Video #1 | Video #2 | Video #3 | Video #4

Hi. This is Tim Plaehn again.

As I promised, in this second presentation I’m going to give you the KEYS TO THE KINGDOM… the goose that laid the golden egg… and Midas’s touch all at once.

I’m going to reveal my proven techniques for identifying the VERY BEST rising dividend investments – stocks that both create a solid, rapidly increasing stream of cash… AND… are most likely to appreciate in value over the long term.

I’m going to show you 5 simple, easy-to-follow research steps that you can do on your own, at home, and that will give you the ability to outperform virtually every stock broker, money manager and newsletter guru you might know.

I mean that literally.

And it WON’T take very long to learn these simple techniques, either – just a few minutes.

I’ve used these simple but powerful techniques to create a steady income stream for myself – and I’ve taught these techniques in seminars to hundreds of ordinary investors.

Now, in my LAST video, I showed you why the KEY to wealth and prosperity lies in one very simple idea: Invest in stocks that consistently make you more and more money each quarter.

In other words, invest in RISING dividend stocks – stocks with a PROVEN track record of paying higher and higher dividends each and every quarter.

I explained why rising dividends is the SINGLE most important factor in predicting both income stability AND future capital gains.

And I showed you the single most important METRIC to use in evaluating a stock: the percentage annual INCREASE in its dividend yield.

I told you I look for AT LEAST a 12% annual increase for four straight quarters.

And I have showed you numerous examples of stocks with rising dividends – and I revealed why FOLLOWING the money… investing in companies that MAKE YOU MONEY… also leads to big winners in terms of capital gains.

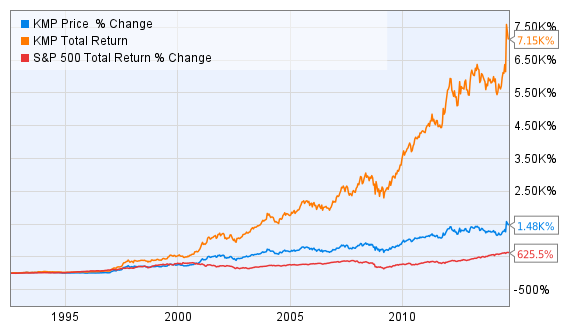

For example, I told you about stocks like Kinder Morgan… which saw an average increase in its dividends of 13% a year… for 18 years in a row!

The result: Before it was bought out in 2014, Kinder Morgan multiplied investors’ money by TEN times over 17 years, turning every $10,000 into $103,000.

But when you add in the $58,000 in dividends earned over the same period, the average annual total return for this stock was 16.83%.

I also explained why investing in companies with high dividend growth rates, like Kinder Morgan, is no longer optional for income investors.

That’s because INDEX INVESTING… passively investing in the market as a whole… hoping a rising tide will lift your boat… will not give you the returns you need going forward to enjoy a prosperous retirement.

As I pointed out in the first video, experts like Vanguard founder Jack Bogel are predicting that future stock returns will be just HALF of what they’ve been in the past, only about 6% a year going forward compared to the 11% we saw over the past 30 years.

And I explained that since real-life investors are rarely 100% invested in stocks 100% of the time, your real-world returns as an index fund investor could be more like only 1% to 3% a year max.

Now, in THIS video I want to show you how I do things step by step… the actual method I follow to identify high-paying dividend stocks.

Now, before I get into the details of how I identify stocks with rising dividend payments, let me say a word about why it’s so difficult for the average investor to do this.

One reason: There is VERY little information available on the Internet about the key metric, which is the percentage increase in the dividend yield.

Sure, you can find different advisors promoting this or that dividend stock.

But if you want to really analyze the stock’s cash payments, you have to look in many different places and make the calculators yourself.

In other words: it takes a ton of work.

But we’re going to simplify that for you right now… so if you do decide to join us in this powerful approach to growing your wealth, you’ll have a head start on most other investors.

Okay, now that I’ve shown you why it’s so hard for ordinary investors to find stocks with rising dividends… let me SHOW you how to do it.

In this segment, we’re going to cover…

- How to find high dividend growth rate stocks

- The characteristics of a high dividend growth stock

- Ranking and rating the stocks I follow

- Analyzing individual companies for continued growth

- Invest in companies that lay out their plans

Okay, so let’s get started…

- How to Find High Dividend Growth Rate Stocks.

Since the Great Depression, there has been a paradigm shift concerning how corporations look at their assets.

In a slow-growth economy, one way for a company to grow its cash flow through what CPA types call “monetizing assets.”

What that means in ordinary English is that a company spins off its various divisions and creates new companies.

These new, smaller companies are often set up to generate strong cash flow growth.

As a result of this trend in American business, the best place to look for high dividend growth opportunities is out of the list of recent – within the last 4 to 5 years – spin-offs. And that is something we can easily find.

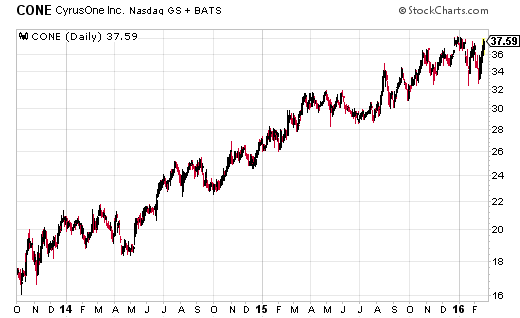

Here’s an example: in January 2013, Cincinnati Bell spun-off its data center business with the IPO of CyrusOne Inc (NASDAQ: CONE).

Over its 3-year life, the CONE dividend has been growing at a rate of 40% annually.

That’s right: 40%.

And as you may recall from our previous video, money pressure like that eventually propels the value of the stock itself upwards.

Not surprisingly, then, the 40% dividend growth rate led to substantial capital gains for investors owning this stock – a tidy 78% return for investors in less than 3 years… despite the lackluster performance of the stock market as a whole in 2015.

- What to Look for in High Dividend Growth Rate Stocks.

Now, high-dividend growth rate stocks typically have several characteristics in common:

First, the he sponsor company usually retains significant ownership in the new company, so that it is the primary recipient of the growing dividend stream.

As investors we’re just along for the ride.

Second, the new company uses a tax-advantage business structure, such as a real estate investment trust (REIT) or publicly traded partnership.

These businesses typically pay no corporate income tax, leaving more cash flow to be paid out as dividends.

Third, the sponsoring company owns additional assets that can be sold over time at cash flow accretive prices – called drop downs – to ensure the new company can hit its growth targets.

- Ranking and Rating High-Growth Dividend Stocks.

You won’t find stock screeners or lists that provide dividend growth rates.

But that’s actually a GOOD thing.

One of the strengths of this strategy is that the majority of investors don’t even know it exists.

And, because it takes a little work, many investors don’t have the time to do the grunt work involved.

That means if you want to use this strategy – and lock-in the 10% to 12% a year annual compound growth rates that will give you the retirement prosperity and independence you want – you’ll have to spend a few minutes a week on some simple, easy steps.

For example, you should develop a list of dividend paying companies – and then set up a simple system to track dividend growth rates.

But rather than you re-inventing the wheel, I’ll show you how to do that right now. There are a few short cuts that make things really easy and quick:

First of all, concentrate on the companies using pass-through business structures that I mentioned earlier – such as Real Estate Investment Trusts (REITs), Master Limited Partnerships (MLPs), or closely related companies.

- Then, sign up for email news release alerts on the company’s investor relations web page each time you find a new dividend growth prospect.

- Maintain a list with yields and the dividend growth rate. I use customized databases that list the stock, and I update the list each time I get a dividend increase announcement. In the earlier video, I showed you how to use a simple online Compound Annual Growth Rate (CAGR) calculator, such as Money Chimp’s, to easily figure out what the growth rate of the dividends are.

These easy steps take a few minutes of your time… but they’re well worth it. They’ll give you a HUGE advantage over just about every investor you’ll ever meet… and even over the talking head “experts” you see on TV.

And once you have a tracking system like this set up, it takes only a few minutes a week to keep your prospect list updated once you have it in place.

I compare this work to the 6 months of classroom time the Air Force put me through before ever letting me near a jet and actually go flying.

- Analyzing Companies in Your Life for Continued Future Growth

Now, this is where things get a bit tricky – but it’s also how you can lock in annual returns most other investors only dream about… especially if we enter a new period of low overall stock market returns.

But to analyze individual companies for growth potential, you need to become familiar with some jargon. These terms relate to the cash flow generated by a company.

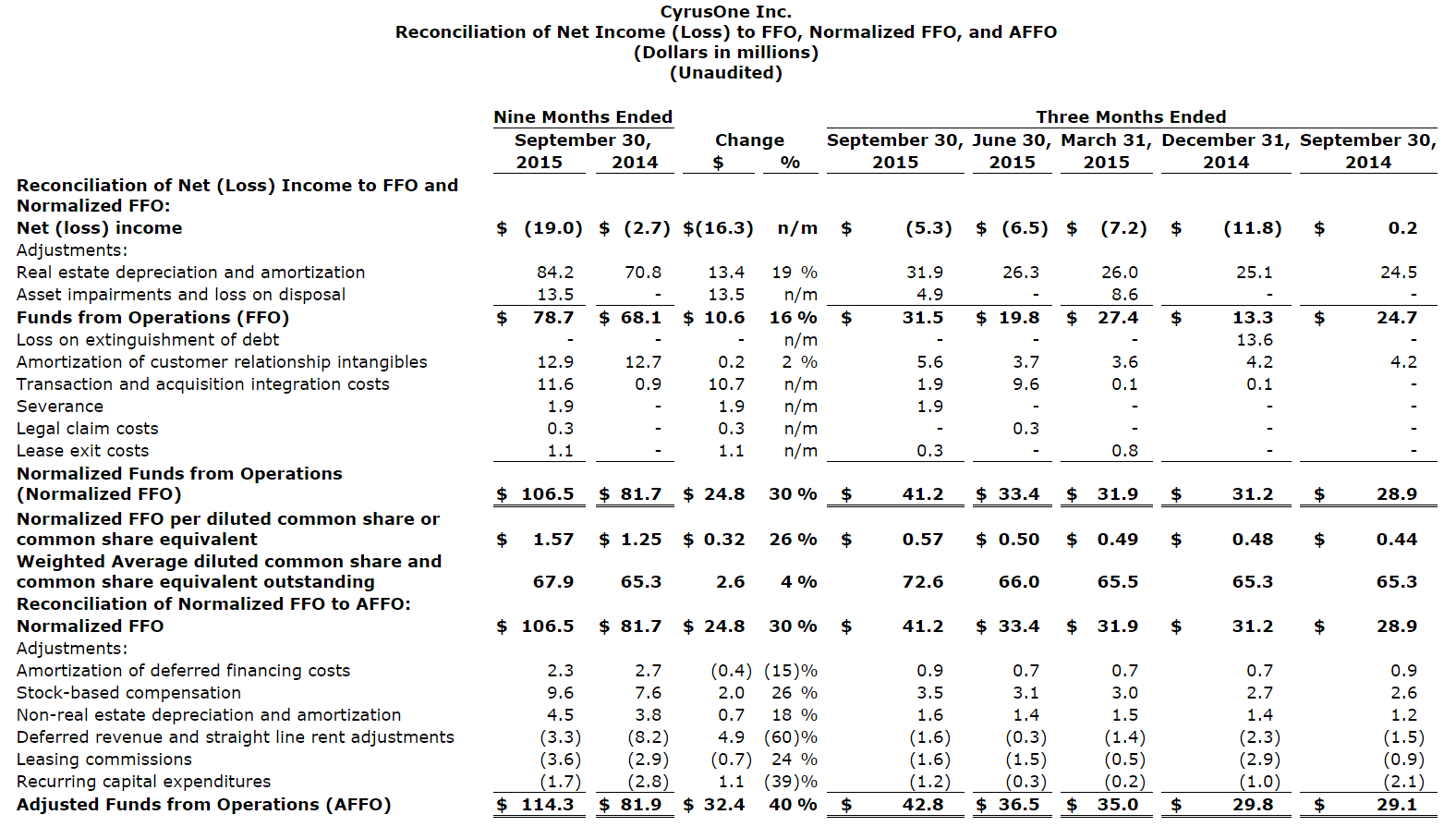

For example, a Real Estate Investment Trust uses the term FFO or AFFO – which means “adjusted funds from operations.”

Other dividend growth focused business types usually refer to their DCF – which means “distributable cash flow.”

In simple terms, the AFFO or DCF per share simply refers to the money a company has available to pay out in cash dividends.

A growing cash flow stream per share provides the fuel to generate a growing dividend stream.

Now, this is very, very important… because with this method I am revealing to you here, you can IGNORE virtually everything else Wall Street likes to talk about – “Earnings per Share”, Wall Street estimates, and ESPECIALLY the temporary and emotionally-driven price swings of a company’s stock in a volatile stock market.

It’s like in sports… or, in my case, flying an F-16.

You have to keep your eye on the ball. You have to figure out the handful of things that are REALLY important… and ignore everything else.

And in investing, what’s really important is MONEY… specifically; the money a company has in its bank account to PAY you for investing in its stock.

The way you keep your eye on that is by zeroing in on the Adjusted Funds from Operations or the “Distributable Cash Flow.”

You can find the PAST reports on these numbers on many websites, including Yahoo Finance among others.

The finance sites like Yahoo don’t break out cash flow. That’s why it’s a foreign concept to the majority of investors.

But the PAST is not good enough. You want to know the FUTURE… what the company is going to do with its dividend going forward.

- Finding Estimates of Future Cash Flow Growth.

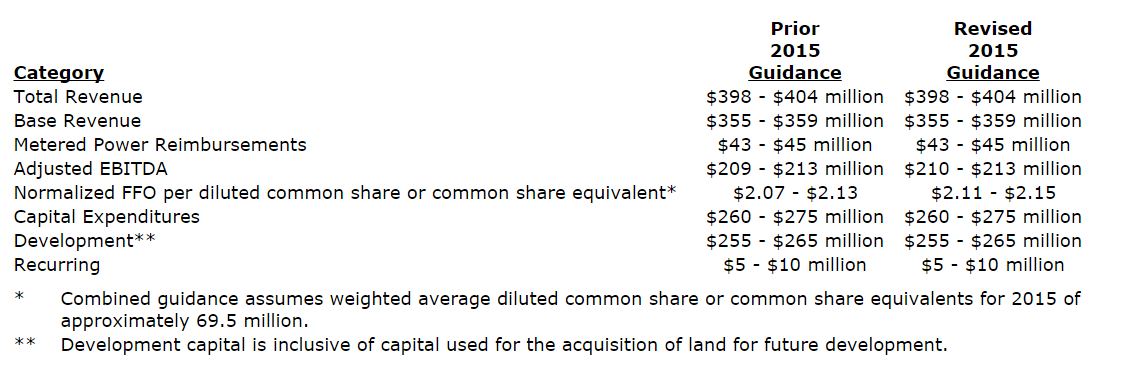

The good news is that many of the high cash flow growth companies are very open about their numbers and projections.

Once you have your list of potential investments, you can check the quarterly earnings reports, look at the cash flow – AFFO or DCF – per share, compare it to the current dividend and guidance and quickly determine if the stock hits your growth goals. Many companies provide “guidance” or management’s forecasts of future revenues, profits, and cash flows. Here’s an example from CyrusOne.

Now as I mentioned in my last presentation, I am looking for AT LEAST a 12% annual dividend growth before I will consider investing in a stock.

You will find companies that have past and projected growth rates of 15%, 20% or even over 25%.

These are our prime targets.

In essence: Buy these and only these stocks — and hold on to them only as long as the dividend growth stays in the teens.

Again, the key is: cash is king. Follow the money… and I mean that quite literally. Watch the company’s CASH FLOW… and make sure it pays you more THIS quarter than last quarter.

The MOMENT a company lowers its dividend payment… drop it like a hot poker.

The beauty of this strategy is that you don’t have to obsess over, or even watch, share prices. (You will anyway… but do your best to ignore them.)

You should focus more on the CASH you see deposited into your brokerage account every quarter (or in some cases, every month), making sure it’s growing by several percent every quarter.

Keep your eye on the ball… and the ball, my friend, is MONEY.

If you do that… if you only invest in stocks that make you more and more money each quarter… you can be confident that, over time, these stocks will also increase their share value by a substantially greater amount than the market as a whole.

And THAT will give you the 10% to 12% annual returns you need to enjoy a prosperous and worry-free retirement.

As an extra bonus, you’ll also be creating multiple streams of income that will supplement your capital gains. With persistence and even a little luck, you’ll end up WEALTHY… and with a substantial flow of cash flooding into your account from dividend payments.

Of course, I’ve only begun to scratch the surface of what I believe is the most powerful and consistent way to create wealth ever.

And it’s not just ME who says this, either.

The truth is, investing in RISING DIVIDEND STOCKS is the hidden wealth secret of the world’s wealthiest investors – men like Warren Buffett, Sir John Templeton, Ray Dalio, and many others.

The truth is, investing in RISING DIVIDEND STOCKS is the hidden wealth secret of the world’s wealthiest investors – men like Warren Buffett, Sir John Templeton, Ray Dalio, and many others.

For example, TheStreet recently analyzed Buffett’s top five stock holdings…

… Wells Fargo… Coca-Cola… American Express… IBM… and Walmart…

… and found that EVERY one has had a RISING DIVIDEND.

Walmart has paid a rising dividend for 40 years; Coca-Cola for 50 years.

So this is NOT just some crazy theory I dreamed up. This is “the” secret behind some of the greatest investing fortunes in history.

These master investors all know that CASH IS KING… and that the secret to investing is to buy companies that MAKE YOU MONEY consistently.

Of course, there’s a lot more to this than what I’ve been able to show you in this presentation.

In fact, my contribution to this investing method is this:

I’ve developed some proprietary techniques of my own that BUILD on what I’ve just shown you… and vastly ACCELERATE the process of building multiple streams of cash income through rising dividend stocks.

And that’s what I’d like to show you in my next presentation: How to AUTOMATE this entire process so your retirement prosperity is virtually guaranteed.

I have some REFINEMENTS that make this approach to growing retirement wealth and income vastly more effective and efficient…

I am really excited about this upcoming presentation. Now that you understand the basics of my approach, I can show you the REALLY powerful tools I use to speed up this entire process.

So, once again… watch your email inbox.

My next presentation is almost done.

Also, as I mentioned the last time, if you stumbled on this video by accident from another site or through a referral from a friend…

… you’re more than welcome…

You’re not going to want to miss this next presentation, either.

Just enter your email address in the box near the bottom of thus page and I’ll make sure you know about it the second it’s posted online.

All questions are addressed in the comments box below.

This is Tim Plaehn. Again, thank you for reading.

[vivafbcomment]

If you stumbled upon this video and want to be on the list for all of the videos just put in your email address below.