Unlock an opportunity once reserved only for the “ultra rich”

Two major events happening now opened up an incredible opportunity for you and me to invest early in this fast-growing (private) company

You won’t find this company on the public markets anywhere… but a similar opportunity is valued at $2.2 billion (and currently, you can enter at a $18M valuation)

(minimum investment just $150)

—> Read below to see how to invest before they must legally close funding

Hey, I’m here in Downtown Austin.

A city that’s slowly becoming the hub of not only public companies like AMD, Dell, EBay, and Tesla… but of hundreds, maybe thousands of new, small businesses.

Forbes, Entrepreneur magazine and CNBC regularly put Austin in the Top 10 places for starting a business.

And I’m seeing this explosion of businesses happening before my eyes.

Which makes it the perfect backdrop for what I’m going to show you today.

That is…

This is a picture-perfect moment in American investing history.

Two major events are simultaneously happening at the same time to present you and me with an opportunity not found anywhere on the public markets.

And with this opportunity comes a brand-new chance at owning a growing company in its early stages… at a low valuation… giving you massive upside.

But it doesn’t stop there.

You’ll also have the ability to collect income at the same time from the same asset.

It’s a rare investment opportunity that hasn’t been open to the public in over 87 years.

For too long, only the big money and those with friends at the “country club” were able to access these deals.

However, with new legislation and good ol’ American innovation…

You, today, have a seat at the table.

Private businesses — i.e. ones not traded on the stock market — are more and more looking to investors like yourself to invest in their companies.

…not banks.

…not venture capitalist sharks.

…or, even just high net-worth investors.

Starting today, you can own a piece of nearly any business in America… meaning, you’re in on the ground floor with the big wigs.

Where I am in Austin… Everyday there’s an opportunity to bump into and meet owners of 7, 8, even 9 figure businesses.

My name’s Jared Nations. I’m the President of Investors Alley. A 22-year old stock and investing publishing company.

Being in this position opens doors for me to sit down and talk with owners of many successful private companies.

And they’re eager to hop on the phone with me and talk shop.

We swap stories, share strategies, and help each other grow our businesses.

I’m getting an inside glimpse into dozens of successful businesses every year.

And right now we’re at the just the start of a major change in the market.

Call it a collision of two major shifts in small businesses in America.

The first being —>

According to NPR, “new businesses are starting at record rates” thanks to the Covid pandemic… and these businesses are looking for investors.

The pandemic has accelerated innovation and people are willing to say “screw it, let’s do it” and jump into business.

Sometimes accidentally…

Julie Friedman wanted to make some special playkits for her daughter who suffered from speech disorders. She created sensory play kits in her kitchen just for fun.

She was just a stay-at-home trying to help her kid.

Soon, the pandemic hit, and her playkits got so popular celebrities like Kim Kardashian were using and promoting them.

These stories are happening again and again.

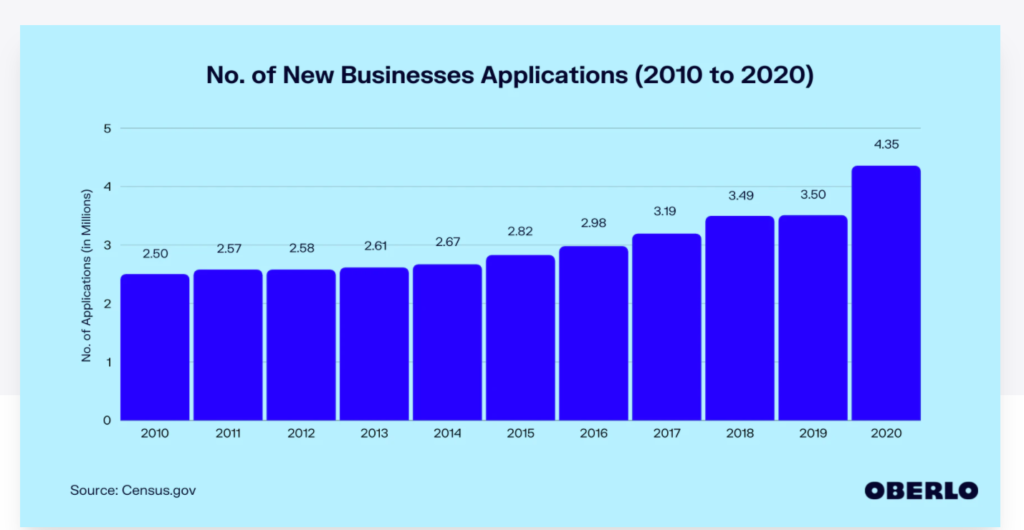

Take a look at this chart from the government Census site…

New business applications have almost doubled in 2020 compared to five years ago.

And 24.3% more than 2019.

Angela Muhwezi-Hall and Deborah Gladney saw many businesses struggling to hire during the pandemic…

So in 2020, they launched QuickHire to help service and skilled industry workers find jobs.

At first, they bootstrapped $50,000 from their savings…

Before taking advantage of what I’m about to share today…

And landed a $350,000 investment from private investors.

Businesses are being born at pace…

That’s what I mean by good ol’ American innovation.

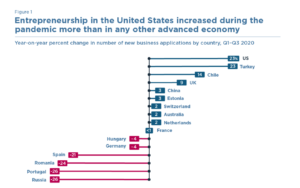

And America was the leader in the entire world for entrepreneurship.

Husband and wife team, Luke and Rebecca Tonks, were accountants at Ernst & Young, one of the top firms in the world.

They quit that job when offices closed and began a business around their passion —> healthy eating but in a Covid world i.e. delivered to your home.

Thus, Nourish Bud was formed.

In the past, only big venture capital firms could invest and gain equity in companies like this

That’s all changed…

For the first time in 87 years, you’re allowed to participate in investing in these non-public companies.

| Ashley Flucas (35), a real estate lawyer, started investing in private companies the past 3 years.

“It’s a chance to create generational wealth.” “It’s the same people doing deals with each other and sharing the wealth, and I’m thinking, how do I break into that?!?” Today, she’s invested in over 200 private companies. |

The reason it’s possible is multi-layered.

Since 1933, the SEC has cracked down on anyone but accredited investors investing in private companies.

“It’s too dangerous” for the common investor like you and me.

Meanwhile, accredited investors landed exit after exit, compounding millions on top of tens of millions.

On average, early-stage investors make 27% per year!

That is 4x higher than the average stock market return.

It’s enough to triple your investment in just three years.

Over 10 years, 27% annual returns would grow a $25,000 investment to almost $273,000!.

So far, only the ultra-wealthy have enjoyed these gains.

Well, all that changed.

In 2012, President Obama signed the JOBS act to allow non-accredited investors the ability to invest in private companies.

Obama wanted to both give the average Joe a chance at making money… but also the ability for small businesses to get off the ground faster (rather than drowning in paperwork from a bank, or slogging to meeting after meeting with a shark venture fund.)

This is just the beginning of the crowdfunding boom.

Businesses could start in a garage, get funding from all over the world, and launch the product without needing to take a single meeting with a bank or venture capitalist.

Compared to the old method in the past —> Open a business, apply for a loan, wait 6 months for approval or beg for outside investment from VC firms.

Businesses WANT you to invest rather than venture capitalists.

It’s cheaper (no lawyer and banker fees), their customers can now be owners, and they’d rather you make the nice returns than the mega-billionaires.

Now, companies like VidAngel go on crowdfunding sites and raise $10 million dollars in 12 days!

Only with “country club” connections in banking/private equity can you get that kind of money fast pre-legalization.

President Trump then piggy-backed off Obama’s JOBS act allowing more companies to invest in private companies… as well as raised the ceiling on ‘how much’ a company could raise privately.

Then in 2020, the SEC made it even easier to invest in these private companies…

Making this the start of one of the biggest investment opportunities of this decade

Rules that went into effect early 2021 included even looser restrictions on allowing you and me to step into these private companies.

For very early stage companies raising on crowdfunding sites…

The SEC raised the limit 5X to what private companies can raise.

On top of that, accredited investors were granted no cap on what they can invest in a very early stage company…

While non-accredited can invest up to their salary or net worth (whichever greater).

As more of these restrictions lift…

There will be more opportunities to put money to work in great companies.

Venture funding globally is hitting a record already:

$125 billion in one quarter!

My colleague in the Atlanta Metro area shared this pic from his local business paper.

Money is flowing into companies at a fast pace…

But also a record number of companies being born.

The more companies available…

The more opportunities you have to enjoy the windfalls of being early.

Arcimoto may be one of the most famous private businesses who raised an early round from investors like yourself… before going public in 2017.

From the lows of 2020, it launched an incredible 2,491% in 11 months!

That would turn every $10,000 invested into $249,100!

Private investors who secured their seat pre-IPO would likely have seen larger gains.

Fat Brands, Inc. is another company who started off with small-time investors. They hold a handful of burger brands, like Johnny Rockets, under their FAT logo.

They IPO’d in 2017 making early investors a bundle…

Since the 2020 lows, the stock is up over 202%.

Ever read those “Chicken Soup for the Soul” books? They have dozens of versions of them it’s hard to keep up. Some for kids now too.

Well, did you know they started off with early investors like yourself… and eventually, they went public in 2017. They skyrocketed 264% over that timeframe.

Amazon’s stock is only up 247% in the exact same timeframe.

One smaller book company beating out the largest bookstore on the planet!

Some opportunities are smaller scale like HVAC or construction companies like I mentioned…

Others are trying to solve major world problems.

InSitu Biologics just finished their private funding round (It is now closed to the public), and their goal is to solve one of the deadliest epidemics in America.

A $635 billion dollar industry, pain relief treatments are typically clouded in controversy with the opioid epidemic.

Insitu Biologics has developed a specialty cream that is non-addictive.

They are still in trial phases… so this is a much riskier play I wouldn’t recommend to invest in at this time.

I’m going to show you today how to get your money into these types of solid businesses.

You can’t buy stock on the public market.

There aren’t any fancy option trades or futures strategy

that gives you access.

The only way to invest is right to the source i.e. you invest, and the company directly receives your money.

Ever watch Shark Tank on TV?

If you haven’t seen it, famous investors like Mark Cuban are on it. Businesses come in, pitch an investment in their company and the “shark” investors negotiate a deal.

These reality star investors are writing a check directly to the founders, and then they’re gaining a return on their money through either equity or debt.

The difference is…

- You don’t need to negotiate terms with these private companies… the deals are set up already (some of them favorable to you including sky-high yields)

- You don’t physically write a check — you’ll be able to simply transfer your money in a few clicks

- You don’t have to search out these deals for yourself. I only share deals if I myself am comfortable putting my own money into them.

| Ivy Mukherjee (28), a product designer, started investing in private companies in 2021.

He started with just $2,000 and $5,000 checks. |

In fact, there’s a way to access up to 12 potential, fully-vetted deals in the next few minutes. And I’ll do all the legwork for you.

In fact, I’ll share my #1 private company investment in a few minutes.

The returns have grown exponentially in the past decade for early investors.

Now, it’s your turn.

Venture capital is great if you’re on the INSIDE

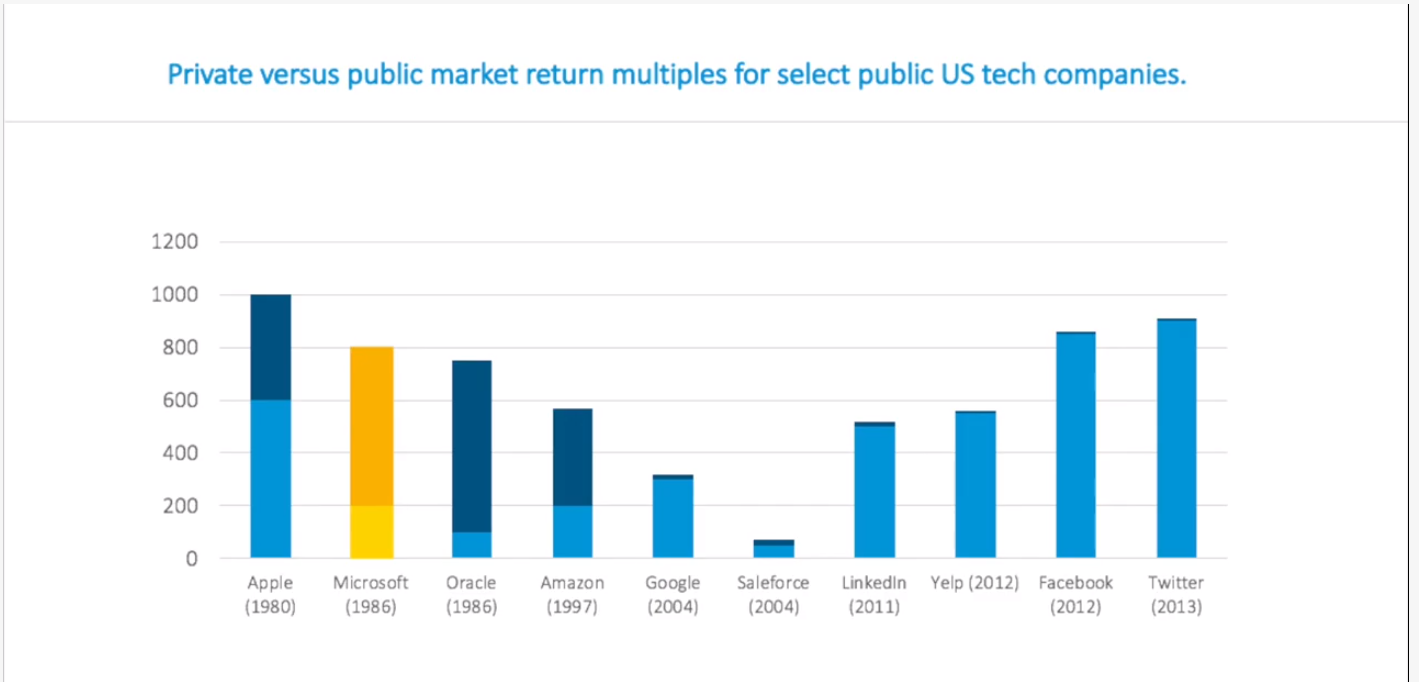

Facebook went public at a $100 billion dollar valuation in 2012.

…as many got in when Facebook was worth less than a billion.

Peter Thiel invested a mere $500k into early Facebook for a 10% stake…

Worth up to $100 million today… a 20,000% return.

Only big wigs had this private company opportunity before.

It wasn’t always like that though:

Companies used to go public at valuations that were palatable for the average joe.

You could wait for an IPO and still be fine.

Amazon IPO’d at a $437 million dollar valuation! Insane.

Amazon is now a trillion dollar company.

Oracle went public around a $195 million valuation… now worth over $250 billion.

Apple and Microsoft were all sub-billion dollar companies at IPO too. Both are now worth over a trillion.

You invest in any of these and you’re up five hundred times and more.

Today, those ‘cheap’ IPO opportunities are gone.

Only wealthy investors and celebrities had access.

Robinhood was a hot topic stock that just went public.

Venture capitalists got in early… even entertainers who had connections, like Snoop Dogg and Nas, made something like five hundred and sixteen times their money when they invested in Robinhood pre-IPO at a low valuation.

A valuation you or I could never gain access to.

Only those with the connections gained a seat at the table. In this case, Nas connected with Andreesen Horowitz (one of the most prestigious and well-known venture capital firms in the world).

You and me, we don’t have those connections.

Instead, we have to wait until the stock goes public. In this case, Robinhood (HOOD) went public at a $32 billion dollar valuation.

Uber, a company that loses money annually IPO’d at $72 BILLION… Airbnb over $30 billion.

Why are lesser companies going public at valuations 100X Amazon’s IPO valuation?

There’s cheap money out there.

Money is so cheap, you have companies going public “blank check” most commonly known as SPACs.

These are companies with just buckets of cash, going public with no revenue or business with the hope of acquiring another private company.

By the time a company goes public today, the insiders already make a fortune.

But also, you have public companies throwing their cash into the ring. Check out all these major players investing in private companies.

Find a way to buy into private companies like the big boys do.

Here’s where you can get a leg up on the competition.

Many of these VC firms and public companies chase the same “unicorn-status” startups. They want to pile in early at a cheap valuation and flip for a huge gain years from now.

Plus, they are full of bloated processes… bureaucracy… board meetings and the like.

You can jump ahead of them.

They can only focus on a few opportunities because they have so many layers of ‘people’ to go through… thus, they only look at a small group of potential businesses to invest in.

For us, we are able to approach sexy companies… and ones that aren’t as “sexy” and written about in Forbes.

Large companies also DO NOT want to invest $1 million dollars into a company. A 27% return is paltry to them.

They’d rather deploy tens of millions… but many small businesses don’t need that (yet).

Hence, big companies and VCs go after the humongous deals.

The ones doing boring things like real estate, industrial solutions, home improvement products… and others.

You can pocket a ton of cashflow and value in those companies.

My #1 company is in one of these high-cashflow niches.

Today, non-accredited investors can start with $1,000 and invest in rounds called Regulation A financing.

Reg As (and A+) only allow companies to raise up to $90 million dollars in funding. After that, they must go public, or raise another round from accredited investors.

As you can imagine, this is perfect for early companies so they can quickly access capital if they don’t have venture capital buddies.

So far, there are an estimated 330,000 investors who have invested in these types of capital rounds.

According to the SEC, as of 2019, over $2.45 billion have been raised for companies who couldn’t access these markets before.

The numbers have grown each year…

Capital raised via Reg A and A+ year by year follows:

2015 (6 months) – ~$100 mill raised

2016 -~$255 mill raised

2017 -~$500 mill raised

2018 -$660 mill raised

2019 saw over a billion.

Alex Lieberman, the founder of email content company, Morning Brew (a company he sold for $75 million) believes everyone will be investing in private companies in the future.

You can start now.

For you, it’s great.

The incredible benefits of investing in these private companies before everyone else

| Karin Dillie (33), an executive at an online shopping company, started with just a small $5,000.

“I didn’t realize I could be an angel [early stage] investor!” “I probably needed someone to give me permission to play the game because investing always seemed so elusive.” |

#1. Diversification from the stock market — 2020 was a great bounce back year for stocks if you bought near the bottom of the March lows. In 2021, the overall market was up, but many stocks rotated. Tech crashed, industrials soared, then in the summer, they switched where tech was strong and vice versa.

Investing off the stock exchanges, you aren’t stuck to the whims of Wall Street. Stock prices can be manipulated by the market makers.

Private companies are run and owned by their founders typically. I like that.

#2. You aren’t enslaved to stock prices – If you’ve followed Investors Alley for a few years, you’ve likely heard from our income guy, Tim Plaehn. He says you should ignore the stock prices when investing in income in strong companies.

With private companies, you aren’t even tempted to ‘panic sell’ like in March 2020. You don’t see the stock prices of private companies as they’re usually only calculated 1x per quarter (if not less). That allows you to keep emotion out of your investing.

You’re also not seeing valuations drop overnight. If the Dow Jones drops 1,000 points tomorrow, it doesn’t matter how companies are doing, most stocks will drop and lose you money. Non-publicly traded investments don’t do that.

#3. You can connect to the founders/owners – I sit down and chat with owners of the deals I source. You think Zuckerberg cares if you buy Facebook stock or not? Nor does he want to talk to you!

#4. Invest in the backbone of America: Imagine hearing from these founders monthly or quarterly. Hear about their journey, how business is going in America, their successes and struggles. This is what America is built on. Over 47.5% of America is employed by small, private businesses. They built America.

#5. Potentially higher yields for you: Not every private company investment pays a yield… but ones that do can be solid double-digit payers. I’ll show you my #1 private company investment today that saw an annualized return over 33% in 2020!

#6. Find companies in any arena you’re passionate about: If you want to invest in environmentally friendly companies, or those that service a problem you yourself have… there are those opportunities.

#7. MOST IMPORTANT → You’re making money when the owners make money. With public stock, the shares are issued and sold… right then, the money is raised for the company. All the share trading after that doesn’t add cash to the company coffers. At the same time, the founders got their stock at super cheap, so when their stock IPOs, they make a good chunk of change on paper.

If you buy a stock after an IPO, and it drops 10%, that stinks. But, for the founders, they bought their shares cheap and they’re still up XXXX%, so they don’t care.

Private companies, you’re investing and the founders don’t see any liquidity unless:

- They produce revenues and succeed

- They return profits to you first before taking some themselves

You’re the VIP in an off-the-stock-exchange investment

At an IPO, the CEO and early investors are the VIP.

They’re some plays out there which will give you other ‘gifts’ in lieu of dividends.

For example, Gryphon call themselves the “next generation of firewall.” As more people are online for work, school and play, cybersecurity is seeing major tailwins.

Palo Alto Networks, a once private cybersecurity company, went public in 2014 and is up over 653% since then.

Gryphon doesn’t pay a yield, which I can understand, but I’m not comfortable with it.

They do, however, offer perks such as discounts off their products.

That’s pretty cool, right?

You’re receiving VIP treatment for being an early adopter and investor.

Consider a private company investment your shot at being a VIP. You’re able to enter an opportunity most others can’t nor know how to.

I’ll show you exactly how to invest in these companies safely and securely. Plus, the pitfalls to watch out for when deciding where to place your capital.

Another perk may be bonus shares on your investment.

Monogram is a 3D printing shop specializing in the $16 billion dollar joint replacement market.

They believe they’ve 3D manufactured joint replacements which are cheaper and more efficient than the current solution.

For their perk, they offer a 10% bonus for all money over $5,000. If you invest $5,000, you get $5,500 worth of stock… $10,000, you get up to $11,000.

Again, you won’t find those kinds of bonuses on the public markets.

Only here, in the private company investment pool. Because these companies can be flexible with terms, and there isn’t as much ‘red tape’ as a public company.

If a company wants to give away cash and gifts to early investors, the SEC allows it in order to promote more investment in those growing businesses.

Another private company, Innovega, raised money from private investors like yourself into their specialty lens. These lenses allow even legally blind people to finally get 20/20 vision.

Miso Robotics builds robots to automate food preparation in restaurants. No longer do people have to be squished next to each other in a hot kitchen. The guys at Miso have built functioning robots to flip burgers and toss fries at the same time. They’re raising private money.

So many companies are raising money this way. And they want to give you part of their company.

Maybe the company goes public… maybe it doesn’t.

You don’t need a private company to go public to reap the rewards.

One company raises funds for farmers to develop agricultural land.

A farmer may need land to raise cattle… another farmer, it’s hemp… I saw one investment that was a cocoa farm in Ghana.

Investors were seeing up to 61% internal rate of returns on their money.

I think it’s great. Farmland is real estate. God ain’t making more land, right? Some folks said they invest to “diversify their assets.”

At 61% internal rates of return, that’s not a bad bet.

Did you know you could invest in whiskey?

You put money into this one company I found, Whiskey Wealth Club, and they hold the whiskey for you as it appreciates in value.

That’s not investing in a company, per se, but you’re diversifying your stock investments with a physical asset.

You can do the same with wine as well. Wine’s had an 89% return in the last 5-6 years.

Some private company products out there are pretty fun.

Investing in wine… sweet!

These founders I met love their companies.

They love what they do.

Sure, they’d love their company to go public and they become rich, but that’s not what drives them.

They’re driven by the visions of their company and how it benefits the world.

… one company I talked with, they simply acquire HVAC companies.

Sounds boring, right?

Well, we’re seeing a massive labor shortage in these types of home improvement areas. This company wants to take a small business potentially run by a near-retiree, polish it off, rebrand it, add new technologies and make it marketable to attract both new customers and employees.

That’s a company which is a necessity in your community and especially mine with these Texas summers!

… another company, they build software to keep construction workers safe on the job site.

The biggest risk and liability for construction workers is one of their guys getting flattened by a steamroller.

You’ve seen the housing boom going on… that’s because there aren’t enough houses being built fast enough.

Construction workers need to work faster, which can lead to mistakes and injuries.

This company has built software that has the potential to be acquired by a large insurer or construction company.

A potential 8-9 figure valuation.

It’s not a sexy business, again, but necessary.

These are just two examples of the owners I’ve met with.

I’m going to show you my #1 private company investment today that’s handing regular cash to people like you.

Again, my name is Jared Nations.

Before becoming President of Investors Alley, I actually had the opportunity to be one of the first employees at a (now) $3 billion startup.

I won’t reveal the name here…

But it was my first glimpse at the inside of a small company.

No doubt I would’ve made millions and millions if I had gone that path.

And I’m writing to you today to share with you the opportunity to invest in a select group of private companies offering income and return potentials not found in the public market.

Even now, at Investors Alley, we’re a small team of less than 12 full-time employees. This allows us to be nimble, to meet with and work on cool collaborations with other private companies like ourselves.

I personally network and am involved in masterminds with companies that earn over $100 million dollars in revenue per year.

All of them led by their founders.

When a company is founder-led, the passion and fire stays lit. After all, the founder doesn’t eat unless the company eats.

Once a company becomes bloated, goes public, the founder retires rich, and for many companies they go stagnant.

They lose motivation to innovate, and may collapse. An example would be Blockbuster or a big box retailer like JCPenney.

When you put up your cold hard cash and invest in a private company… for the most part, you’re betting on the founder to be successful and to never give up.

My employees rely on me to lead our publishing company so they can feed their families.

If we had outside investors like you funding us, I’d fight for them too.

I know what it takes to run a private company. And that makes me a great leader to bring you deal opportunities for growing your wealth and income.

Investing in private companies means you hear from the owners of the companies regularly.

You think if you invest in Microsoft stock, Bill Gates will update you on the inner workings of the company?

Yeah right.

It’s entirely different outside the stock exchanges.

I know because I’ve sat down with incredibly successful entrepreneurs. Some I know have sold their company for multiple eight and nine figures…

Those early investors received huge checks..

Hundreds of companies out there are happy to cut you in on their profits.

And they’ve willing to pay a fat premium to do so.

In fact, my #1 private company opportunity right now is ready to mail you a check with a potential double-digit yield attached.

And that yield is firm.

No fluctuations like a dividend stock who could cut their dividends in half tomorrow if they wanted.

They promise to pay you regularly.

Even if the economy completely collapses, they say they will keep paying… and didn’t lower their payouts during Covid either!

Because they’re in a niche that almost guarantees it will pay you out.

This sounds great…

But why don’t these companies go public?

Here’s the truth…

Every company CAN’T go public.

Every company doesn’t want to go public.

There’s a few reasons:

#1. Going for a full-blown IPO is expensive —> there are audits, fees to investment bankers, listing fees, lawyer fees, marketing fees… the list is endless.

That leads to number two.

#2. If you don’t raise enough at IPO, you can be cancelled —> you could go through the process to IPO with all the fees and audits, but if at the end of the day, there aren’t enough investment firms to buy your shares, the IPO is cancelled by the exchanges.

That doesn’t mean a company ‘is bad’, it simply means there wasn’t enough marketing around the company to attract enough institutional investors.

There are just over 6,000 companies trading on the NYSE and NASDAQ today, and 12,000 on the OTC markets.

There are over 30.2 million small businesses in America.

Meaning… only a small percentage of businesses — 0.00059% to be exact — are public.

Going public is akin to winning the lottery in a way.

#3. There’s a vulnerability to ‘being shorted’ or the price crashing —> If a company goes public on the Nasdaq, but then is heavily shorted (as we’ve seen with meme stocks) or it simply crashes… a company’s value could crash.

Then, the founders are embarrassed, stock is delisted to the OTC exchanges, becomes a penny stock and raising capital becomes an uphill climb.

Staying off the stock exchanges, you, the owners and fellow shareholders aren’t at the mercy of up-and-down markets.

The founders can focus on the company and not on ‘how do I make the stock price go up…”

#4. The private company may not have a news event to spur interest

This goes back to the company not raising enough. If the company doesn’t have the media (aka the ‘wind’) at their backs, there’s little chance retail investors will happily put their money behind the stock.

An IPO needs retail dollars to provide liquidity and volatility in the stock so it moves.

Moving stocks = liquidity = media talking about it.

#5. Many private companies are being bought up before going public

A company like YouTube, Zappos, WhatsApp, Whole Foods… the list is endless.

Many of these private companies were bought out by bigger companies before you ever were able to invest.

Stinks, right?

You find a company that’s awesome early on…

For example, I used Facebook in late 2000’s before it IPO’d…

But you were off-limits to invest.

Not anymore.

#6. Your best brand ambassadors will be your investors.

Think about it… if you owned a small business, wouldn’t you tell others about it?

If you were one of just 100 or 200 people invested in a special, fast-growing company, wouldn’t you be eager to tell others about this little-known company?

Especially if they’re doing something really cool like automating fast food or helping cure the opioid epidemic?

I do for the small businesses I have an interest in.

Last…

#7. Going public means your entire business is in the public eye. Founders have to sacrifice long-term vision for short-term gains in order to keep weak hands holding their shares happy.

I run a private company and we do well. If this were a public company, I’d be pressured to take on loads of debt in order to grow faster so our quarterly reports show ‘improvement.’

Many other publishing companies in my niche have done that… and many are facing the music now (including many shutting down).

By taking a long-term approach, we’ve stayed in business for 22+ years, while others fizzle out after a few years.

If more companies vie to stay private…

This is, then, one of the best… and rare… times in history to get your foot into one of these companies.

Now, there are many different ‘avenues’ investors in non-publicly traded companies can put their money to work.

Most private avenues involve the investor being an “accredited investor.” That simply means they make over $200k in income for the past two years and have a $1 million dollars net worth (minus the value of their house).

Less than 7% of Americans fall into this category.

However, when President Obama opened the doors in 2012 for non-accredited investors to enjoy the spoils of fast-growing private companies, it opened the door for you to join a select group of investment classes.

Instead, they’re ready to partner with you

With recent laws from President Obama and those same laws bettered under President Trump (including recent developments in 2021)…

Becoming an investor in a solid non-public company is now available for anyone.

Even if you aren’t an accredited investor.

And in the next 10 days, it’ll be possible for you to make your first non-public investment.

Now, you might be saying, “Jared, I don’t have $500,000 to invest in some speculative company.”

Luckily, you don’t have to.

First, these companies which you can invest in aren’t some risky startups trying to be the next Google.

The chances of a company becoming the “next Google” are tiny. According to the Corporate Finance Institute, only 15 of the 200 startups a top VC will fund return the lionshare of the profits. 40% will fail. 30% will return their capital i.e. close to 0% gains… and 30% will produce some sort of gain, with only 0.05% producing life-changing returns

Here’s a better alternative…

There are hundreds and hundreds of profitable, successful companies out there who are accepting checks.

And they’ll happily pay you a big premium for your investment.

Second, you don’t need to invest 6, 7, 8 figures into these companies.

Some are happy with as little as $1,000.

Of course, they’d love more. But $1,000 could buy them a part they need, it could cover legal fees on a merger or acquisition. What I love about these small businesses I’ve met with… they’re lean and mean.

You go to a place like the WeWork that’s in the Downtown Austin area here… that company is now a horror story for private companies.

A CEO and founder who spent lavishly his investors’ money. Then, he walked away with a billion dollar check while the company lost hundreds of millions of dollars.

That’s not who I’ve sat down with.

I’m looking for companies that check certain boxes.

A mission behind a company is great.

Their product can be awesome as well.

Those are important for sure.

But those don’t even play into my decision-making when doing due diligence on a potential non-public investment.

The mission and product are secondary to these three important pieces.

#1. The company must be already generating revenue and growing

Investing in low revenue/$0 revenue companies is as high risk as it gets.

Ever heard of the Theranos scam? Elizabeth Holmes, once one of the world’s richest women, now in jail for fraud.

Her product sounded cool… taking blood drops and able to study potential diseases and such with it.

However, it had almost no revenue. Many investors lost all the capital they put in as it was all a scam.

Low revenue isn’t a dealbreaker… but it’s not what I’m interested in right now.

Plus, it’s too risky.

I’ll happily pay a little extra for equity if it means the company has proven there is demand for their service and their operations are working well.

Every company I start looking at… first question is “ How much revenue have you done?”

“Zero,” they say.

“See ya.”

#2. They’re paying out something in the next 12 months.

That could be a regular dividend of some sort… or a liquidation event.

I’m not interested in locking up capital for 5 years. Many billionaire VCs are happy to do that, good for them. Just know they have money spread out among 100+ investments waiting for a home run.

Unless you’re sitting on 8-9 figures of cash, we need to see cashflow in our account.

My #1 private company pays a minimum 5% yield… but it is set to pay much higher than that.

Last year, despite Covid, they paid 36.7%!

I’m going to tell you all about them in a second.

#3. Last, the management teams must be rock solid.

A great product can go far… but a top-tier management company can make it money.

If there’s a bad apple in the CEO chair, a company can be run into the ground.

Know that old joke about the “dumb sons” who take over the company from dad and completely dismantle it?

That isn’t just for laughs. It happens all the time because not everyone is cut out to be an entrepreneur.

Starting businesses is stressful, requires dedication, sacrifice, sleepless nights, and a killer instinct.

I chat with the owners of every private company I’m considering. Some of it is “gut” instinct. Does this exec have what it takes?

Because if you’re investing in a private company, you are their business partner. You know their name, what they like to do for fun, etc. Contrast that with investing in the public stock market where you may not even know the name of the CEO of a company.

Good management teams:

- Have a gameplan for how to grow

- Know how to manage expenses and spend wisely

- Possess intangibles like a “never take no for an answer” attitude

Sounds simple, but I can’t tell you how many “CEOs” of small businesses I’ve talked to that don’t have these qualities.

For me, I grew up in a family of entrepreneurs.

My parents built a successful lighting business which they eventually sold… then started another!

They’ve been very successful, and taught me the lessons to know what makes a company great.

I sat at the dinner table of excellent executives… I know what qualities they must possess to succeed.

The hardest part of investing in a successful private company isn’t the due diligence or ‘when to sell’.

It’s FINDING the deal.

According to Crowdfunding site Crowdstreet, deal volume has declined by 70%…

However, deal demand is up 50%!

More money chasing fewer deals.

Unlike the stock market where you can quickly run through dozens of screeners to find stocks to buy…

There are only expensive databases available to locate private companies raising money… but you’re left alone to do the due diligence on them.

Sure, you could go on Crowdfunding sites, watch the promo videos, and roll the dice…

But I’d call that gambling.

If you can’t sit down with the founders, look them in the eye, grill them on their business model and plan…

Plus, see verified track records of their sales or if they’re a strong team working together in an office and not in their mom’s garage…

Then, you’re gambling.

The only way you find great investments is by meeting people. It’s networking, asking around, and letting others know what you’re looking for.

For me, as President of Investors Alley with direct access to over 200,000+ investors, I can land phone calls with most companies raising money.

Like I said, I’ve had the chance to sit down with multiple private companies and let them pitch me on investing with them.

I live in Austin, one of the Top 10 cities for starting a business, and regularly interface with 8-figure executives.

My financial background and my team’s equipped us with the skills to quickly do due diligence on a company to see if it’s worth looking into.

I shared with you my basic ‘back of the napkin’ 3-piece criteria for quickly evaluating a potential opportunity.

And after talking to many companies, I believe I’ve pinpointed an incredible 1st opportunity for you to invest in.

With your 1st private company deal, it doesn’t make sense to swing for the fences on a risky bet.

I’d rather you see a nice, big ol’ check regularly a la dividends than cross your fingers for an IPO down the line.

That’s why

I’ve located a company in one of the

Hottest industries in the world

— Fintech.

Fintech is the name for companies shaking up the ancient financial industry…

Think —> Robinhood, Venmo, personal finance apps like Mint… Zelle, Paypal, you name it.

Robinhood just went public at a whopping $22B valuation making early investors (including rapper Snoop Dogg) made investments pre-billion dollar valuation.

Covid has accelerated fintech trends…

The industry alone is primed to grow 23.58% per year, and is worth an amazing $5.5 trillion dollars.

The target audience is younger as kids get their hands on more and more dollars.

Being a millennial…when I stumbled on a new company that is disrupting the fintech space, I had to try it for myself.

I’ve located the most useful and innovative savings app every seen on the market

Right now, the only savings app I’ve found is Acorns. My colleague has used it and loves it.

The problem is you save very slow. As in quarters per day. That can take decades to compound anything meaningful.

On top of that, you pay a monthly fee to be invested in their passive funds.

I didn’t like that model…

Instead, I’ve found something better.

A savings app that compounds your money faster… BUT also saves you money on the things you buy.

How it works is it moves a % of your purchase into an investment account each time.

This is great if you have kids who struggle to save.

Meaning, if I buy something for $100… it’ll move a set % into an investment account. Maybe it’s 5%… 10%? That would mean $10 would be transferred into an investment account.

We all know our investments do better over the long-term when passively invested…

That’s what is happening here.

Even better, this company is partnering with airlines, hotels and other businesses to give elite discounts to users.

They just partnered exclusively with one of the largest retailers in the world. (you know them).

If users shop at this retailer, you can earn money back on every purchase.

It’s a true gamechanger.

The user growth has 5X’d in 12 months…

And if you’re worried about “competitors” — this booming fintech play applied for patents on this specific technology and concept.

HOW YOU CAN EARN RETURNS:

(start with just $150)

The company spends $25 to acquire a customer… but they generate an average of $588 per user.

That profitability gap is where we’ll make our returns over the long haul.

Because they’re raising money at just a $18.5 million valuation.

It has a projected $11 million revenue run-rate… which is an incredible revenue -to – valuation ratio.

You generate returns when your early investment converts into equity and the company eventually sells (most likely).

I could see at this run-rate for a buyout of over $100 million dollars. That’s a 440% return.

Obviously, there’s no guarantee they will sell nor you will make any money.

Sound nuts?

The Acorns App (which does a similar idea, but with less savings potential) is currently valued at $2.2 BILLION DOLLARS.

You’re getting access to my opportunity at just above $18 million.

Our play would need to grow 12,200% to hit Acorns valuation! A massive runway.

In total, the company is raising just under $4 million… they’ve raised $1.3M already.

Once this #1 private company hits $4 million in funding, they’ll either be legally forced to:

– Close the investment to the public

– Open a new round for only accredited investors

– Lock out new investors and go public

There’s urgency here because they’re restricted by the SEC on how much they can raise.

Once they hit the limit, the opportunity is closed.

I’ve released two other opportunities in the prior months that CLOSED already to investors.

So this isn’t a fake scarcity pitch… these early investment windows close fast.

I’ve talked to the founder of our #1 opportunity and it’s a family business

The team is led by a father-son duo, which I love.

Backers also include those who helped develop the Acorns app which is one of the most popular financial apps in the world.

The CEO has over two decades of experience in finance and health and has built companies from the ground up.

His last company was acquired for $350 million.

If you’re ready to invest in my #1 private company, I’ll show you how.

It’s a simple process.

I’m going to simply show you how to invest in this company.

In fact, I want to show you right now.

Their minimum investment is $1,000… but you can invest a lot more if you’d like.

All the details on this #1 Private Company Investment are located inside my Dealbook

This is one of my first entries in my Dealbook.

You can learn all the details about this company including:

- The exact steps on how to invest (it’s not the same as buying a stock)

- Details about the founder — the CEO has a 9-figure exit alreadyThe current price of shares (less than a $160 minimum investment)

I’m giving you access to my Dealbook today and for the next 12 months …

I’ll send you my Dealbook right now when you join our first ever deal service, Dealbooks.

You’re getting one of the first cracks at this service.

A service like this has never been done in our entire 22+ year history.

Because we aren’t recommending a public stock to buy here.

For the first time ever, you’ll join us in investing in a private company.

Dealbooks is your gateway to jumping aboard these deals as they come across our desks.

Like I said, the hardest part of private company investing is finding deals. After that, it’s not just finding them, it’s pouring through the background of the company, looking for peeks at their financials and revenue, talking to the founders and more.

This service will do all of that for you.

My team and I will find all the deals, take all the calls, read through the background and potentially the financials of these companies, and more all to bring you deal flow.

That way, you can spend less time networking and searching for deals and instead put your capital to work in the next 10 days.

From now on, you’ll become a part of an elite group.

Majority of people in America… much less investors… know you can finally access equity in private companies.

Some may go public.

Some don’t ever plan to.

Our goal inside Dealbooks is to source deals where we can cashflow quickly.

It’s too risky for me personally to lock up a ton of capital with the ‘hope’ something in the future happens.

I’d rather see income right away.

With my #1 private company pick, we’re going to do that.

By joining DealBook right now, you’ll receive an immediate email with all the details about this top, income-generating private company investment right away.

I have the email ready to send.

Don’t share it with anyone once you get it.

I’ll outline the steps —> one, two, three, four, five for you on how to invest in your first private company over the next 10 days.

I’ll be honest …

This is a big step for us as a publishing company. It’s a big risk for us.

We also know how lucrative private companies can be.

We chatted at one point of charging $2,000+ for access to Dealbooks.

You’re earning an opportunity just today to invest in a fast-growing fintech opportunity that could see a buyout in the future.

What you earn as a Charter Private Investor in Dealbooks is an ability to diversify away from the ups and downs of the market.

You gain another income stream for you and your family…

And, with our #1 private company, you’re putting your money directly into fintech … an area ripe for disruption.

Here’s your next steps:

#1. Click the link below and you’ll be taken to a page to join as a Charter Private Member of Dealbooks.

#2. Immediately, you’ll be taken to a confirmation page (I have nothing else to sell here).

#3. Look out in your inbox for an email from me about this #1 Private Company Investment to make now.

#4. I’ll share exactly WHERE to invest your money and HOW to do it. In no way do I handle your investment in any private company.

#5. Come back to the portal at Dealbooks for even more content.

As a Charter Member, you receive:

- Up to 12 deals per year sent to your inbox! I’ll be doing all the digging for these opportunities. You simply can read about them, invest and your family and friends will then have a million questions about where you find these plays. Dealbooks is your secret.

- Monthly Round-ups on our investments – If I pick up any news about our private companies, I’ll share them with you. Any questions you send in, I’ll also address.

- Interviews with our investing founders: I can’t promise this for every company we source for deals… but there is potential for us to actually chat with the operators of these businesses. Get a peek into their world and what it takes to succeed in business in America.

- Regularly training, resources, and training on how I’m finding deals etc. As this is potentially a new avenue of investment for you… I pledge to share all my research, processes and strategies going forward. It’s an open book. I’ll share step-by-step instructions in how to invest in these deals (as it’s not like buying a stock), plus what I’m looking at, deals that didn’t make sense, etc.

Deal finders at many private equity firms, hedge funds, real estate companies earn multiple 6-figures per year.

I’m talking $200,000+ in addition to potentially 7-figures in bonuses depending on their size.

Other operators charge 1-2% per year to manage your money i.e. they find an asset and plow cash into it.

On a $1 billion dollar fund, that’s up to $20 million per year in fees just to find you a place to stash your capital.

Dealbooks is nothing like that at all.

There are no asset fees…

No hidden fees…

No buy/sell fees…

No commissions…

For one simple charge of not $2,000… or even $1,000…

You can receive up to 12 deals right to your inbox.

The price?

A mere $497.

#1. We’re charging a real cheap price for access to deal flow

#2. We’re not offering any other service to join

I want to see if this is something you truly want.

You’re already a subscriber to one of our products here at Investors Alley. I’m only sending this message to you because you’re a loyal buyer.

If this Charter Member launch is a massive success…

Expect:

… the price to go up to $1,000 minimum.

… more deals to flow in our pipeline

… the higher chance we have to cap membership at a certain limit

We aren’t financial managers. We can’t buy and sell securities for you. We can only show you the way.

Hence, this service will likely be limited in subscriber count in the future.

Join Dealbooks now at an incredible price, become an elite and exclusive private company investor, plus, have fun seeing what deals we come up with.

And I’m ready to put my money where my mouth is.

Because this is a brand-new service…

I’m willing to offer a 12-month money back policy

AND

A 2nd year free if I can’t bring you at least 3 good deals you like enough to invest in

First, spend the next 12 months with me as I source incredible private company deals for you… up to 12, like I said.

Even after 364 days, if you don’t think I delivered for you, call and get a 100% refund on your money.

On top of that…

If I can’t show you at least 3 deals that I think are interesting enough for you to invest in…

I’ll give you a 2nd year free of charge.

These are crazy generous policies, and our founder won’t like it.

But, this is the best way to show you I’m serious about making a private company investment newsletter that kicks butt.

If there isn’t enough interest, I’ll refund your money 100% and I’ll still share my #1 investment with you absolutely free.

BONUS:

Looking for an early stage income opportunity paying dividends?

My very first DealBook investment raised 6-figures for the company.

It’s a real estate opportunity that’s STILL open to you.

This early income company I recommend makes their profits off of:

- Buying a property at a discount

- Fixing it up

- Renting it out

- Refinancing out the money

- Repeating

Their returns have been astounding:

- In 2019, they enjoyed a 44% in annualized return

- In 2020, a 36.7% annualized return

Of course, these only return for two years and past performance does not imply future results. But, this team is motivated and even if they returned half as much money in 2021 I’d be floored by these returns.

I also love this company because their dedicated to taking care of their investors.

In 2020, they created a 5% dividend to make sure that their investors had cash flow during difficult times. (that’s not the max, that’s the bottom floor if everything went wrong, you can expect 5%).

They are the ONLY real estate trust in 2020 who received an SEC amendment to allow this.

I’ve talked to this CEO as well… and he hopes to open 100 offices in America very soon.

He’s actually opened 3 real estate funds up to now.

A seasoned pro and paying minimum 5% dividends… with the potential for capital gains as well.

You can still invest for a minimum of $1,000.

Collect income from a solid asset class.

That’s another deal available to you when you join DealBook today.

WHO THIS IS NOT FOR

If any of these describe you, DO NOT sign up:

- You’re someone who is looking to ‘trade’ private companies

- You’re someone who needs to know the ‘value of their shares’ every day

- You’re someone who needs the money in 30-90 days

- You’re someone happy with average market returns

- You’re someone who wants to invest in the next ‘Google’

First, these private companies aren’t liquid stocks. Some of them can take you weeks to get you money back if you decide to withdraw. There’s no magic button to open the exit door.

Second, private companies aren’t ‘re-valued’ daily like the stock market. I think it’s best you don’t know the value of your shares daily as you won’t panic sell. With private companies, you don’t have a choice. Most re-evaluations take place quarterly.

Third, like I said, you can’t simply click a ‘sell button’ and collect your investment back. Doesn’t work like that. Invest only money you’re okay not having for a few months.

Fourth, if you’re doing well in the markets and not looking for diversification, more interesting companies, etc., it’s fine, don’t join.

Last, we’re looking for companies with steady revenues… no speculative “startup” investing here. Go to Silicon Valley or gamble on Crowdfunding random companies if that’s your thing.

Dealbooks is for you if you’re ready to expand your portfolio.

You’re ready to collect above average premiums from fast-growing companies most have never heard of…

Plus, you want a shot at a company potentially IPO-ing in the future and you’re in on the groundfloor.

Of course, I can’t promise you we’ll nail down an IPO company… but you and me are going to have a ton of fun finding deals together, talking through them, and investing in them.

If you’re ready to unlock private company deals, click the link below.

You’ll go to a secure site to finish becoming a Charter Member and I’ll send you my #1 private company investment right now.

I can’t wait to start this new journey with you.

As my network grows, our deal flow will also grow, so we can be pickier about what we invest in.

That’s why I recommend joining Dealbooksnow:

#1. The price will definitely double in the future

#2. I expect deals will get better and better as the service grows

You’ll also be backed by my 100% refund and extra free year policies.

As President of Investors Alley, I welcome you to our first ever private company investment club.

There’s a seat waiting for you.

We’re going to have a lot of fun.

I also expect our first private company investment check will arrive soon.

Make your first investment now.

With regulation stripped back, this is now one of the best times in history to invest in private companies.

Click the link below now to join Dealbooks.

Jared Nations

President of Investors Alley and Editor of Dealbooks.

PAST OPPORTUNITIES IN DEALBOOK:

- Real estate investment fund (open): I shared this above. They say they’ll pay a minimum 5% dividend… and have enjoyed double-digit returns over the last two years. (we raised over $100k in a couple weeks)

- Oil royalty fund (closed): An opportunity to earn potentially 9-11% from rising oil and gas prices. This royalty opportunity filled up already.

- Sports beverage startup (closed): A potential 13x opportunity in a sports beverage startup that uses state-of-the-art science and is backed by scores of athletes and influencers – and that can actually improve your health, not fill you up with sugar. (will probably re-open in early 2022)

- Money management startup for millennials (open): This company is set to revolutionize how we save – and how we think of savings accounts. Founded by a father-son team and backed by the minds behind the most successful “fintech” apps around, this startup could potentially 10x with its patent-pending savings and cash-back invention, and it’s one-of-a-kind deal with Amazon.

Disclaimer:

Investing in early stage and privately held companies involves substantial risk. Investing in early stage and privately held companies may not be suitable for all investors. Other than the refund policy detailed elsewhere, Investors Alley does not make any guarantee or other promise with respect to any results that may be obtained from using the Investors Alley Dealbook Services (Services). No person subscribing for the Services (“Subscriber”) should make any investment decision without first consulting his or her own personal financial adviser, broker or consultant. Investors Alley disclaims any and all liability in the event anything contained in the Services proves to be inaccurate, incomplete or unreliable, or results in any investment or other loss by a Subscriber. You should only invest only “risk capital” – money you can afford to lose. Investing in early stage and privately held companies involves high degree of risk and you can lose the entire principal amount invested in a relatively short period of time. All investments carry risk and all decisions remain the responsibility of the person making the decision. There is no guarantee that any opportunity identified by Investors Alley or its representatives systems will result in profits or will not produce losses. Subscribers to the Services should fully understand all risks associated with any opportunity identified by Investors Alley before making an investment.

Investors Alley and any content inside of Dealbook (beta) are for general information purposes only. We source our information and content in this communication from diverse sources including SEC filings, current events, interviews, corporate press releases, and information published on funding platforms. That said, the views we express and the conclusions we reach are our own. As such, this document may contain errors, and any investments described in this document should be made only after reviewing the filings and/or financial statements of the company, and only after consulting with your investment advisor. Actual results may differ significantly from the results described herein.