Scared of more stocks to crash?

“Relax”

– says America’s #1

dividend retirement expert

I’ll reveal 3 sectors delivering a ton of dividends

so you can buy more shares at a

huge discount and pay the bills

This is the toughest market environment since 2008.

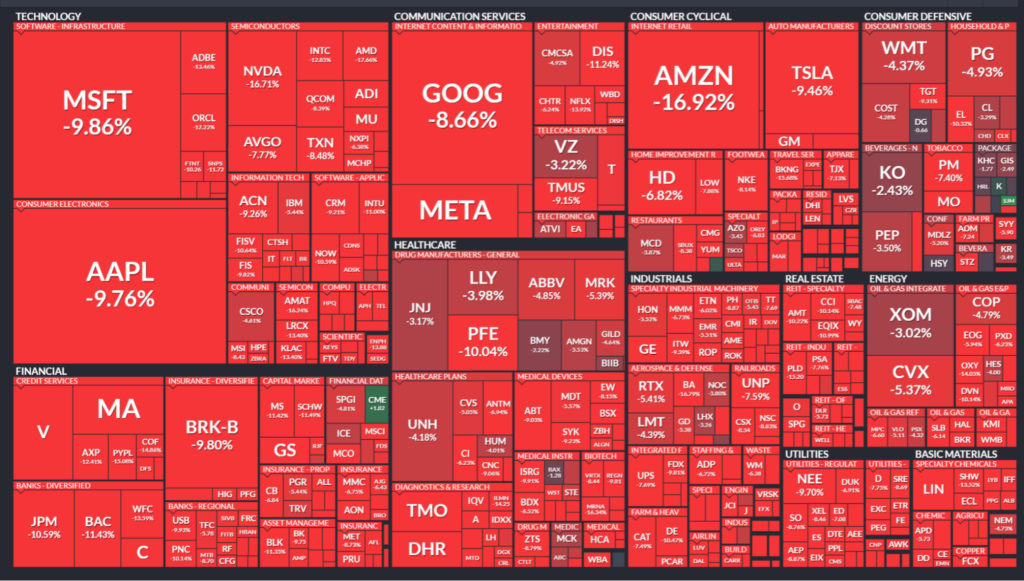

It seems there’s nowhere to hide when everyday stocks look like this:

Retirees… especially those who retired in the last 2 years… are seeing their 401ks and IRAs decimated.

I receive emails everyday from my over 200,000 daily readers, “Tim, where is it safe to put my money?”

And here’s what I write back to them.

I’ve been in the markets for over 30 years… I remember the stagflation of the early 80s… the tech bubble of the 2000s well, and saw many friends and family hurt from the 2008 crash.

If there’s one thing I know for sure, it’s that “taking drastic action” during a market crash is the WORST thing you can do.

Instead, I recommend taking advantage.

In fact, by the end of this post, I’ll show you 3 sectors that could not only shield you from heavy losses…

But they could also be the future leaders in the next 5-10 years.

If you plan to retire or have been retired, this is the most important post you’ll read today.

Because my only goal for my readers is helping them generate income in retirement.

I’m not a ‘hot stock’ guy or a ‘cryptocurrency’ expert. I know nothing about those.

My publisher, Investors Alley, is the #1 news site for retirement income.

And if the last few months have you shaking… wondering if you’re going to ever be able to retire…

I’m here to say “You can relax.”

If you’re interested in more income in retirement…

You might be looking at one of the best opportunities in the last 22 years to collect what should be yours.

And I’m not talking about investing all your IRA into some boring 2% dividend yield stocks…

What if you could start collecting monthly checks that grow and grow every single month. And it can begin today.

Hi, my name is Tim Plaehn.

Hi, my name is Tim Plaehn.Over 300,000 daily read my dividend content with one question on their mind:

“Tim, how the heck do I replace my income when I reach retirement?”

And for the past 8 years, I’ve shared opportunity after opportunity that could’ve paid the bills each month for anyone who followed me.

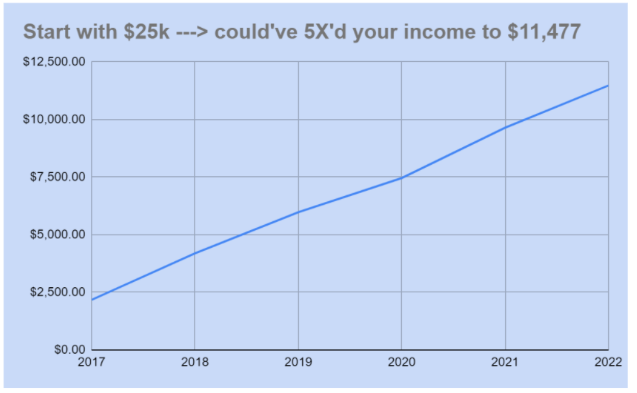

One dividend opportunity could’ve hypothetically turned a $25,000 portfolio into a $11,477 income stream…

Just had to follow my income plan I’ll share today.

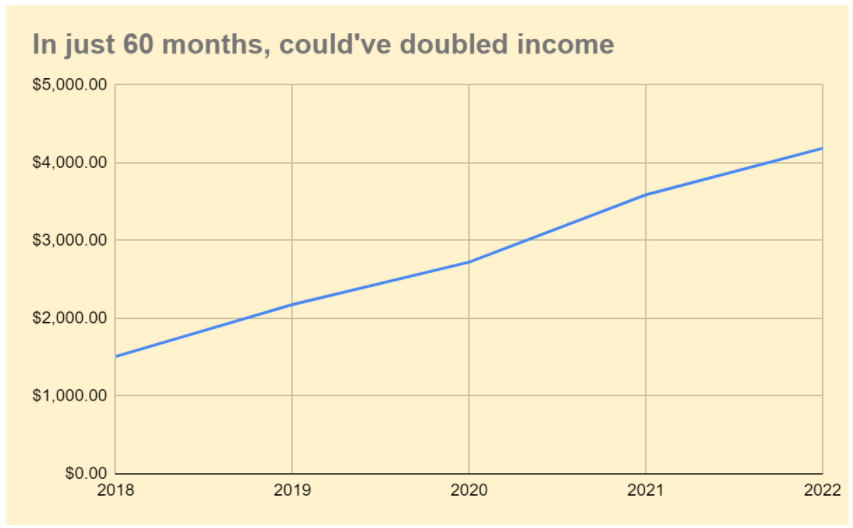

Another could’ve doubled your income in just 60 months following my income plan…

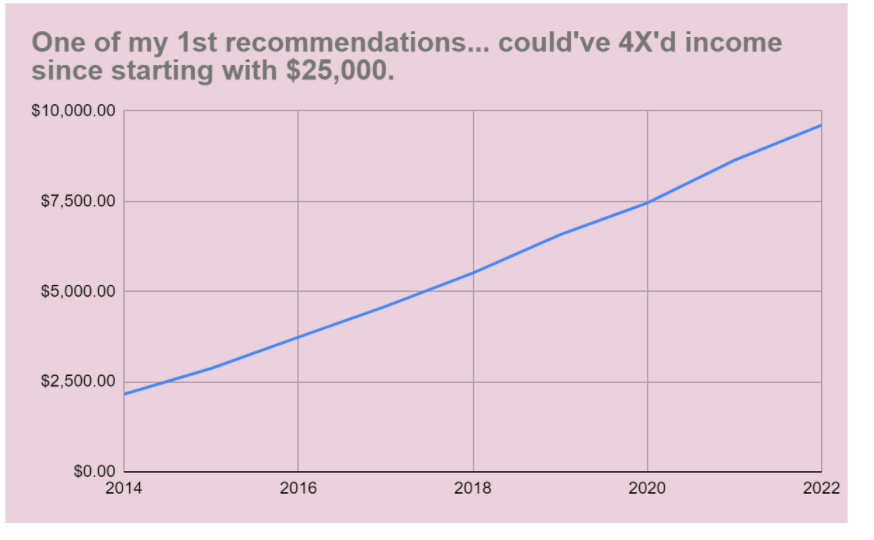

A 3rd could’ve 4X’d your income if you had bought when I recommended.

Income could’ve potentially jumped from $2,153 to $9,610.

These numbers look pretty good. Of course, nothing is guaranteed going forward.

But these numbers are nothing compared to what I believe we could see in the next 2-3 years.

While others battle the ups and downs of share prices…

You could be collecting dividend income like this every month starting today.

No trading. No options. Buy and hold.

Most who invest and advise around stocks travel in suits, fancy cars, jets…

They may be on CNBC or Fox Business talking about the next hot stock or about tech stocks like Peloton, and Zoom, and other tech plays down 50-75%.

Me?

I don’t care about that stuff.

I honestly don’t look at share prices of anything very much.

I’m an income guy.

Monthly income — cash in the bank — hitting the account every single month is where I reside.

Cash I use to:

- Reinvest to earn even more income… or,

- Pay for groceries,

- Cover medical bills,

- Repair the suspension on my Tacoma,

- Pick up heartworm medicine for my dog.

…While the rest of the market panics as tech stocks crater…

I’m out camping in the Nevada mountains in my RV.

See — I’ve been in the markets for 30+ years.

I’m also 65 years old, so I’ve seen everything. Crashes and booms from the 80s, 90s and beyond.

And what I know is one simple truth.

History always repeats itself.

…Whether it’s banks failing during the savings and loan scandal of the 80s happening again 20 years later in 2008…

… Gold spiking during the Carter administration, then jumping again over 20 years later…

And today…

22 years later… history repeating again.

If there’s two times I would’ve picked for buying dividend stocks…

- It’s 2001… as the tech bubble burst

- And right now, 22 years later, as tech stocks again have again cratered.

Because when stocks crashed in 2001…

Money quickly moved into 3 sectors.

3 sectors which produce a lot of income…

And as tech stocks have sold off again… money is flowing right back into these 3 sectors.

3 sectors that pay huge monthly checks.

If you’re retired or close to retirement, you’ll realize soon enough, cash is king in retirement.

The stocks I invest in for monthly income are not well-known. They’re boring.

I’m not trading them… not touching any options, and aren’t talked about on the news.

Companies I buy stock in aren’t trying to go to Mars, if you catch my drift.

They just pay real good income.

And money is flowing into them at a pace I haven’t seen in 22 years… making this an amazing time FOR YOU to start collecting monthly income.ly good cash.

I’m going to reveal 3 sectors where money if flying into at a record pace.

Cash is moving OUT of tech and into these 3 sectors.

It’s how I like it.

Look, I’m 65 years old.

The days of me betting it all on the “next Google or Amazon” are long gone.

People like you and me don’t have the time to wait around for massive capital gains.

We need cash to live now.

Cash to cover our bills every single month.

I’ve been doing this for 30 years. But if you’re new to generating income from your stock portfolio, this is a very important message to read.

Because,

I believe we’re looking at the greatest opportunity in 22 years to generate monthly income from the stock market.

And I want to show you.

I’ve lived through crashes in the 70s, 80s, 90s, 2000s, and beyond.

Right now, tech and growth stocks are melting at a rate I’ve not seen in 22 years since 2000.

Hundreds of billions of dollars pulling out of big-name stocks like Roku and Uber every day…

And funneling into 3 specific sectors.

3 sectors I’ve been talking about for years.

3 sectors that 21,000 of my closest readers could have generated (what I’d estimate) millions of dollars in income from.

3 sectors that already pay incredible monthly income… and should only start paying more.

IT’S ALREADY STARTING…

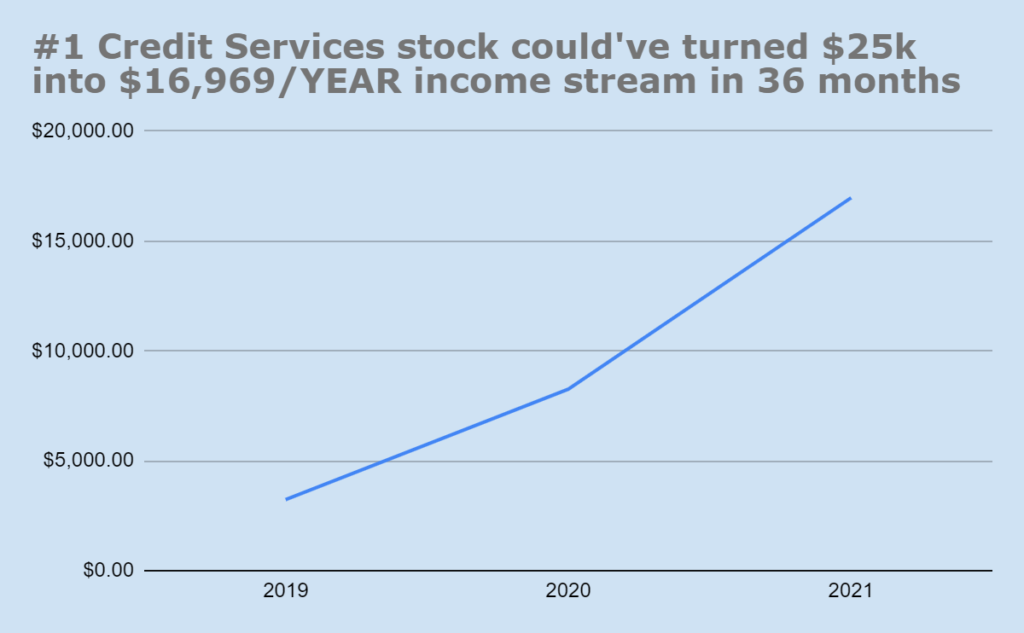

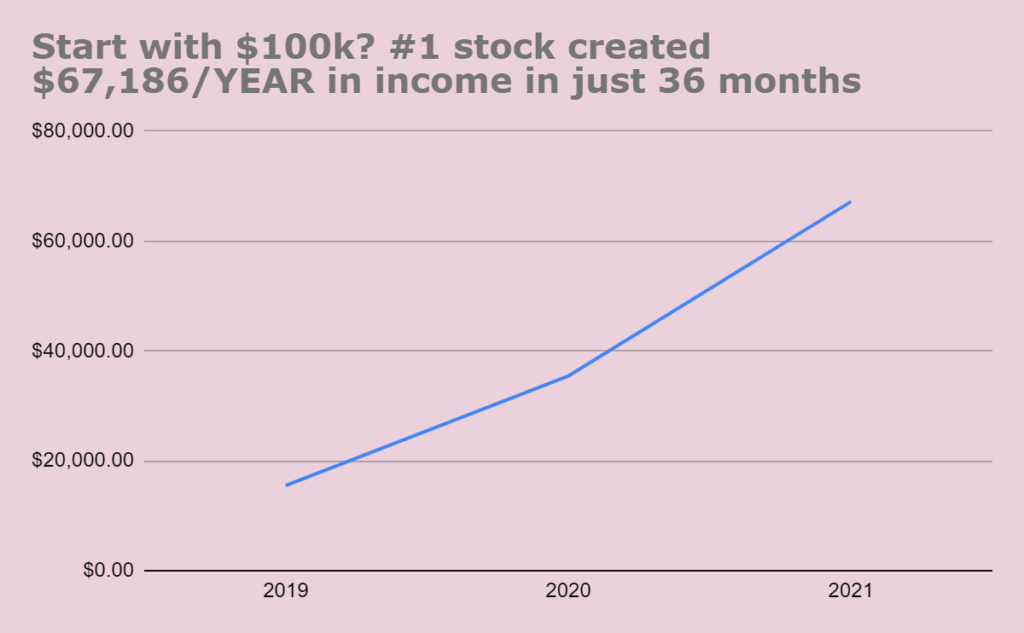

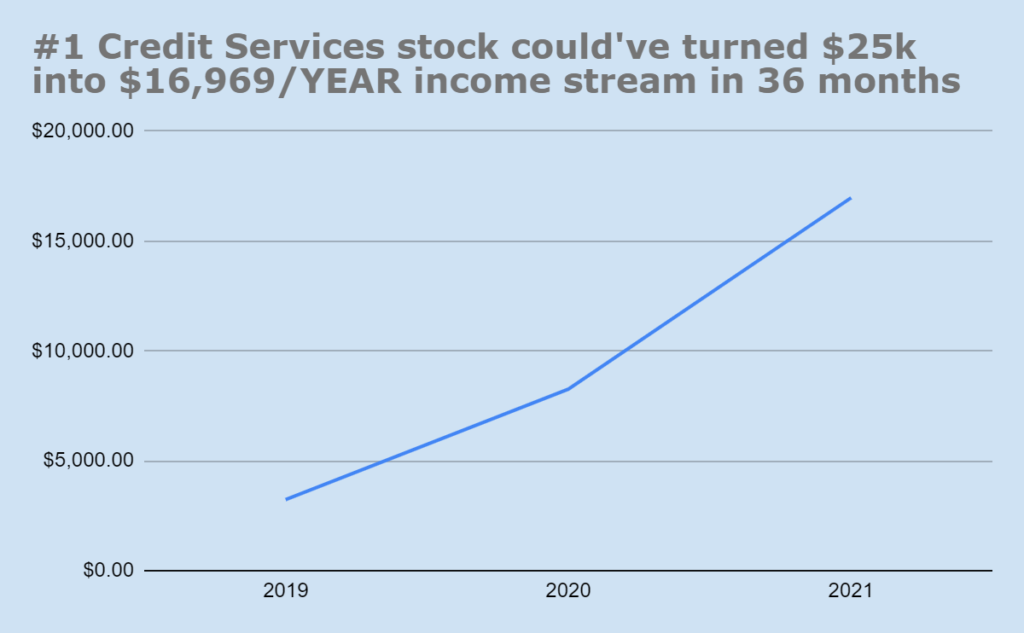

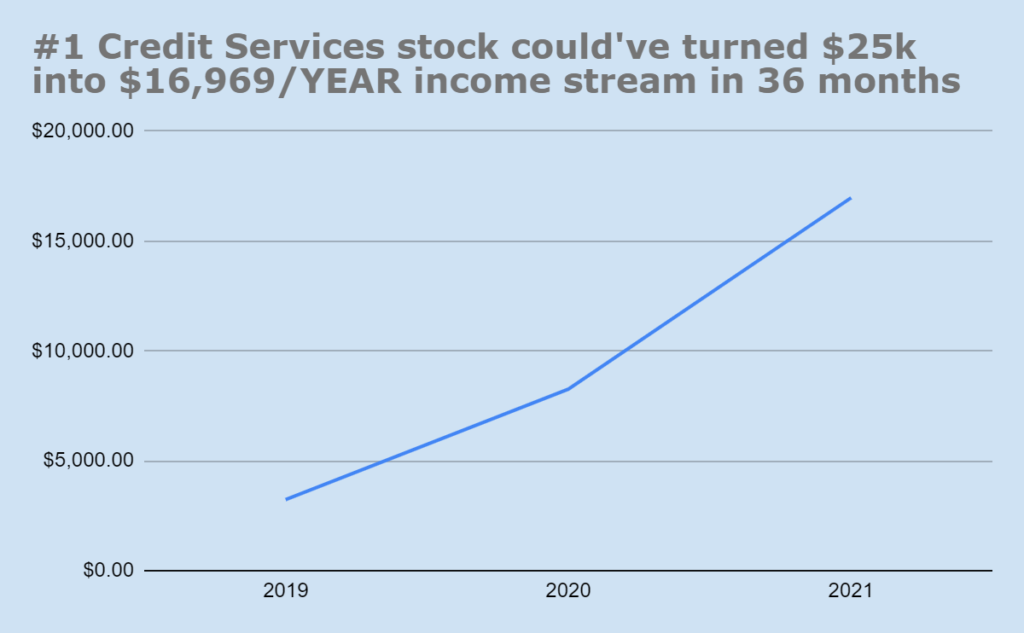

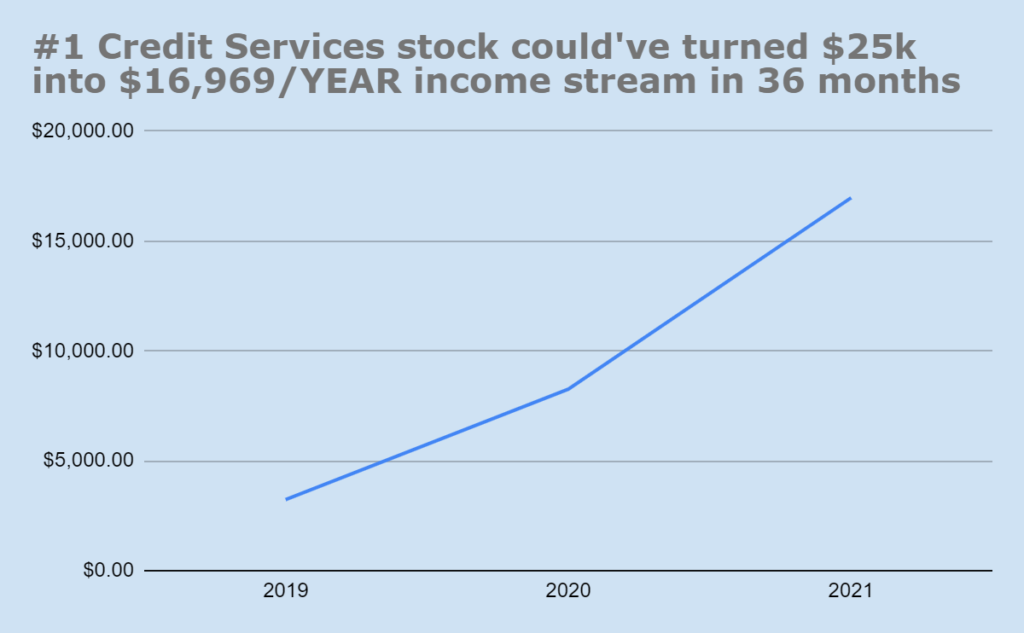

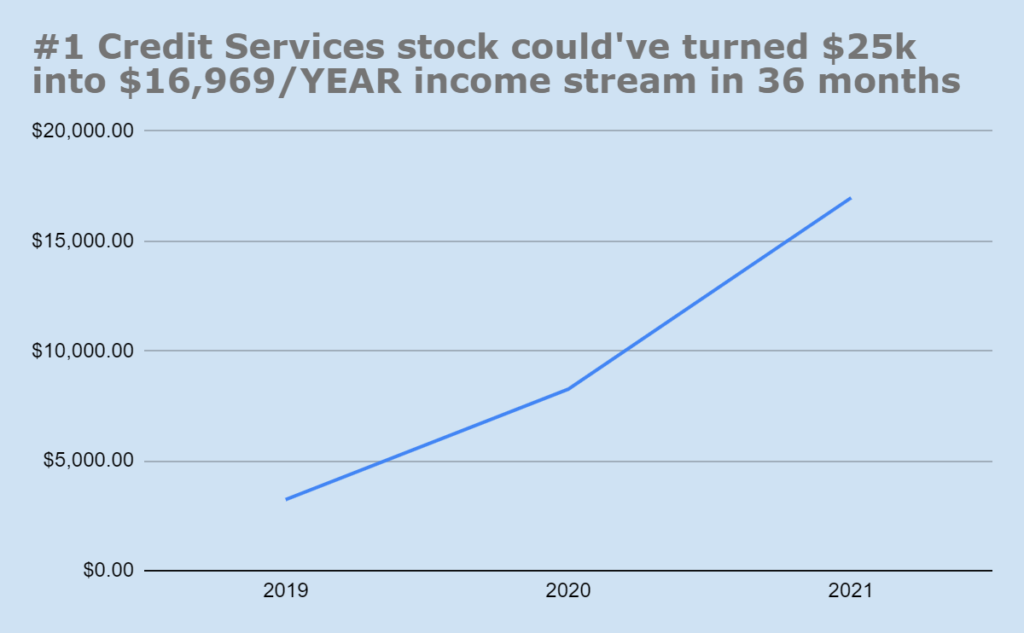

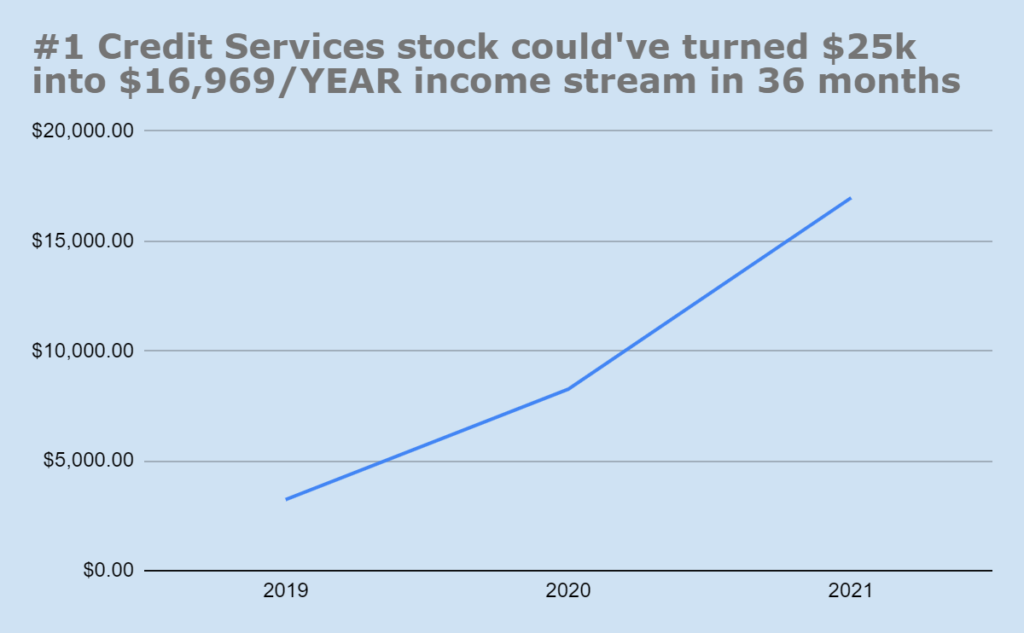

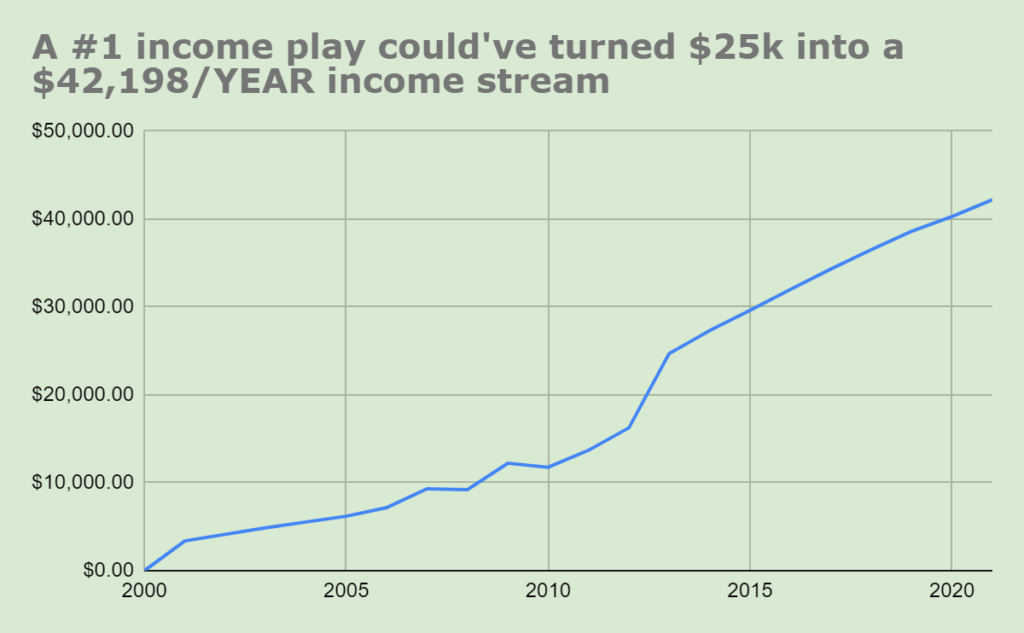

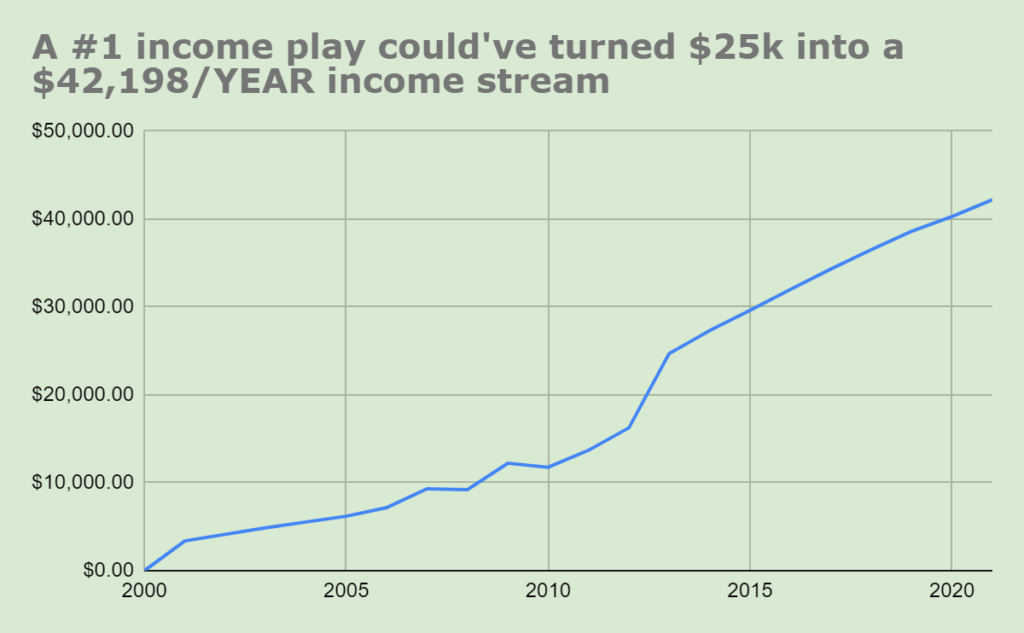

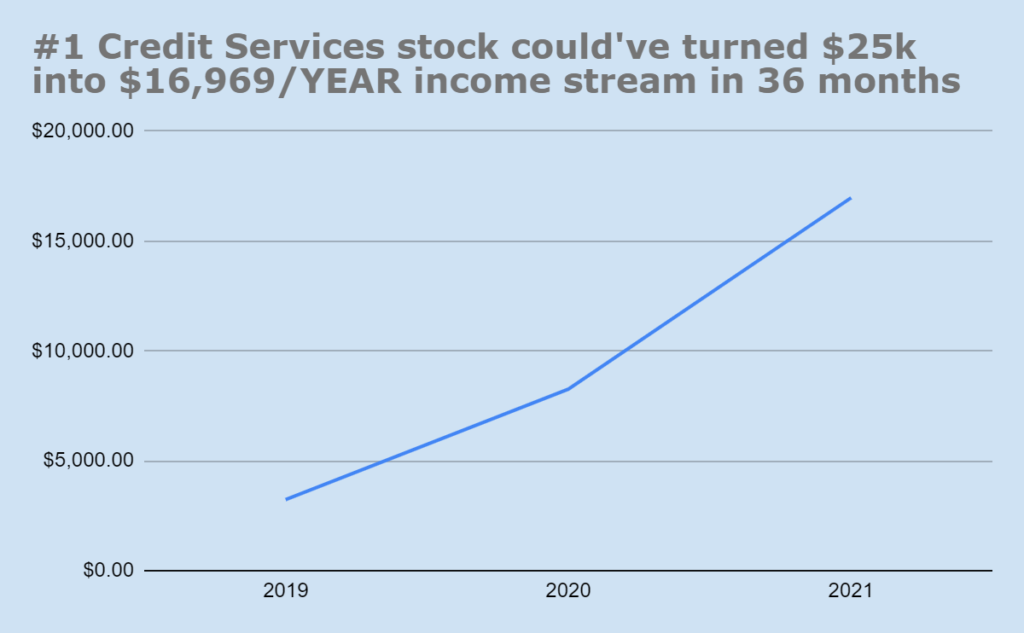

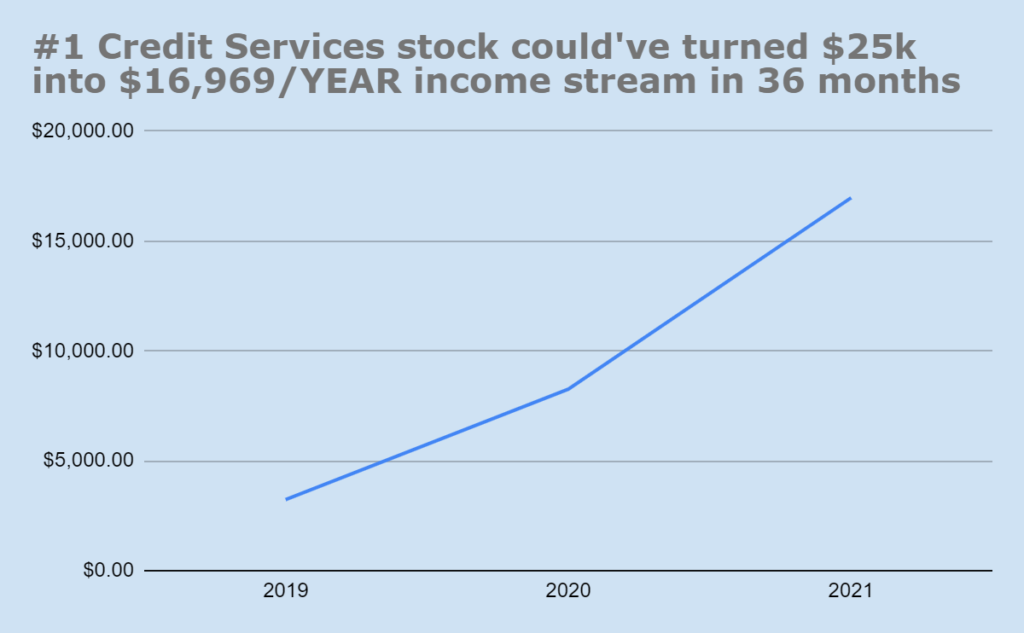

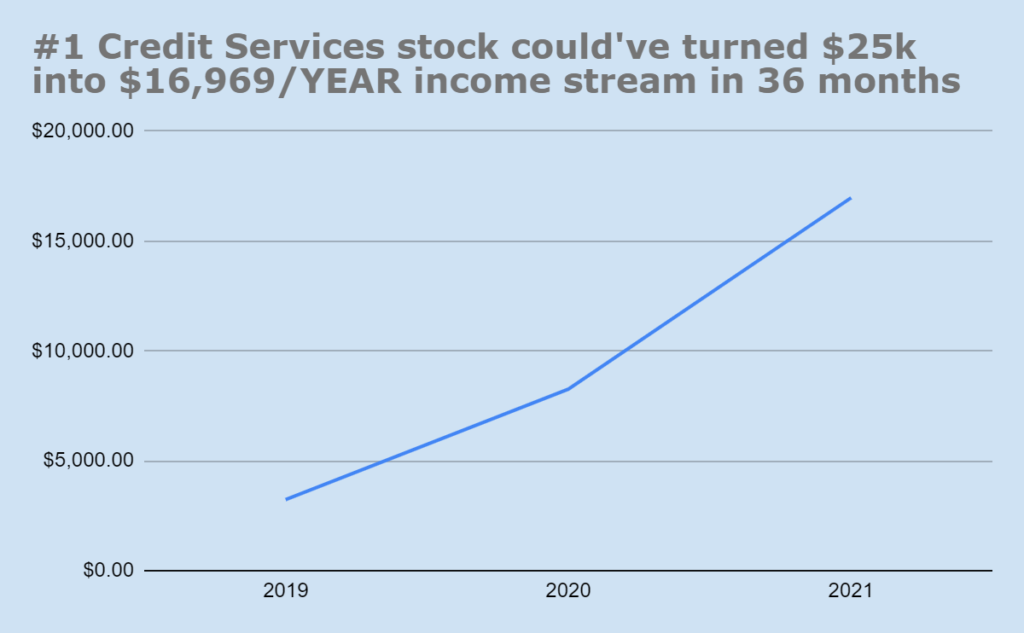

One of my stocks in the last 3 years would’ve turned $25k into a $1,414/month income stream, according to backtesting.

This stock is in one of these 3 sectors.

If you had $100,000 in a retirement account as many of my readers do, after just a few years, backtesting shows you could have already been pulling out $5,656 per month.

These results are not guaranteed but based on projections on our track record

Think about that.

Combine $5,656 with a Social Security check of $1,341 (the average)… we’re talking almost $7,000/month in income alone.

That’s $84,000/year.

Income to live on.

Cover groceries, medical bills, donating to charities… heck, donating to the grandkids as it’s going there anyway, am I right!

I’m not promising you’ll be rich, become a millionaire, or even generate a 1,000% gain on a stock.

The folks chasing these tech names can’t spend their paper money anymore, it’s gone now.

These tech/growth stocks have done complete U-Turns.

They’ve given up ALL their 2020 big gains.

Well-known names like Peloton, Roku, Pinterest, Zoom are on this list.

The party is over for these stocks… maybe for a decade or longer.

But income stocks continue to pay.

I wouldn’t be surprised if retirees who left the workforce in 2020 and 2021 while these stocks were flying high… well, they may be back at the office very soon.

I hope I’m wrong and they can stay retired. And I’m not trying to be negative or forecast what’s to come. There’s no crystal ball hiding in my RV.

But for me, I’m unscathed from these growth stock drops.

Because I’m investing in more boring… less volatile value areas.

Except…

It’s NOT boring to me.

Anytime I can generate monthly income that covers my bills… my groceries, my prescriptions… the gas to fill up my Tacoma, a night out, or more gold and bullets…

I’m free.

Monthly income frees me to explore the world. Travel to different states and meet some of my readers.

If you ever bump into me at a conference, I’ll happily buy you a whiskey and chat about stocks.

That’s what I love doing.

I love what I do.

When you retire, what do you want to do?

Volunteer? Live comfortably.

When you have monthly cash flowing in, you’ll go to bed peacefully and wake up the same way.

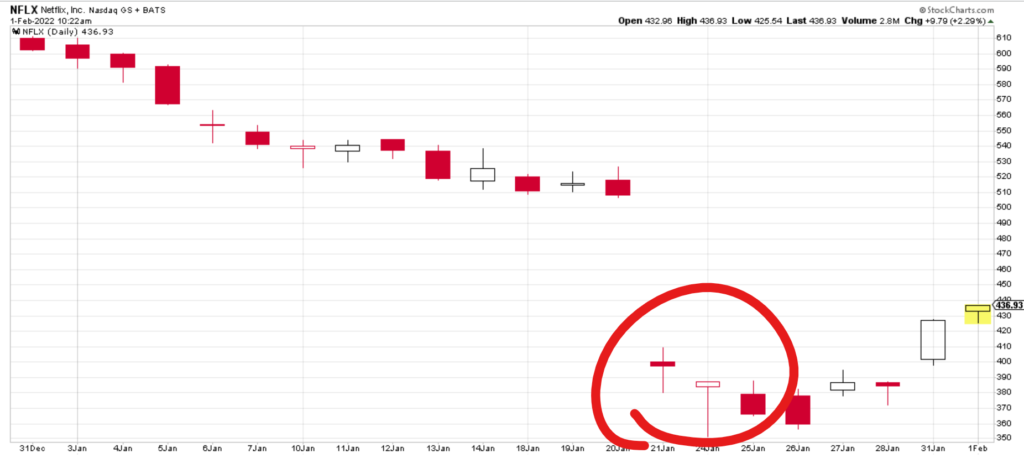

Imagine being at the mercy of this wreckage.

What if you woke up tomorrow and your Netflix stock had just cratered 25% overnight?

That’s what happened to it on January 21, 2022.

Imagine waking up to a -25% drop in your portfolio like Netflix did…

Relying on share prices can be dangerous.

Investors went to bed after Netflix earnings. They wake up, they now own 75% of what they owned 24 hours earlier.

I can’t live like that.

I’d rather wake up and do

what I want to do.

The 300,000 who read my ideas

daily feel the same way.

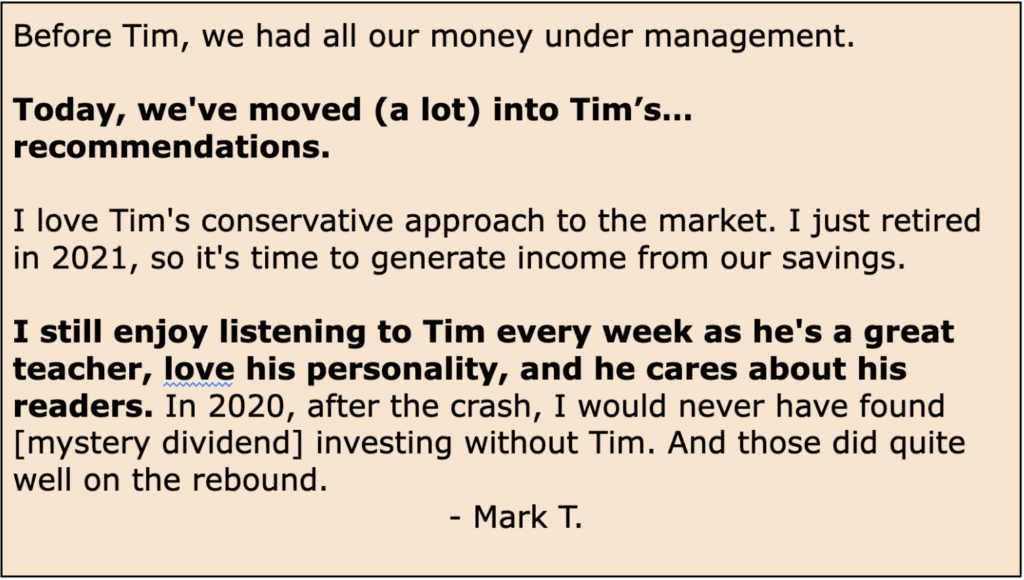

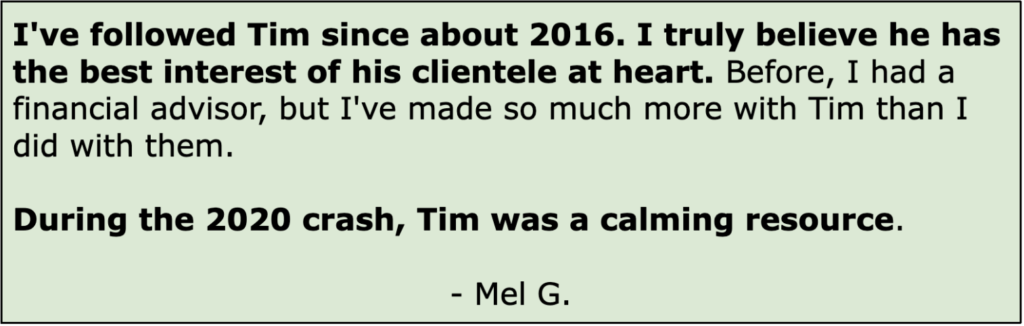

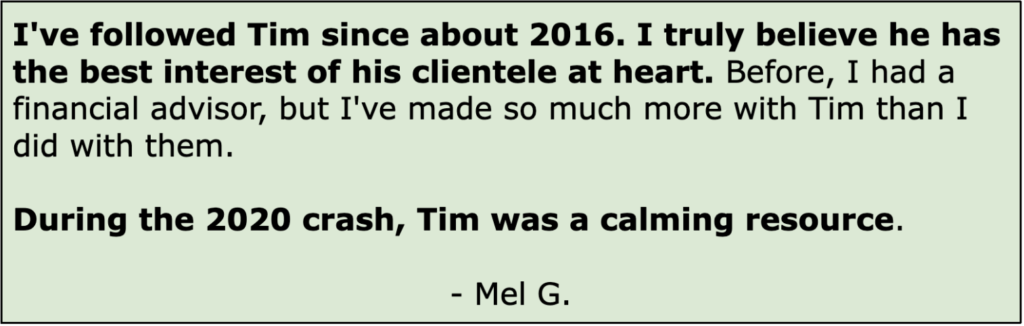

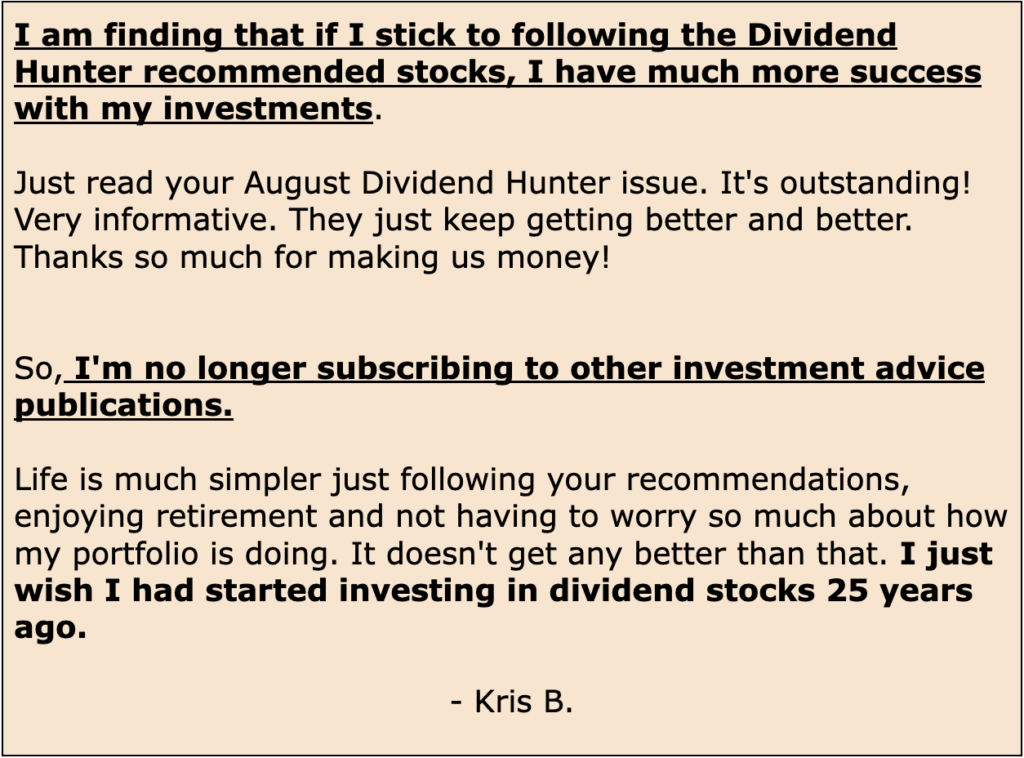

I have dozens of testimonials just like this.

People who realized the ‘old’ way didn’t make sense anymore.

And I’ll tell you about that.

But first, it’s important you fully grasp what’s going on and why this is the best opportunity in 22 years to collect monthly income.

#1. I already shared what’s going on.

Tech stocks are rolling over.

Billions of dollars are being moved all at once.

When Facebook dropped 26% on February 3rd… that’s a $232 billion dollar wipeout!

Money is moving into 3 distinct sectors.

- One sector is something you use daily to survive (you may not even think about it)

- Another is running to near record prices with no end in sight

- A third is a sector I’ll draw income from forever

I’ll share with you the 3 sectors in just a minute… Plus, what you need to do to start collecting monthly income tomorrow.

You only need one special type of stock which I’ll also share for free in a moment.

Here’s how I know what’s going on…

First, I’ve lived through this scenario before, several times since the 70’s to now.

And, second,

The last time we saw tech crash this hard, in 2000…

money flew into these same 3 sectors at breakneck speeds.

These 3 sectors are safe, predictable, and pay some friggin’ good income.

I’ve been in these 3 sectors for years… I beat everyone to the punch.

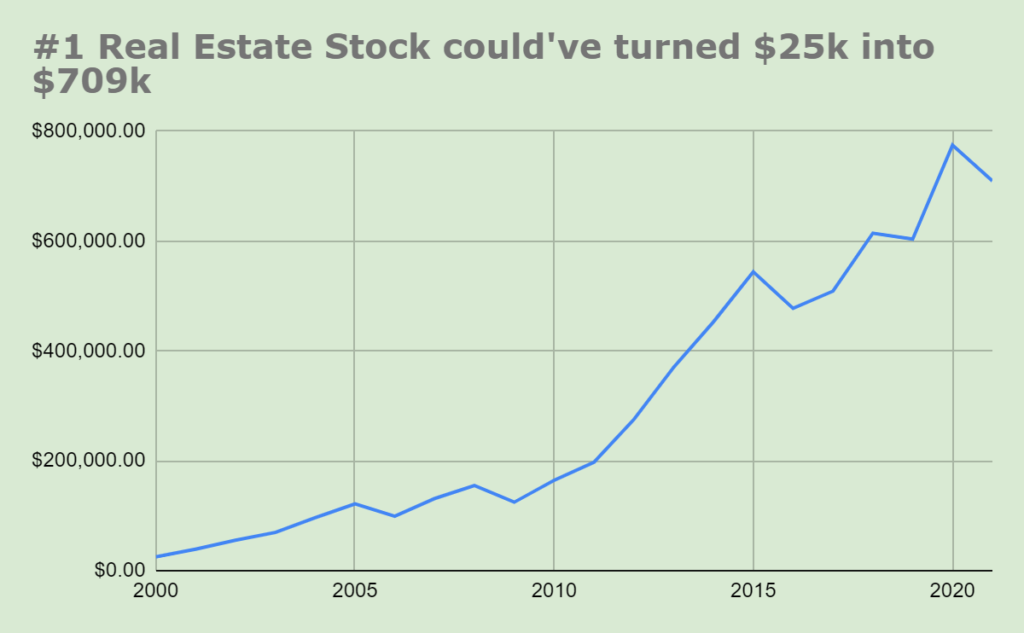

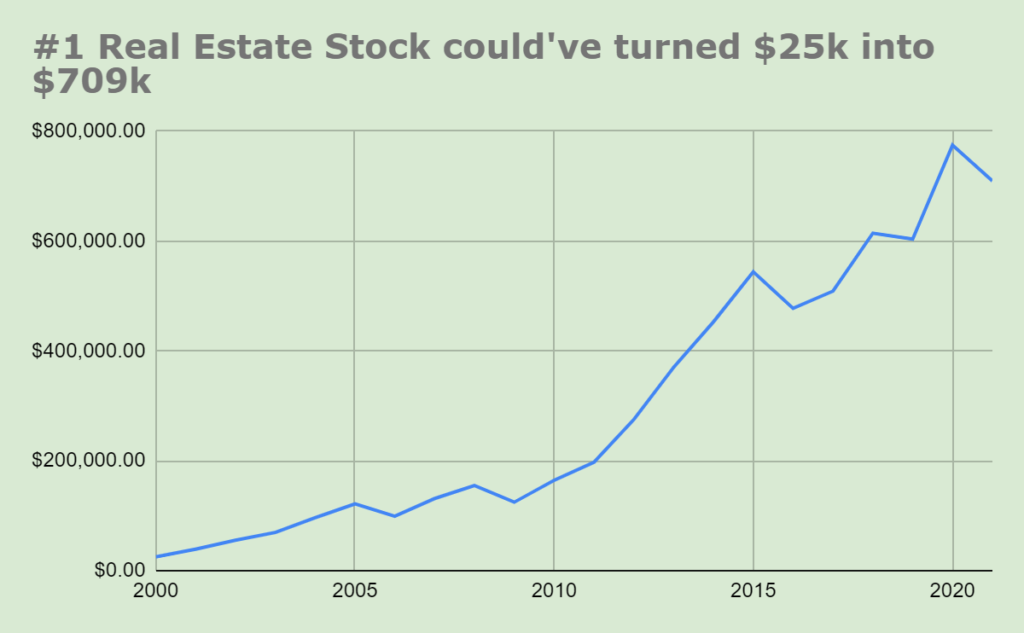

One of my favorite stocks… if you had invested when tech first crashed in 2000…

Backtesting shows you could’ve turned a $25,000 portfolio into over $709,497 following my income plan.

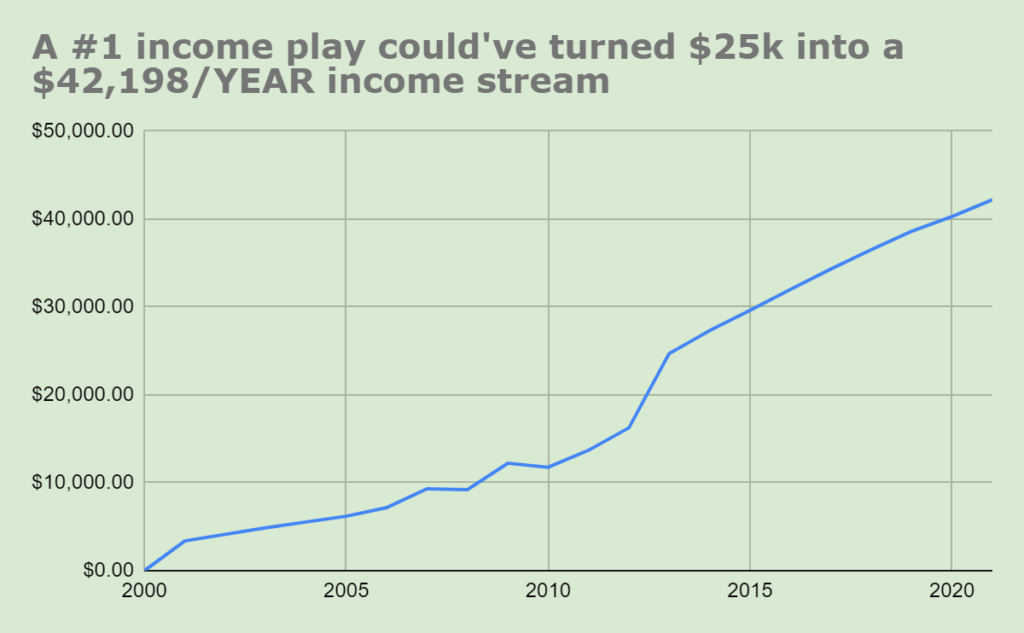

You’d also have a shot at $3,516 per month in monthly income to boot, according to the same backtesting.

That’s $42,198 per year… $421,980 over 10 years!

That’s cash you collect without selling a single share. That’s the power of investing for income vs. trying to ‘time’ the market for capital gains.

(this isn’t a guarantee of future performance… simply projections based on our track record).

No longer will you be at the mercy of the markets.

You can retire knowing your bills will be covered…

You can finish your career whenever you need to.

As one subscriber says, Alan O. has the “option to quit my job” at any time. That’s a pretty neat statement.

No doubt, I hope you’ll feel the same once the first monthly checks hit your bank account.

So, money’s going into tech. I’ve seen this before, and you’ll discover how it’s happening again.

#2 reason for this move out of growth — The Federal Reserve plans to raise interest rates ASAP.

They said they would raise them in March 2022.

And they plan to do more.

Of course, we’ve heard this charade before and they may pull back.

However, when rates rise, there’s a re-valuation of companies, especially tech/growth stocks.

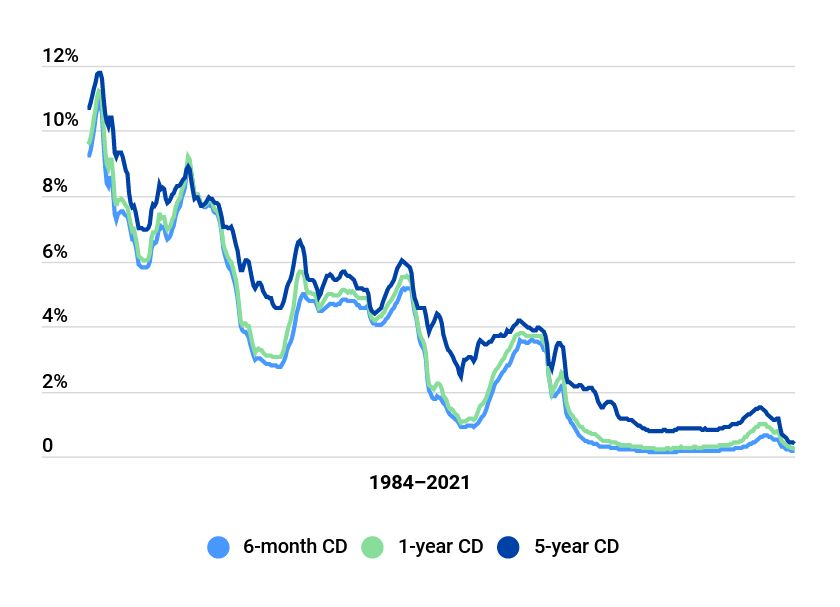

For the past 15 years, keeping money in bonds and savings accounts made no sense.

Remember in the 80’s, you and me could get 5% in our savings account at the old bank? Check out this chart quoting CD payouts from Bankrate.

Income from a savings account has been dead for decades. You must find income elsewhere.

Today, banks offer 0.05%. Bonds are 1%.

The only place to see any return in the public markets was (and still is) stocks. That’s fueled a massive bubble forming in many assets.

Now, I’m not here to warn you of some economic disaster.

Also not here to claim “Google is dead” or some nonsense you might hear on TV.

All I can relay to you is what I see.

With rates rising, yields will be more attractive for folks to move out of stocks and into conservative bonds and the like.

That doesn’t bode well for stocks that pay zero income.

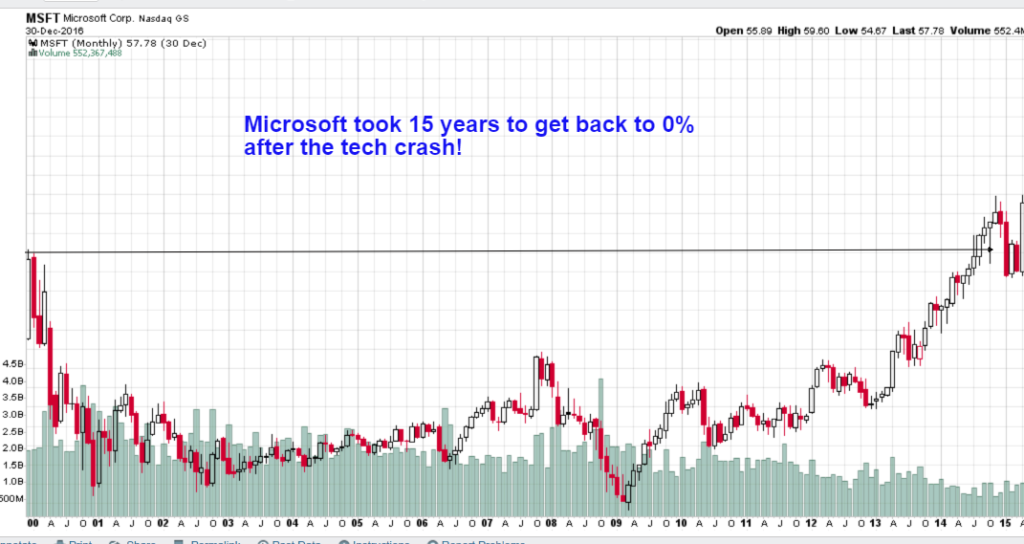

The last time we saw stocks bubble like this during the tech crash…

Many beloved names — some you may own yourself — took a long time to recover.

Microsoft exploded in 2000… then crashed.

It took 15 years to get back to 0%.

Amazon is a cult favorite now.

Crashed in 2000… took 9 years to recover… before crashing again during the Great Recession.

AMD Semiconductors…

This stock took a whopping 19 years to get back to 0% if you had bought at the top of the 2000 tech bubble.

19 years isn’t time you or I have.

If you think stocks will simply bounce back again…

I already shared the Fed is raising rates.

But also check out this new study:

Bank of America just released a prediction claiming it’s not impossible to see 0% stock returns in the next 10 years.

(study released Oct 2021)

Bank of America has a direct interest in stocks going up. Them releasing this type of info can’t be good.

It’s also funny…

When I found this research, I didn’t know there’d be a recommended strategy to fight it.

And actually, the strategy they recommend is what I’ll show you today!

It’s a strategy centered around generating monthly income from little-known stocks.

This monthly income will come from 3 distinct sectors.

They aren’t growth sectors… more “value” sectors. Sectors that we need daily as Americans.

You’re about to gain access, I’ll share:

- 3 stocks to BUY NOW to collect the most monthly income

- 3 sectors seeing huge buying opportunities

- Access to my income plan (that thousands follow), my monthly payout calendar, and 2 bonus reports

Plus, I’m about to share why all retirees should STOP focusing on share prices… and how if you don’t, you could go broke in as little as 3 years.

First, let me give you a proper introduction like I’m supposed to.

I’ll put on a coat for it, too.

Again, my name is Tim Plaehn.

My only focus over the last 30 years has been around income and income alone.

After I left the Air Force as a captain, I was a stockbroker and a licensed financial advisor helping families prepare for their retirement.

I honestly struggled to make a living for myself and for my clients.

None of the complicated “formulas” or “trading methods” seemed to benefit us… only those who taught and sold the funds behind them made any real dough.

So I left and struck out on my own.

I discovered it’s easy to sit on the side of the table and ‘advise’ folks on what to do with their money.

But, it’s an entirely different ball game to be out in the world, scraping by making a living, trying to save for retirement.

The climax for me was when I moved to Uruguay to start up a small business and eventually retire.

It was a hard life.

If I took my foot off the gas working for a second… money stopped coming in.

Much like a job… if I wasn’t working… I wasn’t earning.

This is a fact hitting many retirees on Day 1 of retirement.

Working = income = the treadmill of only earning active income.

One night a rich friend shared the ultimate secret of “Cash is King.”

The way to generate cash for life was build up enough to buy assets that pay YOU cash without you working.

That’s when the light bulb moment about the power of dividends hit me – years later than I wish.

That’s why my main focus for decades has been generating income from a special kind of dividend stock.

Now, you obviously have heard of dividend stocks.

They’re stocks that pay a yield for simply owning shares.

Many stocks, however, only pay a small dividend.

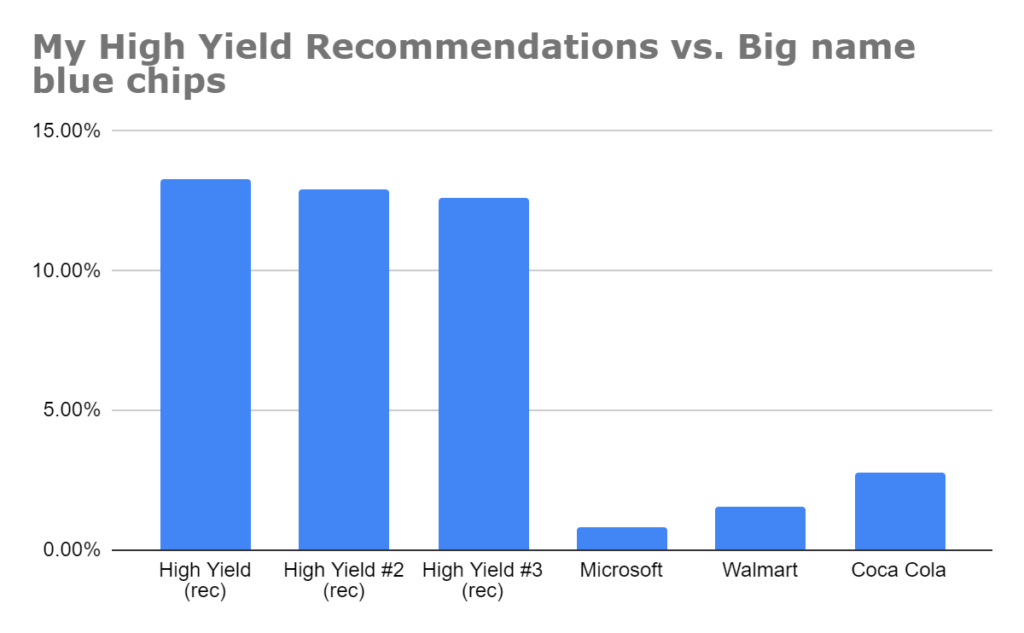

Microsoft, for example, has a dividend of 0.84%. You need $130,000 to generate a simple $1,092 in yearly income.

You can’t live off of $91/month. Or, at least you shouldn’t have to.

You could be seeing 11X more income in your account starting today

Only after months of searching, did I stumble on a special type of dividend stocks.

High-yield dividend stocks.

These are dividend stocks that pay very high yields.

One of my stocks in 2021 had a yield top out at 35%!

“What’s the catch?”

The catch is you must study relentlessly the companies who pay these high-yields and determine they can continue to pay these dividends for months and years to come.

That research is my specialty.

When I’m out lying under the stars in my Tacoma truck bed, it’s not uncommon that I have my phone out, scrolling through the latest dividend news.

I’m reading 10-Ks, listening to earnings calls, even chatting with executives at these high-yield companies.

It’s virtual boots on the ground.

This type of research allows me to move quickly when problems occur with our companies.

Let me give you an example:

My model portfolio launched in 2014…

I’ve been investing in multiple high yield sectors (including the 3 where tech money is flowing into) well before everyone else talked about them.

Suddenly…

In 2020 Covid hit.

Markets crash in March.

Investors are panicking.

I’m holding free emergency briefings with my subscribers sharing different scenarios.

And I made a bold, bold call.

I moved all our stocks into a specialized, mystery ‘dividend’ class.

(I’ll share about this mystery dividend class of stocks in a free report I’ll give you at the end.)

If you had these stocks in your own portfolio, you would’ve been saved.

Every stock was smacked in March 2020.

My high-yield picks were no different. It hurt.

However, I started advising people move their dry powder into this private dividend class and the results in 2020 were incredible.

The boldest call of my career in 2020 saved portfolios… the hypothetical returns were huge.

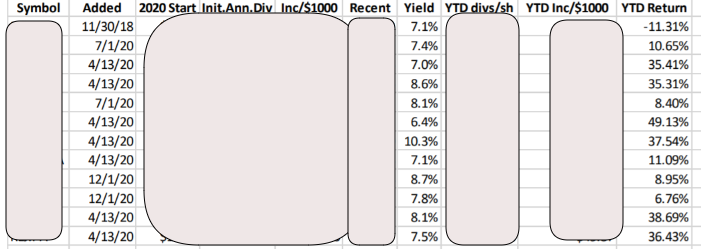

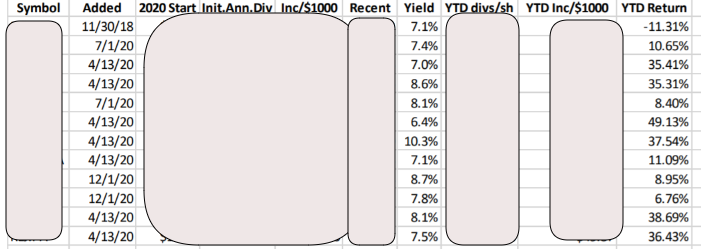

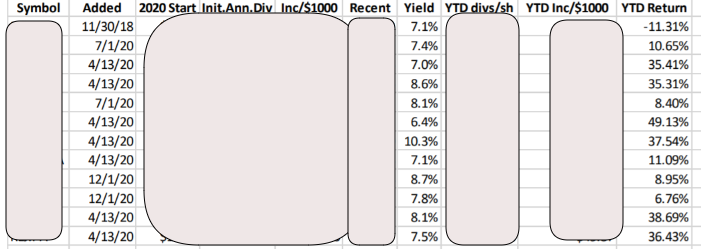

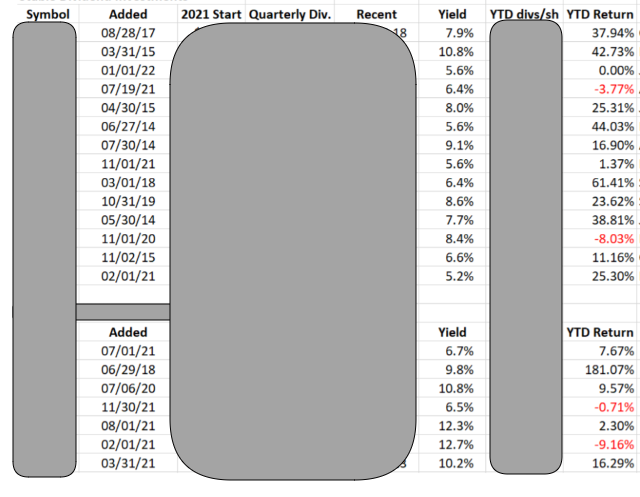

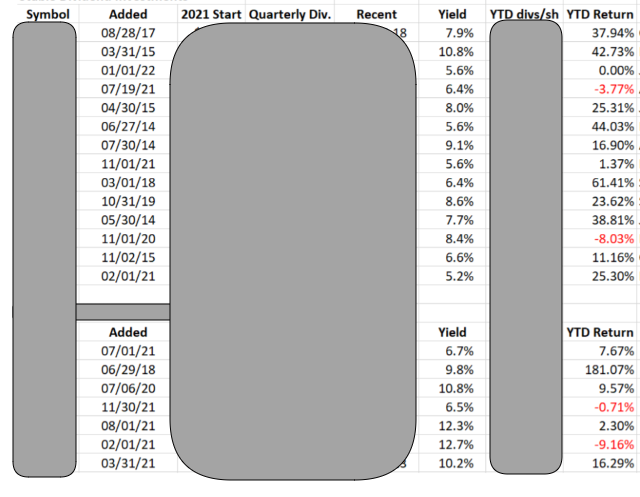

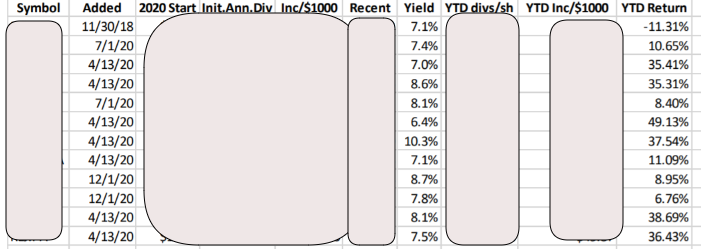

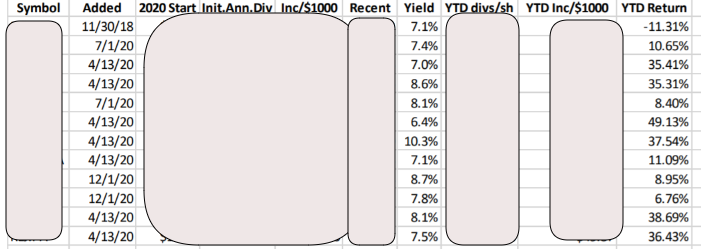

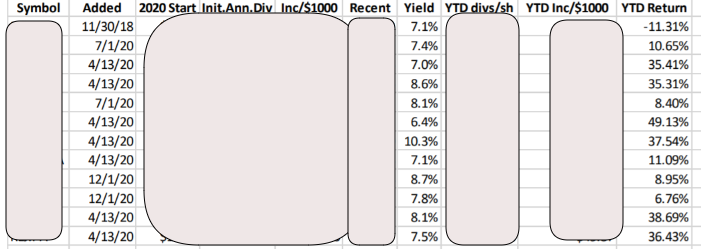

See how we added many on April 13, 2020.

Check out how these stocks did by the end of December.

Some are 37%… 49%… another 38%… 36%…

But notice the yields too.

Up to 10.3% on top of your capital gains.

It was a major move I recommended for readers and backtesting shows it paid off in spades. Because I’m not here to passively recommend high-yield monthly income to you.

I’m here to do the heavy lifting so YOU can passively put your money in and know I’m working for you.

(Of course, I can’t promise future performance.)

2021 turned out to be an excellent year for high-yields too.

That’s because we started to see tech sell off… crypto too.

And money flowing into my 3 top high-yield sectors.

Check out the hypothetical returns on the stocks I picked at the time:

Notice only 4 losses… and they’re small.

Meanwhile, the gains went up as high as 181%. Another 61% winner in there… 42%… 38%…

The yields are great as well.

A handful of double digit yields around 10-13%. (not a guarantee of future yields)

And that’s what I want you to focus on.

The monthly income. The yield on your money.

I’m showing you the stock returns so you can see I know what I’m doing. But that’s not the focus.

Stock returns are secondary to monthly income.

In fact, I say,

Don’t even look at share prices again.

Instead, look at how much income you can generate.

If you’re expecting to live off capital gains, you could be headed for a disaster.

This tech bubble pop is likely a reality check for many on this subject.

Capital gains don’t ‘pay the bills.’

It’s just numbers on a screen until the cash is in your checking account paying for your meal.

Unfortunately, the only way to capture your gains on the stock is by doing something crippling…

You have to SELL your stocks to access your cash.

Say you bought Zoom in April 2020 as the pandemic started…

And sold it for an amazing 192% profit in just 6 months… you’d feel great. And you should.

However, once you take out your profits… the “income” is gone. You can keep a few of your Zoom shares and hope it goes up again…

Only to watch it crater 60% in the following 14 months…

What if you retired on a stock, but then it crashed? Could you ever rest easy again?

Dividends protect you from ever feeling gut-punched like this.

Now what do you do? You have zero income now.

Will your retirement survive?

It’s impossible to know where the market will go.

Fund managers aren’t optimistic, with Vanguard’s CEO… the leader of $7 trillion in assets and the largest mutual fund provider… claiming stock market returns will be just 2-4%.

Can you believe that?

2-4%!

It’ll take you 25 years to double your portfolio at that snail’s pace.

(Now you understand why money is flowing into my top 3 high-yield sectors, right?)

But back to capital gains.

Capital gains are not predictable and not reliable.

…thus, leaning on capital gains for retirement is a dangerous game…

I like to use a short story to illustrate this point.

Cashing out your capital gains is like chopping down the most bountiful apple tree in your orchard because you need firewood to stay warm.

Rather than letting it continue to grow and bear more apples, you’re pulling the roots out of the ground. By pulling out the roots, it will produce zero apples in the future.

You’ll enjoy the hundreds of apples it grew over the years — but at some point, those apples will be gone…

The next apple tree you plant may not grow as well as the first one or it may even die due to disease or pests…

Trying to live off your ‘stock gains’ is like cutting down your trees and selling the wood for money. Eventually, you run out of trees and apples.

Then, you’re in big trouble.

Compare that to the orchard which has an assortment of fruit trees. Each one making fruit that you can live off.

If one tree ever starts withering, you’d rip it out and plant a new one… all while still having other fertile trees bearing fruit, supporting you.

This short parable illustrates the difference between investing in capital gains and for income.

I recommend income investing to retirees everyday… and I’m so confident in it, I have my parents doing it.

My folks retired at age 62. They ran the numbers with their advisor expecting to live to age 74.

Well, they lived beyond that… They’re entire financial plan their advisor put together was shot to hell.

So I set them up with reliable income each month and they’re living comfortably.

It’s a strategy I trust for even my parents.

I told them specifically, “You mustn’t live and die based on where the stock market goes.”

Here’s where regular “stock” investors struggle in retirement

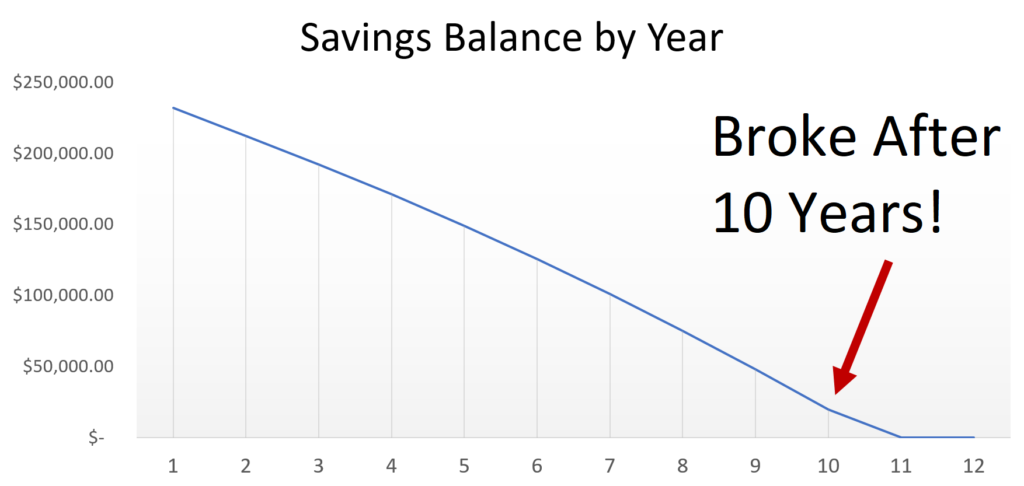

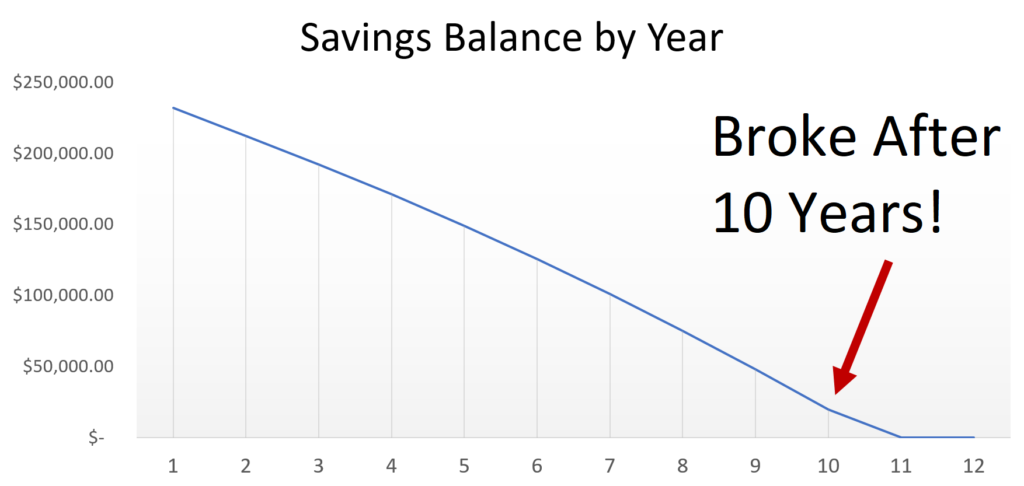

Say you have $250,000 saved up to retire on. Your Social Security check pitches in $1,341 per month.

You believe you only need $4,000 per month to live comfortably on. You may need more or less. New Retirement reports the average income is $48,000/year for retirees.

So, after Social Security, you need to only generate $2,500 per month to live on.

Leading up to retirement, you’d have invested in big-name stocks like Disney, Netflix, even Shopify (the ecommerce platform).

Well, Disney from 2019 – early 2022 recorded 0% gains.

Netflix crashed nearly 50% in 3 months from November 2021.

Shopify dropped the same near-50%.

The “average” stock market gains you hope from growth of 20% disappear quickly.

With Netflix and Shopify, your portfolio is sliced in half.

If you have $250,000 now, at 5% growth, but withdrawing your $2,500 per month to use for bills…

You’re out of money in 10 years.

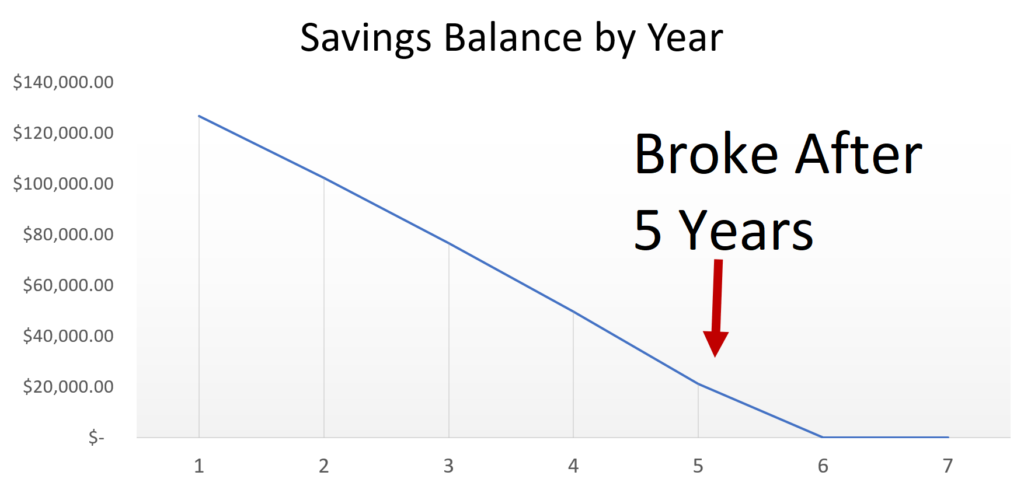

Have $150,000?

Out of money in 5 years.

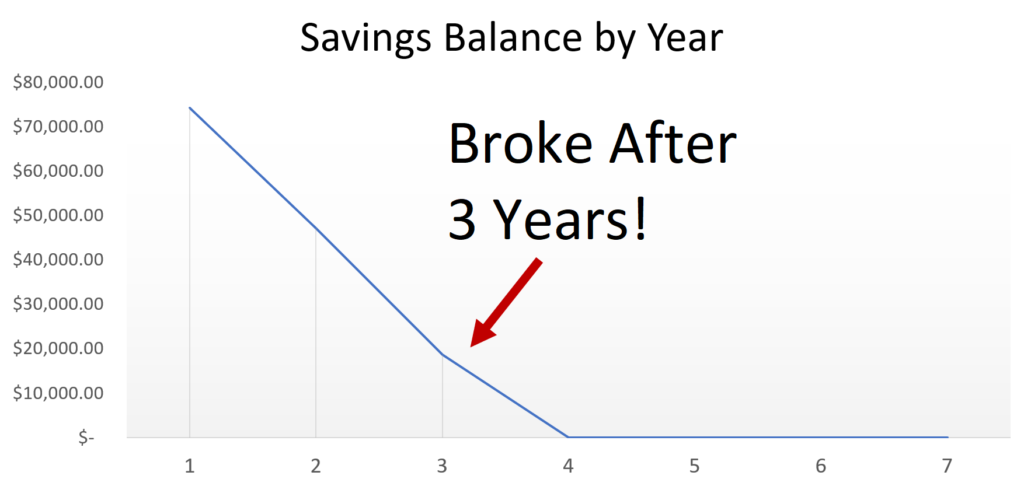

$100,000?

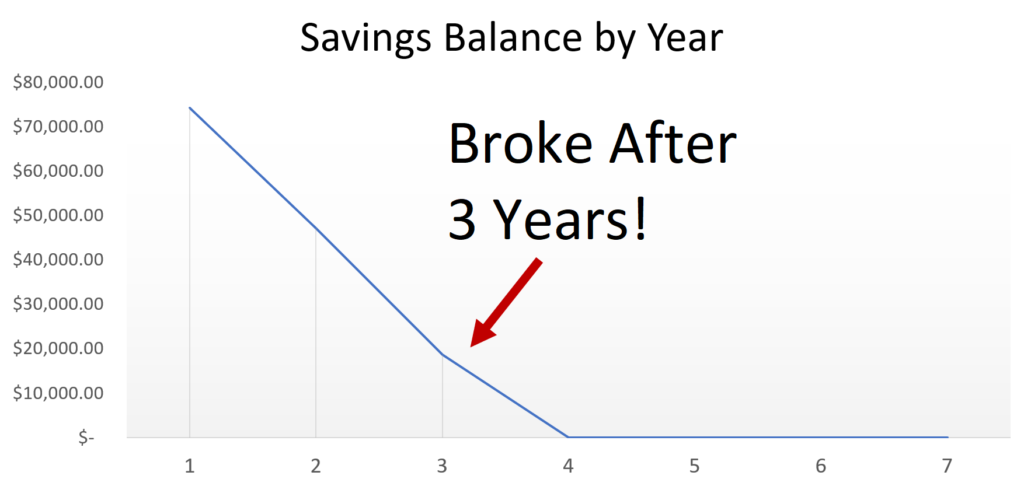

Broke in the middle of Year 3:

Clearly, hoping for endless bull markets won’t get you where you need to be.

At some point, leaning on capital gains is the surefire way to get blindsided.

Don’t give up your retirement and be forced back to work because you bet your IRA on non-income paying stocks

For two decades now, I’ve independently helped over 300,000 daily readers generate income from the markets.

Sure, we’ve seen some nice capital gains…

But monthly income is the sole goal.

And right now,

>3 sectors are seeing major headwinds as tech sells off.

This spells a potential big payday for you every single month starting with as little as $25,000.

Let’s dive in.

I already talked about one stock I recommended that backtesting shows could’ve handed you $1,414/month already after 3 years… starting with a mere $25,000. Just follow my dividend investing plan.

This stock is in a resilient sector during tech drops as it’s usefulness jumps.

And the last time the tech bubble popped in 2000… this sector held up well then.

It’s in the financial space… but not banks.

Actually,

SECTOR #1:

Recession-proof as it’s always needed:

The credit services space.

These are the companies extending credit, merchant/consumer credit cards, and more.

As ‘free money’ dries up, more folks would likely tap into the credit markets. And that’s what we tend to see.

A good example of a company in the space that was around back in 2000 is Capital One. A major player in the credit card space.

From 2000 – 2006… the stock nearly doubled in that time.

The dividend also held steady.

If you had started with $25,000 in 2000…

Followed my dividend investing plan…

By 2021, backtesting shows your account would potentially be worth $325,210.

And you’d be collecting about $815 per month in dividends.

Not that great.

But Capital One isn’t a high-yield dividend payer.

Check out my credit services dividend play, instead.

I think you’ll like this much better.

From just January 2019 to end of 2021… $25k would have exploded to $86,661 in 3 years following my plan, according to my backtesting.

And you’d be collecting $1,414 per month.

(this is not a guarantee of performance, just projections based on my recommendations)

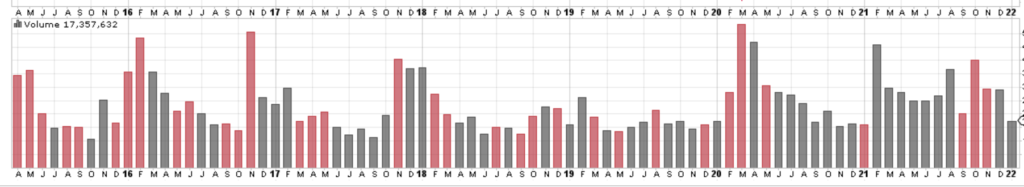

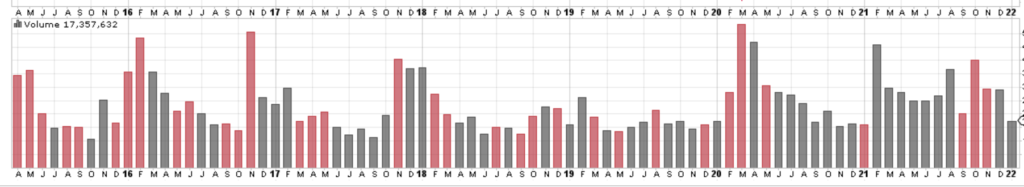

However, also check this out.

In 2014, volume in this stock was extremely low.

Volume is flooding into this stock…meaning, people are buying.

The dividend may be the best part…

The dividend in this credit services stock has TRIPLED in 3 years.

Meaning, investors could collect 3x as much income as before… without lifting a finger.

This stock is incredible… and it’s starting to gain recognition.

You need to be in it.

Details on the ticker in a minute.

That’s sector #1.

The second sector money is flowing into at a rapid pace…

Not a surprise —

Sector #2:

Most powerful asset in the world = OIL

Oil is the ultimate ‘revaluation’ play.

Whenever assets in the market are being re-valued… which is what happens with tech, crypto…

Oil makes the world move.

It also is a requirement for moving goods across the globe. Essential goods, not just junk from China.

When tech stocks crashed in 2000…

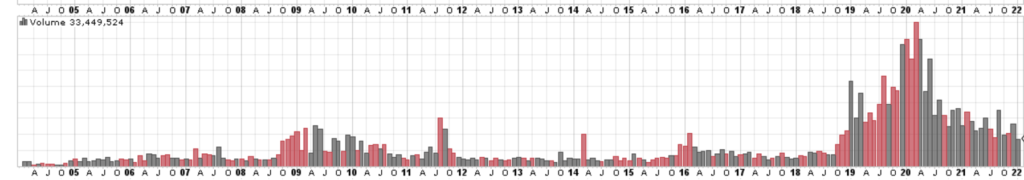

Here’s what XLE (an oil sector ETF) did…

It held up!

Only a slight pulldown as the Iraqi war kicked off.

But notice how the volume (the vertical bars at the bottom) starts picking up.

Oil tripled in value from 2000 – 2008.

Golden oil!

No better stock to buy in January 2000 than Chevron.

One of my subscribers, Glen C., got into dividend stocks because he saw his mother own a ton of Chevron stock and live off the dividend.

The stock pays a nice 4% dividend, but I have a better play in mind.

If you had started with $25,000 in January 2000… followed my dividend strategy…

By 2022, your portfolio would hypothetically have grown to an amazing $483,879. You roll that all into some high yields paying 8, 10, 12%… you’re in good shape. (disclaimer that this is not a guarantee of future performance)

The dividend to my #1 oil play 4X’d in that 22 year timeframe,

which helps a lot.

Still a lot of room to go as oil takes off.

My oil stock to buy now is

more of a value play.

Meaning, you’re getting in at amazing prices and there’s upside on

the dividend and in capital gains.

Like I said, we’re not focusing on capital gains as we aren’t selling shares to fund our life… but if you can get in at a great price, that works very well.

My oil opportunity pays a 5% dividend…

But the stock has been lower as the dividend was cut in 2020.

I expect the dividend to get back to pre-covid levels… and, as of early 2022, it has a double up chance on the dividend.

Meaning, your dividend could double very soon and get back to its old dividend.

Because oil will keep rising.

That’s why I’m not surprised to see a ton of cash coming into the stock.

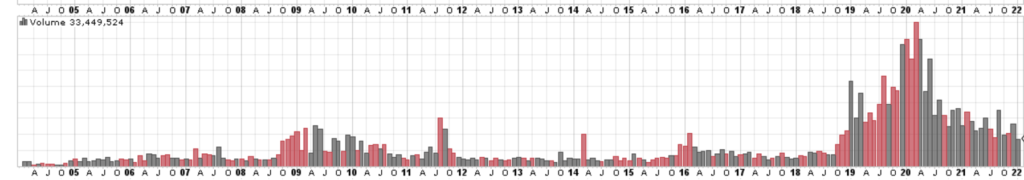

Check out this 15-year volume chart for the stock.

Volume picked up in 2020, 2021, and carried into 2022.

Huge opportunity to collect monthly income.

Double up your income opportunity, in fact.

Last sector… no surprise.

But one of the hottest sectors of the last 10 years, and capital is flowing at a tremendous pace.

Sector #3:

The hottest sector in America right now = Real Estate

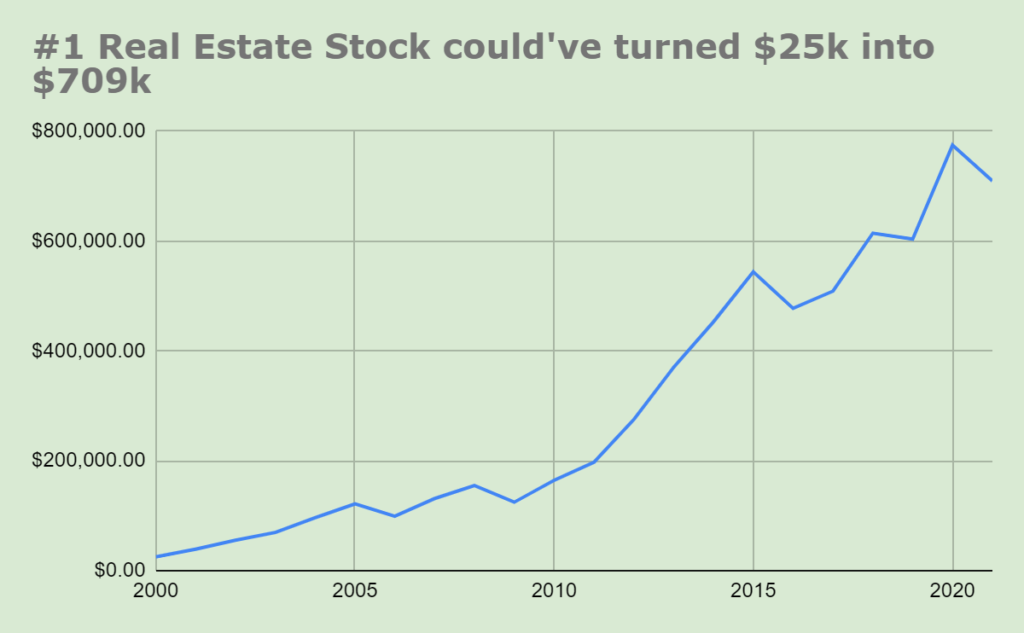

This is the volume chart for the XLRE.

This is an ETF that tracks REAL ESTATE stocks.

Notice how volume has picked up since 2017… yet, YOU didn’t start hearing about how hot real estate was until 2020.

I’ve been recommending real estate high-yield dividend stocks since 2015.

I beat the trend.

And I’m still on top of it.

My #1 real estate dividend stock is a Real Estate Investment Trust (REIT).

If you had invested $25,000 on January 1, 2000… followed my

dividend strategy for 22 years…

In 2021, your portfolio would hypothetically have hit

an incredible $709,497!

You’d also be pocketing a nice $3,516 per month in dividends.

That’s $42,192 per year…

$421,920 in income over 10 years.

That income number is what I’m more concerned with. (no guarantee of future performance)

Volume picked up in this stock in 2014… but now it’s reaching higher levels still:

The REIT invests in industrial and retail spots.

Industrial is necessary for ecommerce (which is hitting records each year thanks to Amazon).

Retail is for those shopping in-person including restaurants. I can’t see those going away anytime soon.

The REIT pays a nice 5.6% dividend.

And it’s raised its dividend every year over the last 10 years.

Meaning, more income each year for your pocket. I expect that to continue.

Ok — I just showed you 3 sectors money is flowing in… and I talked a bit about the #1 stock to buy in each.

You buy all 3 of these stocks

… 1 in credit services.

… 1 in oil.

…1 in real estate.

And you’re on track to collect thousands every single month for life.

My 3 stocks for each hot sector are housed in my brand-new,

never-before-seen report,

3 Top Dividend Payers

Seeing Big Buying.

It’s called that because I showed you that people are purchasing shares at a historic pace.

Inside, I’ll give a breakdown on:

- The actual TICKER symbols of the stocks plus their expected payouts

- Why these 3 stocks and the companies behind them are primed to take advantage of this tech/growth stock crash

- How credit services, oil, and real estate benefit during this money transfer

This is a must-own report during this time in the market.

The value is $99…

But you can claim it as a free bonus if you keep reading.

I won’t stop here.

I’ll even lay out exactly when you’ll collect your first check

from these stocks in a gift for you right now.

I call it my “Monthly Dividend Paycheck Calendar”

I’m going to ‘map out’ to the day when you’ll receive your dividends. This calendar will be updated automatically each month for no fee.

I’ll map out exactly when:

- You need to own the stock to collect the dividends

- When you can expect the cash in your account

- When the next payout one is

It’s easy… I update it every single month.

You simply pull up the calendar online, check out what date you need to own the shares… log into your account if you want to own the dividend…

Then, check back later to see when you’ll receive the money.

No guessing. No research on your part.

The Calendar is manually updated, so that’s another $99 of value. Also included with what I share in a minute.

Already, you’re receiving 3 stocks, plus a calendar to show you exactly when you receive your monthly payments.

But there’s another gift I want to share…

(my most popular premium

report of all-time)

When I shared about backtesting showing my stocks turning $25,000 into a $1,414 income stream… and a portfolio of $86,661 in just 3 years (including an up and down 2020, and a choppy 2021)…

You must follow my 36-month plan to see results like this

I didn’t share HOW you could do that.

Yes, you have to buy the stocks.

But there are a few more steps involved. Pro tips on how to maximize your income.

I don’t have time to share my dividend investing and portfolio management strategy here.

However, I’ll include it as as an add-on to what I’m about to show you, right now.

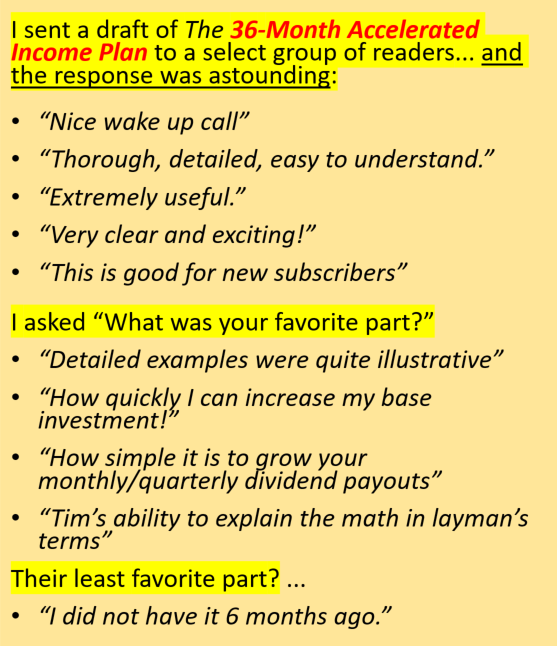

It’s housed in my 36-Month Accelerated Income Plan report. It’s been refreshed as I’ve offered it for years.

Now, it’s updated.

Inside, you’ll discover:

- How to setup your 401(k), IRA, or brokerage account for the plan (takes 12 minutes) so the income continues to flow into your account

- The #1 rule that will double your money regardless of stock price

- A killer strategy to add potentially 245% portfolio increases to your account balance (takes just a few click to set up for free)

- Step-by-step directions on how to execute the 36-month accelerated plan to perfection

When to buy & sell your stocks without losing your shirt

It’s yours as an included add-on.

Another $99 value.

All 3 of these offers… the two reports and the Calendar… work together.

But they miss one key ingredient.

Remember, high-yield dividend stocks require constant research and digging into the financials.

You need to make sure the stocks will continue to pay their dividend.

If they don’t, you could be in for a

surprise, nasty dividend cut.

This requires weekly work of reading 10-Ks, 10-Qs, balance sheets, profit and loss statements, talking with the executives…

All work I love doing. It’s what drives me more than a V6 Toyota Tacoma, if you catch my drift.

I do the research for you.

Remember I also shared that when stocks crashed in 2020… I immediately alerted people to move money into a more “mystery dividend class.”

The growth was incredible for being a rough year for some stocks.

Well, I do all this research inside a special subscription service that

goes for a very, very low price.

It’s a service that keeps you on top of your monthly income without

doing the work.

If you’re retired or near retirement, this dividend service is a must as you move from investing in more high-risk stocks gunning for capital gains…

And searching for more predictable cash flow you can spend or reinvest as you need.

The secret to a high monthly income without doing research yourself is my newsletter, The Dividend Hunter.

All 3 of the bonuses I just shared are included with The Dividend Hunter.

All I ask in return is you join my flagship dividend newsletter, read by 20,000+ paying members called The Dividend Hunter.

Our goal is simple = Create monthly dividend income that pays your bills for life.

There’s content every single week about our stocks and beginner dividend investing lessons.

Here’s what you get as a risk-free member of The Dividend Hunter:

- 12 months of issues where I update our positions, provide dividend investing tips, economic outlooks and more. These hit your inbox in the first week of the month.

- Model portfolio of 34+ high-yield, low risk stocks: All vetted by me personally and I invest my own money into many of them.

- 3 Top Dividend Payers Seeing Big Buying: These are the 3 stocks I mentioned today. One in credit services, one in oil, one in real estate. The yields are a minimum of 5%, and they’re set to grow their dividends as money flows into them.

- Monthly Dividend Paycheck Calendar: My monthly updated map on when ALL Dividend Hunter stocks will pay out their dividends. Not just for the 3 I mentioned… ALL the stocks.

- 36-Month Accelerated Income Plan: This is the secret sauce to setting up a portfolio you know will pay your bills for life. Multiple important strategies here that stretch beyond just “buy the stock and hold.”

- *FREE UPGRADE #1* Weekly Mailbag: Every week, I release a recorded video answering the most pressing questions of the week. Maybe about our portfolio, the stock market, gold, and more.

- *FREE UPGRADE #2* Weekly Buy Recommendations: When one of our stocks goes on sale, you have a shot at buying shares a nice discount. I’ll tell you which stock is on sale.

- *FREE UPGRADE #3* New member orientation webinar: Every month, all new Dividend Hunter subscribers are invited to an orientation. It’s 100% optional. I show you how to navigate the Dividend Hunter portal, where to see which stocks to buy first, common start-up questions, and more.

12-Month No-Risk, Money Back Policy: You have a full 12 months to try out the service. If you don’t like it, get a refund at any point.

This is a full $500 worth of value here…

But you’ll receive a huge discount in just a moment.

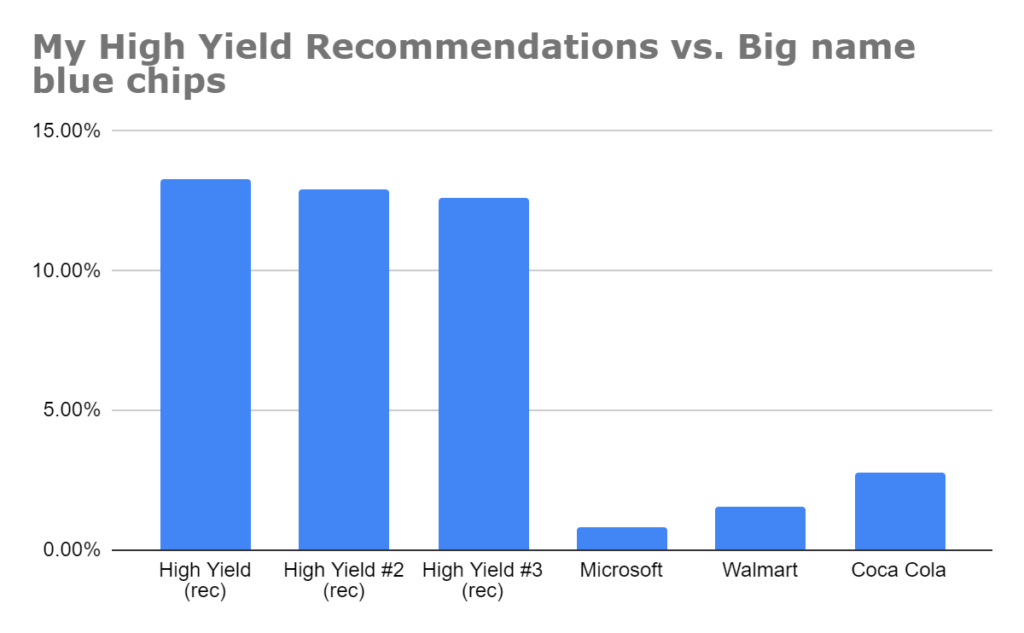

When you compare to normal, “blue chip” dividend stocks… The Dividend Hunter outstrips the dividend yield by a long shot.

It’s time to start collecting high monthly cash today.

Like I said, 20,000+ folks like yourself are already in The Dividend Hunter.

Majority, I’d estimate, are retired or fairly close to retirement.

What they’ve said about me has been flattering:

The Best Deal You’ll Find on The Dividend Hunter ANYWHERE

I’m giving you $500 of value…

The normal retail rate is $99/year for The Dividend Hunter.

That’s pretty good for 34+ stocks, all the bonuses, Weekly Mailbag, Buy of the Week, and more.

However, today, you can grab a 1-year subscription of everything for a mere $49.

$49 right now to unlock monthly income for life.

Getting set up takes just a few minutes…

You could be collecting monthly checks like clockwork for a mere $49.

That’s the price of dinner and wine for two people..

It’s not that much.

And I could charge 10X this amount.

If you got into one of my stocks and start collecting $1,414/month… $49 is paid off for the year in Week 1.

I’m not guaranteeing this… but you can set yourself up for monthly income as soon as today. Many of my stocks pay monthly.

If you’re ready to join 20,000+ others, click the “Join Now” button right now. On the next page, you can claim your spot inside.

After you join, you’ll receive information on logging into the portal at InvestorsAlley.com.

All the stocks you’re looking for are right in there.

This is a complete resource for generating monthly income from simple buying-and-holding stocks.

There’s no trading, options, or timing the market.

We’re not shooting for capital gains.

Cash is King. As a member, you’ll be on the path to monthly checks like clockwork.

It’s a lot of fun, actually.

You’ll receive access to over 34+ dividend stocks! It’s a lot and you don’t have to buy them all.

BONUS: I included a “Start Out Portfolio” so you know of a few more dividend stocks you can add to your portfolio if you don’t want to buy over 34 stocks now.

My reports and issues will break down which make the most sense as you’re getting started.

There’s so many because I have the standard types of high-yields in REITs and oil.

But, there are also two special kinds of high-yield dividend stocks many don’t know exist.

You get stock picks for those as well.

They’re a special breed of dividend stocks which can land you even higher yields.

I’ll tell you everything in a bonus report.

Bonus #1:

In my new report, “Mystery Monthly Dividends,” you’ll discover a basket of dividend stocks that pay unique yields.

One of the stocks paying mystery dividends hit 35% yields in 2021!

They’re a mystery because your dividends are a surprise each month. You could land massive dividends you didn’t expect with these stocks.

It’s truly fascinating and fun.

I talk about these stocks inside this report, included with your The Dividend Hunter membership.

Plus, as a subscriber to The Dividend Hunter, I dug up 7 of these “mystery dividend” companies.

You never know what dividends you might get, and one month could be 35%+ yields on your money.

But that’s not all.

I teased about a “mystery dividend class” of stocks. These were the stocks I advised my readers to move their cash into during the 2020 issues.

I showed you our stocks went up… but not about what made these dividend stocks special.

They’re special because you become the most important shareholder when you buy their shares.

Bonus #2:

I call it “You First” Dividends.

And that’s the bonus report I have in store for you: You First Dividends. You’re first in line for every payout.

Forever.

Your dividend is the safest.

I bet you didn’t know when you buy a dividend stock, you’re actually last in line to receive your income.

“You First” shareholders receive theirs first. And they’re GUARANTEED to do so.

Because that’s the contract you agree to when you buy these special shares. The company can’t cut the dividend on you before common shareholders.

During 2020, common shareholders saw their dividends slashed overnight. Not “YOU First” holders.

I’ll tell you everything in this fourth bonus report.

I have up to 11 in The Dividend Hunter model portfolio. It’s all waiting for you.

Join me inside right now.

I’ll even include a 12-month money back policy.

If over the next 12 months, you do not feel The Dividend Hunter was worth the money, call us up and get a full 100% refund.

For the amount of value you get, I’m tempting to offer zero refunds. I can’t afford to waste time if you’re not serious.

But you deserve to join risk-free. And this my last pitch to get you off the fence.

If a full risk-free policy doesn’t do it, nothing will.

You could join for 364 days…

and still claim a refund.

You can even KEEP all the bonus reports I shared today as a gift for

trying out the service.

You don’t need to consume all the content. You may just want the stock picks. That’s fine.

Or, you may be ready to buy stocks and learn more about our high-yield plays. There’s a ton for everyone.

Join me now.

Income piles up quickly inside The Dividend Hunter.

You could be generating thousands in income starting with 3 stocks seeing huge buying.

Start today.

It’s the greatest time

to do so in 22 years.

$49 is all you need to start.

As you use my dividend investing strategy, that amount can compound extremely fast once you take action.

Now is the time to take action.

If you knew thousands of dollars PER MONTH were at stake for your retirement, would you do something about it?

Chances are, your spouse isn’t interested.

It’s on you.

Set up a monthly income stream where bills are paid with your assets. Not from working. NOT from selling your shares to live.

Selling your shares to survive in retirement is a recipe for disaster.

Instead, be ready to generate income this month from high-yield dividend stocks. I’ll show you the first 3 to buy.

Tech shares are melting… money is flowing into these 3 stocks and their sectors.

Take action for your retirement now.

Join The Dividend Hunter now. You’re backed by a 12-month risk-free money back policy.

I’ll get back to traveling now.

For more income now,

Tim Plaehn

Editor of The Dividend Hunter

P.S. Relying on capital gains is like praying it will never rain again.

In the markets, we will hit another crash and another one after that. I am your backstop to any troubles by guiding you and encouraging you while you create a predictable monthly income stream.

No matter what the markets do, I’ll help you grow your income stream with the absolute best companies. I’m watching these companies like a hawk. Start with the 3 I shared today.

The worst time to start is when trouble hits because then it’s much harder to stick to the system. That’s why you must start now if you’re serious about covering your bills for the rest of your life.