We’ve Closed 43 WINNERS

In 49 Trades This Year!

For All Dividend Investors

A 10-minute covered call strategy is a no-brainer income boost for every dividend investor (even beginners).

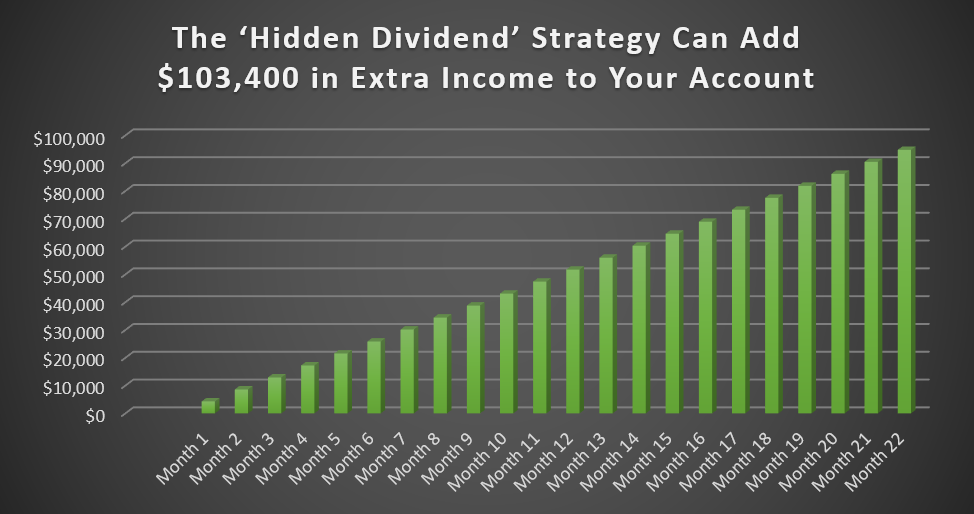

It could add up to $103,000 cash to your bank account.

Dear Reader,

If you invest in dividend stocks…

And you’re NOT using covered calls to supplement your income…

You are “leaving money on the table,” according to Kiplingers.

I agree with them.

In fact, I’d go as far to say you’re missing out on $103,000 in extra income by not using covered calls because:

- They cost $0 in added capital (depending on your account)

- They can produce 45X more income than actual dividend stocks

- They take just 10 minutes to use

- They require almost zero knowledge of options to trade

Meaning, any beginner or advanced investor can begin using this strategy.

Even better…

They work like clockwork again and again.

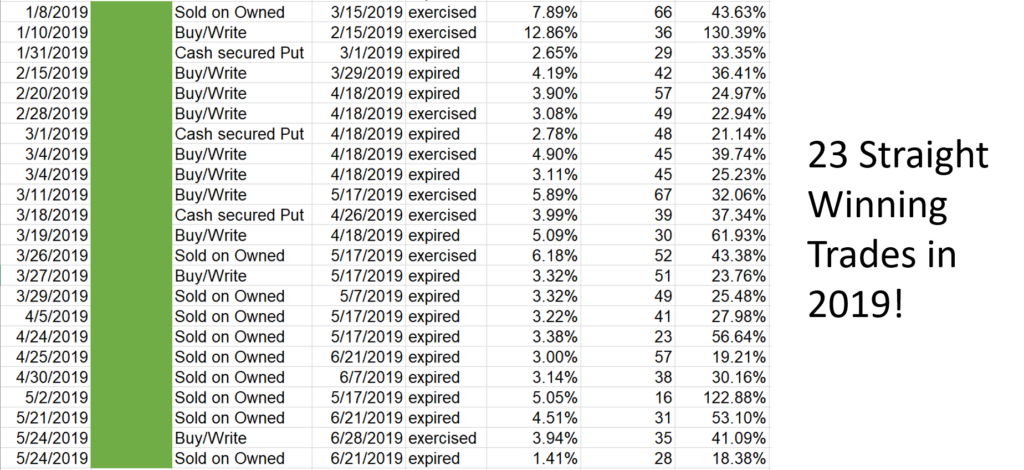

In fact, earlier this year we closed 23 straight winning trades using this strategy.

You don’t earn that kind of winning streak trading options by themselves, or even stocks.

In fact, in almost two years, we’ve produced a 92% win-rate using this strategy as of this writing.

66 trades placed and 72 of them are winners.

Covered calls might be the easiest way to make more income.

And I need to make sure that you’re not missing out.

How would you spend an extra $103,000 cash in the next 24 months?

How would you spend an extra $103,000 cash in the next 24 months?

If you’re already investing in dividend stocks and making an income of any size…

Then, you’re the #1 candidate to earn potentially an extra $103,000 from covered calls in the next 24 months.

And you can do it without risking your house as I showed you.

I admit, when I first heard about this opportunity, I thought it was too good to be true too.

After all, I understand your hang-ups about options.

…options are confusing and complicated…

…options “take too much time”…

…options are super risky…

I’m going to touch all of these points today.

I had these same thoughts for years. Until I found covered calls could supplement my dividend checks…

Even better, you don’t need to stop what you’re doing with your dividend portfolio.

I still collect payouts — some monthly, some quarterly — from my dividend stocks.

But, that’s only the beginning.

Now, there’s a brand new way to juice even more income from these same stocks without selling them.

Frankly, you may not have to touch your dividend stock portfolio at all.

Don’t invest another penny if you don’t want to. Continue to collect your income as you’ve been doing.

But here’s a way to make more.

Much more.

And it’s virtually FREE to do.

I like to think covered calls are a simple and quick way to ‘juice’ your dividend payouts.

The Street writes covered calls are “very helpful in maximizing the returns on your investment.”

Marketwatch claims they’re the perfect solution to “boost retirement income.”

With just a few minutes per month…

With just a few minutes per month…

A few clicks of your mouse…

A few covered call trades can add an avalanche of income to your checking account. Honestly, I believe it’s possible to deposit an extra $103,000 in the next 24 months.

Let me show you:

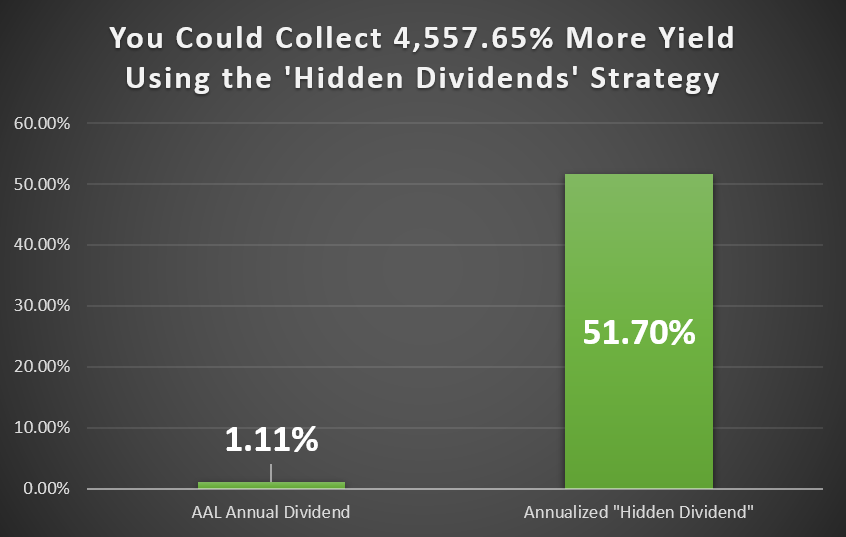

In November 2018, say you moved $100,000 into American Airlines’ stock to grab a measly $1,100 annual dividend. That’s a 1.1% yield.

It seems their stock serves peanuts too.

But, you didn’t sit on your hands.

You’re savvy and manage to collect an extra 3.4% on American Airlines in just 24 days.

Most other investors never get this money…probably because they don’t know how.

Annualized your option income comes out to around a 51.7% return.

You do this every month for 24 months wielding $100,000…

You’d collect an extra $103,000 income. $103,400 to be exact.

Again, that’s ON TOP of the dividends you’re already collecting. In the case of American Airlines, 3,000 shares would generate around $1,100/year.

That’s not much, but it’ll take care of a ticket to Europe.

However, with less than 3,000 shares, you could’ve generated an extra $103,000 in “hidden dividends” within 24 months.

That’s a lot more trips.

Not to mention, that’s 45X MORE income every year than if you simply just held the shares.

Put another way — if American Airline’s dividend stayed the same, you’d be waiting until the year 2061 before you collected the same $103,000 that you could bank in 24 months.

504 months vs. 24 months. I know my choice because I’ll likely be dead by 2061.

That’s the truth. What’s also the truth is that covered call income isn’t some pie-in-the-sky fairy tale.

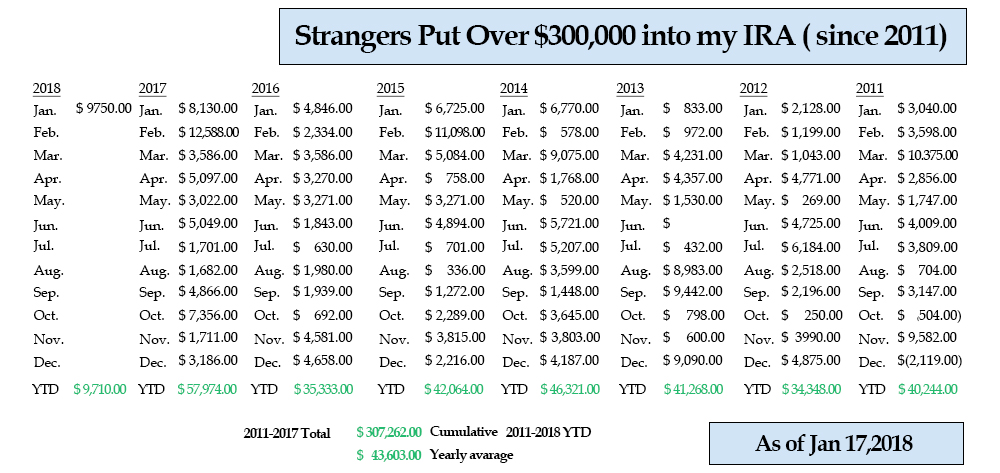

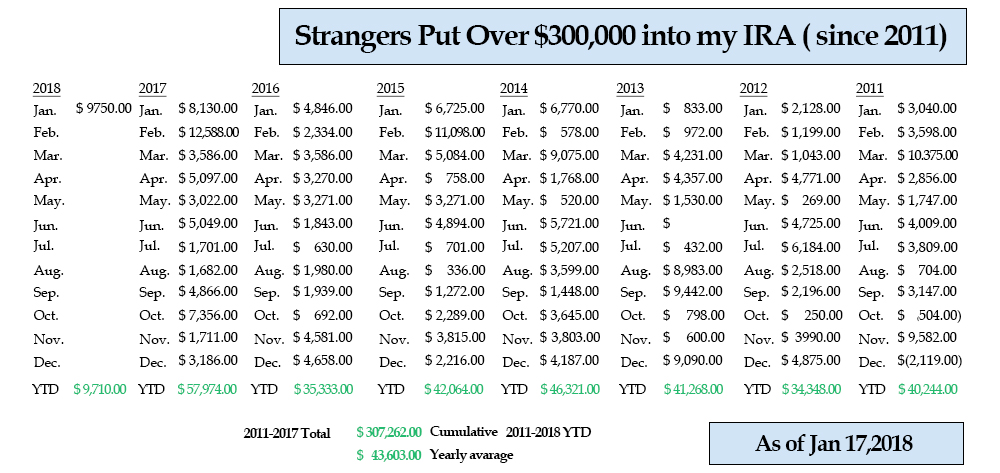

Paul Price, a writer and speaker from Philadelphia, created this chart showing me and many others how he’s captured covered call income again and again for years.

He jokes “Strangers put over $300,000 into my IRA since 2011.”

This chart dates January 2018, so in seven years, he averaged about $87,200 every 24 months with 2017 being the highest.

Meaning, his money and income are rapidly growing.

Paul’s doing the same thing I’ll show you…

Taking stocks we already own…

And squeezing out more income than the company pays in dividends. That’s as good as it gets.

Jaime Darcey, a 48-year old who own a Little Caesars pizzeria, says “I call [covered calls] creating it my own dividend. I shoot to make 1.5% per month.”

That’s the same as earning an extra 18% cash dividend on top of her regular dividend payments.

We tend to shoot for more income each month than Jaime. Still, she’s taking home 2-3X more annualized return than many supposed high-yield stocks with her approach.

Some of my readers are already on pace to the 6-figure mark in 24 months.

- Leo M. says “I’ve been able to withdraw an average of $5,500 per month.”

That’s an average of $132,000 in 24 months.

- Lori B. says “[Tim’s] recommendations have took my portfolio from $20,000 in annual payouts to about $50,000.”

That’s $100,000 on the nose in 24 months.

- Jack G. says “I have increased my dividend income 100%…from $23,000 to $49,000.”

That’s another investor almost hitting $100,000 in 24 months.

Again, keep investing in those dividend stocks for the long haul. That’s what I do in my own retirement account, and I tell my thousands and thousands of readers to do so too.

All I’m saying today is there’s a little-known way to extract even more income from these stocks.

I’ll show you the strategy to use in just a moment.

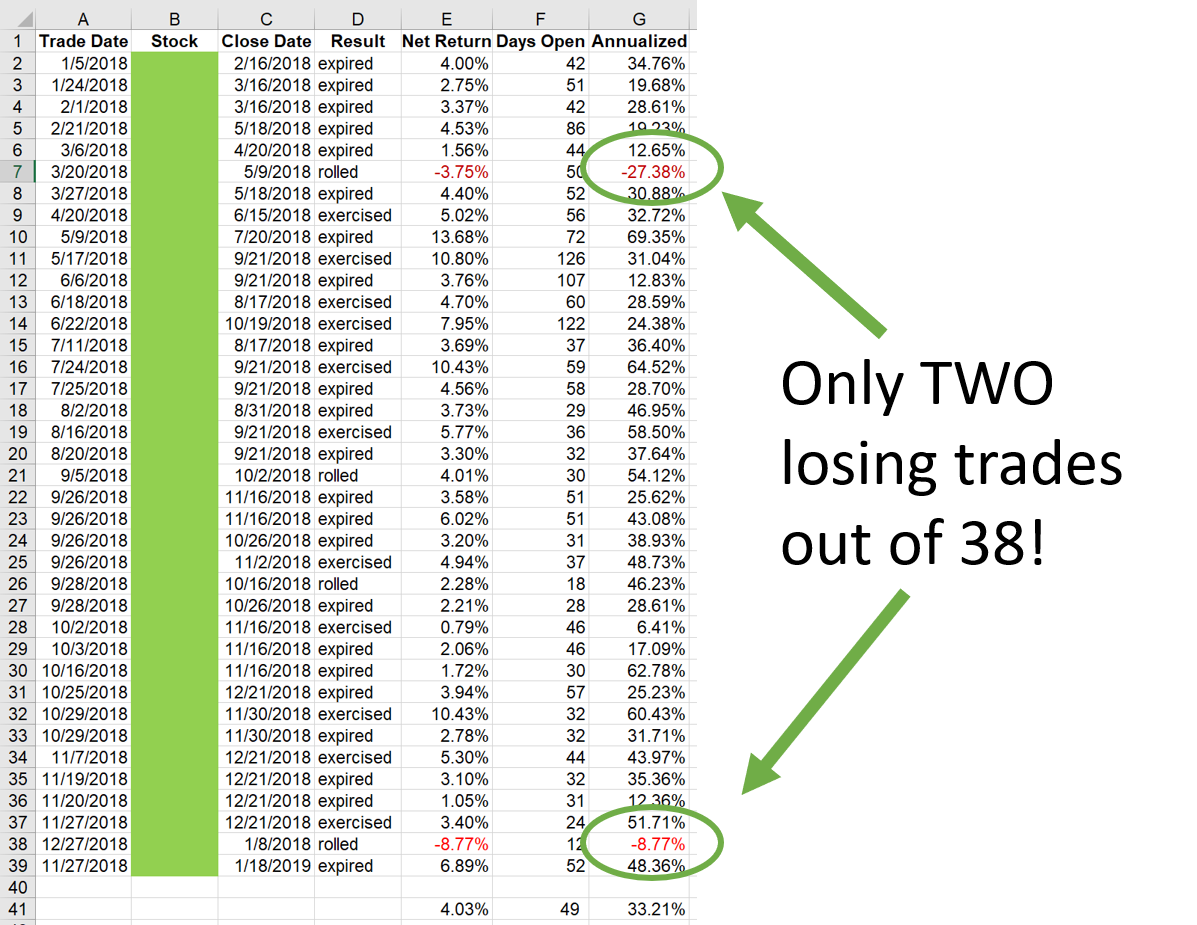

In 2018, we executed this strategy with a 94% success rate.

My colleague, Jay Soloff, achieved a 100% success rate with his trades in 2018 alone. That’s a perfect game in baseball terms. You can’t get any more conservative than that.

Earlier this year, we ripped off 20 straight winners together. And even now we’re posting winner after winner.

Covered Calls Safer than Dividend Stocks Themselves?

Listen up.

You and I invest in dividend stocks for a sure way to create income. Companies alert what they’ll pay us before shipping us our dividend check.

So, we feel pretty comfortable investing in our high-yield plays to capture that income. 100% comfortable, I’d say.

The covered call strategy I’ll show you today is almost the same way…

You get a 90%+ success rate…meaning nearly every opportunity to ‘juice’ your dividends works.

I’d argue it’s even more of a sure thing than investing in dividend stocks. Because companies can cut their dividends tomorrow. With this strategy, you’re in control.

In 2018, we made 38 trades and won 36. A 94% percent. One of our portfolios had a 100% success rate.

To date, we’re 66 out of 72…a 92% win rate.

20 straight winners at one point.

And the steps to secure this extra income can be done while watching TV.

Others don’t do this because they don’t know how.

Here’s another thing:

Covered calls work in any market condition

(Read this if you’re worried about a market crash)

In fact, covered calls can do even better than just sitting on your hands and doing nothing.

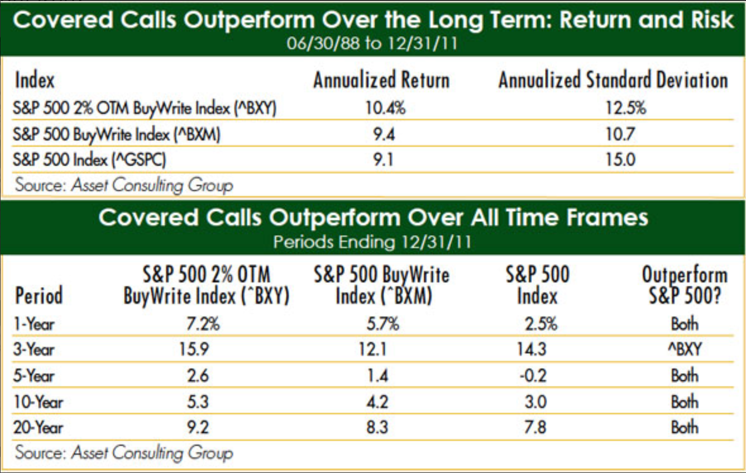

A 23-year study done by the Asset Consulting Group looked at buy-and-hold investors of the S&P 500 through the DotCom bubble burst, the Great Recession and beyond.

During the 23-year study, the S&P 500 grew 360% in that time-frame. That’s quadrupling your money and some.

However, the income strategy I’ll show you…

The one that could add an extra $103,000 into your bank account…

BEAT the S&P 500, sometimes as much as 188% in some years.

Actually, whether you compared the 1-year, 5-year, 10-year, or 20-year performance head-to-head, the income strategy you’re about to discover steamrolled the S&P 500’s performance.

It trucked through some of the worst stock market crashes of all-time.

And it can work for you.

This strategy is quite simple.

The only strategy where you collect EXTRA income on top of your dividend stocks

It’s like a buy-one-get-one-free deal at your local grocery store.

Your only choice is whether you’ll start using this strategy yourself.

Most IRA’s allow you to execute these trades because they see it as a conservative way to create more income.

That’s right, I said ‘create.’

You don’t have to invest any more money. This trade – minus commissions – costs $0 extra to execute.

Brokers do require you own at least 100 shares of your favorite dividend stock. If you already do, you’re all set.

So, unlike buying more dividend stocks (which could total potentially thousands of dollars)…

This covered call strategy is virtually FREE to execute.

And you can collect your first covered call income starting right now.

No more waiting for the next ex-dividend date.

Heck, it doesn’t matter if the company chops the dividend in half tomorrow, you can collect your new covered call income immediately.

Every month, you could walk away with 2-3X more income than the dividend stock pays.

Check out this trade I recommended in October 2018.

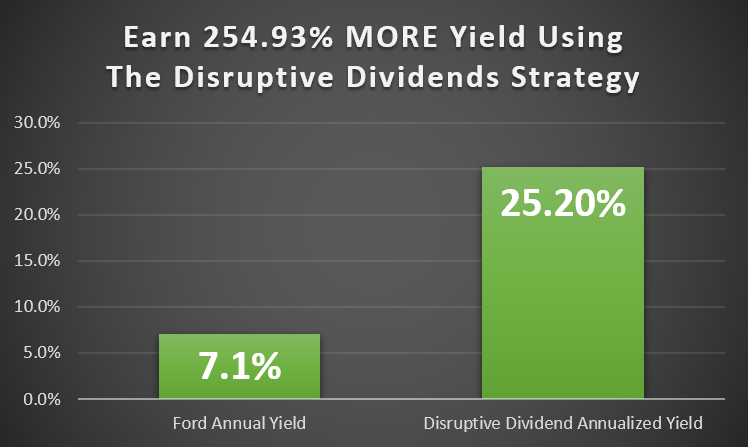

Ford shells out a nice 7.1% dividend annually. As a dividend investor, that draws me in and I recommended readers pile in.

The stock jumped 6% in the next five days…but that was just gravy on top of what happened next.

I showed readers a way to pocket an extra 3.9% over the following 57 days.

Annualized that comes out to a 25.2% return. Or 2.5X more income than if they just collected the dividend.

Again, they received their normal dividend.

However, smart dividend investors would’ve also cashed a payout 2.5X the dividend at the same time.

It’d be like opening a surprise bonus check from work.

If you can make 2.5X more income on top of your dividend, that can go a long way.

Say you’re taking home $30,000 in dividend income. Keep that. But you could also collect potentially another $75,000 on top of that. That’s 2.5X more.

Together, that’s $105,000.

The difference between $30,000 and $105,000 is massive.

Compare a soccer mom’s Honda Odyssey…

VS.

The playboy’s Tesla Model S…

You’d take the Tesla, I’m guessing.

The difference is night and day.

Think about what that extra $75,000…or $103,000 can mean for you and your family.

That’s not only a nicer car.

…that’s paying for your children or grandchildren to attend college.

…a donation that catches the eyes of your Church or charity.

…you’ll catch yourself not looking at the prices anymore at restaurants.

You’re living a brand-new life.

The real question is:

(Watch how easy it is)

Again…and I have to stress this again…

I know options may stir up emotions, some good some bad. I myself used to feel options are a gambler’s playground….lots of upside, lots of risk.

And there are plenty of jokers out there rolling the dice.

However, covered calls I’ve found have proven to be the opposite. You can take smaller risks, but create consistent income doing so.

You actually can make money off of those taking the risks.

Options too risky? Too complicated? Take too long?

I asked my intern to try out covered call. He had never tried this options strategy before, so he was skeptical.

I asked him to record him making the trade. Forgetting he was a millennial, he made the trade in friggin’ Robinhood…an app I do not recommend.

However, the clip he sent me says it all.

In 13 seconds, he made a trade with our favorite AMZA stock.

- It didn’t take long at all

- As you can see, it’s not complicated

- A trade like this will have up to a 94% win rate

But I’m not going to leave you to your own devices.

In just a few minutes, you’ll be able to claim FOR FREE my covered call Masterclass below. It’s a 3-part video series showing you:

- Step-by-step how to make the trades

- How to execute the trades in a variety of brokerage accounts

- Why it’s such an easy, but successful strategy (and how it works)

I’ll walk you thru everything, you won’t be alone.

Let’s think about this strategy in a concrete way.

Let’s think of your dividend stock holdings as… say… a rental property you own.

Maybe after you potentially start making $103,000 extra as you could today, you buy a beach rental property in Naples, Florida for $500,000.

White sandy beaches. Tourists caravaning in year-round. You picked the perfect spot.

Because of that, you can charge a nice $2,000 per month to rent out your place. For the full year, you’re making about 5% on your $500k investment.

You’re a genius.

Suddenly, another guy spots your lavish, cash-cow abode and would like your rental income for himself.

However, at the local watering hole he’s heard rumblings the Naples’ housing market is on the fritz. If he plops down $500k and a crash happens, he’d be in a world of hurt.

So, he says to you: “I’ll pay you $10,000 if for the next 60 days, you give me the option to buy your house at $525,000.”

That’s $25,000 above your home’s value.

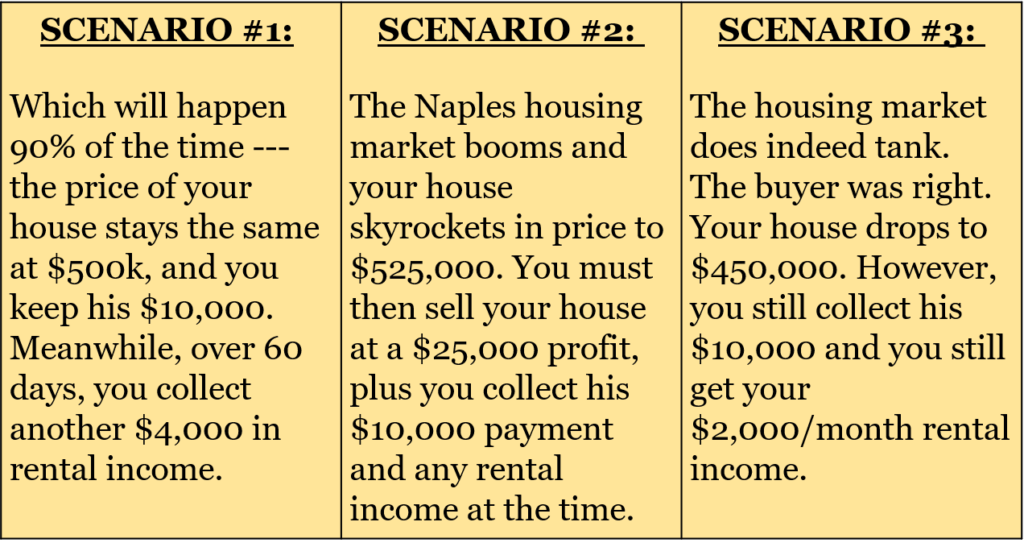

Let’s play through the end game scenarios for you:

In all three scenarios, you keep the $10,000 ‘option’ payment the buyer deposits.

- In Scenario 1, you pocket an extra $10,000 and go on your way. (our goal with our options). Not to mention, continue to collect your $4,000 monthly income. In under 60 days, you earned 2.5X your monthly income for really doing nothing

- In Scenario 2, you do indeed have to sell your house, but you make a $25,000 profit on top of the $10,000 option payment.

With our covered call options, this may happen as well.

We are forced to sell our dividend stocks for a profit.

But, unlike the complications with buying real estate, you can go back to the market 10 minutes later and re-buy the shares. Meanwhile, you’re $10,000 + $25,000 richer.

- In Scenario 3, you lose value on your house, but you still collect the $10,000 premium plus you still earn rental income.

Let’s circle back to trading options on your dividend income assets.

Think about the dividend stocks you own. They fluctuate with the market.

Why not hedge your portfolio with those making ‘gambles’ like the guy who wanted to buy your Naples beach house?

Most folks gambling on options will win 10-30% of the time.

But, it’s possible for you to win 92% of the time doing the opposite of most options gamblers.

I’m a conservative and contrarian investor at heart. So when I hear something like that, my ears perk up.

That’s why this options strategy is recommended by Ally Bank, Vanguard and Charles Schwab.

Warren Buffett and his firm Berkshire Hathaway have made an estimated $37.1 billion from covered calls options strategy.

Carl Icahn has done the same for his $13 billion dollar firm, Icahn Enterprises.

- Forbes even says covered call is the path to “getting rich off options.”

- Bloomberg writes you can “enhance income…especially in an environment characterized by low interest rates.”

- Nasdaq believes covered calls are a “low-risk income strategy, and one of the lowest risk strategies an investor can use.”

I told you we had a 94% success rate in 2018. 35 of our 37 trades were winners.

And just recently we closed out 23 winning trades in a row following this same strategy.

Nasdaq produces research from the Chicago Mercantile Exchange that looked at mountains of option data and says up to “94% of covered call options” were winners.

I’ll show you exactly how to start trading these options and winning 92-94% of the time or more today.

With the covered call strategy, you could be collecting not one, but two streams of income.

Dividend income.

And…

Supplemental income.

All at the same time.

Now, whenever I mention options to some investors, they stand their ground saying “They will never trade options.”

I’m not here to tell you that dividend stocks aren’t good enough.

They are. I invest much of my own money in the high-yield investments featured in The Dividend Hunter.

Option income is simply a way to amplify your income. And:

- Is virtually FREE to do

- Takes just 10 minutes per week

- Plus, like I said, it hands you extra cash on top of your dividend income

I believe you could add another $103,000 in cash income on top of your dividends just by following this one easy strategy.

If an extra $103,000 isn’t worth the effort, then by all means, the rest of what I have to say will not be helpful.

It’s a darn shame, but it’s up to you.

In fact, this entire strategy may not be for you if:

…You aren’t comfortable trying something different than just buying and selling stock. I’m telling you, if you’ve bought a house before, trading the covered call options strategy will be like shooting fish in a barrel.

…It’s also not for you if you’re already comfortable with the dividend income you make now. I can’t speak for you, so that’s a personal decision you can discuss with your family.

…Finally, if you don’t have the time. I believe it will take you only 10 minutes per month, but perhaps you aren’t near an internet connection enough. That’s okay as well.

However if you’re interested in collecting this income, let me show you how.

My name is Tim Plaehn. Thanks for being a member of my services.

My name is Tim Plaehn. Thanks for being a member of my services.

Only a subscriber like you is getting access to this strategy, so take that as you may.

I’ve been investing for over 30 years.

I spent years as a stockbroker and as a Certified Financial Planner. And I’ll tell you, the covered call options strategy is not something I ever recommended to my clients.

Not because it’s risky or only for those with big bank accounts…

But because I didn’t understand options.

Plus, my role as a CFP was to not increase your income, but rather to not lose you money.

It’s a sad fact, but true.

My boss worried more about keeping clients than helping you make money.

Today, as the editor for The Dividend Hunter and other services, I’m able to help you in all aspects with your income.

And the results have worked out for my dividend subscribers:

- Kevin G. wrote me: “I am now a dividend Income Investor. My dividend income is now well in excess of $50,000 per year, and to date I have not had to touch any of it for living expenses.”

- Jim M. told me: “You have provided me with a new sense of confidence. I have invested just under $100k and my return percentage is higher than my financial agent can manage.”

- Matt S. emailed: “I have received enough dividend income so that my wife was able to quit her job and stay home with our son. Without the dividend income over the last couple years this would not have been possible.”

But stopping at high-yield opportunities would be doing you a disservice.

So I hunted for ways to make even more income. Strategies that could pour a ton more cash into your pockets.

Then, our company, Investors Alley, hired Jay Soloff.

The difference is, he’s the options expert, I’m the dividend expert.

Jay’s traded options for over 21 years. Not only that, he traded on the floor of the largest Option Exchange in the world — the CBOE.

There’s something unique about Jay.

Not only was he a trader on the floor…he was a Market Maker.

The Market Maker is the ‘invisible hand’ in the market. They provide liquidity to keep traders buying and selling.

This is important because the Market Makers see the ebb and flow of the market. Jay’s experience behind the scenes has provided him with insight into the options market other folks simply don’t have.

That’s how in 2018, when many folks got crushed by the markets…

Jay showed readers how to capture gains from options to the tune of:

- 127% in 23 days on GLD

- 148% in 28 days on SQ

- 229% in 36 days on SMH

- 213% in 13 days on Netflix

- 79% in 22 days on SPY

- 63% in 24 days on SPY

- 117% in 21 days on SPY

- 96% in 36 days on QQQ

- 114% in 42 days on MRVL

And those are just to name a few.

He’s really brought a lot of knowledge on options to our team here at Investors Alley.

…I find great paying dividend stocks…

…He finds great income option opportunities from those same stocks…

Create two income streams in one.

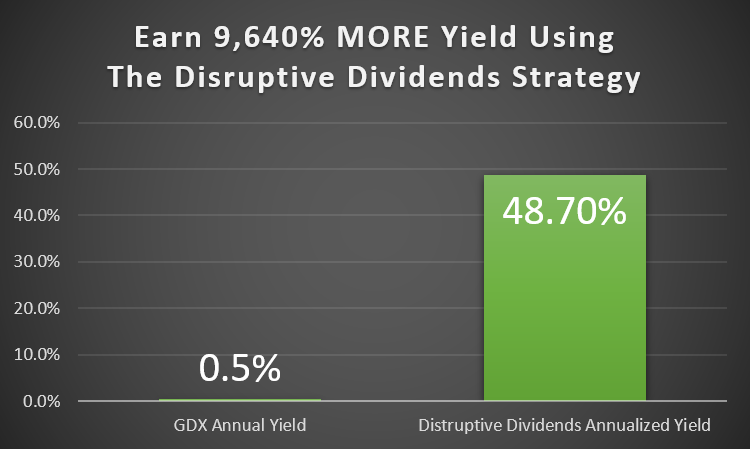

Take this trade of the VanEck Gold Miners ETF – GDX.

Normally, it pays around 0.5% dividend. Not great, but it’s more yield than Amazon’s stock.

Jay found a trade in September 2018 — right when the markets were about to crash — that yielded a 4.94% return in a mere 37 days. Annualized that’s a 48.7% gain or 96X more income than just holding GDX over that same time.

It’s your choice.

Either wait until the year 2115 when you’re long gone to collect the same rate of income…

Or, earn it in a mere 37 days with covered calls.

That’s how fast this extra income can pile up.

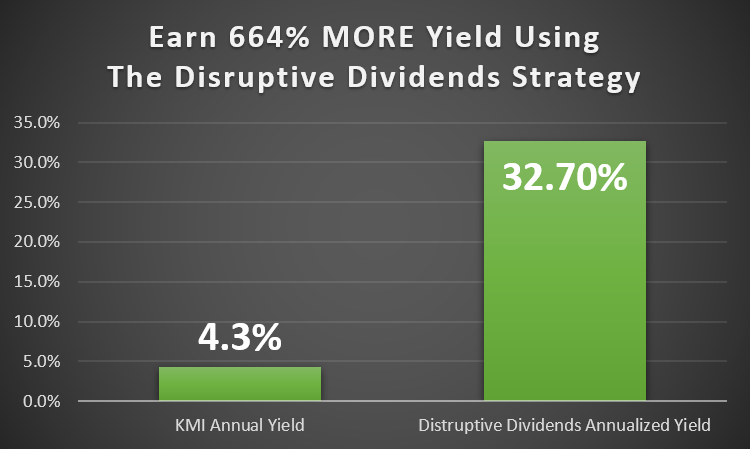

How about this trade I recommended on Kinder Morgan (KMI). It pays a nice 4.28% annual dividend.

I wanted to collect that, but didn’t want to wait a full 12 months to get it.

So, instead I put on a covered call options trade and collected a 5.02% return in under two months. Annualized that’s a 32.7% gain or 5.5X more income on top of their standard dividend.

I’ll show you one more.

This one’s a bit more interesting.

And it really shows you the power of options vs. just buying and holding stocks.

This is one of the reasons Nasdaq believes the covered call strategy is “one of the lowest risk strategies an investor can use.”

It can actually take risk off the table when a stock tumbles.

In November 2018, I recommended General Electric. At that point, the 18th largest US company had slumped 43% from it’s high in October.

Before it axed its dividend in December, I felt the stock was primed to bottom and shoot up.

Unfortunately, the stock tumbled another 14%.

But, our options strategy hedged our risk.

I recommended a trade and you could’ve pocketed 5.3% in 44 days or a 43.9% annualized return. That trade lessened our losses.

But in the end it worked out perfectly. The stock shot up 36% in under three months.

We were back in the black.

Speaking of which, that’s another huge benefit of the “Disruptive Dividend” strategy.

I told you before you can make two streams of income.

But that wasn’t the whole truth.

Actually…

- Dividends

- Option income

- Capital gains

I’ll bet you a whiskey there isn’t another asset in the markets that gives you this.

Look at that GE trade again.

- You make a small dividend of $0.01/share

- You also make a 43.9% annualized option return

- Plus, a 36% capital gain in three months

Annualized over 12 months, that would be a 187% total gain at that same pace.

Capital gains don’t always happen, but they are a nice addition to our wealth when they come.

I recommended covered call trades on KMI twice in 2018.

In one instance,

- We collected $0.20/share (a 4% annual yield)

- We pocketed 32.7% annualized “Disruptive Dividend”,

- But also, in three months, the stock bumped 11%

At that pace, over 12 months that would come out to an 81% total gain.

With just one stock, you can create three different streams of income and wealth.

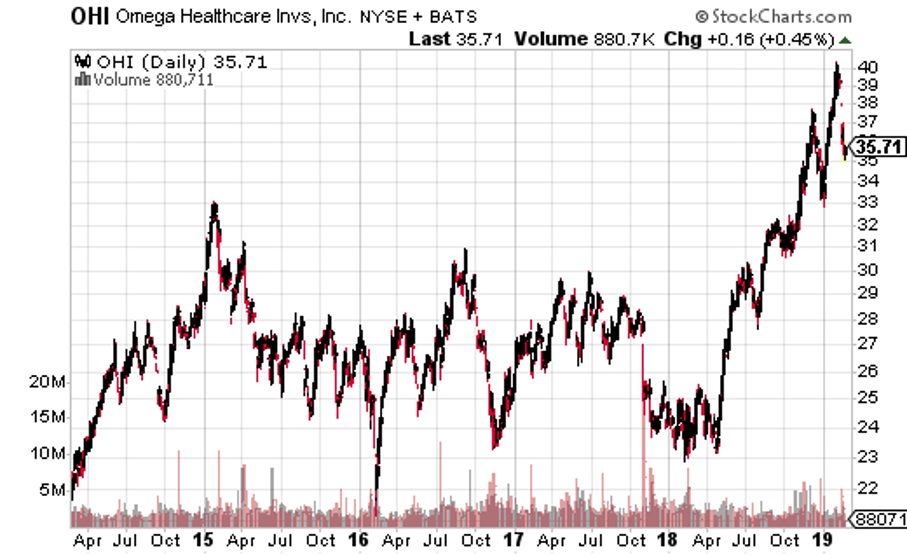

Like when I recommended Omega Healthcare (OHI) in May 2018.

We pretty much nailed the 5-year bottom on the stock.

We caught it just as it started it’s rise again. If you had followed my recommendation in May:

- You would’ve collected a nice $0.66/share dividend (8% annual yield)

- Not to mention, a 31% annualized option income

- Plus, the stock is up 38% since my recommendation

That’s over 75% total gains.

With these kind of gains in your account, you can see how it’s not hard to generate an extra $103,000 in income in 24 months.

With our ‘spin’ on covered calls, you could:

Collect 45X More Income Over the Next 30 Days

I showed you our American Airlines trade from November 2018.

You could’ve collected an extra 3.4% income using options on American Airlines in under 30 days. Annualized that comes out to around a 51.7% return.

The stock normally only pays out around 1.1% annually.

Meaning, you could generate 45X more income within 30 days.

That’s the same as if you make $1,000 in income this year…

You could make $45,000 instead.

If you earn $2,000 today…

You could earn $90,000 instead.

If you collect $5,000 in income now…

You could be collecting $225,000.

All it takes is around 10 minutes per week a few clicks of your mouse, and the use of my “Disruptive Dividend” strategy.

“Disruptive Dividend” is what I call our spin on covered calls:

- Collect dividend income

- Collect option income

- All from one stock

With it, we’ve amplified dividends in a way many didn’t know exist.

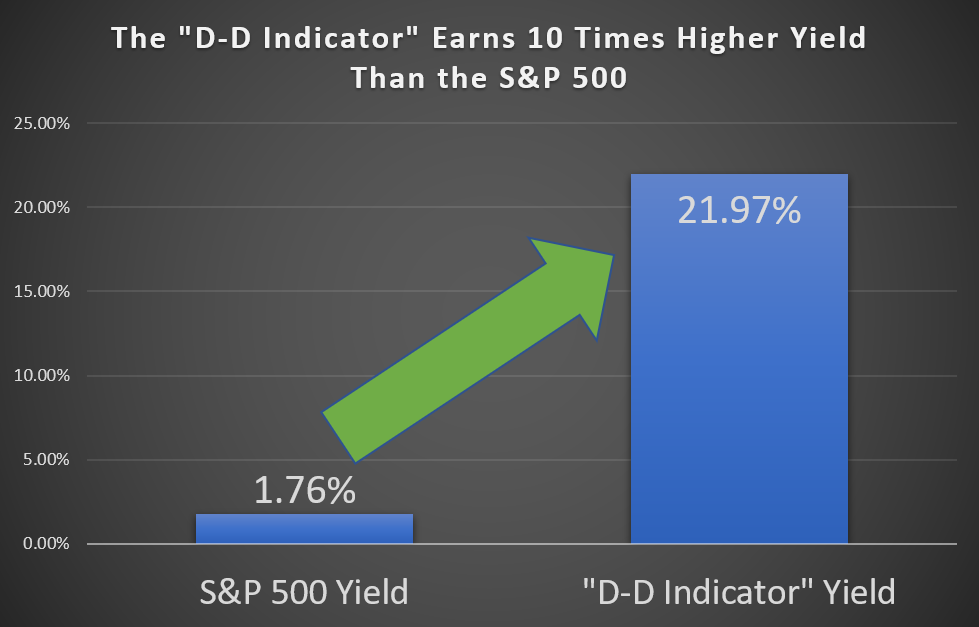

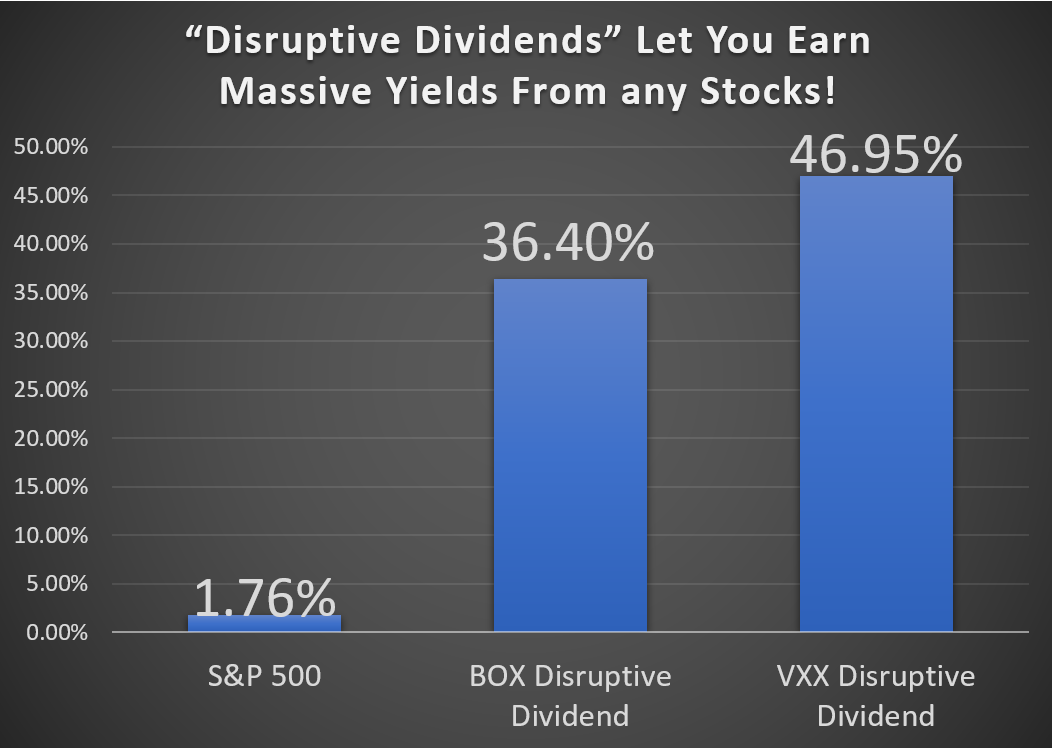

With the “Disruptive Dividend” strategy (or indicator if you will) we’ve earned over 10X the S&P yield.

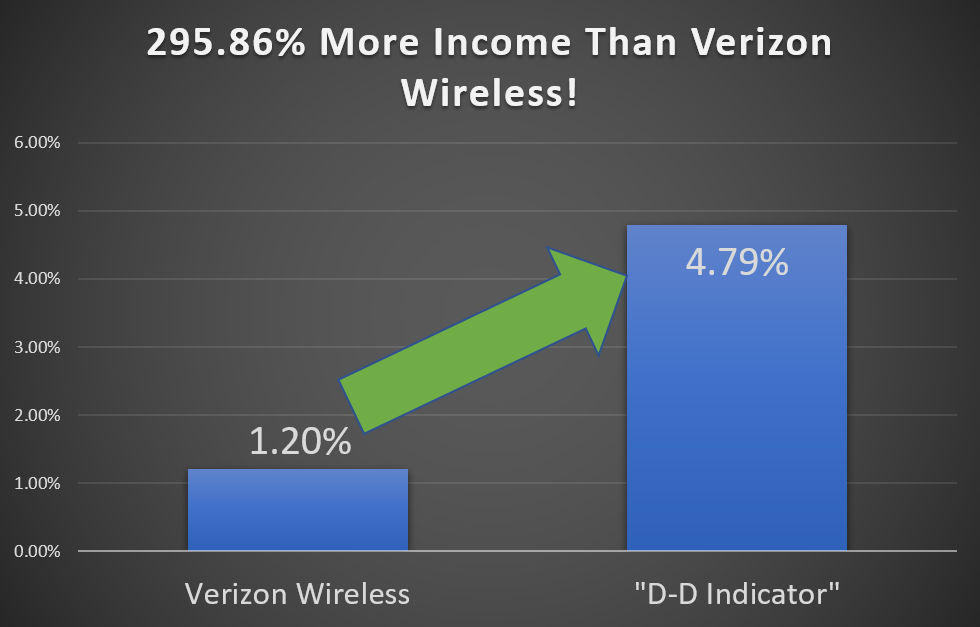

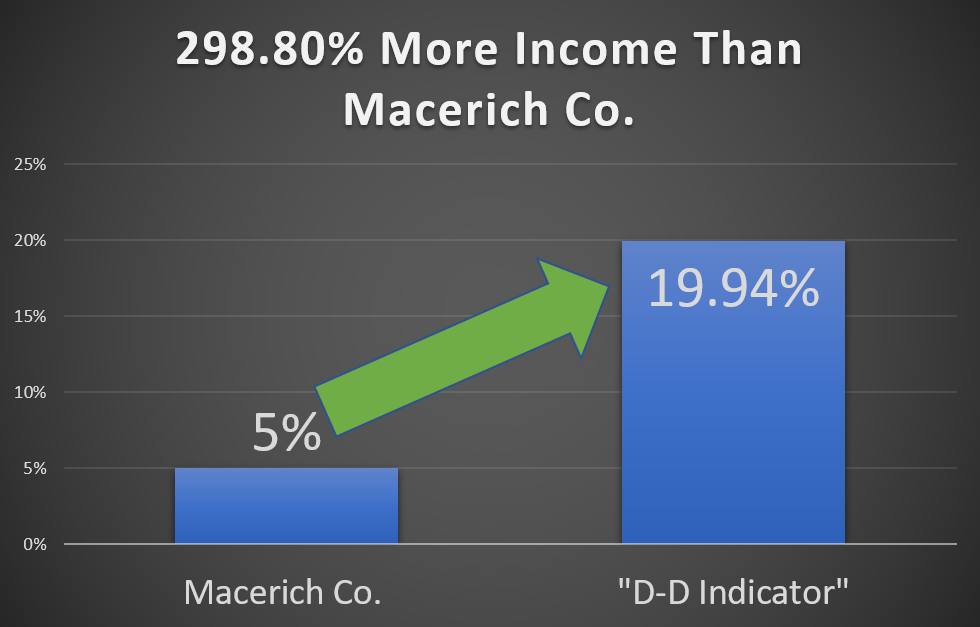

You’ll see how we increased the yield of Verizon Wireless by 295.86%…

We’ll also share how we increased the yield on Macerich Co. by 298.80%…

This is all possible for you when you start now.

I already showed you one man – Paul- who’s made over $300,000 doing exactly this.

Of course, Paul isn’t alone.

An adjunct financial professor who invests in his spare time, John Alford, says he’s generated “annualized yields of 60-80%.”

He loves using covered calls because he can “generate 2-3X yield on dividend-paying stocks.”

Like I mentioned, if you already own at least 100 shares of your favorite dividend stock, you are qualified to use my “Disruptive Dividends” covered call strategy.

If not, there are many cheap ones out there. We traded Ford’s stock last year around the $7.50 share price. Math’s pretty easy — 100 shares amounts to $750, and you’re good to go.

I’d love to show you how this strategy works if you’re open to it.

In fact, rather than explain it through words, I’d like to show you. And I’ll show it to you.

On camera.

Jay and I will take you by the hand and help you every step of the way.

We’ll even field all your questions.

Every step of executing this strategy to add an extra $103,000 to your income in the next 24 months… you’ll see it.

In fact, I won’t shoulder this task alone. I’ll unveil this presentation with the options expert himself, Jay Soloff.

A multi-million dollar portfolio manager called him “Mr Options.”

The extremely popular Money Show held annually added Jay to their “All-Star of Options Trading” panel.

He rarely gives presentations. When he does, it’s not unusual for 500 people or more to attend.

However, I’ve convinced Jay to join me for this exclusive presentation. I’m calling it

The “Disruptive Dividends” FREE LIVE Event on

October 15th, 2019

The LIVE event will be held October 15th, 2019 at 8:00 pm eastern. It will last about 60 minutes depending on how many questions we get.

If you can’t make it, I’ll send you a copy of the recording, no worries.

On the call, you’ll discover:

- The entire “Disruptive Dividends” covered call strategy from start to finish

- What income returns you can expect in the next 30 days, plus

- “Mr. Options”, Jay Soloff, will give you a peek into his portfolio and show you how to make the trades (what buttons to push, how to enter your orders, etc..)

And much more beyond that.

At the end of the session, we’ll present our three most popular dividend stocks to use the “Disruptive Dividend” covered call strategy on.

Those I’ll save for the event.

But I don’t want you to have to watch the entire presentation to get your first trades. I have three to show you right now.

Meaning, I have seven covered call trades to show you. They’re all inside my brand new report,

“Top 3 Disruptive Dividends for $103,000 in Extra Income”

Top “Disruptive Dividend Stock” #1: 69% annualized yields + 12% dividend payouts

We used the “D-D” options strategy on this same stock six different times in 2018. On two different occasions we banked over 64% annualized returns.

Maybe even more enticing…

This stock pays an appetizing double-digit yield.

We’re looking at a truly dynamic opportunity here. You get to collect your 12% yield no matter what, but can also collect up to 69% annualized on top of that.

Put that together, if you had a mere $65,000…

With both the yield + the “D-D” options strategy, you could potentially walk away with up to 82% annualized cash income every year.

In 24 months, that’s potentially $106,600 in total income collected.

The company is a Real Estate Investment Trust (commonly known as a REIT). Located in Arkansas, when I recommended it in May, it promptly shot up 20% in the next 24 days.

This “Disruptive Dividend” company is involved in telecommunications. They collect rental income from a $6 billion dollar giant. So whenever someone makes a phone call, connects their smartphone to the internet, or logs in at home to their wireless internet, this company could potentially be collecting a percentage of the revenue.

They then pay out that revenue to you. A whole 12% worth which is quite a sum compared to most dividend payers yielding 1-5%.

It’s an amazing opportunity, but that’s only my first play to show you.

Top “Disruptive Dividend Stock” #2: Massive Income + Potential 237% Profits on the Way

This second company we traded five times in 2018. You could’ve traded it more…as often as you like, but we only officially recommended it five times.

One trade landed us a 29% annualized return…

Another 31%…

24%…then 26%.

It’s been a cash cow for readers that we tap into again and again.

The company is a Fortune 500 company based out of Houston. They’re one of the largest natural gas providers in the country.

Natural gas prices have hit a 3-year low.

But prices always bounce back.

You’d be getting shares while natural gas is suppressed meaning you’re getting in early.

The last time they spiked, shares skyrocketed as high as 237%. Meaning, you could bank massive capital gains, while also generating an 8% yield, and multiple double-figure annualized yields with the “D-D” strategy.

Top “Disruptive Dividend Stock” #3: Dividend Going Up Every Year…Now on Flash Sale

My third pick we traded three times in 2018 and I expect more in the coming months. We’ve seen annualized gains up to 19%.

On top of that, it’s yielding a tidy $3/share each year (6% yield). I like the play because it’s raised it has dividend 29% in the past five years.

The company based in Santa Monica, California, has been around since the 1960’s. It’s one of the top five owners of shopping centers in America. They own over 54 centers and over 51 million square feet of space.

Their stock hit the rocks during the Great Recession dropping from $100 to around $6 in 2009. Well, they came storming back handing investors as high as 1,341% gains.

They’re on sale again and there are both income and profit opportunities out there.

Now, let me be clear.

Now, let me be clear.

These are my top three plays. That doesn’t mean you can’t use the “Disruptive Dividend” covered call strategy with your own income stocks. You can.

I’ve simply found these three stocks to give me and my readers more income on all fronts.

So, right now, I want to give you access to:

- The LIVE “Disruptive Dividends” covered call webinar ($149 value)

- Top 3 Disruptive Dividends for $103,000 in income ($99 value)

Absolutely FREE today.

This is all the training you need plus the stocks to generate income from all in one place.

Even better, (and unprecedented in the industry)

You’re getting not one, but two experts walking you through everything.

A 30-year dividend investing veteran. And…

A 21-year professional options trader.

Both Jay and I have experience trading stocks and options professionally. Myself as a stockbroker, Jay as a Market Maker on the floor of the CBOE.

With a rocky stock market and government programs like Social Security potentially under the knife, it was time to create the ultimate income stream.

Combining dividends and options. A method when combined could produce an extra $103,000 in income for you in 24 months.

Over the same period, your Social Security benefits will average around $31,200. A full 71% less than what we can show you today with “Disruptive Dividends.”

Keep cashing your SS checks.

And add a third income stream on top of your benefits and your dividend stocks.

We want this to be a powerful income stream that not only changes your life and how much you make…But also something you can rely on for not just 12 months…but 12 years….25…and beyond no matter where you are on the road to retirement.

That’s why simply showing you the strategy and what dividend stocks to generate income wasn’t the full solution.

Jay and I wanted to go a step further.

That’s why we co-edit one of the lone dividend options services on the planet, 30 DAY DIVIDENDS.

30 Day Dividends is the complete solution for generating the MAXIMUM amount of income using covered calls

Every month, we walk you through exactly HOW and WHAT to trade for EXTRA INCOME

As a member of The Dividend Hunter already, you’ll get an inside look at how to invest in high-yield stocks.

As a member of The Dividend Hunter already, you’ll get an inside look at how to invest in high-yield stocks.

30 Day Dividends also invests in high-yield stocks, but our goal is to generate income on top of our dividends.

With the right amount of shares, you don’t have to invest another cent into your portfolio if you don’t want to.

The “Disruptive Dividend”” strategy — which is our one and only strategy inside 30 Day Dividends — is meant to create 45X…even 96X more cash income from your dividend stocks.

That’s why 30 Day Dividends is a more advanced service than say The Dividend Hunter.

30 Day Dividends is an active trading service.

Your ‘active’ trading is as little as 10 minutes per month, but it requires more attention than simply buying and holding stocks.

Here’s what to expect:

First: You’ll see around 2-3 new “Disruptive Dividend” covered call option trades come through your inbox every month. You don’t have to trade all of them if you don’t want, but you have quite a choice.

Second: You’ll get alerts on how to execute the trade and why we are doing it.

Third: We are there every step of the way to show you what buttons to click and the option terms to understand.

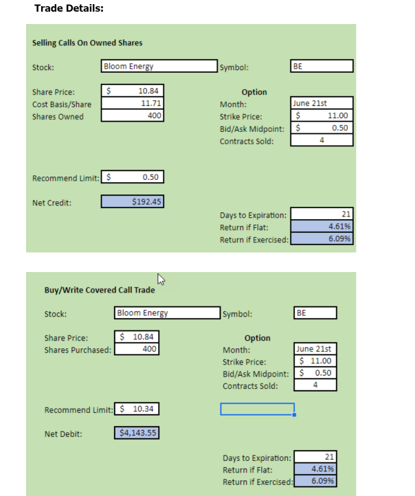

Here’s how a trade will look in your inbox:

The top shows if you already own shares.

The bottom box is if you DO NOT own the stock already.

You see I recommend:

- What price to buy the stock at

- What price to sell the option at

- How many days out the option will expire

- The strike price (you’ll learn about this on the live call)

- The potential profit

In this case, you could collect up to 6.09% in 21 days. If you think of it as a dividend, that’s an annualized yield of 105%.

That’s the largest dividend you’ll ever see.

But the trades are only the beginning.

You also get a ton of education to go along with the trades.

Third: Every month, you’ll get the 30 Day Dividends Monthly Newsletter.

Each issue is packed with thoughts on the month ahead, updates on the trades, what’s working, what’s not. After 12 months of these issues, you’ll be in the top 1% of those understanding options. (You also get free access to 54 back issues for more education.)

Fourth: Every month, we hold a LIVE Strategy Session. Our next call is coming up soon and you want to be there.

Both Jay and I hop on a call with all subscribers and go through our predictions on the market ahead, we discuss our trades, but most importantly, we answer your questions. The Q&A sessions sometimes go 30-45 minutes alone. We’re an open book, ask away. (You also get access to our past Strategy Sessions for free as well. All sessions are recorded).

Fifth:

A special bonus I told you about before:

Covered Call Options Masterclass

($397 value for FREE)

Jay has put together a special Masterclass series helping you make these options trades with 100% confidence.

It’s a 3-part video masterclass that will only take you about 28 minutes to go through and understand.

On this Masterclass, Jay will cover:

- The #1 options strategy used equally by multi-billion dollar hedge fund managers, trading professionals and individual investors

- 5 reasons why this trade is so popular on Wall Street (hint: they are high probability trades)

- The secret to why “Disruptive Dividends” have almost 0% risk if you own dividend stocks

- How “Disruptive Dividends” options trades lowers your losses in the next market selloff

- The simple 3-step way to pick the correct option for the most income, most dividend income, and profit (anyone can do this)

- The one stock we recommend NOT to use this strategy with

- A step-by-step blueprint inside your brokerage on how to trade the strategy. He pretends you’re an absolute beginner of options.

This Masterclass is built right into your login portal. There you get video trainings on how to place your trades and other common questions (including portfolio management).

The retail price for all of 30 Day Dividends is $1,995.

Which, for an options trading service, is fairly cheap. Poke around at other services and what they charge.

I saw one option service retail for $5,000.

You’re not going to have to invest anything close to $5,000 or $1,995.

But it’d be fair to charge that much.

Especially when you get an additional bonus on top of what I’ve already shared.

On top of the:

- 2-3 covered call trades per month

- Alerts and education with each trade

- 12 monthly issues of 30 Day Dividend Monthly Newsletter

- Monthly LIVE strategy sessions

- Your “3-part Disruptive Dividends Masterclass”

It’s this…

Jay Will Send You Income Generating Alerts on Some of the Hottest Stocks on the Planet That DON’T Pay Dividends

Jay’s a master at what he does. With 30 Day Dividends, not only will he find us income opportunities with dividend-paying stocks…

He’s also offered to send you alerts on non-dividend paying stocks.

In 2018, he recommended using covered calls o extract income from Box, Inc. five times.

Box, Inc. — commonly known as just Box — is Dropbox’s main competitor. They are a cloud storage center for businesses.

They pay $0 in dividends. But Jay’s found a ‘backdoor’ way to generate your own ‘yield.’

Here are the annualized returns on all five of his Box, Inc. trades:

- 36%

- 38%

- 35%

- 46%

- 63%

All were winners. Big winners too.

Remember, Jay had a 100% success rate in 2018 even while the market cratered twice.

Box wasn’t his only non-dividend prize catch.

He also recommended FireEye and Netflix.

Netflix he recommended for annualized gains of 39% and 31%.

FireEye he nailed again and again.

His annualized totals for those trades were: 59%, 29%, and 60%. Even better, all three of these trades were within 32 days.

You can do this every single month.

In total, on top of my monthly dividend-play recommendations, you’ll also have Jay chiming in with his own opportunities. Sometimes they are on dividend stocks, like American Airlines or GDX.

Others, like Box and Netflix are bonus moves you can act on.

Jay’s trades alone are worth $1,000/year.

But you’re getting them added to your membership for free. No charge.

Really, it’s a steal what you’re getting today. Let’s summarize:

- 12 months of 30 Day Dividends: That includes 12 monthly issues, 12 LIVE strategy sessions, a free ticket to our Video Channel, 2-3 trade alerts and education ($1,995 value)

- Disruptive Dividend Covered Call Options Webinar: Jay and I will walk you step-by-step through the “Disruptive Dividend” strategy, answer questions and discuss our top 4 trades. ($149 value).

- Top 3 Disruptive Dividend Stocks for $103,000 in Income: My biggest plays that include one stock already paying 12% per year, another that could skyrocket 237% in share price alone, and another trading cheap now that’s increased dividends the past five years. ($99 value)

- Jay’s Bonus “Non-Dividend” Option Plays: Expect 1-2 of those each month on stocks like Netflix, Box, and others. Jay had a 100% success rate with his recommendations in 2018. He’s shooting for that and higher gains this year. ($1,000 value)

- The Disruptive Dividends Options Masterclass: This 3-part video series clocks in at a mere 28 minutes (less than a half-hour TV show), and has our options expert, Jay Soloff, walk you thru why we use this strategy and how to actually make the trades. You can refer back to this Masterclass again and again. ($397 value)

- Private Access to the Investors Alley Portal: Immediately after you invest today, you’ll receive confidential credentials to access all the materials and trades now.

- Easy-to-Reach Customer Support: We have a team ready to answer any questions at any time during business hours. If you’re worried about your subscription, or you lost your password, they will get you back up in a jiffy.

- [NO STRESS] A complete walk-through as many times as you need on HOW and WHAT to trade with covered calls. (Most who join 30 Day Dividends are new option traders).

In total, you’re getting $3,640 of value.

And that’s on the low end.

Like I said, other options services can go as high as $5,000 retail. And that’s for only one editor on staff.

You get two editors for the price of one.

You get dividend expertise and options expertise rolled into one premium package.

That alone is worth more than $5,000.

But we’re not asking for $5,000 today…or $3,640…or even the base retail price of $1,995.

Today only, your investment is a mere $995.

For an opportunity to generate $103,000 in the next 24 months from stocks you may already own…I’m asking for less than 1% of that right now.

Click the button below to join today and to sit in on the live Disruptive Dividends webinar on Monday the 15th.

Thousands have subscribed to our services, and we’ve received acclaim from 30 Day Dividends subscribers, including:

******************

In August I bought NAT per your 30-Day Dividend recommendation. I … have already made back my subscription fees plus. Consider me hooked!

— Alan F – 30 Day Dividends subscriber

I know you ask folks about NRZ. I have made about 20% in that one since I bought it. I have also made about 14% with JCAP. I bought BTE on a breakout yesterday and it is up 13% already.

Thanks for all your help Tim. I really appreciate the hard work you do to bring us … 30 Day Dividends.

— Jerry M – 30 Day Dividends subscriber

I’m a subscriber to…30 Day Dividends. I am VERY HAPPY with your newsletters and they’ve helped me a LOT! I am doing much BETTER than I ever did on my own or with ANY OTHER program!

— Ross H – 30 Day Dividends subscriber

I thoroughly enjoy and have benefited from … 30 Day Dividends and [I] have cancelled several other newsletter services that have not demonstrated the level of communication and performance you and your team have provided to your subscribers.

Thank you for all your time and efforts on our behalf.

— Bob G – 30 Day Dividends subscriber

As a late-adopter to the options trades, I wanted to let you know in only about 6 months, I have collected $967 in premiums and my net gain is $1,648 after call fees and buy/write costs.

This is from doing single contracts only. Seeing the potential with multiple contracts, I continue to allocate more funds to this segment of my overall plan.

This is exciting for me and I appreciate you opening up this additional service for us to learn and benefit from the coaching you and Jay provide through 30 Day Dividends. Many thanks!

— Stan S – 30 Day Dividends subscriber

I’m not alone in receiving acclaim, Jay’s had his own testimonials:

Sean S. told Jay: I’ve won about 85% of the trades, and minimized losses. So your service has been a great learning tool for me and my trading. I try to do about $1,400 -$1,500 each week in revenue. More as my cash balances grow.

$1,500 per week comes out to $156,000 after 24 months. Amazing.

Harry S. wrote Jay: I read your email a little too late yesterday, but just closed out the NFLX butterfly for 5.10, an over 260% gain! Thanks for a great trade!!

Hunter S. said: Thank you for the advice…[my trade] with QQQ and [another] with VIX, I profited about $2,000.

But, I don’t want you to just take my word or the word of my subscribers.

I want you to feel 100% comfortable joining Jay and I inside 30 Day Dividends.

…even more comfortable than the win-rate Jay posted in 2018…

That’s why I’m giving you a DOUBLE GUARANTEE starting now.

You are GUARANTEED a $10,000 Income Stream Today

In the next 12 months, you will — at minimum — generate $10,000 in income.

That’s a 10X guarantee on the $995 investment you make today in 30 Day Dividends.

That $10,000 income mark is based on a $50,000 dividend portfolio, which is pretty reasonable for most retirement accounts.

Now, remember, with the “Disruptive Dividend”” strategy, you don’t need to purchase additional shares if you meet the 100 share minimum.

That means you could use the option strategy we use inside 30 Day Dividends and essentially create (at minimum) $10,000 out of thin air.

I believe what you’ll see the system and are fully onboard, you’ll easily blow past $10,000 and be able to collect $103,000 in the next 24 months.

But, a 10X guarantee is pretty reasonable.

If you don’t hit that, you can call my offices and get a second year free after 12 months.

That means you could use the service 365 days and still be eligible for a $995 credit. That’s how confident I am.

But I won’t stop there.

You also get:

Our 60-Day Stress-Free Satisfaction Guarantee

Get a subscription to 30 Day Dividends today.

If after a full 60 days, you’re not’ entirely satisfied or you don’t believe we can back up what I said today, we will do everything we can to make sure you’re fully satisfied.

That means we will find the right product that better fits you at no charge to you. To be clear, there will not be any refunds given for your first year membership.

Still, I believe this is a no-brainer offer for you. That’s my honest opinion.

Because if you’re already investing in dividend stocks, it only makes sense to not only invest in the best dividend plays, but also collect income on top of income.

You might say it’s the biggest loophole in the stock market today. You’re getting a 2-for-1 deal truly.

And you aren’t investing $5,000 or even $1,995 to get unrestricted access.

…$995 for a trading service is unheard of in financial publication services.

…$995 for an options trading service…it’s unthinkable.

I wouldn’t be surprised if our CEO raised the price after you finish reading this.

For $995, you have an opportunity at a 6-figure income stream in 24 months.

Not only that, every day you don’t collect this option income…money Kiplinger says you’re “leaving on the table”, is a day of earning you don’t get back.

You’re already invested in dividend stocks, meaning you understand the value of income assets. I salute you for that.

Why would you not use a second strategy — one that we had up to 100% success with in 2018 — to generate potentially 45X…even 96X more income in as little as 30 days?

Because really you have two choices.

#1: continue to earn your dividends like you should and be happy with that, or

#2: continue to earn your dividends like you should but earn more income on top of those same stocks.

Up to $103,000 more in cash income with up to 100% certainty.

What would you do with that money in your account?

Maybe you buy that Naples beach house.

Get that Tesla Model S.

Invest and make more.

Whatever it is, it’s up to you.

But it’s your choice.

If you’re ready to take the next step in your income journey, click “Add to Cart” button below. You’ll be redirected to a secure page to finish your order.

We could rip off another 20 winners starting tomorrow.

Don’t miss out.

Join myself, Tim Plaehn, and Jay Soloff inside 30 Day Dividends now.

Click the button below.

Thank you,

Tim Plaehn

P.S. Like I mentioned…if you invest in dividend stocks to generate income…especially an income you plan to rely on for years to come…covered calls are a ‘no-brainer’ for your IRA, 401(k), or brokerage. It’s extra income you can generate without having to buy more shares.

If you’re nervous that you won’t be able to figure out options…,or,

If you believe options will ‘take too much time’…or,

If you believe options are too complicated with all the different ‘terms’ and verbiage…

I promise Jay and I are here for you every day to help you figure it all out. I’m betting after an hour of training, you’ll want us to leave you alone because you’ll ‘get it.’ We’re here for you.

So, when you’re ready, join us to start your amazing subscription to 30 Day Dividends. Click the button below.

FREQUENTLY ASKED QUESTIONS

I’ve never traded options before, what if I don’t understand it?

This is a premium service. We cover absolutely everything. First, we have a video channel with a 3-part series on how to trade the “Disruptive Dividends” strategy. That will lay the groundwork.

Next, the live (and will be recorded) event on October 15th will show you again how to make our trades, how we profit with 30 Day Dividends, and provides plenty of opportunity for asking questions. The process is almost the same for every trade. Once you made one trade, you’ve essentially made them all!

Then, we have our monthly strategy session which goes through all our trades and we can answer all your questions including clearing up any issues.

Plus, both Jay and I are available any time over email. We regularly help our members place their trades over email. We have your back and are 100% committed to your success!

You’re covered all the way around.

Are there any guarantees with 30 Day Dividends so I’m covered?

We have two guarantees.

First, we believe you could easily hit $103,000 in 24 months. But we are willing to guarantee in the next 12 months, you will — at minimum — generate $10,000 in income.

We know you could hit 6-figures, but getting folks to simply try the strategies requires some convincing. That’s why we know if you just make a few trades this year (not all of them) you could add an extra $10,000 to your account and we GUARANTEE IT or else you get a second year free.

That $10,000 income mark is based on investing a minimum of $50,000 in the trades, which is pretty reasonable for most retirement accounts.

Once you feel comfortable reaching $10,000, we’ve found it’s easier for folks to blow past that towards 6-figures. Hence, the $10,000 guarantee.

Not to mention, a $10k guarantee is a 10X guarantee on the $995 investment you make today in 30 Day Dividends.

You could use the service 365 days and if you don’t have the opportunity to make at least $10,000 in extra income you’ll be eligible for a second year for free. That’s how confident I am.

But, that’s not all, you also get our 60-day stress free option guarantee. If after a full 60 days, you’re not’ entirely satisfied or you don’t believe we can back up what I said today, we will do everything in our power to make you happy.

That means we will find exactly the right product that fits your needs. To be clear, this means there will be no refunds, but you get a full credit for what you’ve invested.

Those two guarantees are solid and protect you.

Do I need to make all the trades you recommend to succeed? I don’t have time.

Absolutely not.

Every trade is individual. If you miss this week’s alert, you can jump in next week. If you are in a country with no internet and miss a month, you can jump right back in.

In 2018, we made 37 recommendations and won 35 of them. 94% success.

This year, we’re having another stellar year. We’ve already closed 20 straight winners and counting!

You didn’t need to trade all those to be successful and make back your $995. Just a few would’ve been fine.

We like to provide options hence the multiple alerts.

What’s the minimum amount of money I need to use this options strategy?

It’s not a matter of portfolio as much as the share count. To execute the “Disruptive Dividends” strategy, you need at least 100 shares of your favorite dividend stock.

Typically, the higher the share price of the stock, the more “hidden dividend” income you can make. So, as your income and portfolio grow, so does the potential option income you make as well. It’s the magic of compounding.

For some dividend stocks, like when I recommended Ford’s stock, you only needed around $700 – $800 to start using this strategy.

I recommend much more so it’s worth your while in terms of effort.

The key is this: If you already have 100 shares of a dividend stock, you can use this strategy. In fact, NOT USING IT means you’re essentially leaving money on the table. The money’s there for you, you just need to know how and when to access it. Hence, 30 Day Dividends.

I can’t make the live event on October 15th. What do I do?

The event will be recorded. You can watch it anytime after that. We recommend attending LIVE so you can ask questions and get them answered.

However, if you can’t, it’s not a problem at all. You can always email us your questions or attend the next month’s live session as well.

We hold a live call every month on a variety of topics. So no worries if you miss this first call. You’ll still have access to the recording and plenty more live calls.

We hold these calla to help new subscribers like yourself get comfortable with 30 Day Dividends right away.

Options are a scam aren’t they?

Honestly, I thought they were in my early career. Now, we have an expert floor trader with 21 years of experience on our staff here at Investors Alley (Jay Soloff). And I’m learning new stuff all the time.

Options aren’t a scam. They are just badly used by inexperienced investors who don’t know what they’re doing.

Our strategy has over a 90% success rate because we ARE NOT trying risky option strategies. We only recommend (inside 30 Day Dividends and always) safe, conservative option trades to both protect your money and remove high flying bets.

Join 30 Day Dividends and we will show you more the power of using options to make income on top of your dividends. Plus, you’ll see how to use options the right way (not the gambler’s way).

Honestly, I believe this is as risk-free and a no-brainer offer you will ever see. That’s my straight-forward opinion.