Even the World’s Largest Retailer Only Grew 1.8% Last Year

Don’t Settle for Chump Change When You Can…

Fast Track Your Retirement Income

With “Diamond Dividends”

And Potentially Increase Your Income by

108% in Only 7 Months

No trading… no options… just buy and collect!

Dear Reader,

More people are retiring earlier than ever before.

Business Insider says…

“America’s new retirement age is 62 – or younger.”

And the Pew Research Center reports over half of the 55+ population is already kicking back in comfort.

But I know it’s possible to do it even faster than that.

You probably think this seems too good to be true.

It might even sound downright impossible with everything that’s happening right now.

Prices are going through the roof, wages can’t keep up with inflation, and some people are tapping into their savings just to stay afloat.

I wouldn’t be surprised if you don’t believe me.

That’s why I’m going to show the proof so you can decide for yourself.

Because the fact is I’ve seen folks retire as young as 38.

(I’ll explain how in just a second.)

Gone are the days of working your fingers to the bone just for a slim shot at freedom later in life.

Your perfect retirement could be just around the corner much faster than you think.

All you need is the right strategy.

“Diamond Dividends” could be the most important discovery for millions of Americans planning to retire in the next few years (or those already retired)…

By putting more income into your bank account each month…

While also creating a nest egg so big you can’t spend it all…

Without having to constantly make risky trades.

The “Holy Grail” combination of rising dividends and fast stock appreciation makes this completely different from anything available in the market.

Would you like to collect 32%, 55%, and even 108% more income starting today?

You can, just like Joe.

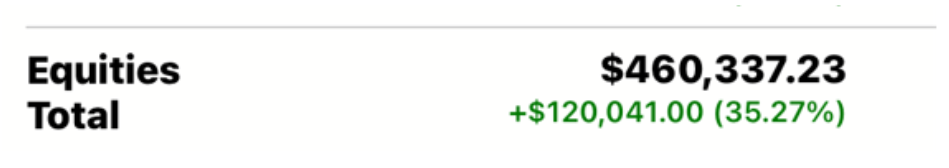

He recently sent me this screenshot of his bank balance.

Three years ago he got laid off without any notice.

To make matters worse, he was neck deep in medical bills and taking care of his wife too.

He started investing in “Diamond Dividends” after seeing the incredible potential and hasn’t looked back since.

Joe isn’t the only person joining the “retirement revolution.”

Don from New York lost all his income when the insurance company canceled his disability benefits, but he says he’s built a healthy nest egg and is set for life after only 9 months.

And then there’s Glen who now spends his days doing volunteer work.

“In 2019, I found Tim Plaehn, and now I’m more confident than ever that by the time I turn 67, I’ll be okay. I won’t have to worry anymore.“

Now I can’t promise your results will be exactly the same as Joe, Don, or Glen.

What I can do is show you the incredible potential for “Diamond Dividends” to change your life.

This powerful strategy can quickly increase both your income and wealth together at the same time.

Set it up once and you don’t need to do anything else.

Simply “set and forget” and your dream retirement could become a reality in just a few, short years from today.

There’s only one catch…

“Diamond Dividends” Are Extremely Difficult to Uncover

You won’t see them on the front page of The Wall Street Journal, Bloomberg, or CNN.

Just like real diamonds, you have to dig deep to find them.

But when you do, boy oh boy is it worth it.

Just one or two “Diamond Dividends” are enough for you to join the thousands of retirees already living their days stress-free.

Imagine your new life tomorrow…

Hitting a personal best on a PGA Tour golf course…

Going on vacation with your family and friends…

Life is a lot easier when you have more money than you can spend.

… Take up a new hobby

… Travel the world

… Spend time with your grandkids

Do the things you want to do for the rest of your life.

There are two ways to make this happen.

The first:

Continue with the same old investments you’ve always used in the past and pray for a miracle.

Unfortunately, traditional strategies leave a lot to be desired.

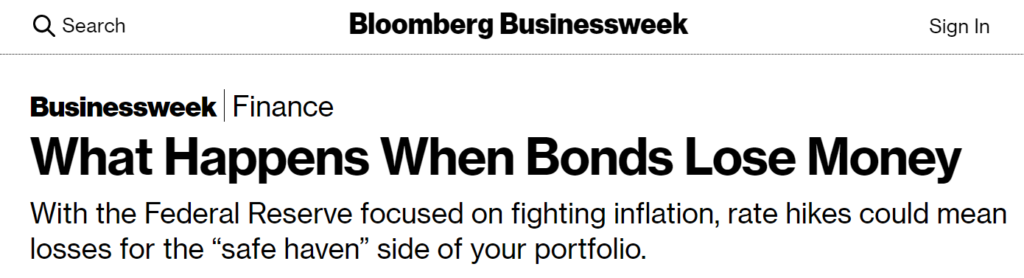

Say you want to play it safe with government bonds.

Inflation would like a quick word with you…

This so-called “safe play” could now start losing you money.

It’s not surprising since 10-year treasury notes only pay a measly 1.9%.

Or maybe you want to swing for the fences on a high risk, high reward play like options.

Simply blink at the wrong time and you could end up losing everything.

Planning for retirement doesn’t need to be so difficult.

Especially when there’s a better way.

Today I’ll show you a brand new strategy which breaks all the rules of investing…

One that grows both your income and portfolio together in one shot…

And puts more money in your pocket without trading multiple times every day.

After burning the midnight oil to find out everything about “Diamond Dividends”, I’ve developed 3 key criteria every stock must pass in order to make the cut.

Using this checklist turns the process from finding a needle in a haystack into…

A repeatable system that works in any market.

Record high levels of inflation?

Doesn’t matter.

Volatile market conditions?

Still works like a charm.

But unless you know specifically what to look for, you’ll always be fumbling around in the dark like a miner without a torch.

Don’t worry, I’ll give you the complete checklist in just a moment…

And show you exactly how to use it…

Because choosing the wrong stocks could delay your retirement by 5, 10, or even 20 years.

How to Spot “Second Rate” Dividend Stocks

(And Stop Sabotaging Your Retirement!)

Dividend stocks are a great way to receive regular income payments.

I don’t think anyone would disagree.

However, most people only know about the “dime a dozen” companies in the mainstream media.

You see, the question you should be asking isn’t whether you’re getting paid or not…

But what amount you’ll actually receive…

And how much money you’re losing out on.

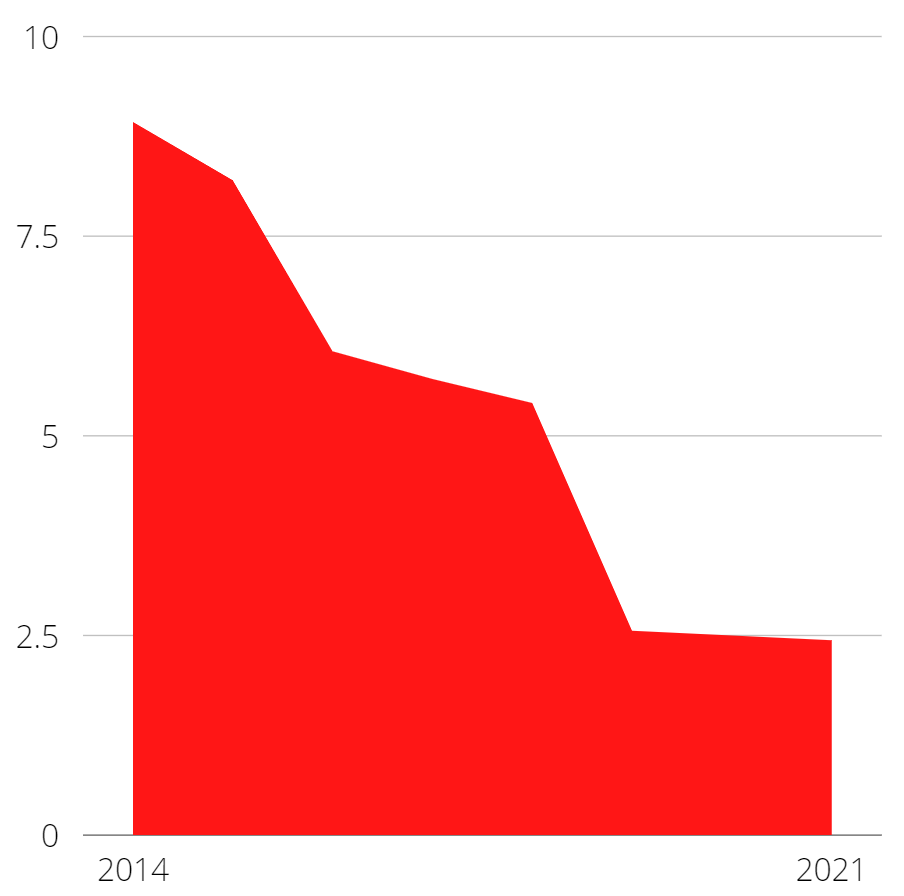

Take Buffett’s favorite drink company Coca-Cola (KO) for example.

Look closely at this chart showing the dividend’s year-on-year change.

It’s been decreasing for the last 8 years in a row.

Meanwhile, the income for one of my “Diamond Dividends” in the realty sector grew 150% in just 2 years!

Why are the results so different?

Simply put, some stocks always hand out the same dividends.

The amount never changes.

On the other hand…

“Diamond Dividends” continually pay you an increasing amount every month…

At the same time the stock also grows in value.

Compare this to a “buy low and sell high” strategy where you only get a shot at profits when the stock price increases.

Or a traditional dividend strategy where you’re limited to fixed amounts.

What if there was a way to double your chances and get the best of both worlds?

“Diamond Dividends” Are Unlike Anything You’ve Seen Before

Enjoy increasingly higher payouts and passively grow your income every month…

While also taking advantage of rising stock prices to expand your portfolio in your sleep…

Without spending all day glued to the computer checking the markets.

The goal is to make more while doing less.

Take my realty play for example.

The share price jumped 12% during the same period as the dividends grew by 150%.

This “double dipping” method makes rising dividend stocks extremely powerful by growing both your income and wealth in a single hit.

Opportunities like this are rarer than hen’s teeth.

But don’t go diving in head first just yet.

It’s important to understand that not all rising dividends are the same.

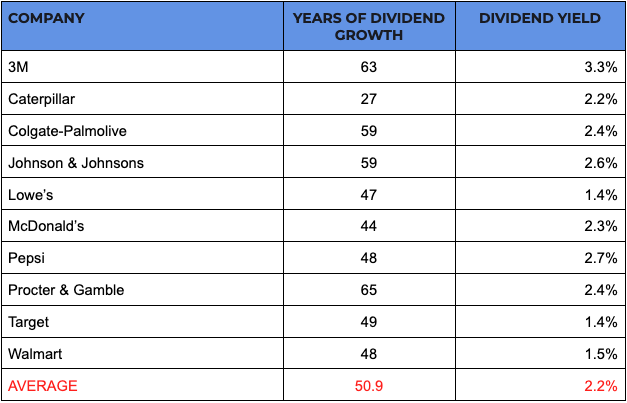

Look at the “S&P 500 Dividend Aristocrats” to see what I mean.

These stocks are famous for handing out increasing dividends every year.

But on average you’re only looking at yields of 1-3%.

It’s not much better when you look at the dividend growth rate.

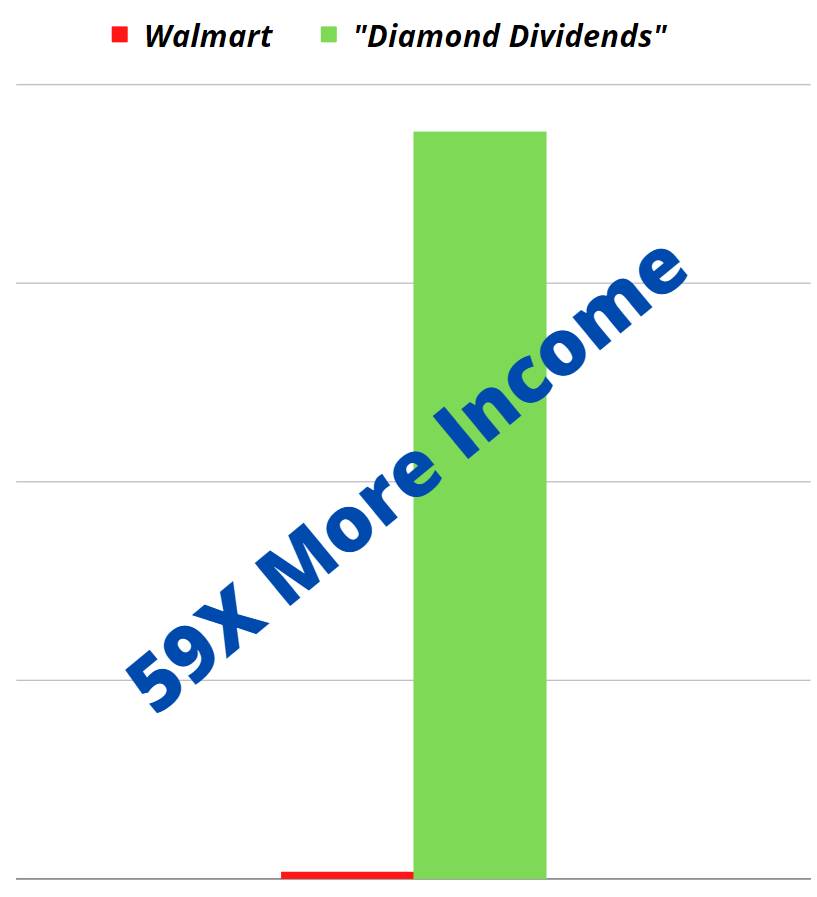

Walmart raised its dividends by a microscopic 1.8% last year.

Colgate did slightly better with 4.4%

Even Pepsi only managed a lackluster 5.4%.

Yawn.

If boring single-digit growth like this is enough to satisfy you then be my guest.

However, if you’re looking to accelerate your retirement…

And want to start enjoying your dream life sooner…

You’ll love the breakneck growth of “Diamond Dividends”…

- 32% in 2 years in the biopharmaceutics industry

- 55% in 3 years on a storage facility investment

- And 108% in 7 months in the accommodation sector!

By following along with my strategy and investing in the accommodation play when I recommended it…

You could have turned an income of $10,000 into $20,800 in just over half a year.

Don’t forget that once the system is set up then it grows your money for you by itself.

You don’t need to constantly scour the market for “hidden signals”…

Squint at migraine-inducing financial reports for hours on end…

Or mindlessly stare at spreadsheets until you pass out.

Creating the retirement you’ve always wanted has never been easier.

I’ve been trading the markets for 30 years and have never seen anything as fast and powerful as “Diamond Dividends.”

Finally, here’s a way to put more money in your pocket every month…

Up to 108% more income in only 7 months…

While also growing your portfolio at the same time.

I’ll go through how “Diamond Dividends” work in just a second…

And also give you my top three picks so you can get started today…

First allow me to briefly introduce myself…

My Friends Call Me “R.V.”

Hi, my name is Tim Plaehn, and my life has been a wild ride.

After studying mathematics and joining the U.S. Air Force as an F-16 fighter jet pilot…(almost dying on multiple occasions)…

I’ve been a licensed financial advisor and traded as a professional stockbroker…

And now I’m the Chief Retirement Income Strategist at Investors Alley.

I’ve appeared as a guest speaker on MoneyShow, rubbed shoulders with big wigs on Wall Street, and attended closed door events with wealth managers at Charles Schwab.

But these days my colleagues jokingly call me “R.V.” because I prefer driving across the country and exploring the great outdoors.

![]()

At the end of the day I’m just a regular guy who loves my dog, RV, and whiskey.

As I get older, I want to spend my days doing what I love, not the things I have to do.

I don’t want to be in a financial situation where I’m forced to work forever.

I want to retire on my terms.

That’s why I use safe, reliable investments which consistently pay me without daily micro-management.

Dividends tick all the boxes.

You’re already familiar with my work as the editor of The Dividend Hunter.

Some of our recent wins include 11.2% on USA, 12.6% on QYLD, and 13.4% on SLVO.

These are all fantastic dividends which will keep paying you steady paychecks every month like clockwork.

It’s part of the reason why I have 20,000+ happy subscribers just like you.

Today I want to take things a step further and show you how to really supercharge your income.

Based on backtesting, if you had used my “Diamond Dividend” strategy then theoretically…

Your portfolio’s growth rate could have increased 21.49% in 2020…

And skyrocketed by 47.11% in 2021.

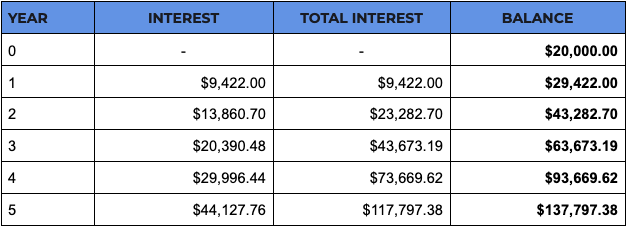

Just say you have an income of $20,000 a year.

By following the “Diamond Dividend” strategy to the letter using my current rate of growth, you could have hypothetically collected $29,422 instead.

What if you want more?

Say your goal is $40,000 to retire comfortably.

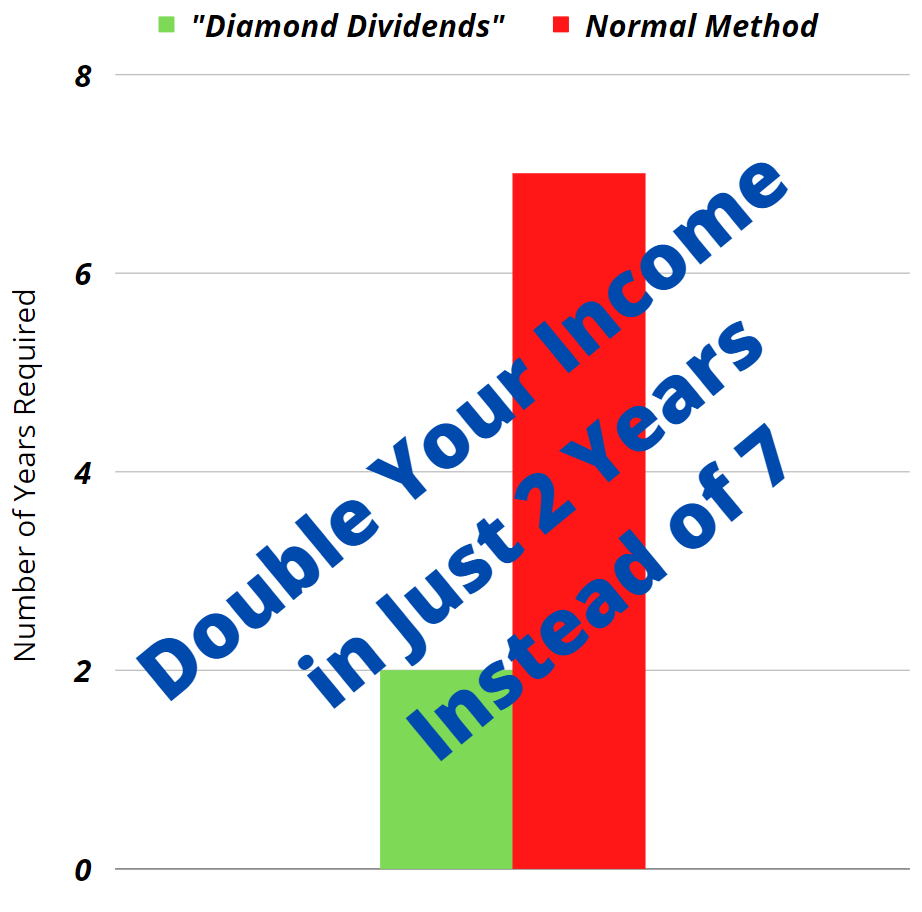

Normally it takes about 7 years at an average return of 10% per annum to double your balance.

At the rate of 47.11% you would have smashed that target in only 2 years.

And if you still want more?

Simply set things up once and the “Diamond Dividends” will keep growing your portfolio for you without any additional work.

Here’s a sample calculation based on my current growth rate to show you the life-changing potential of this strategy.

Potentially 5X an income of $20,000 into more than $100,000 in just 5 years.

Remember, this is money you can start spending immediately.

Enjoy dinners out at fancy restaurants.

Treat your family and friends too.

Buy that new car you’ve been eyeing but haven’t pulled the trigger on yet.

To be perfectly clear, I’m not saying you’re guaranteed to see continuous growth of 47.11% every year.

These numbers simply show you what is possible and doesn’t mean you’ll make exactly the same results.

But even if the rate of return is slightly different, one thing is always the same…

The “Diamond Dividend” system keeps on working for you by itself once you’ve set it up.

You don’t even need to add money to your account.

This strategy is all about doing less work, not more.

In fact, you’re halfway there with your current dividend portfolio.

Continue using the high-yield dividend strategies from The Dividend Hunter to generate steady income just like you’re already doing.

Simply add “Diamond Dividends” to the mix and watch them quickly grow your existing investments all on its own.

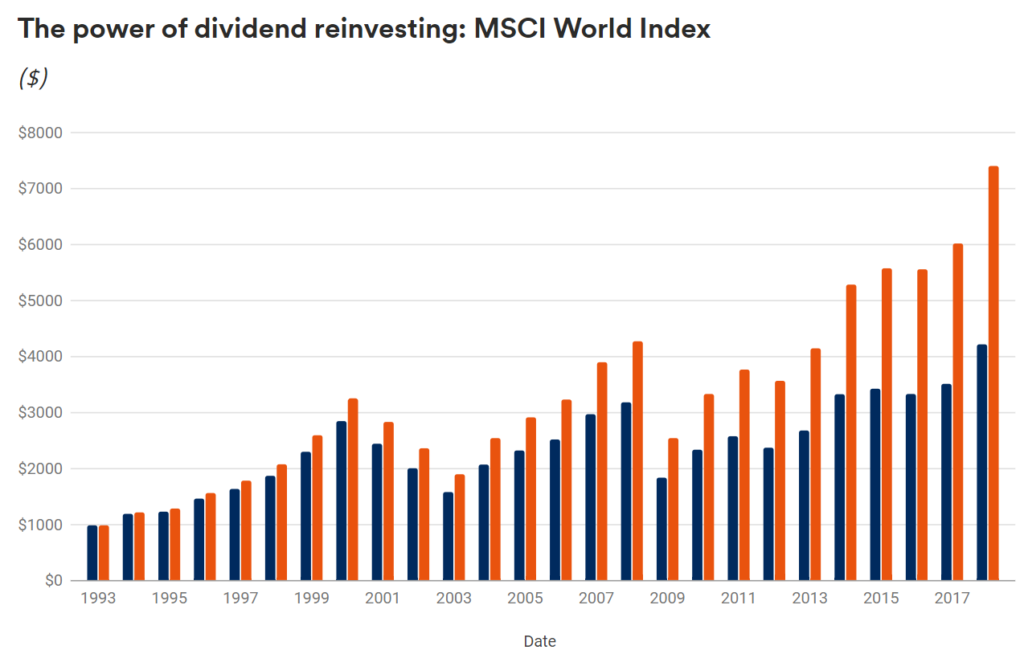

Einstein said “compound interest is the eighth wonder of the world.”

Let compound interest work its magic for you with dividend reinvesting.

The blue bars represent normal returns.The orange bars show how much more you could receive from compound interest by reinvesting dividends.

“Diamond Dividends” make it easy to grow your income and portfolio so you can put up your feet earlier.

Joe retired from his engineering career at 38.

Jason now lives abroad thanks to his rising dividend portfolio.

Now I’m not saying you’ll achieve the same results as Joe or any of my own readers.

Remember, there are no guarantees when it comes to investing.

I’ve definitely made some wrong calls myself.

- -1.55% on an asset management company

- -4.17% on the public utilities industry

- -8.36% on a financial play

However, these losses pale in significance when compared to my winners that grew their dividends by 32%, 55%, and 108%.

There’s never been a simpler way to fund your retirement while you sleep.

My readers certainly agree.

“I see that same phenomenon with Tim’s way of investing. My money is working for me all the time — growing in capital gains and dividends growing then reinvested. I’m recycling my money over and over and it’s growing.”

– Glen

“Thanks for what you do, my account balance hasn’t looked this good ever.”

– Brad

These results are all possible because of one simple reason…

“Diamond Dividends” Can Fast Track Your Retirement With 59X More Income in Just 7 Months

“Diamond Dividends” are truly one of a kind.

I don’t know any other investment which can grow both your dividends and stock value at such lightning fast speeds.

You don’t even have to make any trades or add money to your account.

The same thing happened again with my real estate stock specializing in self-storage properties.

Dividends jumped by over 57%, while the share price gained 13% in 2 years.

And then there’s my home run in the accommodation sector.

108% higher dividends and a 50% bump in stock value after only 7 months.

Imagine increasing your income from $20,000 to $41,600 in just over half a year…

While also growing your portfolio by 50%…

Without making any trades.

That’s enough to buy a brand new Chevrolet Trailblazer.

The goal of “Diamond Dividends” is to make more money for you with as little work as possible.

(Like getting the equivalent of a free car in less than a year.)

Compare this to an “off the rack” dividend stock like Walmart.

During the same 7 month period, the retail giant’s dividends rose by a pitiful 1.8%.

Your $20,000 would have made a measly $360.

That wouldn’t even cover the cost of replacing a set of wheels.

Investing in “Diamond Dividends” instead of Walmart could have resulted in 59X more income in just 7 months!

Now of course I can’t guarantee you’ll increase your income by 108% in 7 months.

I’m simply showing you the powerful potential of this strategy within a very short period.

These aren’t your single-digit growth rates from “lame duck” dividends handed out by mainstream companies.

The outsized returns from “Diamond Dividends” can make the difference between a run-of-the-mill retirement where you have to cut out coupons in order to make ends meet…

Or living life on your own terms.

Like Lenae who is on her way to potentially retiring within the next 5 years.

“I especially appreciate your honesty and knowing that you occasionally invest in a dud and will admit it to all; it makes you human and your programs credible… I’m just an average Jane who grew up dirt poor on a dairy farm in ND and worked my tail off to get to where I am now, and if I can do it anyone can.”

Don’t forget that this approach is completely hands off once you’ve set everything up.

You don’t need to constantly check your investments every single minute.

You don’t need to worry about timing the market.

You don’t need to repeatedly make trades all day long and wear yourself out.

Simply do the things you want to do and your money will keep growing passively for you.

Jim says…

“Thanks for everything you do, and I know my kids appreciate you also. But they just do not know it yet. You are doing an excellent job.”

How can you join Jim, and thousands of others in this new “retirement revolution?”

Follow This “Diamond Dividend Checklist” and You’ll Never Have to Worry About Money Again

Rising dividend stocks are one of the most powerful investment tools available in your arsenal.

It’s like the difference between using a cannon or a water pistol.

Simply use this 3-step checklist to find your next “Diamond Dividend” pronto.

- Long Term Sustainable Operations

Everybody knows a company must be profitable in order to pay dividends.

But only companies with long term sustainable operations can afford to continually hand out rising dividends.

Look for long term plays which you can potentially sit on for years.

This strategy is all about collecting more money while doing nothing.

(Not frantic short term trading.)

Factors to consider include:

- How much cash flow is coming in?

- Is the company in the middle of a temporary boom or will it be viable for years to come?

- Is the cash balance increasing every year?

The last thing you want to do is fill your portfolio with “firecrackers” — companies which make a quick bang and then fizzle out overnight.

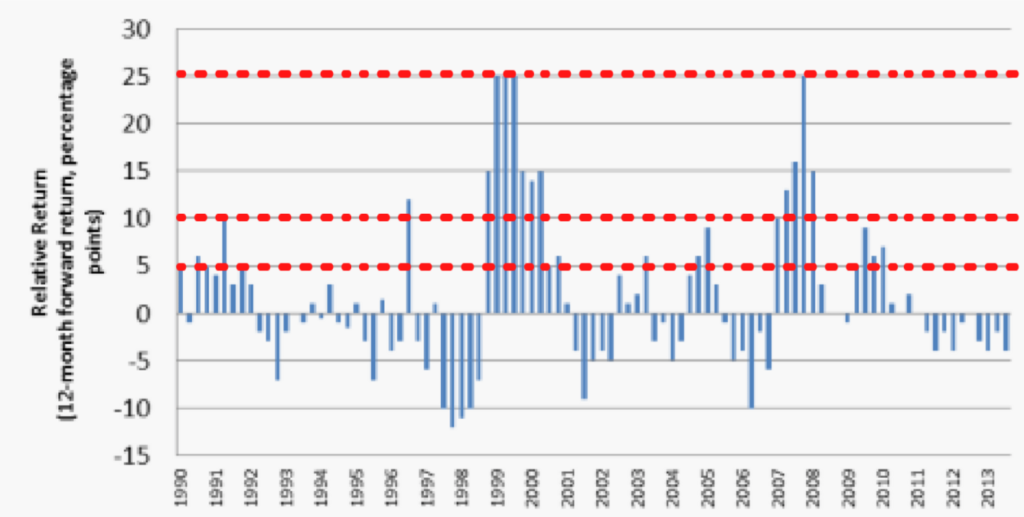

- Compare Relative Returns

All investments come with an opportunity cost.

If you buy stock A then you’re forgoing stock B.

Understanding relative returns is an important part of maximizing your growth.

Take a look at this chart from an analysis by Morgan Stanley.

The bars above the zero line show how much dividend stocks outperformed non-dividend paying stocks over a 23-year span.

You’ll see a consistent trend of higher relative returns by 5%, 10%, and even 25%.

That’s because companies which pay dividends have stronger balance sheets and focus on growing cash flow.

But not all rising dividend stocks are the same.

How much risk are you willing to accept?

Everybody’s situation is different.

Compare the relative returns across various industries to determine the risk versus reward profile that best suits your financial goals.

Because you never want to put all your eggs into one basket…

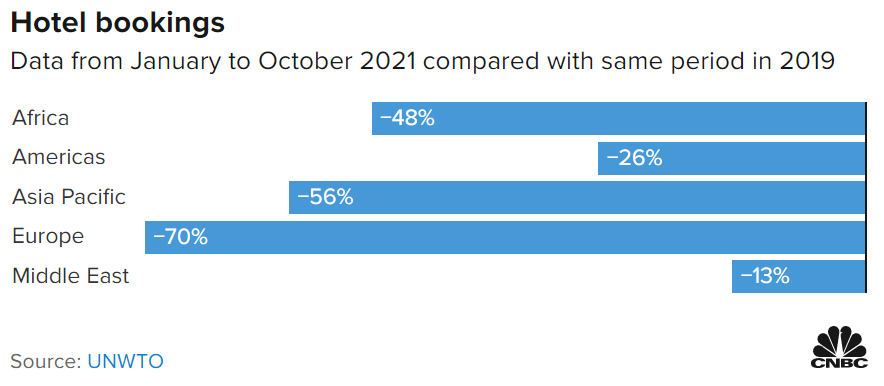

- Look at More Than Just the Financials

Choosing the right industry is critical for this strategy to work.

That’s why I spend so much time researching the market and understanding macro trends.

Say you found a company whose dividends rose by 45% over a 2 year period while the stock price was also trending upwards.

Sounds good on paper, right?

The next thing you know, the entire world has shut down and everyone is staying at home.

Fast forward to today and this company has stopped paying out dividends completely.

If you had bought into Marriott then you’d be left hanging out to dry right now.

Will the hotel industry recover?

Nobody knows.

But I’m not willing to risk my retirement on a “maybe.”

The worldwide hotel industry has been losing money for the last two years in a row.

Now of course finding “Diamond Dividends” involves a bit more digging than what I’ve just mentioned.

Every stock must pass my rigorous “profitability stress test” or else it gets tossed out with the trash.

While there are plenty of dividend stocks growing at a single-digit pace…

Simply “okay” results aren’t good enough for my readers…

So I only recommend stocks that I believe will help people retire in as little as a few years.

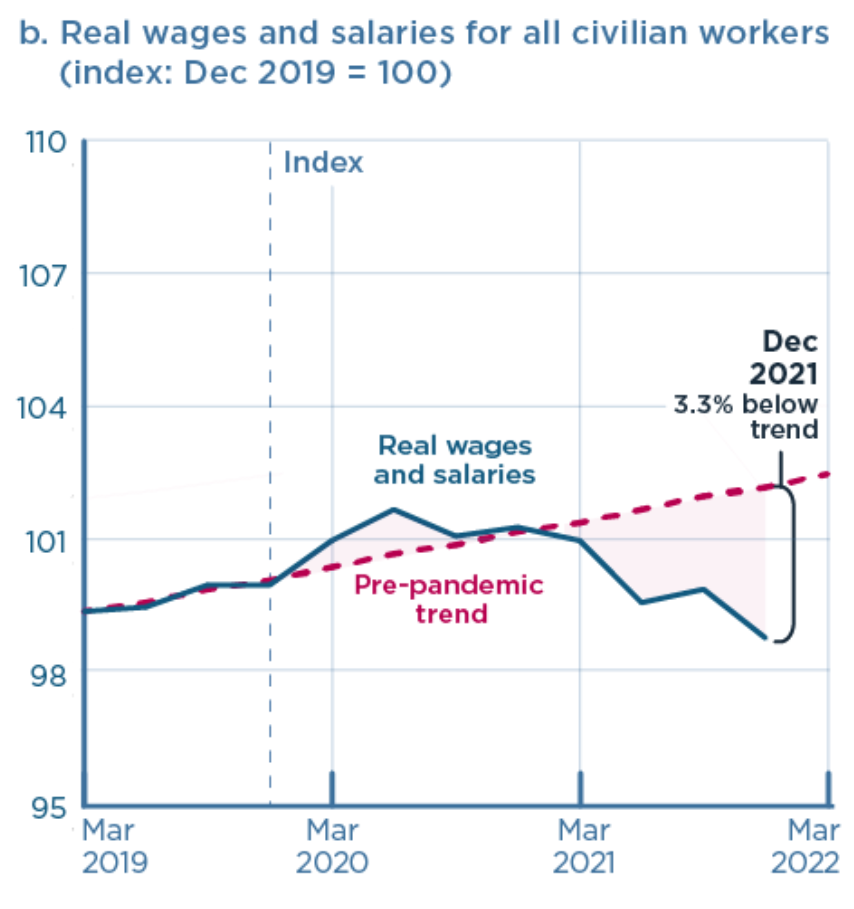

The Top 3 Reasons Why I Recommend Rising Dividend Stocks

You deserve the best of the best when it comes to rising dividend stocks.

Don’t make the mistake of buying “beginner traps” like Walmart.

Dividends rose by 1.8% since last year while the stock only crept up 0.39%.

No, that’s not a typo.

Less than a 1% rise over 12 months.

Meanwhile, real wages have effectively dropped 3.3%.

While technically both the dividends and the stock price did rise, you still would have lost money due to inflation.

Like I said earlier, you shouldn’t have to settle for scraps.

Especially when it’s something as important as your retirement fund because investing in the wrong stock is expensive.

It’s not just the fees you should be worried about, I’m talking about the opportunity cost.

Instead of buying Walmart…

If you had bought just one of the picks in my “Diamond Dividend” strategy…

#1: Rising Dividend Stocks Could Have Increased Both Your Income and Portfolio by Over 445%

Imagine hitting your retirement goal 4 times faster.

Imagine saying goodbye to your job in 1 year instead of four.

Imagine being able to do whatever you want in 12 months from today.

And this isn’t just a short term strategy…

#2: Rising Dividend Stocks Make More Money for You Over Time

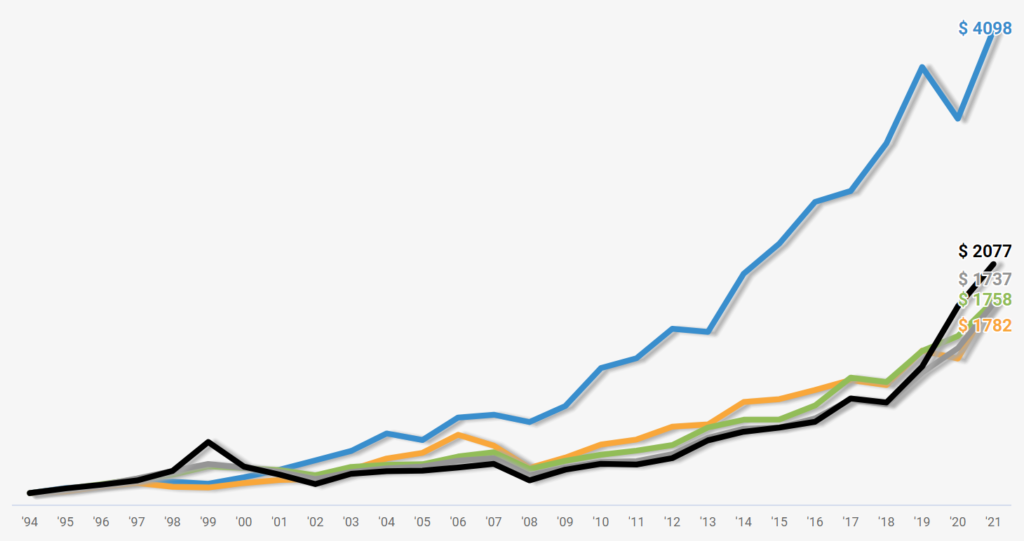

This chart shows how investing $100 in a rising dividend stock compares to the major stock indices.

Blue: Rising dividend stock

Gray: S&P 500

Black: NASDAQ

Green: Dow Jones

Your original investment could have increased 40 times in value.

That’s twice as much as the S&P 500’s results over the same period.

Imagine doubling your money without doing any additional work.

The difference between a nest egg of $500,000 or a $1 million can completely change your life.

Choose the right investment from the get-go and you could be kicking up your feet and playing with your grandkids next year.

But making the wrong choice could delay your retirement and force you to keep working for many more years to come.

That’s time you’ll never get back.

If you’re not investing in rising dividends then you could be missing out on a lot more than just money.

#3: Rising Dividend Stocks Protect You Against an Uncertain Future

The price of everything is going up.

Gas, groceries, and even housing have all been hit hard with no end in sight.

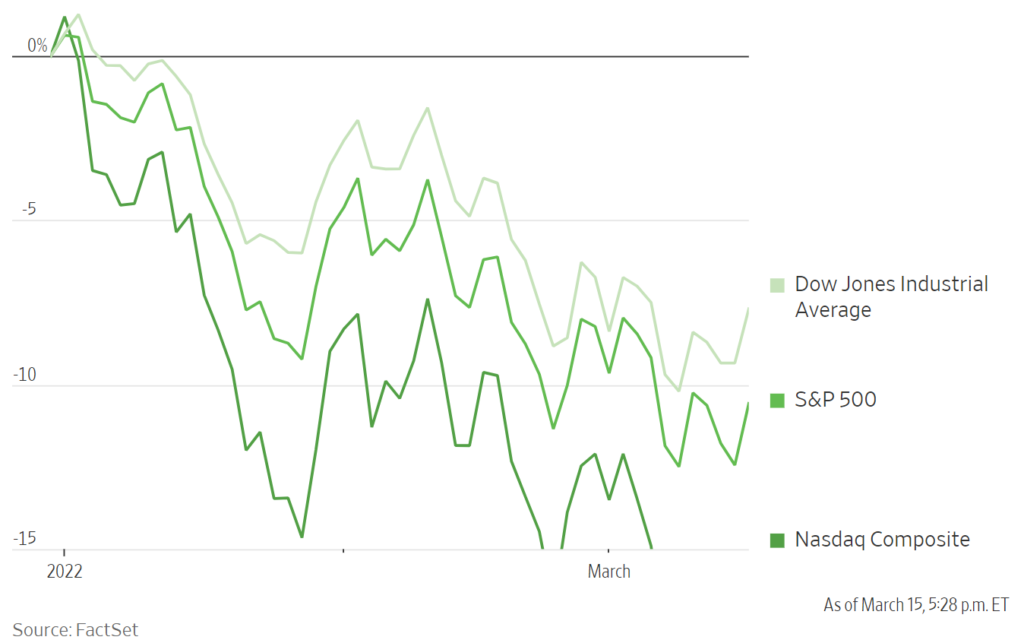

Now the Fed has started increasing interest rates for the first time in more than three years as well.

It’s no wonder confidence in the market is so badly shaken.

Both the S&P 500 and the Nasdaq had their worst January this year in over a decade.

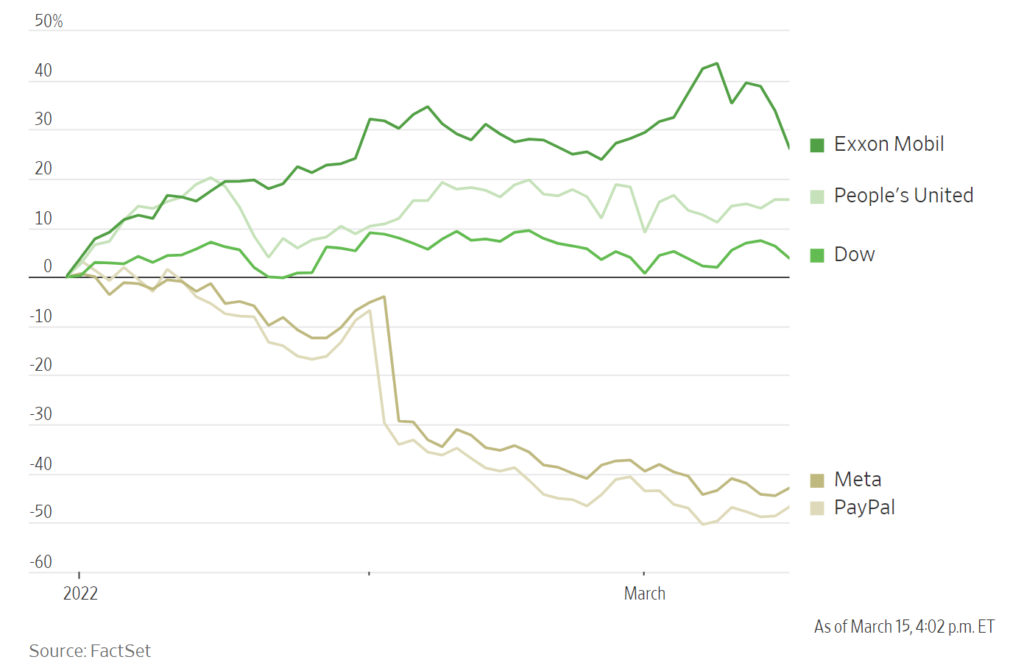

Investors are pulling out their money fast but where are they putting it instead?

Yep, you guessed it — dividend stocks.

It’s no surprise when you see how dividend payers are performing versus non-payers.

Non-dividend paying tech stocks have lost their charm and investors are piling into “boring” dividend stocks.

The reason is simple: these companies have the staying power to survive through chaotic markets while still paying out dividends for years.

Obviously I don’t have a crystal ball and can’t predict the future.

Call me boring but I’d rather play it safe than lose everything on a crapshoot.

I want “money in the hand” so that I can enjoy my life instead of constantly worrying if it’ll all turn into fairy dust tomorrow.

That’s why I can confidently recommend rising dividend stocks.

Now I don’t just talk the talk.

Unlike other so-called “gurus” who don’t have any skin in the game…

I invest alongside you using the exact same picks and strategy…

And the results are off the chart.

If you had followed my “Diamond Dividend” strategy exactly as I laid it out then hypothetically…

Your portfolio could have increased its growth rate by 21.49% in 2020…

And in 2021 it could have jumped by a whopping 47.11%…

Without making a single trade.

Now that’s what I call maximum return for minimum effort.

However, it’s important to understand that past performance doesn’t represent what will happen in the future.

I can’t guarantee you’ll see exactly the same results.

But I do know that the “traditional” method of socking away money for retirement just doesn’t work anymore in 2022.

The last thing I want to do is keep working until my back breaks.

I want to drive on the open roads with my dog.

I want to enjoy my life in comfort.

And most of all, I want to make it happen as quickly as possible.

As I promised earlier, I’m going to give you my top three “Diamond Dividends” today.

Simply buy these stocks to watch your bank account and portfolio grow on its own.

You’ll find all the ticker symbols, yields, and extensive research inside…

“The Forever Retirement Portfolio Report”

Hit the ground running with my top three “Diamond Dividends” already vetted for you.

I dive deep into each company’s background, market cap, competition, cash flow, growth strategy, development plans, as well as statistics, charts, and graphs about anything you could ever want to know.

Here’s a sneak peek of what you’ll find inside…

First is my real estate play.

This stock is a REIT, meaning it doesn’t have to pay corporate income taxes.

In addition, at least 90% of net income must be handed out to shareholders as dividends.

This company is one of America’s largest owners and operators of self-storage facilities, which is a very recession-resistant market.

In 2015, it started with around 220 properties…

But today, it holds over 1,000 self-storage properties located in 42 states with approximately 67.8 million rentable square feet.

Since I first recommended this stock, shares have returned 107% or 14.6% compounded annually.

You can expect this stock to provide increasing returns for many years to come.

Next up is my oil play.

This company has operations across Oklahoma, Texas, and the Rocky Mountains.

Over the last few years it’s made acquisitions worth over $13 billion and cash flow has improved by 781.6% since last year.

Revenue, net income, and total assets are all up over the last 12 months as well.

Its products are used by businesses all over the world and demand is continually increasing.

The outstanding financials make this a must buy for investors seeking long term growth.

But mouth watering as this stock sounds, I’ve got one for you that’s even better…

My third pick focuses on electricity.

I’ve saved the best for last.

This company is the world leader in terms of electricity generated from the sun and wind.

Revenue, net income, and assets have all increased every year since 2013 with a current market cap of $156 billion.

The EPS and DPS growth rates are approximately 80% and 150% higher compared to the S&P 500.

Improvements in wind and solar technology will continue to further drive down costs and improve profits.

The forward-thinking business approach makes this a great stock you can simply buy and hold forever.

I couldn’t believe my eyes when I first discovered this “sleeper.”

This isn’t a diamond in the rough.

This is the real deal, the finest example of a “Diamond Dividend” I’ve ever seen.

All the details are laid out for you inside the special report.

Everything is summarized in an easy-to-understand format.

Simply click “buy” to watch your income and wealth grow before your eyes.

This is the easiest way to put more money in your account today without any extra work.

You don’t need to do hours of boring research.

You don’t need to take unnecessary risks on unproven stocks.

Best of all, you don’t need to wait long to see returns.

The dividends for my energy play grew 664% in just 12 months as the stock soared 150%!

And that’s just one of the “Diamond Dividends” included inside the report.

Tim S. and his wife used this same strategy to retire and relocate to their dream home in Spain.

“We went all-in on Tim’s (Plaehn’s) recommendations. [He] has been an incredible resource for us.”

So have many of my other readers too.

R.Y. works as a family physician.

But her job is extremely busy so she used to hire a money manager.

Unfortunately she told me she went through 5 different “professionals” and still ended up with “mediocre results and high fees.”

That’s why she started using “Diamond Dividends” on her own because of the amazing growth potential and hands off approach.

Now she uses this strategy to also fast track her husband’s retirement and her children are onboard too.

This report takes all the guesswork out of how to secure your first “Diamond Dividend.”

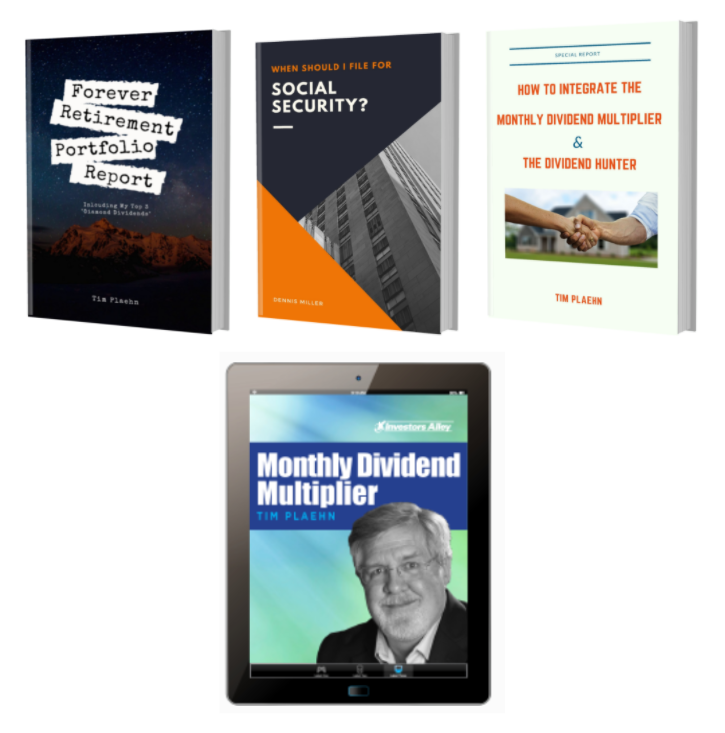

Today you can get instant access to “The Forever Retirement Portfolio Report”…

Together with another special report…

“When Should I File For Social Security?”

You’ve worked hard all your life and now it’s time to collect Social Security.

After all, you’ve earned every penny.

The burning question for many people is “how do I get the highest amount possible?”

Unfortunately it isn’t so clear cut.

There’s no “one size fits all” answer.

That’s why I asked Dennis Miller to help out.

Dennis is an expert in all things relating to Social Security.

He’s a “RetireMentor” at Marketwatch, consultant for Fortune 500 companies including GE, Mobil, and IBM, international lecturer, contributor to the American Management Association, and a member of the Mensa Society.

Dennis’ book “When Should I File For Social Security?” is the perfect way for you to get started on the right foot.

Inside you’ll discover…

- How to safeguard your nest egg regardless if the market crashes or interest rates go through the roof…

- The #1 mistake people are making which can cost you up to $323,000…

- The 5 steps you must take to protect yourself even if Social Security completely dries out tomorrow…

- And much more…

Today I’d like to give you both the “Forever Retirement Portfolio Report” and “When Should I File For Social Security?”…

Along with an invitation to my premium newsletter called the Monthly Dividend Multiplier so you can…

Start Living Your Dream Retirement Today

The Monthly Dividend Multiplier is a members-only service in which I focus exclusively on “Diamond Dividends.”

Your subscription gives you unlimited access to…

- 12 monthly newsletters which recap how your portfolio is performing to date, along with summaries of upcoming dividend dates and yields. You’ll also receive an up-to-date analysis every month about what’s happening in the market, as well as what you can expect in the coming months ahead.

- Mailbag Videos where I answer questions from members so you can ask me anything and get personalized in-depth feedback on any topic.

- Bonus #1: Portfolio Rebalancing Tool

Being prepared for any situation is the best way to protect your future. This tool instantly calculates the optimal allocation for your portfolio and shows you exactly which shares to buy. It’s perfect for running “what if” scenarios with different amounts and works with just one click.

- Bonus #2: Training Resources Collection

The market is constantly changing and it’s my duty to stay on top of it for you. That’s why I’ve added this section full of extra training resources to keep you in the loop, including regular portfolio updates and additional commentary.

- Bonus #3: Special Report Library

Additional reports including “Getting Started with the Monthly Dividend Multiplier”, “9 All-Star Dividend Growth Stocks”, “The Go-To Wealth Building Strategy”, and many more…

In addition, I’d also like to give you another guide…

“How to Integrate the Monthly Dividend Multiplier and The Dividend Hunter”

Your stocks in The Dividend Hunter give you exceptionally high dividend yields.

This is a great way to earn continuous income without batting an eyelid.

But it’s only one half of the puzzle.

The Monthly Dividend Multiplier is the other part you’ve been missing.

It’s the fuel that adds fire to your income and wealth growth and sends them both flying to the moon.

This is the fastest way I know to passively increase your income by 32%, 55%, and even 108% in as little as 7 months.

This report shows you how to balance these two complementary strategies to achieve your goals, no matter if you need cash flow or capital growth.

Everybody’s situation is different, so flexibility is the key to creating a retirement that lasts for decades.

Simply refer back to this guide whenever your situation changes.

This special report is yours when you become a member today.

Normally the retail price for a yearly subscription to the Monthly Dividend Multiplier is $1,997.

That’s already a steal compared to hiring a money manager.

Financial advisors often charge a flat fee starting from $3,000 plus 1% of profits earned.

And many won’t even take on new clients unless you invest a minimum amount.

There are no minimum requirements to use the Monthly Dividend Multiplier.

You can start collecting more income today no matter the size of your portfolio.

However, I want to make this a no-brainer decision for you.

That’s why I’m also throwing in access to…

Live Monthly Strategy Calls

Every month I hold a live call with members.

During these strategy sessions I dive deep into how the Monthly Dividend Multiplier works.

I’ll walk you step-by-step through my plays so you can sleep easy knowing your retirement is safe and secure.

Every session is different but usually includes a combination of strategy, tactics, and breaking developments.

Plus, I get the chance to connect with you one-on-one to help you get the best performance from your investments.

Everything is recorded so you can always watch the video replays later.

Here’s what my members are saying…

“I was in The Dividend Hunter, but I didn’t need retirement income right now, I needed more growth. I joined Monthly Dividend Multiplier and discovered it’s safer than growth stocks… Growth in your portfolio is important… to get more dividends over time you have to have capital appreciation. Not to put all your eggs in one basket.”

– Charles

“I am happy that I joined your program. I would not be at the point I am today without your advice. Thank you!”

– Milton

“I am very pleased with the returns I am receiving. I have invested in various services in the past, but so far yours is the only one I feel satisfied with and would recommend to others.”

– Donald

“I started your [system] in February – March ’18 and am very nicely up. I now have the entire list of recommended stocks in my portfolio… Very pleased so far. Thank you!”

– Barry

“Monthly Dividend Multiplier allows me dividend growth plus capital appreciation. My returns are higher in this service overall. I use it for compounding our wealth.”

– James

Nobody wants to work past 65 and still have to worry about money.

Retirement should be about having fun…

Enjoying life…

And doing the things you want to do.

This simply isn’t possible with traditional investing methods

Whereas thousands of people have already retired on their own terms thanks to “Diamond Dividends”.

This is your chance to join them too.

Subscribe to the Monthly Dividend Multiplier Today for Only $1,997 $595 (70% Off) and Receive…

Along with…

- One full year of unlimited access to Monthly Dividend Multiplier…

- 12 newsletters with the latest development in the market, performance recaps, and upcoming dividend dates and yields…

- Live Monthly Strategy Calls where I dive deep into strategies and tactics to optimize your portfolio…

- Mailbag Videos for you to ask questions about anything and get in-depth feedback…

- Bonus #1: Portfolio Rebalancing Tool

- Bonus #2: Additional Training Resources

- Bonus #3: Special Report Library

- Along with your complimentary copies of “The Forever Retirement Portfolio Report”, “When Should I File For Social Security?” and “How to Integrate the Monthly Dividend Multiplier and The Dividend Hunter”…

… All for only $1,997 $595 (70% off) when you sign up today.

“I trust Monthly Dividend Multiplier to build my nest egg and I recommend it to anyone who loves dividend investing and appreciation in their portfolio.”

– Don

The part of my job I love the most is talking to people.

Many tell me they simply want to retire in comfort.

I don’t think that’s asking for too much.

For too long investors have been getting the short end of the stick when it comes to retirement planning.

If you’re worried about the future, rest assured you’re not alone.

Inflation is ravaging the economy.

The market doesn’t know which way is up or down.

Even the “gold standard” of bonds could collapse soon.

That’s why I want to make my research accessible to as many people as possible with this special offer.

But don’t sleep on this opportunity.

Today is the lowest price the newsletter will ever be available and my publisher could cancel the discount at any time.

Click the button below to finalize your order and get immediate access to the members-only area.

Welcome to the club.

Tim Plaehn

Editor of the Monthly Dividend Multiplier

Investors Alley

“I put a lot of trust into Tim. I love his updates and he helps me through drawdowns in the market. Tim’s taught me to see those as opportunities to buy, and it’s worked out.”

– Joe

“Join [Tim] to collect dividends and enjoy capital gains too for growing your wealth. I’m really enjoying it so far.”

– Walt

“Your advice and information, along with some other research, have been a key source of help in this ongoing process [of building our system].”

– Jerry

Subscribe to the Monthly Dividend Multiplier Today for Only $1,997 $595 (70% Off)

Frequently Asked Questions

How is the Monthly Dividend Multiplier different from The Dividend Hunter?

The Dividend Hunter focuses on high-yield dividend strategies to create continuous income. 11.2% on USA, 12.6% on QYLD, and 13.4% on SLVO are just some of the dividends you’re already receiving every month. This is money you can immediately use to pay your bills and still have some left over for a rainy day.

The Monthly Dividend Multiplier aims for income growth on a much bigger scale… 32%, 55%, and even 108% gains aren’t uncommon… while also growing your portfolio at the same time.

These two strategies work together to give you the best of both worlds. Simply sit back and watch the returns quickly compound as you race towards retirement while putting up your feet.

What are “Diamond Dividends?”

“Normal” dividend stocks only pay a fixed amount with zero growth, whereas “Diamond Dividends” continually pay you an increasing amount every month while the stock value also grows.

If you had followed one of my realty plays, you could have increased your income by 150% and expanded your portfolio by 56% in less than 2 years.

These super rare stocks provide more bang for your buck and are only available for members of the Monthly Dividend Multiplier.

Who is the Monthly Dividend Multiplier for?

Do you want to continually keep growing your income? Then the Monthly Dividend Multiplier is right for you.

Retiring is simply the first step. The average life expectancy is now longer than ever. You’ll need more and more money just to keep up with the increasing costs of living. The Monthly Dividend Multiplier increases both your income and wealth every month to set you up for a life of comfort for as long as you live.

It takes 7 years for a regular investment strategy to double your money, but at the current rate of my “set and forget” method it would only take you 2 years. That’s more money for you to spend immediately or simply reinvest — the choice is yours.

The best part is owning a portfolio means you’re already halfway there. The strategies in the Monthly Dividend Multiplier work hand-in-hand with The Dividend Hunter, so you don’t need to change a single thing with your current investments.

Who isn’t the Monthly Dividend Multiplier for?

I want to be clear this isn’t a “get rich quick” scheme. Yes, you can potentially see very fast growth but it doesn’t happen overnight. Patience is important as often the best strategy is to do nothing and simply let your dividends and portfolio grow.

How long will the 70% discount last?

Normally a subscription costs $1,997 but today I’m reducing the price to $595 (70% off). The special discount is only available through this page, so if you come back tomorrow and the offer has been taken down then it means it’s too late. There’s no reason to pay full price so sign up now.

What should I do after joining the Monthly Dividend Multiplier?

First, check out “Getting Started with the Monthly Dividend Multiplier.” Then follow my recommendations in the “Forever Retirement Portfolio Report” and buy your first 3 “Diamond Dividends.” You’ll find all the reports in the bonus section inside the members-only area.

Next, read through the other guides, jump on the live calls to get the latest updates, and ask me any questions you might have.

Then just sit back and relax.

Your dream retirement is right around the corner.

“Dividend growth investing [is] the best long-term investment strategy to become financially independent.”

– Jason

P.S. Did you skip straight to the end?

Here’s a quick summary:

- There’s a “retirement revolution” sweeping across the country and people are retiring earlier than ever before…

- It’s thanks to a brand new strategy which breaks all the rules of investing by increasing both your income and wealth at the same time…

- These ultra rare “Diamond Dividends” give you the chance to grow your income by 32%, 55%, and 108% without having to constantly make trades or even add money to your account…

- You can get instant access to my top three “Diamond Dividends” and start fast tracking your retirement today…

Still on the fence?

Here’s one last reader story…

“I am using your dividend growth recommendations to build my retirement portfolio. For the price of your newsletter it is a real bargain. I have made money on share price and yield so thank you.”

– Dan

Subscribe to the Monthly Dividend Multiplier Today for Only $1,997 $595 (70% Off)

“I’ve loved my results with Tim. He lets me know what he’s thinking. I really like Tim’s invested in the stocks alongside me. Since Tim looks close to my age, he relates to me, and I trust him a lot.”

– Don