Everyday places to find 38.5% dividend yields in this market

- Did you know you could collect 38.5% dividend yields whenever one of the 9,863 new mortgages gets signed today?

- What about banking 12.9% returns whenever one of the 11 million people today fills up their tank with all the expensive gasoline?

- Or, pocketing an incredible 25.9% yield from Americans spending $642 billion in entertainment each year whether skiing, going to the movies, or spoiling your spouse at a resort.

*****************

I’m about to show you a dozen or so amazing, but ordinary places where 38.5% income is hiding.

It’s hiding in plain sight and you could be enjoying these dividend payouts starting today.

I’ve found a select few locations throw off the biggest and best yields:

…gas stations…

…small businesses…

…new mortgages…

…new apartment leases…

And a few others.

Each of these types of transactions generate tons of hidden income for investors.

Income you didn’t know YOU’ve been paying when you went to fill up your gas tank this week.

What I love about these high-yield locations is you’re not betting the farm on 1-singular company ‘making it big’ or doing well.

You’re not buying Exxon, Walmart, Disney or any of those ‘mainstream’ dividend companies.

Instead, I’ve discovered a new way to completely flip dividend investing on its head.

But that doesn’t mean it’s complicated or requires thousands of hours trading.

In fact, buy and hold these high-yields like regular stocks. No trading required.

Over 20,000 readers are doing this right now with me.

Carve out a small section of your portfolio and you’re done. It’s really that simple and the income can pile up quickly.

I mean, if you could collect 38.5% total yields over a few years…

- $5,000 is throwing off $1,925 in income.

- $25,000 is generating $9,625 in income.

Eventually, you can be just like Joe.

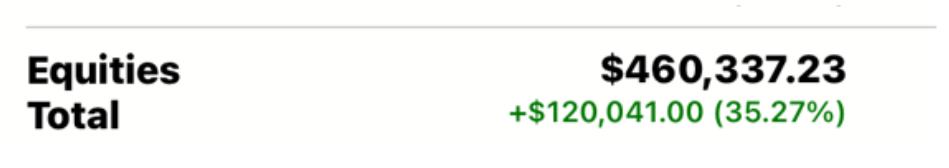

He recently sent me this screenshot of his bank balance.

Three years ago he got laid off without any notice.

To make matters worse, he was neck deep in medical bills and taking care of his wife too.

He started investing in these high-yield dividends after seeing the incredible potential and hasn’t looked back since.

Joe isn’t the only one…

Don from New York lost all his income when the insurance company canceled his disability benefits, but he says he’s built a healthy nest egg and is set for life after only 9 months.

Sure, you’re not getting rich, per se, with dividends.

But, you have to admit, this bit of extra cash can go a long way.

$10k in extra income per year can buy you a few extra trips… more date nights with your spouse… more gifts for the kids and grandkids.

It’s why I have 100% of my own, personal 401k invested

in the high-yield stocks I’ll show you.

You already know having income in a time like this is more important than ever.

Cash is King during tough times.

Yet…

- Bonds are still paying nothing in income.

- 5% Savings accounts are still a fossil of the 80s.

- Freezing your money in CDs will generate about as much income as actually putting your money in a freezer.

Your last hope is doing what everyone else does for income…settling for investing in low yielding stocks that don’t even beat inflation…

But, like I said… that’s everyone else… but it doesn’t have to be you anymore.

You simply need to know exactly where to invest.

That’s what I’ll show you right now.

From now on:

- You’ll be in the know enjoying an amazing 87.7% potential yield whenever your neighbors pay their electric bill.

- You’ll smile because whenever someone buys a stock, rather than just the stockbroker getting rich, you’re also collecting cash dividends.

In my portfolio, after just 12 months, you could’ve collected 14.5% in dividends to be exact.

Not too long in the future, that 14.5% will balloon to potentially 101%+ yields in no time. You’ll see how it works.

This isn’t a marketing trick. Nor am I making numbers up. These are actual returns in my portfolio if someone had bought when I recommended.

I’ll show you the proof.

However, this takes time. An 87.7% yield doesn’t happen today. For this particular investment, it took 8 years to get there.

But others took only as little as 12 months.

It requires 3 easy steps to generate these high yields I’ll share in a minute.

For me, I’m collecting dividend checks this big regularly.

Just this quarter, I’ll collect 70 dividend checks inside my own personal portfolio, automatically…

without doing a thing…

70 per quarter… up to 280 per year.

That’s 70 income streams…

That doesn’t mean I own 70 stocks.

Some dividend players pay out monthly.

Imagine what you could do with 70 different checks.

You got 2 checks per month for working a job.

I get 4 per week or 16 per month automatically dropped into my account. No depositing checks or asking for them.

I’m 100% invested in these cash cows in my retirement.

They will pay my bills for life

I can’t pay my bills with stock gains. Not unless I try and time the market to sell.

Why would I waste time trading like that?

I’d rather be collecting check after check to put gas into my Tacoma no matter the price of oil…

Buy a bottle of my favorite Japanese whiskey without looking at the price tag…

And spend my time — and money — doing what makes me happy… exploring America’s beautiful landscape.

I can collect this income automatically, like I said. No staring at my computer, or trying to catch an internet signal to login to my account.

The money shows up again and again like clockwork.

This can happen for you.

| “I never believed in my life I would be able to have this much in my portfolio in what I would consider a very short time”

– Steven D. |

“Since joining you in late 2016, we have done well with your recommendations. With this much extra income, life is good. (We are leaving on a 10 day Caribbean cruise today!)”

– Mel G. |

“Thanks for what you do, my account balance hasn’t looked this good ever, and I’ve only been on board a few months.”

– Brad B. |

You simply need to buy the right dividend payers, and I’ll show you how.

They’re easy to spot when you know what to look for.

Imagine getting paid a cash dividend every time someone fills their tank

I have one play that delivered 15.5% yields like this when you stop at Chevron for gas.

You could’ve got this same yield whenever you picked up dog food at PetsMart… or shopped at Aldi for groceries.

$25,000 initially could have handed you up to $7,338.

That yield on your $25k is over an easy 36 months.

You don’t buy PetsMart or Aldi stock (as an example) to generate this income.

That’s what normal dividend investors do…

Instead, I look to compound opportunities in a better, faster, more lucrative way.

Collect a potential 29.1% yield from

technology innovations…

Most tech stocks like Netflix and Facebook or cryptocurrencies don’t even pay any dividends.

Yet, with one little-known loophole, you could’ve generated 29.1% in dividend yields on your cash after 3 years from these same technologies.

Rather than risk your savings on Netflix’s volatile stock… earn income with a much safer play.

All you had to do was buy the opportunity I pointed out…

And a small $25,000 stake would have thrown off over $11,378 in dividends.

Better yet, the opportunities have gotten even bigger than this…

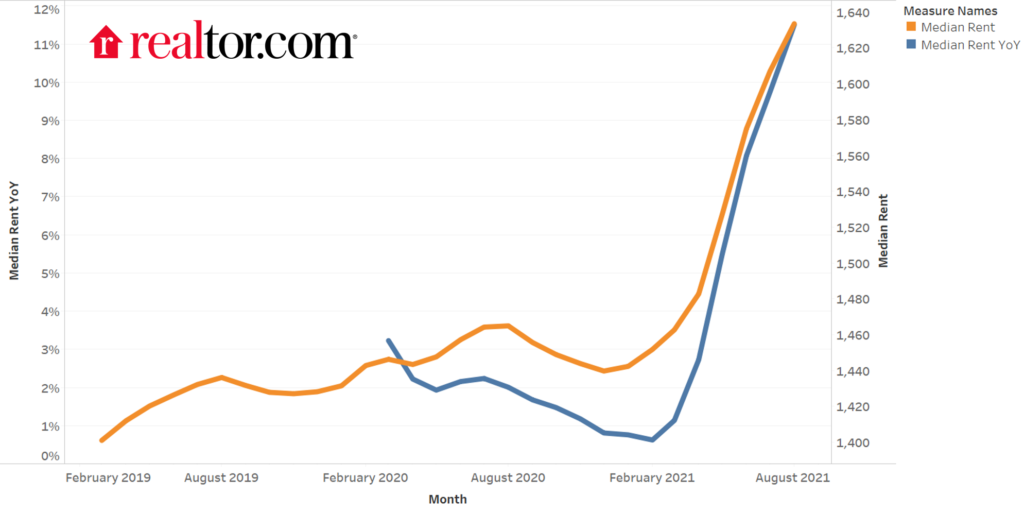

What if you could invest in the smokin’ hot rental real estate market and collect a 126.8% dividend yield everytime a lease gets signed

Yet, you’ve probably heard about the shortage of rental homes available, especially as single family home prices rocketed higher.

Realtor.com reports rents skyrocketing double-digits, year-over-year, since the pandemic.

You had a shot alongside me to ride this wave and collect 126.8% yields with a little-known dividend stock…

My opportunity could’ve taken $25,000… and generated over $31,707 in dividends alone! This would’ve been over 6 years.

Meaning, if you had followed my 3 easy steps, you could’ve gotten back your entire investment stake and ridden off into the sunset with virtually $0 in risk!

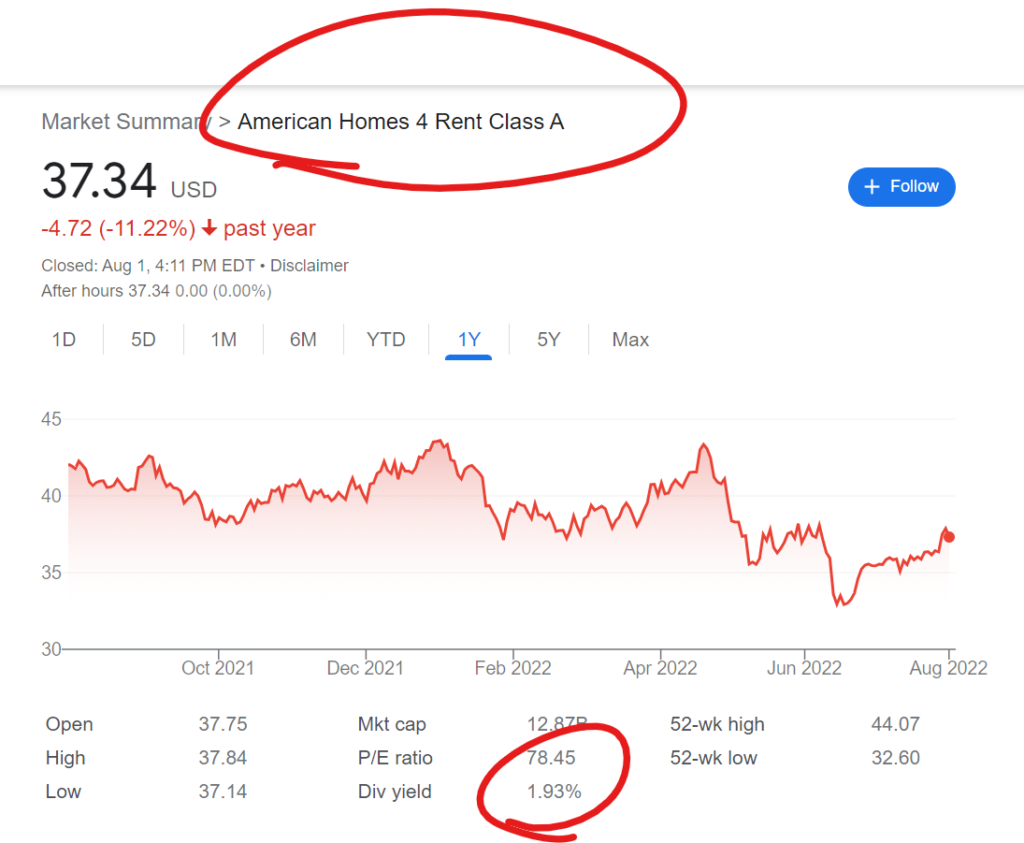

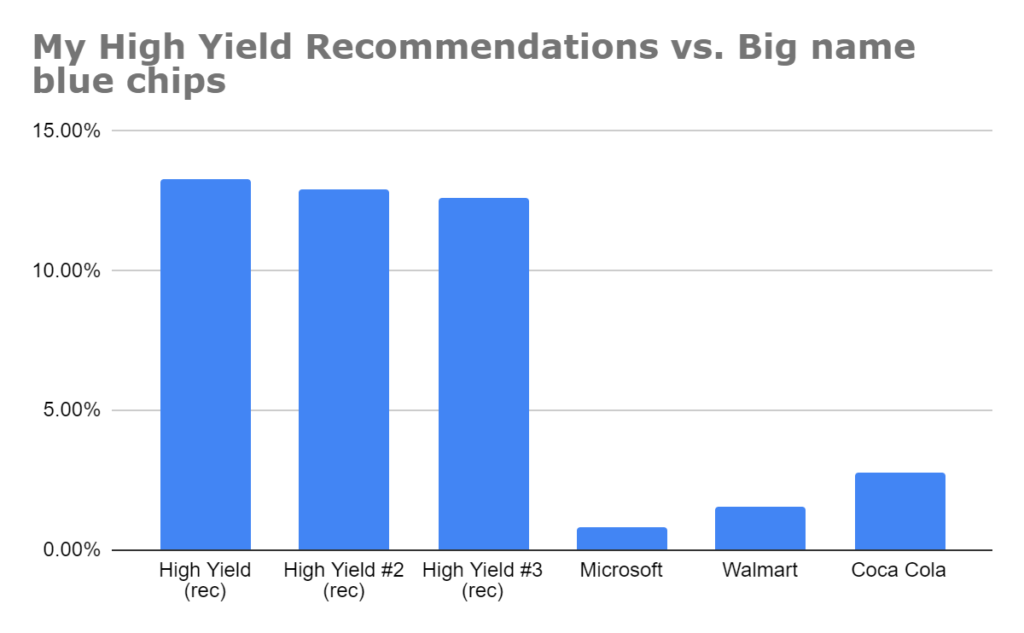

No, you aren’t buying a stock like American Homes 4 Rent. That’s what everyone else does.

Here’s where everyone else invests…not you anymore.

They only pay a pitiful 1.93% yield.

Over the same 6 year period as American Homes 4 Rent…

My high-yield stock produced 8.5X MORE INCOME than American Homes 4 Rent despite investing in the same exact asset class.

And American Homes 4 Rent is a $13 billion dollar juggernaut. They aren’t small potatoes and are widely heralded on Wall Street.

My high yield play? You likely never have heard of it… but the dividends keep going up year-after-year.

126.8% yield in real estate sounds great.

But it doesn’t stop there…

What if you could get a slice of every online purchase

in America…

To the tune of 134.2% dividend yields!

Now, that sounds unbelievable.

But one of my top opportunities I’ve ever shared… and I still recommend … has produced a compounded 134.2% yield.

Meaning, just $25,000 invested has thrown off an incredible $33,438 in dividends over an 8 year span.

Just think when you see your spouse…

Their friends… your neighbors…

All piling up packages at their doorstep… you could be collecting a piece of that income.

Not by investing in Amazon though. They don’t even give out dividends (they should!).

You’d invest in a much different opportunity.

An opportunity better than if Amazon doled out dividends… because you’d be getting a cut of packages Amazon delivered no matter what happens with the economy or Amazon’s business.

Plus, as I’m showing you too… you don’t need a ton of your portfolio to start collecting these historic dividend yields.

$25,000 is producing up to $33,438 in dividends.

If you have a $250,000 portfolio…

You could’ve collected up to $277,442 in dividends over the last decade. Imagine that much cash in your hand.

All income.

These yields do not include stock gains or adding more money into your portfolio. It’s pure income.

Here, we got all our entire basis back in dividends… meaning, we technically now have $0 invested. So all capital gains are risk-free profits on our money.

And I keep seeing more and more of these opportunities pop up.

I’ll reveal my top 3 high-yield dividend plays by the end of this page…

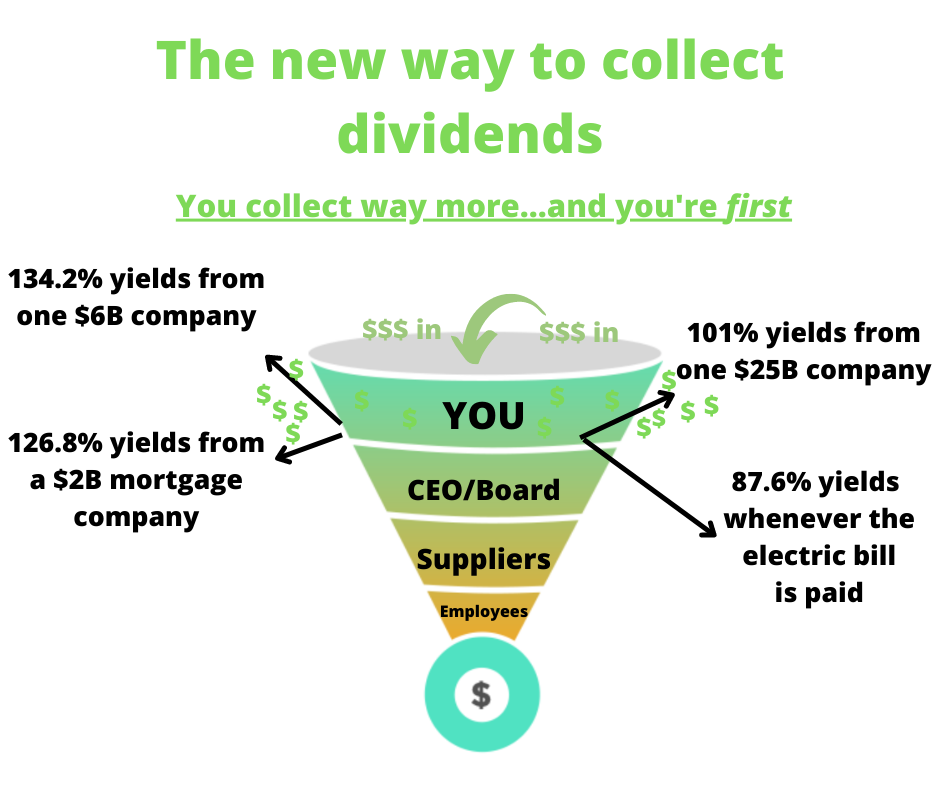

But, like I said, you first have to let go of how you thought investing in dividends was meant to be.

The old way to invest in dividends is dead.

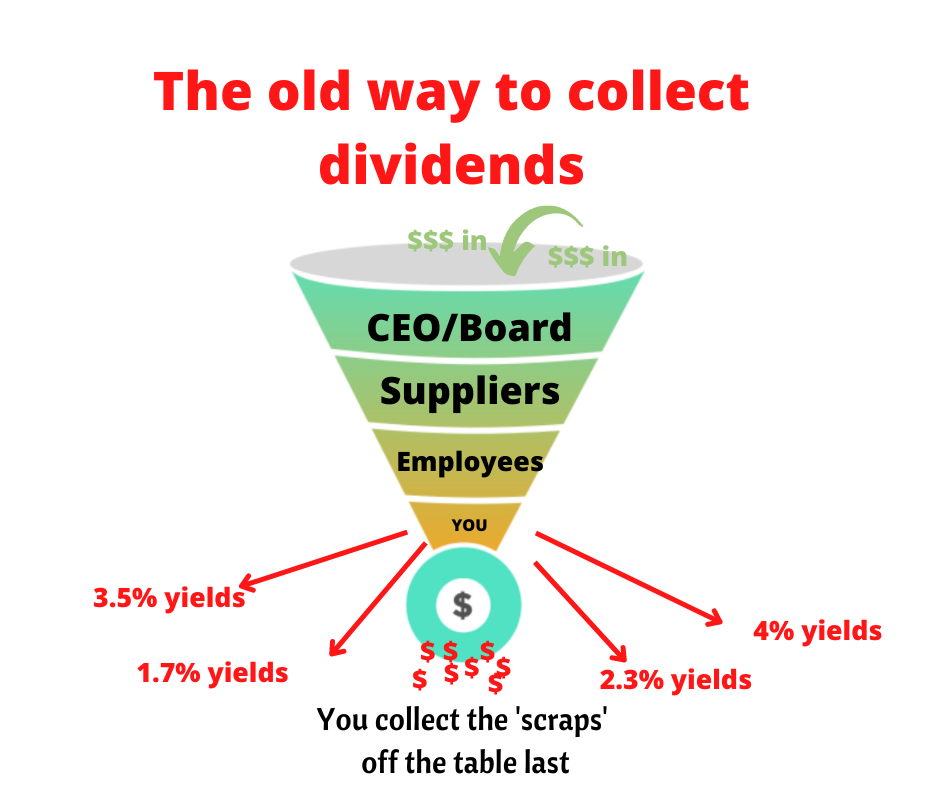

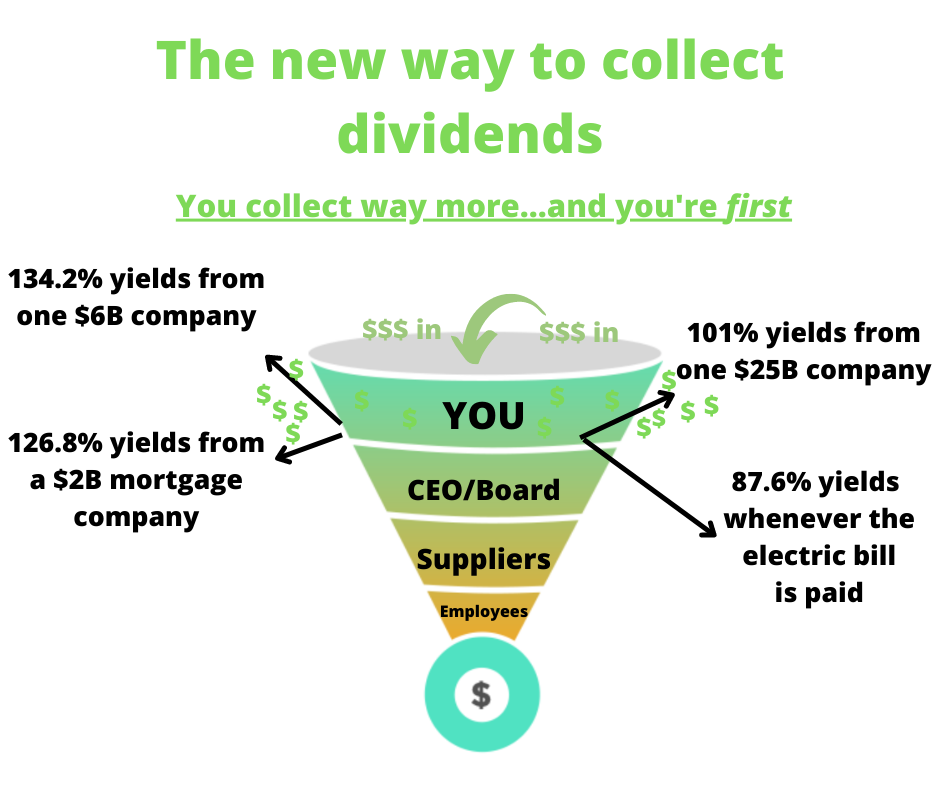

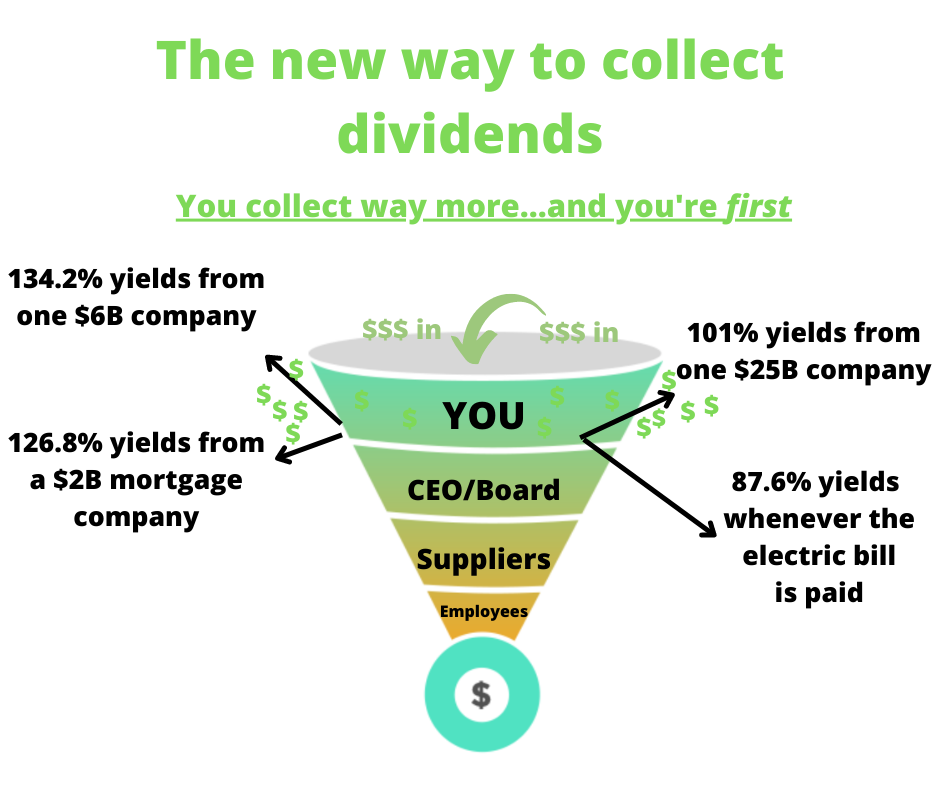

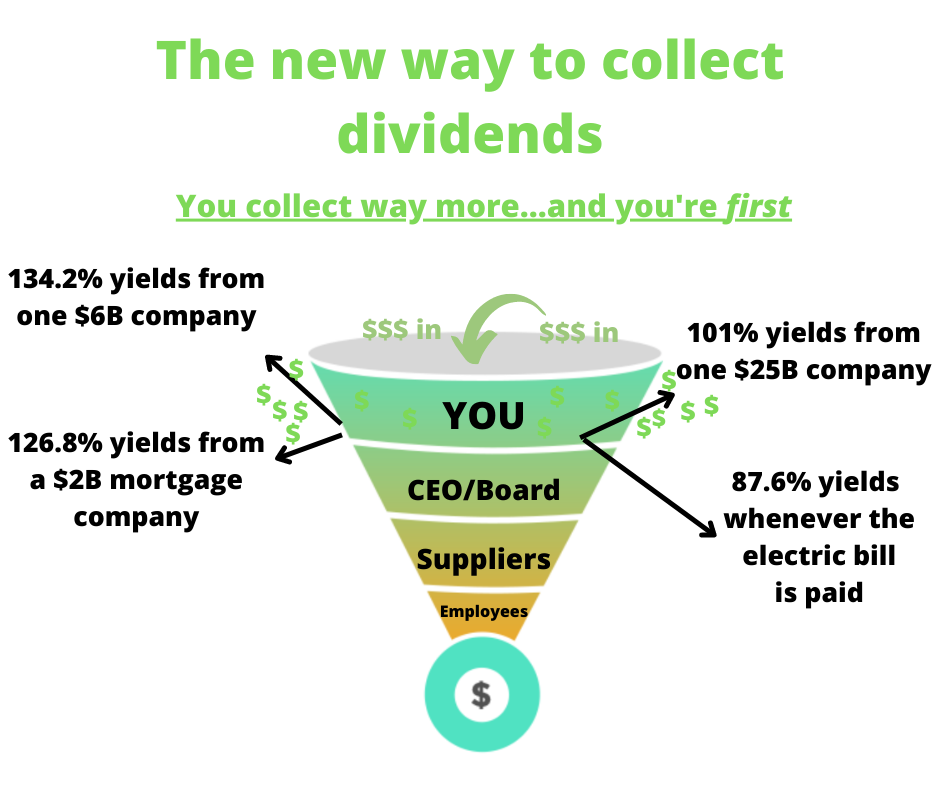

Here’s how the old way of dividend investing looks:

Money goes in…

But it doesn’t go to you.

Not even close.

Instead, you’re paid last and everyone else gets paid before you!

Take a company like Exxon.

They generate their cash selling their (now) extremely expensive oil. It’s drilled out of the ground, refined, and sold to you at a premium at the pump.

They’re seeing record profits.

Exxon gets record profit… your income stays bottom-of-the-barrel low

Yet, as an Exxon shareholder, you’re NOT seeing record income in your own bank account.

No. You’re at the bottom of the line.

Revenue for Exxon comes in…

Their CEO gets paid first… his secretary, his lawyers… obviously the suppliers, the employees…

What else?

The VPs $1,000 dinners, their private jets, chauffeur, politicians…

They all receive their checks before you.

Then… when all is tallied up by the accountants (who also get paid before you)…

…a little bit of money trickles down to you.

A 3.73% yield.

Which is actually an above average yield nowadays.

You should be happy, right?

Maybe before. But you aren’t even beating inflation at those weak numbers!

At 9% inflation, you lose 5% of purchasing power every year!

And if you think Exxon’s stock returns will bail you out…

In 5 years, they’ve returned 5.5% in capital gains.

Yet, Exxon is constantly on the ‘Top 10’ dividend lists. Everyone loves them.

But where are you on the food chain?

Still… at the very, very bottom.

Meanwhile, I could’ve shown you how to generate a 15.5% return…that’s 3X more!

And you would’ve done it a completely different way. The NEW way to invest for income.

Which I’m going to show you in a minute.

Let’s look at another example of the old way….

Take Walmart. The pillar of American consumerism.

Everyone shops at Walmart. Myself included.

Yet, you invest in their stock… you’d think you’d be handsomely rewarded with dividends forever. They generate $576B of revenue per year for darn sake.

Sorry to burst the bubble…

But the Walton heirs aren’t exactly handing out buckets of cash.

You go and buy a share of Walmart now… you’re looking at a 1.74% dividend yield.

Why so little?

Well, retail is a low margin business. 1-5% is the norm.

Because guess who is getting paid first?

The Walton heirs…

Their board of directors…

Their low benefit, low paid employees…

Their Great Value knock-off brands they sell…

All of them get money and funding before you.

You, again, are at the bottom.

You are not important to Walmart. These companies are worse than politicians. They won’t even lie about this to your face.

Essentially, your money is not important.

Record year by Walmart? Doesn’t matter. You get your 1.74% yield and be quiet.

You’re there with your bowl out like Oliver Twist, “please Mr. Walton, may I have some more!”

(“No” is the answer you’d get if you called their investors desk).

“But their stock has done great!” you might say.

Sure it has. During a debt-fueled, Federal Reserve-crazed stock bubble! Everyone did great then. We all felt rich.

I bet your house has doubled in value the last few years.

I don’t need to show you stats to tell you those high-flying days are over.

Now, we’re looking at a different economy.

And when the economy is rough…Walmart’s stock doesn’t treat you well either.

Like from 2000-2011…

Walmart’s stock returned nearly 0% in capital gains!

0%.

What Walmart does during bad economic times

The Walton kids get rich…

Your dividend income is pennies.

Your stock gains are $0.

You’ve lost 11 years of potential compounding.

That’s not a mistake I want you to make.

Meanwhile, I’m investing in small business opportunities… some retail linked… and collecting up to 101% over the years.

We aren’t investing in Walmart… rather, we’re investing in opportunities that collect money before Walmart even puts the product on their shelves.

That doesn’t come on Day 1. It takes time and a few steps I’ll show you. But, again, this is a real-life recommendation in my portfolio for over 8 years.

I spotted this dramatic change for collecting huge yields years ago.

Now, I’m going to share it with you.

First, let me introduce myself.

My name is Tim Plaehn.

I’ve been called the “most trusted” man in finance by my readers

| “I’ve never trusted someone in finance more than Tim. Now, I buy his recommendations right away in the service.

Put your money into these, they don’t fluctuate a ton and your dividends are growing. Your effective yield will be much higher.” – RG, an investor in high yields since 2017 |

Before helping folks with their retirements, I was a captain in the Air Force.

You could say it was here I got my itch to help others.

Nothing grounds you more than multiple flights nearly going up in fiery flames.

After I retired from the service, I was a Certified Financial Planner doing what I could to help others retire well.

However, I was handcuffed on what I could say and what I could recommend.

That’s when I teamed up with Investors Alley.

My publisher, Investors Alley, was founded in 1998, before many mainstream publications including the Motley Fool and MarketWatch.

But rather than focus on the next ‘big thing’ in tech or cryptocurrency or the ‘news of the day’…

We focus on one single area.

An area that makes us far less money than other big-name publications… but it’s the most important.

We’ve become the leading resource for generating retirement income for the average American.

We send out over 5 million emails every month.

100,000+ retirees just like you have read my retirement income ideas and many have followed along to set themselves up to retire for good.

99% when they first join me are skeptical because I do not recommend washed-out, ragged advice you see everywhere.

They say, “Tim, my financial advisor doesn’t understand why you recommend this.”

I’ve been recommending energy assets for the past 5 years.

Long before we hit historic oil prices.

Everyone scoffed at oil in 2018 after the 2016 oil crash.

Until one new skeptical reader said he had a chance at 150% gains on a little-known midstream company you’ve never heard of, Antero Midstream.

Recommended oil at bottom of Covid crash… up 150% in a year!

Talking heads want to talk about the “next Amazon.” Not me.

I ignore that guff.

I look where no one else does.

When oil was trading for negative $37, I was still recommending to buy.

I called a trade that would’ve ‘set you up for life.’

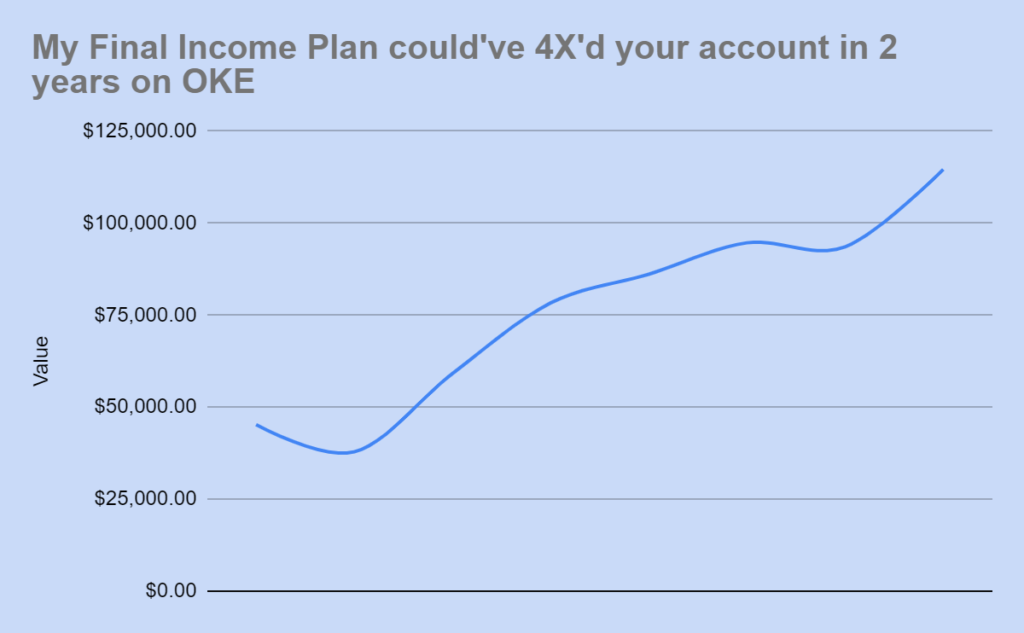

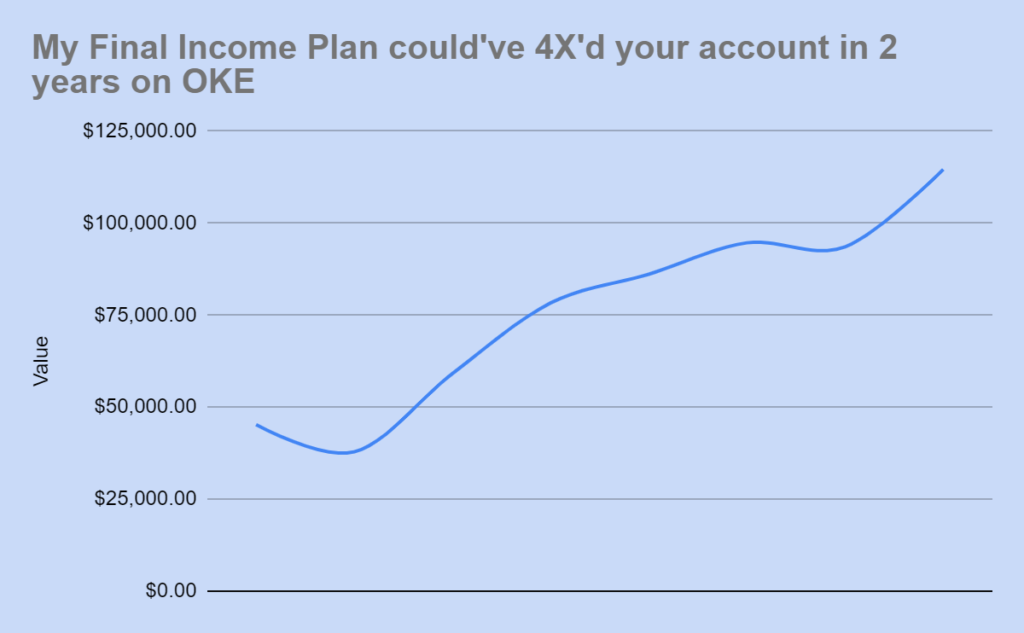

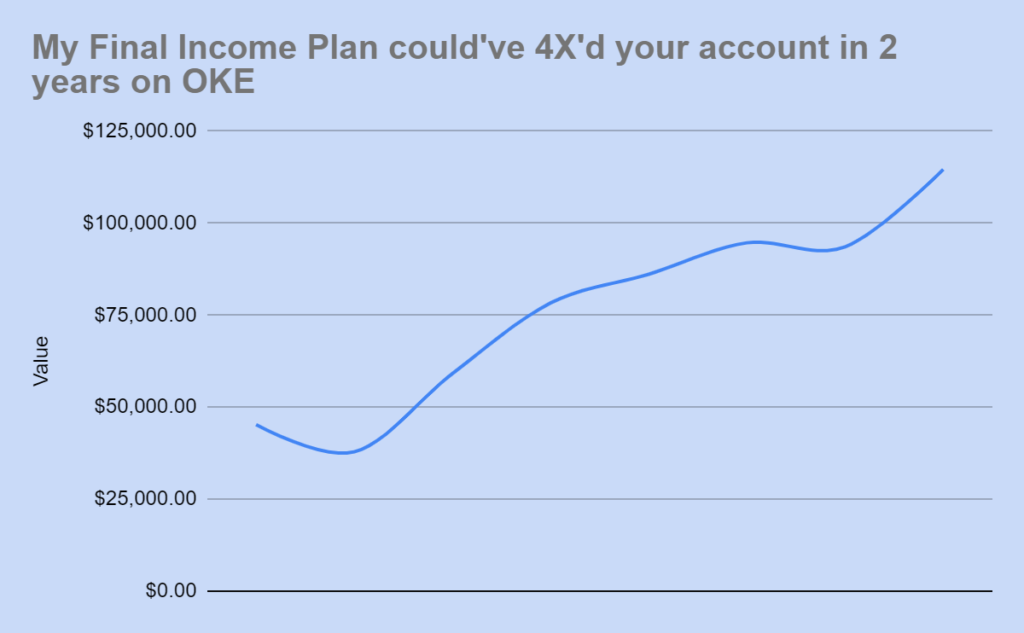

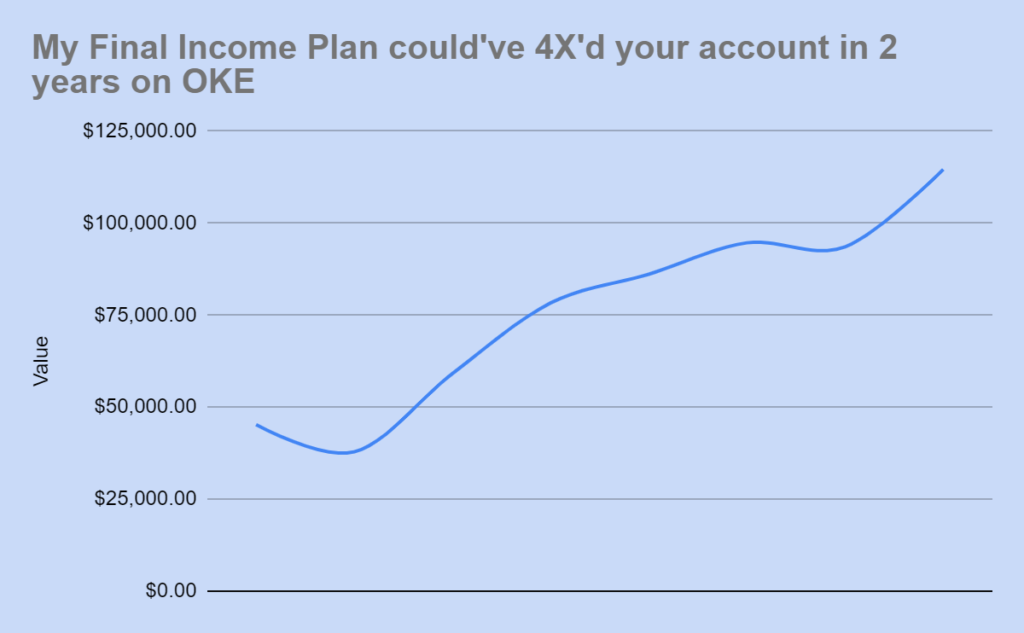

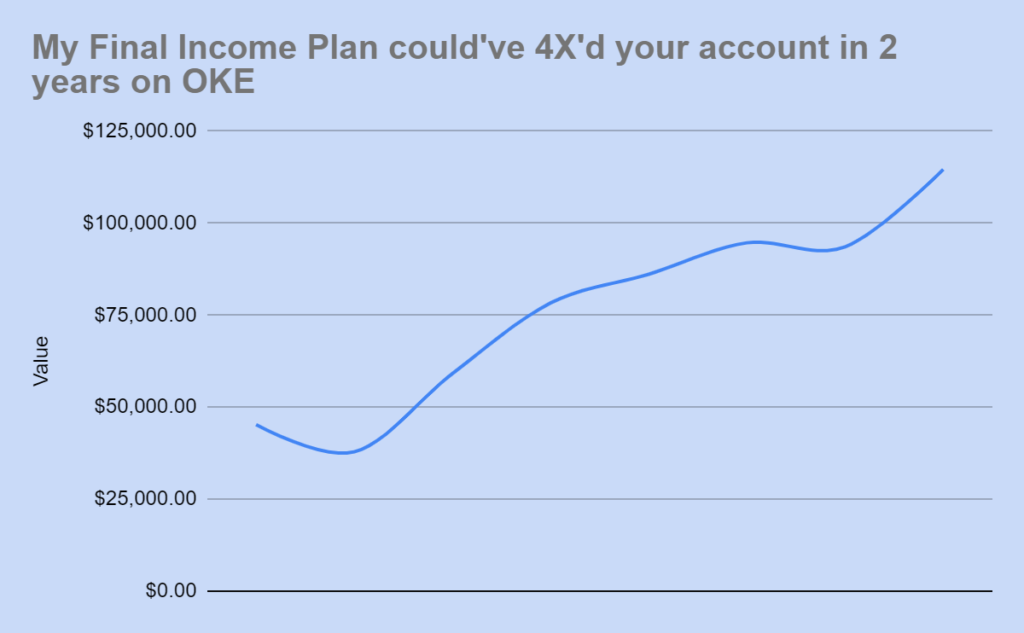

I recommended a little-known oil stock with the symbol, OKE.

Following my strategy…someone who bought OKE starting with $25k would’ve 4X’d their account in 3 years.

Even if you started with $5k, it would’ve worked just the same.

OKE is also at multi-year highs.

All the gurus recommend the riskiest tech stocks… until stocks like Peloton and Zoom collapse 80% in 6 months.

Instead, in September 2020… months after the “Covid stock bump”, I wrote about potential 100% gains in two stocks… Ralph Lauren and Tanger Outlet.

Boring to most.

I posted this… no one listened… but watch what happened

“Retail is dead… people will only buy online!” everyone claimed.

Turns out that was a bigger lie than ‘inflation is transitory.’

Ralph Lauren ended up soaring close to 100% gains… hit 88% in 7 months at its peak with a 3% dividend kicker.

But Tanger did even better…

264% gains in 8 months… and a 5% dividend income stream to boot!

My call was at the very bottom.

Both have stayed in the green while the overpriced tech names are still floundering and the stock market’s down double digits.

In fact,

86% of my main dividend recommendations have beaten the market through 2022’s crash.

Not 100% – I’ll never promise you every investment makes huge yields. You’ll always hear the good and the bad from me.

The bad today being for years you’ve been duped by CEOs collecting big bonuses while you are force-fed amazingly low yields.

Well, those days are over.

Because… through investing in my unique dividend finds… you’re about to be first in line when it comes to collecting dividends.

You don’t need to do any fancy trading. There’s no special paper to sign or using margin-debt to purchase.

Simply buy and hold the right dividend stocks that pay you first.

I like to think about dividends in this new way…

And when you start changing your thinking alongside me, you’ll realize how much future income is on the table for you and your family.

Corporate bankers and hedge fund traders make a lot of money. I’m talking up to $300k per year plus bonuses.

Most hedge funds don’t outperform the market…

So why do they get paid so much?

Simple.

They are closest to the money first. They’re the ‘bridge’ between your money going into an investment.

Meaning, as money passes through the hedge fund, they can slice the pie how they see fit. Often meaning they take heavy fees for doing sub-par work strictly because of the position they’re in.

Now, that’s a fairly on-the-nose example…

But let’s look at another example…

Real estate.

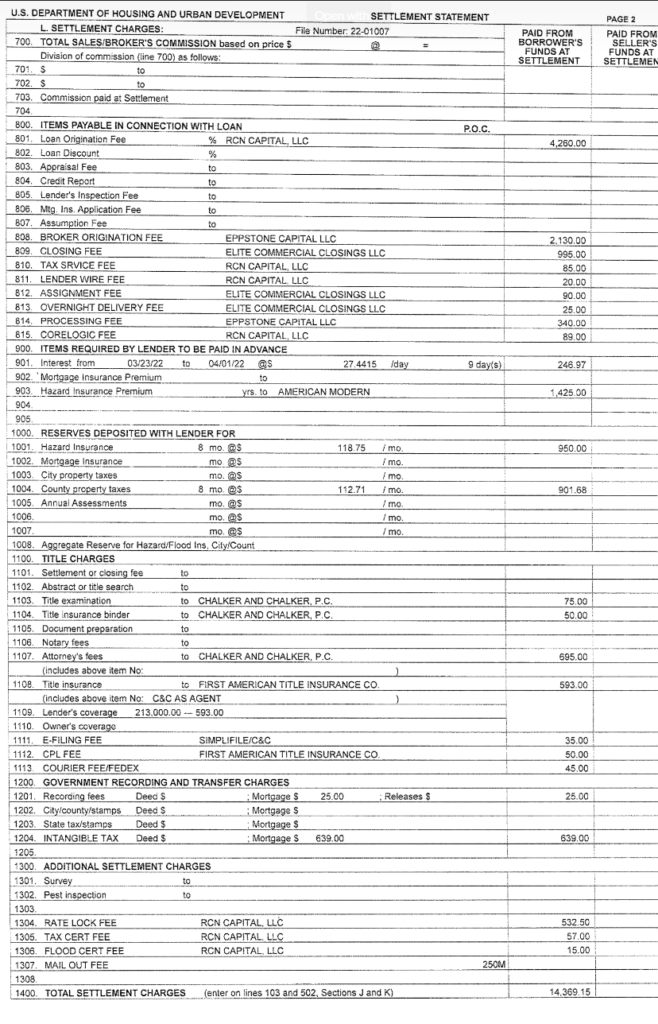

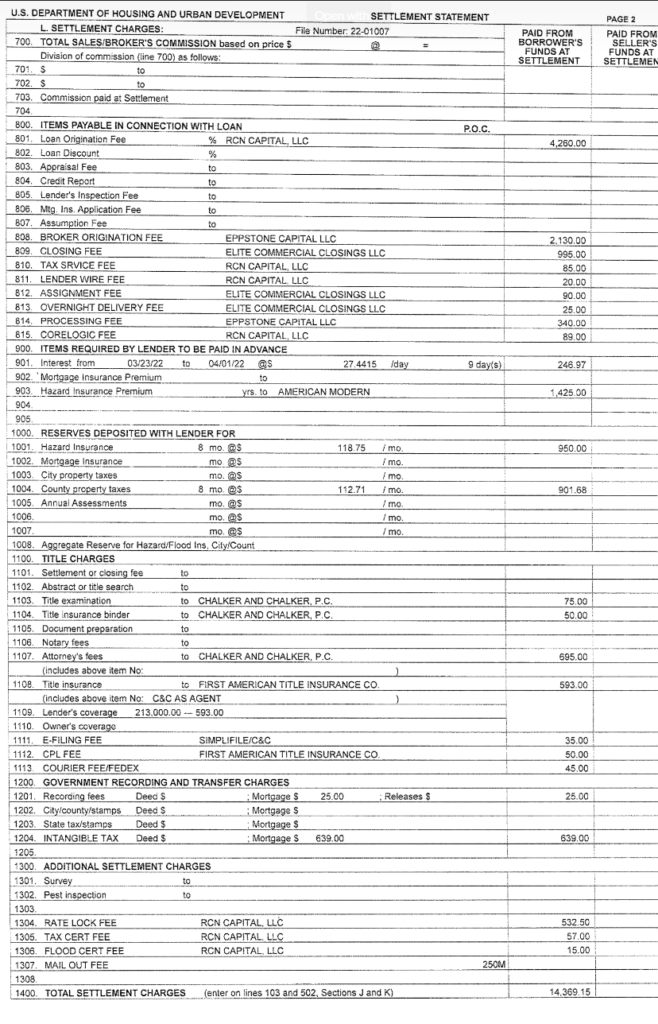

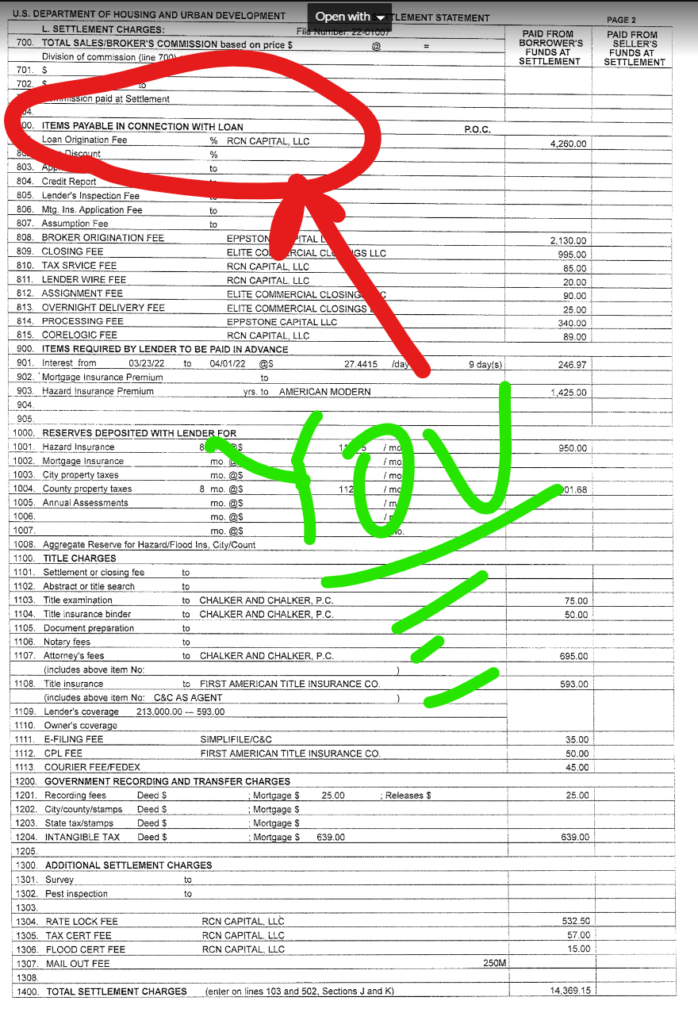

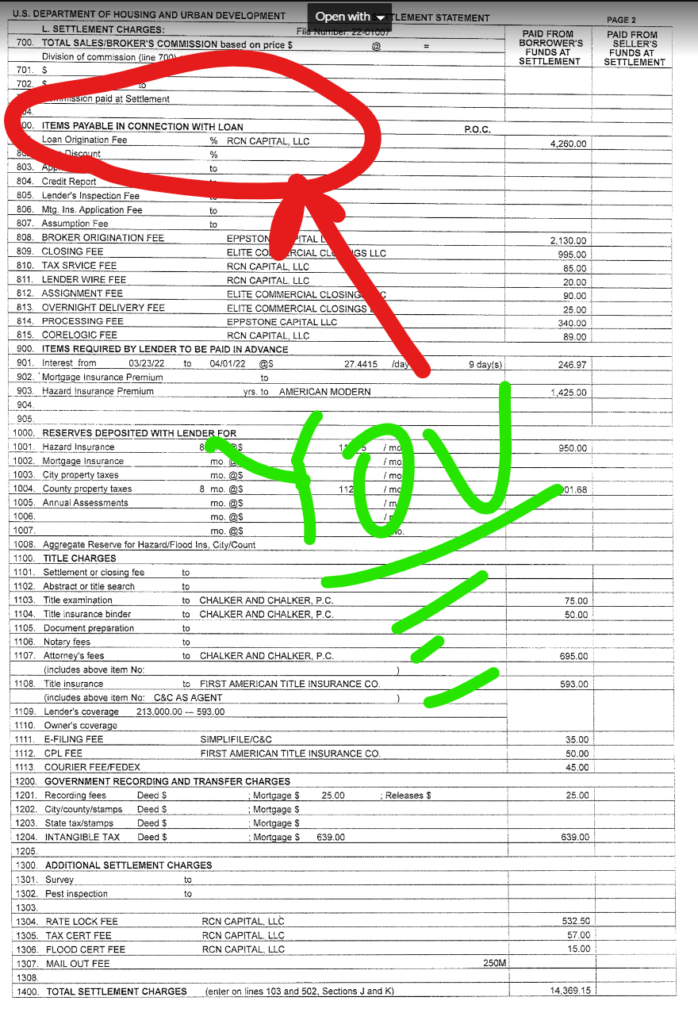

Have you ever looked at a closing document of a real estate transaction? Maybe when you refinanced your mortgage recently.

It’s actually quite the song-and-dance.

Here’s a recent closing statement from a colleague’s home refinancing.

Look closely at this one page… Because it’s a friggin’ bloodbath for him.

Before the settled cash even hits my colleague’s bank account… so many hands have already taken their share.

To the tune of thousands and thousands of dollars.

…lawyers

…broker

…title company

…insurance

…mortgage company

There’s too many to name here!

They set their prices. Sometimes you don’t even know until the closing table what fees you’ll be paying out the nose for.

The key, though, much like a stockbroker, money goes through their hands before it hits yours.

Before you get your paycheck every 2 weeks, who takes out money before it hits your account?

Of course, the dang government. They get their slice. They set the price and you pay it.

And this is the new way to invest in dividends I want to show you.

Except, you’re not receiving checks from poor souls paying income taxes…

You’re banking dividend checks from companies with huge piles of cash ready to pay you first.

…before the CEO of big corporations— YOU ARE PAID

…before the employees — YOU GET A CHECK

…before the board settles a lawsuit — YOU ARE IN THE 1st POSITION TO BE PAID

You’re receiving cash from revenue before money is frittered away with bad spending.

No longer are you stuck with crumbs.

Instead, you can get paid first before everyone in the company.

Look at Exxon again.

You don’t make a penny as an investor until someone stops by an Exxon station, pumps gas for $100/tank and that money is deposited into Exxon’s account.

That $100 is then chopped up six ways to Sunday.

Maybe you, the shareholder, end up with a few bucks… or maybe not.

You’re at the bottom here…

For the most part, you’re only paid if Exxon’s oil successfully and consistently makes it into your gas tank every year.

And that’s if Exxon decides to keep paying and believes it can be profitable.

I’m not interested in that.

Instead, I want to get paid by Exxon before the oil even gets out of the friggin’ ground.

That’s why I invest in an opportunity that is the “IRS” of gas.

A company that can charge what it wants to oil and gas companies…

For as long as they want…

To be the ‘middleman’ who gets first crack at the money.

In this case, we’re closest to the oil (something more valuable than ever)… which means we can peel off cash everytime oil moves.

We aren’t waiting for it to make its way into your gas tank.

Oil moves… we’re paid.

Oil is drilled… paid.

Even better, my stock has paid a 15.5% yield for those who followed my recommendation since the beginning and reinvested the gains.

That could grow $25k —> $7,338 total income in a short 3 years.

And that rate could double soon according to my research.

You just need to invest.

I’ll show you the company to invest in too.

We’re paid before Exxon’s fat cat board gets a penny.

You’re first.

But that’s just one opportunity.

I have many more.

Some even are backed by the government.

Let me share with you what I mean.

The Walmart example again.

The Walton clan pays you a 1.7% dividend. Their dividend can be cut tomorrow if they want.

A few ‘stable’ companies cut their dividends to zero recently:

- American Airlines

- General Motors

- Nordstrom

- Hilton

- Boeing

- Disney

Now, a few of these have clawed back to start paying out paltry dividends again…

But the point is —> your dividends, however low they are, can be here and gone tomorrow.

These are household names too. Disney, for darn’s sakes. Name a kid who can’t name a single Disney character. Impossible. Yet, even Disney isn’t immune to taking dividends out of your pocket.

Dividends you rely on for retirement.

Meanwhile…

In some instances, dividend companies I recommend are required by LAW to pay you.

Walmart can cut their 1.7% dividend.

My small business play? The one that’s generated a 101% yield over time for us…

They are required by Title 1 of HR 7554 to pay you cash. Some even pay out every month if that doesn’t make it even sweeter.

This company generates their cash in an easy way…

They get small businesses off the ground. When that new restaurant in town needs capital to jumpstart their launch, my company helps.

When a retail store is ready to sell their newest fashion designs, my company believes in the American Dream and getting those dreams started.

Here’s the kicker…

YOU get paid before

…employees

…suppliers

…even the landlord takes a backseat to you

You could be like every other dividend investor.

You buy stock in the actual business…. wait until the business sells an item, pays their staff, rent, interest on their loans… and finally pays you the scraps at the end.

Or…

Get paid at the top of the heap. And receive even more than other dividend investors!

It’s pretty neat and lowers the risk, I’d say.

I have a stock that does all that and more.

Plus, they’re required to pay you dividends.

Mine pays me monthly like clockwork. Have owned it since 2014. I will buy and hold it forever. This stock is strong and I don’t see it slowing.

If that ‘government required’ dividend sounds great…

I have one more to share with you.

I showed you my colleagues’ closing statement on a mortgage.

Well… what if you could get a cut of millions of mortgages at signing?

Before they receive the funds to pay for the home of their dreams… you’re paid!

You’re line item #1 on the closing statement. That’s you.

Rather than buying a popular homebuilder stock, like D.R. Horton…

A stock that will yield you a measly 1.2% dividend… and doesn’t hold up well during a downturn in real estate.

Like when it took 11 years to get back to break-even after the Great Recession…

You can’t risk chasing a stock like that, especially as real estate prices are out of control (as you know).

Instead, my dividend payer is collecting cash no matter if real estate prices go up or down.

We’re also protected because the government REQUIRES you receive your dividends per an SEC Bulletin dating back to the 1960s.

This is another dividend ‘buy and hold forever’ stock I’ve had in my own portfolio since 2017.

The returns are phenomenal…

And the company is still producing consistent cash flow.

This stock is one of the favorites for my readers… and it could become one of yours as well.

So far, we’ve generated a phenomenal 126.8% yield over time with this stock.

That number will keep going up.

But

You must follow 3 steps right now to

start seeing record yields

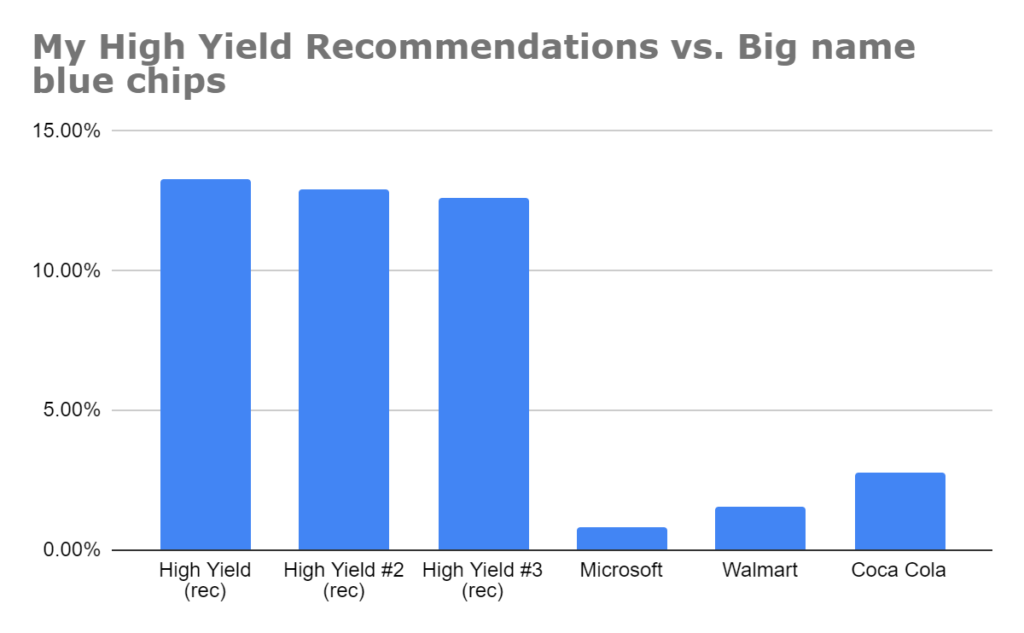

1. Invest in high-yield dividend stocks

The only way to start generating income this quickly is with high-yield dividend stocks.

High yields are little-known dividend companies that can pay out massive dividends every single year.

That’s way more than most big name stocks.

Some even pay them monthly.

If you start off yielding a simple 13%…

You have $200,000… you’re automatically collecting $26,000 per year in income.

That’s $260,000 in income over the next 10 years…

$2,166 per month.

Imagine a $2,166 check hitting your inbox every single month.

That’s 50% more than Social Security…

You can pay for the grocery bills, electricity, gas as it goes up.

It’s cash you get to keep.

In retirement, the ones who can weather a storm are those with cash. Cash is King.

All those “bitcoin millionaires” bragging about their gains in 2021… an asset that made $0 in income…

All wiped out.

Same with all the high-growth, no-profit growth stocks.

You can’t spend capital gains in retirement.

Try and take your 401k balance to the doctor’s office and see if that will buy your medicine. It won’t.

“Wait, Tim, how are you generating 38.5% or even 101% yields?”

Easy:

2. Use my simple compounding strategy to quickly explode your yield

This strategy is automatic, you can click a button right in your portfolio.

Then… sit back and watch your yield rapidly advance.

There’s no wild trading or additional capital necessary.

But, it’s important you know exactly what buttons to hit in your account, and I’ll share those with you in my special, free report.

Once you put this compounding strategy to work…

You’ll see the yields go from their normal 8-10%…

To 101%+ yields in just a few years.

I’ll happily show you the way.

However, you need to invest in the right high-yield stocks…

That’s why I’m only looking for ones that do one thing really well:

3. High-yield stocks must have a strong backing to keep paying their dividend (and potentially increasing it)

You’ve likely heard some things about high-yields in the past:

… ‘the dividends are only high for short time, then they get cut”

… ‘these stocks don’t go up in value”

… ‘these companies are junk and use dividends to lure in bad investors.’

Let me share an honest truth with you:

All these concerns are 100% valid.

There are many high-yields who only have high dividends for a short time — maybe the price dropped or management pumped up dividends to lure in investors.

Many high-yield stocks don’t go up in value a ton.

However, when you find the right high-yield stocks, you can buy and hold them forever, collect steady dividends, and increase your yields fast.

And that’s the opportunity I’m ready to show you.

Many high-yields are on the cusp of exploding their dividend payouts in the next 6-12 months.

When Covid hit, some of my high-yield stocks cut their dividends down. Not to zero… but the cuts did hurt.

Well, many of my plays are on the rebound…

Many have NOT reached their prior dividend levels.

I have confidence they will as I study the SEC filings and earnings reports… I look for strong backing they will keep paying their dividends. (remember, that was step #3).

If I still see that potential, I have confidence we will retreat back to pre-2020 dividend levels.

In fact, my #1 real estate stock… the one who pays you first for every mortgage…is still 50% below the 2019 dividend.

That is a huge arbitrage opportunity for you.

You could potentially see a 100% raise in the next 12 months.

For example, if you buy this stock now and generate $10,000…

anything!

And it’s there for taking.

I want to share this stock with you, plus the 2 others I’ve already teased inside my brand-new special report, The 101% Yield Club.

But this isn’t just a report about 3 opportunities.

I want to detail out my entire retirement strategy to generate income.

In fact, inside, you’ll discover:

- My #1 strategy to quickly compound income every single month.

- 4 types of income assets I’m putting 100% of my 401k into at the money

- A 36-month plan that can pay your bills for life in retirement

These steps help you grow your yields fast…

But also learn:

- 2 must-have qualities before I even consider a high-yield dividend stock.

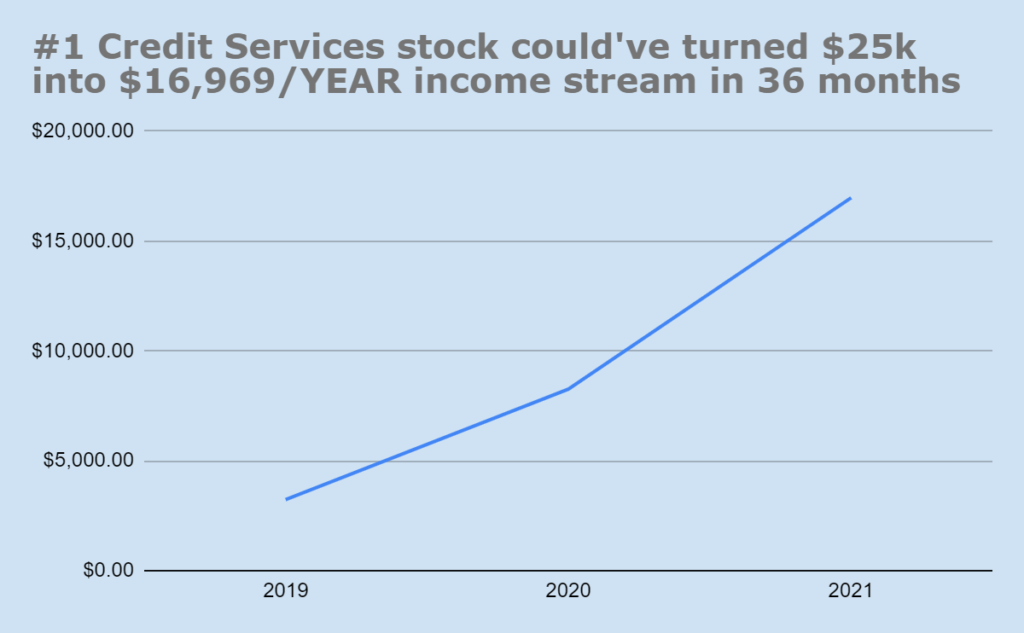

- Step by step strategy to generate $16,969/income starting with a $25,000 portfolio

- #1 strategy to automatically boost the size of your dividend checks without lifting a finger

- How I (personally) am doubling my income stream every two years in 6 simple steps

- 4 steps to building wealth for yourself and the next generation (without clipping coupons)

[BONUS] Generate huge YIELDS around your house WITHOUT any stocks!

- The goldmine website online to generate $100… $200… even $500 bucks in a single weekend

- The $100’s of dollars stashed in your car (you just need to know where to look)

- Items around your house that buyers fall over themselves to pay you for

- A “cleansweep” trick that could bring $60-$100 to light in one evening

- The one call to your bank that could add a surprise $1,000 in your savings account this year

Most importantly, to collect huge yields I also include:

- 3 dividend stocks to buy and hold for lifetime income

My top 3 stocks are ones you’ve never heard of.

Much like no one had heard of OKE…

Before it could’ve 4X’d for someone who followed my plan:

Or, Antero Midstream…

As it skyrocketed 150% from the lows.

Get my top 3 high yield dividend stocks to buy and hold forever inside The 101% Yield Club

- HUGE YIELDER #1: A 9% dividend payer has already returned 68% of my basis to me just in dividends! This stock gives out loans and buys property in the commercial space. They’re one of the most secure high-yield plays I’ve ever seen. Their profits have doubled in the last 12 months.

- HUGE YIELDER #2: A top mortgage stock that’s been one of the best performers in Dividend Hunter history. I’ve received 100% of my principal back just in dividends from my initial recommendation. The dividend pulled back during the Covid bust… and now is the time to jump in and potentially see a 100% dividend jump soon.

- HUGE YIELDER #3: A company investing in small businesses which make up the backbone of America. I’ve received 54% of my principal back… plus have seen 29% capital gains from my initial recommendation. This is my subscribers most popular stock. This company has returned 3X to other small business investing stocks. Dividends are up 97% from IPO… and already back to pre-covid dividend levels.

That anyone who bought one of my top 3 stocks when I recommended now has a cost basis of nearly $0 with at least one of the stocks..

Meaning, you would essentially have recouped your entire investment. Any capital gains or income from here would be an unlimited risk-free return on your money.

Risk-free returns… imagine that.

Not only that, I’ll show you how to think about allocation for your portfolio, when to buy, when to sell and more.

The 101% Yield Club is a manual you’ll refer back to again and again.

You can start generating 101% yields with as little as $25,000.

There’s no limit to how much you can invest.

These are not illiquid opportunities. You can invest all your cash if you wish, but I don’t recommend it.

But that’s only the beginning.

Because you can then turn all that newfound money into potentially thousands, tens of thousands, even hundreds of thousands when you compound the money.

You only need to start with $25,000, and you aren’t timing the market to sell.

You could start with more than $25,000… like one of my readers, R.C., who has over $262k in these plays.

One of my readers, R.G. sent me this screenshot putting over $262k into these dividend stocks

Biggest piece to start besides a plan… is the stock to kick off your portfolio.

Inside, I share 3 stocks I myself buy and plan to hold forever.

But these can’t make up the bulk of your holdings.

High-yield dividend stocks need to be tracked and monitored regularly to make sure the dividend is stable.

I’m reading daily about my companies. I’m talking about SEC filings, listening to earnings calls, maybe connecting with a fund manager at times…

To create a portfolio that continually throws off dividends every single month for life.

Eventually, you could collect up to 5 dividends per week like I do.

Or, even quickly grow your income from just $25k like one of my stocks did.

However, it takes time… and effort.

It’s not a fully passive job for me.

But it could be for you.

See, in order to start collecting huge yields from everywhere, you need to have the right stocks in your portfolio.

Right now, there are currently 4,178 dividend stocks in existence.

You need to trim that list down to about 10-20 great names.

I can show you the exact names to put in.

The actual portfolio you need access to is only in one place on the internet.

I do all this high-yield research inside a special subscription service that goes for a very, very low price.

It’s a service that keeps you on top of your monthly dividend income without any of the work.

If you’re retired or near retirement, this dividend service is a must as you move from investing in more high-risk stocks gunning for capital gains…

And searching for more predictable cash flow you can spend or reinvest as you need.

The secret to a high monthly income without doing research yourself is my newsletter, The Dividend Hunter.

My 101% Yield Club manual I shared is included with The Dividend Hunter.

All I ask in return is you join my flagship dividend newsletter, read by 20,000+ paying members called The Dividend Hunter.

Our goal is simple = Create monthly dividend income that pays your bills for life.

There’s content every single week about our stocks and beginner dividend investing lessons.

Here’s what you get as a risk-free member of The Dividend Hunter:

- 12 months of issues where I update our positions, provide dividend investing tips, economic outlooks and more. These hit your inbox in the first week of the month.

- Model portfolio of 34+ high-yield, low risk stocks: All vetted by me personally and I invest my own money into many of them.

- 101% Yield Club: The most important book on the market for generating a ton of income! This is the blueprint for generating cash to pay your bills in retirement each month.

- *FREE UPGRADE #1* Weekly Mailbag: Every week, I release a recorded video answering the most pressing questions of the week. Maybe about our portfolio, the stock market, gold, and more.

- *FREE UPGRADE #2* Weekly Buy Recommendations: When one of our stocks goes on sale, you have a shot at buying shares a nice discount. I’ll tell you which stock is on sale.

- *FREE UPGRADE #3* New member orientation webinar: Every other month, all new Dividend Hunter subscribers are invited to an orientation. It’s 100% optional. I show you how to navigate the Dividend Hunter portal, where to see which stocks to buy first, common start-up questions, and more.

- 12-Month Money Back Policy: You have a full 12 months to try out the service. If you don’t like it, get a refund for the subscription fee at any point.

This is a full $1,000 worth of value here…

But you’ll receive a huge discount in just a moment.

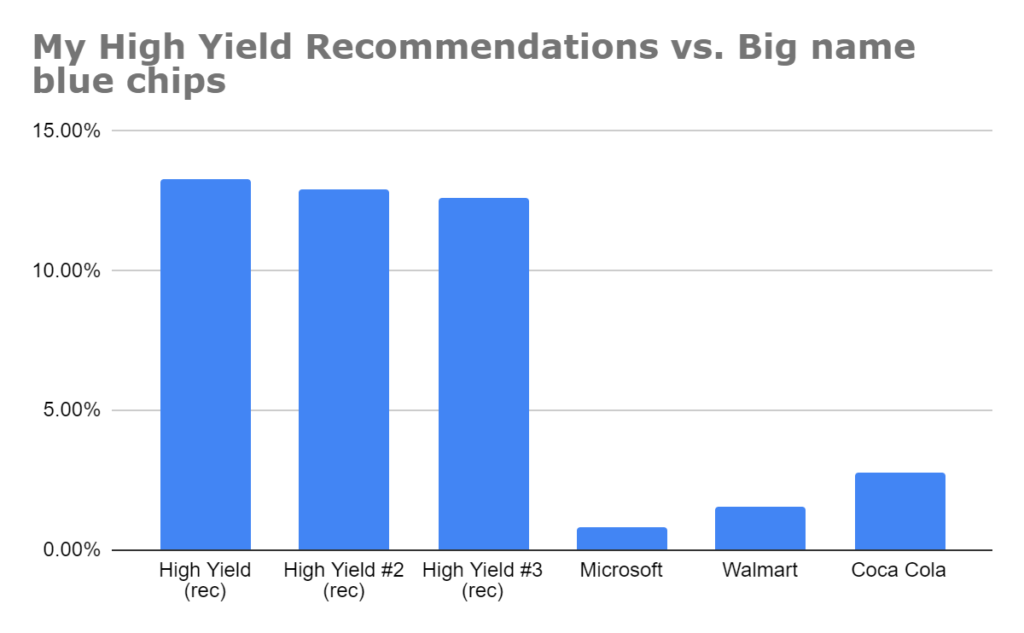

When you compare to normal, “blue chip” dividend stocks… The Dividend Hunter outstrips the dividend yield by a long shot.

It’s time to start collecting high monthly cash today.

Like I said, 20,000+ folks like yourself are already in The Dividend Hunter.

Majority, I’d estimate, are retired or fairly close to retirement.

What they’ve said about me has been flattering:

However, for joining today… I want you to get paid even faster!

Here’s a free bonus:

What if I could get you EVEN HIGHER up the ladder to be paid dividends?

I bet you didn’t know when you buy a dividend stock, other shareholders get paid before you.

I know… this never ends. Everyone seems to be ahead of us.

Well… what if you could get to the very top of the pile and collect your dividends BEFORE every other shareholder?

“You First” shareholders receive theirs first. And they’re GUARANTEED to do so.

Because that’s the contract you agree to when you buy these special shares. The company can’t cut the dividend on you before common shareholders.

During 2020, common shareholders saw their dividends slashed overnight. Not “YOU First” holders.

In 2020 Covid hit.

Markets crash in March.

Investors are panicking.

Other ‘editors’ close up their newsletter.

I’m holding free emergency briefings with my subscribers sharing different scenarios.

And I made a bold, bold call.

I moved all our stocks into a specialized, mystery ‘dividend’ class most don’t know exist.

If you had these stocks in your own portfolio, you would’ve been saved.

Every stock was smacked in March 2020.

My high-yield picks were no different. It hurt.

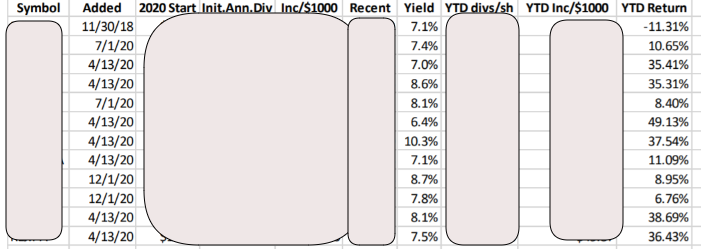

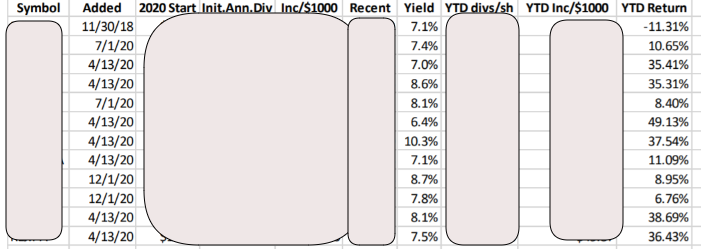

However, I started advising people to move their dry powder into these “YOU First” dividends and the results in 2020 were incredible.

The boldest call of my career in 2020 saved portfolios…

the hypothetical returns were huge.

See how we added many on April 13, 2020.

Check out how these stocks did by the end of December.

Some are 37%… 49%… another 38%… 36%…

But notice the yields too.

Up to 10.3% on top of your capital gains.

We want steady returns and that is what “YOU First” dividends bring.

It was a major move I recommended for readers and backtesting shows it paid off in spades. Because I’m not here to passively recommend high-yield monthly income to you.

I’m here to do the heavy lifting so YOU can passively put your money in and know I’m working for you.

(Of course, I can’t promise future performance.)

I’ll tell you everything in this special “YOU First” bonus report.

I have up to 11 of these amazing plays in The Dividend Hunter model portfolio. It’s all waiting for you.

Join me inside right now.

This is the Best Deal You’ll Find on The Dividend Hunter ANYWHERE

I’m giving you $1,000 of value…

The normal retail rate is $99/year for The Dividend Hunter.

That’s pretty good for 34+ stocks, all the bonuses, Weekly Mailbag, Buy of the Week, and more.

However, today, you can grab a 1-year subscription of everything for a mere $79.

$79 right now to unlock monthly income for life.

That’s just $0.13 per day.

Getting set up takes just a few minutes…

You could be collecting monthly checks like clockwork for a mere $79.

That’s the price of dinner and wine for two people..

It’s not that much.

And I could charge 10X this amount.

If you’re ready to join 20,000+ others, click the “Join Now” button right now. On the next page, you can claim your spot inside.

After you join, you’ll receive information on logging into the portal at InvestorsAlley.com.

All the stocks you’re looking for are right in there.

This is a complete resource for generating monthly income from simple buying-and-holding stocks.

There’s no trading, options, or timing the market.

We’re not shooting for capital gains, they’re just extra.

100% of my own personal 401k is in Dividend Hunter stocks!

My year-over-year income growth is 50%!

I am not someone who writes about stocks for fun.

I send you recommendations I myself am considering.

100% of my 401k is in Dividend Hunter investments.

This is part of the reason I collect 70 dividend checks per quarter… or 5 per week.

You know your co-pilot during your retirement isn’t some fancy-talking suit.

It’s someone like you building a retirement.

That’s what you can expect inside The Dividend Hunter. So join now.

You could join for 364 days… and still claim a refund.

You can even KEEP my 101% Yield Club book I shared today as a gift for trying out the service.

You don’t need to consume all the content. You may just want the stock picks. That’s fine.

Or, you may be ready to buy stocks and learn more about our high-yield plays. There’s a ton for everyone.

Join me now.

Income piles up quickly inside The Dividend Hunter.

The dividend checks do as well to keep income coming in.

And I’ll include one more bonus:

Last Bonus:

Tim Plaehn’s “Dividend Trade of the Decade”

On May 6, 2020, I recommended my first ever “Trade of the Decade.”

The stock?

EnLink Midstream. An oil play.

This is when oil was hitting -$30 a barrel.

I said go big on ENLC at $1.77. It paid an impossible 20% dividend at the time.

As you know, oil didn’t stay beat down.

It hit prices not seen in a decade.

ENLC skyrocketed 546% in 2 years.

Even better, you’d be enjoying essentially a 24% dividend on your cost basis of $1.77 as the dividend went up 22% in that 24 months.

That’s a play you could retire on.

A $250,000 portfolio would be generating $60,000 in dividend income per year!

Well, there’s another opportunity now.

But, if you want to accelerate your income with my Plan…

I have another “Dividend Trade of the Decade” recommendation.

It’s a stock that’s currently paying 12%+ yields and has been beaten down (much like ENLC was).

The stock’s in the tech field which has its share of bruises.

The company has raised its dividends for the past 9 years, including a 50% dividend bump since Covid.

This company is funding the biggest ideas coming out of Silicon Valley in industries worth a combined $5 trillion…

You and I cannot invest in early seed rounds, they’re simply not open to the general public.

But this stock opens up a 100% legal “backdoor”… Silicon Valley’s top startups rolled into one income stock.

Their list of portfolio companies is a who’s who in tech…

- 23andMe

- DocuSign

- Lyft

- Evernote

Partners like Goldman Sachs and Google Ventures…

This dividend tech stock has…$1 Billion of potential deals lined up.

This is a “Dividend Trade of the Decade” and I’ll give it as a bonus alongside my “101% Yield Club” plays.

Click the button below to start.

You’ll be taken to a private and secure page to enter your information to claim your special reports, the stocks and your Dividend Hunter subscription, plus everything I listed above.

This is the most important decision for your retirement you may make.

And it’s only going to cost $79. That’s a small price to pay to dramatically transform how you invest in dividends.

Stop getting paid last!

Get paid first… the new way:

Huge yields lay ahead for you.

Click the button below, you’ll then have just one more click to access everything in the next few minutes,

Thank you,

Tim Plaehn

Editor of The Dividend Hunter

P.S. On the next page, I also have 4 more bonuses to share with you. One of them is access to my monthly dividend calendar. It tells you when to own a stock to collect your dividend.. Another is a special software to track your dividends. Click the button above now.