Here’s everything you get TODAY with Takeover Letter:

5 acquisition targets: My top 5 plays to buy right now. Buy 1 share of each and it’ll cost less than $76. Once news is announced, these babies will rocket higher and you’ll be too late. Average winner is 83% up to 194% profits!

Monthly issue to your inbox: Every 1st of the month, I’ll send you a brand-new issue of the Letter with updates on positions, news alerts, personal updates, any changes to our portfolio and more.

Instant Takeover alerts: If a new buy recommendation comes in before a newsletter is released, I’ll send you an email. If we are ready to cash out for up to 194% gains, I’ll send you another alert.

Monthly Live Webinar:

Each month, we’ll get together to review our acquisition targets, talk through the current markets, and discuss what’s impacting our positions.

Weekly Takeover Mailbag video series: Every week, I shoot a video answering every question you have about bank stocks, the economy, updates on our positions and more.

24/7 portal access: Everything is housed in a secure online portal at Investors Alley (a 22-year mainstay publisher in this industry). We’ve been around longer than Motley Fool.

60-day money back policy: If after 60 days, this isn’t right for you, get a full refund, no questions asked.

What would you pay for takeover targets when I have a 98.5% win rate

and 32% of the picks end up over 100%?

Average pick has a 83% profit.

That beats most hedge funds who barely beat the market.

Not to mention, you’re diversified in sectors that are still consolidating and necessary for day-to-day life. Everyone needs money to borrow!

If you have $50,000 allocated across all positions…

An 83% average profit means you’re generating $41,500 in profit!

Over the past decade, if you had invested $5,000 into every single pick…

You’d walk away with $270,593 in profits alone!

What is something like that worth?

For $270k in profits, you’d happily pay $10-$15k I’m sure. I would!

A bank analyst doing all the work I’m doing would charge you $192k/year I’d estimate?

For the Takeover Letter… the #1 takeover letter on the market with a 98.5% success rate…

I’d normally charge $4,997.

That’s a steal with how much in profits you could make.

But I’m not charging $4,997…

Not $3,997…

Not $2,997…

Not even $1,997!

Because this is the early launch of Bank Takeover Letter, I’m cutting the price all the way down to $595.

A mere $1.63 per day. Less than coffee today.

Click the button below and you’ll be taken to a secure page to join for a mere $1.63/day right now.

And I don’t want you to stay on the fence.

That’s why:

I told my publisher I wouldn’t launch this service without my 60-day money back policy

I only want people who WANT to be in this service.

However, I still want you to feel protected when purchasing. After all, very few people out there are talking about these 5 small stocks you’ll see.

You deserve to join a service and test it out for the first 60 days.

That’s why, for the next 60 days, if at any time you feel Takeover Letter is not for you, I’ll give you a full refund. No questions asked.

You’re covered 100% by me to absolutely love this service.

It’s a lot of fun investing in potential acquisitions…

And then to see the press release come through saying “GNBC bank being acquired.”

Imagine when this similar headline hits your inbox for your next bank stock

There’s nothing like the excitement of seeing your stock getting bought out!

(this one landed us a 194% return in 2 years)

It’s quite a thrill.

And 5 takeover targets is just the beginning…

We have 29 takeover targets ALREADY in the Takeover Letter portfolio

Meaning, there are dozens of more plays to buy now too

Even though this is a buy-and-hold service…

That doesn’t mean there isn’t any ‘fun.’

Not only are you getting alerts when to sell for big profits…

I’m adding more takeover targets every single month.

You’re starting with 5 right now…

There’s 29 total in the model portfolio right now.

In the past, I’ve had up to 40 small companies in the portfolio at one time.

So, these first 5 picks aren’t the end.

It’s just the beginning.

By next month, you’ll have more.

Tim – this service is incredible because you really know what you are doing! Truly very impressive! I only wish I would have devoted a larger portion of my portfolio to it earlier.

– Richmond B.

Melvin’s results speak for themselves. He is shooting the lights out in a completely underfollowed sector. I wouldn’t trust anyone else.

– Tobias C.

Tim Melvin has a no nonsense approach to investing. He has decades of experience. He has perspective, wisdom, and a sublime sense of humor. If you wish to trade your own account and pick your own stocks, Tim’s advice is first rate.

– Steve L.

As others are bought out, more will take their place…

Dozens of triple-digit winners in your future

with takeovers

I’m closing out a takeover trade, on average, 5X per year.

If over the next 37 years, there are 5 takeover closeouts… and 32% of them go for 100%+ gains…

If over the next 37 years, there are 5 takeover closeouts… and 32% of them go for 100%+ gains…

You’re looking at potentially 59 triple-digit winning opportunities in the years and decades to come.

That alone could be enough to retire on and pass on wealth to your children and grandchildren.

But you must join the Takeover Letter right now.

And seats will fill up.

Joining now makes sure you get in before a takeover announcement happens.

Once an announcement of a takeover happens…

It’s too late.

There could be news tomorrow. I don’t know.

I’m telling you about 5 that are still “buy now” opportunities. I even gave you the ‘buy up to’ price.

They are still stocks to buy or else you wouldn’t be reading this.

However, you must join Takeover Letter to get my acquisition targets.

Click the button below and join on the next page.

I’ll see you inside,

Tim Melvin

Editor of Takeover Letter

FAQ:

How much do I need to invest today?

To buy the stocks? As little as $76 to get one share of each of these 5 stocks.

To invest in the Takeover Letter? $595..

And that number is going up very soon. You’re receiving an early sneak peek at a discounted price.

I expect this service to go for $1,997 or even $2,997 in years to come.

Is there a refund policy for Takeover Letter if I find it’s not for me?

Of course. You get 60-days risk free to try it out. If after that, you don’t think it’s for you, get a full refund of every penny.

What’s the goal of the Takeover Letter?

To buy stocks that are takeover targets. The timeframe could be 12 months or a few years. There’s no telling as the banking industry moves slowly.

I have made 65 closed recommendations over the past decade… 64 were profitable.

32% went for 100%+ gains. Meaning, every three picks doubled your money.

That’s our goal.

Why join Takeover Letter today?

You’ll get my 5 top stocks about to be acquired. These 5 picks are already on the move. One was up 16% in the first month. I just closed out a takeover for a 70% winner.

As the markets loosen up, M&A will explode again. You’re buying at the bottom.

Join me inside the Takeover Letter now!

FAQ:

How much do I need to invest today?

To buy the stocks? As little as $76 to get one share of each of these 5 stocks.

To invest in the Takeover Letter? $595.

And that number is going up very soon. You’re receiving an early sneak peek at a discounted price.

I expect this service to go for $1,997 or even $2,997 in years to come.

Is there a refund policy for Takeover Letter if I find it’s not for me?

Of course. You get 60-days risk free to try it out. If after that, you don’t think it’s for you, get a full refund of every penny.

What’s the goal of the Takeover Letter?

To buy stocks that are takeover targets. The timeframe could be 12 months or a few years. There’s no telling as the banking industry moves slowly.

I have made 65 closed recommendations over the past decade… 64 were profitable.

32% went for 100%+ gains. Meaning, every three picks doubled your money.

That’s our goal.

Why join Takeover Letter today?

You’ll get my 5 top stocks about to be acquired. These 5 picks are already on the move. One was up 16% in the first month. I just closed out a takeover for a 70% winner.

As the markets loosen up, M&A will explode again. You’re buying at the bottom.

Join me inside the Takeover Letter now!