Video #1 | Video #2 | Video #3 | Video #4

Hello.

It turns out that cash is king not just in the sense that it can buy what you want… and that people who have cash usually have an easier time getting their way.

No, the phrase “cash is king” also contains within it the secret to market-beating returns in the stock market – and to YOUR retirement prosperity.

Believe it or not, this is a secret that has only really been discovered in just the last few years through some very complex mathematical analysis…

… but which can actually be boiled down to a simple calculation any high school student can do in two seconds.

Now listen.

If you’re like me, the LAST thing you want to do is read another friggin presentation on investing…

I get that.

… but trust me when I say this, this particular one could literally change your life.

I know that sounds hard to believe, but it’s true.

The reason I can say that is because what I am about to reveal to you… and it will take less than 25 minutes to read… changed my life forever.

Literally.

It introduced me to a new approach to investing that many people have heard about – at least recently — but which almost NO ONE uses correctly or consistently…

… and yet this investing approach has been SO SUCCESSFUL for me that it has given me the life I’ve always dreamed of.

And what I’m MOST proud of is teaching ordinary investors how to use this approach to really grow their wealth and get ready for a prosperous retirement.

It’s how I’ve been able to bag profits like…

… 79% on VLP since I recommended it in December 2013…

… 44% on NTI since I recommended it in August 2013…

… 41% on HASI in just the past year…

… 21% in just 7 months on VTR… and then another 31% on it when I re-recommended it again.

… 37% on MIC in the past 17 months…

Now, I’m not telling and showing you all this to brag.

Instead, I’m telling you this because I want you to know that you absolutely can do this, too.

In fact, if you had been following the specialized dividend strategy I’m going to reveal over the past ten years, you could have potentially turned every $100,000 portfolio into $400,000…

… even with the 2008-2009 stock market crash.

And in just the past 12 months alone, you could have pocketed monthly checks worth up to $5,140, even with the market as volatile as it has been.

And in just the past 12 months alone, you could have pocketed monthly checks worth up to $5,140, even with the market as volatile as it has been.

You see, when I was a stock broker for more than 10 years, we used all sorts of very complicated methods to evaluate stocks and try to create successful investing programs for our clients.

We looked at all sorts of indicators and used all sorts of methods.

We used technical and fundamental analysis. Stochastics. All that stuff you read about in investment newsletters and trading magazines.

Most of all that was a complete waste of time…

… and the handful of methods that were actually useful were often so complicated no one could understand them.

So, if you’ve struggled to make money investing over the past 10 or 20 years… as the stock market crashed and rebounded over and over again… don’t worry.

Believe me when I say this:

It’s NOT your fault… and you’re definitely NOT alone.

As we’ll see in a moment, millions of people are in EXACTLY the same situation.

In more ways than one, investing today is like walking into the world’s biggest casino – with millions of flashing lights going off in your face, bells and whistles everywhere, and people screaming and yelling 24/7.

For YEARS… I struggled to make money for both myself and my clients… but then I discovered this mathematical secret I mentioned that completely changed everything I knew about investing – and transformed my life as well.

For YEARS… I struggled to make money for both myself and my clients… but then I discovered this mathematical secret I mentioned that completely changed everything I knew about investing – and transformed my life as well.

In a nutshell, I discovered that cash is king in investing as well.

I discovered that if you totally ignore 99% of what you hear about the stock market and different stock indicators, and instead concentrate on just ONE simple mathematical calculation… a calculation I’m going to show you in just a minute… you can outperform almost all other investors CONSISTENTLY by 3, sometimes 4 to one.

This one simple idea can add literally hundreds of thousands, even MILLIONS of dollars to your portfolio over the next 5 to 20 years.

That’s NOT an exaggeration.

What I want to show you could be the difference between you enjoying an income of $7,000 to $20,000 a month guaranteed… or ending up broke, barely surviving on Social Security and the charity of friends and family.

And that is true even if you haven’t saved very much money yet – and are either already retired or only have a few years left before retirement.

I know that sounds hard to believe… but it is literally true.

And I’d like to share that secret today.

It won’t cost you a single dime, I promise.

This is NOT a sales pitch.

There is nothing to buy.

More specifically, I’d like to show you…

… why you CAN retire with a very healthy income – even if you don’t have much cash put away yet and don’t have much time before you quit working…

… the real reason why the total return for retail investors over the past 20 years has been closer to 2.5% a year on average, not the 9.85% advertised for the S&P 500…

… why younger investors (those in their 30s and 40s) have the potential to become genuinely wealthy simply by following this one simple rule when they invest…

… what the government and Wall Street are NOT telling you about index funds and index investing…

… what “sequence of returns” means and why your entire financial future could depend on you knowing what it reveals about your retirement…

… and that’s just for starters.

Now, before I get into all that, I should take a moment to tell you who I am.

My name is Tim Plaehn.

I’m a former mathematician who became an F-16 fighter pilot in the United States Air Force.

That’s me on the left… way back in the 1980’s: a younger man serving our nation and flying one of the most awesome aircraft ever built – the General Dynamics F-16 Fighting Falcon.

Believe it or not, these two callings have more in common that you might think.

I jokingly say that what I do today requires more calm under pressure than flying a fighter jet at 600 miles per hour.

As for the specifics: I currently serve as senior research analyst for income and dividend investing here at Investors Alley… I am the editor of The Dividend Hunter and 30 Day Dividends investment advisory services… both of these services are focused on generating consistent and reliable income for regular investors no matter which way the market goes.

Here’s a picture of Investors Alley’s corporate headquarters in New York.

I don’t live anywhere near there, of course.

I live on the backside of Lake Tahoe in Nevada, where I spend my free time in the outdoors… taking care of my dogs… enjoying the natural surroundings… and collecting fat dividend checks from investments I’ve been putting money into for more than 20 years.

After many years of sharing my investment recommendations with just a small number of VIP clients, I started writing about investments in 2007.

My articles have been published on websites like The Motley Fool, Chron.com, SFGate, Wikinvest, iStockanalyst, and Seeking Alpha.

At last count I currently have over 3,000 followers on Seeking Alpha.

My reputation has grown to the point that I am now invited to make presentations and sit on dividend discussion panels at The Money Show, Invest Fest, and by Bloomberg and several other financial news outlets.

When a group wanted to launch a new master limited partnership (MLP) focused website a couple years back, they came to me to research and write the articles needed to help the site reach its goals of providing top notch investment education.

Now in the next few minutes, I’m going to reveal what I believe is the single most effective strategy for investing in general – but especially for building a prosperous retirement in the next 5 to 20 years.

It’s this amazingly simple approach to growing wealth that has let me retire early and enjoy the life of my dreams.

If you can understand and apply ONE simple concept, I believe you can become richer than you ever thought possible.

You can definitely retire with plenty of money to enjoy life.

So, let’s get right to it, shall we?

The first thing you have to understand is this:

Index investing is DEAD.

By that I mean, if you think you can just park your money in some Vanguard Index Funds or any other company’s funds for that matter… forget about them… and you’ll end up with a prosperous retirement… forget about it.

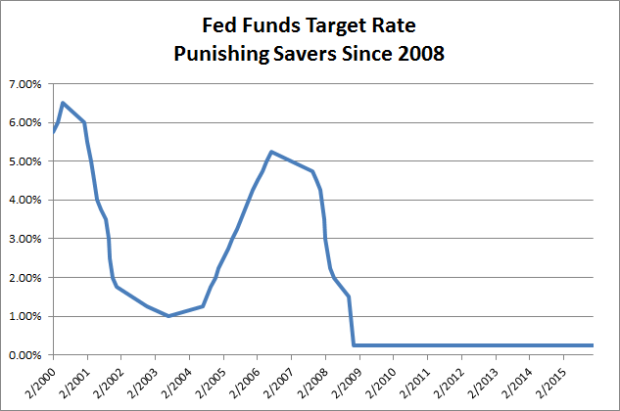

For one thing, the interest rates that formed the core of what is called Modern Portfolio Theory have been near ZERO for over half a decade now.

It’s true that interest rates will rise, but probably not as much as people expect.

The current slow-growth economy means that interest rates will either stay at current levels or be increased by the Fed at a very slow, moderate pace. Investors cannot expect a return to the interest rate levels of the first half-decade of this century.

That means that one of the CENTRAL PILLARS of a traditional retirement relied upon by literally generations of retirees – decent interest from CDs, money market accounts and so on – is GONE.

And it’s actually far worse than that.

What brokers don’t tell you is that the ACTUAL returns that real-life investors get in the stock market are SUBSTANTIALLY less than the market averages… even when the market averages were good!

And the reason is simple: real people are rarely 100% invested in the market at all times.

They invest a little… panic… pull money out… try to time the market… and so on.

When the 2008-2009 market crash hit, many investors panicked and pulled what was left of their nest eggs out of the market… and MISSED the market rebound of the past six years.

They sold at the bottom… and never even saw the coming top.

If that was you, don’t feel bad about it. It was you and about 50 million other people.

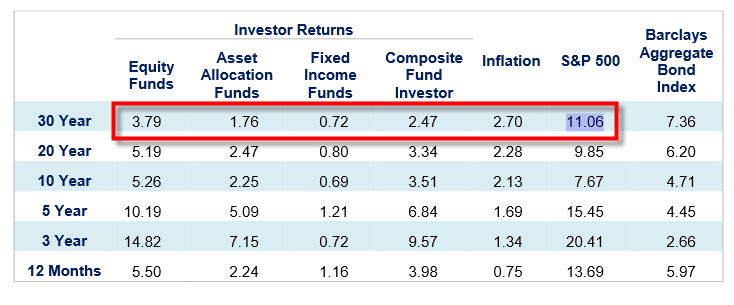

According to Dalbar, a market research firm, the actual returns investors have achieved over the past 10, 20 or 30 years are HALF, or less, than what the S&P 500 actually returned.

For example, over the past 20 years, the S&P 500 has averaged about 9.85% a year… but the returns of average investors in an asset allocation portfolio (a mixture of equity and bond funds) has been just 2.47%.

And here’s another complication:

No one can see the future, but if you’ve been paying attention for the past several years you likely know that stock returns, AS A WHOLE, are expected to be FAR LOWER in the next 10 to 20 years than they’ve been in the past.

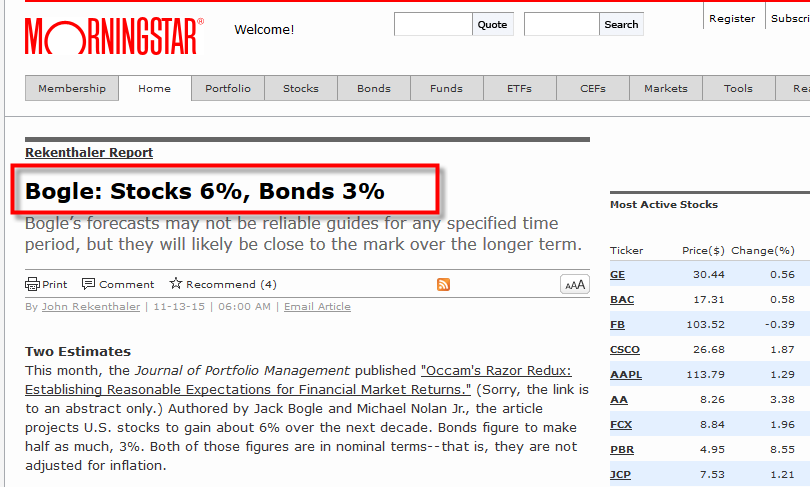

No less an authority than Jack Bogle, founder of Vanguard and widely considered the father of index fund investing, recently predicted that equities will generate average returns of only 6% a year for the coming decade and bonds just 3%.

That’s just about HALF of what the S&P 500 has averaged over the past 30 years.

And Bogle isn’t the only one saying this.

Other experts claim that getting even 6% a year in the S&P 500 may be a stretch.

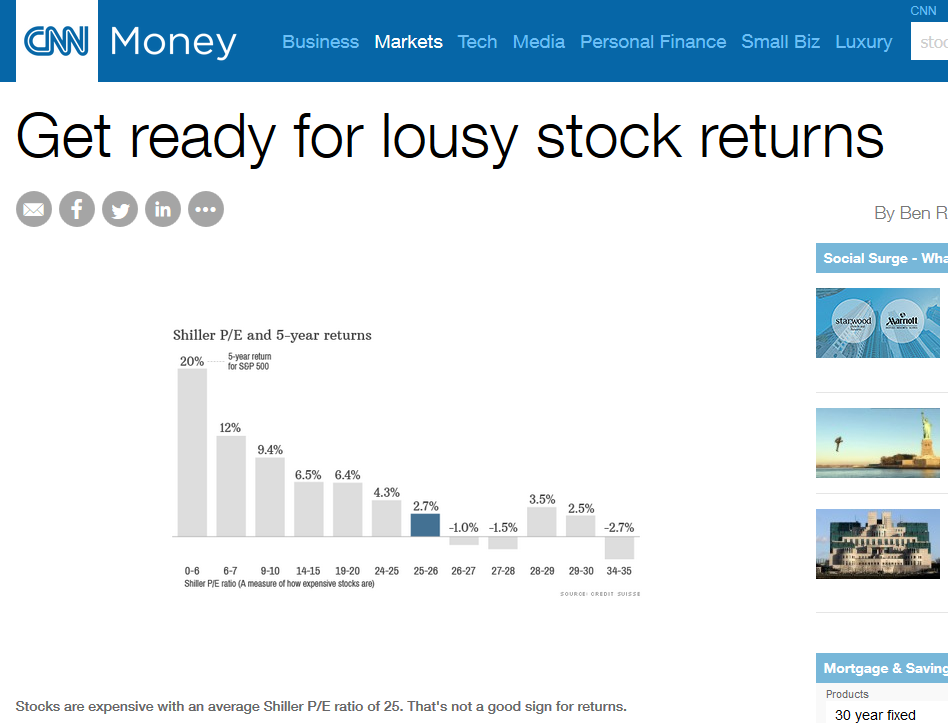

According to Credit Suisse, whenever stocks have reached price levels similar to what they are today, the S&P 500 has averaged between 2.5% and 3.5% for the next five years.

And of course, if real-life stock index investors are only able to make 3.79% a year when the S&P 500 is averaging 11%… how much do you think investors will make when the S&P 500 is only averaging 6% a year, or a little more than half of what it used to make?

The answer: Not very much!

And this will impact you whether you are 5 to 7 years away from retirement… already retired… or even if you’re in your 30s or 40s and have many years before you quit working.

Let me briefly show you the mathematics of it… how it works out in real-life scenarios.

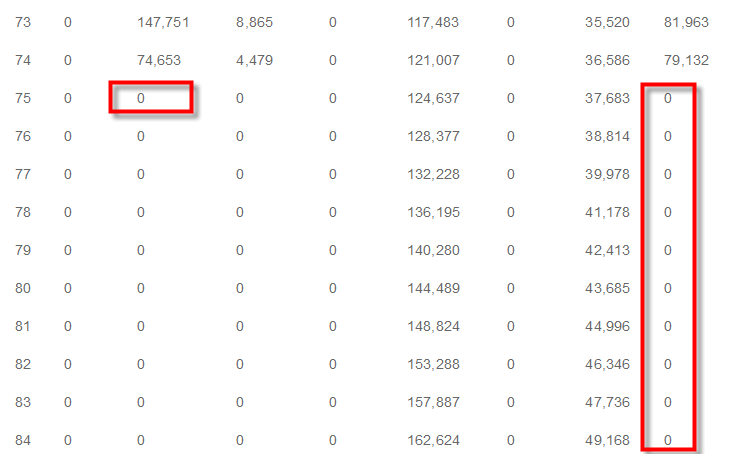

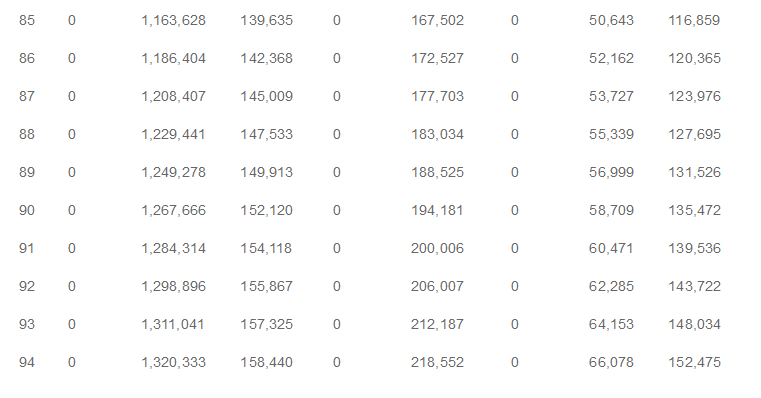

Let’s say you’re lucky and currently have $400,000 stashed away in your retirement account, 401(k) or whatever, and are 5 years away from retiring.

Now, here’s what happens if the experts are right and you only get, say, 6% a year on average going forward and need $80,000 a year to live on.

(As I said, the reality is that real-life investors far under-perform the indexes but let’s be optimistic.)

Starting with $400,000 and assuming you retire in five years at age 65, here’s what it looks like on Mutual of Omaha’s popular “Are My Retirement Savings Sufficient?” Calculator…

At 6% a year and assuming you withdraw around $6,500 a month to live on, you’ll likely run out of money completely at age 74.

Starting with only $400,000 – which isn’t very much anymore – earning 10% to 12% a year… collecting some income from dividends… and getting Social Security… it would be ENOUGH.

In fact, if you could earn an average of 12% a year investing, you’d have enough to collect $80,000 a year for the rest of your life – increasing each year for inflation — and STILL have an extra $1.3 million left over to leave to your kids or heirs when you kick the bucket at age 94!

It’s true.

You can run the numbers yourself…

They mean the difference between retiring with dignity, independence, and peace of mind… and ending up broke, unable to provide for those you love, desperate, and dependent on the kindness of friends, family, and charities.

And here’s the best news of all: You can absolutely reach that 10% to 12% range of returns by using a simple investing method that has only come to light in the last few years…

… and which is SO simple any high school kid can use it.

And here it is right now:

The number one most important factor in investing is to invest SOLELY in companies with a consistent history of RISING dividends.

You’ve probably heard this before… but trust me on this, very few people use this approach systematically, consistently, or correctly.

What people usually do is invest in “high” dividend stocks. They hear about a stock that pays 6% or 8% — say, AT&T — and they invest in that.

But high dividends are NOT what I am talking about.

We all know about stocks that pay high dividends because they’re plummeting in value or aren’t making any money.

You get the 8% or 10% dividend… but the stock itself tanks.

You end up losing money.

That’s NOT going to solve our problem of low index fund returns.

No, what I’m talking about is the RATE OF INCREASE.

In other words: You only want to invest in companies that MAKE YOU MONEY… and that make you MORE AND MORE money each quarter and every year going forward.

It’s that simple.

If a company STOPS making money for you… if it eliminates its dividend or cuts it in any way… you DUMP it instantly.

Let’s say a stock pays a modest dividend starting out, say 3.5 cents a share.

But it INCREASES that dividend each and every quarter by 5%.

Good examples of growth like that are EQT Midstream Partners (EQM) and Sunoco Logistics Partners (SXL).

You want to invest with dividend growth rates like that because, over time, the dividend increases are reflected in the stock prices.

The stocks may decline temporarily – due to bad economic news in general – but eventually the pressure from all that CASH pushes the stock price upwards.

You end up with a fat cash payment every month or every quarter… AND with stocks that have appreciated 10%, 15%, sometimes 20% a year or more!

Let me give you some examples…

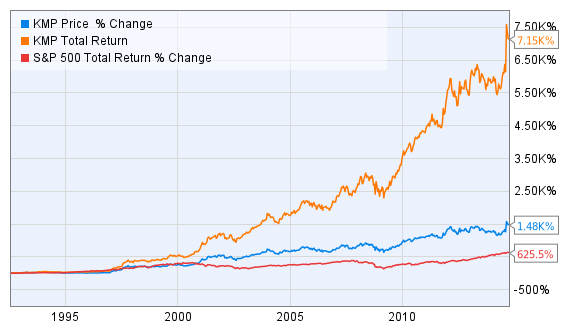

Take a look at this stock: Kinder Morgan.

The IPO occurred in February 1997 at $10.62 a share with an initial annual dividend of 94 cents a share – which worked out to an annual yield of 8.8%.

Not too shabby.

But here’s why this turned into a prime stock pick:

The dividend grew at a 13% annual compound growth rate… for 18 straight years!

Eventually, the company was bought out at $103 a share with a final dividend rate of $5.58 a share.

Had you bought 1,000 shares of this MLP back in 1997, once you realized its dividend was growing at 13% a year, you’d have made about TEN times your money on the stock itself… turning every $10,000 invested into $103,000…

AND… you would have earned another $58,660 in dividend payments along the way.

AND… you would have earned another $58,660 in dividend payments along the way.

Your total return over 17 and a half years: a whopping 16.83% per year, or 1,522% overall!

Think of rising dividend stocks like one of those geysers in Yellowstone Park…and CASH from earnings is like the steam that is building up underground.

That’s how you beat the market consistently… and retire with money to spare.

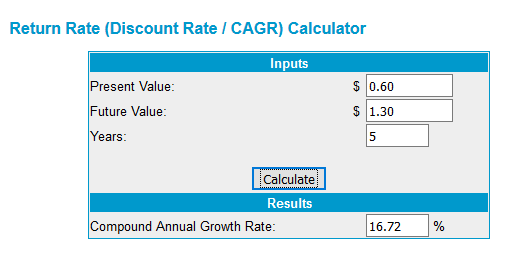

Now, you can use a simple online calculator to figure out what the RATE OF INCREASE is for dividends.

Here’s an example of one from Money Chimp: It takes about three seconds.

If a stock pays an annual dividend of 60 cents today… and in 5 years pays a dividend of $1.30… the RATE OF INCREASE is 16.7% annually.

And this, my friend, is the single most important indicator of a stock’s future appreciation: the rate of increase for its dividends.

I look for an annual rate of increase of AT LEAST 12%… for at least 4 quarters in a row, without any breaks.

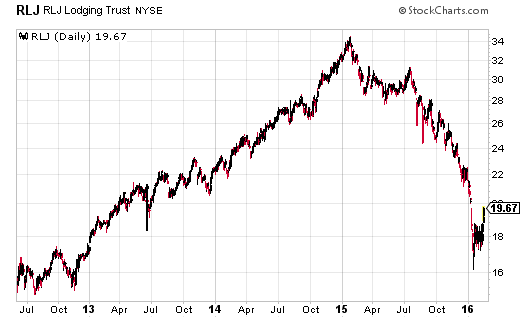

Here’s another example: RLJ Lodging Trust (RLJ)

It had its IPO on May 11, 2011 and immediately dropped to $12 per share and with an annual yield of 3.4% on its dividend.

But the dividend has been increased FIVE times in just four years and is now 120% higher than in 2011.

The result: the stock has DOUBLED in value in just four years, from $12 a share to $24 a share.

Even with the recent dip in the stock market as a whole, that’s an average annual compound return of 18.92%.

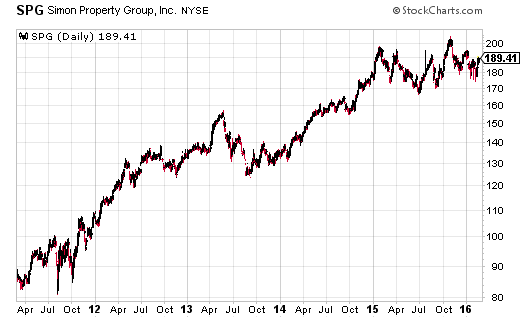

One more quick example: Simon Property Group (SPG), which owns premium outlet shopping centers.

This really is the Holy Grail of investing… the goose that lays the golden egg… and Midas’s Touch… all rolled into one.

Cash really is king.

If you want to become wealthy, invest solely in companies that make you money.

It’s really that simple.

You can forget about 99% of everything else you read about in stocks… all the rumors, all the technical analysis.

Just concentrate on the MONEY… on earnings… and on whether or not a company pays RISING dividends over time.

As you can see, I’m pretty passionate about what I do.

I just HATE seeing people lose so much money investing when making money is actually very EASY – provided you focus on the right things… like how much money a company makes for you on a quarterly basis.

So, I urge you to stay tuned.

Right now, I’m putting the final touches on my NEXT video… which will demonstrate precisely HOW I find stocks with rising dividend payments… and then how I select the very best ones out of this pool of proven winners.

Watch your email inbox.

I’ll let you know when the next video is ready.

If you stumbled on this presentation from another site or through a referral from a friend, and don’t want to miss the next video, simply enter your email address in the box below.

[vivafbcomment]

If you stumbled upon this video and want to be on the list for all of the videos just put in your email address below.